Professional Documents

Culture Documents

FABM-1 - Module 6 - Adjusting Entries - Deferrals

Uploaded by

KJ JonesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FABM-1 - Module 6 - Adjusting Entries - Deferrals

Uploaded by

KJ JonesCopyright:

Available Formats

Fundamentals of Accountancy, Business and

Governor Pack Road, Baguio City, Philippines 2600 Management 1

Tel. Nos.: (+6374) 442-3316, 442-8220; 444-2786;

442-2564; 442-8219; 442-8256; Fax No.: 442-6268 Grade Level/Section: Grade 11- ABM

Email: email@uc-bcf.edu.ph; Website: www.uc-bcf.edu.ph

MODULE 6 – FABM 1 Subject Teacher: Kenny Jones A. Amlos

ADJUSTING ENTRIES - DEFERRALS

Learning Objectives:

At the end of this module, learners must be able to:

a. Identify accounts to be adjusted;

b. properly record adjusted transactions;

Deferrals

There are often transactions where customers or the business pays something in advance,

these are called prepayments. Prepayments are treated as either assets or expense on the point of

view of the payer; income or liability on the point of view of the recipient of the payment. Deferrals in

accounting this means to defer or to delay recognizing certain revenues or expenses on the income

statement until a later, more appropriate time. Revenues are deferred to a balance sheet liability

account until they are earned in a later period. When the revenues are earned they will be moved

from the balance sheet account to revenues on the income statement.

Expenses are deferred to a balance sheet asset account until the expenses are used up,

expired, or matched with revenues. At that time they will be moved to an expense on the income

statement.

To summarize, adjusting entries needs to be recorded for transactions involving advance

payments.

How to Journalize

In recording for deferrals, you need to know that 2 entries will be needed on the first

accounting period the advance payment was done.

The first entry will be the initial entry, which will tell us what method will be used and will help us

determine the adjusting entry needed at the end of the accounting period. Initial entry is simply the

journal entry when the transaction happened.

The second entry will be the adjusting entry, which will tell us how much will be deferred or is

consumed of the advance payment.

Methods

As mentioned above, there will be an initial entry which will tell us what method is being used

by the company.

o When the company pays in advance

▪ Asset Method

▪ Expense Method

o When the company receives advance payments

▪ Income Method

▪ Liability Method

The kind of method will tell us how we should treat what the advance payment is and will be

adjusted at the end of the accounting period to reflect the proper amount of the asset, liability,

income, and expense.

For example, in the first scenario where the company paid in advance, it can either treat the

payment as an asset or expense (depending on company policy). At the end of the accounting

period, it will be adjusted to reflect the amount corresponding to the asset of expense account.

Fundamentals of Accountancy, Business & Management - 1 Page 1 of 7

Fundamentals of Accountancy, Business and

Governor Pack Road, Baguio City, Philippines 2600 Management 1

Tel. Nos.: (+6374) 442-3316, 442-8220; 444-2786;

442-2564; 442-8219; 442-8256; Fax No.: 442-6268 Grade Level/Section: Grade 11- ABM

Email: email@uc-bcf.edu.ph; Website: www.uc-bcf.edu.ph

MODULE 6 – FABM 1 Subject Teacher: Kenny Jones A. Amlos

Format (Default Entries)

Below are the default entries to be followed for this type of adjusting entry.

1. When the Business pays in advance

a. Asset Method

INITIAL ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

Prepaid (Name) ###

Cash ###

To record advance payment by company

Simply replace the “(Name)” with the appropriate name. For example, if the advance

payment was for rent, then it would look like this:

INITIAL ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

Prepaid Rent ###

Cash ###

To record advance payment of rent

ADJUSTING ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

(Name) Expense ###

Prepaid (Name) ###

To record expense

At the end of the accounting period, the asset account must be reduced and an

expense account will be created because the asset was already used.

An adjusting is necessary to reflect the proper amount of asset and expense since the

entire amount of the advance payment is not utilized but only a portion of it must be

recognized as expense depending in the period that had passed.

