Professional Documents

Culture Documents

Peanut Marketing News - May 6, 2021 - Tyron Spearman, Editor

Uploaded by

Morgan IngramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Peanut Marketing News - May 6, 2021 - Tyron Spearman, Editor

Uploaded by

Morgan IngramCopyright:

Available Formats

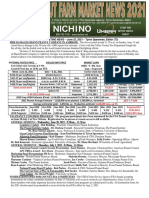

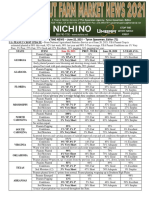

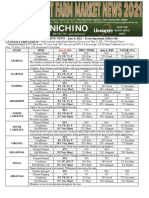

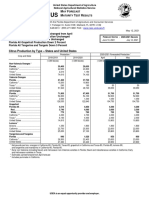

PEANUT MARKETING NEWS – May 6, 2021 – Tyron Spearman, Editor (52)

NATIONAL POSTED PRICE SHELLED MKT PRICE MARKET LOAN WEEKLY PRICES

from USDA each Tuesday at 3 PM, USDA - 9 - Mo. loan Average prices

Good til Next day at 12:01 am EST. insp. = Inspected Marketing by type

Week- May 4, 2021 Date – 5-5, 2021 Farmer stock tons Date – 04-24-2021

$424.55 per ton/Runners Shelled Runners 2019-20 Crop 2020-21 Crop Runners - $.207- $414t

$415.57 per ton/Spanish 2020 Crop - $.53- $.55 lb. Date 5-6-2020 5-5-2021 Spanish – none

$428.74 per ton/Valencia 4-28-20 Jum$.85+ Med.$.85 Loans 2,340,990 2,435,355 Virginias - $.238 - $476t

$428.74 per ton/Virginia Blanched Whole - $.80 to $.90 Redeemed 1,115,824 1,308,948 Average - $.212 -$424 t

Same as last week 5-2-19 Jum $.46 Med, $.45 In Loan 1,225,166 1,126,407 Runners –117,965,000#

Splits $.44 Estimate 2,748,043 t 3,067,168 t Virginia –20,491,000#

4-23-2021 (2020 crop) Inspected 2,752,280 t 3,107,188 t Spanish – none

2020 Crop USDA Estimate (Final)- 1,616,000 acres harvested X 3,796 lbs. ac = 3,067,168 tons TOTAL –138,456,000#

2021 Peanut acreage Estimate – 1,625,500 acres, down 2% DOWN $0.4 ct/lb

2021 Farmer Stock Contracts – $500 per ton /$475 per ton, plus $25 per ton premium on seed and/or High Oleic (HO)

VC – Virginias – Some $500/$520 per ton, + $25 per ton for irrigated, Runners -$475 per ton + $25 for HO or irrigation.

Prices Received by Aug 2020 Sept 2020 Oct 2020 Nov 2020 Dec 2020 Jan.2021 Feb.2021 Mar. 2021 Projected PLC

Farmers (PLC $.205 $.205 $.209 $.212 $.204 $.205 $.205 $.212 Price

2019 Program) $410 ton $410 ton $418 ton $424 ton $408 ton $410 ton $410 ton $424 ton $420 per ton

PLC PROGRAM FOR PEANUTS - Price Loss Coverage (PLC) PLC program payments are issued when the effective price of a

covered commodity is less than the respective effective reference price for that commodity. The effective price equals the higher of

the national market year average price (MYA) or the national average loan rate for the covered commodity. The effective reference

price is the lesser of 115% of the reference price or an amount equal to the greater of the reference price or 85% of the average of

MYA prices from the 5 preceding years, excluding the highest and lowest price.

This new method of calculating the PLC payment rates will allow the effective reference price to be greater than the

statutory reference price if the historic average of MYA prices is greater than the statutory reference price. PLC payments are not

dependent upon the planting of a covered commodity or planting of the applicable base crop on the farm. PLC payments, if triggered,

will be paid on 85% of the farm’s base acres of each covered commodity with a PLC election where the farm has been enrolled.

