Professional Documents

Culture Documents

RV Exam Case Studies

RV Exam Case Studies

Uploaded by

CAAniketGangwal0 ratings0% found this document useful (0 votes)

27 views2 pagesThe document describes a bond issued on 1/1/2005 with a par value of Rs. 1000, coupon rate of 10% payable semi-annually, and redeemable on 31/12/2020. It asks the reader to calculate the yield-to-maturity and value of the bond as of 1/1/2013 and 1/3/2013 for a purchaser on 1/1/2013.

Original Description:

Original Title

Rv Exam Case Studies

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document describes a bond issued on 1/1/2005 with a par value of Rs. 1000, coupon rate of 10% payable semi-annually, and redeemable on 31/12/2020. It asks the reader to calculate the yield-to-maturity and value of the bond as of 1/1/2013 and 1/3/2013 for a purchaser on 1/1/2013.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views2 pagesRV Exam Case Studies

RV Exam Case Studies

Uploaded by

CAAniketGangwalThe document describes a bond issued on 1/1/2005 with a par value of Rs. 1000, coupon rate of 10% payable semi-annually, and redeemable on 31/12/2020. It asks the reader to calculate the yield-to-maturity and value of the bond as of 1/1/2013 and 1/3/2013 for a purchaser on 1/1/2013.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

a. Bond issued on 1/1/05 (par value Rs.

1000) coupon rate 10% payable semi

annually (On 30th of June and 31st of December every year). Discount Rate

12%. The bond is redeemable on 31/12/20. Mr X purchases the same on

1/1/13.

i. Calculate the YTM

ii. What Is the value of bond as on 1/1/13

iii. What is the value of bond as on 1/3/13

a. Ramesh and Company a leading manufacturer of Healthcare products, had a return

on Equity in 1992 of 31.4% and paid out 36% of earnings as dividends. It earned a

net income of 1625$ Million on a book value of equity of $5171 Million. As a

consequence of healthcare reforms, it is expected that the return on equity will drop

to 25% in 1993 and that the dividend payout ratio will remain unchanged.

1. Estimate the growth rate in earnings based on 1992 Figures.

2. Estimate the growth rate in 1993, when the ROE Drops from 31.4%

to 25%.

3. Estimate the growth rate after 1993, assuming that 1993 numbers

can be sustained in future.

You might also like

- Ch5Probset Bonds+Interest 13ed. - MasterDocument8 pagesCh5Probset Bonds+Interest 13ed. - Masterpratiksha1091No ratings yet

- Financial Management June 13 Exam Paper ICAEW PDFDocument6 pagesFinancial Management June 13 Exam Paper ICAEW PDFMuhammad Ziaul Haque50% (2)

- ISA 3.0 E-Learning Assessment TestDocument20 pagesISA 3.0 E-Learning Assessment TestCAAniketGangwalNo ratings yet

- JPIA Current LiabilitiesDocument7 pagesJPIA Current LiabilitiesKimboy Elizalde PanaguitonNo ratings yet

- Tutorial 40 Sem 2 20212022Document6 pagesTutorial 40 Sem 2 20212022Nishanthini 2998No ratings yet

- Assignment 2Document3 pagesAssignment 2SatyabrataNayakNo ratings yet

- Review QuestionsDocument4 pagesReview QuestionsValentina NotarnicolaNo ratings yet

- Group 4Document3 pagesGroup 4Pham Kim LienNo ratings yet

- 326 HW 1Document3 pages326 HW 1Qing YiluoNo ratings yet

- Debt ExerciseDocument5 pagesDebt ExerciseGiang Truong ThuyNo ratings yet

- 4thsession - RIL Bonds CaseDocument6 pages4thsession - RIL Bonds CaseVignesh_230% (2)

- Banking, Inflation and Exchange Rates Notes and QuestionsDocument22 pagesBanking, Inflation and Exchange Rates Notes and QuestionsKelvinNo ratings yet

- 2023 Tute 6 ValuationDocument6 pages2023 Tute 6 ValuationThảo TrươngNo ratings yet

- Module-1 IAPM Valuation of Fixed-Income SecuritiesDocument5 pagesModule-1 IAPM Valuation of Fixed-Income Securitiesgaurav supadeNo ratings yet

