Professional Documents

Culture Documents

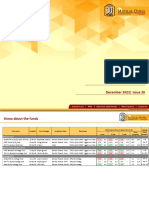

Montly Fund Fact Sheet

Uploaded by

Aaron FooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Montly Fund Fact Sheet

Uploaded by

Aaron FooCopyright:

Available Formats

AmIncome

3-year

Fund Volatility

0.1

Very Low

September 2018 Lipper Analytics

31 Jul 2018

AmIncome (the "Fund") aims to provide you with a regular stream of monthly income* by investing in money market and other fixed income instruments.

The Fund is suitable for investors:

• seeking invest their cash portion of their investment portfolio;

Top 5 Holdings (as at 31 August 2018)

• seeking to preserve their capital**;

• seeking to invest their excess cash for short-term***; Sabah Development Bank Berhad 7.93%

• seeking a stream of potential monthly income*; and CIMB Group Holdings Berhad 4.04%

• have short or medium-term**** investment goals DRB-Hicom Berhad 3.62%

Note: *The income could be in the form of units or cash RHB Bank Berhad 3.43%

** Capital preservation does not mean that the capital is guaranteed or protected Sunway Berhad 3.28%

*** Short-term period refers to a period of one (1) year or less. Source: AmFunds Management Berhad

**** Short to medium-term refers to an investment horizon of one (1) to three (3) years.

Asset Allocation* (as at 31 August 2018)

Any material change to the investment objective of the Fund would require Unit Holder's

approval.

Corporate bonds, Money market

Investment Strategy 52.14% deposit, 34.33%

• Short to medium term fixed income instruments (i.e debt instruments with maturity of no longer

than five (5) years) with minimum short-term local credit rating of P2 (by RAM) or MARC2 (by

MARC) or long-term credit rating of A3 (by RAM) or A- (by MARC).

• With the exception of unforeseeable circumstances the weighted average maturity of the Fund's

investments will not exceed one year.

Note: "Short term credit rating" refers to the credit rating of an instrument for a period less than twelve

(12) months issued by local credit rating agency whereas "long term credit rating" refers to a credit Commercial

Cash and others, papers, 10.17%

rating for a period of at least five (5) years. 3.36%

Asset Allocation

• At least 70% of the Fund’s NAV will be invested in money market instruments, short to medium- * As percentage of NAV. Please note that asset exposure for the Fund is subject to frequent change on a daily basis.

term fixed income instruments (i.e. debt instruments with a term to maturity of no longer than five Source: AmFunds Management Berhad

(5) years) and negotiable instruments of deposit with tenure of five (5) years or less, where

Fund Performance (as at 31 August 2018)

investment in negotiable instruments of deposit is capped at 30%; and

• Up to 30% of the Fund’s NAV in cash.

Cumulative performance over the period (%)

Source: AmFunds Management Berhad 80.00

Fund Details 70.00

60.00

Fund Category Fixed Income

50.00

Fund Launch Date 20 January 2000

Offer Price at Launch MYR 1.00 40.00

NAV (31 Aug 2018) MYR 1.00 30.00

Total Units (31 Aug 2018) 2,989.65 million 20.00

Fund Size (31 Aug 2018) MYR 3,042.12 million 10.00

Annual Management Fee Up to 0.75% p.a. of the NAV of the Fund 0.00

Annual Trustee Fee Up to 0.05% p.a. of the NAV of the Fund Jan-00 Aug-18

AmIncome

Entry Charge Nil

Exit Fee Nil Malayan Banking Berhad 1-Month Fixed Deposit Rate

Redemption Payment Period * The first RM50 million will be on the following Business Day The value of units may go down as well as up. Past performance is not indicative of future performance.

upon receipt of redemption request Source: AmFunds Management Berhad

* Any amount above the first RM50 million will be no later

than four (4) Business Days after receipt of redemption

Performance Data (as at 31 August 2018)

request

* A second redemption request submitted will only be

1m 6m 1 yr 3 yrs 5 yrs

processed once the first redemption request has been fully

paid

Fund (%) 0.30 1.76 3.40 10.14 16.73

* Note: The Manager may for any reason at any time, where

applicable, extend the payment of the net redemption

*Benchmark (%) 0.26 1.58 3.08 9.44 16.30

proceeds no later than ten (10) calendar days from the date

the redemption request is received by the Manager. *Malayan Banking Berhad 1-Month Fixed Deposit Rate

