Professional Documents

Culture Documents

ABFA1023

ABFA1023

Uploaded by

E T0 ratings0% found this document useful (0 votes)

9 views9 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views9 pagesABFA1023

ABFA1023

Uploaded by

E TCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

KOLE UNIVERSITY TUNKU ABDUL RAHMAN

FACULTY OF ACCOUNTANCY, FINANCE AND BUSINESS

ACADEMIC YEAR 20197020

JANUARY/FEBRUARY EXAMINATION

yAMENTALS

"THURSDAY, 30 JANUARY 2020 ‘TIME: 9.00 AM 11.00 AM @ HOURS)

DIPLOMA IN BUSINESS STUDIES (FINANCE AND INVESTMENT)

DIPLOMA IN BUSINESS STUDIES (INTERNATIONAL BUSINESS)

DIPLOMA IN BUSINESS STUDIES (LOGISTICS AND SUPPLY CHAIN MANAGEMENT)

DIPLOMA IN ACCOUNTING

DIPLOMA IN BANKING AND FINANCE

DIPLOMA IN BUSINESS ADMINISTRATION

DIPLOMA IN E-MARKETING

DIPLOMA IN HUMAN RESOURCE MANAGEMENT

DIPLOMA IN MARKETING

Instructions o Candidate:

‘Thi paper consists of four queton nd you ae requir to answer ALL FOUR) qestions.

All workings that suport the answers shouldbe shown

‘Marks wil be awarded fo layin presentation an logical arguments.

‘You ae required to continue with fresh page when answering new questions or parts ofthe question.

"This question paper consists oF quaions on 9 pnd pages

ABEAL023 FUNDAMENTALS OF ACCOUNTING

Answer ALL FOUR (question,

‘Question

‘The following figures have been exacted fiom the books of Abraham Enterprise forthe month of

‘November 2019

1 Sales tdger balance bf De 83,570

cr so

Purchases ledger blancs bit Dre 550

cr 4at0

30 Monthly tol of:

(Cash purcases| 230,600

Credit purchases 330,700

Cath sales 250,200

: CCeditsales 440,300

Retum ouivards 2,800

Discounts reeived(on eet puretased) ‘4400

Interestcharged by supplies 350

Bad debis writen off 190

Return inwards 1650

Interest charged on eustomers 70

Increase inthe allowance for doubt debts 3.80

Discounts allowed(on credit sles) 3.340

Receipts fom customers 346,600

Payments to supplies 337,950,

Bills payable ised bythe company forthe debt owed to

thecompany 13,500

Dills receivable sue bythe customers forthe debt

cowed to the company 109,00

Sls ledger balance oft aginst purchases ledger 15,50

Sales leer credit balance as at 30 November 1,080

Purchases ledger debit belance as at 30 November ‘660

‘The accountant has discovered thatthe tol of all tho inividusl accounts in the sales ledger was

RMI20,290, The amount didnot agree with te balance refleted inthe wade receivables conte

account: Upon vestigation, te following errors were foun:

1, Thesale journal was undercastby RMG,S00,

2. Alba debt of RMT0O was coestly debited to tho bad debts account in the general ledger but

‘omit om the Fit of blares, above,

3. Retur inwards of AMI, 110 was property postod tothe respective subsidiary ledger but omited

ftom the contol acourt,

4. Adliscount of RM200 allowed on credit sles wat propery recorded the ash receipts ura

bt omited from the eubidiary edge.

“This question paper consists 074 quis on paad pases,

AREAIO23 FUNDAMENTALS OF ACCOUNTING

usin 1 Contnsed)

5

‘An individual account (bit balance) of RM3O0 was listed twice inthe subdir ledger

‘edule.

