Professional Documents

Culture Documents

sTOCK PLANS2

Uploaded by

Franz Apple0 ratings0% found this document useful (0 votes)

14 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagessTOCK PLANS2

Uploaded by

Franz AppleCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

I.

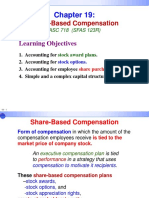

Stock Award Plans (T19-1)

A. The compensation is a grant of shares of stock.

B. The shares usually are restricted so that benefits are tied to continued employment.

1. Usually shares are subject to forfeiture if employment is terminated within some

specified number of years from the date of grant.

2. The employee cannot sell the shares during the restriction period.

C. The compensation is simply the market price of the stock at the grant date.

1. Compensation is accrued as expense over the service period for which

participants receive the shares.

2. The service period usually is the period from the date of grant to when restrictions

are lifted (the vesting date). (T19-2)

D. If restricted stock is forfeited, related entries previously made would simply be

reversed.

II. Stock Option Plans (T19-3)

A. Allow recipients the option to purchase (a) a specified number of shares of the firm's

stock, (b) at a specified price, (c) during a specified period of time.

B. For tax purposes, plans can either qualify as an “incentive stock option plan” under the

Tax Code or be "unqualified plans." Under a qualified incentive plan, the recipient

pays no income tax until any shares acquired are subsequently sold. On the other hand,

the company gets no tax deduction at all. With a nonqualified plan the employee can’t

delay paying income tax, but the employer is permitted to deduct the difference

between the exercise price and the market price at the exercise date. (T19-4)

C. The accounting objective is to report the fair value of compensation expense during the

period of service for which the compensation is given. (T19-5)

D. Compensation is measured at the grant date, estimated using an option-pricing model

that considers the exercise price and expected term of the option, the current market

price of the underlying stock and its expected volatility, expected dividends, and the

expected risk-free rate of return.

E. When forfeiture estimates change, the cumulative effect on compensation is reflected

in current earnings. (T19-6)

F. When options are exercised, cash is debited for the amount received, and stock accounts

replace paid-in capital – stock options. (T19-7)

G. If compensation from a stock option depends on meeting a performance target, then

whether we record compensation depends on whether or not we feel it’s probable the

target will be met. (T19-8)

H. If the target is based on changes in the market rather than on performance, we record

compensation as if there were no target.

I. Under U.S. GAAP, a deferred tax asset is created for the cumulative amount of the fair

value of the options expensed. Under IFRS, the deferred tax asset isn’t created until

the award is “in the money;” that is, has intrinsic value. (T19-9)

J. If recipients gradually become eligible to exercise their options rather than all at once,

the plan is said to have “graded vesting.” In such a case, most companies view each

vesting group (or tranche) separately, as if it were a separate award. Companies also

are allowed to account for the entire award on straight-line basis over the entire vesting

period. Either way, the company must recognize at least the amount of the award that

has vested by that date.

You might also like

- Adp QUANIC MARTIN-converted (1st Try)Document12 pagesAdp QUANIC MARTIN-converted (1st Try)Quanic Martin100% (1)

- Advanced Financial Accounting: Solutions ManualDocument18 pagesAdvanced Financial Accounting: Solutions ManualTịnh DiệpNo ratings yet

- Notes On Excise TaxesDocument19 pagesNotes On Excise TaxesLalaine ReyesNo ratings yet

- Share-Based Compensation-Share OptionsDocument16 pagesShare-Based Compensation-Share OptionsLawrence YusiNo ratings yet

- Fins2643 Final NotesDocument27 pagesFins2643 Final NotesDaniel GohNo ratings yet

- 1.Share-Based CompensationDocument3 pages1.Share-Based CompensationFranz AppleNo ratings yet

- Tax Implications5Document5 pagesTax Implications5Franz AppleNo ratings yet

- 3.universal CommunicationsDocument4 pages3.universal CommunicationsFranz AppleNo ratings yet

