Professional Documents

Culture Documents

Weekly Option Strategy

Weekly Option Strategy

Uploaded by

Mnvd prasad0 ratings0% found this document useful (0 votes)

71 views3 pagesThe document discusses a short strangle options trading strategy. It involves simultaneously selling slightly out-of-the-money put and call options on the same stock with the same expiration date. Maximum profit occurs if the stock price stays between the strike prices on expiration. The strategy is recommended for Bank Nifty weekly options with different probability levels of success and potential profit/loss amounts.

Original Description:

Option weekly

Original Title

WEEKLY-OPTION-STRATEGY

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses a short strangle options trading strategy. It involves simultaneously selling slightly out-of-the-money put and call options on the same stock with the same expiration date. Maximum profit occurs if the stock price stays between the strike prices on expiration. The strategy is recommended for Bank Nifty weekly options with different probability levels of success and potential profit/loss amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

71 views3 pagesWeekly Option Strategy

Weekly Option Strategy

Uploaded by

Mnvd prasadThe document discusses a short strangle options trading strategy. It involves simultaneously selling slightly out-of-the-money put and call options on the same stock with the same expiration date. Maximum profit occurs if the stock price stays between the strike prices on expiration. The strategy is recommended for Bank Nifty weekly options with different probability levels of success and potential profit/loss amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

www.plindia.

com

WEEKLY EXPIRY OPTION STRATEGY

The short strangle option strategy is a limited profit, unlimited risk options trading strategy that is taken when the

underlying stock is expected to experience little volatility in the near term.

What is the strategy?

The short strangle, also known as sell strangle, is a neutral strategy in options trading that involve the simultaneous

selling of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and

expiration date.

How it works??

Maximum profit for the short strangle occurs when the underlying stock price on expiration date is trading between the

strike prices of the options sold. At this price, both options expire worthless and the options trader gets to keep the

entire initial credit taken as profit.

Strategy Recommended:

Bank Nifty Weekly Option Expiry Trade with Probability

Bank Nifty 30800

Straddle 510

Upper Break Even 31300

lower Break Even 30300

Proposed Trade with 70% chances for success

Trade Type Rate Net Gain Stoploss LTP MTM

Bank Nifty 31300 CE Sell 77 167 210

Bank Nifty 30300 PE Sell 90 167 210

Proposed Trade with 90% chances for success

Trade Type Rate Net Gain Stoploss LTP MTM

Bank Nifty 31500 CE Sell 43 98 120

Bank Nifty 30100 PE Sell 55 98 120

Proposed Trade with 95% chances for success

Trade Type Rate Net Gain Stoploss LTP MTM

Bank Nifty 31600 CE Sell 30 76 95

Bank Nifty 30000 PE Sell 46 76 95

Disclaimer / Disclosures:

We/I, Ms. Shilpa Rout, Research Analysts, M.B.A, B.E authors and the names subscribed to this report, herebycertifythatallof the views

expressed inthis research report accurately reflect our views about the subjectissuer(s)orsecurities.Wealsocertify that no part of our

compensationwas,is,orwillbedirectlyor indirectlyrelatedtothespecificrecommendation(s)orview(s)in thisreport.

Terms & conditions and other disclosures:

Prabhudas Lilladher Pvt. Ltd, Mumbai, India (hereinafter referred to as “PL”) is engaged in the business of Stock Broking, Portfolio Manager, Depository

Participant and distribution for third party financial products. PL is a subsidiary of Prabhudas Lilladher Advisory Services Pvt Ltd. which has its various

subsidiaries engaged in business of commodity broking, investment banking, financial services (margin funding) and distribution of third party

financial/otherproducts,details inrespectof whichareavailableatwww.plindia.com

This document has been prepared by the Research Division of PL and is meant for use by the recipient only as information and is not for circulation.

This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as

an offer to sell or a solicitation to buy or sell any security.

The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the

accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature

fortheinformation, statementsandopiniongiven,madeavailableorexpressedhereinorforanyomissiontherein.

Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as

well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be

sought from an independent expert/advisor.

Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as

principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to

publication.

PL may from time to time solicit or perform investment banking or other services for any company mentioned in this document. PL is

registered as Research Analyst under Securities and Exchange Board of India (Research Analysts) Regulations, 2014

PL submits that no material disciplinary action has been taken on us by any Regulatory Authority impacting Equity Research Analysis activities. PL or its

researchanalystsoritsassociatesorhisrelativesdonothaveanyfinancialinterestinthesubject company.

PL or its research analysts or its associates or his relatives do not have actual/beneficial ownership of one per cent or more securities of the subject

companyattheendofthe month immediatelyprecedingthedateofpublication oftheresearch report.

