Professional Documents

Culture Documents

Forex Trading Sessions - Everything You Need To Know From Strategy To Execution

Uploaded by

Forex Master WorkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forex Trading Sessions - Everything You Need To Know From Strategy To Execution

Uploaded by

Forex Master WorkCopyright:

Available Formats

arrel) = 63.14▲ All Share (J203) = 66 390▼ Rand / Dollar = 14.59▼ Rand / Pound = 20.

05▲

Search share name or index... A–Z Best Indices Retail Forex Currencies Crypto Commodities News Open a FREE Trading

Shares Buys Funds Account

Popular Best Brokers Forex No Deposit Bonus FSCA Regulated Forex Brokers Open a Bitcoin Wallet Broker of the Month

32

Major Announcement : The Biggest DeFi Cryptocurrency Token Launch of 2021 is now live – Buy Tokens Here

32

Search share name or index... Get Free Stock Alerts - Sign Up Here

0

Forex Trading Sessions – Everything you

need to know from Strategy to

68

Execution Most visited Pages

Sign In ( Stock Alerts )

Best Shares to Buy

Buy Bitcoin Legally

Forex NO DEPOSIT Bonuses

OPEN A TRADING ACCOUNT

Best Forex Brokers

Forex Trading for Beginners

Dollar to Rand

JSE Top 40

JSE All Share Index

SASOL

CAPITEC

SHOPRITE

In this how to guide, we unpack Forex trading sessions and explain everything you need to know

from strategy to execution in the four timelines: Sydney, Tokyo, London, and New York.

While the Forex marketplace is open 24/7, five and a half days a week, there are periods when there is

consistent volatility and periods where nothing much happens.

Learn how to trade Forex. Download our free e-book

This content is locked!

Please support us, use one of the buttons below to unlock the content.

Best Shares

to Buy*

Daily alerts

Understanding the trading sessions and the best times to trade is important for any Forex day trading Enter rst name

strategy or any other strategy for that matter.

Enter your email

The idiom – timing is everything – is particularly applicable for the Forex market, so get out your

Sign Me Up

calendar and start planning around the International Date Line!

powered by MailMunch

What is the International Date Line (IDL)?

The IDL is an imaginary line on the surface of the earth which outlines the border or boundary between

one day and the next day. This line is the reference point for the world’s time zones, which were created

to ensure a common time system.

As you can see in the image below the IDL runs from the North pole to the South pole dividing the

earth between east and west hemispheres.

How is time measured?

GMT – Greenwich Mean Time is the starting point of where earth’s time zones are measured found at

the London Greenwich Observatory.

UTC – Co-ordinated Universal Time took over from GMT and is time maintained via clocks in labs

located around the world.

Time zones in Africa

There following are time zones relevant to this article:

West Africa Time Zone WAT (UTC+1)

Central Africa Time Zone CAT (UTC+2)

East Africa Time Zone EAT (UTC+3)

Nigeria Time

South Africa Time Zone (UTC+3)

Egypt Cairo Time

It is agreed that the new Forex calendar day starts according to the International dateline. The first

market on the dateline to open is New Zealand and so the first market to open is the Sydney session.

Most Forex traders will hone in on the most popular trading periods known as a “Forex 3-session

strategy” focusing on Tokyo, London and New York sessions.

Below we have created a table of all four trading sessions and the conversions based on Summer/Spring

and Autumn/Winter periods.

South African Forex Market trading times

Hours for trading Forex means the time when you can place an Open/Close position, exchange currency

and speculate on price changes of pairs.

Basically, the trading hours are based on the time in which investors, banks and companies would be

open. Typically, in South Africa that is between 9 AM and 5 PM.

The Forex market operating hours in South Africa, Johannesburg are:

SAST Period Start and End Times

Download only 05:00 AM – 08:00 AM

Admin and download 08:00 AM – 09:00 AM

Automated trading 09:00 AM – 05:00 PM

Admin 05:00 PM – 06:00 PM

Market in Download only 06:00 PM – 03:00 AM

Please note: At 5 PM every day, New York time, the market closes for a few minutes – exactly for how

long depends on the broker but is usually anywhere between two to five minutes.

All Four Trading Sessions for Autumn/Winter in South Africa **

** Not including Day light savings

Season dates: Mar/Apr to Oct/Nov

TIME UTC/GMT SAST South African Time Zone

Sydney Open 22:00 Open 23:00

Sydney Close 06:00 Close 8:00

Tokyo Open 00:00 Open 1:00

Tokyo Close 08:00 Close 10:00

London Open 08:00 Open 9:00

London Close 16:00 Close 18:00

New York Open 13:00 Open 14:00

New York Close 21:00 Close 23:00

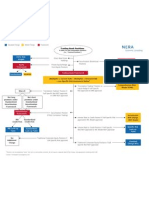

The 24-hour market in SA, during winter Season looks like this:

Some Forex trading sessions overlap so they are both open at the same time and you will find these

are some of the busiest times in your trading day.