Payment will be issued after the end of the marketing year of the covered commodity, but not before October 1 of the year following

the program year.

The March average price for peanuts was posted at $.212 or $424 per ton. This reflects the improved prices that farmers are

receiving for 2021 crop peanuts. The projected PLC price was also posted at $420 per ton. Reference price for peanuts is $535 ton.

AMS NEEDS RAW SHELLED PEANUTS - The Agricultural Marketing Service has issued Solicitation for the procurement raw

shelled peanuts (3,872,000 lbs). Please note bids are due Tuesday, May 11, 2021 by 9:00 a.m. Central Time. Questions regarding

this procurement should be directed to t: Cheryl A. Davis, cheryla.davis@usda.gov, (816) 926-3377.

COMMODITY SPECIFICATION-RAW SHELLED PEANUTS, From CURRENT CROP YEAR , RUNNER TYPE

PEANUTS 3. MEDIUM or JUMBO GRADE [American Peanut Shellers Grade Standards] http://www.peanut-

shellers.org/pdf/tradingrules.pdf 4. AFLATOXIN NOT TO EXCEED 15 PARTS PER BILLION (ppb).

FARMERS UPSET THAT THEY MAY LOSE THE FARM - President Joe Biden's speech to Congress last week laid out the

details of a tax plan to help pay for his infrastructure proposal and other domestic proposals.

Not mentioned in those plans are proposals to nearly double the tax rate for capital gains and eliminate stepped-up basis

beyond a $1 million exemption as well.

The plan would raise the capital gains rate from 20% to 39.6% for people who earn more than $1 million. IRS data from

2018 returns shows this would only affect about one-third of 1% of American taxpayers -- .32% -- who have adjusted gross income of

more than $1 million, as well as having capital gains or losses on their tax returns.

The plan also calls for raising the corporate tax rate from 21% to 28% as well. And in another proposal expected to come

from the president, he will pitch a plan to eliminate stepped-up basis when passing on property to heirs. Farmers with little equipment

could easily have $1million in assets. They fear the family would have to sell the farm to pay capital gain if the farmer dies.

You might also like

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesMorgan IngramNo ratings yet

- June 20, 2021Document1 pageJune 20, 2021Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - June 8, 2021 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - June 8, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Spring 2021 Academic AchievementDocument18 pagesSpring 2021 Academic AchievementMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Alabama Crop Progress and Condition ReportDocument2 pagesAlabama Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Peanut Marketing News - May 11, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - May 11, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Cit 0521Document3 pagesCit 0521Morgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Floriculture 2021Document2 pagesFloriculture 2021Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Alabama Crop Progress and Condition ReportDocument2 pagesAlabama Crop Progress and Condition ReportMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - April 26, 2021 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 26, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- 4.9% and Peanut Butter Maintaining Volume, Up 4.2%. Stocks and Processing Report Had Estimated A 3.3% IncreaseDocument1 page4.9% and Peanut Butter Maintaining Volume, Up 4.2%. Stocks and Processing Report Had Estimated A 3.3% IncreaseMorgan IngramNo ratings yet

- Peanut Marketing News - May 4, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - May 4, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

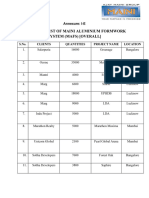

- Customer List of Maini Aluminium Formwork System - MafsDocument6 pagesCustomer List of Maini Aluminium Formwork System - MafsgurushankarNo ratings yet

- Oneworld Training BookletDocument2 pagesOneworld Training BookletYasirRazaNo ratings yet

- Wage Account November 2020M HN-1Document12 pagesWage Account November 2020M HN-1Pavel ViktorNo ratings yet

- 66993-Article Text-136421-1-10-20110608 PDFDocument18 pages66993-Article Text-136421-1-10-20110608 PDFGokulNo ratings yet

