Professional Documents

Culture Documents

Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 1 & 2

Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 1 & 2

Uploaded by

Ma Teresa B. CerezoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 1 & 2

Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 1 & 2

Uploaded by

Ma Teresa B. CerezoCopyright:

Available Formats

ADVANCE ACCOUNTING 2015 | ANTONIO DAYAG JR.

Chapter 15

Problem I

Investment in Shy Inc. [P2,500,000 + (15,000 P40)] 3,100,000

Cash 2,500,000

Common Stock 30,000

Paid in capital in excess of par (P40 - P2) 15,000 570,000

Paid in capital in excess of par 30,000

Acquisition Expense 67,000

Deferred Acquisition Charges 90,000

Acquisition Costs Payable 7,000

Problem II

Cash consideration transferred P 300,000

Contingent performance obligation __15,000

Fair value of Subsidiary P 315,000

Less: Book value of SS Company (P90,000 + P100,000) 190,000

Allocated excess P125,000

Less: Over/under valuation of assets and liabilities:

Increase in building: P40,000 x 100% P 40,000

Increase in customer list: P22,000 x 100% 22,000

Increase in R&D: P30,000 x 100% 30,000 __92,000

Goodwill P 33,000

Investment in SS Company 315,000

Cash 300,000

Estimated Liability on Contingent Consideration 15,000

Acquisition Expense (or Retained earnings) 10,000

Cash 10,000

Not Required: The working paper eliminating entry on the date of acquisition, 6/30/20x4 would be:

Receivables 80,000

Inventory 70,000

Buildings 115,000

Equipment 25,000

Customer list 22,000

Capitalized R&D 30,000

Goodwill 33,000

Current liabilities 10,000

Long-term liabilities 50,000

Investment in SS Company 315,000

You might also like

- Financial Statements Answers FFFFFFFFFFF PDFDocument27 pagesFinancial Statements Answers FFFFFFFFFFF PDFJHEYNo ratings yet

- Investment BankingDocument7 pagesInvestment BankingSuvash KhanalNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- WorldCom ScandalDocument2 pagesWorldCom ScandalchulipzNo ratings yet

- Solution Chapter 15Document36 pagesSolution Chapter 15Jane Ellaine BantaNo ratings yet

- Work Sheet Moises Dondoyano Information SystemDocument1 pageWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)

- M&ADocument13 pagesM&AMouneeshNo ratings yet

- Dr. Who Accounting Cycle 2020 2021Document18 pagesDr. Who Accounting Cycle 2020 2021Jasmine P. Manlungat - EMERALDNo ratings yet

- 2.1.1 Toshiba Accounting Fraud - CaseDocument14 pages2.1.1 Toshiba Accounting Fraud - CaseThe Brain Dump PH100% (1)

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- PDF Solution Manual Partnership Amp Corporation 2014 2015pdfDocument85 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015pdfGenevieve Anne AlagonNo ratings yet

- History With PicturesDocument10 pagesHistory With PicturesBaylon Rachel100% (1)

- International Database Contry WiseDocument221 pagesInternational Database Contry WiseLeo100% (2)

- Final AccountDocument7 pagesFinal Accountswati100% (3)

- Activity Review StatementDocument5 pagesActivity Review Statementangel ciiiNo ratings yet

- Chapter 2 - MCDocument12 pagesChapter 2 - MCMiya Crizxen RevibesNo ratings yet

- Consolidated FS MCDocument2 pagesConsolidated FS MCRyan Prado AndayaNo ratings yet

- UNIT 3 Accounts Receivable PDFDocument11 pagesUNIT 3 Accounts Receivable PDFVilma HermosadoNo ratings yet

- Homework Presentation of Financial StatementsDocument1 pageHomework Presentation of Financial StatementsAmy SpencerNo ratings yet

- Investment in AssociateDocument5 pagesInvestment in AssociateLorence Patrick LapidezNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Stage 1 Ffa3Document3 pagesStage 1 Ffa3Khalid AzizNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Afar JNDocument2 pagesAfar JNjasonnumahnalkelNo ratings yet

- Accounting For Business Combinations Pre7 - MidtermDocument1 pageAccounting For Business Combinations Pre7 - MidtermJalyn Jalando-onNo ratings yet

- BAb V Buku Bu IInDocument6 pagesBAb V Buku Bu IInAditya Agung SatrioNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- Accounts SOL 2022Document12 pagesAccounts SOL 2022akshitapaul19No ratings yet

- Year 2Document10 pagesYear 2Joeven DinawanaoNo ratings yet

- Chapter 17 Answer Key-1Document4 pagesChapter 17 Answer Key-1NCTNo ratings yet

- 7-3 PT Pandu Dan PT SadewaDocument2 pages7-3 PT Pandu Dan PT SadewaTeam 1No ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Solution Cash FlowDocument7 pagesSolution Cash FlowritamNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- BSA 315 Accounting For Business CombinationDocument5 pagesBSA 315 Accounting For Business CombinationJeth MahusayNo ratings yet

- Far Chapt6 Ass1 AchasDocument6 pagesFar Chapt6 Ass1 AchasAshley AchasNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- Ans 31 To 41Document2 pagesAns 31 To 41Mallet S. GacadNo ratings yet

