Professional Documents

Culture Documents

AIOF1 A Class Factsheet Apr20

Uploaded by

shemanth123Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AIOF1 A Class Factsheet Apr20

Uploaded by

shemanth123Copyright:

Available Formats

y

nl

O

s

or

di

te

In

d

ve

st

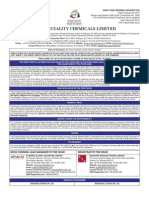

ASK India Opportunities Fund 1

Fund Factsheet - April 2020

re

cc

rA

Fo

Investment Manager Fund Manager Commentary

Financial markets across the globe rallied in April as markets reacted to businesses we have always focussed on, those that are very

ASK Capital Management Pte. Ltd. the stimulus packages announced by various governments to help conservatively levered with strong market positions and an ability to

individuals and businesses. The various central banks made strong consistently generate high returns on capital employed over a sustained

moves to ensure there was ample liquidity in their respective systems to period of time.

Investment Adviser ensure smooth functioning. Signs have emerged that the world is starting Finance businesses, given the nature of the business, are generally

to get a grip on the spread of COVID-19 and there is gradual lift of the highly levered. With challenges on growth and asset quality these

ASK Investment Managers Limited lockdowns in various countries, including India. The equity markets businesses have borne the brunt of selling in this pandemic led market

recovered some of the losses from the previous month with the crash. During the month of April, the Bankex Index underperformed the

benchmark BSE500 up 14.9% in USD terms during the month while the benchmark. The RBI announced a 25bps reverse repo cut (in addition to

Fund gained 11.1%. Since the beginning of the year the Fund continues to the 90bps cut announced in March) during April in addition to the steps

Fund Manager outperform the benchmark by 3.4 percentage points net of fees. mentioned previously. Yet banks are choosing to place around ~INR7.5

In India, the unprecedented lockdown announced in the month of March Tn (~USD98 Bn) in funds with the RBI under the reverse repo window.

Gaurav Sharma, CFA was extended through until 3 May with various relaxations announced Many individuals, small businesses and several corporates have opted

towards the end of the month in areas with no/low number of COVID-19 for the announced moratorium. Some of these are out of genuine need

cases. The RBI has announced liquidity enhancement measures during while for others it is about keeping excess liquidity in uncertain times.

Investment Objective the month which included Targeted Long-Term Repo Operations (TLTRO NBFCs, particularly smaller ones, have been sharply impacted as they

2.0) with a total liquidity injection of INR1 Tn (~USD13 Bn) to ensure bear the brunt of slowing growth and Asset Liability Management

The Fund aims to generate long-term ample liquidity to Non-Banking Financial Companies (NBFC), Mutual mismatch – on one hand they need to give a moratorium to their own

Fund Institutions (MFIs) and Micro, Small & Medium Enterprises customers but on the other hand, are not likely to receive the same from

returns by investing in well managed, (MSMEs) amongst others where it was needed the most. It also their lenders. Among our finance exposure Bajaj Finance, Bajaj Finserv

announced a special liquidity window of INR500 Bn (~USD6.6 Bn) to open and Cholamandalam have seen a sharp impact on their stock price. That

entrepreneurially driven, high quality a line of credit to MFIs in the wake of closure of six debt funds by a said, given the long-term structural appeal of the sector, the size of

prominent global asset manager (Franklin Templeton) to prevent opportunity and its significant effect on the economy, it is an important

Indian companies with the ability to contagion risk in the system. sector to have presence in, especially with stronger names such as those

As highlighted by the Government, more calibrated fiscal and monetary in the Fund portfolio. Moreover, the companies in the portfolio have

generate compounded earnings growth measures will be announced from time to time depending on the displayed an ability of navigating through multiple crises/challenges in the

past (2013 liquidity scare, demonetisation in 2016, ILFS crisis in 2018).

over long periods of time. The Fund uses economic situation. These measures will help the country in the rebuilding

While the current crisis is unprecedented on many counts and material

phase as the nation starts to move out of the lockdown in a graded/staged

adverse implication on FY21 performance is undeniable, we are confident

a disciplined, bottom-up, rules-based manner.

that well-managed financial entities will come out stronger and leaner and

As is the case across the globe, COVID-19 has clearly impacted the thus gain market share from relatively weaker names into the future.

