Professional Documents

Culture Documents

SS4 Application

Uploaded by

Vincent de Paul GOUNOUOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SS4 Application

Uploaded by

Vincent de Paul GOUNOUCopyright:

Available Formats

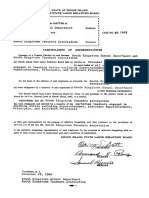

Form

(Rev. December 2017)

SS-4 Application for Employer Identification Number

(For use by employers, corporations, partnerships, trusts, estates, churches,

government agencies, Indian tribal entities, certain individuals, and others.)

EIN

OMB No. 1545-0003

▶ Go to www.irs.gov/FormSS4 for instructions and the latest information.

Department of the Treasury

Internal Revenue Service ▶ See separate instructions for each line. ▶ Keep a copy for your records.

1 Legal name of entity (or individual) for whom the EIN is being requested

VIPAGO LLC

Type or print clearly.

2 Trade name of business (if different from name on line 1) 3 Executor, administrator, trustee, “care of” name

4a Mailing address (room, apt., suite no. and street, or P.O. box) 5a Street address (if different) (Do not enter a P.O. box.)

2093 PHILADELPHIA PIKE

4b City, state, and ZIP code (if foreign, see instructions) 5b City, state, and ZIP code (if foreign, see instructions)

CLAYMONT, DELAWARE 19703

6 County and state where principal business is located

NEW CASTLE, DELAWARE

7a Name of responsible party 7b SSN, ITIN, or EIN

VINCENT DE PAUL GOUNOU FOREIGN

8a Is this application for a limited liability company (LLC) 8b If 8a is “Yes,” enter the number of

(or a foreign equivalent)? . . . . . . . . Yes No LLC members . . . . . . ▶ 1

8c If 8a is “Yes,” was the LLC organized in the United States? . . . . . . . . . . . . . . . . . . Yes No

9a Type of entity (check only one box). Caution. If 8a is “Yes,” see the instructions for the correct box to check.

Sole proprietor (SSN) Estate (SSN of decedent)

Partnership Plan administrator (TIN)

Corporation (enter form number to be filed) ▶ Trust (TIN of grantor)

Personal service corporation Military/National Guard State/local government

Church or church-controlled organization Farmers’ cooperative Federal government

Other nonprofit organization (specify) ▶ REMIC Indian tribal governments/enterprises

Other (specify) ▶ DISREGARDED ENTITY Group Exemption Number (GEN) if any ▶

9b If a corporation, name the state or foreign country (if State Foreign country

applicable) where incorporated

10 Reason for applying (check only one box) Banking purpose (specify purpose) ▶

Started new business (specify type) ▶ LLC Changed type of organization (specify new type) ▶

Purchased going business

Hired employees (Check the box and see line 13.) Created a trust (specify type) ▶

Compliance with IRS withholding regulations Created a pension plan (specify type) ▶

Other (specify) ▶

11 Date business started or acquired (month, day, year). See instructions. 12 Closing month of accounting year DECEMBER

03-19-2021 14 If you expect your employment tax liability to be $1,000 or

13 less in a full calendar year and want to file Form 944

Highest number of employees expected in the next 12 months (enter -0- if none).

annually instead of Forms 941 quarterly, check here.

If no employees expected, skip line 14.

(Your employment tax liability generally will be $1,000

or less if you expect to pay $4,000 or less in total wages.)

Agricultural Household Other If you do not check this box, you must file Form 941 for

every quarter.

15 First date wages or annuities were paid (month, day, year). Note: If applicant is a withholding agent, enter date income will first be paid to

nonresident alien (month, day, year) . . . . . . . . . . . . . . . . . ▶

16 Check one box that best describes the principal activity of your business. Health care & social assistance Wholesale-agent/broker

Construction Rental & leasing Transportation & warehousing Accommodation & food service Wholesale-other Retail

Real estate Manufacturing Finance & insurance Other (specify) ▶ WHOLESALE

17 Indicate principal line of merchandise sold, specific construction work done, products produced, or services provided.

