Professional Documents

Culture Documents

Collection of Internal Revenue Taxes

Uploaded by

Greta Almina Garcia0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageCollection of Internal Revenue Taxes

Uploaded by

Greta Almina GarciaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

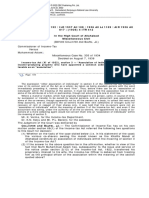

SUMMARY OF PROCEEDINGS UNDER THE NIRC

IV. COLLECTION OF INTERNAL REVENUE TAXES Period: Period:

PREJUDICED PARTY

BIR TX

(BIR OR TX) With Assessment Collection

3 yrs from due date if return

MODES OF COLLECTION: filed on or before due date

3 yrs from actual date of filing

1. Administrative: (the assumption is BIR has issued a FAN) if return filed beyond due date

10 yrs from discovery by BIR

W of Distraint on personal properties

TX may opt to pay tax due; OR of filing of fraudulent return

TX may post a bond double the 5 yrs from receipt by TX of FAN

amount of tax due. In the (administrative or judicial)

meantime, TX who is presumed to

have filed a protest on the FAN

may file an appeal to CTA DIV as 10 yrs from discovery by BIR

W of Levy on real properties

the protest is deemed denied of non-filing of return

when BIR issues W of D/L;

2. Judicial ( civil/criminal case) within agreed period (waiver)

Civil Case in ordinary courts No Assessment Collection

If court of origin is

MTC,METC,MCTC, prejudiced 10 yrs from discovery by BIR of

MTC/METC/MCTC RTC CTA party appeals to RTC (15 No Assessment ( applicable filing of fraudulent return

days), then to CTA EN only by way of filing (judicial proceedings only)

BANC( 30 days), then to SC civil/criminal case in court, 10 yrs from discovery by BIR of

within Metro P 400 THOUSAND MORE THAN P 400 File Answer, otherwise, BIR

(15 days); If court Sec. 222 NIRC) non-filing of return (judicial

Manila AND BELOW THOUSAND PESOS presents evidence ex-parte;

of origin is RTC, prejudiced proceedings only)

1M AND ABOVE

party appeals to CTA DIV (15

EXCLUSIVE OF PENALTIES,

days), then to CTA EN BANC

outside of Metro P 300 THOUSAND MORE THAN P 300 AND SURCHARGES (30 days), then to SC (15

Manila AND BELOW THOUSAND PESOS days);

Criminal Case in ordinary courts

BIR can immediately enforce collection on disputed assessments

File counter-affidavit before Fiscal. and can immediately issue Warrants of Distraint, Garnishment,

Criminal Case first filed before the Fiscal, and in case of findings of probable cause, fiscal files

Trial proceeds in court with TX as If court of origin is and/or Levy upon the happening of the following events:

information in ordinary courts

accused; MTC,METC,MCTC, prejudiced

party appeals to RTC, then to

If with specified amount, the jurisdiction of courts in criminal cases is determined as follows: CTA EN BANC (30 days) ,

then to SC(15 days); A. Upon issuance by the Commissioner or its authorized

MTC/METC/MCTC RTC CTA If court of origin is RTC, representative of its final decision on the disputed assessment

prejudiced party appeals to against the taxpayer, or

CTA DIV (30 days), then to

within Metro P 400 THOUSAND MORE THAN P 400 B. Upon filing of a Petition for Review before the Court of Tax

CTA EN BANC (15 days), Appeals in Division or En Banc of the BIR’s decision upholding

Manila AND BELOW THOUSAND PESOS then to SC (15 days) ; If the assessment.

1M AND ABOVE EXCLUSIVE OF PENALTIES, AND court of origin is CTA,

SURCHARGES appeal to CTA En BAnc (30 Thus, the BIR has the option of immediately collecting a disputed

outside of Metro P 300 THOUSAND MORE THAN P 300 days), then SC (15 days); tax liability unless the CTA enjoins its enforcement after

Manila AND BELOW THOUSAND PESOS requiring the taxpayer to post a bond of up to double the

amount of the alleged tax liability.

If court of origin is

If without specified amount, the jurisdiction of courts in criminal cases is determined as follows:

MTC,METC,MCTC, prejudiced

party appeals to RTC, then to

MTC/METC/MCTC RTC CTA CTA EN BANC (30 days) ,

then to SC (15 days);

If court of origin is RTC,

prejudiced party appeals to

within or outside penalty is 6 yrs and penalty is more than

no jurisdiction CTA DIV (15 days) , then to

of Metro Manila 1 day and below 6 yrs and 1 day

CTA EN BANC (30 days),

then to SC (15 days);

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Real Property TaxationDocument1 pageReal Property TaxationGreta Almina GarciaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Summary of Proceedings Under The LGC of 1991 Real Property Taxation VI. Collection of Real Property Tax (Treasurer's Office)Document1 pageSummary of Proceedings Under The LGC of 1991 Real Property Taxation VI. Collection of Real Property Tax (Treasurer's Office)Greta Almina GarciaNo ratings yet