investment approach to identify such Indian economy hard. The severity of impact will only be known once the

lockdowns are lifted and businesses start to function once again. While While the current pandemic has posed challenges for all companies,

companies that are trading at reasonable the timeline cannot be predicted, businesses that have a significantly there will emerge pockets of opportunity as we come out of the crisis. We

leveraged balance sheet will be impacted more so while cash rich continue to investigate such buying opportunities for the portfolio.

prices compared to their intrinsic value. businesses will be far more likely to emerge stronger and with increased Companies with low leverage and high-quality management that can

market share. We also believe that the shift from unorganized businesses position the businesses to ride out the crisis and take advantage of the

to organized will accelerate once the economy starts to normalize. opportunities will be the eventual winners. Whilst we expect short term

volatility to continue, our high focus on such companies should help us

Benchmark Businesses that have an ability to increase market share profitably should

deliver superior returns in the medium term.

continue to deliver superior value creation. These are the kind of

S&P BSE 500

Top 10 Holdings Sector Allocation

Fund Facts Sr. No. Stock Name Portfolio (%) Sector Portfolio (%)

1 PI Industries Ltd 8.4 Financials 21.9

Launch Date 06 July 2017

2 Divi's Laboratories Ltd 7.7 Consumer Staple 14.4

Total Fund Size USD 29.71 Mn

3 Pidilite Industries Ltd 7.3 Chemicals 14.1

Share Class A

4 Britannia Industries Ltd 7.2 Materials 14.1

NAV* 0.751

5 Dabur India Ltd 7.2 Industrials 10.5

Base Currency USD

6 Asian Paints Ltd 6.8 Consumer Discretionary 8.6

Management Fee 2.00% p.a

7 Kotak Mahindra Bank Ltd 6.1 Healthcare 7.7

Sales Charge Up to 5%

8 Havells India Ltd 5.7 Auto 7.3

Fund Domicile Singapore

9 Bajaj Finance Ltd 5.2 Cash 1.4

Fund Type Open-ended, Equity

10 MRF Ltd 5.2 Total

Pricing Daily

Total 66.8 100.0

Dealing cut-off 5:00pm Singapore The total may not add to 100 due to rounding.

Income Distribution Accumulated/Reinvested

Fund Performance

Investors Accredited Investors

USD Returns Fund (USD, %) Index (USD, %)

* as of 30 April 2020

Period A Class BSE500 Index MSCI India

1 Month 11.1 14.9 15.5

Fund Codes

3 Month -22.2 -22.7 -19.7

Share Class ISIN Bloomberg

6 Month -19.3 -21.9 -19.7

Class A SG9999016463 BBG00GTMC812

YTD -19.7 -23.1 -20.7

1 Year -14.9 -23.0 -21.5

Available to Accredited Investors/Institutional

Investors/Professional Investors in Singapore, Since Inception -24.9 -18.4 -13.5

Hong Kong, Switzerland and United Kingdom

Source: Bloomberg; Performance as of 30 April 2020

y

nl

O

s

or

di

te

In

d

ve

st

ASK India Opportunities Fund 1

Fund Factsheet - April 2020

re

cc

rA

Fo

Selling Legends

Notice to Residents of Singapore

In Singapore, the offer or invitation to subscribe for or purchase Units in the Sub-Funds, is an exempt offer made only: (i) to "institutional investors" pursuant to Section 304 of the Securities and Futures Act, Chapter

289 of Singapore (the "Act"), (ii) to "relevant persons" pursuant to Section 305(1) of the Act, (iii) to persons who meet the requirements of an offer made pursuant to Section 305(2) of the Act, or (iv) pursuant to, and in

accordance with the conditions of, other applicable exemption provisions of the Act (collectively, the "qualified persons").

The offer or invitation of the Units, does not relate to a collective investment scheme which is authorised under Section 286 of the Act or recognised under Section 287 of the Act. The Fund is not authorised or

recognised by the Monetary Authority of Singapore (the “MAS” or the "Authority") and the Units are not allowed to be offered to the retail public. Each Sub-Fund may be listed as a restricted scheme under the Sixth

Schedule to the Securities and Futures (Offers of Investments) (Collective Investment Schemes) Regulations of Singapore.

Notice to Residents of Switzerland

In Switzerland, the Fund may only be offered or distributed to qualified investors. The Fund's Representative in Switzerland is Oligo Swiss Fund Services SA, Av. Villamont 17, 1005 Lausanne, Switzerland, Tel: +41

21 311 17 77, email: info@oligofunds.ch. The Fund's paying agent is Banque Cantonale de Genève. Any Fund Documentation may be obtained free of charge from the Swiss Representative. In respect of the

Shares distributed in or from Switzerland, the place of performance and jurisdiction is Lausanne (Switzerland).

