Professional Documents

Culture Documents

Us Stagflation In 70S Script Intro (t nghĩ cái này để t nói thôi k cần đưa vào slide thôi kiểu script riêng ấy, nma nếu đưa vào bảo nhé)

Uploaded by

tuan sonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Us Stagflation In 70S Script Intro (t nghĩ cái này để t nói thôi k cần đưa vào slide thôi kiểu script riêng ấy, nma nếu đưa vào bảo nhé)

Uploaded by

tuan sonCopyright:

Available Formats

US STAGFLATION IN 70S

Script

Intro (t nghĩ cái này để t nói thôi k cần đưa vào slide thôi kiểu script riêng

ấy, nma nếu đưa vào bảo nhé)

When people think of the U.S. economy in the 1970s, many things come to

mind:

High oil prices

Unemployment

Recession

And Stagflation

Why the biggest economy in the world at that time experienced such a depresed

period ?

Overview

Inflation seemed to feed on itself. People began to expect continued increases in

the price of goods, so they bought more. This increased demand pushed up

prices, leading to demands for higher wages, which pushed prices higher still in

a continuing upward spiral. Labor contracts increasingly came to include

automatic cost-of-living clauses, and the government began to peg some

payments, such as those for Social Security, to the Consumer Price Index, the

best-known gauge of inflation.

While these practices helped workers and retirees cope with inflation, they

perpetuated inflation. The government's ever-rising need for funds swelled

the budget deficit and led to greater government borrowing, which in turn

pushed up interest rates and increased costs for businesses and consumers even

further. With energy costs and interest rates high, business investment

languished and unemployment rose to uncomfortable levels.

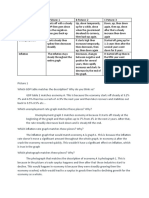

Issue started to appear

Troubling signs began to emerge in the late 1960s. Unemployment rose by 33%

between 1968 and 1970, while the consumer price index went up by 11%. At the

same time, real wages began to stagnate. Simultaneous inflation and stagnation,

nicknamed stagflation, puzzled economic analysts: usually, when wages fell,

prices fell, and when wages increased, prices increased. But not in the 1970s. As

a result, Americans had less purchasing power, and increasingly expensive

American exports were at a disadvantage in the international market. In 1971,

the United States experienced its first unfavorable international trade balance

since 1893

United States of America's annual GDP growth from 1970

8

7.3

6 5.6 5.4 5.6

5.2

4.6 4.6

4

Percentage

3.3 3.2

2.6

0.2

0

-0.2 -0.2

-0.5

-2

-1.9

-4

Years

Cause of stagflation

1. THE OLD EMBRAGO

In 1971, Richard Nixon attempted to remedy inflation by imposing a 90-day

wage and price freeze. At the same time, he attempted to boost American

exports by taking the dollar off the gold standard, devaluing the currency.

These measures resulted in a short-term improvement (just long enough to

get Nixon reelected in 1972) but did nothing to address the tangled roots of

the problem.

In October 1973, the United States supported Israel after a surprise attack by

Egypt and Syria in the Yom Kippur War. The oil-rich nations of the

Middle East, already angry with the United States for devaluing the dollar

(the currency used to purchase oil) determined to exact their revenge with an

oil embargo. Led by Saudi Arabia, the Organization of the Petroleum

Exporting Countries (OPEC) announced an oil shipping embargo against

the United States as well as Israel's European allies

Th

e effects were immediate and dire. The price of oil shot up to $11.65 per

barrel, an increase of 387%. Lines miles-long formed at gas stations. The

United States consumed one third of the world's oil, and its citizens quickly

discovered just how much of daily life depended on cheap oil. Families

living in far-flung suburbs depended on automobiles to get everywhere.

Even after the embargo ended in March 1974, prices for oil remained about

33% higher than they had been before the crisis

The prevailing belief as promulgated by the media has been that high levels

of inflation were the result of an oil supply shock and the resulting increase

in the price of gasoline, which drove the prices of everything else higher.

This is known as cost-push inflation. According to the Keynesian economic

theories prevalent at the time, inflation should have had an inverse

relationship with unemployment, and a positive relationship with economic

growth. Rising oil prices should have contributed to economic growth.

