Professional Documents

Culture Documents

An Assignment On Fund Management

Uploaded by

arvind singhalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Assignment On Fund Management

Uploaded by

arvind singhalCopyright:

Available Formats

An

Assignment On

Fund Management

Topic: Financial Planning & it’s approaches

Submitted To:. Submitted By:

Prof. N.S. Malik. Sonali

190101040015

MBA ‘FINANCE’

HARYANA SCHOOL OF BUSINESS

GURU JAMBHESHWAR UNIVERSITY OF SCIENCE & TECHNOLOGY

HISAR (HARYANA)

Financial Planning:

Financial independence is now an integral part of

our complex lives. Gone are the days when it meant having enough to

tide over one's personal needs without really having to struggle. In

current times, due to various reasons like a fast-paced life, job

insecurities and high inflation rates (that erode the value of money),

being financially competent in the present as well as the future should

is of prime importance for every individual.

However, it is widely observed that most individual's spend their life

in earning money and saving it but ignoring the third most important

aspect, financial planning, i.e. managing money. The process of

financial planning entails understanding an individual's present and

future earnings ability, analysing future financial requirements (like

buying a house) and developing a path to create wealth and reach

those goals as per the individual's ability to tolerate investment-

related risks. Further, financial plans must be dynamic to reflect the

ongoing changing market environment and the changing needs of the

individuals.

Financial planning is a step-by-step approach to meet one’s life goals.

A financial plan acts as a guide as you go through life’s journey.

Essentially, it helps you be in control of your income, expenses and

investments such that you can manage your money and achieve your

goals.

If you take a closer look at the above examples, you’ll find that there

is one factor that connects all of them: money. You need to have an

adequate amount of money to fulfil your goals and desires. More

importantly, you need to have money at the right point in time.

For example, if you want to build up a corpus of Rs. 10 lakh for your

daughter’s college education through investments, you need to grow

this amount by the time she turns 18. Not a year later. This is where

financial planning becomes essential.

Financial planning includes:

1.Planning for the amount of capital or investment required for a

business to carry out its operations in a smooth way.

2.Determining and comparing sources of funds both internally and

externally.

3.Making of suitable rules and policies for administration and

utilization of funds.

4.Identify risks and issues with all the estimations.

5 Objectives of Financial Planning:

The most prominent five objectives of financial planning are the

following:

1.Estimating the total capital required:

The first step in financial planning is to determine the actual

investment or capital required. The capital requirement can be further

divided into two categories, i.e. short term requirements and long

term requirements. Capital required depends on a number of factors

like the requirement of current and fixed assets advertisement and

operation expenses.

2. the sources, availability, and timing of funds:

Determining the sources and timing of funds is as tricky as anything

else. The required amount of funds should be available at the right

time according to business needs. Financial planning helping in

determine the inexpensive source of funds and make sure that funds

are available at the right time.

3.Determining the business capital structure:

The capital structure of a business is considered as the composition of

total external or internal debt to the shareholder’s capital. Financial

planning includes the decision on debt to equity ratio and kind of

investment required both in the short term and long term which

doesn’t affect the capital structure of the company.

4.Avoid excess generation of funds:

Unnecessary excess and shortage of funds are always an expensive

deal for businesses.One of the most important objectives of financial

planning is to prevent the business from rising of unnecessary funds.

Excess funds are just an idle asset of a business that cannot generate

any revenue for the business but have their own cost.

5.Counter strategies for Risks:

Financial planning identifies the risks and issues associated with the

business plan.Once the issues are identified at the planning stage, the

counter strategies are prepared to counter the identified issues. This

ensures the smooth completion of the project and saves a lot of

money and time.

Importance of Financial Planning:

Financial planning helps businesses to prepare a balanced plan for

their short term and long goals. The most common importance is as

follows:

1.Arrange funds according to the project need at the right time.

2.Financial planning helps to plan and execute long term development

which plays a vital role in the growth of the business.

