Professional Documents

Culture Documents

C 9 70 Grad V Finanzamt Traunstein

Uploaded by

nicoleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C 9 70 Grad V Finanzamt Traunstein

Uploaded by

nicoleCopyright:

Available Formats

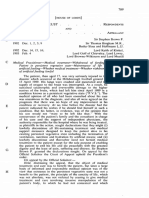

Case 9/70 Franz Grad v Finanzamt Traunstein [1970]

Facts: Different Council Decisions stated that Member States shall replace their system of

turnover taxes by the common system of value-added tax to the carriage of goods, prohibiting to

concurrently apply additional tax systems of a similar nature in trade between Member States. Mr

Franz Grad brought a direct action before the Munich Finance Court against a tax the German

customs office imposed him for the carriage of goods from Germany to Austria. In connection

with these proceedings, the Munich Finance Court referred for a preliminary ruling whether

Council Decisions produce direct effects as regards the legal relationship between Member States

and individuals and whether these provisions create individual rights which Member States must

protect.

Held: According to Article 189 EEC Treaty regulations are directly applicable and therefore

capable of producing direct effects. However, it does not follow that other categories of legal

measures mentioned in that article can never produce similar effects. It would be incompatible

with the binding effect attributed to decisions to exclude in principle the possibility that persons

affected may invoke before the courts the obligation imposed by a Decision. It must be ascertained

whether the nature, background and wording of its provision are capable of producing direct

effects in the legal relationships between its addressee and third parties. The obligation contained

in the relevant Decisions is unconditional and sufficiently clear and precise to be capable of

producing direct effects.

You might also like

- Fairness in EU Competition Policy : Significance and Implications: An Inquiry into the Soul and Spirit of Competition Enforcement in EuropeFrom EverandFairness in EU Competition Policy : Significance and Implications: An Inquiry into the Soul and Spirit of Competition Enforcement in EuropeNo ratings yet

- Faccini DoriDocument3 pagesFaccini DoriZana FokinaNo ratings yet

- EU Int 2 DraftDocument3 pagesEU Int 2 DraftSanket MNo ratings yet

- Case SchemppDocument3 pagesCase SchemppPolina SeleznevaNo ratings yet

- European Employment Law - Case StudyDocument25 pagesEuropean Employment Law - Case StudymmNo ratings yet

- Case:ECJ-Manfredi V Lloyd Adriatico Ioan Iulian Curelaru: The Opinion Contains 71 Articles - The Competition Authority HasDocument4 pagesCase:ECJ-Manfredi V Lloyd Adriatico Ioan Iulian Curelaru: The Opinion Contains 71 Articles - The Competition Authority HasIoan Iulian CurelaruNo ratings yet

- Session 5 AssignmentsDocument3 pagesSession 5 AssignmentsIno MamNo ratings yet

- Direct Effect EU & WTODocument6 pagesDirect Effect EU & WTOZefanyaNo ratings yet

- Brussels I ReviewDocument8 pagesBrussels I ReviewpatNo ratings yet

- Giuliano Lagarde Report - IntTradeDocument53 pagesGiuliano Lagarde Report - IntTrademjanjNo ratings yet

- CURIA - Ceva Jurispr GermaniaDocument26 pagesCURIA - Ceva Jurispr GermaniaSimona GeruNo ratings yet

- Question 1: The Structure of Public Procurement Law Is Getting Even More Important ForDocument4 pagesQuestion 1: The Structure of Public Procurement Law Is Getting Even More Important ForwahringerNo ratings yet

- End-Sem Competition FinalDocument97 pagesEnd-Sem Competition FinalShubham PhophaliaNo ratings yet

- Reimbursement of Taxes Levied in Breach of EU Law: Réka SomssichDocument54 pagesReimbursement of Taxes Levied in Breach of EU Law: Réka SomssichYvzNo ratings yet

- Cartels - Competition LawDocument7 pagesCartels - Competition LawAmanda Penelope WallNo ratings yet

- DEUTSCHE BANK vs. CIRDocument2 pagesDEUTSCHE BANK vs. CIRStef Ocsalev100% (1)

- CL - 3 - EU Competence On Contract LawDocument27 pagesCL - 3 - EU Competence On Contract LawAbdullah hatamlehNo ratings yet

- Wyrok Keck PDFDocument7 pagesWyrok Keck PDFKarolina OcioszyńskaNo ratings yet

- Mitchell Working Paper Series: Europa InstituteDocument19 pagesMitchell Working Paper Series: Europa InstituteRevekka TheodorouNo ratings yet

- Topic 2 - Direct Effect, Indirect Effect, and State LiabiltyDocument58 pagesTopic 2 - Direct Effect, Indirect Effect, and State LiabiltyLauren TempleNo ratings yet

- WTO Essay FinalDocument9 pagesWTO Essay FinalClaire O'LearyNo ratings yet

- EU Law - Course 15 - Free Movement of GoodsDocument7 pagesEU Law - Course 15 - Free Movement of GoodsElena Raluca RadulescuNo ratings yet

