Professional Documents

Culture Documents

CC 6

CC 6

Uploaded by

Kath LeynesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CC 6

CC 6

Uploaded by

Kath LeynesCopyright:

Available Formats

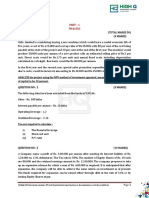

Problem 12-35

Ready Electronics is facing stiff competition from imported goods. Its operating income margin has

been deciding steadily for the past several years. The company has been forced to lower prices so

that it can maintain its market share. The operating results for the past 3 years are as follows:

Year 1 Year 2 Year 3

$10,000,00 $9,000,00

Sales 0 $9,500,000 0

Operating Income 1,200,000 1,045,000 945,000

15,000,00

Average assets 15,000,000 15,000,000 0

For the coming year, Ready’s president plans to install a JIT purchasing and manufacturing system.

She estimates the inventories will be reduced by 70% during the first year of operations, producing a

20% reduction in average operating assets of the company, which would remain unchanged without

the JIT system. She also estimates that sales and operating income will be restored to Year 1 levels

because of simultaneous reduction in operating expenses and selling prices. Lower selling prices will

allow Ready to expand its market share. (Note: Round all numbers to two decimal places.)

Required

1. Compute the ROI, margin, and turnover for Year 1,2, and 3.

2. Suppose that in Year 4 the sales and operating income were achieved as expected, but inventors

remained at the same level as in year 3. Compute the expected ROI, margin and turnover.

Explain why the ROI increased over the Year 3 level.

3. Suppose that the sales and net operating income for Year 4 remained the same as in Year 3 but

inventory reductions were achieved as projected. Compute the ROI, margin, and turnover.

Explain why the ROI exceeded the Year 3 level.

4. Assume that all expectations for Year 4 were realized. Compute the expected ROI, margin, and

turnover. Explain why the ROI increased over the year 3 level.

You might also like

- Responsibility AccountingDocument10 pagesResponsibility AccountingCheny MabiniNo ratings yet

- CVP QuizDocument1 pageCVP QuizJoana Mica Surbona SIBUYONo ratings yet

- MFAAssessment IDocument10 pagesMFAAssessment IManoj PNo ratings yet

- Mock April 2021 Stephenson, Descoin, TaylorDocument8 pagesMock April 2021 Stephenson, Descoin, TaylorHaroon KhurshidNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- 17Document4 pages17Serene Nicole Villena60% (5)

- Day 11 Chap 6 Rev. FI5 Ex PRDocument8 pagesDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- Question Bank FM MID TERMDocument3 pagesQuestion Bank FM MID TERMsatyam skNo ratings yet

- Cash Flow Estimation Class ExcerciseDocument5 pagesCash Flow Estimation Class ExcercisethinkestanNo ratings yet

- FCES - Damanhour 3 Year - 2 Term: Management AccountingDocument11 pagesFCES - Damanhour 3 Year - 2 Term: Management Accountingahmedgalalali497No ratings yet

- ConfidentialDocument6 pagesConfidentialabel khuloane nhlapoNo ratings yet

- Responsibility AccountingDocument4 pagesResponsibility AccountingEllise FreniereNo ratings yet

- Man MockDocument7 pagesMan MockFrederick GbliNo ratings yet

- Chapter # 8 Exercise & ProblemsDocument4 pagesChapter # 8 Exercise & ProblemsZia Uddin0% (1)

- Extra Questions For Mid Term Test 2 - MA2 - ACCADocument10 pagesExtra Questions For Mid Term Test 2 - MA2 - ACCANguyễn NgaNo ratings yet

- 2019 AFM Unit Test 1 Answer KeyDocument8 pages2019 AFM Unit Test 1 Answer KeyDR. PRASANTH.BNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- CVP Analysis Quiz and Exam QuestionsDocument4 pagesCVP Analysis Quiz and Exam QuestionsWafah HadjisalicNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- BBA 2004 Business Accounting and Financial ManagementDocument17 pagesBBA 2004 Business Accounting and Financial ManagementUT Chuang ChuangNo ratings yet

- Accounting 50 Imp Questions 1642414963Document75 pagesAccounting 50 Imp Questions 1642414963vishal kadamNo ratings yet

- FM Income Statement Forecasting Problems Sem VDocument5 pagesFM Income Statement Forecasting Problems Sem Vsatyam skNo ratings yet

- CF Pre Final 2022Document3 pagesCF Pre Final 2022riddhi sanghviNo ratings yet

- HandouDocument4 pagesHandouAbhishek ParmarNo ratings yet

- Attachment Tutor 3Document6 pagesAttachment Tutor 3Florielyn Asto ManingasNo ratings yet

