Professional Documents

Culture Documents

Week 9 Tutorial Solutions

Uploaded by

Farah PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 9 Tutorial Solutions

Uploaded by

Farah PatelCopyright:

Available Formats

Tutorial 9 (Week beginning 23th September 2019)

Topic 8: Special journals and control accounts as a lead-in to cash

management (bank reconciliation)

SOLUTIONS TO HOMEWORK QUESTIONS

1. BE6.5 (p. 397)

(a) Cash receipts journal

(b) Cash payments journal

(c) Cash payments journal

(d) Sales journal

(e) Purchases journal

(f) Cash receipts journal

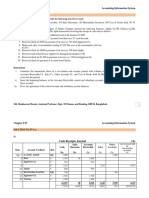

2. PSA6.1 (p. 404)

Computer Supplies Ltd

(a)

Cash Receipts Journal

CR4

Discount Accounts Other Cost of Sales Dr

Date Account Credited Ref Cash Dr Allowed Receivable Cr Sales Accounts Inventory Cr

Dr Cr Cr

Apr. 1 S Wiggle, Capital 301 18,000 18,000

4 Computer for U √ 4,998 102 5,100

5 PC West Ltd √ 1,860 1,860

8 Cash Sales 21,736 21,736 13,040

10 East PC Ltd √ 2,400 2,400

11 Inventory 120 1,650 1,650

23 PC West Ltd √ 4,500 4,500

29 Office Supplies √ 3,600 3,600

58,744 102 17,460 21,736 19,650 13,040

Cross-footing Totals $71,886

Dr Total = $71,886 ($58,744 + $102 + $13,040)

Cr Total = $71,886 ($17,460 + $21,736 + $19,650 + $13,040)

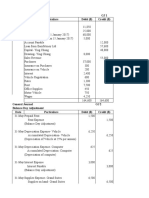

(b)

General Ledger

Accounts Receivable

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 22,050

30 CR4 17,460 4,590

Accounts Receivable Subsidiary Ledger

East PC Ltd

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 4,650

10 CR4 2,400 2,250

Office Supplies Ltd

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 3,600

29 CR4 3,600 0

PC West Ltd

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 8,700

5 CR4 1,860 6,840

23 CR4 4,500 2,340

Computers for U Ltd

Date Explanation Ref. Debit Credit Balance

Apr. 1 Balance 5,100

4 CR4 5,100 0

(c) Accounts receivable balance $4,590

Accounts Receivable subsidiary account balances:

East PC Ltd $2,550

PC West Ltd 2,340

Total $4,590

3. Q7.7 (p. 480)

(a) A dishonoured cheque occurs when the bank on which the cheque is drawn

refuses to pay the cheque, because it has been cancelled or because the balance of

the account on which it is drawn is less than the amount of the cheque.

(b) It reduced the balance of the bank account reported on the bank statement.

The dishonoured cheque should be recorded in the Cash at Bank account. It does not

appear in the bank reconciliation statement.

(c) A dishonoured cheque should be entered into the cash receipts as a reduction

in cash receipts. The adjusting entry in the company’s ledger accounts is a debit to

Accounts Receivable and a credit to Cash.

4. The following information is provided for Southern Cross Cricketers Ltd:

Southern Cross Cricketers Ltd

Bank Reconciliation as at 31 May 2019

Cash balance per bank statement 4,817.00 Cr

Add Deposits not credited 284.00

5,101.00

Less Unpresented cheques:

506 161.00

509 220.00 (381.00)

Balance per cash at bank ledger account 4,720.00 Dr

CASH PAYMENTS JOURNAL

Date Name Chq. Bank

No.

