Professional Documents

Culture Documents

What Is A Business Asset

Uploaded by

FirdaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is A Business Asset

Uploaded by

FirdaCopyright:

Available Formats

What is a Business Asset?

A business asset is an item of value owned by a company. Business assets span many categories.

They can be physical, tangible goods, such as vehicles, real estate, computers, office furniture, and

other fixtures, or intangible items, such as intellectual property.

Special Considerations

Current Assets Vs. Non-Current Assets

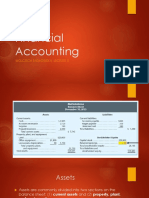

Business assets are divided into two sections on the balance sheet: current assets and non-current

assets. Current assets are business assets that will be turned into cash within one year, such as cash,

marketable securities, inventory and receivables, debts owed to a company by its customers for

goods or services that have been delivered or used but not yet paid for. These assets may only have

value for a short while, but they are still treated as business assets.

Non-current assets, or long-term assets, on the other hand, are less liquid assets that are expected

to provide value for more than one year. In other words, the company does not intend on selling or

otherwise converting these assets in the current year. Non-current assets are generally referred to

as capitalized assets since the cost is capitalized and expensed over the life of the asset in a process

called depreciation. This includes items such as property, buildings, and equipment.

Depreciation and Amortization of Business Assets

Tangible or physical business assets are depreciated, while intangible business assets are amortized,

the process of spreading the cost of an intangible asset over the course of its useful life. When

businesses amortize and depreciate expenses, they help tie an asset's costs to the revenues it

generates.

Depreciation is calculated by subtracting the asset's salvage value or resale value from its original

cost. The difference between the cost of the asset and salvage value is divided by the useful life of

the asset. If a truck has a useful life of 10 years, costs $100,000, and has a salvage value of $10,000,

the depreciation expense is calculated as $100,000 minus $10,000 divided by 10, or $9,000 per year.

In other words, instead of writing off the entire amount of the asset, capitalized business assets are

only expensed by a fraction of the full cost each year.

Valuing Business Assets

The value of business assets vary and can change over time. Many current, tangible assets, such as

vehicles, computers and machinery equipment tend to age and some may even become obsolete as

newer, more efficient technologies are introduced.

When companies want to use an asset as collateral or to substantiate depreciation deductions they

can get them valued by an appraiser.

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Types of AssetsDocument19 pagesTypes of AssetsMylene SalvadorNo ratings yet

- Framework For Preparation of Financial StatementsDocument7 pagesFramework For Preparation of Financial StatementsAviral PachoriNo ratings yet

- ASSIGNMENT - Jollibee Foods Corp. Financial Forecasting Exercise - by Catherine Rose Tumbali, MBA 2nd Sem, Section 70069Document7 pagesASSIGNMENT - Jollibee Foods Corp. Financial Forecasting Exercise - by Catherine Rose Tumbali, MBA 2nd Sem, Section 70069Cathy Tumbali100% (1)

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- AC15 Quiz 2Document6 pagesAC15 Quiz 2Kristine Esplana Toralde100% (1)

- Chapter 3 ExercisesDocument3 pagesChapter 3 ExercisesLê Chấn PhongNo ratings yet

- What Is A Business AssetDocument1 pageWhat Is A Business AssetFirdaNo ratings yet

- How Business Assets Work: Balance Sheet Historical CostDocument2 pagesHow Business Assets Work: Balance Sheet Historical CostLin MarieNo ratings yet

- Fixed Asset Vs Current AssetDocument3 pagesFixed Asset Vs Current AssetSheila Mae LiraNo ratings yet

- Noncurrent AssetsDocument6 pagesNoncurrent AssetsJohn Matthew CallantaNo ratings yet

- Fixed Asset in AccountingDocument7 pagesFixed Asset in Accountingnallarahul86No ratings yet

- Revenues On The Income StatementDocument4 pagesRevenues On The Income Statementkishorepatil8887No ratings yet

- Professional Practices Lecture 18Document40 pagesProfessional Practices Lecture 18Talha Chaudhary100% (1)

