Professional Documents

Culture Documents

Savings+Pots+Summary+Box TSB13899 Web (02.21)

Uploaded by

luzipopOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Savings+Pots+Summary+Box TSB13899 Web (02.21)

Uploaded by

luzipopCopyright:

Available Formats

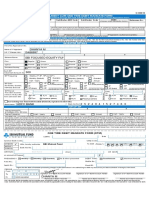

Savings

Savings Pot.

Summary box

Account name Savings Pot

What is the interest rate? Interest rate with bonus (includes a fixed bonus of 0.04% for the first 0.04% Gross Monthly/0.05% AER (variable)

12 months)

Interest rate without bonus (applicable after 12 months) 0.01% Gross Monthly/0.01% AER (variable)

Interest is calculated each day and paid monthly.

Can TSB change the Yes. We can move the interest rate up or down at any time. Our Savings Pots terms and conditions explain when we’ll do this.

interest rate? If we increase the interest rate, we’ll make details of the rate change available in branch, on the phone and on our website, within 3 days of

the change.

If we decrease the interest rate, we’ll let you know personally and give you at least 14 days’ notice.

What would the estimated Based on a £1,000 deposit, with no deposits or withdrawals made from the account, and variable interest rates remaining the same.

balance be after 12 & 24

Initial Deposit £1,000

months based on a £1,000

deposit? Year 1 Interest earned at 0.04% Gross Monthly/0.05% £0.50

AER (variable) (includes a bonus of 0.04% for the

first 12 months)

Estimated balance after 12 months £1,000.50

Year 2 Interest earned at 0.01% Gross Monthly/0.01% £0.10

AER (variable)

Estimated balance after 24 months £1,000.60

This is an example only and doesn’t take into account your individual circumstances.

How do I open and Ways to open A Savings Pot is opened automatically with a Spend & Save or Spend & Save Plus account. You can also open

manage my account? additional pots in the following channels:

• Mobile app

• In branch

Who can open You must be:

• 18 or over; and

• A UK resident; and

• Have a Spend & Save or Spend & Save Plus account

How much £5,000 is the maximum that can be paid into your Savings Pot. This excludes interest earned on the account.

money can I put

in my account?

Open with £1 minimum opening balance.

Manage • Mobile app

your account • In branch

• Over the phone

• Online

Can I withdraw money? Withdrawals Yes, instant access

allowed

Withdrawal No withdrawal penalties apply

charges

How to withdraw Transfer to the Spend & Save or Spend & Save Plus account linked to your Savings Pot.

Additional information • Accounts can be held in sole or joint names, and will reflect the names on the Spend & Save or Spend & Save Plus account linked to

your Savings Pot

• Interest is paid gross (without taking off tax)

• If you earn more interest than the Personal Savings Allowance, you may have to pay extra tax yourself

• The Personal Savings Allowance is £1,000 for basic rate taxpayers and £500 for higher rate taxpayers. Additional rate taxpayers don’t

receive a Personal Savings Allowance

• Account can be closed at any time without charge by visiting a TSB branch or via the mobile app

• You can have up to 5 Savings Pots per Spend & Save or Spend & Save Plus account.

Interest rates and interest calculations correct as at 23 February 2021.

If you’d like this in another format such as large print, Braille or audio please ask

in branch or call us on 03459 758 758 (lines are open from 8am to 8pm, 7 days

a week).

If you have a hearing or speech impairment you can contact us using Text Relay or Textphone on 0345 835 7982

(lines open from 7am to 11pm, 7 days a week).

The opening hours of our Telephone Banking advisor services are 8am to 8pm Monday to Sundays to speak to a Partner. Our lost and stolen card and fraud reporting lines are open 24/7. Not all Telephone

Banking services are available 24 hours, 7 days a week. Calls may be monitored or recorded.

Rates can change at any time and you should check the current interest rate before applying for the account.

AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Gross rate is the contractual rate of interest payable before the

deduction of income tax.

TSB Bank plc. Registered Office: Henry Duncan House, 120 George Street, Edinburgh EH2 4LH. Registered in Scotland No. SC95237. Authorised by the Prudential Regulation Authority and regulated by

the Financial Conduct Authority and the Prudential Regulation Authority under registration number 191240.

TSB Bank plc is covered by the Financial Services Compensation Scheme and the Financial Ombudsman Service.