PL or its research analysts or its associates or his relatives do not have any material conflict of interest at the time of publication of the research report.

PL or its associates might have received compensation from the subject company in the past twelve months.

PL or its associates might have managed or co-managed public offering of securities for the subject company in the past twelve months or mandated

by the subject company for any other assignment in the past twelve months.

PL or its associates might have received any compensation for investment banking or merchant banking or brokerage services from the subject company in

the past twelve months.

PL or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage

services from the subject company in the past twelve months

PL or its associates might have received any compensation or other benefits from the subject company or third party in connection with the research

report.

PL encourages independence in research report preparation and strives to minimize conflict in preparation of research report. PL or its analysts did not

receive any compensation or other benefits from the subject Company or third party in connection with the preparation of the research report. PL or its

Research Analystsdonothaveanymaterialconflictofinterestatthetimeofpublicationofthisreport.

It is confirmed that Mrs. Shilpa Rout, MBA, Research Analyst of this report has not received any compensation from the companies mentioned in the

report in the preceding twelve months

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. TheResearch

analystsforthisreportcertifiesthatalloftheviewsexpressedinthisreportaccuratelyreflect hisorher personalviewsabout the subject company or

companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific

recommendations or views expressed in this report.

The research analysts for this report has not served as an officer, director or employee of the subject company PL or its research analysts have not engaged

in market making activity for the subject company.

Our sales people, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that

reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions

that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all o the foregoing,

among other things, may give rise to real or potential conflicts of interest.

PL and its associates, their directors and employees may (a) from time to time, have a long or short position in, and buy or sell the securities of the subject

company or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the

financial instruments of the subject company or act as an advisor or lender/borrower to the subject company or may have any other potential conflict of

interestswithrespecttoanyrecommendationandotherrelatedinformationandopinions.

You might also like

- Trade Like Chuck: How to Create lncome in ANY MARKET!From EverandTrade Like Chuck: How to Create lncome in ANY MARKET!Rating: 3 out of 5 stars3/5 (1)

- Think Like a Whale Trade as a SharkFrom EverandThink Like a Whale Trade as a SharkRating: 2.5 out of 5 stars2.5/5 (2)

- A Simple Options Trading Strategy Based On Technical IndicatorsDocument4 pagesA Simple Options Trading Strategy Based On Technical IndicatorsMnvd prasad100% (1)

- Guide To Moving Averages: The UltimateDocument23 pagesGuide To Moving Averages: The UltimateShakar RajNo ratings yet

- VIXFuturesBasisTrading 2 Rev1Document16 pagesVIXFuturesBasisTrading 2 Rev1samuelcwlsonNo ratings yet

- Investment AnalysisDocument35 pagesInvestment AnalysisChen XuNo ratings yet

- Role of The Sell SideDocument8 pagesRole of The Sell SideHoward AndersonNo ratings yet

- Straddle Including Expiry DayDocument47 pagesStraddle Including Expiry DayMnvd prasadNo ratings yet

- Sources of Short Term FinancingDocument74 pagesSources of Short Term FinancingKim TaengoossNo ratings yet

- ApptioDocument196 pagesApptiovicr100No ratings yet

- Swing Trading Simplified - Larry D SpearsDocument115 pagesSwing Trading Simplified - Larry D SpearsPedja100% (2)

- Commodities CorpDocument5 pagesCommodities CorpmirceaNo ratings yet

- CIMA F2 Course Notes PDFDocument293 pagesCIMA F2 Course Notes PDFganNo ratings yet

- Profits - Successful Transaction in Private Placement ProgramDocument4 pagesProfits - Successful Transaction in Private Placement ProgramDavid Enmanuel Rodriguez LopezNo ratings yet

- Scott Redler Super Simple Gap Trading EbookDocument18 pagesScott Redler Super Simple Gap Trading EbookSujitKGoudar100% (1)

- Vishwas's ProjectDocument71 pagesVishwas's ProjectRAMJI VISHWAKARMANo ratings yet

- What I Learnt as an Analyst: Sharing of Experience in Investment and AnalysisFrom EverandWhat I Learnt as an Analyst: Sharing of Experience in Investment and AnalysisRating: 5 out of 5 stars5/5 (2)

- Derivative Report: CommentsDocument3 pagesDerivative Report: CommentsAngel BrokingNo ratings yet

- Derivatives Report, 28 February 2013Document3 pagesDerivatives Report, 28 February 2013Angel BrokingNo ratings yet

- Derivatives Report 16th January 2012Document3 pagesDerivatives Report 16th January 2012Angel BrokingNo ratings yet

- Derivatives Report, 30th April 2013Document3 pagesDerivatives Report, 30th April 2013Angel BrokingNo ratings yet