Source Benchmark: *AmFunds Management Berhad

Investment Manager AmFunds Management Berhad

Source Fund Return : Novagni

Income Distribution Income is calculated daily and paid monthly within 14 days The Fund Performance is calculated based on NAV-to-NAV using Time Weighted Rate of Return (''TWRR'') method

after the last day of each month or on full redemption

Source: AmFunds Management Berhad

Calendar Year Return

2017 2016 2015 2014 2013

Fund (%) 3.22 3.62 3.11 2.87 2.77

*Benchmark (%) 2.95 3.06 3.15 3.08 3.00

*Malayan Banking Berhad 1-Month Fixed Deposit Rate

Source Benchmark: *AmFunds Management Berhad

Source Fund Return : Novagni

The Fund Performance is calculated based on NAV-to-NAV using Time Weighted Rate of Return (''TWRR'') method

Disclaimer

Based on the Fund’s portfolio returns as at 31 July 2018, the Volatility Factor (''VF'') for this Fund is 0.1 and is classified as "Very Low" (Source: Lipper). "Very

Low" includes funds with VF that are lower 1.885 (Source: Lipper). The VF means there is a possibility for the Fund in generating an upside return or downside

return around this VF. The Volatility Class (''VC'') is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision and VC

will be revised every six months. The Fund’s portfolio may have changed since this date and there is no guarantee that the Fund will continue to have the same

VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC.

The information contained in this material is general information only and does not take into account your individual objectives, financial situations or needs. You

should seek your own financial advice from an appropriately licensed adviser before investing. You should be aware that investments in a unit trust fund carry

risks. An outline of some of the risks is contained in the Master Prospectus dated 10 September 2017 & 1st Supplemental Master Prospectus dated 4 January

2018 (collectively referred as the “Prospectus”). The specific risks associated with investment of the Fund are credit and default risk, cancellation of units risk,

income distribution risk, liquidity risk, interest rate risk and counterparty credit risk as contained in the Prospectus. Unit prices and income distribution, if any, may

rise or fall. Past performance of a Fund is not indicative of future performance. Please consider the fees and charges involved before investing. Units will be

issued upon receipt of completed application form accompanying the Prospectus and subject to terms and conditions therein.

Where a distribution is declared, you are advised that following the distribution, the Net Asset Value (“NAV") per unit will be reduced from cum-distribution NAV

to ex-distribution NAV. Where a unit split is declared, you are advised that following the issue of additional units, the NAV per unit will be reduced from pre-unit

split NAV to post-unit split NAV. Kindly take note that the value of your investment in Malaysian ringgit will remain unchanged after the distribution of the

additional units.

You have the right to request for a copy of Product Highlights Sheet for the Fund. You are advised to read and understand the contents of the Product Highlights

Sheet and the Prospectus before making an investment decision. The Prospectus has been registered with the Securities Commission Malaysia, who takes no

responsibility for its contents. You can obtain a copy of the Product Highlights Sheet and the Prospectus from any of our representative office and authorized

distributor. AmFunds Management Berhad does not guarantee any returns on the investments. In the event of any dispute or ambiguity arising out of the other

language translation in this leaflet, the English version shall prevail.

Note: Unless stated otherwise, all fees, charges and/or expenses disclosed in this material are exclusive by way of example and not limitation, goods and services

tax, value added tax, consumption tax, levies, duties and other taxes as may be imposed by the Government of Malaysia from time to time (collectively known as

“Taxes”). If these fees, charges and/or expenses are subject to any Taxes, such Taxes shall be borne and payable by the Unit Holders and/or the Fund (as the

case may be) at the prevailing rate, including any increase or decrease to the rate, in addition to the fees, charges and/or expenses stated herein.

Privacy Notice: AmFunds Management Berhad (Company Registration: 154432-A) issued its Privacy Notice as required by Personal Data Protection Act 2010,

which details the use and processing of your personal information by AmFunds Management Berhad. The Privacy Notice can be accessed via

www.aminvest.com and is also available at our head office. If you have any queries in relation to the Privacy Notice of AmFunds Management Berhad, please

feel free to contact our Client Service Officers at Tel: +603 2032 2888 OR e-mail: enquiries@aminvest.com.

