Professional Documents

Culture Documents

Week #8 ACCT 3039 Transfer Pricing Question 10-7

Uploaded by

Priscella LlewellynOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week #8 ACCT 3039 Transfer Pricing Question 10-7

Uploaded by

Priscella LlewellynCopyright:

Available Formats

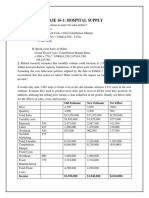

10-7

The Glass Division of Westfall manufactures a variety of glasses and vases for household use. The vases

can be sold externally or internally to Westfall’s Florist Division. Sales and cost data on a basic 10- inch

vase are given below;

Unit selling price $2.70

Unit variable cost $1.25

*Unit product fixed cost $0.50

Practical capacity in units 500,000

*$250,000/500,000

During the coming year, the Glass Division expects to sell 400,000 units of this vase. The Florist Division

currently plans to buy 150,000 vases on the outside market for $2.70 each. The manager of the Glass

Division, approached the manager of the Florist Division and offered to sell the 150,000 vases for $2.65.

The Glass Division manager explained to the Florist Division manager that he can avoid selling costs of

$0.10 per vase by selling internally and that he would split the saving by offering a $0.05 discount on

the usual price.

Required :

(i) What is the minimum transfer that the Glass Division would be willing to accept? What is

the maximum transfer price that the Florist Division would be willing to pay? Should an

internal transfer take place? What would be the benefit or loss to the firm as a whole if the

internal transfer takes place?

(ii) Suppose The Florist Division’s manager knows that the Glass Division has idle capacity. Do

you think that she would agree to the transfer price of $2.65? Suppose she counters with an

offer to pay $2.00. If you were the manager of the Glass Division would you be interested in

this price? Explain with supporting computations.

(iii) Suppose that Westfall’s policy is that all internal transfers take place at full manufacturing

cost. What would the transfer price be? Would the transfer take place?

You might also like

- CH 07 DOitDocument4 pagesCH 07 DOitHanna DizonNo ratings yet

- Problem 12-37 Return On Investment and Economic Value Added Calculations With Varying AssumptionsDocument2 pagesProblem 12-37 Return On Investment and Economic Value Added Calculations With Varying AssumptionsKath Leynes0% (1)

- Soal AM Pertemuan 11-12 - Decision Making and PricingDocument4 pagesSoal AM Pertemuan 11-12 - Decision Making and PricingfauziyahNo ratings yet

- MS - WS-1 (Breakeven)Document2 pagesMS - WS-1 (Breakeven)Ronard OriolNo ratings yet

- MS - WS-1 (Breakeven)Document2 pagesMS - WS-1 (Breakeven)Ronard Oriol0% (1)

- MS WS 1 (Breakeven)Document2 pagesMS WS 1 (Breakeven)Omkar Reddy Punuru100% (1)

- Assignment Iac FmasDocument6 pagesAssignment Iac FmasMarjorie PagsinuhinNo ratings yet

- Week 2 Accy312Document7 pagesWeek 2 Accy312Su Suan TanNo ratings yet

- Assigment 12Document1 pageAssigment 12Muhammad Riskli ValdiNo ratings yet

- MA Case Question 11-72Document2 pagesMA Case Question 11-72guptarahul1992No ratings yet

- Akuntansi Manajemen Asistensi 11 (Decision Making and Relevant Information)Document3 pagesAkuntansi Manajemen Asistensi 11 (Decision Making and Relevant Information)Dian Nur IlmiNo ratings yet

- Introductory Chemistry A Foundation 7th Edition Test Bank Steven S ZumdahlDocument36 pagesIntroductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahldiesnongolgothatsczx100% (39)

- Full Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF Full ChapterDocument23 pagesFull Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF Full Chaptervergencyooelite.vafrzk100% (19)

- MA Tutorial 2Document6 pagesMA Tutorial 2Jia WenNo ratings yet

- Practice Problems 1Document5 pagesPractice Problems 1Murtaza PoonawalaNo ratings yet

- Seminar Materials: Management Analytics 1 Global MBA Ou Tang October 2014Document8 pagesSeminar Materials: Management Analytics 1 Global MBA Ou Tang October 2014Vicky SinhaNo ratings yet