In reality, the 1970s was an era of rising prices and rising unemployment;

the periods of poor economic growth could all be explained as the result of

the cost-push inflation of high oil prices. This was not inline with Keynesian

economic theory.

2. THE NIXON SHOCK

The Nixon Shock was three actions that Nixon took.

- He instituted a 90-day freeze on all wages and prices. He set up a Pay

Board and Price Commission to approve any increases after the 90 days.

Conveniently, it would control prices until after the 1972 presidential

campaign. That's how he planned to control inflation.

- Nixon imposed a 10% tariff on imports. His goal was to lower the trade

deficit and protect domestic industries. Instead, the tariffs raised import

prices.

- He removed the United States from the gold standard. That had kept the

dollar's value tied to a fixed amount of gold since the 1944 Bretton Woods

Agreement.

- The crisis occurred when the United Kingdom tried to redeem $3 billion

for gold. The United States didn't have that much gold in its reserves at

Fort Knox. So Nixon stopped redeeming dollars for gold. That sent the

price of the precious metal skyrocketing and the value of the

dollar plummeting. That sent import prices up even more.

- These last two policies raised import prices, which slowed growth. Then

growth slowed even more because U.S. companies couldn't raise prices to

remain profitable. Since they couldn't lower wages either, the only way to

reduce costs was to lay off workers. That increased unemployment.

Unemployment reduces consumer demand and slows economic growth.

In other words, Nixon's three attempts to boost growth and control

inflation had the opposite effect.

3. STOP-GO MONTERY POLICY

The Federal Reserve's attempts to fight stagflation only worsened it.

Between 1971 and 1978, it raised the fed funds rate to fight inflation, then

lowered it to fight the recession.1 6 1 7 This "stop-go" monetary policy

confused businesses. They kept prices high, even when the Fed lowered

rates. That sent inflation up to 13.3% by 1979.9

Federal Reserve Chair Paul Volcker ended stagflation by raising the rate

to 20% in 1980. But it was at a high cost. It created the 1980-1982

recession.

You might also like

- StagflationDocument5 pagesStagflationKunal JainNo ratings yet

- Submission Deadline Marks and FeedbackDocument4 pagesSubmission Deadline Marks and Feedbackramanpreet kaurNo ratings yet

- Total Customer Engagement: Designing and Aligning Key Strategic Elements To Achieve GrowthDocument12 pagesTotal Customer Engagement: Designing and Aligning Key Strategic Elements To Achieve Growthhydfgk03No ratings yet

- A Survey Analysis of Service Quality For Domestic AirlinesDocument12 pagesA Survey Analysis of Service Quality For Domestic AirlinesBùi Trung HiệpNo ratings yet

- MG223 - Week5 - Managing Small Business StartupsDocument27 pagesMG223 - Week5 - Managing Small Business StartupsM BNo ratings yet

- BP-Entrepreneurship, Franchising and Small BusinessDocument41 pagesBP-Entrepreneurship, Franchising and Small BusinessS- AjmeriNo ratings yet

- 1-Explain The STP Process Highlighting The Key Challenges in Each Step. (30 Marks) The Full STP ProcessDocument6 pages1-Explain The STP Process Highlighting The Key Challenges in Each Step. (30 Marks) The Full STP ProcessAli Al-mahwetiNo ratings yet

- Buying ElectronicsDocument7 pagesBuying ElectronicsAnonymous Rn5SFJW0No ratings yet

- In TMT Digital India Unlock Opportunity NoexpDocument40 pagesIn TMT Digital India Unlock Opportunity Noexpjugraj randhawaNo ratings yet

- Glastonbury - From Hippy Weekend To International Festival: Source: Getty ImagesDocument3 pagesGlastonbury - From Hippy Weekend To International Festival: Source: Getty ImagesSuren TheannilawuNo ratings yet

- Macro Economics: Basics by VyasDocument21 pagesMacro Economics: Basics by Vyasshashank vyasNo ratings yet

- SHRM WateenDocument22 pagesSHRM WateenAli FarooqNo ratings yet

- Analysing Slow Growth of Mobile Money Market in India Using A Market Separation PerspectiveDocument26 pagesAnalysing Slow Growth of Mobile Money Market in India Using A Market Separation PerspectiveAakanksha SharmaNo ratings yet

- Data Science Project Workflow: The Software Engineering Side That Often Gets OverlookedDocument35 pagesData Science Project Workflow: The Software Engineering Side That Often Gets OverlookedSajeedNo ratings yet