- Derivatives Report 09 Aug 2012Document3 pagesDerivatives Report 09 Aug 2012Angel BrokingNo ratings yet

- Derivatives Report 29 Aug 2012Document3 pagesDerivatives Report 29 Aug 2012Angel BrokingNo ratings yet

- Derivatives Report, 20 February 2013Document3 pagesDerivatives Report, 20 February 2013Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 30th November 2011Document3 pagesDerivatives Report 30th November 2011Angel BrokingNo ratings yet

- Derivatives Report 30 Jul 2012Document3 pagesDerivatives Report 30 Jul 2012angelbrokingNo ratings yet

- Derivatives Report, 14 March 2013Document3 pagesDerivatives Report, 14 March 2013Angel BrokingNo ratings yet

- Derivatives Report 23 Oct 2012Document3 pagesDerivatives Report 23 Oct 2012Angel BrokingNo ratings yet

- Get Trading Tips With 2 Days Free TrialsDocument11 pagesGet Trading Tips With 2 Days Free Trialscapitalstroke1No ratings yet

- Derivatives Report, 11 June 2013Document3 pagesDerivatives Report, 11 June 2013Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Stock To Trade On Bounces 202003300855158325372Document6 pagesStock To Trade On Bounces 202003300855158325372flying400No ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 17 Oct 2012Document3 pagesDerivatives Report 17 Oct 2012Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 30-Aug-2012Document3 pagesDerivatives Report 30-Aug-2012Angel BrokingNo ratings yet

- Derivatives Report 12 Dec 2012Document3 pagesDerivatives Report 12 Dec 2012Angel BrokingNo ratings yet

- MTF Stock Pick - 28-04-21-Heritage FoodsDocument3 pagesMTF Stock Pick - 28-04-21-Heritage FoodsKaran SinghNo ratings yet

- Derivatives Report, 12 April 2013Document3 pagesDerivatives Report, 12 April 2013Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 16 Aug 2012Document3 pagesDerivatives Report 16 Aug 2012Angel BrokingNo ratings yet

- Derivatives Report 07 Dec 2012Document3 pagesDerivatives Report 07 Dec 2012Angel BrokingNo ratings yet

- Derivatives Report 11 Jul 2012Document3 pagesDerivatives Report 11 Jul 2012Angel BrokingNo ratings yet

- Derivatives Report 18 Sep 2012Document3 pagesDerivatives Report 18 Sep 2012Angel BrokingNo ratings yet

- Derivatives Report, 05 March 2013Document3 pagesDerivatives Report, 05 March 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Derivatives Report 06 Dec 2012Document3 pagesDerivatives Report 06 Dec 2012Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 17th January 2012Document3 pagesDerivatives Report 17th January 2012Angel BrokingNo ratings yet

- Derivatives Report, 21 March 2013Document3 pagesDerivatives Report, 21 March 2013Angel BrokingNo ratings yet

- Option Writing (11-02-2020) - 202002111240535114872Document4 pagesOption Writing (11-02-2020) - 202002111240535114872ramajssNo ratings yet

- EPIC Research ReportDocument9 pagesEPIC Research Reportapi-221305449No ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 1st JanDocument3 pagesDerivatives Report 1st JanAngel BrokingNo ratings yet

- EPIC Research ReportDocument10 pagesEPIC Research Reportapi-221305449No ratings yet

- Derivatives Report, 20th May 2013Document3 pagesDerivatives Report, 20th May 2013Angel BrokingNo ratings yet

- Deirvatives Report 27th DecDocument3 pagesDeirvatives Report 27th DecAngel BrokingNo ratings yet

- Derivatives Report 30 Oct 2012Document3 pagesDerivatives Report 30 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 10th October 2011Document3 pagesDerivatives Report 10th October 2011Angel BrokingNo ratings yet

- Derivatives Report 9th February 2012Document3 pagesDerivatives Report 9th February 2012Angel BrokingNo ratings yet

- Derivatives Report 28th December 2011Document3 pagesDerivatives Report 28th December 2011Angel BrokingNo ratings yet

- Derivative Report Derivative Report: CommentsDocument3 pagesDerivative Report Derivative Report: CommentsAngel BrokingNo ratings yet

- Derivatives Report 05 Oct 2012Document3 pagesDerivatives Report 05 Oct 2012Angel BrokingNo ratings yet

- Weekly Derivative ForesightDocument5 pagesWeekly Derivative ForesightRomelu MartialNo ratings yet

- MT-Daily Equity Morning Update 27 Dec 2011Document4 pagesMT-Daily Equity Morning Update 27 Dec 2011Mitesh ThackerNo ratings yet

