Professional Documents

Culture Documents

FSAQ1

Uploaded by

Faith Reyna TanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FSAQ1

Uploaded by

Faith Reyna TanCopyright:

Available Formats

2nd Semester SY 2020-2021

AEC12 – Governance, Business Ethics, Risk Management and Internal Control

FSAQ1 – Risk Management

Questions:

1. Why is there an increased attention and emphasis on risk management for corporations these days?

2. Explain the significance of Establishing the context as a step for risk management.

3. Briefly explain and differentiate the three major categories of risks presented by Cabrera in her book.

Multiple Choice Questions:

1. The risk that refers to uncertainty about the rate of return caused by the nature of the business is

a. Business risk c. Liquidity risk

b. Default risk d. Financial risk

2. The risk associated with the uncertainty created by the inability to turn investment quickly for cash

a. Interest rate risk c. Business risk

b. Liquidity risk d. Default risk

3. The risk that the real rate of return will be less than the nominal or stated rate of return due to inflation is

referred to as

a. Purchasing power risk c. Default risk

b. Liquidity risk d. Business risk

4. Operations risk is manifested in all of the following except

a. Process stoppage c. Interest rates volatility

b. Technological obsolescence d. Management fraud

5. Financial risk is manifested in all of the following except

a. Environment risk c. Credit risks

b. Liquidity risks d. Market liquidity risks

6. Non-financial risks associated with Financial Institutions include the following except

a. Integrity risk c. Regulatory risk

b. Leadership risk d. Derivative risk

7. ISO 31000 suggests that once risks have been identified and assessed, techniques to manage the risks should be

applied. These techniques include the following except

a. Disregard c. Sharing

b. Retention d. Reduction

8. The technique of eliminating or reducing risk which could mean losing out on the potential gain is called

a. Risk avoidance c. Risk retention

b. Risk sharing d. Risk reduction

9. ___________ involves accepting the loss or benefit of gain from a risk when it occurs

a. Risk avoidance c. Risk reduction

b. Risk retention d. Risk sharing

10. Which is the first step in the enterprise-wide risk management process?

a. Implement action plans c. Develop/design action plans

b. Monitor and report risk d. Identify, source, and measure risks

You might also like

- The Simple Rules of Risk: Revisiting the Art of Financial Risk ManagementFrom EverandThe Simple Rules of Risk: Revisiting the Art of Financial Risk ManagementNo ratings yet

- FSAQ1Document1 pageFSAQ1Rhea May BaluteNo ratings yet

- AEC12 - Governance, Business Ethics, Risk Management and Internal ControlDocument1 pageAEC12 - Governance, Business Ethics, Risk Management and Internal ControlRhea May BaluteNo ratings yet

- Governance Chapter 11 Nina Mae DiazDocument3 pagesGovernance Chapter 11 Nina Mae DiazNiña Mae DiazNo ratings yet

- QUIZ 1 Risk Answers PDFDocument6 pagesQUIZ 1 Risk Answers PDFLandeelyn Godinez100% (1)

- Finma 1 Module 3 Lesson 1Document15 pagesFinma 1 Module 3 Lesson 1Jeranz ColansiNo ratings yet

- Different Risks ReviewerDocument2 pagesDifferent Risks ReviewerAngel Keith MercadoNo ratings yet

- Risk Management & Insurance QuizDocument2 pagesRisk Management & Insurance QuizApdy Aziiz Daahir100% (1)

- Risk Management Limuel Dela CruzDocument23 pagesRisk Management Limuel Dela CruzPRINCESS MENDOZANo ratings yet

- False: I. True or FalseDocument11 pagesFalse: I. True or FalseValerie Estonanto LazatinNo ratings yet

- Questions and AnswersDocument50 pagesQuestions and AnswersPRISS100% (1)

- Quiz 2 - Controlling Risk (With Answers) PDFDocument5 pagesQuiz 2 - Controlling Risk (With Answers) PDFJay Mark AbellarNo ratings yet

- Entrepreneurial Mind-Unit-8Document24 pagesEntrepreneurial Mind-Unit-8Altaire Gabrieli DayritNo ratings yet