ECOMMERCE

18 Has the applicant entity shown on line 1 ever applied for and received an EIN? Yes No

If “Yes,” write previous EIN here ▶

Complete this section only if you want to authorize the named individual to receive the entity’s EIN and answer questions about the completion of this form.

Third Designee’s name Designee’s telephone number (include area code)

Party INCFILE.COM LLC- NICHOLAS SIHA 888-462-3453

Designee Address and ZIP code Designee’s fax number (include area code)

17350 STATE HWY 249 #220, HOUSTON, TX 77064 877-919-2613

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete. Applicant’s telephone number (include area code)

Name and title (type or print clearly) ▶ VINCENT DE PAUL GOUNOU - MEMBER 201-582-8935

Applicant’s fax number (include area code)

Signature ▶ Date ▶

03 / 20 / 2021

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 16055N Form SS-4 (Rev. 12-2017)

You might also like

- EIN Form PDFDocument3 pagesEIN Form PDFVivek Surya100% (4)

- A User Manual for Life on Earth (Enclosure Version 2)From EverandA User Manual for Life on Earth (Enclosure Version 2)Rating: 5 out of 5 stars5/5 (1)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet

- A Resolution Which May Be Adopted by The Members To Authorize The Opening of A Bank Account, and It Also Designates Who Has Signature Authority For The Bank AccountDocument15 pagesA Resolution Which May Be Adopted by The Members To Authorize The Opening of A Bank Account, and It Also Designates Who Has Signature Authority For The Bank AccountEvan100% (2)

- Employer Identification Number (EIN) Application / RegistrationDocument3 pagesEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- Allocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositDocument4 pagesAllocation of Refund (Including Savings Bond Purchases) : 56 Direct DepositJahe FameNo ratings yet

- Lawfully Yours: The Realm of Business, Government and LawFrom EverandLawfully Yours: The Realm of Business, Government and LawNo ratings yet

- Form 1099-INT - 2022 - Template1 - Document 01Document9 pagesForm 1099-INT - 2022 - Template1 - Document 01chamuditha dilshanNo ratings yet

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of RepresentativeJohn KammererNo ratings yet

- UCC 1 On File and Uploaded - 20170625 - 0001Document63 pagesUCC 1 On File and Uploaded - 20170625 - 0001PriyaSiranEL100% (2)

- AcctauthDocument2 pagesAcctauthIva JacksonNo ratings yet

- Beyond Frontiers: U.S. Taxes for International Self-Published AuthorsFrom EverandBeyond Frontiers: U.S. Taxes for International Self-Published AuthorsRating: 1 out of 5 stars1/5 (1)

- Fundamentals of Forensic Science - Vol - IDocument81 pagesFundamentals of Forensic Science - Vol - IBrock Lesnar60% (5)

- Path To FreedomDocument201 pagesPath To FreedomlostvikingNo ratings yet

- 13 Irs Form 56Document2 pages13 Irs Form 56DarioNo ratings yet

- Information Referral: Section A - Information About The Person or Business You Are ReportingDocument3 pagesInformation Referral: Section A - Information About The Person or Business You Are ReportingEMV ISLANDNo ratings yet

- US Internal Revenue Service: f56f AccessibleDocument2 pagesUS Internal Revenue Service: f56f AccessibleIRS100% (1)

- US Internal Revenue Service: p3909Document20 pagesUS Internal Revenue Service: p3909IRSNo ratings yet

- Name ChangeDocument2 pagesName ChangeAleria ButlerNo ratings yet

- F 8832Document8 pagesF 8832Matthieu Clave100% (1)

- Power of Attorney: Tax Form Instructions: 1. PurposeDocument3 pagesPower of Attorney: Tax Form Instructions: 1. PurposeNdao86No ratings yet

- Negotiable InsturmentsDocument19 pagesNegotiable Insturmentsishasingh14289No ratings yet

- Mazhar SS4 FormDocument2 pagesMazhar SS4 Formmazharpalal02100% (2)

- Change To Domestic Employer Identification Number (EIN) Assignment by Toll-Free PhonesDocument3 pagesChange To Domestic Employer Identification Number (EIN) Assignment by Toll-Free PhonespeteycostaNo ratings yet