A cash refund of RM230 had been made to Bryan, entered into his secount and in the contro

‘account but no credit not a ben raze,

Required:

o

©

©

CConstict the Trade receivables control account and Trade peyables cont secount for the

‘month of November 2019 (smacks)

Prepare a revised trade receivables contol account afer adjustments fr the errors and

comisions. (Saks)

Prepare a statement showing the adjustment that are necessary tthe list of personal eecount

‘alaces in the sales ledge (Gas)

(Total 25 marks

"Tie quanln paper coniats of 4 guess on paved poo

4

‘ABEA1023 FUNDAMENTALS OF ACCOUNTING

Question

‘Aurore Sn, Bhd bas provided the following bank statement and cash bock (bank com) forthe

‘month of November 2019

Cash book (bank column only)

2019 2019

Novemier at | Nove Sow

25 Sales 5368 | 25 Balance bid 3,540

26 Queen Bhd 25,012 [25 BerotCo. 32s

26 Prince Bhd 18722 |25 Giggle Bot. 10322 68,921

2 Alex Sin.Bhi. 108314 | 26 Machinery 10823 7,700,

2 Commission 3.720 | 26 Foais Trang 10324 5200

2 toms anz20

n 103266830

. 28 10527400

29 10328 3,500,

30 Blane eld 2010

- Bee 159,636

Desomber

oo

ta

i ‘Cheque No, 10520 “i300 | ~

[Sting re: as “iso ride

Denes : W279 De

Inet 029 be

Fr Tha Na TORT seo

hago Ne. 1222 = S155

“Chagse Ns 10225-— “mss

TESS Dr

Tos | ~~ br

se

: 29305 Dr

‘AEA 1023 FUNDAMENTALS OF ACCOUNTING

@ mas)

6inais)

(© mais)

(Sais)

(Tost: 25 marks]

Question 2 (Continued)

Required:

() Reconcile so opening balances of the Bank account andthe Bank Statement,

(©) Prepare te revised cash book forthe month of November 2019.

(©) Prepare abank reconliation statement a8 a 30 November 2019,

(© Enplan the following ms:

© Stanting order,

)—_Unpresente cheque

i) Bankechargs.

Question 3 .

“

‘Beyan and Sana rin partnership sharing profits and fase a 0 per cnt an 40 pce respostively

Adkitional information

‘At Apri 2018, the partners have the flowing balances:

artets | Capa ascount | Cart account

RM RM.

oat 0000 2,000

Salina 50,000 ‘400 Cr

(0n30 September 2018, he following partners’ drawing were made: Bryan RM8,00, Salina

'RM24,000. There were no other drawings. Interest charged on partners" ravings athe rate

of 10 per ant per your,

‘There have bgen no changes to the capital accounts during the year: ineest was agreat atthe

rate of 8 per cenboneapitlnecounts

‘The net ming prof ofthe frm befor dealing with partners interest and Sling salary for

‘he yar ended 31 March 2018 was RMH2,000

Salina sented toa sry of RMI6,000 po year.

‘Ths question paper consists of4 questions on pred pages

a

Required:

Prepare the road os ppopiion scout fr the yer cade 31 Mach 2015

(sma)

(©) Preprthe pane’ caret scouts aa 31 March 20195 raat)

(© Give ANY TWO @) advantages of purer nas)

®

Cardiff Ato Mast ses a perpetual method inventory sytem and reports the following transactions

forthe month of November for one of ts product:

: Dave TBaplanaon | Unit] CosiPrice

November RM,

1 | Beginning inventory 20 3.00

+ 5 | Purhases 3 325

13 | Sates 2 19

20| Purchases 1 355

24 Purchases 3 370)

30) sales 3B 799)

Required:

(@) Prepare inventory records using the FIFO metho. (omarks)

(©) Give ANY ONE () disadvantage of using te FIFO method fer valuation of invertors.

‘maek)

(otal: 25 mars)

Ts gaeton paper consi oF quewions on pated pages

1

ABEA1025 FUNDAMENTALS OF ACCOUNTING

Qusstion

“

‘A rele of cildens clothing has pepared his draft financial statements forthe year ended 31

‘December 2018, The suspense account stowed an opening debit balance of RM&.S0. Also, he drat

‘0 profi was RMS0,00.

o

“The debit side ofthe cash ook has been undesast by RM20,00.