Example:

On May 1, 2021, Naka Rinta Company paid P180,000 to Nagpa Rinta Company which is

equivalent to an annual rent.

Assuming that the company uses calendar year and annual accounting period, the following will be the entries.

INITIAL ENTRY

Debit Credit

Date Entry

(In PHP) (In PHP)

May 1, 2020 Prepaid Rent 180,000.00

Cash 180,000.00

To record advance payment of rent

ADJUSTING ENTRY

Dec 31, 2020 Rent Expense 120,000

Prepaid Rent 120,000

To record rent expense

Fundamentals of Accountancy, Business & Management - 1 Page 2 of 7

Fundamentals of Accountancy, Business and

Governor Pack Road, Baguio City, Philippines 2600 Management 1

Tel. Nos.: (+6374) 442-3316, 442-8220; 444-2786;

442-2564; 442-8219; 442-8256; Fax No.: 442-6268 Grade Level/Section: Grade 11- ABM

Email: email@uc-bcf.edu.ph; Website: www.uc-bcf.edu.ph

MODULE 6 – FABM 1 Subject Teacher: Kenny Jones A. Amlos

Computation:

180,000 / 12 = P 15,000

15,000 x 8 = P 120,000

Notice that the amount recorded in the adjusting entry for the rent expense is the

amount equivalent to 8 months. This is because only 8 months have passed since May, that

means, the expense that the company needs to recognize is only the amount equal to

that 8- month span. We also need to reduce the asset (Prepaid Rent) account by the

same amount because it was already used for a good 8 month.

b. Expense Method

INITIAL ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

(Name) Expense ###

Cash ###

To record advance payment by company

In this entry, instead of recording the item as an asset, we record it as expense

immediately.

ADJUSTING ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

Prepaid (Name) ###

(Name) Expense ###

To record expense

At the end of the accounting period, the expense account must be reduced because

the entire amount of the advance payment is not yet used and an asset account will be

created to reflect the remaining value of the advance payment.

Example:

On May 1, 2021, Naka Rinta Company paid P180,000 to Nagpa Rinta Company which is

equivalent to an annual rent.

Assuming that the company uses calendar year and annual accounting period, the following will be the entries.

INITIAL ENTRY

Debit Credit

Date Entry

(In PHP) (In PHP)

May 1, 2020 Rent Expense 180,000.00

Cash 180,000.00

To record advance payment of rent

ADJUSTING ENTRY

Dec 31, 2020 Prepaid Rent 60,000

Rent Expense 60,000

To record rent expense

In the adjusting entry under expense method we must reduce the expense by the

amount of the remaining amount, unlike in the asset method where the amount recorded

is the amount equivalent to the period that passed.

Fundamentals of Accountancy, Business & Management - 1 Page 3 of 7

Fundamentals of Accountancy, Business and

Governor Pack Road, Baguio City, Philippines 2600 Management 1

Tel. Nos.: (+6374) 442-3316, 442-8220; 444-2786;

442-2564; 442-8219; 442-8256; Fax No.: 442-6268 Grade Level/Section: Grade 11- ABM

Email: email@uc-bcf.edu.ph; Website: www.uc-bcf.edu.ph

MODULE 6 – FABM 1 Subject Teacher: Kenny Jones A. Amlos

2. When the Business was paid in advance

a. Income Method

INITIAL ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

Cash ###

(Name) Income ###

To record advance payment to company

We will recognize the account as an income initially but you need to remember that

this will violate the realization concept hence, we need to adjust our income and

recognize a liability at the end of the accounting period.

ADJUSTING ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

(Name) Income ###

Unearned (Name) Income ###

To record unearned income

Deferred (Name) Income may also be used.

A liability account must be recognized to reflect the amount of service not yet

rendered to client.

Example:

On May 1, 2021, Nagpa Rinta Company was paid P180,000 by Naka Rinta Company

which is equivalent to an annual rent.

Assuming that the company uses calendar year and annual accounting period, the following will be the entries.

