Professional Documents

Culture Documents

FINANCIAL REHABILITATION and INSOLVENCY ACT of 2010

Uploaded by

Lara DelleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINANCIAL REHABILITATION and INSOLVENCY ACT of 2010

Uploaded by

Lara DelleCopyright:

Available Formats

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

Financial Rehabilitation and Insolvency Act (FRIA):

Governs all petitions filed after it has taken

effect.

Governs all further proceedings in insolvency, Fair Valuation – means what a willing owner, not

suspension of payments and rehabilitation cases compelled to sell, would take, and a willing purchaser

pending at the time it became effective (except if would pay, when not compelled to buy.

the application of FRIA would not be feasible or

would work injustice) *In determining whether the debtor’s liabilities are

greater than his assets, reference must be made to the fair

Policy of the State: Encourage debtors, both natural valuation of his assets. The debtor’s assets must not, at fair

valuation, be sufficient to pay his debts.

and juridical persons, and their creditors to collectively

and realistically resolve and adjust competing claims and

Insolvency Law vs. Bankruptcy Law

property rights.

Insolvency laws operated on the petition of an

Specifically:

insolvent debtor to discharge him from his debts.

1. Ensure a timely, fair, transparent, effective, and

Bankruptcy laws operated on petition of a debtor’s

efficient rehabilitation or liquidation of debtors;

creditors for the purpose of applying his property to the

2. Ensure or maintain certainty and predictability in

payment of his debts.

commercial affairs;

3. Preserve and maximize the value of the assets

*Both bankruptcy and insolvency statures may be

of debtors; initiated by either creditor or debtor, and may be used for either

4. Recognize creditor rights; purpose.

5. Respect priority of claims;

6. Ensure equitable treatment of creditors who are Debtors covered by FRIA

similarly situated; and 1. Sole proprietorship duly registered with Dept. of

7. Facilitate a speedy and orderly liquidation of Trade and Industry

these debtors’ assets and the settlement of their 2. Partnership duly registered with the Securities

obligations. and Exchange Commission

3. Corporation duly organized and existing under

Insolvency – refers to the financial condition of a debtor Philippine laws

that is generally unable to pay its or his liabilities as they 4. Individual debtor who has become insolvent as

fall due in the ordinary course of business or has defined in the law (FRIA).

liabilities that are greater than its or his assets.

Debtors not covered by FRIA

Balance Sheet Test – denotes the state of a 1. Banks

person whose liabilities are more than his 2. Insurance companies

assets. It is that relative condition of a man’s 3. Pre-need companies

assets and liabilities that the former if all made 4. National and Local government agencies or

immediately available, would not be sufficient to units

discharge the latter. 5. Unincorporated company

*In this sense, insolvency is similar to 6. Joint venture (not registered as partnership with

bankruptcy. the SEC)

7. Estate of deceased person

Equity Test – the inability of a person to pay his 8. Trust

debts as they become due in the ordinary course

of his business. The person may be insolvent Claim – refers to all claims or demands of whatever

although he may be able to pay his debts at nature or character against the debtor or its property,

some future time on a settlement and winding up whether for money or otherwise, liquidated or

of his affairs. unliquidated, fixed or contingent, matured or unmatured,

*In this sense, the debtor is said to be illiquid

disputed or undisputed, including but not limited to:

not bankrupt.

1|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

All claims of the government (whether national and Suspension of Payment Rules of Procedures for

or local) including taxes, tariffs and custom Insolvent Debtors (FLSP Rules).

duties

Claims against directors and officers of the Involuntary Liquidation Proceedings – for juridical

debtor arising from the acts done in the debtors, jurisdiction over all persons affected by the

discharge of their functions falling within the proceedings is acquired upon publication of the petition

scope of their authority or motion under Section &, Rule 2(B) of the FLSP Rules.

*The claim must be against the debtor or its property.