2019 CR

Jun Car 510 1,000

4

4 D.H.A 511 26

9 D. Grace 512 87

19 C. Goode 513 260

10 Investments 514 1,908

15 Wages 515 150

18 Petrol 516 97

20 Drawings 517 20

29 Oil 518 16

30 Wages 519 150

30 D. Grace 520 115

CASH RECEIPTS JOURNAL

Date Name Rec. No. Bank

2019 DR

Jun 1 Capital 16 500

5 V. Daly 17 39

5 Fees 18-56 1247

12 Fees 57-85 1537

16 G. 86 68

Press

30 Int. Rev. Voucher 29 52

SOUTHERN CROSS CRICKETERS LTD

BANK STATEMENT

DR CR BALANCE

June

1 4,817.00CR

1 C/C 284.00 5,101.00CR

2 State Duty 1.00 5,100.00CR

2 Federal Duty 3.00 5,097.00CR

2 C/C 500.00 5,597.00CR

3 506 161.00 5,436.00CR

6 C/c 1,286.00 6,722.00CR

7 Fee 5.00 6,717.00CR

8 510 1,000.00 5,717.00CR

13 C/C 1,537.00 7,254.00CR

14 512 87.00 7,167.00CR

14 513 260.00 6,907.00CR

17 C/C 68.00 6,975.00CR

17 514 1,908.00 5,067.00CR

18 515 150.00 4,917.00CR

21 517 20.00 4,897.00CR

22 511 26.00 4,871.00CR

30 Citicorp Int 20.00 4,891.00CR

Direct Payment

Required:

(a) Prepare the Cash at Bank ledger account showing the final balance at 30 June 2019.

(b) Prepare the bank reconciliation as at 30 June 2019.

(a)

CASH PAYMENTS JOURNAL

Date Name Chq. Bank

No.

2019 CR

Jun Car 510 1,000

4

4 D.H.A 511 26

9 D. Grace 512 87

19 C. Goode 513 260

10 Investments 514 1,908

15 Wages 515 150

18 Petrol 516 97

20 Drawings 517 20

29 Oil 518 16

30 Wages 519 150

30 D. Grace 520 115

Progress total 3,829

State duty 1

Federal duty 3

Fee 5

Total 3,838

CASH RECEIPTS JOURNAL

Date Name Rec. No. Bank

2019 DR

Jun 1 Capital 16 500

5 V. Daly 17 39

5 Fees 18-56 1,247

12 Fees 57-85 1,537

16 G. Press 86 68

30 Int. Rev. Voucher 52

29

Progress 3,443

total

Interest 20

Total 3,463

Date 2016 Details $ Date Details $

2016

1 June O/balance 4,720 30 June Payments 3,838

30 June Receipts 3,463 C/balance 4,345

8,183 8,183

O/balance 4,345

(b)

Southern Cross Cricketers Ltd

Bank Reconciliation as at 30 June 2019

Cash balance per bank statement 4,891.00 Cr

Add Deposits not credited 52.00

4,943.00

Less Unpresented cheques:

509 220.00

516 97.00

518 16.00

519 150.00

520 115.00 (598.00)

Balance per cash at bank ledger account 4,345.00 Dr

5. Brash Limited prepares a bank reconciliation twice a month. The following information

relates to the fortnight ending 15 June 2019.

Brash Ltd. Bank Reconciliation Statement as at 31 May 2019

Balance as per Bank Statement 2,918 CR

Add: deposit not credited 600

3, 518

Less: Unpresented cheques/debits

Chq No. 287 8,000

Chq No. 288 800 8,800

Balance as per Bank Ledger account (CR) 5,282

Stellar Bank: Bank Statement: Account: Brash Ltd. 15 June 2019

Date Particulars Debits Credits Balance DR/CR

1-Jun Balance 2,918 CR

Ch287 8,000 5,082 DR

Deposit 600 4,482 DR

6-Jun Deposit 1,602 2,880 DR

Bank fees 54 2,934 DR

14-Jun Ch290 180 3,114 DR

Deposit 846 2,268 DR

15-Jun Ch291 90 2,358 DR

Chq returned: Dishon’d 1,602 3,960 DR

Interest 360 3,600 DR

Cash Receipts Journal

Date Particulars Rec # Details Bank

6-Jun J Gerrand 82 1,602 1,602

14-Jun Sales 83 864 864

15-Jun J Webster 84 396

Sales 85 1,188 1,584

Progress Total 4,050

Cash Payments Journal

Date Particulars Chq # Bank

13-Jun Wages 290 180

Council Rates 291 90

15-Jun F Crowe 292 558

Progress Total 828

General Ledger

Date Details $ Date Details $

Note: Assume that all cash journal entries to 15 June are correct.