- Accounting of Fixed AssetsDocument6 pagesAccounting of Fixed Assetsnallarahul86No ratings yet

- Assets, Liabilities, and The Balance SheetDocument19 pagesAssets, Liabilities, and The Balance Sheetdebojyoti100% (1)

- Fixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ADocument7 pagesFixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ARandal SchroederNo ratings yet

- Depreciation and AmortisationDocument2 pagesDepreciation and AmortisationShweta BajpaiNo ratings yet

- Types of AssetsDocument2 pagesTypes of AssetsJustine Airra OndoyNo ratings yet

- Balance Sheet 2. Income Statement (P&L) 3. Cash Flow StatementDocument4 pagesBalance Sheet 2. Income Statement (P&L) 3. Cash Flow StatementArjit KumarNo ratings yet

- What Is The Difference Between Rent Receivable and Rent PayableDocument3 pagesWhat Is The Difference Between Rent Receivable and Rent PayableMa. Angela GarciaNo ratings yet

- L6 DepreciationDocument35 pagesL6 DepreciationVall Halla100% (1)

- 12 Prepare Financial ReportsDocument48 pages12 Prepare Financial Reportstigistdesalegn2021No ratings yet

- 08 Revenue, Expense and Capital IssuesDocument35 pages08 Revenue, Expense and Capital Issuesraghavendra_20835414100% (1)

- Personal Assets: AssetDocument6 pagesPersonal Assets: AssetDipak NandeshwarNo ratings yet

- Economía de Minerales: Balance SheetDocument48 pagesEconomía de Minerales: Balance SheetLucasPedroTomacoBayotNo ratings yet

- MCom - Accounts ch-8 Topic5Document16 pagesMCom - Accounts ch-8 Topic5Sameer GoyalNo ratings yet

- 08 Revenue, Expense and Capital IssuesDocument35 pages08 Revenue, Expense and Capital IssuesjayaNo ratings yet

- Examples of Assets AreDocument2 pagesExamples of Assets AreBella AyabNo ratings yet

- Assets, Liabilities, Equity, RevenueDocument17 pagesAssets, Liabilities, Equity, RevenueAlfred MphandeNo ratings yet

- Acfm Unit 4Document47 pagesAcfm Unit 4begumayesha7366No ratings yet

- Current Assets and Non-Current Assets: Monday GroupDocument11 pagesCurrent Assets and Non-Current Assets: Monday GroupGJ BadenasNo ratings yet

- What Is Cash FlowDocument31 pagesWhat Is Cash FlowSumaira BilalNo ratings yet

- The Accounting EquationDocument4 pagesThe Accounting EquationjcwimzNo ratings yet

- Cash Flow and Funds FlowDocument17 pagesCash Flow and Funds FlowNitinNo ratings yet

- Capital Expenses or Expenditures Are Payments by A Business For Fixed Assets, Like BuildingsDocument4 pagesCapital Expenses or Expenditures Are Payments by A Business For Fixed Assets, Like BuildingsMichelle MirandaNo ratings yet

- Business Financial Terms - Definitions: Acid TestDocument11 pagesBusiness Financial Terms - Definitions: Acid Testaishwary rana100% (1)

- Unit V IOME Sem VDocument6 pagesUnit V IOME Sem VJagmohan Rajput100% (1)

- 02 Handout 1Document6 pages02 Handout 1Stacy Anne LucidoNo ratings yet

- Bunwin Residence: Is The Company Profitable??Document6 pagesBunwin Residence: Is The Company Profitable??Pum MineaNo ratings yet

- General Price Level AccountingDocument6 pagesGeneral Price Level AccountingMahroosh Khan004No ratings yet

- Acid Test: Hariapankti@yahoo - Co.inDocument14 pagesAcid Test: Hariapankti@yahoo - Co.inAbhijeet Bhaskar100% (1)

- Does The Balance Sheet Always BalanceDocument3 pagesDoes The Balance Sheet Always BalanceJacqueline Anne MalonzoNo ratings yet

- Tools of Working CapitalDocument34 pagesTools of Working CapitalShiva Prasad33% (3)