- Share-Based Compensation: Learning ObjectivesDocument48 pagesShare-Based Compensation: Learning ObjectivesMark S MadsenNo ratings yet

- Part B: Earnings Per Share: Not SubtractedDocument3 pagesPart B: Earnings Per Share: Not SubtractedFranz AppleNo ratings yet

- Advisory Note On Stock OptionsDocument5 pagesAdvisory Note On Stock Optionssmita goelNo ratings yet

- Variable Consideration - Price Dependent On Future Event/sDocument3 pagesVariable Consideration - Price Dependent On Future Event/scarlamiranda27No ratings yet

- 2009 F-5 Class NotesDocument3 pages2009 F-5 Class NotesChris Tian FlorendoNo ratings yet

- Part - 1 - Dashboard - Revenue RecognitionDocument5 pagesPart - 1 - Dashboard - Revenue RecognitionbagayaobNo ratings yet

- Quiz 4 Dilutive Securities and EPSDocument6 pagesQuiz 4 Dilutive Securities and EPSKirstein Hammet DionilaNo ratings yet

- Tax Planning Mgt. DecisionsDocument18 pagesTax Planning Mgt. Decisionsnandan velankarNo ratings yet

- JK Shah BookDocument147 pagesJK Shah Bookka28000111222No ratings yet

- R14 - Lesson 5 - Share-Based CompensationDocument8 pagesR14 - Lesson 5 - Share-Based CompensationDhar CHanNo ratings yet

- TCP-V1 2024Document244 pagesTCP-V1 2024Roshan SNo ratings yet

- Share-Based Compensation-Share OptionsDocument16 pagesShare-Based Compensation-Share OptionsMiaNo ratings yet

- 32171final ST Mat p1 Jan13 cp7Document35 pages32171final ST Mat p1 Jan13 cp7sivanpillai ganesanNo ratings yet

- AS 9 - Revenue RecognitionDocument15 pagesAS 9 - Revenue RecognitionMansi NigadeNo ratings yet

- Stockholder'S Equity: CompositionDocument4 pagesStockholder'S Equity: Compositionalfred_gabriel_1No ratings yet

- IFRS 15 - Revenue From Contracts With CustomersDocument7 pagesIFRS 15 - Revenue From Contracts With CustomersamananandxNo ratings yet

- MODULE Midterm FAR 3 Share BasedDocument17 pagesMODULE Midterm FAR 3 Share BasedKezNo ratings yet

- ICAI Guidance Note - Employee Share-Based PaymentsDocument66 pagesICAI Guidance Note - Employee Share-Based PaymentssagarganuNo ratings yet

- Restricted StockDocument3 pagesRestricted StockAn NguyễnNo ratings yet

- Ind AS 102 - Share Based PaymentDocument7 pagesInd AS 102 - Share Based PaymentKashika AgarwalNo ratings yet

- Act 6J03 - Comp2 - 1stsem05-06Document12 pagesAct 6J03 - Comp2 - 1stsem05-06ROMAR A. PIGANo ratings yet

- CMS Business School (Jain Deemed-To-Be University)Document7 pagesCMS Business School (Jain Deemed-To-Be University)Bijosh ThomasNo ratings yet

- 2009 F-7 Class NotesDocument3 pages2009 F-7 Class NotesChris Tian FlorendoNo ratings yet

- Chapter 2 Current LiabilitiesDocument7 pagesChapter 2 Current LiabilitiesVirgilio Evangelista100% (1)

- Test Bank - Far2 CparDocument17 pagesTest Bank - Far2 CparChristian Go100% (1)

- Part - 1 - Dashboard - IFRS Differences in AccountingDocument3 pagesPart - 1 - Dashboard - IFRS Differences in AccountingbagayaobNo ratings yet

- (1 Copy) Abmf2093Document10 pages(1 Copy) Abmf2093Cp SeowNo ratings yet

- Accounting - Investment AccountDocument11 pagesAccounting - Investment AccountDevansh ChhedaNo ratings yet