- Dialog Records Rs 6.0Bn Net Profit For FY 2012: 18 February, 2013. ColomboDocument3 pagesDialog Records Rs 6.0Bn Net Profit For FY 2012: 18 February, 2013. Colomboran2013No ratings yet

- Managing Brand Equity in The Digital Age: Croma's Omni-Channel RetailingDocument10 pagesManaging Brand Equity in The Digital Age: Croma's Omni-Channel RetailingETCASESNo ratings yet

- India Outlook StanC 10sep22Document14 pagesIndia Outlook StanC 10sep22Piyush PatilNo ratings yet

- Michelin Presentation FinalDocument43 pagesMichelin Presentation FinalFahmid FarooqNo ratings yet

- Overview of Indian Policy "Electro Magnetic Field (EMF) Radiation From Mobile Towers & Handsets"Document22 pagesOverview of Indian Policy "Electro Magnetic Field (EMF) Radiation From Mobile Towers & Handsets"misonokaraNo ratings yet

- © 2007 Thomson South-WesternDocument33 pages© 2007 Thomson South-WesternardaaaNo ratings yet

- 02 MAMMOET Slides Communication Syste Concept LIUDocument13 pages02 MAMMOET Slides Communication Syste Concept LIUajay_kangraNo ratings yet

- Flip KartDocument10 pagesFlip KartAKANKSHA SINGHNo ratings yet

- Comparison Between India and ChinaDocument92 pagesComparison Between India and Chinaapi-3710029100% (3)

- S F M Mimo P 5G H-Cran: Calable and Lexible Assive Recoding ForDocument7 pagesS F M Mimo P 5G H-Cran: Calable and Lexible Assive Recoding ForMónicaTapiaNo ratings yet

- The Data of MacroeconomicsDocument43 pagesThe Data of MacroeconomicsAlex DraganNo ratings yet

- TBLA TATA Chroma Business CaseDocument48 pagesTBLA TATA Chroma Business CaseShubham GuptaNo ratings yet

- Analysis of Business Failure Occurred To "Abc PLC-"Document12 pagesAnalysis of Business Failure Occurred To "Abc PLC-"Mohamed NidhalNo ratings yet

- 3 - LTE HetNet Application Scenario and Networking StrategyDocument95 pages3 - LTE HetNet Application Scenario and Networking StrategyHuy LieuNo ratings yet

- CROMA FinalDocument21 pagesCROMA Finalsharajain0% (1)

- Reliance DigitalDocument27 pagesReliance Digitalkaran tussharNo ratings yet

- History and Alternative Views of Macroeconomics: Krugman'S Macroeconomics ForDocument18 pagesHistory and Alternative Views of Macroeconomics: Krugman'S Macroeconomics ForMegha BanerjeeNo ratings yet

- Hotel Niyaaz Project-10Document45 pagesHotel Niyaaz Project-10rahulkalpatri100% (1)

- HR Om11 ch03Document103 pagesHR Om11 ch03Yopi TheaNo ratings yet

- SoC or System On Chip Seminar ReportDocument28 pagesSoC or System On Chip Seminar ReportVivek PandeyNo ratings yet

- Situational Analysis: 3.1 Detailed Company Analysis (600 Words)Document17 pagesSituational Analysis: 3.1 Detailed Company Analysis (600 Words)IshanShikarkhaneNo ratings yet

- Indoor Mimo Performance With Hspa+ and Lte PDFDocument79 pagesIndoor Mimo Performance With Hspa+ and Lte PDFАлексейNo ratings yet

- Blackberry CaseDocument10 pagesBlackberry CaseMurk Zeeshan JokhioNo ratings yet

- © 2007 Thomson South-WesternDocument44 pages© 2007 Thomson South-Westerncharlie simoNo ratings yet

- Cross-Culture ManagementDocument11 pagesCross-Culture ManagementMuhammad Sajid SaeedNo ratings yet

- Etisalat S Connected Commerce PlatformDocument6 pagesEtisalat S Connected Commerce PlatformAhmed SelimNo ratings yet

- 1MA286 2e AntArrTest 5GDocument30 pages1MA286 2e AntArrTest 5GSatadal GuptaNo ratings yet

