Professional Documents

Culture Documents

Petitioner Respondents Sycip, Salazar, Feliciano & Hernandez Law O Ce

Uploaded by

ervingabralagbonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Petitioner Respondents Sycip, Salazar, Feliciano & Hernandez Law O Ce

Uploaded by

ervingabralagbonCopyright:

Available Formats

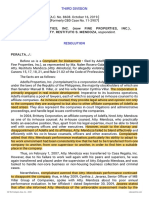

SECOND DIVISION

[G.R. No. L-66653. June 19, 1986.]

COMMISSIONER OF INTERNAL REVENUE, petitioner, vs.

BURROUGHS LIMITED AND THE COURT OF TAX APPEALS ,

respondents.

Sycip, Salazar, Feliciano & Hernandez Law Office for private

respondent.

SYLLABUS

1. TAXATION; TAX ON FOREIGN CORPORATION; 15% BRANCH

REMITTANCE TAX; SHALL BE IMPOSED ON THE PROFIT ACTUALLY REMITTED

ABROAD. — As correctly held by respondent Court in its assailed decision —

"Respondent concedes at least that in his ruling dated January 21, 1980 he

held that under Section 24(b) (2) of the Tax Code the 15% branch profit

remittance tax shall be imposed on the profit actually remitted abroad and

not on the total branch profit out of which the remittance is to be made.

Based on such ruling petitioner should have paid only the amount of

P974,999.89 in remittance tax computed by taking the 15% of the profits of

P6,499.89 in remittance tax actually remitted to its head office in the United

States, instead of P1,147,058.70 on its net profit of P7,647,058.00.

Undoubtedly, petitioner has overpaid its branch profit remittance tax in the

amount of P172,058.90."

2. ID.; RULES AND REGULATIONS; ANY REVOCATION, MODIFICATION OR

REVERSAL THEREOF; CANNOT BE GIVEN RETROACTIVE EFFECT; EXCEPTION;

CASE AT BAR. — Petitioner's aforesaid contention is without merit. What is

applicable in the case at bar is still the Revenue Ruling of January 21, 1980

because private respondent Burroughs Limited paid the branch profit

remittance tax in question on March 14, 1979. Memorandum Circular No. 8-

82 dated March 17, 1982 cannot be given retroactive effect in the light of

Section 327 of the National Internal Revenue Code which provides — "Sec.

327. Non-retroactivity of ruling. Any revocation, modification, or reversal of

any of the rules and regulations promulgated in accordance with the

preceding Section or any of the rulings or circulars promulgated by the

Commissioner shall not be given retroactive application if the revocation,

modification, or reversal will be prejudicial to the taxpayer except in the

following cases (a) where the taxpayer deliberately mistakes or omits

material facts from his return or in any document required of him by the

Bureau of Internal Revenue; (b) where the facts subsequently gathered by

the Bureau of Internal Revenue are materially different from the facts on

which the ruling is based, or (c) where the taxpayer acted in bad faith." (ABS

CBN Broadcasting Corp. v. CTA, 108 SCRA 151-152).

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

DECISION

PARAS, J : p

Petition for certiorari to review and set aside the Decision dated June

27, 1983 of respondent Court of Tax Appeals in its C.T.A. Case No. 3204,

entitled "Burroughs Limited vs. Commissioner of Internal Revenue" which

ordered petitioner Commissioner of Internal Revenue to grant in favor of

private respondent Burroughs Limited, tax credit in the sum of P172,058.90,

representing erroneously overpaid branch profit remittance tax.

Burroughs Limited is a foreign corporation authorized to engage in

trade or business in the Philippines through a branch office located at De la

Rosa corner Esteban Streets, Legaspi Village, Makati, Metro Manila.