Rehabilitation Court has no jurisdiction over claims of a debtor

against his own debtors or against third parties. - for individual debtors, jurisdiction over the

person of the debtor is acquired upon service of

*FRIA covers both monetary and non-monetary claims.

summons in accordance with Section 15, Rule 3(C).

Remedies of Insolvent Debtor:

Suspension of Payment Proceedings – jurisdiction over

1. Judicial (e.g., rehabilitation and suspension of

all persons affected by the proceedings is acquired upon

payment under FRIA)

the publication of Suspension of Payments Order.

2. Extrajudicial (e.g., dacion en pago)

*Any order issued by the court is under the procedural

Remedies under FRIA rules is immediately executory.

Rehabilitation

o Voluntary Advantages of Judicial Remedies (FRIA)

o Involuntary 1. Retention of Management

o Pre-negotiated 2. Non-withholding of Supply

Out-of-Court restructuring 3. Protection from certain actions and processes

Liquidation 4. Exemption from taxes

o Voluntary 5. Compromise binding

o Involuntary 6. Cram-down Power

Petition for suspension of payment (for individual 7. Binding effect of Rehabilitation Plan

debtors)

SUSPENSION OF PAYMENT – a petition for

Nature of Proceedings under FRIA suspension of payment is a remedy available to an

The proceedings under FRIA are proceedings in individual debtor who seeks to suspend the payments

rem. In rem actions are against the thing itself and they outside of the necessary or legitimate expenses of his

are binding upon the whole world. business while the proceedings are pending.

The court need not acquire jurisdiction over the

person of the defendant in actions in rem because they Who Can File: Only individual debtors can file a

are not directed against any person. The court need only petition for suspension of payment.

to acquire jurisdiction over the res.

*An individual debtor is a natural person who

Acquisition of Jurisdiction (FRIA) is a resident and a citizen of the Philippines who has

Rehabilitation Proceedings – the court acquires become insolvent.

jurisdiction over all persons affected by the proceedings

upon publication of the notice of the commencement of Who Cannot File:

the proceedings and the Commencement Order in any o Creditors cannot file a petition for

newspaper of general circulation in the Philippines for suspension of payment against the

two (2) consecutive weeks. debtor

o Corporations and other juridical persons

Voluntary Liquidation Proceedings – both juridical and o Non-Philippine citizen

individual debtors, jurisdiction over all persons affected

by the proceedings is acquired upon publication of the Venue – the petition is filed in the court having

Liquidation Order as provided in the Financial Liquidation jurisdiction over the province or city where the

2|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

debtor has resided for six (6) months before the *To form a majority, it is necessary that (i)

filing of the petition. 2/3 of the creditors voting unite upon the

same proposition and (ii) claims represented

by the majority vote amount at least 3/5 of

BASIC PROCEDURE: the total liabilities of the debtor mentioned in

the petition.

Filing of Petition

o The debtor files his verified petition for *A creditor who incurred his credit within 90

suspension of payment and must attach days prior to the filing of the petition is not

the following: entitled to vote.

Schedule of debts and liabilities

Objections to Proposal

Inventory of assets

o If any creditor has dissented from and

Proposed agreement with the

creditors protested against the vote of the

majority (proposal and amendments

*The petition must indicate the names of approved by majority of the creditors

at least three (3) nominees to the during the

position of commissioner.

creditors’ meeting), may file an objection

GENERAL RULE: From the time of filing the petition with the court within 10 days from the

and for as long as proceedings remain pending, no date of the last creditors’ meeting.

creditor can sue or institute proceedings to collect his

claim.

o GROUNDS:

EXCEPTION:

Creditors having claims for personal labor, Defects in the call for the

maintenance, expense of last illness, etc., meeting, in the holding thereof

incurred within 60 days immediately before and in the deliberations had

filing. which prejudiced the rights of

Secured creditors the creditors;

Fraudulent connivance between

Action on Petition one or more creditors and the

o If the court finds the petition sufficient in individual debtor to vote in favor

form and substance, it will, within five (5) of the proposed agreement;

working days from the filing the petition, Fraudulent conveyance of

issue the Suspension Order. claims for the purpose of

obtaining a majority.