- DUP 955 Future of Retail VFINALDocument40 pagesDUP 955 Future of Retail VFINALSid MichaelNo ratings yet

- 93096v00 Beamforming Whitepaper PDFDocument22 pages93096v00 Beamforming Whitepaper PDFEmre KilcioğluNo ratings yet

- 4G. TechnologyDocument39 pages4G. TechnologySunny JamesNo ratings yet

- India's Growth Story:: Keynesianism Vs NeoliberalismDocument26 pagesIndia's Growth Story:: Keynesianism Vs NeoliberalismGunjan PruthiNo ratings yet

- Presentation Vodafone StrategyDocument26 pagesPresentation Vodafone StrategyNancy EkkaNo ratings yet

- A Study On Electronics Retail Branded Outlet and Consumer Satisfaction With Respect To ItDocument26 pagesA Study On Electronics Retail Branded Outlet and Consumer Satisfaction With Respect To ItnischalkumarNo ratings yet

- Airtel StrategiesDocument3 pagesAirtel Strategiesprabhakar_elexNo ratings yet

- BanglalinkDocument29 pagesBanglalinkMohammad Shaniaz IslamNo ratings yet

- Report of ROBIDocument21 pagesReport of ROBIShironamhin Light100% (1)

- India Struggles To Avoid Curse of StagflationDocument8 pagesIndia Struggles To Avoid Curse of StagflationSohil KisanNo ratings yet

- It Strategy Mobitel L.S.A.Y.I. Siriwardhana Mba - 13 - 3365Document7 pagesIt Strategy Mobitel L.S.A.Y.I. Siriwardhana Mba - 13 - 3365Nuwan WeerasekaraNo ratings yet

- Indian Readiness For E-CommerceDocument9 pagesIndian Readiness For E-CommerceTUSHAR RATHINo ratings yet

- Marketing Strategies of Vodafone 1Document194 pagesMarketing Strategies of Vodafone 1Mayank SondhiNo ratings yet

- Economics Usa Vs IndiaDocument8 pagesEconomics Usa Vs IndiakripaneshNo ratings yet

- Why Stagflation (Probably) Won't Reoccur: Economic Growth Inflation Demand Market EconomyDocument5 pagesWhy Stagflation (Probably) Won't Reoccur: Economic Growth Inflation Demand Market EconomyAREPALLY NAVEEN KUMARNo ratings yet

- Stagflation-Writen ReportDocument2 pagesStagflation-Writen ReportSophia AndresNo ratings yet

- 1973 Oil CrisisDocument2 pages1973 Oil CrisisMinahill AkramNo ratings yet

- November 2007: How Have Oil Prices Behaved in Recent Decades?Document4 pagesNovember 2007: How Have Oil Prices Behaved in Recent Decades?studentNo ratings yet

- Stagflation AssDocument15 pagesStagflation AssXaini AliNo ratings yet

- Group 5 - Bond and Stock ValuationDocument56 pagesGroup 5 - Bond and Stock Valuationtuan sonNo ratings yet

- NihonngoPro N4 Soumatome Tu Vung Kanji Tieng Viet PDFDocument120 pagesNihonngoPro N4 Soumatome Tu Vung Kanji Tieng Viet PDFtuan sonNo ratings yet

- FILE - 20210824 - 173736 - Scan 24 Th8, 2021Document1 pageFILE - 20210824 - 173736 - Scan 24 Th8, 2021tuan sonNo ratings yet

- Policies To Reduce InflationDocument8 pagesPolicies To Reduce Inflationtuan sonNo ratings yet

- Economic Boom and Effects. Some Solutions of The UK GovernmentDocument4 pagesEconomic Boom and Effects. Some Solutions of The UK Governmenttuan sonNo ratings yet

- The UKs Sustained Growth Between 1997 and 2008Document6 pagesThe UKs Sustained Growth Between 1997 and 2008tuan sonNo ratings yet

- Summary:: Fueled by Low Interest Rates and Tax Cuts. After Hitting A Trough of 7.5% in 1988, Interest RatesDocument6 pagesSummary:: Fueled by Low Interest Rates and Tax Cuts. After Hitting A Trough of 7.5% in 1988, Interest Ratestuan sonNo ratings yet

- 106 Powerpoint InflationDocument8 pages106 Powerpoint InflationRingle JobNo ratings yet