Required:

(a) Complete and post both cash receipt and cash payment journals above.

(b) Prepare the bank ledger account above to show how it would appear after cash

journals have been posted on 15 June.

(c) Prepare a Bank Reconciliation Statement at 15 June 2019.

(a)

Cash Receipts Journal

Date Particulars Rec # Details Bank

6-Jun J Gerrand 82 1,602 1,602

14-Jun Sales 83 864 864

15-Jun J Webster 84 396

Sales 85 1,188 1,584

Progress Total 4,050

J Gerrand (Dishon) (1,602)

Interest revenue 360

Total 2,808

Cash Payments Journal

Date Particulars Chq # Bank

13-Jun Wages 290 180

Council Rates 291 90

15-Jun F Crowe 292 558

Progress Total 828

Bank charges 54

Total 882

(b)

Date Details $ Date 2019 Details $

2019

15 June Receipts 2,808 June 1 O/balance 5,282

C/balance 3,356 June 15 Payments 882

6,164 6,164

O/balance 3,356

(c)

Brash Ltd. Bank Reconciliation Statement as at 15 June 2019

Balance as per Bank Statement 3,600 DR

Less Bank error: deposit under entered 18

Balance as per Bank Statement (adjusted) 3,582 DR

Add Unpresented cheques

Chq No. 288 800

Chq No. 292 558 1,358

4,940

Less Deposits not credited (396+1188) 1,584

Balance as per Bank Ledger account 3,356 CR

You might also like

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- 13 BRSDocument8 pages13 BRS21ke23b15089No ratings yet

- Tutorial 2 - General Ledger-2Document1 pageTutorial 2 - General Ledger-2Thi Yen Nhi NguyenNo ratings yet

- Question Ex 1,2,3Document10 pagesQuestion Ex 1,2,3Ludmila DorojanNo ratings yet

- Case Study Acct MGT - ACCT 102 - FinalDocument5 pagesCase Study Acct MGT - ACCT 102 - FinalbrightsparksintlNo ratings yet

- Bank Reconciliation: Date (2020) Item Checks Deposits BalanceDocument1 pageBank Reconciliation: Date (2020) Item Checks Deposits BalancePrincess EscovidalNo ratings yet

- LB301 2017 08Document4 pagesLB301 2017 08Clayton MutsenekiNo ratings yet

- Tutorial Sheet 4Document8 pagesTutorial Sheet 4Hhvvgg BbbbNo ratings yet

- Preparing Financial StatementsDocument15 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Irfan Fauzan Tugas 3Document25 pagesIrfan Fauzan Tugas 315 - Irfan Fauzan100% (1)

- Tutorial ListDocument14 pagesTutorial ListAnggaNo ratings yet

- Bank ReconcilliationDocument22 pagesBank ReconcilliationAli BhattiNo ratings yet

- Bbe 1101 (Fund. of Accounting) Lecture Notes - Dealing With Bank OverdraftsDocument5 pagesBbe 1101 (Fund. of Accounting) Lecture Notes - Dealing With Bank OverdraftsSAMSON OYOO OTUKENENo ratings yet

- Naura Alya Khalista - EA E - PG1 PG2 PG3Document8 pagesNaura Alya Khalista - EA E - PG1 PG2 PG3Naura AlyaNo ratings yet