Growing your investments in a changing world

You might also like

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- 258 - HCEP Factsheet Oct 2022Document2 pages258 - HCEP Factsheet Oct 2022Sundaresan MunuswamyNo ratings yet

- Ppfas MF Factsheet For November 2022Document17 pagesPpfas MF Factsheet For November 2022Srikanth VgNo ratings yet

- Amanah Saham Nasional: January 2023Document1 pageAmanah Saham Nasional: January 2023Afif ApihNo ratings yet

- Getting Smarter Series Roll Down StrategyDocument5 pagesGetting Smarter Series Roll Down Strategykishore13No ratings yet

- Mirae Asset Focused Fund FM Station April 2023Document3 pagesMirae Asset Focused Fund FM Station April 2023iamrameceNo ratings yet

- Managed Fund January 2021Document3 pagesManaged Fund January 2021CHEONG WEI HAONo ratings yet

- Webinar With Zerodha - Kalpen Parekh: February 22, 2019Document7 pagesWebinar With Zerodha - Kalpen Parekh: February 22, 2019SPNo ratings yet

- Amanah Saham Nasional: April 2022Document1 pageAmanah Saham Nasional: April 2022Alin AmanNo ratings yet

- Background: Set by RBI Way Back On April 3, 2008Document15 pagesBackground: Set by RBI Way Back On April 3, 2008TunirNo ratings yet

- HDFC December 2023Document137 pagesHDFC December 2023Diksha DuttaNo ratings yet

- PPFAS Long Term Value Fund: (An Open Ended Equity Scheme)Document4 pagesPPFAS Long Term Value Fund: (An Open Ended Equity Scheme)Abhishek SahuNo ratings yet

- NipponIndia ETF 5 Year GiltDocument28 pagesNipponIndia ETF 5 Year GiltshashanksaranNo ratings yet

- Parag Parikh Conservative Hybrid Fund: See OverleafDocument12 pagesParag Parikh Conservative Hybrid Fund: See OverleafTunirNo ratings yet

- Baroda BNPP MF Fund Facts January 2023 1751Document56 pagesBaroda BNPP MF Fund Facts January 2023 1751Jahangir ChohanNo ratings yet

- NFO Leaflet - Kotak FMP SR 304 - 3119 DaysDocument5 pagesNFO Leaflet - Kotak FMP SR 304 - 3119 Daystan anNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDocument2 pagesAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNo ratings yet

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqNo ratings yet

- HDFC MF Factsheet - November 2022Document112 pagesHDFC MF Factsheet - November 2022PrasannaNo ratings yet

- Canara Robeco Equity Tax Saver Fund - ELSS with 3-year lock-in & tax benefitsDocument25 pagesCanara Robeco Equity Tax Saver Fund - ELSS with 3-year lock-in & tax benefitsmayankNo ratings yet

- Kotak Multi Asset Allocation Fund A4 Leaflet (Digital Copy)Document4 pagesKotak Multi Asset Allocation Fund A4 Leaflet (Digital Copy)AnanthNo ratings yet

- Kotak Multicap Fund-SIDDocument122 pagesKotak Multicap Fund-SIDsenthilkumarNo ratings yet

- Axis Banking & Psu Debt Fund: Key Information Memorandum and Application FormDocument17 pagesAxis Banking & Psu Debt Fund: Key Information Memorandum and Application FormAnkur KaushikNo ratings yet

- Axis MF Factsheet Dec 2021Document107 pagesAxis MF Factsheet Dec 2021Prince ANo ratings yet

- HDFC MF Factsheet - October 2022Document104 pagesHDFC MF Factsheet - October 2022srivatsanpersonalNo ratings yet

- Fund Fact Sheets - Prosperity Bond FundDocument1 pageFund Fact Sheets - Prosperity Bond FundJohh-RevNo ratings yet

- Mirae Asset India Opportunities Fund Product Update Dec 2017Document2 pagesMirae Asset India Opportunities Fund Product Update Dec 2017pramodkrishnaNo ratings yet

- Ppfas MF Factsheet For September 2023Document16 pagesPpfas MF Factsheet For September 2023arunkumar arjunanNo ratings yet

- About Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Document14 pagesAbout Parag Parikh Flexi Cap Fund: (Please Visit Page 2)TunirNo ratings yet

- April 2022 Factsheet - (Direct Plan)Document114 pagesApril 2022 Factsheet - (Direct Plan)Prince ANo ratings yet

- 259 - ETP Factsheet Oct 2022Document2 pages259 - ETP Factsheet Oct 2022Sundaresan MunuswamyNo ratings yet