- And Controlling Areas or Events With A Potential ForDocument7 pagesAnd Controlling Areas or Events With A Potential ForVenice Marie ArroyoNo ratings yet

- DetailedcbokDocument6 pagesDetailedcbokapi-3733726No ratings yet

- RISK ManagementDocument6 pagesRISK ManagementRoshini ManoharNo ratings yet

- Risk ResponseDocument2 pagesRisk Responsean scNo ratings yet

- Domain 5Document186 pagesDomain 5Nagendra KrishnamurthyNo ratings yet

- Quizz 1.answerDocument3 pagesQuizz 1.answerKookie ShresthaNo ratings yet

- Advance Risk Management Chapter 4Document12 pagesAdvance Risk Management Chapter 4rjyasir1985No ratings yet

- M03 Rejd Ge 11e SG C03 PDFDocument14 pagesM03 Rejd Ge 11e SG C03 PDFAtticus SinNo ratings yet

- Cae01-Chapter 7 ModuleDocument8 pagesCae01-Chapter 7 ModuleLintonNo ratings yet

- Principles of Risk Risk Management Specimen Examination Guide v2Document10 pagesPrinciples of Risk Risk Management Specimen Examination Guide v2Anonymous qAegy6GNo ratings yet

- Risk ManagementDocument2 pagesRisk ManagementZariah GtNo ratings yet

- MGT 209 - CH 11 NotesDocument7 pagesMGT 209 - CH 11 NotesAmiel Christian MendozaNo ratings yet

- Quiz 1Document3 pagesQuiz 1Mukti Shankar ShresthaNo ratings yet

- Topic 7 Individual Activity ACCDocument11 pagesTopic 7 Individual Activity ACCheyNo ratings yet

- Solution Manual For Principles of Risk Management and Insurance 13th Edition by RejdaDocument7 pagesSolution Manual For Principles of Risk Management and Insurance 13th Edition by Rejdaa23592989567% (3)

- Risk Management (SM) ICMAP Attempts Qs - xlsx-1Document8 pagesRisk Management (SM) ICMAP Attempts Qs - xlsx-1Sibgha FayyazNo ratings yet

- Unit Iii Risk ManagementDocument5 pagesUnit Iii Risk ManagementAllister Rex CamanseNo ratings yet

- FIMA 40053: Risk Management (Midterm Examination)Document18 pagesFIMA 40053: Risk Management (Midterm Examination)Kim Ella100% (1)

- GBERMIC - Module 11Document8 pagesGBERMIC - Module 11Paolo Niel ArenasNo ratings yet

- Principles of InvestmentDocument35 pagesPrinciples of InvestmentUsman RafiqueNo ratings yet

- l5m2 - Mock Exam Question Paper - 19.08.20-1Document11 pagesl5m2 - Mock Exam Question Paper - 19.08.20-1jane100% (1)

- Full Download Test Bank For Risk Management and Insurance 12th Edition James S Trieschmann PDF Full ChapterDocument36 pagesFull Download Test Bank For Risk Management and Insurance 12th Edition James S Trieschmann PDF Full Chapterondogram.betulinpwl1gz100% (20)

- Test Bank For Risk Management and Insurance 12th Edition James S TrieschmannDocument36 pagesTest Bank For Risk Management and Insurance 12th Edition James S Trieschmanncreutzerpilement1x24a100% (40)

- Full P3 Case Study BookletDocument302 pagesFull P3 Case Study BookletAli ShahnawazNo ratings yet

- NIBM - Risk MGMTDocument5 pagesNIBM - Risk MGMTNB SouthNo ratings yet

- Book 1 - Foundations of Risk Management PDFDocument19 pagesBook 1 - Foundations of Risk Management PDFmohamed0% (1)

- Types of RisksDocument2 pagesTypes of RisksMitchell NathanielNo ratings yet

- Enterprise Risk Management1Document14 pagesEnterprise Risk Management1ralph100% (1)

- Quiz 1 Multiple ChoiceDocument2 pagesQuiz 1 Multiple ChoiceGoal Digger Squad VlogNo ratings yet