- AssetsDocument4 pagesAssetsCLLN FILESNo ratings yet

- Current Assets & Current LiabilitiesDocument11 pagesCurrent Assets & Current LiabilitiesRoshni ChhabriaNo ratings yet

- Fofm Word File Roll No 381 To 390Document26 pagesFofm Word File Roll No 381 To 390Spandan ThakkarNo ratings yet

- BACNTHIDocument3 pagesBACNTHIFaith CalingoNo ratings yet

- A Balance SheetDocument3 pagesA Balance SheetKarthik ThotaNo ratings yet

- Did You KnowDocument3 pagesDid You KnowEllaine Pearl AlmillaNo ratings yet

- Working CapitalDocument18 pagesWorking CapitalASHWINI SINHANo ratings yet

- Accounting Equation: Ads by GoogleDocument9 pagesAccounting Equation: Ads by GoogleOliver HarmonNo ratings yet

- Revenue ExpendituresDocument8 pagesRevenue ExpendituresAdvertising Alaska Holiday100% (1)

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Acid TestDocument45 pagesAcid TestMahendar Yash100% (1)

- Important HighlightsDocument2 pagesImportant HighlightsSyed Zeeshan ArshadNo ratings yet

- Accounts 1Document5 pagesAccounts 1SujithNo ratings yet

- Limitations of The Balance SheetDocument14 pagesLimitations of The Balance SheetFantayNo ratings yet

- Accounting - DefinitionsDocument4 pagesAccounting - DefinitionsYashi SharmaNo ratings yet

- Acc Financial Statement Proj InfoDocument13 pagesAcc Financial Statement Proj InfoSandhya ThaparNo ratings yet

- Intangible AssetsDocument10 pagesIntangible Assetssamuel debebeNo ratings yet

- English Accounting TermsDocument8 pagesEnglish Accounting TermsRobiMuhammadIlhamNo ratings yet

- Intangible Assets AssignmntDocument5 pagesIntangible Assets AssignmntSuleyman TesfayeNo ratings yet

- Financial Reporting: Othm Level 5 Diploma in Accounting and BusinessDocument33 pagesFinancial Reporting: Othm Level 5 Diploma in Accounting and BusinessDime PierrowNo ratings yet

- BINUS University: Question 1 of 5 (Point 15%)Document5 pagesBINUS University: Question 1 of 5 (Point 15%)FirdaNo ratings yet

- Nama: Firda Arfianti NIM: 2301949596 Kelas: LB53 Revenue CycleDocument17 pagesNama: Firda Arfianti NIM: 2301949596 Kelas: LB53 Revenue CycleFirdaNo ratings yet

- Firda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3Document2 pagesFirda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3FirdaNo ratings yet

- Firda Arfianti - LC53 - Consolidated Workpaper, Wholly Owned SubsidiaryDocument3 pagesFirda Arfianti - LC53 - Consolidated Workpaper, Wholly Owned SubsidiaryFirdaNo ratings yet

- Firda Arfianti - LC53 - Equity Method, Two Consecutive YearsDocument5 pagesFirda Arfianti - LC53 - Equity Method, Two Consecutive YearsFirdaNo ratings yet

- Firda Arfianti - LC53 - Eliminating Entries, Noncontrolling InterestDocument3 pagesFirda Arfianti - LC53 - Eliminating Entries, Noncontrolling InterestFirdaNo ratings yet

- Top 2 Ways Corporations Raise CapitalDocument1 pageTop 2 Ways Corporations Raise CapitalFirdaNo ratings yet

- HSW Group (Jakarta Pusat)Document1 pageHSW Group (Jakarta Pusat)FirdaNo ratings yet

- Name: Firda Arfianti NIM: 2301949596 Class: LA53 GSLC 1 Assignment Chapter 4 - Preventing FraudDocument2 pagesName: Firda Arfianti NIM: 2301949596 Class: LA53 GSLC 1 Assignment Chapter 4 - Preventing FraudFirdaNo ratings yet

- Will Baby Boomers Bankrupt Social SecurityDocument2 pagesWill Baby Boomers Bankrupt Social SecurityFirdaNo ratings yet