- Acc Formula PNS CycleDocument19 pagesAcc Formula PNS CycleJING RONG GOHNo ratings yet

- Assignment 03 Tam3535-Management Studies: R.A.D.S.Niwarthana Center-Colombo DUE-DATE-12/13/2022Document7 pagesAssignment 03 Tam3535-Management Studies: R.A.D.S.Niwarthana Center-Colombo DUE-DATE-12/13/2022K.A.S.A.pierisNo ratings yet

- Chapter 7 Correction of Errors (II) TestDocument6 pagesChapter 7 Correction of Errors (II) Test陳韋佳No ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Tutorial Test 2-SolutionDocument7 pagesTutorial Test 2-SolutionUyen NguyenNo ratings yet

- Bank Reconciliation Solution - Uhuru Sacco LTD V1Document9 pagesBank Reconciliation Solution - Uhuru Sacco LTD V1Daniel Dayan SabilaNo ratings yet

- Grade 8 EMS Excercise MemoDocument13 pagesGrade 8 EMS Excercise MemoElon RuskNo ratings yet

- Voucher System-Problem 6 and 7 (ABDULLAH, SALMA B.) - 122631Document9 pagesVoucher System-Problem 6 and 7 (ABDULLAH, SALMA B.) - 122631Salma AbdullahNo ratings yet

- Practice Problem 21: Name Date Course/Year ScoreDocument3 pagesPractice Problem 21: Name Date Course/Year ScorePaw VerdilloNo ratings yet

- Bank Reconcilation - ProblemDocument2 pagesBank Reconcilation - ProblemRayeed AliNo ratings yet

- Diagnostic QuizDocument3 pagesDiagnostic QuizXENA LOPEZNo ratings yet

- Baf 1101financial Accounting 1Document3 pagesBaf 1101financial Accounting 1MORRIS GICHININo ratings yet

- Topic 6 Multiple Choice QuestionDocument8 pagesTopic 6 Multiple Choice Question黄颀桓No ratings yet

- Accountacy For Lawyers Assignement 1Document7 pagesAccountacy For Lawyers Assignement 1Leticia HipangelwaNo ratings yet

- Test Reconciliation Grade 11Document6 pagesTest Reconciliation Grade 11Stars2323100% (2)

- Bank Reconciliation.xlsxDocument12 pagesBank Reconciliation.xlsxAireen Shelvie BermudezNo ratings yet

- C7 - Bank Recon (Solution)Document2 pagesC7 - Bank Recon (Solution)NUR FARAH AISYAH SHARUDINNo ratings yet

- GJ GL TB AjpDocument17 pagesGJ GL TB AjpseviraaawrNo ratings yet

- 4 5805514475188521061Document8 pages4 5805514475188521061Gena HamdaNo ratings yet

- MC- Bank Reconciliation and Proof of CashDocument4 pagesMC- Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- InstructionsDocument8 pagesInstructionsPhuong ThuyNo ratings yet

- Chapter # 07 Accounting Information SystemDocument4 pagesChapter # 07 Accounting Information SystemdadfasNo ratings yet

- BBAW2103Document10 pagesBBAW2103Zack MJNo ratings yet

- Acc 3 Revision Questions 18Document6 pagesAcc 3 Revision Questions 18Danielle WatsonNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- Ac108 May2017Document5 pagesAc108 May2017Sahid Afrid AnwahNo ratings yet

- General Journal GJ1 Date Particulars Debit ($) Credit ($)Document25 pagesGeneral Journal GJ1 Date Particulars Debit ($) Credit ($)Jennifer ChandraNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- The Starr Theater QuestionDocument4 pagesThe Starr Theater QuestionDefitra Hidayatullah100% (3)

- Cash Book - AnswersDocument6 pagesCash Book - AnswersJoshNo ratings yet

- Southeast University: Midterm AssignmentDocument6 pagesSoutheast University: Midterm AssignmentNaufel Saad KhanNo ratings yet

