Professional Documents

Culture Documents

Perocho Audit Prob Final Quiz 2

Uploaded by

Vinz Patrick E. Perocho0 ratings0% found this document useful (0 votes)

8 views5 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views5 pagesPerocho Audit Prob Final Quiz 2

Uploaded by

Vinz Patrick E. PerochoCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

VINZ PATRICK EDIOS PEROCHO BSA-3

Problem 1: Audit of Chun Corporation

Chun Corporation

Statement of Financial Performance

For the period ended, December 2017

Net Sales PHP 495,554.00

Less: Costs of Goods Sold PHP 222,600.00

Gross Profit PHP 272,954.00

Less: Operating Expenses

General and Administrative Expenses PHP 69,587.00

Selling Expenses PHP 63,473.00

Operating Income PHP 139,894.00

Other revenues and expenses

Gain on Sale of Investment PHP 89,340.00

Dividend Income PHP 7,590.00

Interest Expense -PHP 12,650.00

Loss from Settlement of Litigation -PHP 35,000.00

Loss from Expropriation of Properties -PHP 48,000.00

Loss of Warehouse due to Disaster -PHP 42,150.00

Loss on written-off inventory -PHP 17,024.00 -PHP 57,894.00

Income before tax PHP 82,000.00

Less: Income Tax 32% PHP 26,240.00

Net Income PHP 55,760.00

Chun Corporation

Statement of Changes in Retained Earnings

For the period ended, December 2017

Retained Earnings, January 1 PHP 187,000.00

Correction Error - unrecorded revenue PHP 60,000.00

Corrected beginning balance PHP 247,000.00

Add: Net Income for the period PHP 55,760.00

Dividends declared during the year -PHP 80,000.00

Retained Earnings, Decemeber 31 PHP 222,760.00

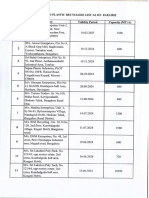

Problem 2: Audit of Brilliant Cosmetics Inc.

1.) Sales PHP 451,000.00

Sales Returns and Allowances -PHP 3,900.00

Sales Discounts -PHP 880.00

Freight Charges PHP 3,500.00

Adjusted Net Sales PHP 449,720.00 b

2.) Inventory, beg. PHP 89,700.00

Purchases PHP 141,600.00

Purchase returns and allowances -PHP 8,496.00

Freight-in PHP 5,525.00

Accrued Freght-in PHP 570.00

Adjusted Costs of Goods Available for Sale PHP 228,899.00 c

3.) Unadjusted Inventory, end PHP 20,550.00

Goods held for Consignment PHP 18,600.00

Adjusted Ending Inventory PHP 39,150.00 d

4.) Sales Salaries and Commissions PHP 25,000.00

Advertising Expense PHP 16,090.00

Legal Services PHP 2,225.00

Insurance and Licenses PHP 7,680.00

Travel Expense-Sales Representatives PHP 4,560.00

Depreciation Expense-Sales/Delivery Equipment PHP 6,100.00

Depreciation Expense - Office Equipment PHP 4,200.00

Utilities PHP 6,400.00

Telephone and Postage PHP 1,475.00

Miscellenous Selling Expenses PHP 2,740.00

Officer's Salaries PHP 36,600.00

Unadjusted Balance PHP 113,070.00

Freight out PHP 3,500.00

Unrecorded Sales Commission PHP 108.00

Increase in Doubtful Accounts PHP 5,060.00

Unrecorded Advertising Expense PHP 606.00

Unrecorded Supplies Expense PHP 955.00

Unrecorded Depreciation PHP 650.00

Operating Expenses PHP 123,933.00 a

5.) Supplies Inventory PHP 2,180.00

Supplies on hand -PHP 1,225.00

Supplies Expense PHP 955.00 b

6.) Unadjusted Doubtful Accounts -PHP 160.00

Increase in Doubtful Accounts PHP 5,220.00

Adjusted Doubtful Accounts Expense PHP 5,060.00 b

7.) Unadjusted Interest Revenue PHP 550.00

Unrecorded Interest Receivable PHP 560.00

Adjusted Interest Revenue PHP 1,110.00 d

8.) Adjusted Net Sales PHP 449,720.00

Less: Cost of Goods Sold

Goods Avail for Sale 228,899

Ending Inventory (39,150) PHP 189,749.00

Gross Profit PHP 259,971.00

Less: Operating Expenses PHP 123,933.00

Operating Profit PHP 136,038.00

Other Expenses and Revenues

Interest Expense (4,520)

Loss on Sale of Equipment (72,600)

Interest Revenue 1,110

Gain on Sale of Assets 7,820

Dividend Income 5,150 -PHP 63,040.00

Net Income from continuing operation before taxes PHP 72,998.00 c

9.) Income from continuing operations before tax PHP 72,998.00

Multiply by: Income Tax Rate PHP 0.30

PHP 21,899.40

Income Taxes or 21,900 c

10.) Income from continuing operations after taxes PHP 51,098.00

Add: Gain from Discontinued Operation (net of tax) PHP 28,000.00

Net Income to be closed in retained earnings PHP 79,098.00 a

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mile High Cycles CaseDocument6 pagesMile High Cycles CaseShubh TanejaNo ratings yet