- FMG (Part-1) EUDocument6 pagesFMG (Part-1) EUUsama BakshNo ratings yet

- Domotorfy - Kiss - Firniksz - Ostensible DichotomyDocument24 pagesDomotorfy - Kiss - Firniksz - Ostensible DichotomyBorbála DömötörfyNo ratings yet

- CASE OF ASSOCIATION OF CIVIL SERVANTS AND UNION FOR COLLECTIVE BARGAINING AND OTHERS v. GERMANYDocument26 pagesCASE OF ASSOCIATION OF CIVIL SERVANTS AND UNION FOR COLLECTIVE BARGAINING AND OTHERS v. GERMANYArtem KobrinNo ratings yet

- 2.challenging The Existence or Exercise of EU CompetenceDocument11 pages2.challenging The Existence or Exercise of EU CompetenceNataliaNo ratings yet

- Lenko StraipsnisDocument16 pagesLenko StraipsnisAuguste MartinelyteNo ratings yet

- Keck TestDocument6 pagesKeck Testcs4rsrtnksNo ratings yet

- Free Movement of GoodsDocument2 pagesFree Movement of GoodsalphimranchowdhuryNo ratings yet

- Direct Effect Essay AnswerDocument6 pagesDirect Effect Essay Answeryoganyah arjunanNo ratings yet

- Overriding Mandatory Laws in International ArbitrationDocument18 pagesOverriding Mandatory Laws in International ArbitrationIsak JohannssonNo ratings yet

- Why Judicial Control of Price Terms in Consumer Contracts Might Not Always Be The Right Answer - Insights From Behavioural Law and EconomicsDocument37 pagesWhy Judicial Control of Price Terms in Consumer Contracts Might Not Always Be The Right Answer - Insights From Behavioural Law and EconomicsMaximus L MadusNo ratings yet

- Van GendDocument2 pagesVan GendLiviu IordacheNo ratings yet

- Weatherill2001 Article TheEuropeanCommissionSGreenPapDocument61 pagesWeatherill2001 Article TheEuropeanCommissionSGreenPapRoshanNo ratings yet

- Deutsche Vs CIR - RamirezDocument2 pagesDeutsche Vs CIR - RamirezTats YumulNo ratings yet

- Privatisation and Regulation of BusinessDocument24 pagesPrivatisation and Regulation of BusinessTarakeshwar AllamsettyNo ratings yet

- EU LAW - SubstantiveDocument22 pagesEU LAW - SubstantivejosephanehringNo ratings yet

- Antitrust: Commission Opens Investigation Into Possible Anticompetitive Conduct by Google and Meta, in Online Display AdvertisingDocument2 pagesAntitrust: Commission Opens Investigation Into Possible Anticompetitive Conduct by Google and Meta, in Online Display AdvertisingaNo ratings yet

- Tax Treaties and Domestic Tax Legislation: Norms of Co-ExistenceDocument4 pagesTax Treaties and Domestic Tax Legislation: Norms of Co-ExistenceSnigdha Raj100% (1)

- COMPETITION ACT 16/1989 of 17th JulyDocument29 pagesCOMPETITION ACT 16/1989 of 17th JulySilvana ZetNo ratings yet

- The Van Gend en Loos CaseDocument10 pagesThe Van Gend en Loos CasekisszerelmeNo ratings yet

- Intt 442Document17 pagesIntt 442n.iremodaciNo ratings yet

- Chapter 5 Anti-Dumping Measures: Verview of UlesDocument31 pagesChapter 5 Anti-Dumping Measures: Verview of UlesRAISALORENA CHAVEZGONZALEZNo ratings yet

- What Is An Undertaking?: Undertaking: For The Purpose of EU Antitrust Law, Any Entity EngagedDocument4 pagesWhat Is An Undertaking?: Undertaking: For The Purpose of EU Antitrust Law, Any Entity EngagedAdrian BuculeiNo ratings yet

- Anti Dumping Measures and AgreementDocument24 pagesAnti Dumping Measures and AgreementAqib khanNo ratings yet

- Eu LawDocument7 pagesEu Lawh1kiddNo ratings yet

- Regula' LawDocument20 pagesRegula' LawVictorNo ratings yet

- Choice of Law - Cross Border AccidentsDocument27 pagesChoice of Law - Cross Border Accidentsnino.berulava440No ratings yet

- Third Group of Model CasesDocument16 pagesThird Group of Model CasesBetty YueNo ratings yet

- Insights and Commentary From DentonsDocument3 pagesInsights and Commentary From DentonsAnonymous 8ZWoWx7No ratings yet

- All ER (EC) 1998Document633 pagesAll ER (EC) 1998AlanNo ratings yet

- Chorzow Factory Case DigestDocument5 pagesChorzow Factory Case Digestamun din0% (1)

- C 6 64 EnelDocument6 pagesC 6 64 EnelAndrea TanNo ratings yet

- Enforcement of EU Environmental Law IIDocument25 pagesEnforcement of EU Environmental Law IITracy BaiNo ratings yet

- Blogpost: Case C-676/21: Second-Hand Car Sale Regulation in Europe Through TaxationDocument3 pagesBlogpost: Case C-676/21: Second-Hand Car Sale Regulation in Europe Through TaxationtumylamNo ratings yet

