Professional Documents

Culture Documents

Inventory Cost Analysis

Uploaded by

HoudaifaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Cost Analysis

Uploaded by

HoudaifaCopyright:

Available Formats

[Company Name]

Inventory/Cost of Goods Sold Analysis

[Date]

Dark gray cells will be calculated for you. You do not need to enter anything into them.

[Product A] [Product B] [Product C] [Product D] Total

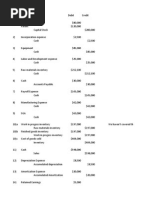

Inventory unit analysis:

Number of units in inventory—beginning of period 1,200 1,000 1,200 1,300 4,700

Production 700 800 600 600 2,700

Units available for sale 1,900 1,800 1,800 1,900 7,400

Units sold 800 600 500 750 2,650

Number of units in inventory—end of period 1,100 1,200 1,300 1,150 4,750

Cost of goods sold analysis:

Beginning inventory $800,000 $750,000 $900,000 $1,200,000 $3,650,000

Add: purchases 400,000 400,000 450,000 600,000 1,850,000

Cost of goods available for sale 1,200,000 1,150,000 1,350,000 1,800,000 5,500,000

Less: ending inventory 770,000 900,000 925,000 1,000,000 3,595,000

Total cost of goods sold $430,000 $250,000 $425,000 $800,000 $1,905,000

Inventory costing:

Cost per unit—beginning of period $666.67 $750.00 $750.00 $923.08 $776.60

Cost per unit—end of period $700.00 $750.00 $711.54 $869.57 $756.84

Variance ($33.33) $0.00 $38.46 $53.51 $19.75

Weighted average cost (Cost of goods available

for sale/Units available for sale) $631.58 $638.89 $750.00 $947.37 $743.24

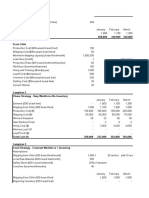

Ending inventory breakdown:

Value of ending inventory (from above) $770,000 $900,000 $925,000 $1,000,000 $3,595,000

Finished goods inventory $400,000 $375,000 $450,000 $600,000 $1,825,000

Work in progress 300,000 325,000 350,000 300,000 1,275,000

Raw materials 70,000 200,000 125,000 100,000 495,000

Total ending inventory $770,000 $900,000 $925,000 $1,000,000 $3,595,000

Composition of Ending Inventory Balances

Raw materials

Work in progress

Finished goods

inventory

$70,000

$300,000

$400,000 $200,000

$325,000

$375,000 $125,000

$350,000

$450,000 $100,000

$300,000

$600,000

[Product A] [Product B] [Product C] [Product D]

You might also like

- Inventory-Cost of Goods Sold Analysis1Document2 pagesInventory-Cost of Goods Sold Analysis1Wahab Ahmad KhanNo ratings yet

- Inventory-cost of goods sold analysis1Document2 pagesInventory-cost of goods sold analysis1arabindapradhan92650No ratings yet

- Nur Haliza Daeng Besse - Inventory Dan Aktiva TetapDocument28 pagesNur Haliza Daeng Besse - Inventory Dan Aktiva TetapNurhaliza DaengNo ratings yet

- Group 2 - Lap3Document12 pagesGroup 2 - Lap3Vũ Lan OfficialNo ratings yet

- Answer To The Question From The BookDocument11 pagesAnswer To The Question From The BookCindy KimNo ratings yet

- Variable Costing Case Part A SolutionDocument3 pagesVariable Costing Case Part A SolutionG, BNo ratings yet

- Hans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentDocument4 pagesHans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentHans Gabriel T. CabatinganNo ratings yet

- Kinney and Raiborn - Chapter 6Document11 pagesKinney and Raiborn - Chapter 6Vincent Luigil AlceraNo ratings yet

- Tut 5_9.23Document4 pagesTut 5_9.23Thanh MaiNo ratings yet

- (Company Name) Inventory/Cost of Goods Sold Analysis (Date)Document3 pages(Company Name) Inventory/Cost of Goods Sold Analysis (Date)Mxplatform Mx PlatformNo ratings yet

- (Company Name) Inventory/Cost of Goods Sold Analysis (Date)Document3 pages(Company Name) Inventory/Cost of Goods Sold Analysis (Date)Mxplatform Mx PlatformNo ratings yet

- (Company Name) Inventory/Cost of Goods Sold Analysis (Date)Document3 pages(Company Name) Inventory/Cost of Goods Sold Analysis (Date)Mxplatform Mx PlatformNo ratings yet

- Ms Excel 2007 WinxpDocument2 pagesMs Excel 2007 WinxpMxplatform Mx PlatformNo ratings yet

- Exhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsDocument6 pagesExhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsSangtani PareshNo ratings yet

