Professional Documents

Culture Documents

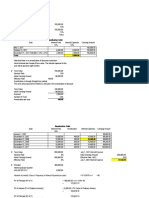

Brief Exercise 10.1: Cash Payment For Interest Expense in Y1

Uploaded by

KAINAT MUSHTAQ0 ratings0% found this document useful (0 votes)

17 views5 pagesThe documents provide examples of calculating interest expenses and proceeds from the sale of bonds.

Document 1 calculates the quarterly and annual interest expenses for a 1-year $10,000 loan at 8% interest.

Document 2 calculates the effective interest rate of 4.8% for a $500,000 loan with an 8% rate after a 40% tax deduction.

Document 3 outlines details of $1,000,000 bonds sold at 98% of par value with a 6% interest rate paid quarterly.

Document 4 demonstrates calculations for $1,000,000 bonds sold at 101% of par value with a 5% interest rate.

Documents 5 and 6 provide additional examples of bond

Original Description:

Original Title

Chapter 10

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe documents provide examples of calculating interest expenses and proceeds from the sale of bonds.

Document 1 calculates the quarterly and annual interest expenses for a 1-year $10,000 loan at 8% interest.

Document 2 calculates the effective interest rate of 4.8% for a $500,000 loan with an 8% rate after a 40% tax deduction.

Document 3 outlines details of $1,000,000 bonds sold at 98% of par value with a 6% interest rate paid quarterly.

Document 4 demonstrates calculations for $1,000,000 bonds sold at 101% of par value with a 5% interest rate.

Documents 5 and 6 provide additional examples of bond

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views5 pagesBrief Exercise 10.1: Cash Payment For Interest Expense in Y1

Uploaded by

KAINAT MUSHTAQThe documents provide examples of calculating interest expenses and proceeds from the sale of bonds.

Document 1 calculates the quarterly and annual interest expenses for a 1-year $10,000 loan at 8% interest.

Document 2 calculates the effective interest rate of 4.8% for a $500,000 loan with an 8% rate after a 40% tax deduction.

Document 3 outlines details of $1,000,000 bonds sold at 98% of par value with a 6% interest rate paid quarterly.

Document 4 demonstrates calculations for $1,000,000 bonds sold at 101% of par value with a 5% interest rate.

Documents 5 and 6 provide additional examples of bond

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

Brief Exercise 10.

Loan amount 10,000

Loan time period 1 year

Interest rate 8% per annum

Date of borrowing April. 1

Interest payments Quartely 3-months

Cash payment for interest expense in Y1

Interest exp per year 800

Interest exp per month 66.67

Interest exp per quarter 200

Interest exp for Y1 (3 quarters) 600

Cash payment for interest expense in Y2

Interest exp for 4th quarter (Y2) 200

Total interest exp 800

Brief Exercise 10.2

Loan amount 500,000

Interest rate 8%

Tax rate 40%

Before income tax interest cost 40,000

Tax savings 16,000

Interest cost (net of income tax) 24,000

Effective interest rate net of income tax 4.80%

i(1-tax rate)

Applying effective interest rate 24,000

Brief Exercise 10.3

Bonds sold 1,000,000

Bond interest rate 6%

Interest is paid quarterly

Bonds sold at 98

Amount received from sale of bonds 980,000

Annual interest $ 60,000

Quarterly interest $ 15,000

Brief Exercise 10.4 Brief Exercise 10.5

Bonds sold 1,000,000 Bonds sold

Bond interest rate 5% Bonds sold at

Bonds sold at 101 Bond interest rate

Life of bonds

Amount received from sale of bonds 1,010,000

Annual interest $ 50,000 Cash received from sale of bonds

Quarterly interest $ 12,500 Cash paid for interest in 1st year

Discount on sale of bonds

1st year interest exp recognized

Interest paid

Plus: Amortization of discount

1st year interest exp recognized

ef Exercise 10.5 Brief Exercise 10.6

$ 500,000 Bonds sold $ 700,000

97 Bonds sold at 102

5% Bond interest rate 6.50%

10 years Life of bonds 10 years

$ 485,000 Cash received from sale of bonds $ 714,000

$ 25,000 Cash paid for interest in 1st year $ 45,500

$ 15,000 Premium on sale of bonds $ 14,000

1st year interest exp recognized

$ 25,000 Interest paid $ 45,500

$ 1,500 Less: Amortization of premium (1400)

$ 26,500 1st year interest exp recognized $ 44,100

You might also like

- Black's Law Dictionary, 2nd Edition (1910)Document1,322 pagesBlack's Law Dictionary, 2nd Edition (1910)The Observer100% (6)