- Derivatives Report 09 Jul 2012Document3 pagesDerivatives Report 09 Jul 2012Angel BrokingNo ratings yet

- EPIC Research ReportDocument10 pagesEPIC Research Reportapi-221305449No ratings yet

- Strategy Name Number of Option Legs Direction: Bull Call Spread Two Moderatly BullishDocument3 pagesStrategy Name Number of Option Legs Direction: Bull Call Spread Two Moderatly BullishMnvd prasadNo ratings yet

- Date Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioDocument3 pagesDate Gicre (S1) Closing Icicigi (S2) Closing Spread Differential RatioMnvd prasadNo ratings yet

- Monthly Income StrategyDocument1 pageMonthly Income StrategyMnvd prasadNo ratings yet

- Grand Bundle PDF Course: SBI Clerk Prelims 2021Document17 pagesGrand Bundle PDF Course: SBI Clerk Prelims 2021Mnvd prasadNo ratings yet

- ConsolidatedCustomerInvoice 33357992 9NY 1621438454Document1 pageConsolidatedCustomerInvoice 33357992 9NY 1621438454Mnvd prasadNo ratings yet

- Fire Insurance ClaimDocument4 pagesFire Insurance ClaimAMIN BUHARI ABDUL KHADERNo ratings yet

- #RELIANCE Facing Resistance From Supply Zone For NSE - RELIANCE by JayChhatbar - TradingView IndiaDocument2 pages#RELIANCE Facing Resistance From Supply Zone For NSE - RELIANCE by JayChhatbar - TradingView IndiaAbhiNo ratings yet

- Npa and Public SectorDocument23 pagesNpa and Public SectorpriyaNo ratings yet

- Act 109 Farmers' Organization Act 1973Document30 pagesAct 109 Farmers' Organization Act 1973Adam Haida & CoNo ratings yet

- Alm, Car BaselDocument4 pagesAlm, Car BaselAayush RawatNo ratings yet

- Lindner 5Document16 pagesLindner 5Ties de KokNo ratings yet

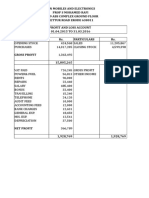

- Sun Mobiles and Electronics Prop S Mohamed Rafi No.19 Abs Complex Ground Floor Mettur Road Erode 638011 Profit and Loss Account 01.04.2015 TO 31.03.2016 Particulars Rs. Particulars RsDocument6 pagesSun Mobiles and Electronics Prop S Mohamed Rafi No.19 Abs Complex Ground Floor Mettur Road Erode 638011 Profit and Loss Account 01.04.2015 TO 31.03.2016 Particulars Rs. Particulars RssamaadhuNo ratings yet

- Ratio Analysis of Banking SectorDocument2 pagesRatio Analysis of Banking SectorKrishna SharmaNo ratings yet

- MGT ACC3Document46 pagesMGT ACC3MsKhan0078No ratings yet

- Capital Adequacy CalculationDocument9 pagesCapital Adequacy CalculationSyed Ameer HayderNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinanceArijit BhattacharyaNo ratings yet

- Benjamin Robinson Resume - Nasa Full-TimeDocument2 pagesBenjamin Robinson Resume - Nasa Full-Timeapi-257999005No ratings yet

- TrustDocument4 pagesTrusteldene tampicoNo ratings yet

- US Internal Revenue Service: p1212 - 1996Document14 pagesUS Internal Revenue Service: p1212 - 1996IRSNo ratings yet

- 7th Pay Commission Gazette NotificationDocument10 pages7th Pay Commission Gazette NotificationHitendra ToliaNo ratings yet

- Quis Seb UASDocument5 pagesQuis Seb UASHafiz FadhlanNo ratings yet

- Bitcoin Financial Regulation: Securities, Derivatives, Prediction Markets & GamblingDocument78 pagesBitcoin Financial Regulation: Securities, Derivatives, Prediction Markets & GamblingCoin CenterNo ratings yet

- Introduction To Insurance IndustryDocument15 pagesIntroduction To Insurance Industryabhimails100% (5)

- Depository and Custodial ServicesDocument3 pagesDepository and Custodial ServicesHatim EzziNo ratings yet

- PNL and Risk Analysis For Credit DerivativesDocument36 pagesPNL and Risk Analysis For Credit DerivativesTheodor MunteanuNo ratings yet

- Senate Hearing, 107TH Congress - Nomination Hearing For Phyllis K. Fong, Walter Lukken, Sharon Brown - Hruska and Douglas L. FloryDocument130 pagesSenate Hearing, 107TH Congress - Nomination Hearing For Phyllis K. Fong, Walter Lukken, Sharon Brown - Hruska and Douglas L. FloryScribd Government DocsNo ratings yet