Notification through Publication and Notices

o The Order is published in a newspaper Hearing and Issuance of Order

of general circulation in the province or o The court must hear and pass upon

city in which the petition is filed once a such objection within 30 days from the

week for two (2) consecutive weeks. date of filing and in a summary manner.

o The first publication should be made

within seven (7) days from the time of IF APPROVED PROPOSED AGREEMENT IS

the issuance of the Order. ANNULLED BY THE COURT: The court will declare the

proceedings terminated and the creditors will be at

Creditors’ Meeting and Voting by Creditors liberality to exercise their rights which may correspond to

o The creditors will meet on the time, date them.

and place designated by the court in the

Order. IF APPROVED PROPOSED AGREEMENT IS UPHELD

*The presence of creditors holding claims at OR NO OPPOSITION: The court will order that the

least 3/5 of the liabilities is necessary in agreement be carried out and all parties bound thereby

holding the meeting. to comply with its terms.

o The creditors and the individual debtor

will discuss the propositions in the Commissioner – will preside the creditors’ meeting in

proposed agreement and put them to a connection with the proceedings.

vote.

3|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

1. Debtor has assets that can generate more cash

Qualifications: if used in its daily operations than if sold

1. Must be a natural person 2. Liquidity issues can be addressed by a

2. Citizen of the Philippines or a resident in practicable business plan that will generate

the Philippines for six (6) months enough cash to sustain daily operations

immediately preceding his appointment 3. Debtor has a definite source of financing for the

3. Of good moral character and with proper and full implementation of the

acknowledged integrity, impartiality and Rehabilitation Plan that is anchored on realistic

independence assumptions and goals.

4. Has the requisite knowledge of

insolvency laws, rules and procedures Infeasible Rehabiliation Plan:

5. Has no conflict of interest 1. Absence of a sound workable business plan

2. Baseless and unexplained assumptions, targets

Prohibited Transactions and goals

The following are prohibited upon the issuance 3. Speculative capital infusion or complete lack

of the Order and while the so long as the proceedings thereof for the execution of the business plan

relative to the suspension of payments are pending: 4. Cash flow cannot sustain daily operations

5. Negative net worth and the assets are near full

depreciation or fully depreciated.

1. Sale, transfer, encumbrance or disposition by

the individual debtor of his property

a. EXCEPT: Those used in the ordinary Court-supervised Rehabilitation

operations of commerce or industry in Voluntary – if an insolvent debtor initiates the

which the petitioning individual debtor is rehabilitation proceedings

engaged.

2. Individual debtor is prohibited from making any To file the petition, there must be

payments outside of the necessary or legitimate approval from:

expenses of his business or industry. (i) Owner in case of single

proprietorship

REHABILITATION – refers to the restoration of the (ii) Majority of the partners in

debtor to a condition of successful operation and case of partnership

solvency, if it is shown that its continuance of operation (iii) Majority of vote of the board

is economically feasible and its creditors can recover by and vote of stockholders

way of the present value of payments projected in the representing at least 2/3 of

Rehabilitation Plan. capital stock in case of

corporations

Types:

Court-supervised: Voluntary Involuntary – if a creditor or group of creditors

Court-supervised: Involuntary (with aggregate claims of at least P1 million or at

Pre-negotiated least 25% of subscribed capital or partners’

Out-of-court of Informal contribution) initiates the rehabilitation

proceedings

Purpose:

1. To efficiently and equitably distribute the Venue for Petition

assets of the insolvent debtor to its Sole Proprietorship

creditors o the petition must be filed in the RTC

2. To provide the debtor with a fresh start which has jurisdiction over the principal

office of the debtor

*If rehabilitation is not feasible, the appropriate Corporation, Partnership or Association

proceeding would be a liquidation proceeding instead of a

(principal office in Metro Manila)

rehabilitation proceeding.