- TAAAAF USD Fund Performance and DetailsDocument7 pagesTAAAAF USD Fund Performance and DetailsJason Wei Han LeeNo ratings yet

- Samco Active Momentum Fund - KIMDocument25 pagesSamco Active Momentum Fund - KIMArpNo ratings yet

- Fidelity Flyer Fund InfoDocument3 pagesFidelity Flyer Fund InfoThanniru VenkateshNo ratings yet

- Annual Report Set 9 Open Ended Debt Schemes - 11Document40 pagesAnnual Report Set 9 Open Ended Debt Schemes - 11vinitNo ratings yet

- Groww Nifty Total Market Index Fund KIMDocument37 pagesGroww Nifty Total Market Index Fund KIMG1 ROYALNo ratings yet

- Makmur Fund - Apr 23Document3 pagesMakmur Fund - Apr 23mid_cycloneNo ratings yet

- Ppfas MF Factsheet For May 2023Document18 pagesPpfas MF Factsheet For May 2023sathiya JNo ratings yet

- HDFC MF Index Solutions Factsheet - November 2022Document51 pagesHDFC MF Index Solutions Factsheet - November 2022srivatsanpersonalNo ratings yet

- Axis Asset Management Company LimitedDocument73 pagesAxis Asset Management Company LimitedMohammad MushtaqNo ratings yet

- AL Debt Fund - One Pager - v3Document2 pagesAL Debt Fund - One Pager - v3kanikaNo ratings yet

- Fixed Maturity Plans (FMP) : Retail ResearchDocument2 pagesFixed Maturity Plans (FMP) : Retail Researcharun_algoNo ratings yet

- Kim - Sbi Multicap FundDocument86 pagesKim - Sbi Multicap FundSuman SauravNo ratings yet

- Guidelines on Commercial PaperDocument14 pagesGuidelines on Commercial PaperZahed IbrahimNo ratings yet

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocument1 pageFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanNo ratings yet

- Acumen - RBI Monetary Policy Review - December 2019Document4 pagesAcumen - RBI Monetary Policy Review - December 2019mfsrajNo ratings yet

- BdocDocument1 pageBdocSandeepVeturyNo ratings yet

- Fund Fact SheetDocument4 pagesFund Fact SheetSizweNo ratings yet

- PPFCF Fact Sheet July 2021Document13 pagesPPFCF Fact Sheet July 2021Dhruv PatelNo ratings yet

- Riskometerschemes of Ppfas Mutual FundDocument1 pageRiskometerschemes of Ppfas Mutual Fundswapnil solankiNo ratings yet

- Managing your money using Value Investing principlesDocument17 pagesManaging your money using Value Investing principlessaivenkatesh13No ratings yet

- Axis Hybrid 9Document12 pagesAxis Hybrid 9Arpan PatelNo ratings yet

- Axis Liquid Fund: Key Information Memorandum and Application FormDocument20 pagesAxis Liquid Fund: Key Information Memorandum and Application FormKripa KBabyNo ratings yet

- Hybrid MF NavigatorDocument25 pagesHybrid MF NavigatorSavio Institute of science and Technology , TJNo ratings yet

- RHB Islamic Global Developed Markets FundDocument2 pagesRHB Islamic Global Developed Markets FundIrfan AzmiNo ratings yet

- NBP Funds: NBP Savings Fund (NBP-SF)Document1 pageNBP Funds: NBP Savings Fund (NBP-SF)Mian Abdullah YaseenNo ratings yet

- 5 - L&T India Value Fund - KIM - September 30, 2022Document66 pages5 - L&T India Value Fund - KIM - September 30, 2022ag1982agNo ratings yet

- HDFC Multi Cap Fund LeafletDocument2 pagesHDFC Multi Cap Fund LeafletAkash BNo ratings yet

- Puzzle 2 WordsDocument1 pagePuzzle 2 WordsAaron FooNo ratings yet

- Puzzle 1 WordsDocument2 pagesPuzzle 1 WordsAaron FooNo ratings yet

- Nombor KecemasanDocument2 pagesNombor KecemasanAaron FooNo ratings yet

- Master Prospectus 10 Sept 2017Document184 pagesMaster Prospectus 10 Sept 2017Aaron FooNo ratings yet