- Notes IFRS 2 Share Based PaymentsDocument32 pagesNotes IFRS 2 Share Based Paymentssteven lino2No ratings yet

- Property, Plant, and Equipment: Acquisition and Disposal: Chapter ObjectivesDocument20 pagesProperty, Plant, and Equipment: Acquisition and Disposal: Chapter ObjectivesCatherine Joy MoralesNo ratings yet

- Ias 19 - Employee Benefits QUESTION 57-17Document9 pagesIas 19 - Employee Benefits QUESTION 57-17Janella Gail ArenasNo ratings yet

- Bonds and Long Term LiabilitiesDocument5 pagesBonds and Long Term LiabilitiesDivine CuasayNo ratings yet

- 221 PrintDocument23 pages221 PrintChara etangNo ratings yet

- Rev RogDocument3 pagesRev RogDibyansu KumarNo ratings yet

- InvestmentsDocument2 pagesInvestmentsAlora EuNo ratings yet

- Pas 19,20,21Document53 pagesPas 19,20,21ssamporna19157No ratings yet

- Afar 06-03 Long Term Construction ContractDocument6 pagesAfar 06-03 Long Term Construction ContractDjenny De GuzmanNo ratings yet

- REVISED EMPLOYEES BENIFITS IAS 19 and IFRS 2Document8 pagesREVISED EMPLOYEES BENIFITS IAS 19 and IFRS 2It'z Pragmatic IbrahimNo ratings yet

- Study MaterialDocument7 pagesStudy MaterialGochi GamingNo ratings yet

- As 13 - Investment AccountsDocument6 pagesAs 13 - Investment AccountsJiya Mary JamesNo ratings yet

- IFRS 2 Share Based Payment Final Revision ChecklistDocument17 pagesIFRS 2 Share Based Payment Final Revision ChecklistEmezi Francis ObisikeNo ratings yet

- Revenue RecognitionDocument9 pagesRevenue RecognitionBerlian NovitaNo ratings yet

- MATERIALDocument8 pagesMATERIALVatsal ParmarNo ratings yet

- 1 - Current LiabilitiesDocument4 pages1 - Current LiabilitiesAlex JeonNo ratings yet

- SERIES 3 NFA Test Exam QuestionsDocument10 pagesSERIES 3 NFA Test Exam QuestionsAndreiNo ratings yet

- Accounting Intermediate Task E13-7Document8 pagesAccounting Intermediate Task E13-7Dodi PrasetyaNo ratings yet

- Chapter 18 IRMDocument33 pagesChapter 18 IRMWissamMouakNo ratings yet

- Chapter 20: Hybrid Financing: Preferred StockDocument4 pagesChapter 20: Hybrid Financing: Preferred StockChaudhary AliNo ratings yet

- Share Based PaymentsDocument3 pagesShare Based PaymentsPushTheStart GamingNo ratings yet

- PFRS 9, Paragraph 4.1.2, Provides That A Financial Asset Shall MeasuredDocument3 pagesPFRS 9, Paragraph 4.1.2, Provides That A Financial Asset Shall MeasuredSwai RosendeNo ratings yet

- Share Based NotesDocument5 pagesShare Based NotesJP MJNo ratings yet

- Dysas Center For Cpa Review (Dccpar) : Financial AccountingDocument9 pagesDysas Center For Cpa Review (Dccpar) : Financial AccountingFernando III PerezNo ratings yet

- NFRS 15 - Revenue From Contracts With CustomerDocument18 pagesNFRS 15 - Revenue From Contracts With CustomerApilNo ratings yet

- SBR Assigment-Liam'sDocument7 pagesSBR Assigment-Liam'sbuls eyeNo ratings yet

- Multiple-Choice QuestionsDocument11 pagesMultiple-Choice QuestionsFranz AppleNo ratings yet

- Lecture Outline: Share-Based Compensation and Earnings Per ShareDocument3 pagesLecture Outline: Share-Based Compensation and Earnings Per ShareFranz AppleNo ratings yet