INITIAL ENTRY

Debit Credit

Date Entry

(In PHP) (In PHP)

May 1, 2020 Cash 180,000.00

Rent Income 180,000.00

To record advance collection of rent

ADJUSTING ENTRY

Dec 31, 2020 Rent Income 60,000

Unearned Rent Income 60,000

To record liability for rent

Always remember that “Unearned (Name) Income” or “Deferred (Name) Income” is a

liability account and not an income account.

The amount to be recorded in the adjustment will be the amount equivalent to the

remaining period of the advance payment.

Fundamentals of Accountancy, Business & Management - 1 Page 4 of 7

Fundamentals of Accountancy, Business and

Governor Pack Road, Baguio City, Philippines 2600 Management 1

Tel. Nos.: (+6374) 442-3316, 442-8220; 444-2786;

442-2564; 442-8219; 442-8256; Fax No.: 442-6268 Grade Level/Section: Grade 11- ABM

Email: email@uc-bcf.edu.ph; Website: www.uc-bcf.edu.ph

MODULE 6 – FABM 1 Subject Teacher: Kenny Jones A. Amlos

b. Liability Method

INITIAL ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

Cash ###

Unearned (Name) Income ###

To record advance payment to company

This time, we will recognize the advance payment as a liability. As the time passes or as

you render the service, the liability will be reduced, hence, an adjustment must be made

to reflect the income already earned by the company.

ADJUSTING ENTRY

Debit Credit

Entry

(In PHP) (In PHP)

Unearned (Name) Income ###

(Name) Income ###

To record income earned

An income account must be recognized to reflect the amount of service already

rendered to client.

Example:

On May 1, 2021, Nagpa Rinta Company was paid P180,000 by Naka Rinta Company

which is equivalent to an annual rent.

Assuming that the company uses calendar year and annual accounting period, the following will be the entries.

INITIAL ENTRY

Debit Credit

Date Entry

(In PHP) (In PHP)

May 1, 2020 Cash 180,000.00

Unearned Rent Income 180,000.00

To record advance collection of rent

ADJUSTING ENTRY

Dec 31, 2020 Unearned Rent Income 120,000

Rent Income 120,000

To record earned income

The amount to be recorded in the adjustment will be the amount equivalent to the

period of rendering the service.

Fundamentals of Accountancy, Business & Management - 1 Page 5 of 7

Fundamentals of Accountancy, Business and

Governor Pack Road, Baguio City, Philippines 2600 Management 1

Tel. Nos.: (+6374) 442-3316, 442-8220; 444-2786;

442-2564; 442-8219; 442-8256; Fax No.: 442-6268 Grade Level/Section: Grade 11- ABM

Email: email@uc-bcf.edu.ph; Website: www.uc-bcf.edu.ph

MODULE 6 – FABM 1 Subject Teacher: Kenny Jones A. Amlos

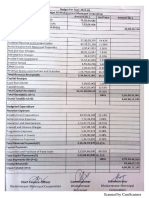

ECQ Co. paid GCQ Inc. an amount of ₱60,000 on October 1, 2019 as payment for Office Rental

covering a 6-month period.

Analysis: The amount of ₱60,000

was already collected and

recorded on October 1, 2019.

However, Under the accrual basis

of accounting and realization

concept, a portion of the rent

income is not yet earned

representing the rental from

January 1 to March 31, 2020 that is

called “deferred income”. On the

part of the lessee, that portion is

referred to as “pre-paid expense”.

Under liability method, the adjusting entry to record deferral of pre-collection would be:

Dec. 31 Deferred Rent Income 30,000

Rent Income 30,000

To record deferred rent income

The lessor (GCQ Inc.) should adjust the liability account at the end of the accounting period.

The account title “Unearned rent income” can be used in lieu of Deferred rent income which is a

liability account.

Under income method, the adjusting entry to record deferral of pre-collection would be:

Dec. 31 Rent Income 30,000

Deferred Rent Income 30,000

To record deferred rent income

The lessor (GCQ Inc.) should adjust the income account at the end of the accounting period.