- CHAPTER 7 - ORGANIZATIONAL STRUCTURE AND DESIGN Multiple Choice QuestionsDocument19 pagesCHAPTER 7 - ORGANIZATIONAL STRUCTURE AND DESIGN Multiple Choice QuestionsKAINAT MUSHTAQ83% (6)

- Business Plan (Bigasan)Document10 pagesBusiness Plan (Bigasan)Harold Kent MendozaNo ratings yet

- Chapters 5-6: Use The Following For The Next Two QuestionsDocument9 pagesChapters 5-6: Use The Following For The Next Two QuestionsJane Ruby Jenniefer67% (3)

- Mcqs On Chapter 7 Foundation of PlanningDocument7 pagesMcqs On Chapter 7 Foundation of PlanningKAINAT MUSHTAQ100% (1)

- (TEST BANK and SOL) Bonds PayableDocument6 pages(TEST BANK and SOL) Bonds PayableJhazz DoNo ratings yet

- Income Statement Information For The Last YearDocument2 pagesIncome Statement Information For The Last YearAtif KhanNo ratings yet

- Balance Sheet Current LiabilitiesDocument3 pagesBalance Sheet Current LiabilitiesamirNo ratings yet

- Code of CommerceDocument56 pagesCode of Commerceviktor samuel fontanilla91% (11)

- Brief Exercise 10.1: Cash Payment For Interest Expense in Y1Document5 pagesBrief Exercise 10.1: Cash Payment For Interest Expense in Y1JAHANZAIBNo ratings yet

- IA2 Worksheet-BONDS PAYABLE - 101010Document11 pagesIA2 Worksheet-BONDS PAYABLE - 101010aehy lznuscrfbjNo ratings yet

- Hutang JK PanjangDocument24 pagesHutang JK PanjangYoan88No ratings yet

- Bonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocument49 pagesBonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessCOURAGEOUSNo ratings yet

- F78 BonDSDocument7 pagesF78 BonDSDawood Adel DhakallahNo ratings yet

- Bond RefundingDocument8 pagesBond RefundingvanvunNo ratings yet

- Exercise 3 - PoA 2 (Agatha Theresa Chelsea Augustien)Document7 pagesExercise 3 - PoA 2 (Agatha Theresa Chelsea Augustien)Jeremy Michael HariantoNo ratings yet

- Bonds PayableDocument8 pagesBonds Payablekrisha milloNo ratings yet

- Exercise 3 - Long-Term Liabilities - Jeremy MichaelDocument12 pagesExercise 3 - Long-Term Liabilities - Jeremy MichaelJeremy Michael HariantoNo ratings yet

- Corporation: SolutionDocument6 pagesCorporation: Solutionibrahim mohamedNo ratings yet

- Fin Exam 1Document14 pagesFin Exam 1tahaalkibsiNo ratings yet

- Lobrigas Unit4 Topic2 AssessmentDocument7 pagesLobrigas Unit4 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Compound Financial InstrumentsDocument12 pagesCompound Financial InstrumentsLoro AdrianNo ratings yet

- Chapter 10 - Bond Prices and YieldsDocument15 pagesChapter 10 - Bond Prices and YieldsMarwa HassanNo ratings yet

- (TEST BANK and SOL) Bonds PayableDocument6 pages(TEST BANK and SOL) Bonds PayableJhazz DoNo ratings yet

- MODULE 6 Interest Rates and Bond ValuationDocument7 pagesMODULE 6 Interest Rates and Bond ValuationAngel CecilioNo ratings yet

- Homework Accounting 12Document5 pagesHomework Accounting 12Waleed ArshadNo ratings yet

- Valuation of Bonds NumericalsDocument30 pagesValuation of Bonds NumericalsankitNo ratings yet

- Lyons Document Storage Corporation: Bond Accounting: Lake PushkarDocument9 pagesLyons Document Storage Corporation: Bond Accounting: Lake PushkarantonioNo ratings yet

- IA2 Chapter 9 ActivitiesDocument7 pagesIA2 Chapter 9 ActivitiesShaina TorraineNo ratings yet

- Practice Set: 12 Years 3 Years 3.0373Document3 pagesPractice Set: 12 Years 3 Years 3.0373Michael AninoNo ratings yet

- Problemsets Whatifanalysis Aishu 15thmay 1Document11 pagesProblemsets Whatifanalysis Aishu 15thmay 1Deepak SharmaNo ratings yet

- Random Problem 2 (Pinky)Document23 pagesRandom Problem 2 (Pinky)spur iousNo ratings yet