(©) Last year's allowsnoe for doubtful debs was RMT,700. This yes allowance fer doubt

debts amounted to RMIG000, “Tae amount was incoresly debited inthe allowance for

‘abil des account

(©) Tas bank semen saws «oa irs of RMN, bt hi as ot Bean eso in the

(G) Depreciation was calculated at RMSO0 but entered into depreciation account as RMSO.

However, vas conety recorded in the aseumtlated depreciation account

(© Discounts resived of RMS,700 ha ben redid to the ade Payables Contol Account

(—Cariage inwards of RN2.200 bas ben entered a a credit in the cariag inwards acount.

Required:

(2) Prepare the suspense acount o clea the diferences, (Smal)

©) Compe the adjusted net profit forthe year ended 31 December 2019. mais)

(2) Briefly explain the following eors:

©) Bnorofcommision, co)

()— Brorof principle co)

‘hs quesion paper comin OF4 questions Oa pied pages

ABEALO23 FUNDAMENTALS OF ACCOUNTING

Question 4 (Continasi

®

Presented below are the summarised financial statements of Hip Trading and Hop Enterprise.

‘Statements of profit or los forthe year ended 31 December 2019,

Sales

Less: Cost of goods sod

Opening inventories

Purchases

‘Less Closing inventories

oss Prot

Less: Expenses

Depreciation

wages an saree

Question 4 (continued)

Other expenses

Nerpirosie

ip Enterprise

Statements of financial position a 31 December 2019

Non-current ates

Bauipment

Current ase

Inventories

‘Trade receivables

Banke :

guy

pening capital

|Adé: NevPrfit

Less Drawings

Curent ible

“rade payables

me RM, = RM

730,000 980,000

150,000 100,000

300,000 420,000

450,000 520,000

130,000 320,000 95,000 440,000,

410,000 540,000

5,000 20,000

190,000 300,000

65,900 260.000 50,000_370,000,

150,600 370,00

65,000 42000

130,000 95,000

135,000 150,00

25, 290,000 12,500 __357:500

355,000 299,50

35,000 32,000

10,000 170,000

235,000 252,000

39,000 196,000, $8500 193,00

139,000 106,000

355,000, 299,500

"This qusion pape consis oF 4 questions on 9 prints pees,

ABEA1023 FUNDAMENTALS OF ACCOUNTING

Question 4 Continved)

Required:

(©) Caleustethe following ratios foreach business:

© Camentrato, mats)

()—uickraticg mats)

(Gi) Gross profit asa percentage of sles marks)

Go) _Netprofitas percentage of sles; macs)

(©) Inventories tumover kines; marks)

(09) Tre reoeivabestumover days marks)

(Comment on th aaci pero of Hp Enterprise and Kop Enterprise, Which business

seems tobe the mors efficent? Give possible reasons. ‘mats,

(Teva: 25 marks}

‘This question paper consists O74 quedions on pated pages,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Group Discussion TipDocument5 pagesGroup Discussion TipE TNo ratings yet

- Consumers' Awareness and Knowledge About Food Waste in Selangor, MalaysiaDocument7 pagesConsumers' Awareness and Knowledge About Food Waste in Selangor, MalaysiaE TNo ratings yet

- Double Taxation Avoidance Agreement Between Malaysia and TheDocument41 pagesDouble Taxation Avoidance Agreement Between Malaysia and TheE TNo ratings yet

- Effects of Idols in Youths Thakkar, M. and Lortie, K. L.: International Network Organization For Scientific ResearchDocument5 pagesEffects of Idols in Youths Thakkar, M. and Lortie, K. L.: International Network Organization For Scientific ResearchE TNo ratings yet

- Plastics and Packaging: Reckitt Benckiser Group PLC (RB)Document5 pagesPlastics and Packaging: Reckitt Benckiser Group PLC (RB)E TNo ratings yet

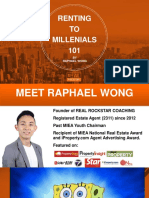

- Raphael Wong, Renting To Millennials 101 - What Do They WantDocument19 pagesRaphael Wong, Renting To Millennials 101 - What Do They WantE TNo ratings yet