Professional Documents

Culture Documents

Bnaking Money

Bnaking Money

Uploaded by

Abdul Salam0 ratings0% found this document useful (0 votes)

9 views3 pagesMoney banking and finance assignment

Original Title

bnaking money

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMoney banking and finance assignment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesBnaking Money

Bnaking Money

Uploaded by

Abdul SalamMoney banking and finance assignment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

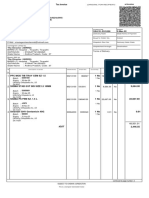

Name Abdul Salam

Roll No. 036

Subject. Money banking and finance

Program. BSAG 4th Semester

Minhaj University Lahore

Demand for money refers to desire to hold money for.fulfilling different

requirements. People keep money for day-to-day activities, to meet

consequential expenses and to invest on shares and debentures. J.M.Keynes, in

his General Theory used a new term ‘liquidity preference’ for the demand for

money. J.M.Keynes suggested three motives which led to the demand for money

in an economy. They are as follows:

(a)Transaction demand for money:

When people hold cash to meet daily transactions is called transaction demand for money. The

transaction motive relates to the demand for money for the day to day expenditure of individuals

and business firms. The need for holding cash arises due to a time gap between receipt of income

and the consumption expenditure. As income increases, people like to spend more and in turn they

demand more money to hold. The Transaction demand for money is represented as follows: Md T =

f (Y) where, Md T represents the transaction demand for money, Y represents the income of an

individual and T represents functional relationship between two variables.

(b) Precautionary Motive:

People keep money to meet unexpected expenses or circumstances, e.g.

people hold cash to meet medical treatment, accidents, emergencies, to

perform some rituals or celebrations etc. We need to hold cash for meeting

such emergencies in our life. If we demand money for such needs, it is known

as precautionary demand for money. As income rises, precautionary demand

for money also gets increased and if the income falls, the precautionary

demand for money also falls. This can be expressed as follows: Mdp = f (Y),

where Mdp represents the precautionary demand for money, Y represents the

income of an individual and ‘f’ represents functional relationship between two

variables.

(c) Speculative Motive:

Some people hold cash to invest on shares, debentures, gold, immovable

properties etc. The speculative demand for money refers to the demand for

money that people hold as idle cash to speculate with the aim of earning

capital gains and profits. According to J.M.Keynes there will be inverse

relationship between the rate of interest and speculative demand for money.

If the rate of interest is low the people desire to keep more cash with them

and vice versa. So, the speculative demand for money is inversely related to

the expected rate of interest. This can be expressed as follows: Mds = f (ie),

where Mds represents the Speculative demand for money, (ie), represents the

expected rate of interest, and ‘f ’ represents functional relationship .

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Financial Analyst CFA Study Notes: Quantitative Methods Level 1Document8 pagesFinancial Analyst CFA Study Notes: Quantitative Methods Level 1Andy Solnik33% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- TheEconomist 2024 03 16Document355 pagesTheEconomist 2024 03 16liangchen0920No ratings yet

- Valuation Apr 05Document10 pagesValuation Apr 05justine reine cornicoNo ratings yet

- Quiz - Chapter 11 - Pfrs For SmesDocument5 pagesQuiz - Chapter 11 - Pfrs For SmesJosh BustamanteNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- 2020.Q3 Goehring & Rozencwajg Market CommentaryDocument33 pages2020.Q3 Goehring & Rozencwajg Market Commentarygenid.ssNo ratings yet

- Political Environment BE5: Pushkar BajracharyaDocument14 pagesPolitical Environment BE5: Pushkar BajracharyaStraightedge KadayatNo ratings yet

- American Apparel Case StudyDocument8 pagesAmerican Apparel Case StudyELIZABETHNo ratings yet

- Bir Rdo 51 Lists of Authorized BanksDocument3 pagesBir Rdo 51 Lists of Authorized BanksAljohn SebucNo ratings yet

- Nri BankingDocument48 pagesNri BankingKrinal Shah100% (1)

- Econ TB CaseStudyAnsDocument22 pagesEcon TB CaseStudyAnskpgrxvybcfNo ratings yet

- Supplementary Material Ib EconomicsDocument20 pagesSupplementary Material Ib EconomicsIzyan LiraniNo ratings yet

- Crane 85T-7976 KECDocument1 pageCrane 85T-7976 KECRajuNo ratings yet

- The Effectiveness of The Microcredit Programme in BangladeshDocument14 pagesThe Effectiveness of The Microcredit Programme in Bangladesh娜奎No ratings yet

- Future Phoenix of WorldDocument10 pagesFuture Phoenix of WorldPradipta DashNo ratings yet

- Decimals Level 3 - Ex 5Document2 pagesDecimals Level 3 - Ex 5Welly Boss HwiNo ratings yet

- Current Issues and Problems of PakistanDocument24 pagesCurrent Issues and Problems of PakistanAlifiya AunaliNo ratings yet

- Project On Foreign BanksDocument68 pagesProject On Foreign BanksPawan Gurhani100% (1)

- Mitsubishi Heavy Industry PBB 1Document3 pagesMitsubishi Heavy Industry PBB 1studentsurfpro4No ratings yet

- PT Instruction Note No 01 of 2023 24 Cost Containment Measures 16-10-2023Document14 pagesPT Instruction Note No 01 of 2023 24 Cost Containment Measures 16-10-2023Krash KingNo ratings yet

- UDC (BS-11) : 3. Name 4. Father's Name 5. CNIC No. 6. GenderDocument3 pagesUDC (BS-11) : 3. Name 4. Father's Name 5. CNIC No. 6. Gendersajjad hussainNo ratings yet

- Yazu's Computer ExamDocument7 pagesYazu's Computer Examywankadia1101No ratings yet

- OSU ListDocument6 pagesOSU ListyogitaanosalesNo ratings yet

- The Royal Monetary Authority of Bhutan Act 1982Document26 pagesThe Royal Monetary Authority of Bhutan Act 1982Sonam PhuntshoNo ratings yet

- Inv 2428Document8 pagesInv 2428adarsh pagidiNo ratings yet

- - Huỳnh Thị Thiên Nhi: Câu HỏiDocument9 pages- Huỳnh Thị Thiên Nhi: Câu HỏiBông GấuNo ratings yet

- AS SBM - Strategic ChoiceDocument38 pagesAS SBM - Strategic ChoicesajedulNo ratings yet

- IB Economics IA Coversheet enDocument1 pageIB Economics IA Coversheet ensupergoodboi666No ratings yet

- RSKMGT Module II Credit Risk CH 3-Techniques For Estimation of PDDocument9 pagesRSKMGT Module II Credit Risk CH 3-Techniques For Estimation of PDAstha PandeyNo ratings yet

- CabDocument49 pagesCabMuhammad AsifNo ratings yet