Professional Documents

Culture Documents

Activity #2 AK-benefits

Uploaded by

Jamaica DavidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity #2 AK-benefits

Uploaded by

Jamaica DavidCopyright:

Available Formats

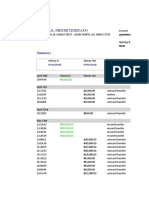

Part I-Theories

1. C

2. C

3. D

4. D

5. B

Part II-Comprehensive Problem

(1) FVPA-Jan 1 6,000,000

Contribution 1,000,000

Actual Return 900,000

FVPA- Dec 31 7,900,000

(2) PBO- Jan 1 5,000,000

Current Service Cost 700,000

Past service cost 200,000

Int exp (10% x 5M) 500,000

Dec in PBO -actuarial gain (500,000)

PBO- Dec 31 5,900,000

(3) FVPA-Dec 31 7,900,000

PBO-Dec 31 5,900,000

Prepaid/accrued benefit cost-surplus 2,000,000

Asset Ceiling- December 31, 2019 1,200,000

Effect of Asset Ceiling 800,000

(4) Current service cost 700,000

Past service cost 200,000

Int exp on PBO (10% x 5M) 500,000

Int inc on FVPA (10% x 6M) (600,000)

Int exp on effect of asset ceiling (10% x 300,000) 30,000

Employee benefit expense 830,000

(5) Actual return 900,000

Interest income 600,000

Remeasurement gain on plan assets 300,000

Decrease in PBO- actuarial gain 500,000

Effect of asset ceiling - Dec 31 800,000

Effect of asset ceiling - Jan 1 300,000

Total change in the effect of asset ceiling 500,000

Interest expense on effect of asset ceiling (10% x 300k) (30,000)

Remeasurement loss on the effect of asset ceiling 470,000

Remeasurement gain on plan asset 300,000

Actuarial gain on PBO 500,000

Remeasurement loss- asset ceiling (470,000)

Net remeasurement gain 330,000

(6) Employee benefit expense 830,000

Prepaid/accrued benefit cost 500,000

Cash 1,000,000

Remeasurement gain-OCI 330,000

(7) P/ABC - Jan 1, asset ceiling -debit 700,000

Debit adjustment 500,000

P/ABC - Dec 31, asset ceiling- debit 1,200,000

Part III- Problem Solving

Problem A

(1) PBO-Jan 1 6,700,000

Interest expense (6,700,000 x 10%) 670,000

Actuarial loss due to increase in PBO 150,000

Current service cost 280,000 squeezed

Benefits paid (600,000)

PBO- Dec 31 7,200,000

(2) FV of plan assets, Jan 1 6,500,000

Employer contribution 300,000

Actual return 700,000 *

Benefits paid (600,000)

FV of plan assets, Dec 31 6,900,000

(3) Actual Return 700,000

FV of plan assets, Jan 1 (6.5m x 10%) 650,000

Remeasurement gain 50,000

Problem B

(4) Current service cost 90,000

Interest exp (1m x 10%) 100,000

Past service cost 30,000

Int income (950k x 10% ) (95,000)

Employee benefit expense 125,000

Net remeasurement loss 2019 15,000

Defined benefit cost 140,000

Problem C

(5) Current service cost 700,000

PBO beg interest exp (3,750,000 x 10%) 375,000

Interest income (3,500,000 x 10%) (350,000)

Settlement gain (50,000)

Employee benefit expense 675,000

(6) Actual return 420,000

Interest income 350,000

Remeasurement gain 70,000

Dec in PBO 100,000

Net remeasurement gain 170,000

Problem D

(7) PBO Jan 1 5,200,000

Current service cost 800,000 *

Interest exp (5.2m x 12%) 624,000

Remeasurement loss on obligation 36,000

Benefits paid (740,000)

PBO Dec 31 5,920,000

Current service cost 800,000

Interest exp 624,000

Interest income (5m x 12%) (600,000)

Employee benefit expense 824,000

Problem E

(8) FVPA Jan 1 7,552,500

PBO Jan 1 6,900,000

P/ABC 652,500

Asset Ceiling 300,000

Effect of Asset Ceiling 352,500

PBO Jan 1 6,900,000

Interest exp (6.9 m x 10%) 690,000

Current service cost 788,500 *

Benefits paid (585,000)