- Buffet-Line CorpDocument1 pageBuffet-Line CorpFranz AppleNo ratings yet

- 5.sovran Metals CorporationDocument4 pages5.sovran Metals CorporationFranz AppleNo ratings yet

- 5.rensing, IncDocument1 page5.rensing, IncFranz AppleNo ratings yet

- Parsons CoDocument1 pageParsons CoFranz AppleNo ratings yet

- 3.wyrick CompanyDocument1 page3.wyrick CompanyFranz AppleNo ratings yet

- Ch06 Process CostingDocument11 pagesCh06 Process CostingFranz AppleNo ratings yet

- UPSIMI V CIR (2018) Justice MartiresDocument5 pagesUPSIMI V CIR (2018) Justice MartiresJesimiel CarlosNo ratings yet

- Basic TaxationDocument45 pagesBasic TaxationTessa De Claro89% (9)

- Notes - Business Environment-KMB-201 Unit-1Document30 pagesNotes - Business Environment-KMB-201 Unit-1Jaspreet BhatiaNo ratings yet

- SUB: Letter of Intent For Leasing Out Unit NoDocument1 pageSUB: Letter of Intent For Leasing Out Unit NoHoney ShuklaNo ratings yet

- G.R. No. 203754Document4 pagesG.R. No. 203754Ryw100% (1)

- Module 6 Documentary Stampt Tax PDFDocument22 pagesModule 6 Documentary Stampt Tax PDFTitania ErzaNo ratings yet

- Invoice 23001479Document1 pageInvoice 23001479Laxman AdhikariNo ratings yet

- 1cmh SampleDocument41 pages1cmh SampleBattlefield HackerNo ratings yet

- Presentation On Clubbing of Income Under Income TaxDocument11 pagesPresentation On Clubbing of Income Under Income TaxCA Arpit Gupta100% (2)

- TAX 655 Milestone Three Guidelines and RubricDocument2 pagesTAX 655 Milestone Three Guidelines and RubricAmit KumarNo ratings yet

- Consti2 PolicepowerDocument132 pagesConsti2 PolicepowerlitoingatanNo ratings yet

- M&A ProcessDocument58 pagesM&A ProcessKashhyap PatelNo ratings yet

- Times Leader 09-09-2012Document77 pagesTimes Leader 09-09-2012The Times LeaderNo ratings yet

- Globo PLC H1 2015 ReportDocument20 pagesGlobo PLC H1 2015 Reportjenkins-sacadonaNo ratings yet

- Maddison Articles Moghul 3Document30 pagesMaddison Articles Moghul 3Arvind Sanu MisraNo ratings yet

- Accounting Voucher PDFDocument1 pageAccounting Voucher PDFraio interionfashionNo ratings yet

- Chart of Accounts SamplesDocument9 pagesChart of Accounts Samplesredro50% (2)

- Commercial Law Cases 102212212Document66 pagesCommercial Law Cases 102212212tyansi lehetyNo ratings yet

- IRR of RA 10752Document15 pagesIRR of RA 10752Jea BelindaNo ratings yet

- CGT AssignementDocument4 pagesCGT AssignementBrandon SibandaNo ratings yet

- IRS Audit Guide For Farm Hobby LossesDocument81 pagesIRS Audit Guide For Farm Hobby LossesSpringer Jones, Enrolled Agent100% (1)

- Discontinued OperationsDocument2 pagesDiscontinued OperationsBwwwiiiiiNo ratings yet

- An AHP Decision Model For Facility Location SelectionDocument14 pagesAn AHP Decision Model For Facility Location Selectionyogesh85No ratings yet

- 2 Republic Vs Guinto AldanaDocument10 pages2 Republic Vs Guinto Aldanamary elenor adagioNo ratings yet

- FormDocument40 pagesFormSundar PabbareddyNo ratings yet

- 200 QuestionsDocument36 pages200 Questionsnicacadavero06No ratings yet

- Surfside Beach PPP DataDocument4 pagesSurfside Beach PPP DataWMBF NewsNo ratings yet