Professional Documents

Culture Documents

Sarla Verma vs. DCT

Sarla Verma vs. DCT

Uploaded by

Nikhilparakh0 ratings0% found this document useful (0 votes)

11 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageSarla Verma vs. DCT

Sarla Verma vs. DCT

Uploaded by

NikhilparakhCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Principles for Computation of Compensation in Fatal Motor Accidents: A Case review of Sarla

Verma v. DTC, (2009) 6 SCC 121.

I. Facts of the Case:

On 18-04-1998 a man of 38 years old named Rajinder Prasad died in the motor accident. He was a scientist

and was employed at ICMR on a monthly salary of Rs. 3402/- The family members of the deceased filed a

suit for compensation amounting Rs. 16 Lakhs before MACT. On 06-08-1993 the judgement was passed

and only Rs. 5,94,000/- with the interest @ 9% p.a was granted. They were dissatisfied with the

compensation awarded so they challenged the same before the Hon’ble High Court. The High Court passed

an order and awarded Rs. 702624/- as compensation. The petitioners were again dissatisfied from the order

of H.C and went to Supreme Court for enhancement of compensation.

II. Issues raised before the supreme court:

1. What should be the addition to income for future prospects? (2) How the deductions for personal and

living expenses shall be made? (3) What will be the criteria for selecting the multiplier? (4). How the

final compensation shall be calculated?

III. Judgment:

The supreme court held that the term ‘Just compensation’ shall be not just in terms of law, it shall be just

and fair compensation. Since there was a lot of irregularities in computation of compensation the supreme

court made the following guidelines to be followed while computing the compensation.

1. For calculation of income which shall include the future prospects a thumb rule has been

formulated:

(a). If deceased is age below 40 yrs. & permanent Job addition of 50%. (b)If deceased is age b/w 40-50 yrs.

- Addition of 30%. (c) If deceased is above 50 yrs. - No addition. (c) If deceased is self-employed or on

fixed salary, then only actual income at the time of death.

2. For Calculation of deductions in personal and living expenses it was standardized as under:

(a).1/3 of annual income if no. of dependent members is 2 to 3. (b)1/4 of annual income if no. of dependent

members is 4 to 6. (c)1/5 of annual income if no. of dependent members is greater than 6

3. For Selection of Multiplier

The court held that the multiplier should be chosen from the said table with reference to the age of the

deceased. Finally, the multiplier to be used should start with an operative multiplier of 18 (for the age groups

of 15 to 20 and 21 to 25 years), reduced by one unit for every five years, that is M-17 for 26 to 30 years, M-

16 for 31 to 35 years, M-15 for 36 to 40 years, M-14 for 41 to 45 years, and M-13 for 46 to 50 years, then

reduced by two units for every five years, that is, M-11 for 51 to 55 years, M-9 for 56 to 60 years, M-7 for

61 to 65 years and M-5 for 66 to 70 years.

4. Computation of final compensation:

(a). Deduction towards personal expense. (b)Total Contribution to family(c). Multiplier as per age range (c)

Loss of dependency to the family (d). Addition to it Rs. 5,000/- as loss of estate + Rs. 10,000/- as loss of

consortium + 5,000/- as funeral expense.

Therefore, the final formula is: -

Total compensation = Total contribution to family * multiplier + Loss of estate + Loss of Consortium

+ Funeral Expense.

Now applying the formula in the present case

The total compensation = 57658*15+5000+10000+5000 = 884870/-

(Supreme Court awarded Rs. 165246/- (Rs 719624/- earlier awarded) with the interest @6 % p.a.)

The Supreme Court finally settled the law and laid down the principle for the ‘Just Fair and Equitable’

Compensation for fatal motor accidents.