SESSION OPEN

SESSION OVERLAP

SESSION CLOSED

SA TRADING TIME

24 HOUR

SYDNEY TOKYO LONDON NEW YORK

DAY

00:00 AM OPEN

01:00 AM OPEN OPEN

02:00 AM OPEN OPEN

03:00 AM OPEN OPEN

04:00 AM OPEN OPEN

05:00 AM OPEN OPEN

06:00 AM OPEN OPEN

07:00 AM OPEN OPEN

08:00 AM CLOSE OPEN

09:00 AM OPEN OPEN

10:00 AM CLOSE OPEN

11:00 AM OPEN

12:00 PM OPEN

1:00 PM OPEN

2:00 PM OPEN OPEN

3:00 PM OPEN OPEN

4:00 PM OPEN OPEN

5:00 PM OPEN OPEN

6:00 PM CLOSE OPEN

7:00 PM OPEN

8:00 PM OPEN

9:00 PM OPEN

10:00 PM OPEN

11:00 PM OPEN CLOSE

Open and close times for sessions

Remember day light savings when clocks are set forward or backward depending on the seasons –

Autumn (Fall)/Winter and Spring/Summer – and which hemisphere a session is in.

Depending on the season you will need to factor in the time shift as countries move to or from daylight

savings – luckily you will only have to factor it in for three trading sessions because Tokyo does not

have day light savings.

Day light savings takes place in Mar/April and Oct/Nov, therefore the open and closing times of the

Forex market will need to be adjusted.

During the Northern Hemisphere’s winter, when the New York session closes it will be midnight

(00:00) in South Africa.

When is Forex Trading closed?

Nearly all financial institutions, except the Middle East, are closed over weekends. Therefore, there is no

liquidity and not much point trading in Forex over weekends.

The Forex exchanges only close on two dates

Christmas Day

New Year’s Day

Forex Trading Strategies

To be a successful trader, there are many qualities and attributes that you need, amongst them

are:

The ability to work and keep calm under stress

Being a risk taker

Persistence and tenaciousness

The ability to make quick decisions

But none of these will matter if you do not have a good solid trading strategy that you feel comfortable

with and stick to.

If it is a solid well-reasoned strategy that other traders have used extensively with great success than

you will be able to have the confidence needed to stick to your strategy and be disciplined about it with

“following your gut” or doing erratic trades.

A Forex trading strategy is a system that a Forex trader uses to determine when to buy or sell a currency

pair.

A good Forex trading strategy allows for a trader to analyse the market, recognize specific indicators

and market conditions and confidently execute trades while mitigating risk as much as possible.

Timeframe for your trading

There are many types of trading styles and they are in different time frames from short to long. All of

them have been widely and successfully used.

Great traders will acquaint themselves with different strategies, and it’s best that beginner traders stick

to one strategy and look for those indicators that mark the strategy you are following.

More experienced traders will have built enough knowledge and experience to use the right strategy for

the current market conditions.

There are three criteria traders can use to compare different

strategies on their suitability:

Time resource required

Frequency of trading opportunities

Typical distance to target

Risk and reward

For example, position trading typically is the strategy with the highest risk but can give you the highest

reward with little time spent on the trade.

Scalping, on the other hand, is much lower risk because you are dealing with lower value amounts but

requires a great deal of time and a remarkably high frequency of trades.

It is important to get to know the different strategies and what suits your personality and lifestyle.

Do you love to do research and spend lots of time making trades? Or can you not be bothered?

Do you want to invest and just ride the trade out for a bit of time?

As you read all the following strategies try, and see which ones resonate with you.

What informs a Forex trading strategy?

Technical analysis and fundamental analysis is key

The two main analysis styles that traders use in formulating their strategies are technical analysis and

fundamental analysis. They aren’t always mutually exclusive but more often than not, one will be used

as the primary analysis tool.

Technical analysis is the study of price movements in a market.

It has become a popular approach to trading due to the advancement of technology which allows real

time analysis as well as charting packages and platforms that can handle large amounts of data very

quickly.

In technical analysis traders use historic chart patterns and indicators to predict future trends in the

market.

These charts can show past and present performance of a market and can help predict future trends

before entering a trade.

Fundamental analysis on the other hand is all about looking at the economic well-being of a country,

and how the state of a country can affects its currency.

It does not focus on currency price movements but rather the strength of that currency itself.

A trader that uses fundamental analysis will be looking at a country’s inflation, trade balance, gross

domestic product, unemployment/employment rates and their central bank’s benchmark interest rates.