3.Financial planning helps to prepare for any shortcomings and risks.

This rise the chances of success for the project.

4.Proper financial planning gives a competitive edge by arranging

sufficient funds for every stage of the project.

5.Financial Planning helps in ensuring a reasonable balance between

outflow and inflow of funds so that stability is maintained.

6.Financial Planning ensures that the suppliers of funds are easily

investing in companies which exercise financial planning.

7.Financial Planning helps in making growth and expansion

programmes which helps in long-run survival of the company.

8.Financial Planning reduces uncertainties with regards to changing

market trends which can be faced easily through enough funds.

9.Financial Planning helps in reducing the uncertainties which can be a

hindrance to growth of the company. This helps in ensuring stability

and profitability in concern.

How Financial Planning Works

There’s no mystery when it comes to financial planning. What it

requires is simply taking a personal, detailed look at your objectives

and aims and deciding how best to achieve them. Once you decide

what you want, you can make plans to get from where you are today

to where you want tomorrow.

We use a 6 step Financial Planning Process:

Step 1: No Obligation Initial Meeting:

At this meeting, we will listen to your financial concerns and discuss

what financial planning can do to help you achieve your financial

objectives. Identifying your financial goals and objectives will be the

foundation of your financial plan.

Step 2: Fact-finding:

We delve a little deeper into what you want to do in the future, how

much your current lifestyle costs, what financial commitments you

have and what future aspirations you have. To correctly establish an

overall picture of your finances, goals (short, medium and long term),

and attitude to risk, a detailed financial questionnaire will be

completed.

Step 3: Analysis:

When all of the required information has been gathered, it will be

analysed in order to fully understand how the client’s current finances

can be optimised to achieve their objectives. This process includes

determining how well the client’s investments match up to their risk

profile, if they have a sufficient emergency fund in place and tax

implications.

Step 4: Presentation Meeting:

Once the analysis and development of your financial plan is complete

we will outline the recommend course of action. After the plan has

been presented, we will thoroughly discuss the plan and address any

questions or concerns, and review the plan if necessary.

Step 5: Implementation:

After agreeing on the final structure of the plan, we will then handle

all of the changes required on your behalf, to ensure all items are

completed appropriately and efficiently.

Step 6: Regular Review:

In life, one thing is consistent: change. In order to adapt to changing

circumstances, and ensure the strategy continues to be relevant to

the client’s requirements, a structured review strategy will be put in

place.

Approaches of Financial Planning:

A true planner will use a defined process to determine the basis for

any recommendations. Inside that process, however, there are still

three main ways to look at how the customer-planner relationship

will evolve.

1. The Single-Purpose Approach

If the planner sells the client a single product, having used the

financial planning process to arrive at his decision, and being

approved by the client, then he has utilized the single-purpose

approach. Some examples might be the banker who opens a trust

account for the benefit of a handicapped child, or a stockbroker who

advises a client to buy shares of a particular company. This approach

solves a single problem for a evolve.

2. The Multiple-Purpose Approach

Many times a client will have concerns and/or needs in a particular

area, such as risk management, or income tax planning. It’s not

uncommon for a planner to take a multiple-purpose approach in

solving the problems. A good example might be a tax attorney who

assists clients with estate, income, and tax planning, or an investment

advisor who is registered with the SEC who assits clients in setting up

a complete portfolio to reach defined goals. Even though the advisor

is helping the client, he or she may still not know the overall financial

situation of the client.

3. The Comprehensive Approach

Comprehensive planners consider all aspects of a client’s financial

position. Since this type of planning must encompass such areas as tax

planning, and legal issues, a team is usually required, consisting of the

planner, an attorney, and a CPA. This type of plan will integrate

different areas of expertise to effectively solve the client’s problems.

Conclusion

Benjamin Franklin has rightly said, “If you fail to plan, you are

planning to fail.” You may have several different financial goals you

wish to achieve but to reach them at the right point in life; you need

to have a financial plan in place at a very young age.

