Professional Documents

Culture Documents

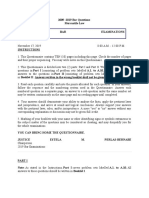

Meco 19

Uploaded by

Shane JesuitasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meco 19

Uploaded by

Shane JesuitasCopyright:

Available Formats

Life Insurance

Terms in this set (10)

1. An insurance company offers doctors malpractice insurance. Assume that malpractice claims against

careful doctors cost $5,000 on average over the term of the policy and settling malpractice claims

against reckless doctors costs $30,000. Doctors are risk-neutral and know whether they are reckless or

careful, but the insurance company only knows that 10% of doctors are reckless. How much do

insurance companies have to charge for malpractice insurance to break even?

$30,000

2. An employer faces two types of employees. Regular workers are 70% of the population and generate

$100,000 in productivity. Exceptional workers are 30% of the population and generate $120,000 in

productivity. Employees know their types and reject salaries below their productivity. If the employer

offers a salary equal to the aver- age productivity in the population, what will be the employer's per-

employee profit?

$6,000

3. An all-you-can-eat buffet attracts two types of customers. Regular customers value the buffet at $20

and eat $5 of food in costs to the restaurant. Hungry customers value the buffet at $40 and eat $10 of

food. If there are 100 of each type in the market for a buffet dinner, what is the restaurant's maximum

profit?

$3,000

4. To combat the problem of adverse selection, ________________ informed parties can employ

________________ techniques.

more; signaling

5. Which of the following can be an example of a signal: An air-conditioning manufacturer offers a 50-

year warranty; A lawyer offers to be paid only if the client wins; A student pursues an MBA.

All of the Above

6. Which of the following is not an example of adverse selection: A business bets the proceeds of a bank

loan on the next NFL game; An accident-prone driver buys auto insurance; A patient suffering from a

terminal disease buys life insurance

A business bets the proceeds of a bank loan on the next NFL game.

7. The demand for insurance arises primarily from people who are

risk-averse.

8. Which of the following is a potential solution to the adverse selection problem faced by insurance

companies: Offer plans with different deductibles so that higher-risk customers accept higher

deductibles; Create a national database of customers that allows companies to look up each person's

historical risk; Mandate that every person purchase insurance

All of the above

9. An insurance company suffers from adverse selection if

safe customers are less likely to insure than risky customers.

10. Which of the following is an example of adverse selection: A safe driver taking greater risk in a rental

car than his own car; A terminally ill person purchasing life insurance; An employment contract

encourages little effort on the part of employees

A terminally ill person purchasing life insurance

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2009-2019 Mercantile Bar Questions OnlyDocument143 pages2009-2019 Mercantile Bar Questions OnlyMeg VillaricaNo ratings yet

- Commonwealth of Kentucky Proof of Insurance: Insurance Company Agency/Company Issuing Card Our Contact InformationDocument3 pagesCommonwealth of Kentucky Proof of Insurance: Insurance Company Agency/Company Issuing Card Our Contact InformationRobert TaylorNo ratings yet

- RFP Design Elevator Replacement Project Xpl189Document52 pagesRFP Design Elevator Replacement Project Xpl189Mary Imogen Gomez de LiañoNo ratings yet

- Tokio Marine Life - IHealth Plus Brochure-2019Document44 pagesTokio Marine Life - IHealth Plus Brochure-2019kinosraj kumaranNo ratings yet

- Interior Design ContractDocument4 pagesInterior Design ContractRocketLawyer100% (3)

- Ong Guan Cuan, Et Al. v. The Century Insurance Co., LTDDocument2 pagesOng Guan Cuan, Et Al. v. The Century Insurance Co., LTDViolet ParkerNo ratings yet

- Marine Hull PresentationDocument19 pagesMarine Hull Presentationm_dattaias100% (5)

- Chapter Non Depository InstitutionsDocument5 pagesChapter Non Depository Institutionstasfaan50% (2)

- Obli 15Document15 pagesObli 15Shane JesuitasNo ratings yet

- 7-1 Scale and Scope: Short Answer QuestionsDocument2 pages7-1 Scale and Scope: Short Answer QuestionsShane Jesuitas100% (1)