Best Forex Trading Strategies

We will be looking at some popular and tested strategies that traders use to be consistently successful;

each strategy involves different investment of time, frequency and risk.

They will incorporate different timeframes as well as different types of analysis and show a wide range of

strategies so that you can see which type suits your demeanour, personality, amount of time available,

and amount of risk you are willing to take into account.

PRICE ACTION TRADING

Price action trading is a technical strategy that is formulated by studying the history of the price of a

currency.

You can use this technique alone or you can also use it with indicators. Price action can be used as a

stand-alone technique or in conjunction with an indicator.

Length of trade

You can implement Price Action Trading in various time periods (long, medium and short-term). The

ability to use multiple time frames for analysis makes price action trading a valuable trading analysis

tool.

Entry/Exit points

There are many methods to determine support/resistance levels which are generally used as entry/exit

points: Some of them are: Candle wicks, Trend identification, Fibonacci retracement, as well as indicators

and oscillators.

Within price action, there is range, trend, day, scalping, swing and position trading.

These strategies adhere to different forms of trading requirements which will be outlined in detail below.

The examples show varying techniques to trade these strategies to show just how diverse trading can

be, along with a variety of bespoke options for traders to choose from.

RANGE TRADING STRATEGY

In range trading you need to recognize support and resistance points and place trades around these key

levels.

This is a good strategy for when the market is fairly stable and not showing a lot of volatility, as well as

not showing clear signs and patterns of any particular trend.

Length of trade

This type of strategy can work for any time frame but you need to keep in mind that breakouts can

occur and so you need to have a risk management strategy in place as well.

Entry/Exit point

Oscillators such as the Relative Strength Index (RSI), Commodity Channel Index (CCI) and stochastics are

a few examples of timing tools that can be used in combination with price action to confirm and validate

signals or breakouts in this strategy.

Range trading can be a very profitable strategy but can come with a hefty time requirement as well.

TREND TRADING STRATEGY

Trend trading is a strategy that tries to ride a markets ongoing directional momentum to make profits.

Length of trade

It is difficult to limit the time frame of Trend trading since the trends themselves differ in length. But

usually it will be a medium to long-term time strategy. You can also use multiple time frame analysis in

trend trading.

Entry/Exit points

An oscillator like RSI, CCI etc would normally determine the entry point and exit points are calculated on

a positive risk-reward ratio that still mitigates any risk.

Traders can use stop level distances, of equal the distance of the movement, for example, to keep from

staying with the trade for too long.

One type of strategy within this strategy is a 50-pip strategy where the stop level is placed 50 pips away

from the entry point in order to manage risk.

When you see a strong trend in the market, trade it in the direction of the trend.

Trend trading can be time and labour intensive, but it can also give you great trading opportunities with

manageable risk compared to the profit that can be made.

This is a strategy, however, for traders that have a strong grasp of technical analysis.

POSITION TRADING

Position trading is a long-term strategy that is more aligned with fundamental factors however, technical

methods can be used as well.

This strategy takes a look at the wide and comprehensive view of the market in the long term and is not

concerned with the small market and price fluctuations that happen in the short and even medium

timeframes.

Length of trade

Position trades have a long-term outlook of weeks, months or sometimes even years.

This type of strategy is for the trader that either has an extreme amount of patience or just does not

have the time or desire to do higher frequency of trades.

This is also for the trader that has a strong grasp of a country’s economic factors and how they will

affect markets.

Entry/Exit points

Looking at the key levels on longer time frame charts (weekly/monthly) are the most useful for position

traders due to the comprehensive view of the market and its movement over longer periods of time.

Entry and exit points can be judged using fundamental analysis as well as technical analysis as per the

other strategies.

DAY TRADING STRATEGY

Day trading is a strategy where you start “from scratch” every day and open trades at the start of the

trading day to close them all within the same trading day.

In other words, all positions are closed before the market closes. This can be a single trade but typically

a day trader will make multiple trades throughout the day.

Length of trade

Trade times range from very short-term (matter of minutes) or short-term (hours) depending on the

market conditions and the patterns and indicators recognized.

But as stated, all trades will be opened and closed within the trading day.

Entry/Exit points

There are many ways to recognize entry and exit points depending on what pattern strategy you are

following.

You could be using a continuation, reversal or neutral chart pattern for the current market condition and

be following a pennant, head and shoulders or triangle pattern.

All these will have their own “rules” about entry and exit of that breakout and how to best manage risk

while making a profit.

This type of strategy is becoming immensely popular with traders because it allows a great number of

trading opportunities and it has a medium risk to reward ratio.

It does, however, require a lot of time spent every day and also a solid foundation of technical analysis is

required.

FOREX SCALPING STRATEGY

Scalping describes the strategy of taking small profits on a frequent basis by opening and closing

multiple positions throughout the day.