You might also like

- Holt McDougal Florida Larson Algebra 1 PDFDocument431 pagesHolt McDougal Florida Larson Algebra 1 PDFArthur Braga91% (11)

- A Comparative Study On He Performance of Multiphase FlowDocument12 pagesA Comparative Study On He Performance of Multiphase Flowfranciani goedertNo ratings yet

- CFP Mock Test Retirement PlanningDocument9 pagesCFP Mock Test Retirement PlanningDeep Shikha100% (4)

- K19 Serie Engine Operation & MaintenanceDocument7 pagesK19 Serie Engine Operation & MaintenanceJOEL RIVERA33% (3)

- Subjectct52005 2009 PDFDocument181 pagesSubjectct52005 2009 PDFpaul.tsho7504No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Questionnaire ObjectiveDocument9 pagesQuestionnaire Objectiveprasadzinjurde100% (3)

- Analysis of Case Sarla Verma & Others V/s DTCDocument11 pagesAnalysis of Case Sarla Verma & Others V/s DTCpsychedelik77790% (10)

- Analysis of Case Sarla Verma Others V S DTCDocument11 pagesAnalysis of Case Sarla Verma Others V S DTCJayalakshmi RajendranNo ratings yet

- Pranay SethiDocument1 pagePranay SethiNikhilparakhNo ratings yet

- Sarla Verma V Uoi SummaryDocument6 pagesSarla Verma V Uoi SummarysankhlabharatNo ratings yet

- Retirement Planning (Finally Done)Document47 pagesRetirement Planning (Finally Done)api-3814557100% (5)

- H. S. Mulia: Prepared byDocument47 pagesH. S. Mulia: Prepared byDevanshu GuptaNo ratings yet

- Smt. Sarla Verma & Ors PDFDocument28 pagesSmt. Sarla Verma & Ors PDFwap7No ratings yet

- How To Use Multiplier TableDocument3 pagesHow To Use Multiplier TabledrumsetmanNo ratings yet

- Pli & RpliDocument5 pagesPli & RpliUma MaheswararaoNo ratings yet

- MACTs Directed by SC To Choose Correct Multiplier As Per Age of Deceased For CompensationDocument9 pagesMACTs Directed by SC To Choose Correct Multiplier As Per Age of Deceased For CompensationLatest Laws TeamNo ratings yet

- R.V. Raveendran and L.S. Panta, JJ.: Equiv Alent Citation: 2009AC J1298Document13 pagesR.V. Raveendran and L.S. Panta, JJ.: Equiv Alent Citation: 2009AC J1298Ishaan JainNo ratings yet

- Sarla VarmaDocument28 pagesSarla VarmaKajeev KumarNo ratings yet

- CCS Pension RulesDocument19 pagesCCS Pension Rulesanandanayak.k1No ratings yet

- 7th CPC Common MemorandumDocument5 pages7th CPC Common Memorandumshannbaby22No ratings yet

- Secction A Answer All The Questions in This Section: TH THDocument4 pagesSecction A Answer All The Questions in This Section: TH THSam TripNo ratings yet

- IRRM AssignmentDocument4 pagesIRRM AssignmentManish JhawarNo ratings yet

- Assignment 1Document2 pagesAssignment 1yashthakurjii1No ratings yet

- GratuityDocument5 pagesGratuitySundaravaradhan IyengarNo ratings yet

- Law of Torts, MV Act and Consumer Protection: Eseries S.37Document8 pagesLaw of Torts, MV Act and Consumer Protection: Eseries S.37LAZY TWEETYNo ratings yet

- Section 80D Deduction For Mediclaim Insurance PremiumDocument46 pagesSection 80D Deduction For Mediclaim Insurance PremiumsameerNo ratings yet

- This Is From FPSB India Sample Paper of RaipDocument25 pagesThis Is From FPSB India Sample Paper of RaipsinhapushpanjaliNo ratings yet

- IandF CT5 201604 ExamDocument7 pagesIandF CT5 201604 ExamPatrick MugoNo ratings yet

- Licensed To:: Finder Doc Id # 918174 Use Law Finder Doc Id For CitationDocument20 pagesLicensed To:: Finder Doc Id # 918174 Use Law Finder Doc Id For CitationBakash ArshNo ratings yet

- Si CiDocument31 pagesSi CiRahul SinghNo ratings yet

- Case Study Finance For ManagerDocument1 pageCase Study Finance For ManagerAyazNo ratings yet

- Retirement Planning Mock Test: Practical Questions: Section 1: 29 Questions (1 Mark Each)Document17 pagesRetirement Planning Mock Test: Practical Questions: Section 1: 29 Questions (1 Mark Each)Ami ShahNo ratings yet