- Chapter # 03 ProblemsDocument99 pagesChapter # 03 Problemsruman mahmoodNo ratings yet

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- 5Document3 pages5Janea Lorraine TanNo ratings yet

- Chapter 4 Caselette Audit of ReceivablesDocument37 pagesChapter 4 Caselette Audit of ReceivablesXXXXXXXXXXXXXXXXXXNo ratings yet

- Local Media479648801608356881Document8 pagesLocal Media479648801608356881Joeven DinawanaoNo ratings yet

- Q No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditDocument4 pagesQ No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditNAFEES NASRUDDIN PATEL0% (1)

- DELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSDocument2 pagesDELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSLoren's Acads AccountNo ratings yet

- Apple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating ActivitiesDocument3 pagesApple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating ActivitiesJaime Alexander PENA VILLABONANo ratings yet

- Advacc 2Document4 pagesAdvacc 2RynveeNo ratings yet

- Sample Trial BalanceDocument2 pagesSample Trial BalanceNikka VelascoNo ratings yet

- Sample Illustration Financial StatementDocument3 pagesSample Illustration Financial StatementJuvy Jane DuarteNo ratings yet

- Audit of FS QuizDocument3 pagesAudit of FS QuizGwyneth TorrefloresNo ratings yet

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- Toaz - Info Prelim Midterm PRDocument98 pagesToaz - Info Prelim Midterm PRClandestine SoulNo ratings yet

- Ex of Cash Flow AnalysisDocument7 pagesEx of Cash Flow AnalysisS. Chakrabarty MeconNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- Far CH7.P7 CH8.P5&7Document4 pagesFar CH7.P7 CH8.P5&7she kioraNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Afar Assign#01. H - JikDocument5 pagesAfar Assign#01. H - JikjasonnumahnalkelNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachDocument2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 6Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 6Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Document4 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Company Ex - Trial Balance - 2012Document7 pagesCompany Ex - Trial Balance - 2012Ma Teresa B. CerezoNo ratings yet

- Incremental Analysis QiuzzerDocument4 pagesIncremental Analysis QiuzzerMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Document2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Ma Teresa B. CerezoNo ratings yet

- Account ID Account Description: Company ExDocument14 pagesAccount ID Account Description: Company ExMa Teresa B. CerezoNo ratings yet

- Statement of CF Company Ex - 2012Document3 pagesStatement of CF Company Ex - 2012Ma Teresa B. CerezoNo ratings yet

- Sem 4 PRDocument50 pagesSem 4 PRMohit AhujaNo ratings yet

- PARTCOR Study GuideDocument2 pagesPARTCOR Study GuideCedric YabyabinNo ratings yet

- CH 6Document18 pagesCH 6Himanshu VermaNo ratings yet

- UTV India Investment CaseDocument3 pagesUTV India Investment CaseRohit ThapliyalNo ratings yet

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Dr. Ram Manohar Lohia National Law University Lucknow 2020Document22 pagesDr. Ram Manohar Lohia National Law University Lucknow 2020simran yadavNo ratings yet

- Top 25 Banking European Edition 2010Document271 pagesTop 25 Banking European Edition 2010Nick EwenNo ratings yet

- Ar Antam 2012 PDFDocument597 pagesAr Antam 2012 PDFYudha PratamaNo ratings yet

- Table Cards TVDocument6 pagesTable Cards TVharishjoshinainitalNo ratings yet

- What Is The Pecking Order Theory-2Document4 pagesWhat Is The Pecking Order Theory-2Sonali BhosaleNo ratings yet

- CORPORATIONDocument54 pagesCORPORATIONThu ThảoNo ratings yet

- Morgan Stanley: About The CompanyDocument1 pageMorgan Stanley: About The Companyaakash urangapuliNo ratings yet

- 3.1.2 Business GrowthDocument8 pages3.1.2 Business GrowthAnuvrat ShankerNo ratings yet

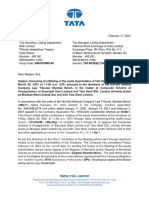

- Tata CorusDocument16 pagesTata CorusTarun Daga100% (2)

- NSE Futures Lot SizeDocument4 pagesNSE Futures Lot SizePeter SamualNo ratings yet

- Tata Steel Limited AnnouncementDocument3 pagesTata Steel Limited AnnouncementEsha ChaudharyNo ratings yet

- Financial Accounting 3BDocument10 pagesFinancial Accounting 3BPRECIOUSNo ratings yet

- Corporate LawDocument36 pagesCorporate LawJahnnavi SarkhelNo ratings yet

- Annual Report 2020 PT Berlina TBKDocument348 pagesAnnual Report 2020 PT Berlina TBKBrown kittenNo ratings yet

- Radio Shack Trust LawsuitDocument72 pagesRadio Shack Trust LawsuitChristopher ZaraNo ratings yet

- ISJ016Document108 pagesISJ0162imediaNo ratings yet

- BECGDocument13 pagesBECGaastha giriNo ratings yet

- Kingsbury AR - 2012 PDFDocument52 pagesKingsbury AR - 2012 PDFSanath FernandoNo ratings yet

- Case 1.2 Professional and Ethical IssuesDocument1 pageCase 1.2 Professional and Ethical IssuesCamille LawsinNo ratings yet