Traders can do this process manually but with the software, tools and algorithms available nowadays,

traders tend to automate this process with predefined guidelines as to when/where to enter and exit

positions.

Length of trade

This strategy is all about short-term trades quick as 1 minute to 30 minutes, as with small returns but

with great frequency to maximize daily profits if possible.

Entry/Exit points

Because this strategy is so short and quick, the most essential part is to identify a trend as it is about to

happen.

Indicators such as the moving average are crucial tools to spot trends. Using these key levels of the

trend on longer time frames allows the trader to see the bigger picture.

These levels will create support and resistance bands.

Scalping gives you the greatest number of trading opportunities in comparison to all the other Forex

strategies but it requires a LOT of time invested, with a strong foundation of technical analysis and it has

the lowest risk to reward ratio.

SWING TRADING

Swing trading is an attempt to profit from the swings in the market. These swings are comprised of

two main parts, the body and the swing point.

In this strategy you want to time your entries so that they catch most of each swing body, somewhere

between the extreme top and bottoms of a swing to maximize profit.

Length of trade

Swing trades are usually medium timeframe positions that are generally held anywhere between a few

hours to a few days but can last up to a few weeks.

Entry/Exit point

Much like the range bound strategy, oscillators and indicators can be used to select optimal entry/exit

positions and times.

Swing trading poses a substantial number of opportunities to trade in a medium risk to reward ratio, but

it requires a strong foundation in technical analysis and requires a lot of time.

CARRY TRADE STRATEGY

A Forex carry trade involves borrowing a currency in a country that has a low interest rate and low yield

to fund the purchase of a currency in a country that has a high interest rate and high yield.

Holding this position overnight will result in an interest payment being made to the trader based on the

“positive carry” of the trade.

The lower yielding currency is referred to as the “funding currency” while the currency with the higher

yield is referred to as the “target currency”.

Length of trade

Carry trades are dependent on interest rate fluctuations between the associated currencies and lend

itself to medium to long-term trades that can last weeks, months and even years.

Entry/Exit points

There are two aspects to a carry trade: exchange rate risk and interest rate risk. Therefore, the best time

to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation.

In terms of the interest rate, this will remain the same regardless of the trend as the trader will still

receive the difference int the interest rate between the target currency and the funding currency.

Carry trading doesn’t require a lot of time investment and it has a medium risk to reward ratio, however

you need to have a strong understanding of the Forex market.

Also, if you are someone who enjoys the rush of doing many trades this may not be for you because

there isn’t a lot of trading opportunities since you hold positions for longer periods of time.

Forex Trading Strategies to use in the Major

Sessions

While you can invest in the Forex market from any African region during the major trading sessions,

trading when the market is the busiest will lead to better profits.

Greater volume and volatility of the Forex market as buyers and sellers make their moves, creates the

best opportunities for traders.

Currency pairs and trading sessions

The session times are important to consider when choosing currency pairs, for example EUR or GBP

pairs should be traded in the London Forex trading session.

The best times to trade the pairs below are from 8:00 AM to 12:00 PM EST because this is when both

New York and London sessions are active.

EUR/USD

GBP/USD

USD/CHF

It is also important to know about the other trading sessions because the Forex market is contingent on

fundamental analysis which is informed by major news, reports, indicators and other data.

Indicators are usually, but not always, released to coincide with active trading sessions on the Forex

marketplace.

It is always good to select your currency pair and then see which Forex trading session is most active,

alternately you can do it the other way around as well.

Ultimately you want to consider all the information available to you which will inform the best trading

times to execute trades, along with your preferred trading strategies.

The Tokyo Session (also called the Asian Session)

The Asian Session is the world’s third largest Forex trading hub with 20% of all Forex trading taking

place during this session made up from trades in Hong Kong, Singapore, and Tokyo.

Below are some of the strategies you could use in the Tokyo session:

OPPORTUNITIES STRATEGIES

Price Action Trading

Action takes place early in day

Potential breakout trades later in the day

Economic data and news coming from

Forex news trading

Australia, New Zealand, and Japan

Japan’s economy is highly dependent

on exports, because China is a major

trade player there are a lot of trades

happening daily. Day trading – daily pivot strategy

There are periods where little trading

Range Trading

happens – ranges hold their positions

Consolidation could take place after

Breakout trading strategy – enter trade

market moves taken in the New York

based on support and/or resistance

session.

Pairs to trade in the Tokyo Session

The AUD/JPY is one of the most volatile pairs during the Tokyo trading session.

One will also see moves in Asia Pacific currency pairs such as AUD/USD and NZD/USD.

Yen pairs are good because of the multitude of Japanese companies doing business.

The London Session (also called the European session)

The London session has nearly 43% of all Forex trades in the world, making London the centre of Forex

trade in Europe alongside Paris, Edinburgh, Geneva, Luxembourg, Frankfurt, Zurich, and Amsterdam.