- Rural BanksDocument11 pagesRural BanksArah Pucayan Porras100% (1)

- 001305012941Document3 pages001305012941RAJEEV MAHESHWARINo ratings yet

- Fstraders Introduction To Our Trading Strategy Credits To B.MDocument22 pagesFstraders Introduction To Our Trading Strategy Credits To B.MsihodahNo ratings yet

- List Member PIPALDocument38 pagesList Member PIPALFahad khandokerNo ratings yet

- P4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFDocument45 pagesP4 Chapter 04 Risk Adjusted WACC and Adjusted Present Value PDFasim tariqNo ratings yet

- Vocabulary To Describe TrendsDocument2 pagesVocabulary To Describe TrendsUlyana RyuminaNo ratings yet

- Plastic Recyclers As On 01.03.2022 KARNATAKADocument10 pagesPlastic Recyclers As On 01.03.2022 KARNATAKAEaswari PrabhuNo ratings yet

- A. - Oreas2023 02 088Document12 pagesA. - Oreas2023 02 088Hugo RodriguezNo ratings yet

- MECLDocument3 pagesMECLVivek KumarNo ratings yet

- Strategy Formulation: Business StrategyDocument29 pagesStrategy Formulation: Business Strategynazek aliNo ratings yet

- ცინცაძე კალისტრატე. ქადაგებები და სიტყვებიDocument306 pagesცინცაძე კალისტრატე. ქადაგებები და სიტყვებიNikoloz NikolozishviliNo ratings yet

- Chapter 1: Meaning, Characteristics and Rationales of Public EnterprisesDocument80 pagesChapter 1: Meaning, Characteristics and Rationales of Public EnterprisesHabteweld EdluNo ratings yet

- Buku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDocument1 pageBuku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDanyep IdrisNo ratings yet

- Ge 113 Module 2Document17 pagesGe 113 Module 2Jean Ann CatanduanesNo ratings yet

- Goolsbee Micro CH15Document4 pagesGoolsbee Micro CH15Carlos García SandovalNo ratings yet

- Regulation of Insurance Companies & Irda, Features of Insurance ContractsDocument2 pagesRegulation of Insurance Companies & Irda, Features of Insurance Contractsvijayadarshini vNo ratings yet

- Pengaruh Komposisi Media Tanam Terhadap Pertumbuhan Dan Hasil Tanaman Pakcoy (Brassica Chinensis L.)Document10 pagesPengaruh Komposisi Media Tanam Terhadap Pertumbuhan Dan Hasil Tanaman Pakcoy (Brassica Chinensis L.)Purwita Sari NugrainiNo ratings yet

- Broad Band INV-TG-B1-70666689-101354947646-July-2023Document5 pagesBroad Band INV-TG-B1-70666689-101354947646-July-2023bhargavaNo ratings yet

- Half Year Report 30.06.2020 in Accordance With FSA Regulation No.5 - 2018Document112 pagesHalf Year Report 30.06.2020 in Accordance With FSA Regulation No.5 - 2018Amilia MarinNo ratings yet

- Market Microstructure and Strategies: Financial Markets and Institutions, 7e, Jeff MaduraDocument41 pagesMarket Microstructure and Strategies: Financial Markets and Institutions, 7e, Jeff MaduraMaulanaNo ratings yet

- Example 2.6: The Demand For Gasoline and AutomobilesDocument1 pageExample 2.6: The Demand For Gasoline and AutomobilesSushmita ShubhamNo ratings yet

- Development Bank of Namibia SME Business Plan GuideDocument2 pagesDevelopment Bank of Namibia SME Business Plan Guideroger100% (1)

- Lecture 2 HS1340Document14 pagesLecture 2 HS1340SUDHANSHU KUMARNo ratings yet

- Digital Banking and Alternative SystemsDocument31 pagesDigital Banking and Alternative SystemsRameen ZafarNo ratings yet

- The Richest Man in BabylonDocument3 pagesThe Richest Man in BabylonHyamber Dennis IorpuuNo ratings yet

- UPSC EPFO EOAO and APFC 1Document143 pagesUPSC EPFO EOAO and APFC 1Raj KumarNo ratings yet

- The Contribution of Tourism To Socio-Economic Development: Myth or Reality?Document29 pagesThe Contribution of Tourism To Socio-Economic Development: Myth or Reality?Ken ReyesNo ratings yet

- Auto Servis Bondowoso EMM Catalogus 2020 Colad Hamach RoninTools LRDocument104 pagesAuto Servis Bondowoso EMM Catalogus 2020 Colad Hamach RoninTools LRsupriyanto yusufNo ratings yet

- History: DiscoveringDocument20 pagesHistory: DiscoveringDaniel Gabriel PunoNo ratings yet