PBO Dec 31 7,793,500

Current service cost 788,500

Interest exp 690,000

Interest income (7,552,000 x 10%) (755,250)

Interest expense on effect of asset ceiling (352,500 x 10% ) 35,250

Employee benefit expense 758,500

Problem F

(9) FVPA beg 7,000,000

Return on assets 500,000

Settlement price of PBO settled (600,000)

Benefits paid (400,000)

Contribution 1,500,000

FVPA ending 8,000,000

Return on plan assets 500,000

Interest income (7m x 10% ) 700,000

Remeasurement loss on plan assets (200,000) OCI-debited

Remeasurement loss on plan assets 200,000

(50

Actuarial gain due to dec in PBO ,000)

Net remeasurement loss 150,000 OCI debited

Problem G

(10) Current service cost 520,000

Interest expense on PBO 590,000

Past service cost 360,000

1,470,000

Problem H

(11) Future salary (500,000 x 1.217) 608,500

Annual pension payment (3% x 608,500 x 15) 273,825 x 6

Multiply by PV of an OA of 1 at 12% for 6 periods 4.111

PV-December 31, 2024 1,125,695 or 273,825 x 6

Multiply by PV of 1 at 12% for 5 periods 0.567

PBO-December 31, 2019 638,269

Problem I

(12) Annual pension or benefit (1,440,000 x 10%) 144,000 or 432,000 for three years

(13)

(a) (b) (axb)

PV

Benefit factor PV

130,60

2019 144,000 0.9070 8

137,14

2020 144,000 0.9524 6

144,00

2021 144,000 1.0000 0

411,75

432,000 4

Int

Current Cost(5%

Date SC ) PV

12/31/201 130,60

9 130,608 8

12/31/202 274,28

0 137,146 6,530 4

12/31/202 432,00

1 144,000 13,716 0

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Step AcquisitionDocument2 pagesStep AcquisitionJamaica DavidNo ratings yet

- Final Term Module Purposive Communication 2 PDFDocument119 pagesFinal Term Module Purposive Communication 2 PDFJamaica David100% (1)

- Special Midterm Exam PDFDocument9 pagesSpecial Midterm Exam PDFJamaica DavidNo ratings yet

- Home Office Branch and Agency Accounting AnswersDocument25 pagesHome Office Branch and Agency Accounting AnswersJamaica DavidNo ratings yet

- Cash N Cash Equivalent Problem Set 1Document3 pagesCash N Cash Equivalent Problem Set 1Jamaica DavidNo ratings yet

- Home Office Branch Accounting 2020 PDFDocument22 pagesHome Office Branch Accounting 2020 PDFJamaica DavidNo ratings yet

- Nature of Internal Control: Multiple Choice QuestionsDocument11 pagesNature of Internal Control: Multiple Choice QuestionsJamaica David100% (1)

- Home Office Branch Accounting 2020 PDFDocument22 pagesHome Office Branch Accounting 2020 PDFJamaica DavidNo ratings yet

- Docxdocx 53 PDF FreeDocument61 pagesDocxdocx 53 PDF FreeJamaica DavidNo ratings yet

- Statement of DefficiencyDocument22 pagesStatement of DefficiencyJamaica DavidNo ratings yet

- Afar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFDocument11 pagesAfar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFJamaica David50% (2)

- This Study Resource Was: Key To Exercise ProblemsDocument8 pagesThis Study Resource Was: Key To Exercise ProblemsJamaica DavidNo ratings yet

- Answers Part2Document1 pageAnswers Part2Jamaica DavidNo ratings yet

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFJamaica David100% (2)

- Quizzer Home Office 3Document11 pagesQuizzer Home Office 3Jamaica David100% (1)

- ACP 311 My Test Bank Problem SolvingDocument22 pagesACP 311 My Test Bank Problem SolvingJamaica DavidNo ratings yet

- This Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Document2 pagesThis Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Jamaica DavidNo ratings yet

- This Study Resource Was: Problem 4-17Document3 pagesThis Study Resource Was: Problem 4-17Jamaica David100% (1)

- Quiz 2 Tax 2 Answer KeyDocument10 pagesQuiz 2 Tax 2 Answer KeyJamaica DavidNo ratings yet

