Professional Documents

Culture Documents

Authorized Representative Declaration (Power of Attorney) : Part 1: Taxpayer or Debtor Information

Uploaded by

Yisrael Ezekiel Yahweh'sOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Authorized Representative Declaration (Power of Attorney) : Part 1: Taxpayer or Debtor Information

Uploaded by

Yisrael Ezekiel Yahweh'sCopyright:

Available Formats

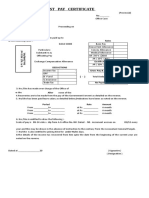

Reset Form

Michigan Department of Treasury Issued under authority of Public Act 122 of 1941.

151 (Rev. 07-19)

Authorized Representative Declaration (Power of Attorney)

INSTRUCTIONS: Use this form to authorize the Michigan Department of Treasury to communicate with a named individual or entity acting

on your behalf. Also use this form to designate a representative to receive copies of correspondence regarding a particular tax dispute

(other than City Income Tax). All information designated as “required” must be supplied for this authorization to be effective.

PART 1: TAXPAYER OR DEBTOR INFORMATION

Taxpayer’s Name (Required) If a business, include any DBA, trade or FEIN, ME or TR Number (Required for business taxes)

assumed name. If filing joint return, include spouse’s name.

Taxpayer or Business Address (Required) Taxpayer’s Social Security Number (Required if Spouse’s Social Security Number

no FEIN, ME, or TR Number listed)

Taxpayer’s E-mail Address Daytime Telephone Number (Required) Fax Number

PART 2: REVOCATION OF AUTHORITY

To revoke the authority of your current representative, check the applicable box in this section. Check only ONE box.

I revoke all prior authorizations. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5 and appoint a new representative in Part 3 who is authorized

under Part 4 and/or 5.

PART 3: REPRESENTATIVE APPOINTMENT

Your representative may be an entity or an individual. If you designate an entity you must also provide an individual as a contact. If no start date is

indicated the authorization is effective as of the date this form is signed. If no expiration date is indicated the authorization is effective until revoked.

Authorized Representative’s Name (Required) Contact Name (Required if an entity is named)

Authorized Representative’s Address (Required) Telephone Number (Required) Fax Number

Authorization Start Date (mm/dd/yyyy) Authorization Expiration Date (mm/dd/yyyy)

Authorized Representative’s E-mail Address

PART 4: TYPE OF AUTHORITY

If you check a box, you authorize your representative to act in that capacity.

1. Receive and inspect confidential information (upon request only). (To have your representative receive copies of all future letters and

notices involving a tax dispute [other than City Income Tax], you must complete Part 5.)

2. Make oral or written presentation of fact or argument.

3. Sign returns. You may restrict authority in boxes 1-4 to a specific matter (Not required)

Tax Type, Debt or Fee Year(s) or period(s)

4. Enter into agreements.

5. All of the above.

PART 5: REQUEST COPIES OF LETTERS AND NOTICES REGARDING A TAX DISPUTE (other than City Income Tax)

By checking this box, you are directing Treasury to send a copy of all future notices and letters involving a particular tax dispute to your

representative named in Part 3 under section 8 of the Revenue Act (MCL205.8). This dispute is for year(s) or period(s) __________________ and

Tax (income tax, sales tax, use tax, etc.)_________________________________________________________ (Tax and year(s) or period(s)

are both required if this box is checked.)

PART 6: TAXPAYER OR DEBTOR AUTHORIZATION

By signing this form, I authorize Treasury to communicate with my representative consistent with the authority granted.