- 2800021Document2 pages2800021Daood AbdullahNo ratings yet

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDocument3 pagesRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNo ratings yet

- Tutorial 6 Valuation - SVDocument6 pagesTutorial 6 Valuation - SVHiền NguyễnNo ratings yet

- WEEK 2 3 ExercisesDocument13 pagesWEEK 2 3 ExercisesÁi Ly NguyễnNo ratings yet

- 4 Relative - Valuation QuestionsDocument3 pages4 Relative - Valuation Questionselianamacedo1720No ratings yet

- Time-Bound Home Exam-2020: Purbanchal UniversityDocument2 pagesTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlNo ratings yet

- 2024 Financial Derivatives Practice QuestionsDocument9 pages2024 Financial Derivatives Practice Questions24a4013096No ratings yet

- 2020 Spring BADM 301N 02 Homework 4 (Revised)Document2 pages2020 Spring BADM 301N 02 Homework 4 (Revised)Olome Emenike0% (1)

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- 4 5953918248238974494Document8 pages4 5953918248238974494Muktar jibo0% (1)

- FA2 03 Bonds Payable PDFDocument3 pagesFA2 03 Bonds Payable PDFdasdsadsadasdasdNo ratings yet

- AL Financial Management May Jun 2014Document2 pagesAL Financial Management May Jun 2014hyp siinNo ratings yet

- FINA201 Tut 3.3 QuestionsDocument3 pagesFINA201 Tut 3.3 QuestionsAyandaNo ratings yet

- Investment AccountingDocument13 pagesInvestment AccountingkautiNo ratings yet

- 1 What Is A Difference Between A Forward Contract and A Future ContractDocument6 pages1 What Is A Difference Between A Forward Contract and A Future ContractAlok SinghNo ratings yet

- Bài tập 2Document2 pagesBài tập 2Nguyễn Thị Hoàng OanhNo ratings yet

- Illustrative Examples - Bonds PayableDocument2 pagesIllustrative Examples - Bonds PayableChuchi SubardiagaNo ratings yet

- Issue of DebenturesDocument2 pagesIssue of DebenturesSheikh Afeef AyubNo ratings yet

- Redemption of DebenturesDocument2 pagesRedemption of DebenturesSofi YounisNo ratings yet

- Rich JacksonDocument2 pagesRich JacksonYolandafitri ZulviaNo ratings yet

- Tutorial 5 - Interest RatesDocument2 pagesTutorial 5 - Interest Rates3tc22hanuNo ratings yet

- 2023 - Tutorial 3 - Interest RatesDocument2 pages2023 - Tutorial 3 - Interest RatesHà ĐàoNo ratings yet

- Chapter 2 - Numerical QuestionsDocument2 pagesChapter 2 - Numerical Questionskapil DevkotaNo ratings yet

- ExerciseDocument6 pagesExerciseevelynn. lolNo ratings yet

- Fiscal and Monetary Policy of IndiaDocument62 pagesFiscal and Monetary Policy of IndiaNIKHIL GIRME100% (1)

- FinMan Unit 5 Tutorial Valuation of Bonds Revised Sep2021Document3 pagesFinMan Unit 5 Tutorial Valuation of Bonds Revised Sep2021Debbie DebzNo ratings yet

- Practice Questions Part 1Document5 pagesPractice Questions Part 1Hai Anh PhamNo ratings yet

- FM Mock Sept 2021Document12 pagesFM Mock Sept 2021Dipesh MagratiNo ratings yet

- CE and HW On Debt SecuritiesDocument3 pagesCE and HW On Debt SecuritiesAmy SpencerNo ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- Test-2: New Scheme Final Course - Group I Paper 2: Strategic Financial ManagementDocument6 pagesTest-2: New Scheme Final Course - Group I Paper 2: Strategic Financial Managementshiva kumarNo ratings yet

- DRM-CLASSWORK - 14th JuneDocument4 pagesDRM-CLASSWORK - 14th JuneSaransh MishraNo ratings yet