- Tax QuizDocument12 pagesTax QuizJamaica DavidNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- WWW Citehr Com 5544 I Need Some Kpi HR Dept Compensation HTMDocument19 pagesWWW Citehr Com 5544 I Need Some Kpi HR Dept Compensation HTMjonniebravoNo ratings yet

- Buying Merchandise 1.1 Related TermsDocument5 pagesBuying Merchandise 1.1 Related TermsAryanNo ratings yet

- Foreign Literature Customer Satisfaction Through Online PaymentsDocument9 pagesForeign Literature Customer Satisfaction Through Online PaymentsJonathanNo ratings yet

- PHL 318 Exam 2 Study Guide-1Document2 pagesPHL 318 Exam 2 Study Guide-1Hunter FougnerNo ratings yet

- Agency Program Coordinator GuideDocument42 pagesAgency Program Coordinator Guidenate mcgradyNo ratings yet

- MCom Sem II Economics Marathi Version Samagra Arthik SankalanDocument138 pagesMCom Sem II Economics Marathi Version Samagra Arthik SankalanHarsh SanganiNo ratings yet

- Unit 1: Module 1 BA121 Basic MicroeconomicsDocument8 pagesUnit 1: Module 1 BA121 Basic Microeconomicsnek ocinrocNo ratings yet

- Chapter 1 Test BankDocument10 pagesChapter 1 Test Bankمحمود احمدNo ratings yet

- FM (Ratio Analysis and Interpretation) - 115648Document11 pagesFM (Ratio Analysis and Interpretation) - 115648EuniceNo ratings yet

- 08 - Barretto Vs Santa MarinaDocument1 page08 - Barretto Vs Santa MarinaRia GabsNo ratings yet

- Elec Midterm ReviewerDocument16 pagesElec Midterm ReviewerArgie DeguzmanNo ratings yet

- Brand Switching PDFDocument12 pagesBrand Switching PDFAbdullah Al Maruf AornoNo ratings yet

- Customer StatementDocument20 pagesCustomer StatementDonaldNo ratings yet

- Randstad Workmonitor 2023Document90 pagesRandstad Workmonitor 2023Ariella HotasiNo ratings yet

- PQP Vs ISO 9001 Clauses List PDFDocument1 pagePQP Vs ISO 9001 Clauses List PDFVpln Sarma100% (1)

- Tindak Lanjut DiklatDocument15 pagesTindak Lanjut Diklatdian kNo ratings yet

- MKT 337 Course OutlineDocument6 pagesMKT 337 Course OutlineMadiha Kabir ChowdhuryNo ratings yet

- Price List Grand I10 Nios DT 01.05.2022Document1 pagePrice List Grand I10 Nios DT 01.05.2022VijayNo ratings yet

- Data Analytics: This Study Resource Was Shared ViaDocument5 pagesData Analytics: This Study Resource Was Shared ViaAmeya SakpalNo ratings yet

- April 7, 2022Document12 pagesApril 7, 2022Rina EscaladaNo ratings yet

- Cel2106 SCL Worksheet Week 4Document3 pagesCel2106 SCL Worksheet Week 4raed nasrallahNo ratings yet

- 2024 - Taylor Kotler ResumeDocument1 page2024 - Taylor Kotler Resumeapi-698814892No ratings yet

- Sales of Goods ActDocument56 pagesSales of Goods ActCharu ModiNo ratings yet

- Capability Statement July 2020 A4Document6 pagesCapability Statement July 2020 A4Nuraiym NetullinaNo ratings yet

- Hesham Saafan - MSC - CPL - Othm: ContactDocument3 pagesHesham Saafan - MSC - CPL - Othm: Contactnemoo80 nemoo90No ratings yet

- Marketing: What Are The Goals of Marketing?Document2 pagesMarketing: What Are The Goals of Marketing?Marlon EllamilNo ratings yet

- Atos SyntelDocument2 pagesAtos SyntelSharad MoreNo ratings yet

- Last Updated On 23 MAY 2020: Tariq - Haque@adelaide - Edu.auDocument5 pagesLast Updated On 23 MAY 2020: Tariq - Haque@adelaide - Edu.auMy Assignment GuruNo ratings yet

- Credit CardsDocument8 pagesCredit Cardsasmat ullah khanNo ratings yet

- Kroll Restructuring AdministrationDocument2 pagesKroll Restructuring AdministrationMarNo ratings yet