Professional Documents

Culture Documents

Rift Valley University, Kality Campus College of Business and Economics Department of Accounting and Finance

Uploaded by

habtamu tadesse0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

Audit Assignment

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesRift Valley University, Kality Campus College of Business and Economics Department of Accounting and Finance

Uploaded by

habtamu tadesseCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Rift Valley University, Kality Campus

College of Business and Economics

Department of Accounting and Finance

Auditing Principles and Practices 2 Assignment –I for 4th year students. ( 20%)

Instruction: Attempt all Questions clearly and Submission deadline date: 10

June2021

1. Define Source and nature of Account receivables

2. List and discuss Auditor’s objective in auditing account receivable and sales.

3. Discuss the importance of evaluating accounting system and internal control

as well as procedures to be carried out during the course of Audit over

inventories and cost of goods sold

4. What auditors do if internal control procedure is not satisfactory of one’s

company sales?

5. What are the procedures typically to be performed by to achieve audit

program for inventories and cost of goods sold

6. How internal control over sales studied and evaluated?

7. What is a Substantive procedure for sales transaction and how auditors

apply?

8. How Auditors verify and examine whether there is effective internal control

regarding account receivables and sales transactions.

9. List and discuss substantive test auditors has to apply for account

receivables

10. What are the Audit programs for verification of receivables and sales

transactions?

11. Define the term: A, clerical accuracy B, occurrence, C valuation, D,

completeness E, presentation and disclosure in relation to performing

substantive test of inventories and cost of goods sold

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

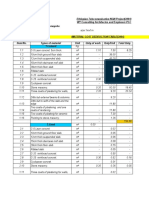

- Bill of Quntity Ato Alem Meles As CorrectedDocument194 pagesBill of Quntity Ato Alem Meles As Correctedhabtamu tadesseNo ratings yet

- Chapter Three Accounting For General and Special Revenue FundsDocument22 pagesChapter Three Accounting For General and Special Revenue Fundshabtamu tadesse100% (2)

- College of Busines and EconomicsDocument51 pagesCollege of Busines and Economicshabtamu tadesseNo ratings yet

- Auditing 2 - Chapter FiveDocument10 pagesAuditing 2 - Chapter Fivehabtamu tadesseNo ratings yet

- Assessment of Cost Accounting SystemDocument41 pagesAssessment of Cost Accounting Systempadm100% (6)

- Chapter One Entrepreneurship and Free Enterprise 1.0: 1 SINTAYEHU TESSEMA:sintetessema@gamail, ComDocument23 pagesChapter One Entrepreneurship and Free Enterprise 1.0: 1 SINTAYEHU TESSEMA:sintetessema@gamail, Comhabtamu tadesseNo ratings yet