Sometime in March 1979, said branch office applied with the Central

Bank for authority to remit to its parent company abroad, branch profit

amounting to P7,647,058.00. Thus, on March 14, 1979, it paid the 15%

branch profit remittance tax, pursuant to Sec. 24 (b) (2) (ii) and remitted to

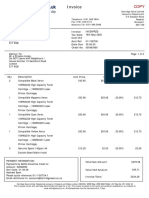

its head office the amount of P6,499,999.30 computed as follows —

Amount applied for remittance P7,647,058.00

Deduct: 15% branch profit remittance

1,147,058.70

tax

——————

Net amount actually remitted P6,499,999.30

Claiming that the 15% profit remittance tax should have been

computed on the basis of the amount actually remitted (P6,499,999.30) and

not on the amount before profit remittance tax (P7,647,058.00), private

respondent filed on December 24, 1980, a written claim for the refund or tax

credit of the amount of P172,058.90 representing alleged overpaid branch

profit remittance tax, computed as follows:

Profits actually remitted P6,499,999.30

Remittance tax rate 15%

—————

Branch profit remittance tax due thereon P974,999.89

Branch profit remittance tax paid P1,147,058.70

Less: Branch profit remittance tax as above

974,999.89

computed

—————

Total amount refundable P172,058.81

On February 24, 1981, private respondent filed with respondent court,

a petition for review, docketed as C.T.A. Case No. 3204 for the recovery of

the above-mentioned amount of P172,058.81. LibLex

On June 27, 1983, respondent court rendered its Decision, the

dispositive portion of which reads —

"ACCORDINGLY, respondent Commissioner of Internal Revenue is

hereby ordered to grant a tax credit in favor of petitioner Burroughs

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

Limited the amount of P172,058.90. Without pronouncement as to

costs.

SO ORDERED."

Unable to obtain a reconsideration from the aforesaid decision,

petitioner filed the instant petition before this Court with the prayers as

herein earlier stated upon the sole issue of whether the tax base upon which

the 15% branch profit remittance tax shall be imposed under the provisions

of section 24(b) of the Tax Code, as amended, is the amount applied for

remittance on the profit actually remitted after deducting the 15% profit

remittance tax. Stated differently — is private respondent Burroughs Limited

legally entitled to a refund of the aforementioned amount of P172,058.90.

We rule in the affirmative. The pertinent provision of the National

Internal Revenue Code is Sec. 24 (b) (2) (ii) which states:

"Sec. 24. Rates of tax on corporations. . . .

(b) Tax on foreign corporations. . . .

(2) (ii) Tax on branch profits remittances. — Any profit

remitted abroad by a branch to its head office shall be subject to

a tax of fifteen per cent (15%) . . . ."

In a Bureau of Internal Revenue ruling dated January 21, 1980 by then

Acting Commissioner of Internal Revenue Hon. Efren I. Plana the aforequoted

provision had been interpreted to mean that "the tax base upon which the

15% branch profit remittance tax . . . shall be imposed . . . (is) the profit

actually remitted abroad and not on the total branch profits out of which the

remittance is to be made." The said ruling is hereinbelow quoted as follows:

"In reply to your letter of November 3, 1978, relative to your

query as to the tax base upon which the 15% branch profits remittance

tax provided for under Section 24 (b) (2) of the 1977 Tax Code shall be

imposed, please be advised that the 15% branch profit tax shall be

imposed on the branch profits actually remitted abroad and not on the

total branch profits out of which the remittance is to be made.

Please be guided accordingly."

Applying, therefore, the aforequoted ruling, the claim of private

respondent that it made an overpayment in the amount of P172,058.90

which is the difference between the remittance tax actually paid of

P1,147,058.70 and the remittance tax that should have been paid of

P974,999.89, computed as follows —

Profits actually remitted P6,499,999.30

Remittance tax rate 15%

—————

Remittance tax due P 974,999.89

is well-taken. As correctly held by respondent Court in its assailed decision —

"Respondent concedes at least that in his ruling dated January

21, 1980 he held that under Section 24 (b) (2) of the Tax Code the 15%

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

branch profit remittance tax shall be imposed on the profit actually

remitted abroad and not on the total branch profit out of which the

remittance is to be made. Based on such ruling petitioner should have

paid only the amount of P974,999.89 in remittance tax computed by

taking the 15% of the profits of P6,499,999.89 in remittance tax

actually remitted to its head office in the United States, instead of

P1,147,058.70, on its net profits of P7,647,058.00. Undoubtedly,

petitioner has overpaid its branch profit remittance tax in the amount

of P172,058.90."