o the petition must be filed in the RTC of

Economically Feasible Rehabilitation Plan the city or municipality where the hear

(Characteristics): office is located

4|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

* If petition involves a group of debtors, the same g. Exact address at which documents

must be filed in the RTC which has jurisdiction regarding the debtor and the

over the principal office of any of the debtors proceedings may be reviewed and

alleged to be insolvent

copied

h. Documents showing that there is

Requirements and Contents

substantial likelihood that the debtor

By the debtor/s:

may be rehabilitated

1. Petition must be verified

2. Must set forth with sufficient particularity

all of the following material facts:

a. Name, business, and principal BASIC PROCEDURE:

address and other addresses of

the debtor; Filing of Petition

b. Nature of the business and o Insolvent Debtor: By filing a petition with

principal activities of the debtor, the court on the grounds provided in the

and the addresses where these FRIA. The petition must be verified to

activities are conducted; establish the insolvency of the debtor

c. History of the debtor and the viability of its rehabilitation.

d. Fact and cause of debtor’s o Creditor/s: By filing a petition for

insolvency rehabilitation with the court on the

e. Specific relief sought grounds provided in the FRIA. The

petition must be verified to establish the

substantial likelihood that the debtor

f. Grounds upon which the petition may be rehabilitated.

is based

g. All pending actions or

Action for Petition

proceedings by or against the

If the court finds the petition for

debtor and the courts or tribunal

rehabilitation sufficient in form and in

where such are pending;

substance, it will, within five (5) working

h. Threats or demands to enforce

days from filing the petition, issue a

claims or liens against the

Commencement Order.

debtor

i. Manner by which the debtor

If the court finds the petition deficient in

may be rehabilitated

substance and in form, it may, in its

j. Exact address at which

discretion, give the petitioner/s a

documents regarding the debtor

reasonable period of time within which

and the proceedings may be

to:

reviewed and copied

amend or supplement the

petition

By the creditor/s:

a. Name, business, and principal address submit such documents as may

and other addresses of the debtor; be necessary

b. Nature of the business and principal put the petition in proper order

activities of the debtor;

*In this case, the five (5) working

c. Circumstances sufficient to support the

days shall be reckoned from the

petition to initiate involuntary

date of the filing of the amended or

rehabilitation proceedings; supplemental petition or the

d. Specific relief sought; submission or the submission of

e. Rehabilitation Plan; such documents.

f. Names of at least three (3) nominees to

the position of rehabilitation receiver *If the deficiency is not complied

(with qualifications, office and email within the extended five-day period,

addresses); the court will DISMISS the petition.

5|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

When COMMENCEMENT ORDER is issued: be entitled to receive distributions arising

The order will set the case for initial hearing, from the proceedings although he is not

which will not be more than 40 days from the entitled to participate.

date of filing of the petition.

Challenge of Claims

Publication of Commencement Order and o Within 30 days from the expiration of the

Delivery of Notices period to inspect the registry of claims,

o The Order is published in a newspaper the debtors, creditors and stakeholders

of general circulation in the province or may submit their challenge to claim/s to

city in which the petition is filed once a the court.

week for two (2) consecutive weeks. o Upon the expiration of the 30-day

o The first publication should be made period, the rehabilitation receiver must

within seven (7) days from the time of submit to the court the registry of claims.

the issuance of the Order.