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- Part 1 - FM & ECO - 27145216 PDFDocument3 pagesPart 1 - FM & ECO - 27145216 PDFMaharajan GomuNo ratings yet

- Managerial AccountingDocument1 pageManagerial Accountingacuna.alexNo ratings yet

- Discussion Questions CVP AnalysisDocument2 pagesDiscussion Questions CVP AnalysisAnnamarisse parungaoNo ratings yet

- CVP Analysis Sheet2Document2 pagesCVP Analysis Sheet2Abhishek kumar sittuNo ratings yet

- Mid Term Exam Paper 4Document2 pagesMid Term Exam Paper 4Rohansh AroraNo ratings yet

- DMMR CVP MathDocument2 pagesDMMR CVP MathSabbir ZamanNo ratings yet

- Assignment 7 FinanceDocument3 pagesAssignment 7 FinanceAhmedNo ratings yet

- Tutorial 1Document5 pagesTutorial 1FEI FEINo ratings yet

- Marginal Costing Serious 2 QuestionsDocument3 pagesMarginal Costing Serious 2 QuestionsLegends CreationNo ratings yet

- Ma2 Examiner's Report S21-A22Document7 pagesMa2 Examiner's Report S21-A22tashiNo ratings yet

- Tutorial 5 - Cash Flow Deciding Capital InvestmentDocument4 pagesTutorial 5 - Cash Flow Deciding Capital InvestmentAmy LimnaNo ratings yet

- Common Size IncomeDocument3 pagesCommon Size IncomeJo MsManNo ratings yet

- 9-Case Study - Financial Forecasts and Crystal Balldoc1outof2Document2 pages9-Case Study - Financial Forecasts and Crystal Balldoc1outof2Sylvain BlanchardNo ratings yet

- AAP - Q2 2023 Earnings Release - FinalDocument9 pagesAAP - Q2 2023 Earnings Release - FinalDaniel KwanNo ratings yet

- Problems On Leverage AnalysisDocument4 pagesProblems On Leverage AnalysisMandar SangleNo ratings yet

- Receivable Management - ProblemsDocument2 pagesReceivable Management - ProblemsMary Berly MagueflorNo ratings yet

- Loblaws Writting SampleDocument5 pagesLoblaws Writting SamplePrakshay Puri100% (1)

- Growth Rate RevenuesDocument2 pagesGrowth Rate RevenuesDudeNo ratings yet

- Ratio Analysis 2Document15 pagesRatio Analysis 2Azmira RoslanNo ratings yet

- Valuation FundamentalDocument4 pagesValuation FundamentalpranavNo ratings yet

- Start Up PlanDocument22 pagesStart Up PlansauravNo ratings yet

- Du PontDocument8 pagesDu PontTên Hay ThếNo ratings yet

- Business FinanceDocument22 pagesBusiness FinancenattoykoNo ratings yet

- Finance Excel AssignmentDocument2 pagesFinance Excel AssignmentKyleLippeNo ratings yet

- M09 Berk0821 04 Ism C091Document15 pagesM09 Berk0821 04 Ism C091Linda VoNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentSYED MUHAMMAD MOOSA RAZANo ratings yet

- Case No. 1 BWFM5013Document8 pagesCase No. 1 BWFM5013Shashi Kumar NairNo ratings yet

- Topic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IIDocument4 pagesTopic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IINur WahidaNo ratings yet

- FINAN204-23A - Tutorial 3Document19 pagesFINAN204-23A - Tutorial 3Xiaohan LuNo ratings yet

- FA Assignment#3 Linking Balance Sheet With Profit and Loss Statement Company Name: Deepak NitriteDocument1 pageFA Assignment#3 Linking Balance Sheet With Profit and Loss Statement Company Name: Deepak NitriteBhaktaNo ratings yet

- Wahyudi 29123005 Case6 Syndicate1 YP69BDocument5 pagesWahyudi 29123005 Case6 Syndicate1 YP69Bwahyudimba69No ratings yet

- Management Accounting Set 1 FinDocument3 pagesManagement Accounting Set 1 FinÃrhan KhañNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- c2 7Document3 pagesc2 7Kath LeynesNo ratings yet

- Which of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Document3 pagesWhich of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Kath LeynesNo ratings yet

- c2 2Document3 pagesc2 2Kath LeynesNo ratings yet

- Which of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Document3 pagesWhich of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Kath LeynesNo ratings yet

- Ass6 10Document1 pageAss6 10Kath LeynesNo ratings yet

- AttDocument8 pagesAttKath LeynesNo ratings yet

- Ass6 7Document1 pageAss6 7Kath LeynesNo ratings yet

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1Kath LeynesNo ratings yet