Professional Documents

Culture Documents

Recording Chanages in Financial Position

Uploaded by

eater PeopleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recording Chanages in Financial Position

Uploaded by

eater PeopleCopyright:

Available Formats

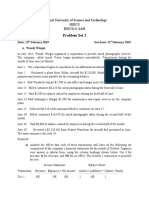

RECORDING CHANGES IN FINANCIAL POSITION

DEMONSTRATION PROBLEM

Stadium parking was organized on July 1 to operate a parking lot near a new sports arena. The following

transactions occurred during July prior to the company beginning its regular business operations.

July 1. Sylvia Snyder opened a bank account in the name of the business with a deposit of $ 45000

cash.

July 2. Purchased land to be used as the parking lot for a total price of $ 140000. A cash down payment

of $ 28000 was made and a note payable was issued for the balance of the purchase price.

July 5. Purchased a small portable building for $ 4000 cash. The purchase price included installation of

the building on the parking lot.

July 12. Purchased office equipment on credit from Suzuki & Company for $ 3000.

July 28. Paid $ 2000 of the amount owed to Suzuki & Company.

The accounting titles and account numbers used by Stadium parking to record these

transactions are as follows;

Cash 1 Notes payable 30

Land 20 Accounts payable 32

Building 22 Sylvia Snyder, capital 50

Office equipment 25

a. Prepare journal entries for the month of July.

b. Post to ledger accounts

c. Prepare a trial balance at July 31.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Fdocuments - in Test BbaDocument5 pagesFdocuments - in Test Bbatop 10 infoNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- EXERCISE 3.11 Journalizing, Posting, and Preparing A Trial: Balance Page 123Document24 pagesEXERCISE 3.11 Journalizing, Posting, and Preparing A Trial: Balance Page 123Ifrah BashirNo ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Ch02 Practice QuestionsDocument2 pagesCh02 Practice QuestionsSharjeel MushtaqueNo ratings yet

- Journal, Ledger & Trial BalanceDocument9 pagesJournal, Ledger & Trial BalanceUsman AyyubNo ratings yet

- Test (BBA)Document5 pagesTest (BBA)Ab Wahab100% (4)

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Uts Asistensi Pengantar Akuntansi 2Document5 pagesUts Asistensi Pengantar Akuntansi 2Falhan AuliaNo ratings yet

- Fin. Acc - Chapter-2 JournalDocument4 pagesFin. Acc - Chapter-2 JournalFayez AmanNo ratings yet

- Sample Papers Updated 1Document20 pagesSample Papers Updated 1ghawiNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument6 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsMuhammad Haris100% (1)

- Tutorial 2Document2 pagesTutorial 2KHANH Du NgocNo ratings yet

- ACC For Manag Mid AssessmentDocument1 pageACC For Manag Mid AssessmentHossain BabuNo ratings yet

- Exam 1 8Document9 pagesExam 1 8Kenneth DelacruzNo ratings yet

- FFA Lec 8 UpdatedDocument9 pagesFFA Lec 8 UpdatedBalochNo ratings yet

- 1321691530financial AccountingDocument21 pages1321691530financial AccountingMuhammadOwaisKhan0% (1)

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- 4 5805514475188521062Document3 pages4 5805514475188521062eferem100% (5)

- Fundamental I AssignmentDocument4 pagesFundamental I AssignmentYisak wolasaNo ratings yet

- AfsDocument2 pagesAfsAtiq ur Rahman0% (2)

- Accounting Paper BSIT 3, BSCS 3Document4 pagesAccounting Paper BSIT 3, BSCS 3Muhammad Zain BakhtawarNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Rubab MirzaNo ratings yet

- Bootcamp - Activity 1Document1 pageBootcamp - Activity 1Fuzail KhanNo ratings yet

- Assignment 3Document3 pagesAssignment 3Rakib Sikder100% (1)

- Fund I Assiaignment No 01Document1 pageFund I Assiaignment No 01mohammedmilki964No ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- AccountingDocument2 pagesAccountingAabroo Fatima0% (1)