- Ia PPT 7Document18 pagesIa PPT 7lorriejaneNo ratings yet

- Activity 5Document5 pagesActivity 5Riane Angelie SaligNo ratings yet

- Fin101 Bonds ValuationDocument6 pagesFin101 Bonds ValuationXYZNo ratings yet

- 1 Premiums: 1.1 Basic Journal EntriesDocument3 pages1 Premiums: 1.1 Basic Journal EntriesAudreySyUyanNo ratings yet

- BAT Unit 5 AssignmentDocument14 pagesBAT Unit 5 AssignmentTalhah WaleedNo ratings yet

- Compilation First Prelim Period SolutionDocument12 pagesCompilation First Prelim Period SolutionHarvyn Kuster AcedilloNo ratings yet

- Liabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryDocument6 pagesLiabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryAreeba QureshiNo ratings yet

- Simple InterestDocument3 pagesSimple Interestjohn gabriel bondoyNo ratings yet

- Sia 1.bonds PayableDocument13 pagesSia 1.bonds PayableYasmin MamugayNo ratings yet

- Essentials of Investments 8th Edition Bodie Solutions ManualDocument16 pagesEssentials of Investments 8th Edition Bodie Solutions Manualdipolarramenta7uyxw100% (25)

- Random Problem 2 Pinkypdf PDF FreeDocument23 pagesRandom Problem 2 Pinkypdf PDF FreeTokis SabaNo ratings yet

- Asset v1 IMF+FMAx+2T2017+Type@Asset+Block@M0 Assessments Activity v2Document12 pagesAsset v1 IMF+FMAx+2T2017+Type@Asset+Block@M0 Assessments Activity v2Nguyễn Trần Thuỳ LinhNo ratings yet

- Myka Eleonor Estole Quiz 5Document8 pagesMyka Eleonor Estole Quiz 5Julienne UntalascoNo ratings yet

- Assignment FMDocument6 pagesAssignment FMAbdulaziz HbllolNo ratings yet

- SolutionsDocument10 pagesSolutionsBillah MagomaNo ratings yet

- Bonds PayableDocument3 pagesBonds Payablegenesis roldanNo ratings yet

- 150 Bruce Ave, Yonkers, NY, 10705 Rooming HouseDocument23 pages150 Bruce Ave, Yonkers, NY, 10705 Rooming HousePatrick EdrosoloNo ratings yet

- Eje, Kaycie Lee D - Problem SolvingDocument2 pagesEje, Kaycie Lee D - Problem SolvingKaycie Lee Dinglasan EjeNo ratings yet

- Lec 04Document14 pagesLec 04Ryan GroffNo ratings yet

- Format of Bond RefundingDocument9 pagesFormat of Bond RefundingvanvunNo ratings yet

- Compound Financial InstrumentDocument10 pagesCompound Financial Instrumentkrisha milloNo ratings yet

- Bond Portfolio ManagementDocument58 pagesBond Portfolio ManagementHarshit DwivediNo ratings yet

- Assignment #2 Investment & Portfolio Management Group 3 (GEN) (G1)Document3 pagesAssignment #2 Investment & Portfolio Management Group 3 (GEN) (G1)ramyNo ratings yet

- Tien Te Review - AnswerDocument23 pagesTien Te Review - Answerdaovantien357No ratings yet

- CFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Document19 pagesCFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Fran GutierrezNo ratings yet

- Accounting For Notes and Loans ReceivableDocument6 pagesAccounting For Notes and Loans ReceivableBvreanchtz Mantilla CalagingNo ratings yet

- Chapter 5Document19 pagesChapter 5Izzy BNo ratings yet

- Exercise 9.1 1Document10 pagesExercise 9.1 1NavinNo ratings yet

- Bond Accounting: Rabia SharifDocument25 pagesBond Accounting: Rabia SharifRabia UmerNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- SWOT Analysis of SamsungDocument4 pagesSWOT Analysis of SamsungKAINAT MUSHTAQNo ratings yet

- Chapter 8 McqsDocument4 pagesChapter 8 McqsKAINAT MUSHTAQNo ratings yet

- Financial Ratios Analysis of NestleDocument17 pagesFinancial Ratios Analysis of NestleKAINAT MUSHTAQNo ratings yet

- E - Banking: University of BelgradeDocument99 pagesE - Banking: University of BelgradeKAINAT MUSHTAQNo ratings yet

- Designing Adaptive Organizations: Posted To A Publicly Accessible Website, in Whole or in PartDocument16 pagesDesigning Adaptive Organizations: Posted To A Publicly Accessible Website, in Whole or in PartKAINAT MUSHTAQNo ratings yet