You might also like

- "From Zero to Millionaire: The Ultimate Guide to Building Wealth and Achieving Financial Freedom"From Everand"From Zero to Millionaire: The Ultimate Guide to Building Wealth and Achieving Financial Freedom"No ratings yet

- Financial PlanningDocument4 pagesFinancial Planningਸਰਦਾਰ ਦੀਪ ਗਿੱਲNo ratings yet

- BrijeshDocument120 pagesBrijeshAakash147No ratings yet

- Comparative Analysis of Various Financial Institution in The Market 2011Document120 pagesComparative Analysis of Various Financial Institution in The Market 2011Binay TiwariNo ratings yet

- FM AssignmentDocument10 pagesFM Assignmentaryamakumari3No ratings yet

- Leverage Capital Markets Money Management: FinanceDocument13 pagesLeverage Capital Markets Money Management: FinanceIYSWARYA GNo ratings yet

- Objectives of Financial PlanningDocument52 pagesObjectives of Financial PlanninggulnazgaimaNo ratings yet

- Personal FinanceDocument4 pagesPersonal Financeroviepaclipan3No ratings yet

- Financial Planning and Tax ManagementDocument11 pagesFinancial Planning and Tax Managementrohit maddeshiyaNo ratings yet

- Leverage Capital Markets Money Management: FinanceDocument13 pagesLeverage Capital Markets Money Management: FinanceIYSWARYA GNo ratings yet

- Financial Management Reference ModuleDocument21 pagesFinancial Management Reference ModuleMohammad Farhan SafwanNo ratings yet

- Financial MGMT MODULE 2Document7 pagesFinancial MGMT MODULE 2Isabelle MariaNo ratings yet

- FT 405 FMAJ Investment Advisor - NotesDocument43 pagesFT 405 FMAJ Investment Advisor - NotesanjaliNo ratings yet

- For a Rich Future Financial Planning GuideDocument11 pagesFor a Rich Future Financial Planning Guidedbsmba2015No ratings yet

- Financial planning guideDocument10 pagesFinancial planning guideHiren PanchalNo ratings yet

- Financial ManagementggsDocument10 pagesFinancial ManagementggsJessica Nicole DuqueNo ratings yet

- Financial Planning and Forecasting StudyDocument16 pagesFinancial Planning and Forecasting Studyprince yadavNo ratings yet

- Financial Management 1Document29 pagesFinancial Management 1Aŋoop KrīşħŋặNo ratings yet

- Financial Planning & Tax Management PDFDocument16 pagesFinancial Planning & Tax Management PDFRanjeet singhNo ratings yet

- 8 Financial Literacy Lesson1Document6 pages8 Financial Literacy Lesson1hlmd.blogNo ratings yet

- Financial Market AssignmentDocument13 pagesFinancial Market AssignmentMasud AhmedNo ratings yet

- Document 3Document3 pagesDocument 3Mariwin MacandiliNo ratings yet

- Objective of Financial PlanningDocument21 pagesObjective of Financial PlanningmayawalaNo ratings yet

- Introduction to Financial ManagementDocument15 pagesIntroduction to Financial ManagementHayes MartinNo ratings yet

- A Study On Financial Planning and Portfolio ManagementDocument8 pagesA Study On Financial Planning and Portfolio ManagementManish JhaNo ratings yet

- Finance Is The Lifeline of Any BusinessDocument22 pagesFinance Is The Lifeline of Any BusinessmeseretNo ratings yet

- Management of Funds and AssetsDocument231 pagesManagement of Funds and AssetsSM Friend100% (2)

- Financial Planning Process GuideDocument54 pagesFinancial Planning Process GuideSham Salonga PascualNo ratings yet

- Functions of Financial ManagementDocument21 pagesFunctions of Financial ManagementAmanNo ratings yet

- FINANCIAL MANAGEMENT PROJECT REPORTDocument13 pagesFINANCIAL MANAGEMENT PROJECT REPORTAli SiddiquiNo ratings yet