- Tradename RegistrationDocument1 pageTradename RegistrationKayla Jordan Blaylock-ElNo ratings yet

- Estates and Trusts: Understanding Income TaxDocument9 pagesEstates and Trusts: Understanding Income TaxPawPaul Mccoy100% (1)

- Application For Employer Identification Number: Ammar AbdulhadiDocument2 pagesApplication For Employer Identification Number: Ammar AbdulhadiAmmarhadi95 HiNo ratings yet

- FTC Facts: The FTC'S Privacy Rule and Auto DealersDocument6 pagesFTC Facts: The FTC'S Privacy Rule and Auto DealersPriya DasNo ratings yet

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationMaryUmbrello-DresslerNo ratings yet

- PFSADocument84 pagesPFSAAkinlabi HendricksNo ratings yet

- Form - 1040 - ES PDFDocument12 pagesForm - 1040 - ES PDFAnonymous JqimV1ENo ratings yet

- Application For A Social Security Card Applying For A Social Security Card Is Free!Document5 pagesApplication For A Social Security Card Applying For A Social Security Card Is Free!Ausar Ptah Re ELNo ratings yet

- Current I-9 FormDocument4 pagesCurrent I-9 Formlegiziano100% (4)

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- W-8ben Irs FormDocument7 pagesW-8ben Irs FormCletise HammondsNo ratings yet

- OAA 13 AuthorizedUserDocument15 pagesOAA 13 AuthorizedUsercamwills2No ratings yet

- W 8benDocument1 pageW 8benSaiful YusufNo ratings yet

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- Tackle Your Payroll Tax Debt: Proven Strategies Every Sub-Contractor Business Owner Should Know While Dealing With the IRSFrom EverandTackle Your Payroll Tax Debt: Proven Strategies Every Sub-Contractor Business Owner Should Know While Dealing With the IRSNo ratings yet

- IRS Form W-9Document4 pagesIRS Form W-9Gary S. Wolfe100% (1)

- I1099msc DFTDocument11 pagesI1099msc DFTVa KhoNo ratings yet

- Bill of ExchDocument52 pagesBill of ExchIta BurhanNo ratings yet

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of Representativegordon scottNo ratings yet

- Securities and Exchange Commission (SEC) - Form13fDocument11 pagesSecurities and Exchange Commission (SEC) - Form13fhighfinance100% (1)

- Individual Indian Money (IIM) Instructions For Disbursement of Funds and Change of AddressDocument4 pagesIndividual Indian Money (IIM) Instructions For Disbursement of Funds and Change of AddressshawnNo ratings yet

- Instructions For Completing The SF 1199A (Direct Deposit Form)Document1 pageInstructions For Completing The SF 1199A (Direct Deposit Form)donald trumpNo ratings yet

- Power of AttorneytempDocument3 pagesPower of Attorneytemplyocco1100% (1)

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationGrayNo ratings yet

- W-7 FormDocument1 pageW-7 FormRaviLifewideNo ratings yet

- 2018 Sav1522 RedemptionDocument4 pages2018 Sav1522 Redemptiondouglas jonesNo ratings yet

- Ucc 1Document2 pagesUcc 1Βασίλειος ΣωτήραςNo ratings yet

- Trade NameDocument3 pagesTrade Namerene andre smithNo ratings yet

- Legal Ethics MCQDocument2 pagesLegal Ethics MCQronasolde50% (2)

- General Instructions For Certain Information Returns: (Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G)Document29 pagesGeneral Instructions For Certain Information Returns: (Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G)Septree Diales SaveroNo ratings yet

- Employee and Independent ContractorDocument14 pagesEmployee and Independent ContractorsmarikaNo ratings yet

- f56 - 2002 Old Form 56FDocument2 pagesf56 - 2002 Old Form 56FMike Sisco50% (2)

- CAPE Accounting Unit 1 2009 P2Document8 pagesCAPE Accounting Unit 1 2009 P2Sachin BahadoorsinghNo ratings yet

- Fss 4Document2 pagesFss 4craz8gtNo ratings yet

- Dissertation Topic MailDocument57 pagesDissertation Topic MailJothsna ChikkodiNo ratings yet