- Pakistan Foregin PolicyDocument18 pagesPakistan Foregin PolicyKAINAT MUSHTAQNo ratings yet

- Villacañas - The Nomos of The Earth and The Scandal of Kant. Commentaries On Carl Schmitt BookDocument8 pagesVillacañas - The Nomos of The Earth and The Scandal of Kant. Commentaries On Carl Schmitt BookAndrsNo ratings yet

- Notes On Special Proceedings: de Leon, 2020 EditionDocument14 pagesNotes On Special Proceedings: de Leon, 2020 EditionNorjanisa DimaroNo ratings yet

- Case Study Chapter 14Document2 pagesCase Study Chapter 14Zaid Al-rakhesNo ratings yet

- OLDHAM MBC SCHEDULE of PERSONS NOMINATEDDocument20 pagesOLDHAM MBC SCHEDULE of PERSONS NOMINATEDPoliceCorruptionNo ratings yet

- عقد شركة اليمامة الطبيةDocument6 pagesعقد شركة اليمامة الطبيةalaatrans1No ratings yet

- Flaws Company Ordinance 1984Document25 pagesFlaws Company Ordinance 1984Yaman TahirNo ratings yet

- American Slavery DissertationDocument8 pagesAmerican Slavery DissertationWriteMyPaperInApaFormatCanada100% (1)

- Puig vs. PenafloridaDocument4 pagesPuig vs. PenafloridaMonikkaNo ratings yet

- The Legacy of Soviet Dissent Dissidents, Democratisation and Radical Nationalism in Russia (East European Studies) (PDFDrive)Document272 pagesThe Legacy of Soviet Dissent Dissidents, Democratisation and Radical Nationalism in Russia (East European Studies) (PDFDrive)AsherNo ratings yet

- 56-59 CPA AwardsDocument4 pages56-59 CPA AwardstanhaianNo ratings yet

- 7 Private Car Package Policy WordingsDocument18 pages7 Private Car Package Policy WordingsShashikant ThakreNo ratings yet

- Data Siswa Mi Bos 20192020 JuldesDocument13 pagesData Siswa Mi Bos 20192020 JuldesAkhir Sebuah DoaNo ratings yet

- Lease Agreement Dows & 1034371 Ontario Inc.Document2 pagesLease Agreement Dows & 1034371 Ontario Inc.Betty Blair FannonNo ratings yet

- 8 Types of Companies in MalaysiaDocument9 pages8 Types of Companies in MalaysiaYingfang HuangNo ratings yet

- Reinstatement FormDocument1 pageReinstatement FormHanzell Faith Bayawa DaculaNo ratings yet

- Indian Talent Exam - HomeDocument4 pagesIndian Talent Exam - HomePRADEEP KUMAR NAYAKNo ratings yet

- Grant v. McAuliffeDocument2 pagesGrant v. McAuliffeEarl Anthony ArceNo ratings yet

- Poplack 2004Document10 pagesPoplack 2004Rodion KsnNo ratings yet

- Waumini Sacco Society Nomination Application Form 2022Document5 pagesWaumini Sacco Society Nomination Application Form 2022Tonny MurungaNo ratings yet

- Chinas Neomarcantilism PDFDocument38 pagesChinas Neomarcantilism PDFhujjatunaNo ratings yet

- Twice - Cry for Me 가사 Lyrics atDocument1 pageTwice - Cry for Me 가사 Lyrics atkayliversidge10No ratings yet

- Delhi Airport: E-Visa Application FormDocument3 pagesDelhi Airport: E-Visa Application FormBismilNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.) : Company: Akzo Nobel India LTD Industry: Paints / VarnishesDocument48 pagesCompany Finance Balance Sheet (Rs in CRS.) : Company: Akzo Nobel India LTD Industry: Paints / VarnishesTEJAS PHAFATNo ratings yet

- Civil RegistryDocument3 pagesCivil RegistryBea CadornaNo ratings yet

- Dme Information Form Cms-10125 - External Infusion PumpsDocument2 pagesDme Information Form Cms-10125 - External Infusion PumpsSonof GoddNo ratings yet

- Application Form: Republic of The PhilippinesDocument5 pagesApplication Form: Republic of The Philippinesmary ann carreonNo ratings yet

- GE 9 - Pre TestDocument2 pagesGE 9 - Pre TestMay Pearl BernaldezNo ratings yet

- People Vs Parana FCDocument8 pagesPeople Vs Parana FCMargo GreenNo ratings yet