- Quiz Group 4Document5 pagesQuiz Group 4Astherielle SeraphineNo ratings yet

- Chapter 1Document2 pagesChapter 1Nazlı YumruNo ratings yet

- Risk Management Limuel Dela CruzDocument24 pagesRisk Management Limuel Dela CruzEDUARDO JR. VILLANUEVANo ratings yet

- Compiled Notes CH 11 15Document26 pagesCompiled Notes CH 11 15Miks EnriquezNo ratings yet

- L5M2 - MOCK EXAM AnswersDocument25 pagesL5M2 - MOCK EXAM AnswersibraokelloNo ratings yet

- FRM一级百题 风险管理基础Document67 pagesFRM一级百题 风险管理基础bertie RNo ratings yet

- 2013 FRM Level 1 Practice ExamDocument93 pages2013 FRM Level 1 Practice ExamDũng Nguyễn TiếnNo ratings yet

- NAME: Anne Marielle Pla Uy I. True or False. Justify Your Answer. Answer: TrueDocument5 pagesNAME: Anne Marielle Pla Uy I. True or False. Justify Your Answer. Answer: TrueMarielle UyNo ratings yet

- Chapter 4 Enterprise Risk Management and Related Topics (Test Bank)Document8 pagesChapter 4 Enterprise Risk Management and Related Topics (Test Bank)by ScribdNo ratings yet

- Risk ManagementDocument7 pagesRisk ManagementEYOB AHMEDNo ratings yet

- Risk Management Mcqs PDFDocument10 pagesRisk Management Mcqs PDFRhx Gangblog61% (18)

- Summative Assessment Business Finance Part 2 With KeyDocument3 pagesSummative Assessment Business Finance Part 2 With KeyRealyn GonzalesNo ratings yet

- 20 Types of Business Risk - SimplicableDocument1 page20 Types of Business Risk - SimplicableSulemanNo ratings yet

- Test Bank For Risk Management and Insurance 12th Edition James S TrieschmannDocument6 pagesTest Bank For Risk Management and Insurance 12th Edition James S Trieschmanndelphianimpugnerolk3gNo ratings yet

- Preparation Unit 6Document26 pagesPreparation Unit 6api-357340520No ratings yet

- Credit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDDocument46 pagesCredit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDzaman asadNo ratings yet

- Rejda Rmi12 Im01Document12 pagesRejda Rmi12 Im01MohammedNo ratings yet

- data - Docs/nsw-Risk - Management - Guide - Small - Business - Pdf&Ei 0Dk2Tim0Jmecomcxkfqe&Usg Afqjcne - Jko92Pmixrru 2Fna4Rbdzz-TqwDocument9 pagesdata - Docs/nsw-Risk - Management - Guide - Small - Business - Pdf&Ei 0Dk2Tim0Jmecomcxkfqe&Usg Afqjcne - Jko92Pmixrru 2Fna4Rbdzz-TqwRushi NaikNo ratings yet

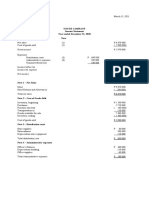

- Exercise No.4 (Acctg 7) - TanDocument1 pageExercise No.4 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Linear Programming Models: Graphical and Computer MethodsDocument91 pagesLinear Programming Models: Graphical and Computer MethodsFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chapter Test - Expenditure CycleDocument4 pagesChapter Test - Expenditure CycleFaith Reyna TanNo ratings yet

- Chapter Test - Revenue CycleDocument3 pagesChapter Test - Revenue CycleFaith Reyna TanNo ratings yet

- AEC12 Chapter 4Document7 pagesAEC12 Chapter 4Faith Reyna TanNo ratings yet

- Chapter Test - Production CycleDocument3 pagesChapter Test - Production CycleFaith Reyna TanNo ratings yet

- Disclaimer: College of Information and Communications TechnologyDocument33 pagesDisclaimer: College of Information and Communications TechnologyFaith Reyna TanNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- Chapter Test - Gen Ledger & RPTG CycleDocument3 pagesChapter Test - Gen Ledger & RPTG CycleFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chapter01 IntroductionToComputerProgrammingDocument23 pagesChapter01 IntroductionToComputerProgrammingFaith Reyna TanNo ratings yet

- Accounting Information SystemDocument58 pagesAccounting Information SystemMohammed Akhtab Ul HudaNo ratings yet

