Professional Documents

Culture Documents

Investor Protection in India

Uploaded by

SHREYA KUMARIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investor Protection in India

Uploaded by

SHREYA KUMARICopyright:

Available Formats

Rules and Regulations:

The SCRA, the SEBI and the Depositories Act, have all been amended by the

Government . Under the SEBI Act and the Depositories Act, SEBI has drafted

regulations for the registration and control of all market intermediaries, as well as the

prevention of unfair trade practices , insider trading, and other illegal activities.

The Government and SEBI issue notices, guidelines, and circulars that market

participants must obey under these Acts. SROs, like stock exchanges, have developed

their own set of rules and regulations.

There are eight important SEBI Rules and Regulations, they are:

1. Registration

2. Code of Conduct

3. Agreement with Clients

4. Proper Books of Accounts and Records, etc.

5. General Responsibilities of an Underwriter

6. Appointment of Compliance officer

7. Board’s Right to Inspect

8. Liability in Case of Default

Investors Awareness Program:

Stock exchanges hold Investor Awareness Programs on a regular basis to educate and

raise awareness among investors about how the capital market works, especially how

stock exchanges operate. These services have been held in almost every state

throughout the country.

The Investor Awareness Program covers wide range of topics, including Investment

Instruments, Portfolio Approach, Mutual Funds, Tax Provisions, Trading, Clearing

and Settlement, Rolling Settlement, Investors Protection Fund, Trade Guarantee Fund,

Dematerialization of Shares, Investors Grievance Redressal System Available with

SEBI, BSE, and Company Law Board, and information on Sentiment Analysis.

Safeguards for Investors:

These are some of the safeguards that investors must adhere to before investing in the

stock market-

1. While choosing a broker/ sub-broker: it only deals with SEBI registered broke or

sub-broker after conducting due diligence. Details on the list of Brokers can be

found in the Exchanges Members list and on the website.

2. While entering into a Contract:

a) Fill out a client registration form with the names of the broker and the sub-broker.

b) Sign a client agreement with a broker or sub-broker. To register as a client of a

BSE Trading Member, all investors must sign this agreement, until entering into

an agreement, the client should check the following:

i. Before signing the agreement on a genuine stamp paper of the required value,

carefully read and recognise the terms and conditions.

ii. For his record, the Client should obtain a signed copy of all documents.

3. While Transacting:

a) Specify the Exchange from which your trade will be conducted to the Broker/

Sub-Broker, and hold a separate account for each Exchange.

b) Within 24 hours of the Trades execution, receive a legitimate Contract Notice

from a Trading Member of the Exchange.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Project Work PDFDocument60 pagesProject Work PDFSHREYA KUMARINo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Rejection of PlaintDocument9 pagesRejection of PlaintSHREYA KUMARINo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

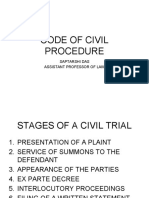

- Journey of A Civil TrialDocument21 pagesJourney of A Civil TrialSHREYA KUMARI0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Joinder Misjoinder and Non JoinderDocument8 pagesJoinder Misjoinder and Non JoinderSHREYA KUMARINo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- To Whom Hindu Law ApplyDocument95 pagesTo Whom Hindu Law ApplySHREYA KUMARINo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Project Dayan PrathaDocument29 pagesProject Dayan PrathaSHREYA KUMARINo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Witch Hunting On JharkhandDocument4 pagesWitch Hunting On JharkhandSHREYA KUMARINo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Laws Relating To Investor Protection in India and USADocument16 pagesLaws Relating To Investor Protection in India and USASHREYA KUMARINo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Ind AS 12Document37 pagesInd AS 12Amal P TomyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Sostac 4 EnterpriseDocument5 pagesSostac 4 EnterprisenanapokuahNo ratings yet

- Zomato LTD.: Investing Key To Compounding Long Term GrowthDocument5 pagesZomato LTD.: Investing Key To Compounding Long Term GrowthAvinash GollaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Key Insights Porter'S Analysis: Packaged Food VS Selected FMCG Industries Category Wise Sale of Foods (CRS)Document2 pagesKey Insights Porter'S Analysis: Packaged Food VS Selected FMCG Industries Category Wise Sale of Foods (CRS)Ratan PrasadNo ratings yet

- FAIIQuiz 1 BsolDocument3 pagesFAIIQuiz 1 BsolHuzaifa Bin SaeedNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SOWC 2012-Main Report EN 21dec2011 PDFDocument156 pagesSOWC 2012-Main Report EN 21dec2011 PDFjllc2004No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ETSY - Etsy, IncDocument10 pagesETSY - Etsy, Incdantulo1234No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- MRP Projects For AutomobileDocument25 pagesMRP Projects For AutomobileSagar Vijayvargiya0% (1)

- Main ReporttDocument45 pagesMain ReporttSapana HiraveNo ratings yet

- RGF Salary Watch 2020 - VIETNAM PDFDocument37 pagesRGF Salary Watch 2020 - VIETNAM PDFcuongtieubinh100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- (Cambridge Short Introductions To Management) Richard Barker - Short Introduction To Accounting Dollar Edition-Cambridge University Press (2011) PDFDocument170 pages(Cambridge Short Introductions To Management) Richard Barker - Short Introduction To Accounting Dollar Edition-Cambridge University Press (2011) PDFMustafa BaigNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 9 Books of AccountsDocument19 pages9 Books of Accountsapi-267023512100% (2)

- What Is PeercoinDocument2 pagesWhat Is PeercoinlauraNo ratings yet

- Aronciano RRLDocument11 pagesAronciano RRLEdward AroncianoNo ratings yet

- What To Text A Girl PDFDocument56 pagesWhat To Text A Girl PDFArturo JR100% (3)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Total Projected CostDocument15 pagesTotal Projected CostElla AbelardoNo ratings yet

- Short Cases For DiscussionDocument35 pagesShort Cases For Discussionw69P50% (2)

- Reliance Retail - A Fresh Approach Towards Retailing in IndiaDocument33 pagesReliance Retail - A Fresh Approach Towards Retailing in IndiaDeepak Singh Bisht100% (3)

- Financial Management (Keshav Kasyap)Document5 pagesFinancial Management (Keshav Kasyap)keshav kashyapNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Business Case For MDMDocument18 pagesBusiness Case For MDMvinay10356No ratings yet

- F & M AccountingDocument6 pagesF & M AccountingCherry PieNo ratings yet

- Rob Parson Morgan StanleyDocument1 pageRob Parson Morgan StanleyLuis Javier Naval ParraNo ratings yet

- Energy and PowerDocument69 pagesEnergy and PowerFahadullah Khan AfridiNo ratings yet

- Presentation David EatockDocument22 pagesPresentation David EatockpensiontalkNo ratings yet

- Chapter 4 Risk and Return IntroductionDocument12 pagesChapter 4 Risk and Return IntroductionAbdu YaYa AbeshaNo ratings yet

- Hitachi CaseDocument15 pagesHitachi CaseManish Goyal0% (1)

- SBI Magnum Tax Gain SchemeDocument14 pagesSBI Magnum Tax Gain SchemeabhiranjanNo ratings yet

- Rms Guide Catastrophe Modeling 2008 PDFDocument24 pagesRms Guide Catastrophe Modeling 2008 PDFSaiKiran TanikantiNo ratings yet

- Limitations of Ratio AnalysisDocument1 pageLimitations of Ratio AnalysisumairNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unit 5-Technical AnalysisDocument21 pagesUnit 5-Technical AnalysisjineshshajiNo ratings yet