- Sessional 1 Solved Sample 1Document4 pagesSessional 1 Solved Sample 1Mîñåk ŞhïïNo ratings yet

- Quiz 1Document3 pagesQuiz 1Van MateoNo ratings yet

- Activities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerDocument9 pagesActivities/ Assessments Lesson 8: Special Journals and Subsidiary LedgerEfril Joy AlbitoNo ratings yet

- Further Information: Schedule of Accounts Receivable MayDocument6 pagesFurther Information: Schedule of Accounts Receivable MaySaifullah WaqarNo ratings yet

- Bank Reconciliation StatementsDocument25 pagesBank Reconciliation StatementsVernan ZivanaiNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Principles OF AccountsDocument9 pagesPrinciples OF AccountsdonNo ratings yet

- Online StatementDocument4 pagesOnline StatementDan0% (1)

- Acc Topic 7Document7 pagesAcc Topic 7BM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Books of Prime Entry: The Cash BookDocument11 pagesBooks of Prime Entry: The Cash Bookأحمد عبد الحميدNo ratings yet

- Assignment No. 2 - Bank ReconciliationDocument7 pagesAssignment No. 2 - Bank ReconciliationVincent AbellaNo ratings yet

- Extra Notes On Risk and ReturnDocument4 pagesExtra Notes On Risk and ReturnFarah PatelNo ratings yet

- BFF2140 Final Exam Formula SheetDocument2 pagesBFF2140 Final Exam Formula SheetFarah PatelNo ratings yet

- Week 8 Tutorial SolutionsDocument8 pagesWeek 8 Tutorial SolutionsFarah PatelNo ratings yet

- Week 7 Tutorial SolutionsDocument6 pagesWeek 7 Tutorial SolutionsFarah PatelNo ratings yet

- BFF2140 - Practice Questions For Final Exam - With - SolutionsDocument15 pagesBFF2140 - Practice Questions For Final Exam - With - SolutionsFarah PatelNo ratings yet

- Corporate Finance I Exam FAQsDocument4 pagesCorporate Finance I Exam FAQsFarah PatelNo ratings yet

- Week 6 Tutorial SolutionsDocument13 pagesWeek 6 Tutorial SolutionsFarah PatelNo ratings yet

- Liabilities tutorial solutionsDocument6 pagesLiabilities tutorial solutionsFarah PatelNo ratings yet

- ACC1100 S1 2018 Exam SolutionDocument15 pagesACC1100 S1 2018 Exam SolutionFarah PatelNo ratings yet

- ACC1100 Semester Two 2017 Exam SolutionDocument10 pagesACC1100 Semester Two 2017 Exam SolutionFarah PatelNo ratings yet

- ACC1100 Semester Two 2017 ExamDocument9 pagesACC1100 Semester Two 2017 ExamFarah PatelNo ratings yet

- Non-Current Assets NotesDocument11 pagesNon-Current Assets NotesFarah PatelNo ratings yet

- "Government Debt Has An Important Role To Play in The Determination of Rates of Return in An Economy." Discuss and Evaluate This StatementDocument2 pages"Government Debt Has An Important Role To Play in The Determination of Rates of Return in An Economy." Discuss and Evaluate This StatementFarah PatelNo ratings yet

- Practice ECF1100 Final Exam Sem 2 2019 SolutionsDocument7 pagesPractice ECF1100 Final Exam Sem 2 2019 SolutionsFarah PatelNo ratings yet

- Special Journals and Internal ControlDocument16 pagesSpecial Journals and Internal ControlFarah PatelNo ratings yet

- Introduction To AccountingDocument63 pagesIntroduction To AccountingFarah PatelNo ratings yet

- Equity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesDocument21 pagesEquity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesFarah PatelNo ratings yet

- Important To Be Used For AccountingDocument2 pagesImportant To Be Used For AccountingFarah PatelNo ratings yet