*The aggrieved party may seek the review of

HOW NOTICES DELIVERD: the decision of the rehabilitation receiver by

filing a motion with the rehabilitation court

If petitioner is the debtor: There

within five (5) days from receipt of

will be service by personal rehabilitation receiver’s decision.

delivery of a copy of the petition

on each creditor holding at least Initial Hearing and Subsequent Hearings

10% of the total liabilities of the o At the initial hearing, the court will:

debtor within five (5) days. Determine the creditors who

If petitioner is the creditor: Direct have made timely and proper

the service by personal delivery filing of their notice of claims;

of a copy of the petition on the Hear and determine any

debtor within five (5) days. objection to the qualifications or

the appointment of the

rehabilitation receiver (and if

Establishment of Registry of Claims necessary, appoint one);

o Within 20 days from rehabilitation

receiver’s assumption of office, he must

establish a preliminary registry of claims.

o Rehabilitation receiver must make

Direct the creditors to comment

registry available for public inspection on the petition and

and provide publication notice by Rehabilitation Plan;

publishing the place and date of Direct the rehabilitation receiver

inspection in a newspaper of general to evaluate the financial

circulation once every week for two (2) condition of the debtor and to

consecutive weeks. prepare and submit to the court

within 40 days from the initial

* The period of inspection cannot exceed 15

hearing a report (provided in

days from the last publication.

Sec. 24 of the FRIA).

Filing of Creditor’s Claim Determine the reasonableness

o The creditors must file their claim at of the rehabilitation receiver’s

fees stated in the Rehabilitation

least five (5) days before the initial

Plan (which will be presumed

hearing.

reasonable unless the creditors

*If a creditor fails to file their claim in object on it)

accordance with the Commencement Order

and such is not listed in the schedule of *The court may hold additionall

debts and liabilities will not be entitled to hearing as may be necessary to

participate in the rehabilitation proceedings. continue the initial hearing process

However, if he files a belated claim, he will but these hearings must be

concluded not later than 90 days

6|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

from the first hearing date fixed in o If the petition is given due course, the

the Commencement Order. court will issue an order directing the

rehabilitation receiver to call a meeting

Creditor’s Comment on the Petition and with the debtor and all classes of

Rehabilitation Plan creditors.

o The creditors will submit their comments

to the court and rehabilitation receiver *The meeting will take place in not less than

within 20 days from the initial hearing. 2 weeks nor more than 4 weeks from the

date of the order to consider the organization

Submission of Report of Rehabilitation of a creditors’ committee.

Receiver

o The rehabilitation receiver will submit its o A creditors’ committee may be

report to the court within 40 days from organized if the creditors, representing

the initial hearing stating his preliminary at least a majority of all the claims as

findings and recommendation, whether: reflected in the registry of claims, cast

The debtor is insolvent; their votes for its creation.

The underlying assumptions,

financial goals and procedures CREDITORS’ COMMITTEE: Will be

to accomplish in the composed of a representative from each of

Rehabilitation Plan are realistic, the following classes:

feasible and reasonable; Secured Creditors

There is substantial likelihood Unsecured Creditors

for the debtor to be successfully Trade Creditors and Suppliers

rehabilitated; Employees of the debtor

The petition should be

dismissed; Creditors’ Meeting to Approve Rehabilitation

The debtor should be dissolved Plan

or liquidated o After the rehabilitation receiver reviews

and revises the Rehabilitation Plan, he

will notify the creditors and stakeholders

that the plan is ready for their

examination.

o Within 20 days from the notification, he

will convene the creditors for the

Grant or Dismissal of Petition or Conversion

of Proceedings

o Within 10 days from receipt of the report purposes of voting on the approval of

of the rehabilitation receiver, the court the plan.

may: o The rehabilitation receiver will notify the

Give due course to the petition court, the creditors or the creditors’

Dismiss the petition committee and the stakeholders of the

Convert the proceedings into approval or the rejection of the Plan

one for the liquidation of the within five (5) days from such voting.

debtor

Submission of Rehabilitation Plan to the

Consultation with Debtors and Creditors Court

o If the court gives due course to the o Within five (5) days from the receipt of

petition, the rehabilitation receiver must the Plan submitted by the rehabilitation

confer with the debtor and all of the receiver, the court will notify the

creditors, and may consider their views creditors that the Rehabilitation Plan has

and proposals in the review, revision or been submitted for confirmation.

preparation of a new Rehabilitation Plan. o Creditors may either obtain copy of the

plan or file an objection thereto.