TSB13899 (02/21)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Transfer Receipt PDFDocument2 pagesTransfer Receipt PDFKahinur KarimNo ratings yet

- Core Banking 1Document54 pagesCore Banking 1glorydharmaraj100% (1)

- International Financial InstrumentsDocument25 pagesInternational Financial InstrumentsChintakunta Preethi100% (1)

- Minimal Conditions For The Survival of The Euro - PRINTEDDocument57 pagesMinimal Conditions For The Survival of The Euro - PRINTEDAdrianaNo ratings yet

- Zephyr Financial Publishers PVT LTDDocument17 pagesZephyr Financial Publishers PVT LTDKeigan ChatterjeeNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument83 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegesma pgriNo ratings yet

- ProsthesisDocument4 pagesProsthesisSam Bradley DavidsonNo ratings yet

- MCQs Book by Sanidhya Saraf SirDocument171 pagesMCQs Book by Sanidhya Saraf SirCa FinalsNo ratings yet

- Intro To Double EntryDocument25 pagesIntro To Double EntryFarhan Osman ahmedNo ratings yet

- Fini619-Internship Report Format (NEW)Document8 pagesFini619-Internship Report Format (NEW)Zeeshan JunejoNo ratings yet

- CV of Mohd. Sariful Islam (Cashier)Document3 pagesCV of Mohd. Sariful Islam (Cashier)Sariful IslamNo ratings yet

- January 2024Document2 pagesJanuary 2024Vikram Kumar GuptaNo ratings yet

- ABM+2 Learning+Material+No.+4Document3 pagesABM+2 Learning+Material+No.+4Gelesabeth GarciaNo ratings yet

- Unit 1 Vouching - 1 - FinalDocument12 pagesUnit 1 Vouching - 1 - Finalshoaib shaikhNo ratings yet

- Bhs Inggris Kelompok 1Document5 pagesBhs Inggris Kelompok 1Jeanice MeNo ratings yet

- Tractor LoansProductDocument10 pagesTractor LoansProductkakali mondalNo ratings yet

- Bank Secrecy Law (R.a. No. 1405)Document1 pageBank Secrecy Law (R.a. No. 1405)jancelmido1No ratings yet

- JAM Trinity ConclusionDocument3 pagesJAM Trinity ConclusionMohit KumarNo ratings yet

- Private-Banking-Signature-July-Dec-23 JS BankDocument4 pagesPrivate-Banking-Signature-July-Dec-23 JS BankMuhammad Aasim HassanNo ratings yet

- RHB Islamic Credit Cards PDSDocument11 pagesRHB Islamic Credit Cards PDSDyana AmnaniNo ratings yet

- CMS Base 2 Q&aDocument16 pagesCMS Base 2 Q&aSoumava BasuNo ratings yet

- Mid Term Test - 01: Principles of AccountingDocument2 pagesMid Term Test - 01: Principles of AccountingAn TuanNo ratings yet

- Medical Repricing 95925429Document10 pagesMedical Repricing 95925429Jason MaldonadoNo ratings yet

- ANNUAL REPORT DANAMON 2021-English - RevDocument727 pagesANNUAL REPORT DANAMON 2021-English - RevnoattaNo ratings yet

- Study of Growing Popularity of Payment Apps in India: ArticleDocument11 pagesStudy of Growing Popularity of Payment Apps in India: ArticleRizwan Shaikh 44No ratings yet

- Paypal Consumer Fees: Last Updated: 28, January 2022Document15 pagesPaypal Consumer Fees: Last Updated: 28, January 2022Zianb WazaniNo ratings yet

- Assignment - Commercial Banking System and Role of RBIDocument6 pagesAssignment - Commercial Banking System and Role of RBIShivam GoelNo ratings yet

- TAN410 Accounting Quiz 2. Review Chapter 2 Chapter 3 Copy QuestionsDocument20 pagesTAN410 Accounting Quiz 2. Review Chapter 2 Chapter 3 Copy QuestionsMichenNo ratings yet

- Why Are Demand Deposits Considered As MoneyDocument7 pagesWhy Are Demand Deposits Considered As Moneytown BoyNo ratings yet

- Dummy - SIP Enrollment PDFDocument1 pageDummy - SIP Enrollment PDFKiranmayi UppalaNo ratings yet