- Practice InventoryDocument9 pagesPractice InventoryDexter KhooNo ratings yet

- Practice Problems For The Final - 2 - UpdatedDocument8 pagesPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- ACTG243 Practice Quiz 7Document4 pagesACTG243 Practice Quiz 7GuruBaluLeoKing0% (1)

- Responsibility Accounting Practice ProblemDocument4 pagesResponsibility Accounting Practice ProblemBeomiNo ratings yet

- Latihan Segmented Reporting Absorption Costing Vs Variable CostingDocument3 pagesLatihan Segmented Reporting Absorption Costing Vs Variable CostingPrisilia AudilaNo ratings yet

- 4 5852725223857587726Document6 pages4 5852725223857587726survivalofthepolyNo ratings yet

- Manual 16 Jun 2021 - Part 1Document6 pagesManual 16 Jun 2021 - Part 1Feni AlvitaNo ratings yet

- Decision Science Quarter I End Term Examination Question PaperDocument4 pagesDecision Science Quarter I End Term Examination Question PaperpriNo ratings yet

- BMGT 321 Chapter 11 HomeworkDocument9 pagesBMGT 321 Chapter 11 HomeworkarnitaetsittyNo ratings yet

- IE323 Study Set 2Document5 pagesIE323 Study Set 2Mehmet ŞahinNo ratings yet

- Quiz in Rel. CostDocument3 pagesQuiz in Rel. CostTrine De LeonNo ratings yet

- CH 11 SolDocument6 pagesCH 11 SolEdson EdwardNo ratings yet

- Solutions To: Original Problems For Managerial AccountingDocument19 pagesSolutions To: Original Problems For Managerial AccountingDickySsiekumpaiIlusiounisNo ratings yet

- Test Bank For Accounting For Decision Making and Control 8th 0078025745Document37 pagesTest Bank For Accounting For Decision Making and Control 8th 0078025745biolyticcrotonicvud19100% (28)

- Full Download Test Bank For Accounting For Decision Making and Control 8th 0078025745 PDF Full ChapterDocument36 pagesFull Download Test Bank For Accounting For Decision Making and Control 8th 0078025745 PDF Full Chapterdoxologyknee3uyj100% (19)

- E303 T 1 F 05 KeyDocument6 pagesE303 T 1 F 05 KeyMeerim BakirovaNo ratings yet

- 1 Ass-2Document13 pages1 Ass-2Kim SooanNo ratings yet

- Unit 2 The Pricing Decision: Target Pricing Cost-Plus PricingDocument3 pagesUnit 2 The Pricing Decision: Target Pricing Cost-Plus PricingBELONG TO VIRGIN MARYNo ratings yet

- Operations Management Pactice QuestionsDocument8 pagesOperations Management Pactice QuestionsHumphrey OsaigbeNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAnne BacolodNo ratings yet

- Chapter 7. KeyDocument8 pagesChapter 7. KeyHuy Hoàng PhanNo ratings yet

- MA Tuto 2Document6 pagesMA Tuto 2Tan WeibinNo ratings yet

- PROBLEM in RELEVANT COSTING 2 OCT 11 2019Document3 pagesPROBLEM in RELEVANT COSTING 2 OCT 11 2019Ellyza SerranoNo ratings yet

- Chicagoland Sweets (Questions 3 and 4) Chicagoland Sweets, A Commercial Baker, UsesDocument5 pagesChicagoland Sweets (Questions 3 and 4) Chicagoland Sweets, A Commercial Baker, UsesIpsita RathNo ratings yet

- MGT Chap 6Document5 pagesMGT Chap 6tomNo ratings yet

- Problem Set 2 - Analyzing Using SpreadsheetsDocument4 pagesProblem Set 2 - Analyzing Using SpreadsheetsAyush SharmaNo ratings yet

- 106fex 2nd Sem 21 22Document9 pages106fex 2nd Sem 21 22Trine De LeonNo ratings yet

- Marketing Maths AssignmentDocument5 pagesMarketing Maths AssignmentjanelleNo ratings yet

- Aactg 15 Relevant CostingDocument7 pagesAactg 15 Relevant CostingRosevelCunananCabrera100% (1)

- BreakevenDocument2 pagesBreakevenAylin ErdoğanNo ratings yet

- ABC Analysis ProblemDocument1 pageABC Analysis ProblemTaz Uddin100% (1)

- Chapter 3 Solution Updated2 PDFDocument4 pagesChapter 3 Solution Updated2 PDFShakkhor ChowdhuryNo ratings yet