- Halina Mountain Resort (B)Document5 pagesHalina Mountain Resort (B)SuzetTe OlmedoNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument18 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Session 32 - IBCDocument7 pagesSession 32 - IBCUnnati RawatNo ratings yet

- How To Use Ichimoku Charts in Forex TradingDocument14 pagesHow To Use Ichimoku Charts in Forex Tradinghenrykayode4No ratings yet

- TMAP Template Classification Tree - Data Combination TestDocument14 pagesTMAP Template Classification Tree - Data Combination Testrajesh.j162763No ratings yet

- Inventories and Investment Theories v2Document10 pagesInventories and Investment Theories v2Joovs JoovhoNo ratings yet

- Reviewer in TaxationDocument9 pagesReviewer in TaxationMerlyn M. Casibang Jr.No ratings yet

- B00o56n3bs EbokDocument387 pagesB00o56n3bs EboksaeedayasminNo ratings yet

- Assignment On Time Value of MoneyDocument2 pagesAssignment On Time Value of MoneyVijay NathaniNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/12 March 2021Document24 pagesCambridge IGCSE™: Business Studies 0450/12 March 2021Wilfred BryanNo ratings yet

- Cnooc LimitedDocument3 pagesCnooc LimitedMahdiNo ratings yet

- Brianne For DC-Mach 10th 2014 FilingDocument136 pagesBrianne For DC-Mach 10th 2014 FilingBrianneforDCNo ratings yet

- Chap 015Document19 pagesChap 015RechelleNo ratings yet

- Quiz Question and Answers of Ratio Analysis Class 12 AccountancyDocument89 pagesQuiz Question and Answers of Ratio Analysis Class 12 AccountancybinodeNo ratings yet

- Philippine Refining Company (Now Known As "Unilever Philippines (PRC), Inc."), Petitioner, vs. Court of Appeals, Court of Tax Appeals, and The Commissioner of Internal Revenue, G.R. No. 118794Document5 pagesPhilippine Refining Company (Now Known As "Unilever Philippines (PRC), Inc."), Petitioner, vs. Court of Appeals, Court of Tax Appeals, and The Commissioner of Internal Revenue, G.R. No. 118794Mae TrabajoNo ratings yet

- Culinary Union Letter To Gaming Control Board Re: Alex MerueloDocument5 pagesCulinary Union Letter To Gaming Control Board Re: Alex MerueloMegan MesserlyNo ratings yet

- And Analysis Functionality: Research KEYDocument1 pageAnd Analysis Functionality: Research KEYranaurNo ratings yet

- Thapa. Bina Thapa. Prakash PDFDocument76 pagesThapa. Bina Thapa. Prakash PDFTILAHUNNo ratings yet

- Parking Garage Planning and OperationDocument182 pagesParking Garage Planning and OperationKhan Lala100% (1)

- 2 David MDocument39 pages2 David MAmol Mahajan100% (1)

- ANALYTICAL STUDY ON FINANCIAL PERFORMANCE OF HINDUSTAN UNILEVER LIMITED Ijariie5525Document8 pagesANALYTICAL STUDY ON FINANCIAL PERFORMANCE OF HINDUSTAN UNILEVER LIMITED Ijariie5525Avishi KushwahaNo ratings yet

- Nyo DT MagazineDocument124 pagesNyo DT MagazineobsramonNo ratings yet

- HDFC Customer Preference & Attributes Towards Saving-AccountDocument50 pagesHDFC Customer Preference & Attributes Towards Saving-Accountpmcmbharat264No ratings yet

- Naveed Shahzad: ObjectiveDocument2 pagesNaveed Shahzad: ObjectiveNaveed ShahzadNo ratings yet

- FRM Presentation 2Document20 pagesFRM Presentation 2Paul BanerjeeNo ratings yet

- VP-DC-009 - e Way BillDocument1 pageVP-DC-009 - e Way BillTechnetNo ratings yet

- Project IRIS PresentationDocument11 pagesProject IRIS PresentationRadha MadhuriNo ratings yet

- What Is The Implication of The Global Crisis To Financial ManagersDocument2 pagesWhat Is The Implication of The Global Crisis To Financial ManagersYenelyn Apistar CambarijanNo ratings yet