Petitioner contends that respondent is no longer entitled to a refund

because Memorandum Circular No. 8-82 dated March 17, 1982 had revoked

and/or repealed the BIR ruling of January 21, 1980. The said memorandum

circular states —

"Considering that the 15% branch profit remittance tax is

imposed and collected at source, necessarily the tax base should be

the amount actually applied for by the branch with the Central Bank of

the Philippines as profit to be remitted abroad."LLpr

Petitioner's aforesaid contention is without merit. What is applicable in

the case at bar is still the Revenue Ruling of January 21, 1980 because

private respondent Burroughs Limited paid the branch profit remittance tax

in question on March 14, 1979. Memorandum Circular No. 8-82 dated March

17, 1982 cannot be given retroactive effect in the light of Section 327 of the

National Internal Revenue Code which provides —

"Sec. 327. Non-retroactivity of rulings. Any revocation,

modification, or reversal of any of the rules and regulations

promulgated in accordance with the preceding section or any of the

rulings or circulars promulgated by the Commissioner shall not be

given retroactive application if the revocation, modification, or reversal

will be prejudicial to the taxpayer except in the following cases (a)

where the taxpayer deliberately misstates or omits material facts from

his return or in any document required of him by the Bureau of Internal

Revenue; (b) where the facts subsequently gathered by the Bureau of

Internal Revenue are materially different from the facts on which the

ruling is based, or (c) where the taxpayer acted in bad faith." (ABS-CBN

Broadcasting Corp. v. CTA, 108 SCRA 151-152)

The prejudice that would result to private respondent Burroughs

Limited by a retroactive application of Memorandum Circular No. 8-82 is

beyond question for it would be deprived of the substantial amount of

P172,058.90. And, insofar as the enumerated exceptions are concerned,

admittedly, Burroughs Limited does not fall under any of them.

WHEREFORE, the assailed decision of respondent Court of Tax Appeals

is hereby AFFIRMED. No pronouncement as to costs.

SO ORDERED.

Feria, Fernan, Alampay and Gutierrez, Jr., JJ ., concur.

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Outline of Topics Taxation Law Review IvDocument6 pagesOutline of Topics Taxation Law Review IvervingabralagbonNo ratings yet

- Outline of Topics Taxation Law Review IvDocument6 pagesOutline of Topics Taxation Law Review IvervingabralagbonNo ratings yet

- Office of The Court Administrator v. TormisDocument20 pagesOffice of The Court Administrator v. TormiservingabralagbonNo ratings yet

- Ethics - FINALS - Additional CasesDocument12 pagesEthics - FINALS - Additional CaseservingabralagbonNo ratings yet

- Certificate of Coordination: Area(s) of OperationDocument3 pagesCertificate of Coordination: Area(s) of OperationervingabralagbonNo ratings yet

- Legal & Judicial Ethics & Practical Exercises SyllabusDocument8 pagesLegal & Judicial Ethics & Practical Exercises Syllabuservingabralagbon100% (1)

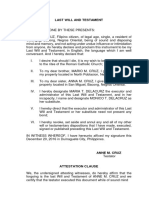

- Last Will TestamentDocument3 pagesLast Will TestamentIELTS75% (4)

- Certificate of Inventory Tacloban CityDocument2 pagesCertificate of Inventory Tacloban CityervingabralagbonNo ratings yet

- People Vs MarbabiesDocument3 pagesPeople Vs MarbabieservingabralagbonNo ratings yet