- Assignment 1 (5%) of The Final Grade. Due Wednesday 22 in ClassDocument2 pagesAssignment 1 (5%) of The Final Grade. Due Wednesday 22 in ClassEric CheungNo ratings yet

- Check Your PensionDocument22 pagesCheck Your Pension229229No ratings yet

- Fiscal Policy InstituteDocument3 pagesFiscal Policy InstituteRick KarlinNo ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- Asm 25560Document9 pagesAsm 25560shivanshu11o3o6No ratings yet

- AKHY Sample PaperDocument24 pagesAKHY Sample PaperShreya PushkarnaNo ratings yet

- Fao 1266 2016 20 05 2022 Final OrderDocument6 pagesFao 1266 2016 20 05 2022 Final Orderthe.advabhishekNo ratings yet

- Assignment 2,3Document8 pagesAssignment 2,3HASSAN AHMADNo ratings yet

- Establishment Rules & ProceduresDocument19 pagesEstablishment Rules & ProceduresAmrita Pal100% (1)

- Esic Jammu Nov12Document16 pagesEsic Jammu Nov12nareshjangra397No ratings yet

- 65 C) Manoj Is Married, Akshat Is Single D) Manoj Is Indian, Akshat Is NRIDocument4 pages65 C) Manoj Is Married, Akshat Is Single D) Manoj Is Indian, Akshat Is NRIsujeetshrivasNo ratings yet

- TestfileDocument8 pagesTestfileAnonymous XbAMoqjmGmNo ratings yet

- S.I. & C.I. TestDocument8 pagesS.I. & C.I. TestSneha SHARMANo ratings yet

- IND 14 CHP 13 2 Homework Sol RETIREMENT Combined 2014Document8 pagesIND 14 CHP 13 2 Homework Sol RETIREMENT Combined 2014Nada Mucho100% (1)

- Individual Taxation (Ay 2019-20)Document29 pagesIndividual Taxation (Ay 2019-20)Mudit SinghNo ratings yet

- Application For RetirementDocument2 pagesApplication For RetirementcrisjavaNo ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- CSARAppDocument6 pagesCSARAppismail shabbirNo ratings yet

- Taxation Law - TheoryDocument29 pagesTaxation Law - TheorySrinivas NuluNo ratings yet

- Taxation - Fisrt Pre-Board - 2016NDocument11 pagesTaxation - Fisrt Pre-Board - 2016NKenneth Bryan Tegerero Tegio100% (2)

- TEST5Document5 pagesTEST5Praveen ChaturvediNo ratings yet

- Quickbooks Payroll Qs Section 3Document7 pagesQuickbooks Payroll Qs Section 3Noorullah0% (1)

- Quiz 6Document15 pagesQuiz 6AnniNo ratings yet

- CFP RaipDocument3 pagesCFP RaipsinhapushpanjaliNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- ProjectDocument13 pagesProjectNikhilparakhNo ratings yet

- AIBE XIV Question Paper SET DDocument16 pagesAIBE XIV Question Paper SET DNikhilparakhNo ratings yet

- Oct 20Document1 pageOct 20NikhilparakhNo ratings yet

- Reasons of Power Theft:: The Electricity Regulatory Commission Act, 1998Document3 pagesReasons of Power Theft:: The Electricity Regulatory Commission Act, 1998NikhilparakhNo ratings yet

- Irfan Khan Objection To BailDocument12 pagesIrfan Khan Objection To BailNikhilparakhNo ratings yet

- Amity Law School Interpretation of Statutes AssignmentDocument9 pagesAmity Law School Interpretation of Statutes AssignmentNikhilparakhNo ratings yet

- Raja Ram Sahu Vs CGDocument15 pagesRaja Ram Sahu Vs CGNikhilparakhNo ratings yet

- Ashutosh Sharma and Ors Reply 2multiDocument17 pagesAshutosh Sharma and Ors Reply 2multiNikhilparakhNo ratings yet

- Cpa and Banking PDFDocument8 pagesCpa and Banking PDFNikhilparakhNo ratings yet

- L03 C03 App Software PDFDocument9 pagesL03 C03 App Software PDFyashiNo ratings yet