Signature (Required) Print Name (Required) Title (Required if a business) Date (Required)

Spouse’s Signature Print Name Title Date (Required if spouse signs)

TREASURY USE ONLY

Division Name Reviewer Initials

Accepted Rejected

Form 151, Page 2

Purpose

Use the Authorized Representative Declaration (Power of Part 5: Requesting copies of letters and notices with

Attorney) (Form 151) to authorize the Michigan Department respect to a tax dispute.

of Treasury (Treasury) to communicate with a named NOTE: This part does not apply to City Income Tax.

individual or entity acting on your behalf. This form may

also be used to revoke your representative’s authority or to If you complete Part 5, you must identify on the line in Part 5

designate a representative to receive letters and notices a single tax matter that is in dispute. The dispute may cover

regarding a particular tax dispute. more than one tax period or year. If you have more than

one dispute with Treasury and want your representative

Required information. If a box includes the word to receive copies of future notices and letters with respect

“Required,” you must provide the information. If a box does to those additional disputes, you must fill out a separate

not contain the required information, the form is invalid and form for each dispute. Part 5 does not give a representative

you will be notified by letter. authority to act on your behalf. You must give your

Part 2: Revoking the authority of a representative. representative authority to act on your behalf by checking

Complete Part 2 if you want to revoke your representative’s one or more boxes in Part 4 if you want your representative

authority in whole or in part or all prior authorizations. After to do more than just receive future notices and letters. Only

you revoke your representative’s authority, you may represent one representative can be authorized to receive future letters

yourself, or you may appoint a new representative. and notices regarding a specific tax dispute under Part 5.

Part 3: Appointing an entity as your representative. Treasury will only send future letters and notices to the

If you appoint an entity as your representative, then any person identified on the most recent form. If you appoint an

individual within that entity is authorized to act on your entity as your representative, future letters and notices will

behalf. For example, if you appoint the XYZ Law Firm as be sent to the attention of the first “Contact Name.”

your representative, any attorney or paralegal from that firm Deceased taxpayer. Do not use this form for a deceased

is authorized to act on your behalf. The “Contact Name” is taxpayer. File a Claim for Refund Due a Deceased Taxpayer

only to ensure that information sent to the entity is directed (MI-1310) with a death certificate and/or a letter of authority

to the individual overseeing your representation. The contact (issued by the probate court) for a personal representative.

name is NOT your sole authorized representative. To appoint

an entity, write in the Name and Address box (for example): MAILING OR FAXING INSTRUCTIONS

XYZ Law Firm Individual taxpayers:

1234 Street Michigan Department of Treasury

City, State, ZIP Code Customer Contact Center

Individual Correspondence Section

Appointing an individual as your representative. If you P.O. Box 30058

appoint a specific individual as your representative, then only Lansing, Ml 48909

that individual is authorized to act on your behalf. Treasury Fax: 517-636-4488

will only discuss with or disclose information to that

individual. For example, if a specific attorney at the XYZ

When Treasury Collections asks for this form and any

Law Firm is named as your representative, Treasury will not

attachments:

discuss with or disclose information to any other attorney or

paralegal at the same firm. To appoint an individual, write in Michigan Department of Treasury — Coll

the Name and Address box (for example): P.O. Box 30149

Lansing, Ml 48909

Lynn Lee Fax: 517-272-5562

XYZ Law Firm

1234 Street

City, State, ZIP Code When a Treasury field office representative asks for this

form, send it as directed by that office.

Part 4: Type of authority: General or limited. You may

grant your representative general or limited authority to act

on your behalf. The actions that your representative may For all others:

take will depend on the boxes that you check in Part 4. Michigan Department of Treasury

Confidential information (box 1) will only be provided upon Customer Contact Center

request; Treasury will not automatically send confidential Registration Section

information to your representative. If you check box 5 in P.O. Box 30778

Part 4, you are granting your representative general authority Lansing, Ml 48909

to act on your behalf regarding any tax return and any debt.

However, granting your representative general authority does

not give the representative the right to receive future copies

of letters and notices unless Part 5 is also completed.

