0% found this document useful (0 votes)

387 views7 pagesBanking Application Test Cases Guide

This document provides information about testing a banking application, including sample test cases. It discusses the importance of domain knowledge for testing banking software and outlines some key characteristics and test phases for banking applications. Sample test cases are provided for validating login functionality, creating new users and roles, and more. The document also notes some challenges in testing banking domains and ways to mitigate them.

Uploaded by

Ramachandran VedanthamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

387 views7 pagesBanking Application Test Cases Guide

This document provides information about testing a banking application, including sample test cases. It discusses the importance of domain knowledge for testing banking software and outlines some key characteristics and test phases for banking applications. Sample test cases are provided for validating login functionality, creating new users and roles, and more. The document also notes some challenges in testing banking domains and ways to mitigate them.

Uploaded by

Ramachandran VedanthamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Banking Domain Application Testing: Introduces the concept of testing in the banking domain, detailing its importance and relevance.

- Banking Domain Knowledge - Introduction: Explains the fundamental knowledge required for banking domain testing, dividing it into traditional and service-based sectors.

- Test Phases in Testing Banking Applications: Outlines the different stages and methods used in testing banking applications, including specific testing techniques.

- Characteristics of a Banking Application: Describes the essential features and characteristics expected in any banking application for effective testing.

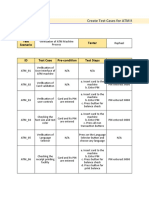

- Sample Test Cases for Net Banking Login Application: Provides sample test cases for testing net banking login functionalities, focusing on various user roles.

- Challenges in Testing Banking Domain & their Mitigation: Identifies common challenges in banking domain testing and suggests ways to mitigate these challenges.

- Summary: Summarizes the importance of banking domain testing and highlights best practices.

- Good Practices: Concludes with a focus on the benefits of good testing practices and the advantages of both manual and automated testing.