The account title “Unearned rent income” can be used in lieu of Deferred rent income which is a

liability account.

Under asset method, the adjusting entry to record deferral of pre-payment would be:

Dec. 31 Rent expense 30,000

Pre-paid rent 30,000

To record deferral of pre-payment

The lessee (ECQ Co.) should adjust the expense account at the end of the accounting period.

Under expense method, the adjusting entry to record deferral of pre-payment would be:

Dec. 31 Pre-paid rent 30,000

Rent expense 30,000

To record deferral of pre-payment

The lessee (ECQ Co.) should adjust the expense account at the end of the accounting period.

Fundamentals of Accountancy, Business & Management - 1 Page 6 of 7

Fundamentals of Accountancy, Business and

Governor Pack Road, Baguio City, Philippines 2600 Management 1

Tel. Nos.: (+6374) 442-3316, 442-8220; 444-2786;

442-2564; 442-8219; 442-8256; Fax No.: 442-6268 Grade Level/Section: Grade 11- ABM

Email: email@uc-bcf.edu.ph; Website: www.uc-bcf.edu.ph

MODULE 6 – FABM 1 Subject Teacher: Kenny Jones A. Amlos

References:

• Banggawan, R., Asuncion, D.(2017).Fundamentals of Accountancy, Business and

Management 1. Aurora Hill, Baguio City: Real Excellence Publishing.

• Ferrer, R., Millan, Z.(2017). Fundamentals of Accountancy, Business and Management 1.

Bakakeng Sur, Baguio City: Bandolin Enterprise.

• Ong, F.(2016). Fundamentals of Accountancy, Business and Management 1. South Triangle,

Quezon City: C & E Publishing.

• Baysa, G., Lupisan, M.(2011). Accounting for Partnership and Corporation. Mandaluyong City:

Millenium books,

• https://www.accountingcoach.com/terms/D/deferral

Fundamentals of Accountancy, Business & Management - 1 Page 7 of 7

You might also like

- FABM-1 - Module 7 - Adjusting Entries - Bad DebtsDocument7 pagesFABM-1 - Module 7 - Adjusting Entries - Bad DebtsKJ JonesNo ratings yet

- FABM-1 - Module 5 - Adjusting Entries - AccrualsDocument7 pagesFABM-1 - Module 5 - Adjusting Entries - AccrualsKJ Jones0% (1)

- FABM-1 - Module 8 - Adjusting Entries - Depreciation & Correcting EntriesDocument7 pagesFABM-1 - Module 8 - Adjusting Entries - Depreciation & Correcting EntriesKJ JonesNo ratings yet

- FABM-1 - Module 9 - Preparation of WorksheetDocument7 pagesFABM-1 - Module 9 - Preparation of WorksheetKJ Jones100% (2)

- FABM-1 - Module 10 - Preparation of FSDocument5 pagesFABM-1 - Module 10 - Preparation of FSKJ Jones100% (1)

- FABM-1 - Module 4 - Recording & ClassifyingDocument9 pagesFABM-1 - Module 4 - Recording & ClassifyingKJ JonesNo ratings yet

- FABM-1 - Module 2 - Principles and ConceptsDocument7 pagesFABM-1 - Module 2 - Principles and ConceptsKJ Jones100% (3)

- FABM-1 Module 3 Accounting EquationDocument6 pagesFABM-1 Module 3 Accounting EquationKJ Jones100% (3)

- FABM 2 Module 3 SFPDocument7 pagesFABM 2 Module 3 SFPJOHN PAUL LAGAO50% (2)

- Fabm 2 Module 10 Vat OptDocument5 pagesFabm 2 Module 10 Vat OptJOHN PAUL LAGAONo ratings yet

- FABM 2 Module 7 Principles of TaxationDocument6 pagesFABM 2 Module 7 Principles of TaxationJOHN PAUL LAGAO50% (2)