- Business Intelligence GuidebookDocument50 pagesBusiness Intelligence GuidebookElsaNo ratings yet

- Local Taxation SummaryDocument21 pagesLocal Taxation SummaryAngie DouglasNo ratings yet

- Texaco Overseas Petroleum Co. v. Libya 17 ILM or 53 ILR 389,1978Document1 pageTexaco Overseas Petroleum Co. v. Libya 17 ILM or 53 ILR 389,1978reyna amor condes0% (1)

- Form B10Document3 pagesForm B10Kocsis ZsoltNo ratings yet

- Merijn 2013 W8-BEN Form - SignedDocument2 pagesMerijn 2013 W8-BEN Form - SignedMerijn Fredriks0% (1)

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsDocument1 pageAnnual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsCarolina AldanaNo ratings yet

- Goodale and Miller ComplaintDocument2 pagesGoodale and Miller ComplaintLeigh Egan100% (1)

- Original For Recipient: Order Number: RDF15750659Document2 pagesOriginal For Recipient: Order Number: RDF15750659Rajat DawraNo ratings yet

- Law 304.1: TAXATION 1: Course SyllabusDocument6 pagesLaw 304.1: TAXATION 1: Course SyllabusJoseph GabutinaNo ratings yet

- Med 2020Document122 pagesMed 2020ISPINo ratings yet

- Safety and Security of Guest and BelongingsDocument7 pagesSafety and Security of Guest and Belongingsstephen rrNo ratings yet

- Chapter Ii - Construction and Interpretation Chapter Iv - Adherence To, or Departure From, Language ofDocument16 pagesChapter Ii - Construction and Interpretation Chapter Iv - Adherence To, or Departure From, Language ofCJNo ratings yet

- National Education Association of RI v. Nicole Solas - Exhibits To Memo of Law in Support of Motion For TRO and Preliminary InjunctionDocument90 pagesNational Education Association of RI v. Nicole Solas - Exhibits To Memo of Law in Support of Motion For TRO and Preliminary InjunctionLegal InsurrectionNo ratings yet

- Case 10 Relevant Facts of The CaseDocument2 pagesCase 10 Relevant Facts of The CaseAFAD100% (2)

- Gyro Compass Standard 22 NX - Standard 22 NX Replaces Standard 22 - SB - 1 - 2020Document2 pagesGyro Compass Standard 22 NX - Standard 22 NX Replaces Standard 22 - SB - 1 - 2020karthikNo ratings yet

- Jose Rizal's Martyrdom: Execution: Presented By: Jasmine Kaye RoblesDocument16 pagesJose Rizal's Martyrdom: Execution: Presented By: Jasmine Kaye RoblesJERSIE MANALONo ratings yet

- UntitledDocument4 pagesUntitledPhillips West News OutletNo ratings yet

- Abubakar - Islam in The PhilippinesDocument19 pagesAbubakar - Islam in The PhilippinesJennica A.No ratings yet

- Finna Weekly Report (New)Document4 pagesFinna Weekly Report (New)Theofanne CrsNo ratings yet

- Saima Wazed WikiDocument3 pagesSaima Wazed WikiMichaelStevansNo ratings yet

- Chanukah Summary of LawsDocument10 pagesChanukah Summary of LawsSkokieShulNo ratings yet

- Important!: Flights Hotel CAR Rentals Manage MY BookingDocument3 pagesImportant!: Flights Hotel CAR Rentals Manage MY BookingAlena FediakinaNo ratings yet

- Mennonite Church USADocument9 pagesMennonite Church USAjoshua33No ratings yet

- Invoice OAD0000137925Document1 pageInvoice OAD0000137925mikhaelyosiaNo ratings yet

- Contract Law AssignmentDocument3 pagesContract Law AssignmentSoham DevlekarNo ratings yet

- Life in Town and in Country in EnglandDocument6 pagesLife in Town and in Country in EnglandchubiborNo ratings yet

- NSTP 1 Common ModuleDocument120 pagesNSTP 1 Common ModuleKenneth Dave SaguirreNo ratings yet

- NDA - LTA SingaporeDocument5 pagesNDA - LTA Singapore2742481No ratings yet