- Office of The Court Administrator V.Document21 pagesOffice of The Court Administrator V.ervingabralagbonNo ratings yet

- A. Plumptre v. RiveraDocument6 pagesA. Plumptre v. RiveraervingabralagbonNo ratings yet

- Caronan v. CaronanDocument8 pagesCaronan v. Caronancarla_cariaga_2No ratings yet

- D. Villahermosa v. Caracol, A.C. No. 7325, Jan. 21, 2015Document6 pagesD. Villahermosa v. Caracol, A.C. No. 7325, Jan. 21, 2015TrudgeOnNo ratings yet

- Aguirre vs. Rana PDFDocument7 pagesAguirre vs. Rana PDFCazzandhra BullecerNo ratings yet

- 2015 Yu - Kimteng - v. - Young20190320 5466 1y9r6ix PDFDocument13 pages2015 Yu - Kimteng - v. - Young20190320 5466 1y9r6ix PDFShiurabelle ApuraNo ratings yet

- 02-13. Catimbuhan V CruzDocument5 pages02-13. Catimbuhan V CruzOdette JumaoasNo ratings yet

- 8 Zafra III V PagatpatanDocument5 pages8 Zafra III V PagatpatanJinnelyn LiNo ratings yet

- Complainants vs. vs. Respondents: Second DivisionDocument6 pagesComplainants vs. vs. Respondents: Second DivisionervingabralagbonNo ratings yet

- Court Suspends Lawyer for 5 Years and Imposes Fine for Repeated Disobedience of Court OrdersDocument4 pagesCourt Suspends Lawyer for 5 Years and Imposes Fine for Repeated Disobedience of Court OrderservingabralagbonNo ratings yet

- in - Re - Order - Dated - October - 27 - 2016 - Issued - By20201127-9-123x8ouDocument5 pagesin - Re - Order - Dated - October - 27 - 2016 - Issued - By20201127-9-123x8ouervingabralagbonNo ratings yet

- Attorney Disbarred for Deceiving and Impregnating Young WomanDocument8 pagesAttorney Disbarred for Deceiving and Impregnating Young WomanDuffy DuffyNo ratings yet

- In Re Benjamin DacanayDocument4 pagesIn Re Benjamin Dacanayjeesup9No ratings yet

- AA - Total - Learning - Center - For - Young - Achievers20200916-9-1hx1arfDocument8 pagesAA - Total - Learning - Center - For - Young - Achievers20200916-9-1hx1arfervingabralagbonNo ratings yet

- 46 Gaw Jr. v. Commissioner of Internal Revenue20210428-11-1x0n8q5Document16 pages46 Gaw Jr. v. Commissioner of Internal Revenue20210428-11-1x0n8q5ervingabralagbonNo ratings yet

- 45 Commissioner of Internal Revenue v. La Flor20210505-11-RpbhzrDocument11 pages45 Commissioner of Internal Revenue v. La Flor20210505-11-RpbhzrervingabralagbonNo ratings yet

- 46 Gaw Jr. v. Commissioner of Internal Revenue (NOTICE)Document9 pages46 Gaw Jr. v. Commissioner of Internal Revenue (NOTICE)ervingabralagbonNo ratings yet

- 157 Adelfa - Properties - Inc. - v. - MendozaDocument7 pages157 Adelfa - Properties - Inc. - v. - MendozaKevin DegamoNo ratings yet

- Third Division: Notice NoticeDocument3 pagesThird Division: Notice NoticeervingabralagbonNo ratings yet

- 42 Allied Banking Corporation v. Commissioner Of20210505-12-Fno6kpDocument10 pages42 Allied Banking Corporation v. Commissioner Of20210505-12-Fno6kpervingabralagbonNo ratings yet

- 44 Commissioner - of - Internal - Revenue - v. - Univation20210505-11-1a1tm6xDocument10 pages44 Commissioner - of - Internal - Revenue - v. - Univation20210505-11-1a1tm6xervingabralagbonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fee Challan 10 Nov 2021Document1 pageFee Challan 10 Nov 2021Choudary UmerNo ratings yet