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- ACC 205 Complete Class AssignmentsDocument39 pagesACC 205 Complete Class AssignmentsDecemberjaan0% (1)

- ACC 205 Complete Class HomeworkDocument40 pagesACC 205 Complete Class HomeworkSwadesh BangladeshNo ratings yet

- Assignment IIDocument3 pagesAssignment IIKirubel FantuNo ratings yet

- Exercises Before Mid-TermDocument6 pagesExercises Before Mid-TermSalmo AbdallaNo ratings yet

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- Acct Jetro Co SolutionDocument5 pagesAcct Jetro Co SolutionJasmin FelicianoNo ratings yet

- CH 01Document2 pagesCH 01vivien0% (1)

- Accounting Equation Practice QuestionsDocument15 pagesAccounting Equation Practice Questionsucseller8986No ratings yet

- Accounting 1 Assignment 1Document1 pageAccounting 1 Assignment 1Aim IrpNo ratings yet

- Accounting QuestionsDocument4 pagesAccounting QuestionsGayaNo ratings yet

- Accounting Final SyllabusDocument8 pagesAccounting Final SyllabusRoufRobin0% (1)

- Ledger Posting/ Trial Balance / Financial StatementsDocument6 pagesLedger Posting/ Trial Balance / Financial StatementsSora 1211No ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- Journal Ledger Trial BalanceDocument8 pagesJournal Ledger Trial BalancejessNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Assignment 2 PFMDocument3 pagesAssignment 2 PFMWasif Imran RARE0% (1)

- CH 01Document2 pagesCH 01flrnciairnNo ratings yet

- Analyzing and Journalizing TransactionDocument3 pagesAnalyzing and Journalizing TransactionAmna PervaizNo ratings yet

- Accounting CycleDocument12 pagesAccounting CycleAwais KhanNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- 01 FA Practice Handout (16!08!12)Document7 pages01 FA Practice Handout (16!08!12)Makhmoor SyedNo ratings yet

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- Adjusting Entries and Worksheet Practice Set 2 Sept 19 AssignmentDocument3 pagesAdjusting Entries and Worksheet Practice Set 2 Sept 19 Assignmenthngrc29No ratings yet

- ST RD TH TH TH TH TH TH TH TH TH TH TH TH TH THDocument2 pagesST RD TH TH TH TH TH TH TH TH TH TH TH TH TH THTarun KatariaNo ratings yet

- Assignment OneDocument6 pagesAssignment OneUser50% (2)

- Bank ReconciliationDocument2 pagesBank ReconciliationlordaiztrandNo ratings yet

- 2008 ch1 ExsDocument21 pages2008 ch1 ExsamatulmateennoorNo ratings yet

- Chapter 4 AssignmentDocument3 pagesChapter 4 Assignmentfatima airis aradais100% (1)

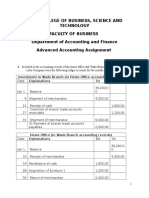

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- A Comparison of Classroom Interaction Patterns of Native and Nonnative Efl TeachersDocument5 pagesA Comparison of Classroom Interaction Patterns of Native and Nonnative Efl Teacherseater PeopleNo ratings yet

- Financials Training DAX2012Document274 pagesFinancials Training DAX2012eater PeopleNo ratings yet

- Performing Rights Fields MappingDocument10 pagesPerforming Rights Fields Mappingeater PeopleNo ratings yet

- Assignment 1 A FaDocument3 pagesAssignment 1 A Faeater PeopleNo ratings yet

- Measuring Business IncomeDocument3 pagesMeasuring Business Incomeeater PeopleNo ratings yet

- Completion of Accounting CycleDocument12 pagesCompletion of Accounting Cycleeater PeopleNo ratings yet

- Financial Accounting: Recording Changes in Financial PositionDocument29 pagesFinancial Accounting: Recording Changes in Financial Positioneater PeopleNo ratings yet

- Fixed Assets-Plant and EquipmentDocument40 pagesFixed Assets-Plant and Equipmenteater PeopleNo ratings yet

- Measuring Business Income CH 3Document37 pagesMeasuring Business Income CH 3eater PeopleNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (14)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)