- Simple Reliable Predictable: Continuous Inkjet PrinterDocument30 pagesSimple Reliable Predictable: Continuous Inkjet PrinterMarcelo MartinezNo ratings yet

- Ingenieria - SismicaDocument38 pagesIngenieria - SismicaJ Pablo QuinteroNo ratings yet

- Module1 F Cstyle StringDocument43 pagesModule1 F Cstyle StringAshvita SalianNo ratings yet

- Manu Oper Monitor Paciente Vitalcare 506N3 CriticareDocument146 pagesManu Oper Monitor Paciente Vitalcare 506N3 CriticareRigoberto Urquijo GarciaNo ratings yet

- Citect ModnetDocument5 pagesCitect ModnetKuncoroNuryantoNo ratings yet

- Literature ReviewDocument18 pagesLiterature ReviewTalha EjazNo ratings yet

- Computer and Cibersecurity Project ReportDocument16 pagesComputer and Cibersecurity Project ReportShourav PodderNo ratings yet

- Visitor Management SystemDocument39 pagesVisitor Management SystemKeerthi Vasan LNo ratings yet

- PMI Case Study: Nasa Autonomous Rotorcraft ProjectDocument5 pagesPMI Case Study: Nasa Autonomous Rotorcraft ProjectAlexander VillanuevaNo ratings yet

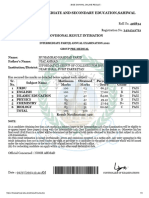

- Result PASS: Board of Intermediate and Secondary Education, SahiwalDocument1 pageResult PASS: Board of Intermediate and Secondary Education, SahiwalAsad Ali ChaudharyNo ratings yet

- Pitaya Dragon Fruit Production and Processing PDFDocument8 pagesPitaya Dragon Fruit Production and Processing PDFAudrey G. OpeñaNo ratings yet

- Intermediate Acctg 3 NotesDocument6 pagesIntermediate Acctg 3 NotesCindy The GoddessNo ratings yet

- Karen Lynn Lacek ResumeDocument4 pagesKaren Lynn Lacek Resumeapi-532679106No ratings yet

- LG and Its CompetitorsDocument50 pagesLG and Its CompetitorsBillGates BNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Market Operation-8811Document2 pagesMarket Operation-8811Charles D. FloresNo ratings yet

- Siemens Pac3200 4200Document12 pagesSiemens Pac3200 4200Anonymous Y6Mrs88No ratings yet

- Constitutional Design and The Promotion of Economic Growth and CompetitivenessDocument13 pagesConstitutional Design and The Promotion of Economic Growth and CompetitivenessEarl HarryNo ratings yet

- Cisco 2960 OpenflowDocument18 pagesCisco 2960 OpenflowLoop AvoidanceNo ratings yet

- How To Edit A PanelView Plus (ViewME) MER FileDocument6 pagesHow To Edit A PanelView Plus (ViewME) MER FileRafael Pertile CarneiroNo ratings yet

- Host Supervisor Assessment Form Ads667 60%Document11 pagesHost Supervisor Assessment Form Ads667 60%Malabaris Malaya Umar SiddiqNo ratings yet

- Subject: International Business Enviornment Topic: Impact of Corona Virus On Global Economy Submitted ToDocument23 pagesSubject: International Business Enviornment Topic: Impact of Corona Virus On Global Economy Submitted Toarchie100% (1)

- Fina Supply V Abilene National Bank - Deception, Concealment, Fraud On Part of One With Superior KnowledgeDocument40 pagesFina Supply V Abilene National Bank - Deception, Concealment, Fraud On Part of One With Superior KnowledgegoldilucksNo ratings yet

- Iot Applications: John Soldatos, PHD ( )Document48 pagesIot Applications: John Soldatos, PHD ( )Muhammad AwaisNo ratings yet

- Final Report Artificial Intelligence in Civil Engineering (8257)Document45 pagesFinal Report Artificial Intelligence in Civil Engineering (8257)050 Syed EhsaanNo ratings yet

- Spool Lift and Loadout ProcedureDocument75 pagesSpool Lift and Loadout ProcedurePhani Kumar G SNo ratings yet