Below are some of the strategies you could use in the London session:

Trading Opportunities Forex Strategies

London morning breakout strategy

High liquidity and lower transaction

costs

Scalp Trading

Volatility subsides at lunch time (the middle

The most volatile Forex trading session of the session) and as traders wait for New

York to open

Price Action Trading

Overlap with New York and some of

Tokyo session

Swing Trading

Trend Trading

Trends will begin during this session and

most times continue to the start of the Reversal trading – trends can sometime

New York trading session reverse at the end of the London session

because European traders lock in profits

Pairs to trade in the London session

Due to the sheer volume of trading that occurs and the high liquidity you can trade nearly any Forex

currency pair.

It is always good to stick with major pairs because they have the tightest spreads and are influenced by

any news announced during the London session.

EUR/USD

GBP/USD

USD/JPY

USD/CHF

Yen crosses such as EUR/JPY and GBP/JPY are also actively traded at this time but do have wider

spreads than major pairs

The New York Session (also called the North American

session)

The New York session is the financial centre of trading in the U.S. with around seventeen percent of all

Forex transactions taking place there.

Because eighty five percent of all Forex trades involve the Dollar, when great U.S. economic data is

announced, it can move the markets.

Below are some of the strategies you could use in the New York session:

Trading Opportunities Forex Strategies

Forex breakout strategy to take

High liquidity in the morning – overlap advantage of volatility due to overlap

with London session makes it the most

liquid period of the day

Scalp Trading

Economic reports are released at the

Trend Trading

beginning of this session

Volatility and liquidity lower as the Moves are smaller – use a different strategy

London session ends such as Range Trading

Reversal trading – chance of reversals in

second half of session as traders’ close

Friday afternoon has little movement

positions for the weekend to limit exposure

to any news

Pairs to trade in the New York Session

Because there is such a high volume of trading in this session nearly any Forex currency pair can be

traded, although is always best to choose the majors.

EUR/USD

USD/JPY

GBP/USD

EUR/JPY

GBP/JPY

USD/CHF

As the dollar is on the other side of most transactions in this session, any big data released from the U.S.

has the potential to wreak havoc on the market as the dollar rises and falls on the back of it.

In conclusion

We would love to say that there is one, best strategy that will always ensure that you make profits, but

that is impossible. There is no single strategy or answer that will fit everyone, even if they are great

strategies in of themselves.

There is no one strategy, just as there is not one best genre of music or film, style of clothes, or cars to

drive. Why? Because personality is a big part of deciding and feeling what will fit YOU best.

Not all people like the same kinds of music or artists, and not all Forex trading strategies will fit your

personality either.

So, how do you know what “fits” you best? As in most things, as you start your trading education it is

important to digest as much information as possible and learn as you go, by doing a lot of

experimentation.

Therefore demo accounts are such an incredible tool for you to grow and learn, since you can try “real

trades” without the risk and stress of trading with your real capital.

This how to guide, looked at the Forex trading sessions and explained everything you need to know

from strategy to execution in the four timelines: Sydney, Tokyo, London, and New York.

As you get the feel for which of these strategies best appeals to you and as you gain more experience

and knowledge in Forex trading, you will be able to better incorporate some of these amazing strategies

into your successful trading careers.

Frequently Asked Questions

What are the trading times for Forex?

Forex trading is available 24 hours a day.

What time frame is best for trading?

Intraday is the best time frame and Intraday Traders will use minute charts which include 1-minute to

15-minute periods. At the end of the day, these traders will exit the market. Intraday Trading makes way

for plenty of opportunities and fewer risks.

What are the South African Forex Market trading times?

View the forex market operating hours in South Africa Johannesburg here

Can you trade Forex at night?

Yes, you can see that Forex is open 24 hours a day.

How long can you hold Forex?

Traders can hold a position for anything from a few minutes to a few years. Both instances have certain

risks though, that the trader should read up on

Louis Schoeman

Featured SA Shares Writer and Analyst.