- Mastering Inventory Testbank SolutionsDocument7 pagesMastering Inventory Testbank SolutionsLade Palkan50% (4)

- Cairo Consulting: Explore Business Options With What-If ToolsDocument14 pagesCairo Consulting: Explore Business Options With What-If ToolsJacob SheridanNo ratings yet

- Dispensers of California (Jeff)Document9 pagesDispensers of California (Jeff)Jeffery KaoNo ratings yet

- Assets Mar 31, 2022 Entry 1 Entry 2 Non-Current AssetsDocument3 pagesAssets Mar 31, 2022 Entry 1 Entry 2 Non-Current AssetsRishab AgarwalNo ratings yet

- Intacc Quiz 1Document6 pagesIntacc Quiz 1Rhea YugaNo ratings yet

- Eddiline C. Umali September 8, 2017 BSBM211 Prof Pablito L. SebuaDocument2 pagesEddiline C. Umali September 8, 2017 BSBM211 Prof Pablito L. SebuaralphNo ratings yet

- Cost of Goods ManufacturedDocument26 pagesCost of Goods ManufacturedAb.Rahman AfghanNo ratings yet

- Swimskin Inc.: ParametersDocument25 pagesSwimskin Inc.: ParametersAbhijeet singhNo ratings yet

- Nancy Guttenberg Esq.President, guttenbergnancy1994@gmail.com505-500-5422Document9 pagesNancy Guttenberg Esq.President, guttenbergnancy1994@gmail.com505-500-5422choong PohNo ratings yet

- CF 19-03-21 (BudgetDocument21 pagesCF 19-03-21 (BudgetTarisya PermatasariNo ratings yet

- Chap10 ProblemsDocument18 pagesChap10 ProblemsNikki GarciaNo ratings yet

- Aaca - Quiz On InventoriesDocument12 pagesAaca - Quiz On InventoriesMitos Cielo NavajaNo ratings yet

- Panganiban, Mary Grace S. OMGT 3101Document12 pagesPanganiban, Mary Grace S. OMGT 3101Mary Grace PanganibanNo ratings yet

- Chapter 10 Answer KeyDocument58 pagesChapter 10 Answer Keyjocelyn palacioNo ratings yet

- GSLC Case Study Master Budget AnalysisDocument3 pagesGSLC Case Study Master Budget AnalysisNatasha HerlianaNo ratings yet

- Inventory ValuationDocument6 pagesInventory ValuationJane Bagui LaluñoNo ratings yet

- Perkins Cove Yacht Company ABC AnalysisDocument9 pagesPerkins Cove Yacht Company ABC AnalysisVSRI1993No ratings yet

- NP EX19 8a JinruiDong 2Document14 pagesNP EX19 8a JinruiDong 2Ike DongNo ratings yet

- Prob 2Document2 pagesProb 2Elliot RichardNo ratings yet

- PR HM 4.31.432Document5 pagesPR HM 4.31.432Indahna SulfaNo ratings yet

- American International University Accounting for Managers Online Lecture Financial StatementsDocument42 pagesAmerican International University Accounting for Managers Online Lecture Financial Statementsdinar aimcNo ratings yet

- Calculate inventory valuation and ending value for two productsDocument2 pagesCalculate inventory valuation and ending value for two productsNguyễn PhươngNo ratings yet

- Assignment 4 CFASDocument6 pagesAssignment 4 CFASAlonah Grace LucaserNo ratings yet

- Hà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICEDocument7 pagesHà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICE31231020411No ratings yet

- Optimize Athena Cycle ProfitsDocument11 pagesOptimize Athena Cycle ProfitsJacob Sheridan100% (2)

- Green MillsDocument8 pagesGreen MillsFlorenciano Johanes25% (4)

- Item Number Unit Cost Demand (Units) Annual $ Vol. % of Annual $ ClassificationDocument7 pagesItem Number Unit Cost Demand (Units) Annual $ Vol. % of Annual $ ClassificationLưu Gia BảoNo ratings yet

- Week 1 Activity 1 Tan GabrielDocument5 pagesWeek 1 Activity 1 Tan GabrieljosejavierpastorNo ratings yet

- Fill Y According To X Fill Y According To XDocument14 pagesFill Y According To X Fill Y According To XAgna AegeanNo ratings yet

- Tanggal Pembelian Penjualan Persediaan Unit Harga/unit Total Unit Harga Total UnitDocument10 pagesTanggal Pembelian Penjualan Persediaan Unit Harga/unit Total Unit Harga Total UnitDeny WilyartaNo ratings yet

- Bai Tap KTQT 2Document12 pagesBai Tap KTQT 2Tram NguyenNo ratings yet

- Managerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020Document10 pagesManagerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020happiest1No ratings yet