Formation of Creditors’ Committee

7|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

Filing of Objections IF MOTION IS GRANTED: The court will

o The creditors may file their objection set the proposed amendments for

within 20 days from receipt of notice hearing not later than 15 days from the

from the court. date of the order.

Objections to the Rehabilitation Plan are Termination of Proceedings

limited to the following grounds: o The rehabilitation proceedings are, upon

Creditors’ support was induced motion by any stockholder or the

by fraud rehabilitation receiver, terminated by

Documents or data relied upon order of the court either declaring a

in the Rehabilitation Plan are successful implementation of the Plan or

materially false and misleading a failure of rehabilitation.

Rehabilitation Plan is in fact not

supported by the voting THERE IS FAILURE OF REHABILITATION

creditors IN THE FF CASES:

Court dismisses the petition

Hearing on Objections Debtor fails to submit a

o The court will issue an order setting the Rehabilitation Plan

time and date for the hearing/s on the No substantial likelihood that the

objections. debtor can be rehabilitated within a

o If it finds merit in the objection, it will reasonable period

order the rehabilitation receiver or other Commission of fraud in securing

party to cure the defect, whenever approval of the Plan or its

feasible. amendments

o If it finds that the debtor acted in bad Court does not confirm the Plan

faith or that it is not feasible to cure the Failure of the debtor to comply with

defect, it will convert the proceedings the FLSP Rules, Rules of Court, or

into one for the liquidation of the debtor. any order of the Court.

Court Action

o If no objections were filed within the COMMENCEMENT ORDER

period of 20 days, or if objections lack in Contents:

merit, the court will issue an order Declare that the debtor is under rehabilitation.

confirming the Rehabilitation Plan. Appoint rehabilitation receiver who may or may

not be from among the nominees of the

*The court has a maximum period of one (1) petitioners

year from the date of filing of the petition to Prohibit the debtor’s suppliers of goods or

confirm a Rehabilitation Plan. services from withholding the supply of goods

and services in the ordinary course of business

(as long as debtor pays after the issuance of the

Amendments to the Approved Rehabilitation Commencement Order)

Plan

o After the confirmation of the

Rehabilitation Plan, the debtor, Authorize the payment of administrative

rehabilitation receiver or any creditor expenses as they become due

may file a verified motion for leave to Set the case for initial hearing

amend the Plan.

Effects:

*The motion must state the reasons Vest the rehabilitation receiver with all the powers and

warranting the amendment of the Plan and functions provided for in the FRIA

the proposed amendments, with a copy Prohibit or otherwise serve as the legal basis for

given to the rehabilitation receiver. rendering null and void the results of any extrajudicial

activity or process to seize property or attempt to

8|Page Lovely Balagon Orais|2021

FINANCIAL REHABILITATION and INSOLVENCY

ACT of 2010

collect on or enforce a claim against the debtor after Criminal action against the individual debtor or

the commencement date owner, partner, director or officer of a debtor

Serve as the legal basis for rendering null and void

any set-off after the commencement date of any debt

owed to the debtor by any of the creditors

Serve as the legal basis for rendering null and void

the perfection of any lien against the debtor’s property

after the commencement date

Consolidate the resolution of all legal proceedings by

and against the debtor to the court

Effectivity and Duration

The Order is effective for the duration of the

rehabilitation proceedings, unless:

earlier lifted by the Court

Rehabilitation Plan is seasonably confirmed or

approved

Rehabilitation proceedings are ordered

terminated by the Court

SUSPENSION ORDER

Effects:

Suspend all actions or proceedings, in court or

otherwise, for enforcement of claims against the

debtor

Suspends all actions to enforce any judgment,

attachment or other provisional remedies against

the debtor

Prohibit the debtor from selling, encumbering,

transferring or disposing in any manner any of its

properties (except in the ordinary course of

business)

Prohibits the debtor from making any payments

of its liabilities outstanding as of the

commencement date (except as may be

provided)

Does not apply to:

Cases already pending appeal in the Supreme

Court as of commencement date.