Table of Contents

1. What is the International Date Line (IDL)?

2. How is time measured?

3. Time zones in Africa

4. South African Forex Market trading times

5. When is Forex Trading closed?

5.1. Forex Trading Strategies

5.2. Timeframe for your trading

5.2.1. There are three criteria traders can use to compare different strategies on their suitability:

6. What informs a Forex trading strategy?

7. Best Forex Trading Strategies

7.1. PRICE ACTION TRADING

7.1.1. Length of trade

7.1.2. Entry/Exit points

7.2. RANGE TRADING STRATEGY

7.2.1. Length of trade

7.2.2. Entry/Exit point

7.3. TREND TRADING STRATEGY

7.3.1. Length of trade

7.3.2. Entry/Exit points

7.4. POSITION TRADING

7.4.1. Length of trade

7.4.2. Entry/Exit points

7.5. DAY TRADING STRATEGY

7.5.1. Length of trade

7.5.2. Entry/Exit points

7.6. FOREX SCALPING STRATEGY

7.6.1. Length of trade

7.6.2. Entry/Exit points

7.7. SWING TRADING

7.7.1. Length of trade

7.7.2. Entry/Exit point

7.8. CARRY TRADE STRATEGY

7.8.1. Length of trade

7.8.2. Entry/Exit points

8. Forex Trading Strategies to use in the Major Sessions

8.1. Currency pairs and trading sessions

8.2. The Tokyo Session (also called the Asian Session)

8.2.1. Pairs to trade in the Tokyo Session

8.3. The London Session (also called the European session)

8.3.1. Pairs to trade in the London session

8.4. The New York Session (also called the North American session)

8.4.1. Pairs to trade in the New York Session

9. In conclusion

10. Frequently Asked Questions

11.

Useful Links Follow Us Most Popular Our Address

Blog Open an Account Address:

Government Bonds Top Forex Brokers in South

Bitcoin to Rand Africa Suite 201, 2nd Floor

South African Banks Branch Price and trade data source: JSE Top 40

The Firs

Codes JSE Ltd All other statistics Dollar to Rand

Terms of Service calculated by Profile Data. All A – Z Shares Cnr Bierman & Cradock

Disclaimer data is delayed by at least 15 JSE All Share Index (ALSI) Avenues

About Us minutes. Top 100 JSE Listed Firms By

Contact Us Market Capitalisation Rosebank

Privacy Policy How to Buy JSE Shares Johannesburg

Advertise With Us Forexsuggest.com

Web Stories 2196

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you

understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money.

You might also like

- EBOOK - Getting Started With ForexDocument27 pagesEBOOK - Getting Started With ForexAnother HumanNo ratings yet

- Interview Trading Psychology Expert Van Tharp PDFDocument9 pagesInterview Trading Psychology Expert Van Tharp PDFcoachbiznesuNo ratings yet

- Beginner 101Document34 pagesBeginner 101Eugene OkpanteyNo ratings yet

- Trading Times For CurrenciesDocument8 pagesTrading Times For CurrenciesHussan MisthNo ratings yet

- Lesson 1 - Trendline & Structure LevelsDocument14 pagesLesson 1 - Trendline & Structure LevelsrontechtipsNo ratings yet

- Entry and Exits: Eurusd Spread: 2 Pips H4Document1 pageEntry and Exits: Eurusd Spread: 2 Pips H4Philip okumuNo ratings yet

- Eakout Trading StrategyDocument18 pagesEakout Trading StrategyrocimoNo ratings yet

- Technical TradingDocument9 pagesTechnical Tradingviníciusg_65No ratings yet

- 21 Questions You Should Answer in Your Trading PlanDocument5 pages21 Questions You Should Answer in Your Trading PlanDenis SimiyuNo ratings yet

- Trade Plan TemplateDocument3 pagesTrade Plan TemplateMarco BarreraNo ratings yet

- Equal Open and Close, Doji PatternsDocument24 pagesEqual Open and Close, Doji PatternsalokNo ratings yet

- Strategy Portfolio: Dravyaniti Consulting LLPDocument13 pagesStrategy Portfolio: Dravyaniti Consulting LLPChidambara StNo ratings yet

- Trading Plan 2021 BILLIONAIRE - Daily Routine, Money Management, RulesDocument2 pagesTrading Plan 2021 BILLIONAIRE - Daily Routine, Money Management, RulesFrancisco Javier Escamilla RebollarNo ratings yet

- Appendix A - Trading Plan Template: Financial GoalDocument3 pagesAppendix A - Trading Plan Template: Financial GoalBrian KohlerNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Build A Profitable StartupDocument1 pageBuild A Profitable StartupSimext TechnologiesNo ratings yet

- Trader's Success Pyramid: A Holistic ApproachDocument12 pagesTrader's Success Pyramid: A Holistic Approachramji3115337No ratings yet

- Trading Journal Binary Option Sep 2019 - by AndreDocument1 pageTrading Journal Binary Option Sep 2019 - by Andrejhon hewatNo ratings yet

- My Personal Trading Plan: Equity Daily Income & Weekly IncomeDocument5 pagesMy Personal Trading Plan: Equity Daily Income & Weekly IncomejanamaniNo ratings yet

- Van Tharp Interview: Overcoming Trading Biases for SuccessDocument14 pagesVan Tharp Interview: Overcoming Trading Biases for SuccesscoachbiznesuNo ratings yet

- Finding The Right Stock Sana SecuritiesDocument45 pagesFinding The Right Stock Sana Securitiesswapnilsalunkhe2000No ratings yet