Notice to Residents of Hong Kong

This fund may not constitute an offer or invitation to the public in Hong Kong to acquire Units. Accordingly, unless permitted by the securities laws of Hong Kong, no person may issue or have in its possession for the

purposes of issue, this IM or any advertisement, invitation or document relating to Units, whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the

public in Hong Kong other than in relation to Units which are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” (as such term is defined in the Securities and Futures

Ordinance of Hong Kong (Cap. 571) (the “SFO”) and the subsidiary legislation made thereunder) or in circumstances which do not result in this IM being a “prospectus” as defined in the Companies Ordinances of

Hong Kong (Cap. 32) (the “CO”) or which do not constitute an offer or an invitation to the public for the purposes of the SFO or the CO. The offer of Units is personal to the person to whom this IM has been delivered

by or on behalf of the Sub-Funds, and a subscription for Units will only be accepted from such person. No person to whom a copy of this IM is issued may issue, circulate or distribute this IM in Hong Kong or make or

give a copy of this IM to any other person. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this IM, you should obtain independent professional advice.

Notice to Residents of United Kingdom

The Sub-Fund is a collective investment scheme pursuant to Section 235 of the Financial Services and Markets Act 2000, as amended (“FSMA”). It has not been authorised, or otherwise recognised or approved,

by the United Kingdom Financial Conduct Authority (the “FCA”) and, as an unregulated scheme, it cannot be promoted in the United Kingdom to the general public. Prospective Holders in the United Kingdom are

advised that all, or most, of the protections afforded by the United Kingdom regulatory system will not apply to an investment in the Sub-Fund and that compensation will not be available under the United Kingdom

Financial Services Compensation Scheme.

The Manager is not authorised by the FCA and, as such, may not make financial promotions in the United Kingdom unless an exemption to the restriction in Section 21 of FSMA is available. Accordingly in the United

Kingdom, the Memorandum, the Appendix and this Disclosure Document are only being communicated to and are directed only at: (i) persons falling within any of the categories of “investment professionals” as

defined in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”) and being persons having professional experience in matters relating to

investments; (ii) persons falling within any of the categories of “high-net-worth entities” as described in Article 49 of the Order; and (iii) any other person to whom it may otherwise lawfully be made. Persons of any

other description should not act or otherwise rely upon the Memorandum, the Appendix and this Disclosure Document or any of their contents.

Important Information

Note: Asset allocation and top holdings/issuers information provided pertain to the underlying fund. The document is prepared for information only and does not contain or constitute an offer, solicitation or

investment advice in any of the sub-funds of ASK Investment Fund. A copy of the Information memorandum (“IM”) and fund appendix is available and may be obtained from the Manager or any of our distributors.

Investors should read the Information Memorandum, Fund Appendix and consult a financial adviser before deciding to make any investment.

In the event of discrepancies between the marketing materials and the IM, the IM shall prevail. The value of the fund and the income from them, if any, may fall and rise. Past performance of the fund or the Manager

and any economic and market trends or forecast, is not indicative of the future or likely performance of the fund or the Manager. Neither the Manager, nor any of its associates, nor any director, or employee accept

any liability for any loss arising directly or indirectly from any use of this document.

This above information is based on information available as at 30 April 2020, unless otherwise stated. The Manager reserves the right to make any amendments to the information at any time without any notice.

This Factsheet is prepared for ‘A’ share class of AIOF1 and this advertisement has not been reviewed by the Monetary Authority of Singapore.

ASK Capital Management Pte Ltd, Registration Number 201104122N

Contact Us

For more information on the Sub-Fund and other share classes please contact:

ASK Capital Management Pte. Ltd. (Singapore)

Tel. No.: +65 6228 9669

Email: info@ask-capital.com

Website: www.askcapitalmanagement.com

Disclosure

Important information: Past performance is not indicative of future results. Units of the Fund are offered only pursuant to the Fund's current Information Memorandum and this

summary should not be construed as an offer to sell or for solicitation of an offer to buy or a recommendation for the securities of the Fund. Any information contained in this fact

sheet shall not be deemed to constitute as advice, an offer to sell/purchase or as an invitation or solicitation to do so for AIOF1 and or the Manager. Employees/ directors shall not

be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use of this information. Recipients of this information should exercise due care