- FABM 2 Module 5 FS AnalysisDocument9 pagesFABM 2 Module 5 FS AnalysisJOHN PAUL LAGAO100% (4)

- FABM-1 - Module 1 - Intro To AccountingDocument13 pagesFABM-1 - Module 1 - Intro To AccountingKJ Jones100% (26)

- Fabm 1 Module 2 Principles and ConceptsDocument10 pagesFabm 1 Module 2 Principles and ConceptsKISHA100% (1)

- FABM 2 Module 8 Income TaxationDocument8 pagesFABM 2 Module 8 Income TaxationJOHN PAUL LAGAO50% (2)

- FABM 2 Module 4 SCFDocument10 pagesFABM 2 Module 4 SCFJOHN PAUL LAGAO100% (3)

- FABM 2 - Comprehensive TaskDocument3 pagesFABM 2 - Comprehensive TaskJOHN PAUL LAGAO100% (1)

- Finance Module 3 FS Prep, Analysis, InterpretationDocument9 pagesFinance Module 3 FS Prep, Analysis, InterpretationKJ JonesNo ratings yet

- Abm Fabm1 Module1Document17 pagesAbm Fabm1 Module1Gladzangel Loricabv67% (3)

- Finance Module 6 Long-Term FinancingDocument5 pagesFinance Module 6 Long-Term FinancingKJ JonesNo ratings yet

- Econ Module-10 Issues Facing The Filipino EntrepreneurDocument5 pagesEcon Module-10 Issues Facing The Filipino EntrepreneurJOHN PAUL LAGAONo ratings yet

- FABM1 Q4 Module 6 Preparing of Reversing EntriesDocument14 pagesFABM1 Q4 Module 6 Preparing of Reversing Entriesrio100% (1)

- FABM 2 Module 2 SCI SCOE PDFDocument10 pagesFABM 2 Module 2 SCI SCOE PDFJOHN PAUL LAGAO100% (4)

- FABM 2 Module 1 Review of Basic Accounting PDFDocument8 pagesFABM 2 Module 1 Review of Basic Accounting PDFJOHN PAUL LAGAO100% (3)

- Econ Module-4 Demand ConceptDocument4 pagesEcon Module-4 Demand ConceptJOHN PAUL LAGAONo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document17 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)Gladzangel Loricabv50% (2)

- FABM1 Q4 Module 1Document23 pagesFABM1 Q4 Module 1Earl Christian BonaobraNo ratings yet

- FABM 2 Module 9 Income Tax DueDocument11 pagesFABM 2 Module 9 Income Tax DueJOHN PAUL LAGAO100% (1)

- FABM 2 Module 6 Cash Bank ReconDocument6 pagesFABM 2 Module 6 Cash Bank ReconJOHN PAUL LAGAO40% (5)

- Accountancy, Business, and Management 1: Analyze Common Business Transactions Using The Rules of Debit and CreditDocument11 pagesAccountancy, Business, and Management 1: Analyze Common Business Transactions Using The Rules of Debit and CreditAngel May Candol100% (1)

- Econ Module-2 Central ConceptDocument6 pagesEcon Module-2 Central ConceptJOHN PAUL LAGAONo ratings yet

- MODULE 6-Economics: Applied Economics Grade Level/Section: GAS-11A Subject Teacher: Joan A. MalaDocument5 pagesMODULE 6-Economics: Applied Economics Grade Level/Section: GAS-11A Subject Teacher: Joan A. MalaJOHN PAUL LAGAONo ratings yet

- Fabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesDocument17 pagesFabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesIva Milli Ayson100% (3)

- FABM 1 Week 3 4Document20 pagesFABM 1 Week 3 4RD Suarez67% (6)

- Fundamentals of Accountancy, Business and Management 1Document16 pagesFundamentals of Accountancy, Business and Management 1Gladzangel Loricabv83% (6)

- FABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessDocument20 pagesFABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessrioNo ratings yet

- BUS ETHICS - Module 6 - The Filipino Value SystemDocument4 pagesBUS ETHICS - Module 6 - The Filipino Value SystemKJ JonesNo ratings yet