- Day 2 - Sample-Trade-PlanDocument3 pagesDay 2 - Sample-Trade-PlanJager HunterNo ratings yet

- 5ers A4 Online-1Document34 pages5ers A4 Online-1A van BrakelNo ratings yet

- Trading PsychologyDocument11 pagesTrading PsychologyAamir Fakih0% (1)

- BOW Indicator V4.0 Trading GuideDocument2 pagesBOW Indicator V4.0 Trading GuideBruno VicenteNo ratings yet

- Compounding SheetDocument4 pagesCompounding SheetMouzam AliNo ratings yet

- Ultimate Loss Recovery Strategy UpdatedDocument3 pagesUltimate Loss Recovery Strategy UpdatedThanaram SauNo ratings yet

- Cryptocurrency Trading Is Very Profitable When Done RightDocument4 pagesCryptocurrency Trading Is Very Profitable When Done RightanonNo ratings yet

- Chart Patterns Double Tops BottomsDocument9 pagesChart Patterns Double Tops BottomsJeremy NealNo ratings yet

- Market Risk FlowchartDocument1 pageMarket Risk FlowchartlardogiousNo ratings yet

- The Trading Plan FSMDocument9 pagesThe Trading Plan FSMDinesh CNo ratings yet

- Livermores Trading Rules SCRBD 1Document2 pagesLivermores Trading Rules SCRBD 1Joel FrankNo ratings yet

- Technical Analysis Terms ExplainedDocument2 pagesTechnical Analysis Terms ExplainedAndré Vitor Favaro Medes de Oliveira0% (2)

- Buddhist TraderDocument54 pagesBuddhist Tradersid100% (3)

- Module 9 - Risk Management & Trading PsychologyDocument132 pagesModule 9 - Risk Management & Trading PsychologyAce LikaNo ratings yet

- Money & Risk PlanDocument2 pagesMoney & Risk PlanJoel SepeNo ratings yet

- 4 5922281635100755097Document69 pages4 5922281635100755097Kumar Amit Singh0% (1)

- How To Stop Overthinking And Start Achieving (7 Proven WaysDocument4 pagesHow To Stop Overthinking And Start Achieving (7 Proven WaysMichael MarioNo ratings yet

- My Trading Goals and ObjectivesDocument11 pagesMy Trading Goals and ObjectivesyhaodforNo ratings yet

- Trade BookDocument32 pagesTrade BookjustshubhamsharmaNo ratings yet

- Miracle of DisciplineDocument10 pagesMiracle of DisciplineMiroslav CiricNo ratings yet

- Git Dos and Don'Ts: Hints and Common Pitfalls Matthias Männich, July 19 2011Document21 pagesGit Dos and Don'Ts: Hints and Common Pitfalls Matthias Männich, July 19 2011puja_malh100% (1)

- Inside A Traders MindDocument19 pagesInside A Traders MindAbhishek SinghNo ratings yet

- A Day in The Life of A Trader - Petri RedelinghuysDocument34 pagesA Day in The Life of A Trader - Petri Redelinghuysmabooz100% (1)

- How Sir Anakin/Investradersph Changed My Trading Journey, and Gave Me An Opportunity To Manage 4 PortfoliosDocument14 pagesHow Sir Anakin/Investradersph Changed My Trading Journey, and Gave Me An Opportunity To Manage 4 PortfoliosallanNo ratings yet

- Jurnal Trading - TP - CLDocument3 pagesJurnal Trading - TP - CLTrader Kaki LimaNo ratings yet

- Robinhood users code trailing stop loss algorithmDocument3 pagesRobinhood users code trailing stop loss algorithmj39jdj92oijtNo ratings yet

- A Review of The Path To ConsistencyDocument8 pagesA Review of The Path To ConsistencyCAD16No ratings yet

- MaaDocument19 pagesMaaHanzala SiddiqueNo ratings yet

- 13 tips for successful forex tradingDocument12 pages13 tips for successful forex tradingMichael MarioNo ratings yet

- Trade The Waves!: AnnouncingDocument11 pagesTrade The Waves!: AnnouncingTanyaradzwaNo ratings yet

- Advance through day trading levels and boost profits with position size limitsDocument15 pagesAdvance through day trading levels and boost profits with position size limitssarav10No ratings yet

- Trading 4Document12 pagesTrading 4Horia IonNo ratings yet

- Professor Trading JournalDocument68 pagesProfessor Trading JournalAman AgrawalNo ratings yet

- Trading Tips and Cheat Sheet For Beginners: DisclaimerDocument14 pagesTrading Tips and Cheat Sheet For Beginners: DisclaimerZayn TranNo ratings yet