- InflationDocument15 pagesInflationsamah.fathi3No ratings yet

- Inflation, Activity, and Nominal Money Growth: Prepared By: Fernando Quijano and Yvonn QuijanoDocument31 pagesInflation, Activity, and Nominal Money Growth: Prepared By: Fernando Quijano and Yvonn QuijanoRizki Praba NugrahaNo ratings yet

- Great DepressionDocument2 pagesGreat DepressionMaricar RoqueNo ratings yet

- Mankiw - Tradeoff Unemployment and InflationDocument36 pagesMankiw - Tradeoff Unemployment and InflationAngelique NitzakayaNo ratings yet

- Chapter 24 - Measuring The Cost of LivingDocument35 pagesChapter 24 - Measuring The Cost of LivingFTU K59 Trần Yến LinhNo ratings yet

- Macroeconomics 1Document25 pagesMacroeconomics 1eunicemaraNo ratings yet

- Blanchard - ch02 A Tour of The BookDocument24 pagesBlanchard - ch02 A Tour of The BookaljonbudimanNo ratings yet

- Bdwbu: Mgwók A - ©BXWZ: Aviyv, Iæz¡ I KVH©KXJZVDocument6 pagesBdwbu: Mgwók A - ©BXWZ: Aviyv, Iæz¡ I KVH©KXJZVChhatra Mohon RoyNo ratings yet

- Types of Unemployment (Blank)Document1 pageTypes of Unemployment (Blank)Prineet AnandNo ratings yet

- Topic 3-UNEMPLOYMENT AND INFLATIONDocument54 pagesTopic 3-UNEMPLOYMENT AND INFLATIONBENTRY MSUKUNo ratings yet

- Midterm ExamDocument2 pagesMidterm ExamAhasan Mahmud 2035133660No ratings yet

- Sec 24.2 MC Correcting Economic Variables For The Effects of InflationDocument6 pagesSec 24.2 MC Correcting Economic Variables For The Effects of Inflationnhanxinh123456789No ratings yet

- Post Mid Sem EEFDocument64 pagesPost Mid Sem EEFYug ChaudhariNo ratings yet

- Macroeconomics Canadian 2Nd Edition Hubbard Solutions Manual Full Chapter PDFDocument28 pagesMacroeconomics Canadian 2Nd Edition Hubbard Solutions Manual Full Chapter PDFkevin.reider416100% (10)

- Principles of Macroeconomics 6th Edition Frank Test Bank 1Document36 pagesPrinciples of Macroeconomics 6th Edition Frank Test Bank 1cynthiasheltondegsypokmj100% (24)

- Table D. Key Employment Indicators by Sex With Measures of Precision, Philippines February2022f, January2023p and February2023pDocument5 pagesTable D. Key Employment Indicators by Sex With Measures of Precision, Philippines February2022f, January2023p and February2023pGellie Rose PorthreeyesNo ratings yet

- BasicsDocument2 pagesBasicsdhwerdenNo ratings yet

- Inflation DefinitionDocument13 pagesInflation DefinitionBrilliantNo ratings yet

- Chapter 5 - (22) (1) - 220310 - 003215Document115 pagesChapter 5 - (22) (1) - 220310 - 003215Celine Clemence胡嘉欣No ratings yet

- Unit 1 - Trends and MovementsDocument45 pagesUnit 1 - Trends and MovementsMarkoNo ratings yet

- Econ CH 6Document4 pagesEcon CH 6BradNo ratings yet

- (123doc) - Chapter-24Document6 pages(123doc) - Chapter-24Pháp NguyễnNo ratings yet

- Chapter 22 Lecture PresentationDocument33 pagesChapter 22 Lecture PresentationMamdouh MohamedNo ratings yet

- Module7 - UnemploymentDocument27 pagesModule7 - UnemploymentMaybelyn de los ReyesNo ratings yet

- Consumer Price Index and Inflation Rate 21082016Document1 pageConsumer Price Index and Inflation Rate 21082016Chaitaly R.No ratings yet

- Econ PuzzleDocument3 pagesEcon Puzzleapi-589326054No ratings yet

- Mis 0302 (Saturday)Document12 pagesMis 0302 (Saturday)Jonapril Dunga-itNo ratings yet

- InflationDocument4 pagesInflationMay WenhettenNo ratings yet