- Defining LiabilitiesDocument15 pagesDefining LiabilitiesFarah PatelNo ratings yet

- Term Sheet For Ongrid Seller NoteDocument4 pagesTerm Sheet For Ongrid Seller Noteapi-279197922100% (1)

- Anwal Gas-TnDocument35 pagesAnwal Gas-TnMaysam Kh67% (3)

- Initial Transfer Copy For MR - Sergio Seade Kuri.Document3 pagesInitial Transfer Copy For MR - Sergio Seade Kuri.Emeka AmaliriNo ratings yet

- Abev3 20-F 2014 EngDocument286 pagesAbev3 20-F 2014 EngTang WtchrprnNo ratings yet

- Export Docs & ProceduresDocument4 pagesExport Docs & ProceduresMahesh KumarNo ratings yet

- Part 2 Intern ReportDocument39 pagesPart 2 Intern ReportPawan ShresthaNo ratings yet

- Chart of AccountDocument5 pagesChart of Accountsana82966534100% (1)

- A220830edeb4be4fd7 24467613Document1 pageA220830edeb4be4fd7 24467613fbicia218No ratings yet

- Topic For Presentation (BM)Document3 pagesTopic For Presentation (BM)Girish GauswamiNo ratings yet

- Swedbank's Year-End Report 2015Document58 pagesSwedbank's Year-End Report 2015Swedbank AB (publ)No ratings yet

- CSEC Question Paper May-June 2016 P-2Document5 pagesCSEC Question Paper May-June 2016 P-2amelia de matasNo ratings yet

- Ratio Analysis of Coca ColaDocument16 pagesRatio Analysis of Coca ColaAlwina100% (1)

- The Evolution of Philippine Currency: From Gold Coins to Modern Paper MoneyDocument4 pagesThe Evolution of Philippine Currency: From Gold Coins to Modern Paper MoneyDonna Mae Tudla0% (1)

- Subscribe to Labour Law Reporter for just Rs. 3600Document1 pageSubscribe to Labour Law Reporter for just Rs. 3600jagshish100% (1)

- Accounts Book - BBA 1st SemDocument96 pagesAccounts Book - BBA 1st SemClay JensenNo ratings yet

- Notes On Monetary ManagementDocument6 pagesNotes On Monetary Managementaqj mbaNo ratings yet

- My Swipe, My Treat 3.0 Promo MechanicsDocument2 pagesMy Swipe, My Treat 3.0 Promo MechanicsMaraNo ratings yet

- Sample Tender For Construction WorkDocument131 pagesSample Tender For Construction WorkSanjay M. ParkarNo ratings yet

- 1 - QPDocument7 pages1 - QPburtontris23No ratings yet

- Assignment 4Document2 pagesAssignment 4Nate LoNo ratings yet

- Hotel RecepitDocument1 pageHotel RecepitparameshNo ratings yet

- Dealroom Embedded Finance v2Document32 pagesDealroom Embedded Finance v2Sushma KazaNo ratings yet

- Deed of PartnershipDocument8 pagesDeed of PartnershipDilip AgrawalNo ratings yet

- Pricing and Valuation of Equity SwapsDocument12 pagesPricing and Valuation of Equity SwapsgileperNo ratings yet

- EdexelDocument12 pagesEdexelManuthi HewawasamNo ratings yet

- Comprehensive Problem-Special JournalsDocument5 pagesComprehensive Problem-Special JournalsFebrian ManuelNo ratings yet

- Dec 2021. VattamDocument11 pagesDec 2021. VattamsadaSivaNo ratings yet

- Mona Mohamed, Menna Selem, Mariam, ManalDocument8 pagesMona Mohamed, Menna Selem, Mariam, ManalMenna HamoudaNo ratings yet

- Preqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFDocument78 pagesPreqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFPaulo MottaNo ratings yet

- Valuation Method ExamsDocument75 pagesValuation Method ExamsRhejean Lozano100% (2)