- NSK Magic 3 System by Nitin Kadam.Document2 pagesNSK Magic 3 System by Nitin Kadam.Raj VasuNo ratings yet

- Adam Khoo OTS2018 Presentation SlidesDocument38 pagesAdam Khoo OTS2018 Presentation Slidesshree bNo ratings yet

- Strategy BookDocument25 pagesStrategy BookjustshubhamsharmaNo ratings yet

- Investment Banking Deal ProcessDocument25 pagesInvestment Banking Deal Processdkgrinder100% (1)

- Primary Dealer System - A Comparative StudyDocument5 pagesPrimary Dealer System - A Comparative Studyprateek.karaNo ratings yet

- Accounting 0452 Revision NotesDocument48 pagesAccounting 0452 Revision NotesMasood Ahmad AadamNo ratings yet

- Block 2Document90 pagesBlock 2G RAVIKISHORENo ratings yet

- Finacle Friendly A Handbook On CbsDocument289 pagesFinacle Friendly A Handbook On CbsS. Allen78% (23)

- Persiapan Pensiun Dan Kesiapan Pensiun Dalam Persepsi Pegawai Negeri Dan Pegawai SwastaDocument17 pagesPersiapan Pensiun Dan Kesiapan Pensiun Dalam Persepsi Pegawai Negeri Dan Pegawai SwastaAlla MandaNo ratings yet

- Your Statement: Account SummaryDocument5 pagesYour Statement: Account SummaryVictor PopaNo ratings yet

- Annual Report: Ekuiti Nasional BerhadDocument131 pagesAnnual Report: Ekuiti Nasional BerhadFiruz Abd RahimNo ratings yet

- Vendor-Form Sakchham KarkiDocument4 pagesVendor-Form Sakchham KarkiMijuna RukihaNo ratings yet

- Income Tax: General Principles: Module No. 4Document4 pagesIncome Tax: General Principles: Module No. 4Jay Lord Floresca100% (1)

- Review Questions For Test #2 ACC210Document8 pagesReview Questions For Test #2 ACC210AaaNo ratings yet

- Valet Parking Locations UAEDocument3 pagesValet Parking Locations UAEvineet sharmaNo ratings yet

- Money MattersDocument2 pagesMoney MattersAndrew ChambersNo ratings yet

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- LomaDocument4 pagesLomaUshaNo ratings yet

- The Global Capitalist Crisis:: Its Origins, Nature and ImpactDocument45 pagesThe Global Capitalist Crisis:: Its Origins, Nature and Impactanmol149No ratings yet

- Time Value of MoneyDocument40 pagesTime Value of MoneyAhmedmughalNo ratings yet

- Assign 4 Answer Partnership Liquidation Millan 2021Document12 pagesAssign 4 Answer Partnership Liquidation Millan 2021mhikeedelantar100% (1)

- Latihan Soal Analysis of Financial StatementDocument7 pagesLatihan Soal Analysis of Financial StatementCaroline H24No ratings yet

- Chang Et Al 2016 Journal of Financial and Quantitative AnalysisDocument54 pagesChang Et Al 2016 Journal of Financial and Quantitative AnalysisLaila AbdallahNo ratings yet

- Finance and Economics - 22 CasesDocument35 pagesFinance and Economics - 22 CasesSeong-uk KimNo ratings yet

- Note Buad804 Mod1 Ksal6urtnfn6pelDocument169 pagesNote Buad804 Mod1 Ksal6urtnfn6pelAdetunji Babatunde TaiwoNo ratings yet

- (FORM IV B (RULE 26 (2) ) ) : Chiripal Poly Films LimitedDocument1 page(FORM IV B (RULE 26 (2) ) ) : Chiripal Poly Films LimitedRahul PowarNo ratings yet

- Lecturer-Led Tutorial Chapter 5 (2023)Document9 pagesLecturer-Led Tutorial Chapter 5 (2023)Ncebakazi DawedeNo ratings yet

- Medina Guce Galindes Salanga 2018 Barangay Governance PDFDocument16 pagesMedina Guce Galindes Salanga 2018 Barangay Governance PDFPaulojoy BuenaobraNo ratings yet

- 2800021Document2 pages2800021Daood AbdullahNo ratings yet

- Revised SALN Form for Public OfficialsDocument2 pagesRevised SALN Form for Public OfficialsJaiden MerinNo ratings yet

- Smart Drive Two Wheeler Insurance PolicyDocument1 pageSmart Drive Two Wheeler Insurance PolicyHungamaSurat SuratNo ratings yet

- Impact of M&A on Tata Steel and Cours GroupDocument8 pagesImpact of M&A on Tata Steel and Cours Groupaashish0128No ratings yet

- Slides Show - Importance of InsuranceDocument8 pagesSlides Show - Importance of InsuranceVeron Melvin YusakNo ratings yet