- Vaibhav 2023 NewDocument71 pagesVaibhav 2023 NewNeo MatrixNo ratings yet

- Calculate Income Tax and Break Even AnalysisDocument3 pagesCalculate Income Tax and Break Even AnalysisAbrar Ahmed KhanNo ratings yet

- USA VERIZON Iphone12 64GB BLUEDocument3 pagesUSA VERIZON Iphone12 64GB BLUEAnna DEGNER100% (1)

- WALC JSC's CIT liability for year ended 31 Dec 2020Document3 pagesWALC JSC's CIT liability for year ended 31 Dec 2020Ngọc MinhNo ratings yet

- Fai1. DISBURSEMENT VOUCHER 3 COPIESDocument56 pagesFai1. DISBURSEMENT VOUCHER 3 COPIESagong lodgeNo ratings yet

- Benitez, Allan Christian C. Doctrine: Bill of Exchange (Definition & Concept)Document5 pagesBenitez, Allan Christian C. Doctrine: Bill of Exchange (Definition & Concept)Arrianne ObiasNo ratings yet

- InvoiceDocument1 pageInvoiceAbhijeet KumarNo ratings yet

- Fixedline and broadband bill detailsDocument3 pagesFixedline and broadband bill detailsTony JanualNo ratings yet

- GST Registration Procedure and FAQsDocument21 pagesGST Registration Procedure and FAQsSahil KumarNo ratings yet

- TD Beyond Checking: Account SummaryDocument4 pagesTD Beyond Checking: Account SummaryJohn BeanNo ratings yet

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMishra SanjayNo ratings yet

- e-StatementBRImo 433801009403539 Oct2023 20231105 022505Document22 pagese-StatementBRImo 433801009403539 Oct2023 20231105 022505Dede Jua KurniasariNo ratings yet

- InvoiceDocument1 pageInvoicesyed aamiriNo ratings yet

- Share Price List: Cost BasisDocument13 pagesShare Price List: Cost BasisChristian Baldonado AngelesNo ratings yet

- E Payment I.T On Salary Mo April-19Document12 pagesE Payment I.T On Salary Mo April-19HussainMohammadUmarNo ratings yet

- Dahab Tower Apartments Payment PlanDocument3 pagesDahab Tower Apartments Payment PlanLexico InternationalNo ratings yet

- Soal Uas Praktikum Akun TambahanDocument20 pagesSoal Uas Praktikum Akun TambahanAl VengerNo ratings yet

- Christopher Driskell - MATH 12 (10.1) the US Tax SystemDocument3 pagesChristopher Driskell - MATH 12 (10.1) the US Tax SystemdriskelltopherNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsPrince kumarNo ratings yet

- Invoice: Invoice Tax Date Cust Ord Acct Ref Date Due Order No. 005463400 Invoice ToDocument2 pagesInvoice: Invoice Tax Date Cust Ord Acct Ref Date Due Order No. 005463400 Invoice ToA PirzadaNo ratings yet

- Account Statement: NSDL Payments BankDocument3 pagesAccount Statement: NSDL Payments BankSantosh Kumar GuptaNo ratings yet

- Proof of Cash MQM ComDocument5 pagesProof of Cash MQM ComCJ alandyNo ratings yet

- Chapter 6 Bank Recon Practice QHDocument3 pagesChapter 6 Bank Recon Practice QHSuy Yanghear100% (1)

- Tax On Individuals Part 2Document10 pagesTax On Individuals Part 2Tet AleraNo ratings yet

- Maxime Carriere (Done Rite Fire Protection Inc)Document1 pageMaxime Carriere (Done Rite Fire Protection Inc)Floyd McDermottNo ratings yet

- TDON1Document2 pagesTDON1Fevzi OzdemirNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesJATIN GOYAL100% (1)

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet