Professional Documents

Culture Documents

Additional Credits and Payments

Additional Credits and Payments

Uploaded by

larryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Credits and Payments

Additional Credits and Payments

Uploaded by

larryCopyright:

Available Formats

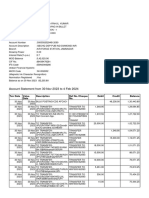

SCHEDULE 3 OMB No.

1545-0074

Additional Credits and Payments

(Form 1040)

Department of the Treasury

▶ Attach to Form 1040, 1040-SR, or 1040-NR. 2020

Attachment

▶ Go to www.irs.gov/Form1040 for instructions and the latest information.

Internal Revenue Service Sequence No. 03

Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number

Part I Nonrefundable Credits

1 Foreign tax credit. Attach Form 1116 if required . . . . . . . . . . . . . . 1

2 Credit for child and dependent care expenses. Attach Form 2441 . . . . . . . 2

3 Education credits from Form 8863, line 19 . . . . . . . . . . . . . . . . . 3

4 Retirement savings contributions credit. Attach Form 8880 . . . . . . . . . . 4

5 Residential energy credits. Attach Form 5695 . . . . . . . . . . . . . . . 5

6 Other credits from Form: a 3800 b 8801 c 6

7 Add lines 1 through 6. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 20 7

Part II Other Payments and Refundable Credits

8 Net premium tax credit. Attach Form 8962 . . . . . . . . . . . . . . . . . 8

9 Amount paid with request for extension to file (see instructions) . . . . . . . . 9

10 Excess social security and tier 1 RRTA tax withheld . . . . . . . . . . . . . 10

11 Credit for federal tax on fuels. Attach Form 4136 . . . . . . . . . . . . . . 11

12 Other payments or refundable credits:

a Form 2439 . . . . . . . . . . . . . . . . . . . . . 12a

b Qualified sick and family leave credits from Schedule(s) H and

Form(s) 7202 . . . . . . . . . . . . . . . . . . . . 12b

c Health coverage tax credit from Form 8885 . . . . . . . . 12c

d Other: 12d

e Deferral for certain Schedule H or SE filers (see instructions) . 12e

f Add lines 12a through 12e . . . . . . . . . . . . . . . . . . . . . . . 12f

13 Add lines 8 through 12f. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 31 13

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71480G Schedule 3 (Form 1040) 2020

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Eom Iii - Test - 25-02-2023Document25 pagesEom Iii - Test - 25-02-2023santucan1100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Introduction To Supply Chain Management: Logistics and S C M (TYBMS Sem - V) 32Document14 pagesIntroduction To Supply Chain Management: Logistics and S C M (TYBMS Sem - V) 32khushi shahNo ratings yet

- Chapter 20 International Trade Finance Answers & Solutions To End-Of-Chapter Questions and ProblemsDocument5 pagesChapter 20 International Trade Finance Answers & Solutions To End-Of-Chapter Questions and ProblemsJemma Jade100% (1)

- KasdanPiutang 4B Kelompok1Document11 pagesKasdanPiutang 4B Kelompok1Estin TasyaNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeIshfaq Ali KhanNo ratings yet

- Additional Child Tax Credit: Schedule 8812Document1 pageAdditional Child Tax Credit: Schedule 8812Ishfaq Ali KhanNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeIshfaq Ali KhanNo ratings yet

- Home Automation by Using ArduinoDocument12 pagesHome Automation by Using ArduinoIshfaq Ali KhanNo ratings yet

- PMP Chapter-7 Project Cost Management.Document28 pagesPMP Chapter-7 Project Cost Management.ashkar299100% (1)

- Ep 9 S 9 Lawp 0 Za 4 y WNDocument6 pagesEp 9 S 9 Lawp 0 Za 4 y WNxikex91345No ratings yet

- Answer KeysDocument26 pagesAnswer Keysmia uyNo ratings yet

- Valuation Method 1Document7 pagesValuation Method 1alliahnahNo ratings yet

- Coca Cola Beverages BotswanaDocument8 pagesCoca Cola Beverages BotswanaTshepiso RankoNo ratings yet

- 1 FrameworkDocument26 pages1 FrameworkIrenataNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Valles Von Virchel EDocument3 pagesSworn Statement of Assets, Liabilities and Net Worth: Valles Von Virchel EMabel AruyalNo ratings yet

- FATA and PakistanDocument11 pagesFATA and PakistanAsif MirzaNo ratings yet

- Chapter 5 - Present Worth AnalysisDocument17 pagesChapter 5 - Present Worth AnalysisMuhammad Saad Bin AkbarNo ratings yet

- BA305 HP Case StudyDocument9 pagesBA305 HP Case StudyRezwanah KhalidNo ratings yet

- PHÂN TÍCH 30 NGÀNH HÀNG - Trang Tính1Document12 pagesPHÂN TÍCH 30 NGÀNH HÀNG - Trang Tính1K60 Nguyễn Hữu Yên HàNo ratings yet

- Bloomberg Businessweek USA - August 10 2020Document70 pagesBloomberg Businessweek USA - August 10 2020Boki VaskeNo ratings yet

- @bei - Fact Sheet Jii70Document1 page@bei - Fact Sheet Jii70Halida An NabilaNo ratings yet

- 5 - World of DividesDocument6 pages5 - World of DividesJose Angelo EscupinNo ratings yet

- Macroeconomics 9th Edition Abel Solutions Manual 1Document22 pagesMacroeconomics 9th Edition Abel Solutions Manual 1rose100% (53)

- Analisis Fundamentalde EmpresasDocument6 pagesAnalisis Fundamentalde EmpresasJHON JANER RODRIGUEZ MONTERONo ratings yet

- Answers 01 Capital-Budgeting Quizzer-1Document8 pagesAnswers 01 Capital-Budgeting Quizzer-1Mary Grace MontojoNo ratings yet

- Checklist of Requirements For Pag-Ibig Housing Loan Under Retail AccountsDocument2 pagesChecklist of Requirements For Pag-Ibig Housing Loan Under Retail AccountsDain MedinaNo ratings yet

- Debit&Credit Card Auto Debit Authorisation (Updated July 2019)Document1 pageDebit&Credit Card Auto Debit Authorisation (Updated July 2019)Nur Saidatul AkhmalNo ratings yet

- Fundamental Concepts/ Principles/ Methods OF Managerial EconomicsDocument15 pagesFundamental Concepts/ Principles/ Methods OF Managerial EconomicsHimanshu DarganNo ratings yet

- Which Index Options Should You Sell?: Roni Israelov Harsha TummalaDocument35 pagesWhich Index Options Should You Sell?: Roni Israelov Harsha TummalaZachary PorgessNo ratings yet

- Test Bank For Using Mis 9th Edition 03Document31 pagesTest Bank For Using Mis 9th Edition 03Quỳnh NguyễnNo ratings yet

- Practice Question of International ArbitrageDocument3 pagesPractice Question of International ArbitrageUSAMA KHALID UnknownNo ratings yet

- Narayana Group of Schools: Bill of Supply OriginalDocument1 pageNarayana Group of Schools: Bill of Supply OriginalSk NurhasanNo ratings yet

- Financial-Management Solved MCQs (Set-14)Document8 pagesFinancial-Management Solved MCQs (Set-14)IqraNo ratings yet

- Study of Venture Capital in India (Synopsis)Document6 pagesStudy of Venture Capital in India (Synopsis)46 Yashika SharmaNo ratings yet