- Distance Education: Instructional ModuleDocument11 pagesDistance Education: Instructional ModuleRD Suarez83% (6)

- Finance Module 7 Risk and ReturnDocument5 pagesFinance Module 7 Risk and ReturnJOHN PAUL LAGAONo ratings yet

- Fabm1 Module 5Document16 pagesFabm1 Module 5Randy Magbudhi50% (4)

- Abm Fabm2 Module 7 Lesson 1 Bank ReconciliationDocument15 pagesAbm Fabm2 Module 7 Lesson 1 Bank ReconciliationAtria Lenn Villamiel Bugal100% (1)

- Finance Module 5 Sources of Short Term FundsDocument5 pagesFinance Module 5 Sources of Short Term FundsKJ JonesNo ratings yet

- Fabm1 Module 1Document2 pagesFabm1 Module 1Alyssa De Guzman75% (4)

- FABM1 Module 6 Accounting Concepts and PrinciplesDocument4 pagesFABM1 Module 6 Accounting Concepts and PrinciplesDonna Bautista100% (2)

- Activity 2 PDFDocument2 pagesActivity 2 PDFJOHN PAUL LAGAO100% (1)

- Learning Activity Sheets in Fundamental of Accountancy, Business, and Management 1Document27 pagesLearning Activity Sheets in Fundamental of Accountancy, Business, and Management 1Rheyjhen Cadawas40% (5)

- BUS ETHICS Module 3 PhilosophiesDocument8 pagesBUS ETHICS Module 3 PhilosophiesKJ JonesNo ratings yet

- FABM 1 NotesDocument24 pagesFABM 1 Notessam100% (14)

- Module 10 - Business Ethics and Social ResponsibilityDocument6 pagesModule 10 - Business Ethics and Social ResponsibilityJOHN PAUL LAGAO50% (2)

- FABM 1 Lesson 1-Introdcution To AccountingDocument7 pagesFABM 1 Lesson 1-Introdcution To AccountingJon Carlo Garcia MacheteNo ratings yet

- Senior High School: Rules of Debit and CreditDocument19 pagesSenior High School: Rules of Debit and CreditIva Milli Ayson50% (2)

- Econ Module-7 CVP AnalysisDocument7 pagesEcon Module-7 CVP AnalysisJOHN PAUL LAGAONo ratings yet

- Finance Module 8 Capital Budgeting - InvestmentDocument8 pagesFinance Module 8 Capital Budgeting - InvestmentKJ Jones100% (1)

- Distance Education: Instructional ModuleDocument10 pagesDistance Education: Instructional ModuleRD Suarez100% (3)

- Accounting Simplified 1Document6 pagesAccounting Simplified 1kala1975No ratings yet

- Adjusting EntriesDocument9 pagesAdjusting EntriesCharmaine Montimor OrdonioNo ratings yet

- Homeplus Loan Application CorpDocument2 pagesHomeplus Loan Application CorpPascual D Monsanto JrNo ratings yet

- Chapter 6 Brief ExercisesDocument8 pagesChapter 6 Brief ExercisesPatrick YazbeckNo ratings yet

- Prepaid ExpenseDocument4 pagesPrepaid ExpenseEhsan Umer FarooqiNo ratings yet

- Annex A-2: Sample Conceptual Framework of Information SystemsDocument1 pageAnnex A-2: Sample Conceptual Framework of Information SystemspetiepanNo ratings yet

- Org-Man Module 7 ControllingDocument9 pagesOrg-Man Module 7 ControllingKJ JonesNo ratings yet

- Org-Man - Module 8 - Functional Areas of ManagementDocument6 pagesOrg-Man - Module 8 - Functional Areas of ManagementKJ JonesNo ratings yet

- Entrep Module 7 Business PlanDocument3 pagesEntrep Module 7 Business PlanKJ JonesNo ratings yet