- Formulation of Financial StrategyDocument52 pagesFormulation of Financial Strategyarul kumarNo ratings yet

- Fundamentals of Finance and Financial ManagementDocument4 pagesFundamentals of Finance and Financial ManagementCrisha Diane GalvezNo ratings yet

- BBA 4th SEMESTER FINANCIAL MANAGEMENT NOTESDocument25 pagesBBA 4th SEMESTER FINANCIAL MANAGEMENT NOTESHimanshu KonwarNo ratings yet

- Financial Literacy ReportDocument12 pagesFinancial Literacy Reportrafaelmariahanne2029No ratings yet

- Financail Management 2 NotesDocument86 pagesFinancail Management 2 NotesRalph MindaroNo ratings yet

- Chapter 1: Introduction To Financial PlanningDocument71 pagesChapter 1: Introduction To Financial PlanningSarojkumar ChhuraNo ratings yet

- MODULE 1 SVV Personal Finance StudentsDocument4 pagesMODULE 1 SVV Personal Finance StudentsJessica RosalesNo ratings yet

- FinMan AE 19 Module 1 Intro To FinManDocument8 pagesFinMan AE 19 Module 1 Intro To FinManMILLARE, Teddy Glo B.No ratings yet

- Financial Planning Made Easy: A Beginner's Handbook to Financial SecurityFrom EverandFinancial Planning Made Easy: A Beginner's Handbook to Financial SecurityNo ratings yet

- Assignment For PMCF8 Module 2:: 1. What Is Wealth Management? Explain BrieflyDocument3 pagesAssignment For PMCF8 Module 2:: 1. What Is Wealth Management? Explain BrieflyMaria Hannah GallanoNo ratings yet

- Chapter 1Document22 pagesChapter 1Trushant MandharkarNo ratings yet

- Financial PlanningDocument47 pagesFinancial PlanningNishaTambeNo ratings yet

- SFM Unit-1Document25 pagesSFM Unit-1Instagram ReelsNo ratings yet

- 6 key strategies for navigating a volatile sharemarketDocument8 pages6 key strategies for navigating a volatile sharemarketAkanksha SrivastavaNo ratings yet

- FINAL MahantheshDocument138 pagesFINAL MahantheshKapil DevNo ratings yet

- Financial Instruments and Investors' PerceptionsDocument15 pagesFinancial Instruments and Investors' PerceptionsAvinash BilagiNo ratings yet

- Natinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section RegularDocument18 pagesNatinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section Regularcn comNo ratings yet

- Business Finance Quarter 3 Module 3-4Document24 pagesBusiness Finance Quarter 3 Module 3-4Rojane L. Alcantara100% (1)

- BSNL Project 2Document79 pagesBSNL Project 2Naveen RamdevuNo ratings yet

- SEC Personal Financial PlanningDocument13 pagesSEC Personal Financial PlanningJagriti100% (3)

- The Financial Planning Process Busfin 3Document2 pagesThe Financial Planning Process Busfin 3darynneNo ratings yet

- Financial Control Blueprint: Building a Path to Growth and SuccessFrom EverandFinancial Control Blueprint: Building a Path to Growth and SuccessNo ratings yet

- Unit 1 Financial Planning and Tax ManagementDocument18 pagesUnit 1 Financial Planning and Tax ManagementnoroNo ratings yet

- Black Book (Pradnya More)Document74 pagesBlack Book (Pradnya More)ahmedsirajkhan147No ratings yet

- Guru Jambheshwar University leasing presentationDocument15 pagesGuru Jambheshwar University leasing presentationarvind singhalNo ratings yet

- Ib-404 Global Strategic Mgt.Document1 pageIb-404 Global Strategic Mgt.arvind singhalNo ratings yet

- MBA 401 (ED) InternalsDocument3 pagesMBA 401 (ED) Internalsarvind singhalNo ratings yet

- Form PDF 645857770010622Document9 pagesForm PDF 645857770010622GURU KRUPANo ratings yet

- Lab Report Covid-19 in The O/O Dsu, Idsp OfficeDocument1 pageLab Report Covid-19 in The O/O Dsu, Idsp Officearvind singhalNo ratings yet

- Lab Report Covid-19 in The O/O Dsu, Idsp OfficeDocument1 pageLab Report Covid-19 in The O/O Dsu, Idsp Officearvind singhalNo ratings yet

- Credit Rating AgenciesDocument12 pagesCredit Rating Agenciesarvind singhalNo ratings yet

- Presentation On The Topic Consumer Behavior & Its Roots: Presented By:-Parveen (40) ChiragDocument29 pagesPresentation On The Topic Consumer Behavior & Its Roots: Presented By:-Parveen (40) Chiragarvind singhalNo ratings yet

- Entrepreneurship Development in India: Presented To:-Presented ByDocument16 pagesEntrepreneurship Development in India: Presented To:-Presented Byarvind singhalNo ratings yet

- Guru Jambheshwar University of Science and Technology: Haryana School of BusinessDocument9 pagesGuru Jambheshwar University of Science and Technology: Haryana School of Businessarvind singhalNo ratings yet

- Lab Report Covid-19 in The O/O Dsu, Idsp OfficeDocument1 pageLab Report Covid-19 in The O/O Dsu, Idsp Officearvind singhalNo ratings yet

- Dr. Komal Dhanda HSBDocument1 pageDr. Komal Dhanda HSBarvind singhalNo ratings yet

- Credit Rating AgenciesDocument12 pagesCredit Rating Agenciesarvind singhalNo ratings yet

- Guru Jambheshwar University leasing presentationDocument15 pagesGuru Jambheshwar University leasing presentationarvind singhalNo ratings yet

- Dr. Komal Dhanda HSBDocument1 pageDr. Komal Dhanda HSBarvind singhalNo ratings yet

- Work Measurement: Saravanan JDocument24 pagesWork Measurement: Saravanan Jarvind singhalNo ratings yet

- 6 ISO 9000 ImplementationDocument30 pages6 ISO 9000 Implementationarvind singhalNo ratings yet

- Factoring & Forfaiting: DR Puja GoyalDocument14 pagesFactoring & Forfaiting: DR Puja Goyalarvind singhalNo ratings yet

- 6 ISO 9000 ImplementationDocument30 pages6 ISO 9000 Implementationarvind singhalNo ratings yet

- Marketing Research ProcessDocument21 pagesMarketing Research Processarvind singhalNo ratings yet

- Gmail - Application For Give Permission To Spring Carnival-2021 - Young Minds For Start-Up India On 01st Apr, 2021. (Education Purpose)Document1 pageGmail - Application For Give Permission To Spring Carnival-2021 - Young Minds For Start-Up India On 01st Apr, 2021. (Education Purpose)arvind singhalNo ratings yet

- Student Verification14Sep2020Document1 pageStudent Verification14Sep2020arvind singhalNo ratings yet

- Student certificate for insurance internshipDocument1 pageStudent certificate for insurance internshiparvind singhalNo ratings yet

- HR policies and their implementations at Jindal IndustriesDocument18 pagesHR policies and their implementations at Jindal Industriesarvind singhalNo ratings yet

- List of EC Degree College - 080920Document1 pageList of EC Degree College - 080920arvind singhalNo ratings yet

- MiscDocument1 pageMiscarvind singhalNo ratings yet

- COMMERCIAL POLICY INSTRUMENTSDocument23 pagesCOMMERCIAL POLICY INSTRUMENTSMANAGEMENT QUIZNo ratings yet

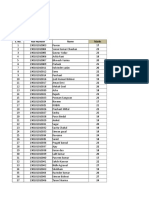

- Attendance Summary (MBAF-307)Document2 pagesAttendance Summary (MBAF-307)arvind singhalNo ratings yet

- MBA Final Syllabus 2010 12 Sem III 808832207Document44 pagesMBA Final Syllabus 2010 12 Sem III 808832207Akanksha Jain100% (1)

- HDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Document5 pagesHDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Srini VasanNo ratings yet

- Turning The Corner, But No Material Pick-UpDocument7 pagesTurning The Corner, But No Material Pick-UpTaek-Geun KwonNo ratings yet

- IE - Chapter 7 (Final)Document52 pagesIE - Chapter 7 (Final)Linh ĐàmNo ratings yet

- CaseDocument10 pagesCasejgiujwNo ratings yet

- Financial Statement Analysis Chapter 2Document10 pagesFinancial Statement Analysis Chapter 2Houn Pisey100% (1)

- Equity ValuationDocument17 pagesEquity ValuationAli SallamNo ratings yet

- Liquidity and Stock MarketDocument4 pagesLiquidity and Stock MarketIMaths PowaiNo ratings yet

- Cash Flow of Cadbury India: - in Rs. Cr.Document6 pagesCash Flow of Cadbury India: - in Rs. Cr.Somraj RoyNo ratings yet

- Lecture 1: Financial Markets Implications of COVID-19Document17 pagesLecture 1: Financial Markets Implications of COVID-19Hassaan BillahNo ratings yet

- Optimize Risk Management for Improved ReturnsDocument62 pagesOptimize Risk Management for Improved ReturnsArun Kumar100% (2)

- Corporation Accounting - DividendsDocument13 pagesCorporation Accounting - DividendsAlejandrea LalataNo ratings yet

- Ven ZestDocument59 pagesVen ZestSuraj JagtianiNo ratings yet

- Answer The Following A Will The Limitation of 20 StocksDocument1 pageAnswer The Following A Will The Limitation of 20 Stockshassan taimourNo ratings yet

- COMM324-03 Investing in Tesla Stock Run-UpDocument2 pagesCOMM324-03 Investing in Tesla Stock Run-UpKendra HalmanNo ratings yet

- Report in BM 222Document5 pagesReport in BM 222Neil Dela Cruz AmmenNo ratings yet

- Finance Assignment 1Document9 pagesFinance Assignment 1NikhilBaveja50% (2)

- CPA Review School Philippines Capital AssetsDocument8 pagesCPA Review School Philippines Capital AssetsJuan Miguel UngsodNo ratings yet

- IAS - 1 Presentation of Financial StatementsDocument8 pagesIAS - 1 Presentation of Financial StatementsAsghar AliNo ratings yet

- Draft ReportDocument138 pagesDraft ReportDanudear Daniel100% (1)

- Financial Literacy JEP 2014Document40 pagesFinancial Literacy JEP 2014Sindhuja BhaskaraNo ratings yet

- Importance of FinTech Collaboration in Hong KongDocument3 pagesImportance of FinTech Collaboration in Hong KongMohiuddinNo ratings yet

- Notes Lecture IIDocument2 pagesNotes Lecture IICigdemSahinNo ratings yet

- Eurex Euro-Swap Futures GuideDocument2 pagesEurex Euro-Swap Futures GuideMarco PoloNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- Mathematics of Finance Canadian 8Th Edition Brown Solutions Manual Full Chapter PDFDocument54 pagesMathematics of Finance Canadian 8Th Edition Brown Solutions Manual Full Chapter PDFretailnyas.rjah100% (9)

- Swot AnalysisDocument40 pagesSwot AnalysisMohmmedKhayyumNo ratings yet

- Eva Tree ModelDocument11 pagesEva Tree Modelwelcome2jungleNo ratings yet

- Developing Klusters in Butchery IndustryDocument13 pagesDeveloping Klusters in Butchery IndustryChimegErdenebatNo ratings yet

- 2010 - RICS - Calculation of WorthDocument52 pages2010 - RICS - Calculation of WorthBenzak UzuegbuNo ratings yet

- (Factsheet) MBDF-21040152Document2 pages(Factsheet) MBDF-21040152YUP SONG GUI MoeNo ratings yet