VER/APR/01

and caution and read the Information Memorandum (if necessary obtaining the advice of other professionals) prior to taking any decision on the basis of this information.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Ultimate Options Trading GuideDocument49 pagesUltimate Options Trading GuideMatthew England58% (12)

- The Ultimate Step-By-Step Guide To Day Trading Penny StocksDocument66 pagesThe Ultimate Step-By-Step Guide To Day Trading Penny StocksAshleyHatcherNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Accounting ResearchDocument28 pagesAccounting ResearchRhanel Joy Cayube100% (2)

- IBanking Interview - LBO Model GuideDocument58 pagesIBanking Interview - LBO Model GuideElianaBakerNo ratings yet

- Equity Research Report SlidesDocument18 pagesEquity Research Report Slidesanton88beNo ratings yet

- Ong Yong v. TiuDocument3 pagesOng Yong v. TiuKenzo RodisNo ratings yet

- A Synopsis Report ON Long Term Investment Decision AT Kesoram Cement LTDDocument10 pagesA Synopsis Report ON Long Term Investment Decision AT Kesoram Cement LTDMOHAMMED KHAYYUMNo ratings yet

- SLHT Business Finance WEEK 910Document7 pagesSLHT Business Finance WEEK 910Ian OcheaNo ratings yet

- Asian Paints-NoidaDocument5 pagesAsian Paints-NoidaKartik JainNo ratings yet

- Seatwork PDFDocument5 pagesSeatwork PDFAnna ReyesNo ratings yet

- Dividends and Dividend Policy: Mcgraw-Hill/IrwinDocument24 pagesDividends and Dividend Policy: Mcgraw-Hill/IrwinKafil MahmoodNo ratings yet

- Working of Stock Market and Depository ServicesDocument59 pagesWorking of Stock Market and Depository ServicesSweta Singh0% (1)

- DCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsDocument5 pagesDCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsJustBNo ratings yet

- A Summer Training Project Report On: Investors Perception Towards Derivatives MarketDocument84 pagesA Summer Training Project Report On: Investors Perception Towards Derivatives MarketVishal SutharNo ratings yet

- Chapter 2 The Asset Allocation DecisionDocument64 pagesChapter 2 The Asset Allocation DecisionZeeshan SiddiqueNo ratings yet

- Schroder Dana Istimewa: Fund FactsheetDocument1 pageSchroder Dana Istimewa: Fund FactsheetbtishidbNo ratings yet

- Ethics CompilationDocument17 pagesEthics CompilationCleofe Mae Piñero AseñasNo ratings yet

- Omkar Speciality Chemicals Ltd.Document259 pagesOmkar Speciality Chemicals Ltd.adhavvikasNo ratings yet

- Industry & Market Trends - Hearing Aids PDFDocument3 pagesIndustry & Market Trends - Hearing Aids PDFsaurabh aggarwalNo ratings yet

- Ptmail - m1221 - Ss - 2 High Growth Stocks For A Millionaires Portfolio Dec21Document16 pagesPtmail - m1221 - Ss - 2 High Growth Stocks For A Millionaires Portfolio Dec21PIYUSH GOPALNo ratings yet

- Question No# 4Document4 pagesQuestion No# 4Javeria Feroze Memon100% (1)

- Mari Petroleum LTD Share CapitalDocument13 pagesMari Petroleum LTD Share CapitalNoor AmjadNo ratings yet

- Investment AccountingDocument13 pagesInvestment AccountingkautiNo ratings yet

- CEO Overconfidence and Financial CrisesDocument16 pagesCEO Overconfidence and Financial CrisesFab ManNo ratings yet

- Cmfas Module 8a 1st Edition Mock PaperDocument13 pagesCmfas Module 8a 1st Edition Mock PaperJkNo ratings yet

- Corporate Finance 1st Edition Booth Test BankDocument32 pagesCorporate Finance 1st Edition Booth Test BankChristinaCrawfordigdyp100% (13)

- Metro Pacific Investments Corporation SEC Form 17 Q 14august2023Document141 pagesMetro Pacific Investments Corporation SEC Form 17 Q 14august2023francisjhamesluzadasNo ratings yet

- Bindura University of Science EducationDocument58 pagesBindura University of Science EducationMaxwell MusemwaNo ratings yet

- 250 Super MidCapsDocument38 pages250 Super MidCapspriya.sunderNo ratings yet

- Indian Financial InstitutionsDocument26 pagesIndian Financial InstitutionsRimple Abhishek Delisha ViraajvirNo ratings yet