- Cross-Border Joint Public Procurement Legal OpinionDocument16 pagesCross-Border Joint Public Procurement Legal OpinionMusa FakaNo ratings yet

- State Liability in EUDocument10 pagesState Liability in EUGo HarNo ratings yet

- The Law Applicable To Employment ContractsDocument17 pagesThe Law Applicable To Employment ContractsmmNo ratings yet

- ECL - Preparation-Tutorials-Ecl PDFDocument97 pagesECL - Preparation-Tutorials-Ecl PDFVương Thảo LýNo ratings yet

- G.R. No. 188550 August 19, 2013 Deutsche Bank Ag Manila Branch, Petitioner, Commissioner of Internal Revenue, RespondentDocument2 pagesG.R. No. 188550 August 19, 2013 Deutsche Bank Ag Manila Branch, Petitioner, Commissioner of Internal Revenue, Respondentgin hooNo ratings yet

- A Role For Tort in Pre Contractual Negotiations An Examination of English French and Canadian LawDocument26 pagesA Role For Tort in Pre Contractual Negotiations An Examination of English French and Canadian LawnicoleNo ratings yet

- Cdo Student Sample Resumes Cover Letters and Thank YouDocument37 pagesCdo Student Sample Resumes Cover Letters and Thank YouBilal LaghariNo ratings yet

- Chart 4 Direct EffectDocument2 pagesChart 4 Direct EffectnicoleNo ratings yet

- Hart On The Open Texture of The LawDocument8 pagesHart On The Open Texture of The LawnicoleNo ratings yet

- Chapter 12 End of Chapter Question AnswersDocument5 pagesChapter 12 End of Chapter Question AnswersnicoleNo ratings yet

- 2 Subject Matter A NotesDocument5 pages2 Subject Matter A NotesnicoleNo ratings yet

- First Class DissertationDocument50 pagesFirst Class DissertationnicoleNo ratings yet

- 4 Subject Matter C NotesDocument5 pages4 Subject Matter C NotesnicoleNo ratings yet

- A Guide To Answering Problem Question With ILAC MethodDocument3 pagesA Guide To Answering Problem Question With ILAC MethodnorshaheeraNo ratings yet

- 2 Subject Matter A NotesDocument5 pages2 Subject Matter A NotesnicoleNo ratings yet

- 2005 Mangold V Helm 2017 11 08 10 42 51Document1 page2005 Mangold V Helm 2017 11 08 10 42 51nicoleNo ratings yet

- 4 Article Xiao YangZLi 127 175Document49 pages4 Article Xiao YangZLi 127 175nicoleNo ratings yet

- Chart 2 Other Methods of ReviewDocument1 pageChart 2 Other Methods of ReviewnicoleNo ratings yet

- Problem Question Direct and Indirect EffDocument2 pagesProblem Question Direct and Indirect EffnicoleNo ratings yet

- Problem Question Direct and Indirect EffDocument2 pagesProblem Question Direct and Indirect EffnicoleNo ratings yet

- 007 The True PictureDocument459 pages007 The True PicturenicoleNo ratings yet

- 4 Cambridge Student LRev 149Document19 pages4 Cambridge Student LRev 149nicoleNo ratings yet

- Chart 4 Direct EffectDocument2 pagesChart 4 Direct EffectnicoleNo ratings yet

- R V Roberts (Kenneth Joseph)Document19 pagesR V Roberts (Kenneth Joseph)nicoleNo ratings yet

- Chart 4 Direct EffectDocument2 pagesChart 4 Direct EffectnicoleNo ratings yet

- The Law On Constructive Trusts of The Family Home Generates Unfairness, Uncertainty and Hardship.' DiscussDocument16 pagesThe Law On Constructive Trusts of The Family Home Generates Unfairness, Uncertainty and Hardship.' DiscussnicoleNo ratings yet

- 6 Legal Issues J61Document29 pages6 Legal Issues J61nicoleNo ratings yet

- Horsey Occupiers1957 AnnotatedDocument3 pagesHorsey Occupiers1957 AnnotatednicoleNo ratings yet

- R V Miller (James)Document71 pagesR V Miller (James)nicoleNo ratings yet

- Pressure GroupsDocument19 pagesPressure GroupsnicoleNo ratings yet

- R V Stone (John Edward)Document9 pagesR V Stone (John Edward)nicoleNo ratings yet

- HE Ivorce of Aw and OralityDocument12 pagesHE Ivorce of Aw and OralitynicoleNo ratings yet

- 2335-Article Text-3582-1-10-20161220 PDFDocument21 pages2335-Article Text-3582-1-10-20161220 PDFnicoleNo ratings yet

- 789 Airedale N H S Trust Respondents V Bland AppellantDocument111 pages789 Airedale N H S Trust Respondents V Bland AppellantnicoleNo ratings yet

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- Global Bank Regulation: Principles and PoliciesFrom EverandGlobal Bank Regulation: Principles and PoliciesRating: 5 out of 5 stars5/5 (2)