- Required:: Financial ManagementDocument5 pagesRequired:: Financial ManagementBKS Sannyasi100% (1)

- CH11Document32 pagesCH11devinaNo ratings yet

- Econ FinalDocument4 pagesEcon FinalhalilozgurNo ratings yet

- 5 Decision Making & Relevant InformationDocument42 pages5 Decision Making & Relevant Informationmedrek100% (1)

- This Study Resource Was: Practice Questions and Answers Inventory Management: EOQ ModelDocument7 pagesThis Study Resource Was: Practice Questions and Answers Inventory Management: EOQ Modelwasif ahmedNo ratings yet

- QuizDocument4 pagesQuizantonitambaNo ratings yet

- Ex 04 Inventory ManagementDocument4 pagesEx 04 Inventory ManagementZulhaily Suaille100% (1)

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- Midterm Decision Analysis ExercisesDocument5 pagesMidterm Decision Analysis ExercisesAYLEN INJAYANo ratings yet

- QUIZ - Chapter 6Document3 pagesQUIZ - Chapter 6Anh Lương QuỳnhNo ratings yet

- Lecture 9 - Audit Reporting ISA 700 (R) - 2020Document43 pagesLecture 9 - Audit Reporting ISA 700 (R) - 2020Priscella LlewellynNo ratings yet

- Week #10 ACCT 3039 Decision MakingDocument3 pagesWeek #10 ACCT 3039 Decision MakingPriscella LlewellynNo ratings yet

- Week #9 ACCT 3039 Environmental Costs Greener CompanyDocument1 pageWeek #9 ACCT 3039 Environmental Costs Greener CompanyPriscella LlewellynNo ratings yet

- Week #12 ACCT 3039 Osage Ltd. Decision MakingDocument1 pageWeek #12 ACCT 3039 Osage Ltd. Decision MakingPriscella LlewellynNo ratings yet

- Week #5 ACCT 3039 Quality CostingDocument2 pagesWeek #5 ACCT 3039 Quality CostingPriscella LlewellynNo ratings yet

- Week #4 ACCT 3039 Sleepeze Company BudgetingDocument1 pageWeek #4 ACCT 3039 Sleepeze Company BudgetingPriscella LlewellynNo ratings yet

- Week #2 ACCT 3039 Worksheet Jan 2021Document6 pagesWeek #2 ACCT 3039 Worksheet Jan 2021Priscella LlewellynNo ratings yet

- Tutorial 6 - Internal Control 2021Document2 pagesTutorial 6 - Internal Control 2021Priscella LlewellynNo ratings yet

- University of The West Indies, Mona Department of Management Studies ACCT 3043 - Auditing I Tutorial Questions 7Document1 pageUniversity of The West Indies, Mona Department of Management Studies ACCT 3043 - Auditing I Tutorial Questions 7Priscella LlewellynNo ratings yet

- Tutorial 8 - Completing The Audit - 2021Document2 pagesTutorial 8 - Completing The Audit - 2021Priscella LlewellynNo ratings yet

- What Are Your Expectations For This Course?Document50 pagesWhat Are Your Expectations For This Course?Priscella LlewellynNo ratings yet

- Week #2 ACCT 3039 Contribution Margin VarianceDocument3 pagesWeek #2 ACCT 3039 Contribution Margin VariancePriscella LlewellynNo ratings yet

- ISA 230 - Audit Documentation Requires That Documentation of Audit WorkDocument2 pagesISA 230 - Audit Documentation Requires That Documentation of Audit WorkPriscella LlewellynNo ratings yet

- The Rate of Inventory Turnover Has Steadily Decreased For 3 Years. RequiredDocument2 pagesThe Rate of Inventory Turnover Has Steadily Decreased For 3 Years. RequiredPriscella LlewellynNo ratings yet

- Tutorial 4 - 2021Document1 pageTutorial 4 - 2021Priscella LlewellynNo ratings yet

- Tutorial 1 - 2021 SummerDocument2 pagesTutorial 1 - 2021 SummerPriscella Llewellyn100% (1)

- Lecture 2 - Auditor Responsibility ObjectivesDocument32 pagesLecture 2 - Auditor Responsibility ObjectivesPriscella LlewellynNo ratings yet

- GKAR2020-23 04 2021 CompressedDocument246 pagesGKAR2020-23 04 2021 CompressedPriscella LlewellynNo ratings yet