- Obli 13Document2 pagesObli 13Shane JesuitasNo ratings yet

- Short Answer Questions: 12-1 Parking Lot OptimizationDocument3 pagesShort Answer Questions: 12-1 Parking Lot OptimizationShane JesuitasNo ratings yet

- Multiple Choice QuestionsDocument2 pagesMultiple Choice QuestionsShane JesuitasNo ratings yet

- Noun Phrases As Noun Phrase Modifiers: ClausesDocument1 pageNoun Phrases As Noun Phrase Modifiers: ClausesShane JesuitasNo ratings yet

- Acctg 121 MidtermsDocument8 pagesAcctg 121 MidtermsShane JesuitasNo ratings yet

- Accounting System-Special Journals Accounting System - Special JournalsDocument27 pagesAccounting System-Special Journals Accounting System - Special JournalsShane Jesuitas100% (1)

- HKN MSC - v.24 (Non Well)Document78 pagesHKN MSC - v.24 (Non Well)أحمد خيرالدين عليNo ratings yet

- CLAA00NB22000001Document1 pageCLAA00NB22000001AkilaNo ratings yet

- MRRF 11.10.2020Document2 pagesMRRF 11.10.2020oijewNo ratings yet

- Travel Elite BRDocument2 pagesTravel Elite BRdevil insideNo ratings yet

- ESIS Claims PO Box 6562 Scranton, PA 18505-6562 +1 913-748-8894 Tel +1 844 890-6967 FaxDocument3 pagesESIS Claims PO Box 6562 Scranton, PA 18505-6562 +1 913-748-8894 Tel +1 844 890-6967 FaxFrank PascarellaNo ratings yet

- Intern Report 1Document32 pagesIntern Report 1Asan Bilal100% (1)

- DZVZL PDFDocument9 pagesDZVZL PDFKingEjlersen4No ratings yet

- Broker Handbook (IBAI)Document69 pagesBroker Handbook (IBAI)Harish IyerNo ratings yet

- Ashish Hooda 1Document3 pagesAshish Hooda 1Amar GuptaNo ratings yet

- The Role of The Motor Insurance Industry in Preventing and Compensating Road CasualtiesDocument67 pagesThe Role of The Motor Insurance Industry in Preventing and Compensating Road CasualtiesRushikesh SonawaneNo ratings yet

- Web Based Application For Insurance ServicesDocument61 pagesWeb Based Application For Insurance ServicesTulsi GoswamiNo ratings yet

- Communication v. SensingDocument6 pagesCommunication v. SensingLester BalagotNo ratings yet

- Summary of Findings, Suggestions and ConclusionDocument16 pagesSummary of Findings, Suggestions and ConclusionPallavi Pallu0% (1)

- MD India Forms & Policy DocumentDocument42 pagesMD India Forms & Policy DocumentYagantiGaneshRaghuveerNo ratings yet

- Star Health ReceiptDocument2 pagesStar Health ReceiptsgmintoogargNo ratings yet

- Coban Performa Invoice - Discount To - Luis Javier 2Document1 pageCoban Performa Invoice - Discount To - Luis Javier 2javierpmejia100% (1)

- Insurence Midterm Exam Full Time B&F 5Document3 pagesInsurence Midterm Exam Full Time B&F 5Abdelnasir Haider100% (1)

- Income Taxation Semi-Final ExaminationDocument12 pagesIncome Taxation Semi-Final ExaminationlalagunajoyNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- Napier V Barkhuizen (569-2004) (2005) ZASCA 119 (2006) 2 All SA 469 (SCA) 2006 (9) BCLR 1011 (SCA) 2006 (4) SA 1 (SCA) (30 November 2005)Document21 pagesNapier V Barkhuizen (569-2004) (2005) ZASCA 119 (2006) 2 All SA 469 (SCA) 2006 (9) BCLR 1011 (SCA) 2006 (4) SA 1 (SCA) (30 November 2005)TiaanvcNo ratings yet

- Lya Stamp Mold Catalogue20200324Document38 pagesLya Stamp Mold Catalogue20200324Imran RehmanNo ratings yet

- Trainer To-Do List - Prior To ClassDocument53 pagesTrainer To-Do List - Prior To ClassCarol ReedNo ratings yet