- III. Refund of Illegally Assessed, Illegally Collected, Erroneously Assessed, and Erroneously Collected Internal Revenue TaxesDocument1 pageIII. Refund of Illegally Assessed, Illegally Collected, Erroneously Assessed, and Erroneously Collected Internal Revenue TaxesGreta Almina GarciaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- ProtestDocument1 pageProtestGreta Almina GarciaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Due Process in Issuance of AssessmentsDocument1 pageDue Process in Issuance of AssessmentsGreta Almina GarciaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Collection of Ordinary Local TaxesDocument1 pageCollection of Ordinary Local TaxesGreta Almina GarciaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shareholder Agreement 26Document51 pagesShareholder Agreement 26Greta Almina GarciaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Rules Governing Redeemable and Treasury SharesDocument2 pagesRules Governing Redeemable and Treasury SharesmarjNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shareholder Agreement 26Document51 pagesShareholder Agreement 26Greta Almina GarciaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Note: Terms and Conditions Below Are Sample Only, Please ReviseDocument3 pagesNote: Terms and Conditions Below Are Sample Only, Please ReviseGreta Almina GarciaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- National Highways Authority of India v. PATEL - KNR (JV)Document11 pagesNational Highways Authority of India v. PATEL - KNR (JV)rayadurgam bharatNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- NATSPEC National BIM Guide AIR Template 22-10-20Document11 pagesNATSPEC National BIM Guide AIR Template 22-10-20Mahbouba FendriNo ratings yet

- Oblicon (January 2023)Document66 pagesOblicon (January 2023)Meniessa DepalubosNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SECTION 212 PD 1096 Part 3Document2 pagesSECTION 212 PD 1096 Part 3Maria Veronica ParillaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Civil Service Code of Conduct - 0Document16 pagesCivil Service Code of Conduct - 0Mahama JinaporNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Central Office: ManilaDocument1 pageCentral Office: ManilaRenz FernandezNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Tutorial Eppa 2823 Law of Contract QUESTION 1:mario Entered Into The Following Two Separate Contracts With PaulDocument4 pagesTutorial Eppa 2823 Law of Contract QUESTION 1:mario Entered Into The Following Two Separate Contracts With PaulnurNo ratings yet

- Rabadilla v. CA DigestDocument2 pagesRabadilla v. CA DigestAmber Anca100% (2)

- Secrecy of Customers AccountsDocument10 pagesSecrecy of Customers AccountslittlemagicpkNo ratings yet

- Nội dung bài thuyết trình-1Document10 pagesNội dung bài thuyết trình-1viet hoangNo ratings yet

- State Investment House Vs Court of Appeals (Case Digest)Document3 pagesState Investment House Vs Court of Appeals (Case Digest)Maria Anna M Legaspi50% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1 United States District Court District of MinnesotaDocument44 pages1 United States District Court District of MinnesotapolitixNo ratings yet

- Application For Registration Information Update/Correction/CancellationDocument3 pagesApplication For Registration Information Update/Correction/CancellationCarmen TabundaNo ratings yet

- Start-Up Legal PackDocument24 pagesStart-Up Legal Packzoya100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Aom Comment 2020-008 (2019-26) Re Legal OfficerDocument2 pagesAom Comment 2020-008 (2019-26) Re Legal OfficerEduard FerrerNo ratings yet

- Chapter 7 Leases Pt1Document5 pagesChapter 7 Leases Pt1EUNICE NATASHA CABARABAN LIMNo ratings yet

- 16 A.C. No. 5687Document4 pages16 A.C. No. 5687Jessel MaglinteNo ratings yet

- Waiver OjtDocument1 pageWaiver OjtMantes, Mellinia M.No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- CIT Vs Muhammad AslamDocument4 pagesCIT Vs Muhammad AslamSAI SUVEDHYA RNo ratings yet

- OCA Circular No. 179-2022Document19 pagesOCA Circular No. 179-2022Kiqs NecosiaNo ratings yet

- Acting As Agent Under A Financial Durable Power of Attorney - An UDocument48 pagesActing As Agent Under A Financial Durable Power of Attorney - An UWayne Ogden100% (1)

- Betita V Ganzon Case DigestDocument2 pagesBetita V Ganzon Case DigestZirk TanNo ratings yet

- In Re Will of ChristiansenDocument2 pagesIn Re Will of ChristiansenKathNo ratings yet

- Leon County Booking Report: Dec. 4, 2021Document3 pagesLeon County Booking Report: Dec. 4, 2021WCTV Digital Team0% (2)

- Citizen DTPDocument37 pagesCitizen DTPPalaniNo ratings yet

- Form 13A (Request For Availability of Name)Document2 pagesForm 13A (Request For Availability of Name)Zaim Adli100% (1)

- Statement in Support of Claim For Service Connection For Post-Traumatic Stress Disorder (PTSD)Document2 pagesStatement in Support of Claim For Service Connection For Post-Traumatic Stress Disorder (PTSD)George DawraNo ratings yet

- Professional Practice PPT - 23.02.20Document14 pagesProfessional Practice PPT - 23.02.20Harsha AlexNo ratings yet

- (ADMIN) Bautista V Workmen's Compensation CommissionDocument1 page(ADMIN) Bautista V Workmen's Compensation CommissionLowela Aileen LimbaringNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 4 - Fajardo, Jr. v. Freedom To Build, Inc.Document8 pages4 - Fajardo, Jr. v. Freedom To Build, Inc.Sophia Lyka OngNo ratings yet