- Entrep - Module 6 - Marketing, Branding, and E-PromotionDocument11 pagesEntrep - Module 6 - Marketing, Branding, and E-PromotionKJ JonesNo ratings yet

- Org-Man Module 6 LeadingDocument6 pagesOrg-Man Module 6 LeadingKJ JonesNo ratings yet

- Org-Man Module 6 LeadingDocument6 pagesOrg-Man Module 6 LeadingKJ JonesNo ratings yet

- Org-Man Module 5 StaffingDocument6 pagesOrg-Man Module 5 StaffingKJ JonesNo ratings yet

- Org Man Module 2 The Firm EnvironmentDocument6 pagesOrg Man Module 2 The Firm EnvironmentKJ JonesNo ratings yet

- Entrep - Module 5 - Capitalization and Sales ProjectionDocument10 pagesEntrep - Module 5 - Capitalization and Sales ProjectionKJ JonesNo ratings yet

- Entrep - Module 3 - Operations and Production ManagementDocument10 pagesEntrep - Module 3 - Operations and Production ManagementKJ JonesNo ratings yet

- Org-Man Module 3 PlanningDocument6 pagesOrg-Man Module 3 PlanningKJ JonesNo ratings yet

- Entrep - Module 4 - Human Resource ManagementDocument5 pagesEntrep - Module 4 - Human Resource ManagementKJ JonesNo ratings yet

- Org-Man Module 4 OrganizingDocument8 pagesOrg-Man Module 4 OrganizingKJ JonesNo ratings yet

- Entrep - Module 2 - Starting A Business, Opportunity, and Opportunity SeekingDocument11 pagesEntrep - Module 2 - Starting A Business, Opportunity, and Opportunity SeekingKJ Jones100% (1)

- Entrep Module 0Document3 pagesEntrep Module 0KJ JonesNo ratings yet

- Entrep - Module 1 - Introduction and Roles of EntrepreneurshipDocument6 pagesEntrep - Module 1 - Introduction and Roles of EntrepreneurshipKJ JonesNo ratings yet

- Netiquette: Formatting MessagesDocument4 pagesNetiquette: Formatting MessagesKJ JonesNo ratings yet

- Org Man - Module 1 - Introduction To ManagementDocument5 pagesOrg Man - Module 1 - Introduction To ManagementKJ Jones100% (2)

- Module 9 - Business Ethics and Social ResponsibilityDocument4 pagesModule 9 - Business Ethics and Social ResponsibilityJOHN PAUL LAGAO100% (2)

- BUS ETHICS - Module 10 - Special Topics and Trends in Business Ethics and Corporate Social ResponsibilityDocument6 pagesBUS ETHICS - Module 10 - Special Topics and Trends in Business Ethics and Corporate Social ResponsibilityKJ JonesNo ratings yet

- Org Man Module 0Document4 pagesOrg Man Module 0KJ JonesNo ratings yet

- BUS ETHICS - Module 5 - The Impact of Belief Systems in The Business Setting 2Document3 pagesBUS ETHICS - Module 5 - The Impact of Belief Systems in The Business Setting 2KJ JonesNo ratings yet

- BUS ETHICS - Module 8 - Business Ethics and The Natural EnvironmentDocument5 pagesBUS ETHICS - Module 8 - Business Ethics and The Natural EnvironmentKJ Jones100% (1)

- Bus Ethics - Module 7 - Major Ethical Issues in The Corporate WorldDocument6 pagesBus Ethics - Module 7 - Major Ethical Issues in The Corporate WorldKJ Jones100% (1)

- BUS ETHICS - Module 6 - The Filipino Value SystemDocument4 pagesBUS ETHICS - Module 6 - The Filipino Value SystemKJ JonesNo ratings yet

- Proclamation 131Document4 pagesProclamation 1317766yutrNo ratings yet

- Public EnterpriseDocument8 pagesPublic Enterpriseraiac047No ratings yet

- Sale of A Motor Vehicle TEMPLATEDocument2 pagesSale of A Motor Vehicle TEMPLATEHANIS MAT HUSSINNo ratings yet