- Costing and PricingDocument7 pagesCosting and PricingsiriusNo ratings yet

- Ain20190418028 ModifiedDocument5 pagesAin20190418028 ModifiedNiomi GolraiNo ratings yet

- UTS AkutansiDocument24 pagesUTS AkutansiAbraham KristiyonoNo ratings yet

- Sales, Costs, Inventory TrackingDocument34 pagesSales, Costs, Inventory TrackingGenie MaeNo ratings yet

- Aging Accounts Receivable and Calculating Doubtful Accounts ExpenseDocument7 pagesAging Accounts Receivable and Calculating Doubtful Accounts Expenselala gasNo ratings yet

- Equity Reconciliation ReportDocument3 pagesEquity Reconciliation Reportapi-3809857No ratings yet

- Bab 2. C. Soal Jawab - Latihan BudgetingDocument16 pagesBab 2. C. Soal Jawab - Latihan BudgetingM Rafi Priyambudi100% (2)

- IA1 ActivityDocument3 pagesIA1 ActivityCzarhiena SantiagoNo ratings yet

- Cost of Goods Available For SaleDocument4 pagesCost of Goods Available For SaleColeen RamosNo ratings yet

- PA1 Team1 P6Document5 pagesPA1 Team1 P6Phuong Nguyen MinhNo ratings yet

- Lecture 4Document33 pagesLecture 4api-3767414No ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Profit and Loss Statement Template (Excel)Document1 pageProfit and Loss Statement Template (Excel)MicrosoftTemplates100% (7)

- LCPL Standard KPM Report Template - ExcelDocument13 pagesLCPL Standard KPM Report Template - Excelmohdmd1No ratings yet

- Business Structure Selector1Document3 pagesBusiness Structure Selector1mukhleshNo ratings yet

- 12 Month Cash Flow Statement1AZXDocument6 pages12 Month Cash Flow Statement1AZXMukhlish AkhatarNo ratings yet

- Simple Payroll CalculatorDocument4 pagesSimple Payroll CalculatormaginguaNo ratings yet

- Manufacturing Output Histogram1Document2 pagesManufacturing Output Histogram1HoudaifaNo ratings yet

- Simple Payroll CalculatorDocument4 pagesSimple Payroll CalculatormaginguaNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Mukhlish AkhatarNo ratings yet

- Idprd 001498Document1 pageIdprd 001498HoudaifaNo ratings yet

- TS1039865901Document4 pagesTS1039865901Raju JadavNo ratings yet

- School Name: Teacher Name Class/Project DateDocument5 pagesSchool Name: Teacher Name Class/Project DateHoudaifaNo ratings yet

- Income StatementDocument19 pagesIncome StatementiPakistan67% (3)

- Opening Day Balance SheetDocument2 pagesOpening Day Balance Sheetapi-3809857No ratings yet

- Employee Absence ScheduleDocument6 pagesEmployee Absence ScheduleUbuntu LinuxNo ratings yet

- Balance Sheet With Financial Ratios1Document1 pageBalance Sheet With Financial Ratios1Indah SusiloNo ratings yet

- Blood Sugar Chart1aaaDocument2 pagesBlood Sugar Chart1aaaHoudaifaNo ratings yet

- Quotation: Your Company NameDocument1 pageQuotation: Your Company NameMoin RazaNo ratings yet

- Personal Monthly Budget Worksheet (Download Spreadsheet)Document2 pagesPersonal Monthly Budget Worksheet (Download Spreadsheet)National Financial Awareness Network100% (27)

- Balance-Sheet US GAAPDocument1 pageBalance-Sheet US GAAPvishnuNo ratings yet

- Adjustable Meeting Agenda Template4Document1 pageAdjustable Meeting Agenda Template4HoudaifaNo ratings yet

- Agenda: Meeting Date Time Venue AttendeesDocument2 pagesAgenda: Meeting Date Time Venue AttendeesHoudaifaNo ratings yet

- NSW & ACT Construction Rail Codes V1.1Document7 pagesNSW & ACT Construction Rail Codes V1.1Mukhlish AkhatarNo ratings yet

- Close Process Checklist FormDocument1 pageClose Process Checklist FormUbuntu LinuxNo ratings yet

- 12month P&L ProjectionDocument1 page12month P&L Projectionapi-3809857No ratings yet

- Project drainage programme reviewDocument2 pagesProject drainage programme reviewMukhlish AkhatarNo ratings yet

- Petty Cash Request4Document1 pagePetty Cash Request4HoudaifaNo ratings yet

- Petty Cash Log4Document1 pagePetty Cash Log4HoudaifaNo ratings yet

- C&P Compliance ReviewDocument4 pagesC&P Compliance ReviewHoudaifaNo ratings yet