- Anual Report AmfundDocument48 pagesAnual Report AmfundAaron FooNo ratings yet

- Presentation Kepuasan KerjaDocument2 pagesPresentation Kepuasan KerjaAaron FooNo ratings yet

- 9bef9DML ModuleII-Channel Power& ConflictDocument50 pages9bef9DML ModuleII-Channel Power& ConflictdebaionNo ratings yet

- BIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed CorporationDocument4 pagesBIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed Corporationliz kawiNo ratings yet

- IntershipDocument16 pagesIntershipVijay DNo ratings yet

- Final Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIADocument94 pagesFinal Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIAhariiNo ratings yet

- Name: - Section: - Schedule: - Class Number: - DateDocument7 pagesName: - Section: - Schedule: - Class Number: - DateChristine Nicole BacoNo ratings yet

- ABCDDocument10 pagesABCDmary maryNo ratings yet

- Alyssa Li ResumeDocument1 pageAlyssa Li ResumeMING JUNo ratings yet

- BBA 5th Sem - Business Ethics-Pre Board QuestionDocument6 pagesBBA 5th Sem - Business Ethics-Pre Board Questiontech proNo ratings yet

- Business LawDocument103 pagesBusiness Law፩ne LoveNo ratings yet

- Erp Dissertation TopicsDocument8 pagesErp Dissertation TopicsPaySomeoneToWriteAPaperCanada100% (1)

- Reflection on Experiences and Organizational Behavior Concepts Learned this SemesterDocument6 pagesReflection on Experiences and Organizational Behavior Concepts Learned this SemesterVaneet SinglaNo ratings yet

- Customer-Centricity in Retail BankingDocument17 pagesCustomer-Centricity in Retail BankingMadalina PopescuNo ratings yet

- SolverDocument32 pagesSolverARCHIT KUMARNo ratings yet

- Chapter 1 - Review of Accounting ProcessDocument13 pagesChapter 1 - Review of Accounting ProcessJam100% (1)

- Kuliah 11 Cash Flow Estimation and Risk AnalysisDocument39 pagesKuliah 11 Cash Flow Estimation and Risk AnalysisMutia WardaniNo ratings yet

- Government and Corporate Social Responsibility (GCSR) Chapter 1: Strategic Public Policy Vision for CSRDocument4 pagesGovernment and Corporate Social Responsibility (GCSR) Chapter 1: Strategic Public Policy Vision for CSRLouelie Jean AlfornonNo ratings yet

- Latest Marketing CV Rishabh Jain-1Document1 pageLatest Marketing CV Rishabh Jain-1Shubham RaiNo ratings yet

- Human Resource Management - Mind Map On Traditional Functions of HRMDocument14 pagesHuman Resource Management - Mind Map On Traditional Functions of HRMZamzam Abdelazim100% (1)

- Pivot Table Practice - SolvedDocument11 pagesPivot Table Practice - SolvedanzarNo ratings yet

- TaxReturn2022 1040Document10 pagesTaxReturn2022 1040Trish Hit100% (3)

- 1-1 Introduction To Failure Analysis and PreventionDocument21 pages1-1 Introduction To Failure Analysis and PreventionIAJM777No ratings yet

- TOGAF+9 2+course+2020Document482 pagesTOGAF+9 2+course+2020Heilly JerivethNo ratings yet

- Managerial EconomicsDocument266 pagesManagerial EconomicsMihret Assefa100% (1)

- 12 Acc c3 Prelim Exam p2 2023 QP AbDocument23 pages12 Acc c3 Prelim Exam p2 2023 QP AbPax AminiNo ratings yet

- ANA A. CHUA and MARCELINA HSIA, Complainants, vs. ATTY. SIMEON M. MESINA, JR., RespondentDocument7 pagesANA A. CHUA and MARCELINA HSIA, Complainants, vs. ATTY. SIMEON M. MESINA, JR., Respondentroyel arabejoNo ratings yet

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankRujean Salar AltejarNo ratings yet

- National Teachers College ManilaDocument6 pagesNational Teachers College ManilaJeline LensicoNo ratings yet

- A1073a1073m 6194Document4 pagesA1073a1073m 6194AFQBAVQ2EFCQF31FNo ratings yet

- Final Payment Certificate DomesticDocument1 pageFinal Payment Certificate DomesticDen OghangsombanNo ratings yet

- Cost of DebtDocument6 pagesCost of DebtrajisumaNo ratings yet