You might also like

- Resolution For Transactions Involving Treasury SecuritiesDocument4 pagesResolution For Transactions Involving Treasury SecuritiesYisrael Ezekiel Yahweh's100% (2)

- Role-of-CFO-in-LG - 2016 - Fair-Market-UsageDocument36 pagesRole-of-CFO-in-LG - 2016 - Fair-Market-UsageYisrael Ezekiel Yahweh'sNo ratings yet

- Labor and Employment Intake Questionnaire-NEWDocument7 pagesLabor and Employment Intake Questionnaire-NEWYisrael Ezekiel Yahweh'sNo ratings yet

- The Messenger of YHWHDocument5 pagesThe Messenger of YHWHYisrael Ezekiel Yahweh'sNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 1Document23 pagesChapter 1RusselNo ratings yet

- Chargeable Event Gains Income Tax Calculator Gain For Top SlicingDocument5 pagesChargeable Event Gains Income Tax Calculator Gain For Top Slicingnoonetwothreefour56No ratings yet

- Tax Q2Document3 pagesTax Q2mijareschabelita2No ratings yet

- Cheating Ourselves The Economic of Tax EvasionDocument35 pagesCheating Ourselves The Economic of Tax EvasionVicmel PakpahanNo ratings yet

- 4.e. INCOME TAXATION - PARTNERSHIPSDocument13 pages4.e. INCOME TAXATION - PARTNERSHIPSTine TungpalanNo ratings yet

- Thesis Writing FinalDocument34 pagesThesis Writing FinalFriends Law ChamberNo ratings yet

- Fabm2 Quarter4 Module 8.1Document16 pagesFabm2 Quarter4 Module 8.1Danny BulacsoNo ratings yet

- Fringe BenefitsDocument5 pagesFringe BenefitsZandra LeighNo ratings yet

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Week 4 Pracquiz PDFDocument16 pagesWeek 4 Pracquiz PDFcalliemozartNo ratings yet

- Summary of Thailand-Tax-Guide and LawsDocument34 pagesSummary of Thailand-Tax-Guide and LawsPranav BhatNo ratings yet

- Business Organization I Cases - Digest (3manresa - 12)Document172 pagesBusiness Organization I Cases - Digest (3manresa - 12)Izza GonzalesNo ratings yet

- Chapter 3 Income Taxation Tabag 2019 Sol ManDocument21 pagesChapter 3 Income Taxation Tabag 2019 Sol ManFMM50% (2)

- Week 6Document8 pagesWeek 6Richelle GraceNo ratings yet

- Ent300 Chapter 7Document10 pagesEnt300 Chapter 7Syaza AmiraNo ratings yet

- Income Tax Procedure PracticeU 12345 RB PDFDocument41 pagesIncome Tax Procedure PracticeU 12345 RB PDFBrindha BabuNo ratings yet

- Taxation LawDocument7 pagesTaxation LawJoliza CalingacionNo ratings yet

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018Document4 pagesReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018Mark Lawrence YusiNo ratings yet

- Preferential Taxation For Senior CitizensDocument53 pagesPreferential Taxation For Senior CitizensNddejNo ratings yet

- Chap 001Document85 pagesChap 001Rong GuoNo ratings yet

- LAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsDocument2 pagesLAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsSyed Jalil abbas100% (1)

- Accounting Past Paper 2Document2 pagesAccounting Past Paper 2Noshair AliNo ratings yet

- Fringe BenefitsDocument24 pagesFringe Benefitsmildred ramirezNo ratings yet

- General Principles: Taxation LawDocument17 pagesGeneral Principles: Taxation LawB-an Javelosa100% (1)

- KEY WORDS Income TaxationDocument15 pagesKEY WORDS Income TaxationAndrew Mercado NavarreteNo ratings yet

- RIT Inclusions and ExclusionsDocument46 pagesRIT Inclusions and ExclusionsBisag AsaNo ratings yet

- 16 CIR vs. Philippine Daily Inquirer, Inc., (GR No. 213943 March 22, 2017)Document24 pages16 CIR vs. Philippine Daily Inquirer, Inc., (GR No. 213943 March 22, 2017)Alfred GarciaNo ratings yet

- 2017 - 2018 Supreme Court DecisionsDocument1,412 pages2017 - 2018 Supreme Court DecisionsJerwin DaveNo ratings yet

- Summer Internship ReportDocument47 pagesSummer Internship ReportBijal Mehta43% (7)