- Examples of Moral HazardDocument1 pageExamples of Moral HazardFirdaNo ratings yet

- The Pros and Cons of Immigration ReformDocument2 pagesThe Pros and Cons of Immigration ReformFirdaNo ratings yet

- Advacc 2 Guerrero Chapter 14Document15 pagesAdvacc 2 Guerrero Chapter 14Drew BanlutaNo ratings yet

- PRTC 1stPB - 05.22 Sol AFARDocument4 pagesPRTC 1stPB - 05.22 Sol AFARCiatto SpotifyNo ratings yet

- Midterm Exam Intermediate Accounting 1Document9 pagesMidterm Exam Intermediate Accounting 111-C2 Dennise EscobidoNo ratings yet

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmeNo ratings yet

- FIM Exel 1 1Document46 pagesFIM Exel 1 1Bao Khanh HaNo ratings yet

- Financial Applications For Eicher Motors PDFDocument43 pagesFinancial Applications For Eicher Motors PDFLogesh KumarNo ratings yet

- Class No 14 & 15Document31 pagesClass No 14 & 15WILD๛SHOTッ tanvirNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsAhmed Rawy100% (1)

- BE AnalysisDocument44 pagesBE Analysissahu.tukun003No ratings yet

- CH - 5 Accounting RatiosDocument47 pagesCH - 5 Accounting RatiosAaditi V100% (1)

- Cost Chapter 1-5Document302 pagesCost Chapter 1-5chingNo ratings yet

- Financial Reporting and Analysis 7th Edition Ebook PDFDocument42 pagesFinancial Reporting and Analysis 7th Edition Ebook PDFdon.anderson433100% (36)

- Partial - Solution - Module 2 - 6theditionDocument16 pagesPartial - Solution - Module 2 - 6theditionJenn AmaroNo ratings yet

- Accs Qns VarietyDocument55 pagesAccs Qns VarietyBharatonNo ratings yet

- Tutorial Questions BBFA1053 2023 JanDocument39 pagesTutorial Questions BBFA1053 2023 JanJoelle LimNo ratings yet

- Target Financial Statement AnalysisDocument6 pagesTarget Financial Statement AnalysisTJ WelbornNo ratings yet

- ABSTRACT Ratio AnalysisDocument13 pagesABSTRACT Ratio AnalysisDiwakar SrivastavaNo ratings yet

- Fundamentals of Advanced Accounting Hoyle 6th Edition Solutions ManualDocument14 pagesFundamentals of Advanced Accounting Hoyle 6th Edition Solutions Manualhorriblebaculite0ly6t100% (26)

- Learner's Guide Senior Secondary Course-AccountancyDocument3 pagesLearner's Guide Senior Secondary Course-AccountancyAkshay KumarNo ratings yet

- Redemption of Preference Shares Format of Balance Sheet Particulars Note No. I Equity & Liabilities 1. Shareholders FundDocument2 pagesRedemption of Preference Shares Format of Balance Sheet Particulars Note No. I Equity & Liabilities 1. Shareholders FundhanumanthaiahgowdaNo ratings yet

- CH 018Document2 pagesCH 018Joana TrinidadNo ratings yet

- FORM 2006124: Caribbean Examinations Council Secondary Education Certificate Examination Principles of AccountsDocument12 pagesFORM 2006124: Caribbean Examinations Council Secondary Education Certificate Examination Principles of AccountsJael BernardNo ratings yet

- CA Final AFM Q MTP 2 May 2024 Castudynotes ComDocument10 pagesCA Final AFM Q MTP 2 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- Swiss Cottage 2023 Prelim P1 AnswersDocument5 pagesSwiss Cottage 2023 Prelim P1 Answersvikalp.singh.sengarNo ratings yet

- A ReportDocument53 pagesA ReportImnoneNo ratings yet

- Full Download Using Financial Accounting Information The Alternative To Debits and Credits 8th Edition Porter Solutions ManualDocument36 pagesFull Download Using Financial Accounting Information The Alternative To Debits and Credits 8th Edition Porter Solutions Manualnoahkim2jgp100% (27)