- 18-07-2023 - Handwritten NotesDocument17 pages18-07-2023 - Handwritten NotesUserTestNo ratings yet

- Diffusion Aceleration and Business Cycle Hickman 1959Document32 pagesDiffusion Aceleration and Business Cycle Hickman 1959Eugenio MartinezNo ratings yet

- Last Five Year PlanDocument4 pagesLast Five Year PlanMamta VermaNo ratings yet

- Laying & Testing of Fire Detection Cable Methods StatementDocument23 pagesLaying & Testing of Fire Detection Cable Methods StatementJanaka Kavinda100% (1)

- Brochure (Khadi Board) (10-2022) Green ColDocument4 pagesBrochure (Khadi Board) (10-2022) Green ColRavindra SharmaNo ratings yet

- Application of The Lewis-Fei-Ranis Model To Japan: TH THDocument2 pagesApplication of The Lewis-Fei-Ranis Model To Japan: TH THShamsur RahmanNo ratings yet

- 10 Segismundo, Ma. Isabella 12 Gilead Apolaki Week 5 Textbook ExercisesDocument2 pages10 Segismundo, Ma. Isabella 12 Gilead Apolaki Week 5 Textbook ExercisesMaria IsabellaNo ratings yet

- Lecture 12 EntrepreneurshipDocument23 pagesLecture 12 EntrepreneurshipKomal RahimNo ratings yet

- Megatrends Digital LivingThe Next Billion Internet UsersDocument40 pagesMegatrends Digital LivingThe Next Billion Internet Userssonstar1991No ratings yet

- International Economics FinalDocument83 pagesInternational Economics FinalMikylla Rodriguez VequisoNo ratings yet

- Our Lady of Fatima University: Senior High School Department Antipolo City CampusDocument4 pagesOur Lady of Fatima University: Senior High School Department Antipolo City CampusRc CokeNo ratings yet

- GSIS TEMPLATE Fire Insurance Application Form (TRAD)Document3 pagesGSIS TEMPLATE Fire Insurance Application Form (TRAD)Ronan MaquidatoNo ratings yet

- Omega Consultancy Services: A Govt. Regd. Test HouseDocument1 pageOmega Consultancy Services: A Govt. Regd. Test HouseSanjoy RoyNo ratings yet

- Nuts and Dried Fruits - Statistical - Yearbook - 2019-2020Document80 pagesNuts and Dried Fruits - Statistical - Yearbook - 2019-2020Tânia Sofia OliveiraNo ratings yet

- 0171 Online Tax Payment PortalDocument1 page0171 Online Tax Payment PortalmohdsabirNo ratings yet

- The Elliot-Wave-Principle: Master and Ride The WavesDocument48 pagesThe Elliot-Wave-Principle: Master and Ride The WavesOburoh Bemigho Peter100% (1)

- PhilEquity Fund ProspectusDocument42 pagesPhilEquity Fund ProspectuskimencinaNo ratings yet

- Wasab Singh Negi (Assessment 2)Document4 pagesWasab Singh Negi (Assessment 2)wasab negiNo ratings yet

- Question 3Document25 pagesQuestion 3Ahmed AbdirahmanNo ratings yet

- Summary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRDocument1 pageSummary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRabhishek ranaNo ratings yet

- Active TRader-Marco Dion Interview Sep 2009Document5 pagesActive TRader-Marco Dion Interview Sep 2009fredtag4393No ratings yet

- Ns 01 2013 PDFDocument136 pagesNs 01 2013 PDFchunochunoNo ratings yet

- 2 - Partnership OperationsDocument14 pages2 - Partnership Operationslou-924No ratings yet

- Gen. Math - 11 - Q2 - WK2Document8 pagesGen. Math - 11 - Q2 - WK2Jehl T Duran50% (2)

- TCM 5Document11 pagesTCM 5ule leNo ratings yet

- Ycoa Accdet Docu XXDocument874 pagesYcoa Accdet Docu XXDezan SAPNo ratings yet