- Supply Chain Case StudyDocument1 pageSupply Chain Case StudyAnooshaNo ratings yet

- Gloablisation and Real Estate MarketsDocument34 pagesGloablisation and Real Estate MarketsNitish313309No ratings yet

- Decodifying The Labour Codes - 11-01-2022Document59 pagesDecodifying The Labour Codes - 11-01-2022Rizwan PathanNo ratings yet

- Customer Relationship and Wealth ManagementDocument65 pagesCustomer Relationship and Wealth ManagementbistamasterNo ratings yet

- Budget 2019-20Document21 pagesBudget 2019-20Pranati ReleNo ratings yet

- Unit I - Logistics ManagementDocument12 pagesUnit I - Logistics ManagementDeepesh PathakNo ratings yet

- Paper2 HL G2 PDFDocument5 pagesPaper2 HL G2 PDFAntongiulio MiglioriniNo ratings yet

- Assignment 2Document2 pagesAssignment 2Rence MarcoNo ratings yet

- The University of Cambodia: Project Management (BUS649)Document13 pagesThe University of Cambodia: Project Management (BUS649)Chheang Eng NuonNo ratings yet

- Module 1Document25 pagesModule 1Gowri MahadevNo ratings yet

- Business Process Management Journal: Article InformationDocument24 pagesBusiness Process Management Journal: Article InformationAnys PiNkyNo ratings yet

- Annual Report 2015-2016: Our MissionDocument219 pagesAnnual Report 2015-2016: Our MissionImtiaz ChowdhuryNo ratings yet

- Stock Broking Economic AnalysisDocument15 pagesStock Broking Economic AnalysisMuhammad AizatNo ratings yet

- Planning Under Mixed EconomyDocument10 pagesPlanning Under Mixed EconomySurendra PantNo ratings yet

- Tilkamanjhi Bhagalpur University, Bhagapur: Writ ERDocument14 pagesTilkamanjhi Bhagalpur University, Bhagapur: Writ ERAnkitaNo ratings yet

- Job Hunting Is Getting Worse by Alana SemuelsDocument4 pagesJob Hunting Is Getting Worse by Alana SemuelsKal LamigoNo ratings yet

- Challenges: A Study of Textile Industry in India: Vanita Vishram Women's College of Commerce, SuratDocument7 pagesChallenges: A Study of Textile Industry in India: Vanita Vishram Women's College of Commerce, SuratSuraj ParmarNo ratings yet

- Federal Reserve Directors: A Study of Corporate and Banking Influence. Staff Report, Committee On Banking, Currency and Housing, House of Representatives, 94th Congress, 2nd Session, August 1976.Document127 pagesFederal Reserve Directors: A Study of Corporate and Banking Influence. Staff Report, Committee On Banking, Currency and Housing, House of Representatives, 94th Congress, 2nd Session, August 1976.babstar99967% (3)

- TurnKey Investing Philosophy (TurnKey Investor Series)Document12 pagesTurnKey Investing Philosophy (TurnKey Investor Series)Matthew S. ChanNo ratings yet

- A Cost of Production Report Is ADocument15 pagesA Cost of Production Report Is AMubasharNo ratings yet

- Hindustan Unilever Marketing Strategies and PoliciesDocument82 pagesHindustan Unilever Marketing Strategies and Policieskanish0% (1)

- CRMDocument19 pagesCRMBanpreet GillNo ratings yet

- Banasthali Vidyapith: Assignment of Advanced AccountancyDocument9 pagesBanasthali Vidyapith: Assignment of Advanced AccountancyAditi GuptaNo ratings yet

- HUD Settlement Statement - 221-1993Document4 pagesHUD Settlement Statement - 221-1993Paul GombergNo ratings yet

- Trade Me ProspectusDocument257 pagesTrade Me Prospectusbernardchickey100% (1)

- Tata Consultancy Services Ltd. Company AnalysisDocument70 pagesTata Consultancy Services Ltd. Company AnalysisPiyush ThakarNo ratings yet