- Meeting Date Time Venue Attendees: 15min Project / Bid Manager C&P Project Owner All Attendees 20min C&P Project OwnerDocument3 pagesMeeting Date Time Venue Attendees: 15min Project / Bid Manager C&P Project Owner All Attendees 20min C&P Project OwnerHoudaifaNo ratings yet

- Princeton Fabrication Inc Produced and Sold 1 200 Units of THDocument1 pagePrinceton Fabrication Inc Produced and Sold 1 200 Units of THAmit PandeyNo ratings yet

- Cost Accounting SummaryDocument36 pagesCost Accounting SummaryFiene NagtegaalNo ratings yet

- ACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Document9 pagesACCA F5 Tuition Mock June 2012 QUESTIONS Version 3 FINAL at 23rd April 2012Hannah NazirNo ratings yet

- Marginal and Absorption CostingDocument21 pagesMarginal and Absorption Costingkelvin mboyaNo ratings yet

- Costs Concepts and ClassificationsDocument44 pagesCosts Concepts and ClassificationsDixi AndriantoNo ratings yet

- Chap 20Document23 pagesChap 20Usama KhanNo ratings yet

- Management Accounting SCDLDocument67 pagesManagement Accounting SCDLyogekumaNo ratings yet

- Chap1 MAS TheoryDocument6 pagesChap1 MAS TheoryRose Agnes EmnaceNo ratings yet

- L2-FIFO Practice ProblemsDocument3 pagesL2-FIFO Practice ProblemslalalalaNo ratings yet

- Chp. 3-5 Strategic Cost Mgmt.Document17 pagesChp. 3-5 Strategic Cost Mgmt.Marie dela serna100% (1)

- 08 Activity 02Document2 pages08 Activity 02•MUSIC MOOD•No ratings yet

- Introduction To Cost Accounting/CostingDocument36 pagesIntroduction To Cost Accounting/CostingHarisvan To SevenNo ratings yet

- Find Study Resources: Answered Step-By-StepDocument4 pagesFind Study Resources: Answered Step-By-StepJohn Carlos DoringoNo ratings yet

- Activity Based CostingDocument7 pagesActivity Based CostingCzar Ysmael RabayaNo ratings yet

- CSU-Andrews Cost Management Quiz 1Document4 pagesCSU-Andrews Cost Management Quiz 1Wynie AreolaNo ratings yet

- Wiley Guide To CMA ExamDocument16 pagesWiley Guide To CMA ExamAriel LopezNo ratings yet

- MBA - Buss Acc and Finance - 1 - RDocument10 pagesMBA - Buss Acc and Finance - 1 - RNikesh MunankarmiNo ratings yet

- Cost TermsDocument4 pagesCost TermsMarivel AmarilleNo ratings yet

- Calculate Break-Even for Parasailing LoanDocument3 pagesCalculate Break-Even for Parasailing LoanKonanRogerKouakouNo ratings yet

- CMA Unit 2 ProblemsDocument7 pagesCMA Unit 2 ProblemsAnand PatilNo ratings yet

- (Course Outline) ACT202 Section 4 PDFDocument4 pages(Course Outline) ACT202 Section 4 PDFSaiyan IslamNo ratings yet

- Job Costing: Mcgraw-Hill/IrwinDocument17 pagesJob Costing: Mcgraw-Hill/Irwinimran_chaudhryNo ratings yet

- ACC4264 Advanced Management Accounting UH (Updated 20 Apr 2020) - January 2022 SessionDocument13 pagesACC4264 Advanced Management Accounting UH (Updated 20 Apr 2020) - January 2022 SessionteoysNo ratings yet

- Corporate Finance 11th ChapterDocument35 pagesCorporate Finance 11th Chapterdt0035620No ratings yet

- Mas Mcqs All Topics 20 1 9Document72 pagesMas Mcqs All Topics 20 1 9Princess Diane RamirezNo ratings yet

- Process Costing Sample ProblemDocument1 pageProcess Costing Sample ProblemHannah CaparasNo ratings yet

- Senior Accountant Fund Accountant in Denver CO Resume Penny YipDocument3 pagesSenior Accountant Fund Accountant in Denver CO Resume Penny YipPennyYip1No ratings yet

- Managerial Accounting QUIZ 1 - SolutionDocument2 pagesManagerial Accounting QUIZ 1 - SolutionPRANAV KAKKARNo ratings yet

- 01 M.Com IDocument38 pages01 M.Com IPratik KanchanNo ratings yet

- Case 4 - Victoria ChemicalsDocument18 pagesCase 4 - Victoria ChemicalsYale Brendan CatabayNo ratings yet