- IFS Module 2Document47 pagesIFS Module 2Dhrumi PatelNo ratings yet

- Electrical Engineering 101: Everything You Should Have Learned in School...but Probably Didn'tFrom EverandElectrical Engineering 101: Everything You Should Have Learned in School...but Probably Didn'tRating: 4.5 out of 5 stars4.5/5 (27)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Analog Design and Simulation Using OrCAD Capture and PSpiceFrom EverandAnalog Design and Simulation Using OrCAD Capture and PSpiceNo ratings yet

- The Age of Agile: How Smart Companies Are Transforming the Way Work Gets DoneFrom EverandThe Age of Agile: How Smart Companies Are Transforming the Way Work Gets DoneRating: 4.5 out of 5 stars4.5/5 (5)

- Laws of UX: Using Psychology to Design Better Products & ServicesFrom EverandLaws of UX: Using Psychology to Design Better Products & ServicesRating: 5 out of 5 stars5/5 (9)

- 507 Mechanical Movements: Mechanisms and DevicesFrom Everand507 Mechanical Movements: Mechanisms and DevicesRating: 4 out of 5 stars4/5 (28)

- Articulating Design Decisions: Communicate with Stakeholders, Keep Your Sanity, and Deliver the Best User ExperienceFrom EverandArticulating Design Decisions: Communicate with Stakeholders, Keep Your Sanity, and Deliver the Best User ExperienceRating: 4 out of 5 stars4/5 (19)

- The Design Thinking Playbook: Mindful Digital Transformation of Teams, Products, Services, Businesses and EcosystemsFrom EverandThe Design Thinking Playbook: Mindful Digital Transformation of Teams, Products, Services, Businesses and EcosystemsNo ratings yet

- Artificial Intelligence Revolution: How AI Will Change our Society, Economy, and CultureFrom EverandArtificial Intelligence Revolution: How AI Will Change our Society, Economy, and CultureRating: 4.5 out of 5 stars4.5/5 (2)

- The Jobs To Be Done Playbook: Align Your Markets, Organization, and Strategy Around Customer NeedsFrom EverandThe Jobs To Be Done Playbook: Align Your Markets, Organization, and Strategy Around Customer NeedsRating: 5 out of 5 stars5/5 (1)

- CATIA V5-6R2015 Basics - Part I : Getting Started and Sketcher WorkbenchFrom EverandCATIA V5-6R2015 Basics - Part I : Getting Started and Sketcher WorkbenchRating: 4 out of 5 stars4/5 (10)

- UX: Simple and Effective Methods for Designing UX Great Products Using UX Programming TheoriesFrom EverandUX: Simple and Effective Methods for Designing UX Great Products Using UX Programming TheoriesNo ratings yet

- Delft Design Guide -Revised edition: Perspectives- Models - Approaches - MethodsFrom EverandDelft Design Guide -Revised edition: Perspectives- Models - Approaches - MethodsNo ratings yet

- A Baker's Dozen: Real Analog Solutions for Digital DesignersFrom EverandA Baker's Dozen: Real Analog Solutions for Digital DesignersRating: 4 out of 5 stars4/5 (1)

- Designing for Behavior Change: Applying Psychology and Behavioral Economics 2nd EditionFrom EverandDesigning for Behavior Change: Applying Psychology and Behavioral Economics 2nd EditionNo ratings yet

- Heat Exchanger Design Guide: A Practical Guide for Planning, Selecting and Designing of Shell and Tube ExchangersFrom EverandHeat Exchanger Design Guide: A Practical Guide for Planning, Selecting and Designing of Shell and Tube ExchangersRating: 4 out of 5 stars4/5 (13)

- Design for How People Think: Using Brain Science to Build Better ProductsFrom EverandDesign for How People Think: Using Brain Science to Build Better ProductsRating: 4 out of 5 stars4/5 (8)

- Design Thinking and Innovation Metrics: Powerful Tools to Manage Creativity, OKRs, Product, and Business SuccessFrom EverandDesign Thinking and Innovation Metrics: Powerful Tools to Manage Creativity, OKRs, Product, and Business SuccessNo ratings yet