- Full Course Test 3Document10 pagesFull Course Test 3Shaily SetiaNo ratings yet

- Valuation of BondsDocument30 pagesValuation of BondsRuchi SharmaNo ratings yet

- Tutorial 2 QuestionsDocument5 pagesTutorial 2 QuestionsNguyễn Thùy Linh 1TC-20ACNNo ratings yet

- Handout 2Document3 pagesHandout 2Anu AmruthNo ratings yet

- Redemption of DebenturesDocument2 pagesRedemption of DebenturesLakshmi PanayappanNo ratings yet

- Forex (Full)Document71 pagesForex (Full)Lee Yong YeNo ratings yet

- Practice Worksheet - IBFDocument3 pagesPractice Worksheet - IBFsusheel kumarNo ratings yet

- Practice QuestionsDocument2 pagesPractice QuestionsNishant JhaNo ratings yet

- Tb15 ExercisesDocument35 pagesTb15 ExercisesReal Ximo PiertoNo ratings yet

- BCM 221 Cat Sept - DraftDocument8 pagesBCM 221 Cat Sept - DraftSALOMENo ratings yet

- TVMDocument3 pagesTVMswapnil6121986No ratings yet

- Tutorial 2 QuestionsDocument5 pagesTutorial 2 QuestionsSik WooNo ratings yet

- Insurance: EFU General Insurance Limited - Analysis of Financial Statements Financial Year 2004 - 1Q 2010Document9 pagesInsurance: EFU General Insurance Limited - Analysis of Financial Statements Financial Year 2004 - 1Q 2010aminafridiNo ratings yet

- Mongolia's Economic Prospects: Resource-Rich and Landlocked Between Two GiantsFrom EverandMongolia's Economic Prospects: Resource-Rich and Landlocked Between Two GiantsNo ratings yet

- How to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongFrom EverandHow to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongNo ratings yet

- 5.civil Case-Mahalaxmi-FinalDocument20 pages5.civil Case-Mahalaxmi-FinalCAAniketGangwalNo ratings yet

- 4.criminal Case-Purroshtam-FinalDocument19 pages4.criminal Case-Purroshtam-FinalCAAniketGangwalNo ratings yet

- MCQ Ind As Day 2Document14 pagesMCQ Ind As Day 2CAAniketGangwalNo ratings yet

- Anuj Jain Vs Axis Bank Limited DefendantDocument12 pagesAnuj Jain Vs Axis Bank Limited DefendantCAAniketGangwalNo ratings yet

- MCQ Ind As Day 13Document14 pagesMCQ Ind As Day 13CAAniketGangwalNo ratings yet

- MCQ Ind As Day 16Document15 pagesMCQ Ind As Day 16CAAniketGangwalNo ratings yet

- MCQ Ind As Day 19Document15 pagesMCQ Ind As Day 19CAAniketGangwalNo ratings yet

- The Cotton Corporation of India LTD - 121202284133105Document20 pagesThe Cotton Corporation of India LTD - 121202284133105CAAniketGangwalNo ratings yet

- Nature of WorkDocument1 pageNature of WorkCAAniketGangwalNo ratings yet

- No. of Printed Pages: 6 1 Master'S Degree in Economics Term-End ExaminationDocument6 pagesNo. of Printed Pages: 6 1 Master'S Degree in Economics Term-End ExaminationCAAniketGangwalNo ratings yet

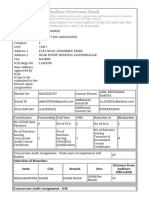

- IOB Concurrent Audit Application 2021-22Document2 pagesIOB Concurrent Audit Application 2021-22CAAniketGangwalNo ratings yet

- Kycubo New Company Form - Final - 18 AprilDocument4 pagesKycubo New Company Form - Final - 18 AprilCAAniketGangwalNo ratings yet

- Reply To Communication For Payment Before Issue of SCNDocument2 pagesReply To Communication For Payment Before Issue of SCNCAAniketGangwalNo ratings yet

- FT11 Day1 COC GKR 02052021Document114 pagesFT11 Day1 COC GKR 02052021CAAniketGangwalNo ratings yet

- Brochure of Career Ascent-June 2021Document4 pagesBrochure of Career Ascent-June 2021CAAniketGangwalNo ratings yet