Cases pending or filed at a specialized court or

quasi-judicial agency which, upon determination

by the court, is capable of resolving the claim

more quickly, fairly and efficiently than the

rehabilitation court.

Enforcement of claims against sureties and other

persons solidarily liable with the debtor, and

accommodation mortgagors or issues of letters

of credit

Any form of action of customers or clients of a

securities market participant to recover or

otherwise claim moneys and securities entrusted

to the latter in the ordinary course of business

9|Page Lovely Balagon Orais|2021

You might also like

- Financial Rehabilitation and Insolvency ActDocument32 pagesFinancial Rehabilitation and Insolvency ActZen Daniel100% (2)

- 2019 Divina FRIA 070919 MJRSIDocument15 pages2019 Divina FRIA 070919 MJRSIMuhammadIbnSulu100% (3)

- FINANCIAL REHABILITATION AND INSOLVENCY ACTDocument10 pagesFINANCIAL REHABILITATION AND INSOLVENCY ACTJaylordPataotao100% (1)

- FRIA Class NotesDocument14 pagesFRIA Class NotesAnonymous wDganZNo ratings yet

- Non-Bank Gfis: GoccsDocument35 pagesNon-Bank Gfis: GoccsAnalyn Grace BasayNo ratings yet

- Fria ReviewerDocument31 pagesFria ReviewerWhere Did Macky Gallego100% (4)

- Reviewer Financial Rehabilitation and Insolvency ActDocument18 pagesReviewer Financial Rehabilitation and Insolvency ActShalala HernandezNo ratings yet

- Summary of The FRIA LawDocument13 pagesSummary of The FRIA LawKulit_Ako1100% (3)

- FRIA Law ReviewerDocument21 pagesFRIA Law ReviewerDakila Maloy100% (7)

- FINANCIAL REHABILITATION AND INSOLVENCY ACTDocument39 pagesFINANCIAL REHABILITATION AND INSOLVENCY ACTMark Joseph M. VirgilioNo ratings yet

- AMLA ReviewerDocument5 pagesAMLA ReviewerZamantha Tiangco100% (1)

- BP 22 Bouncing Checks LawDocument4 pagesBP 22 Bouncing Checks LawWilsonNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010Document5 pagesFinancial Rehabilitation and Insolvency Act of 2010Kira JorgioNo ratings yet

- REVIEW OF THE FINANCIAL REHABILITATION AND INSOLVENCY ACTDocument65 pagesREVIEW OF THE FINANCIAL REHABILITATION AND INSOLVENCY ACTSao DirectorNo ratings yet

- FRIA With ConclusionDocument8 pagesFRIA With ConclusionNrnNo ratings yet

- Fria NotesDocument13 pagesFria NotesMary SmithNo ratings yet

- FRIA HandoutDocument30 pagesFRIA HandoutSofia Brondial100% (1)

- FRIA NotesDocument6 pagesFRIA Notesaquanesse21100% (1)

- FRIA Finals ReviewerDocument15 pagesFRIA Finals ReviewerSamantha Reyes100% (1)

- Pdic LawDocument28 pagesPdic LawPaul Christian Lopez Fiedacan100% (2)

- BP 22 Bouncing Checks LawDocument4 pagesBP 22 Bouncing Checks LawLe Obm SizzlingNo ratings yet

- RA 10142 Financial Rehabilitation and Insolvency ActDocument25 pagesRA 10142 Financial Rehabilitation and Insolvency ActCharles DumasiNo ratings yet

- Philippines Insolvency Laws OverviewDocument194 pagesPhilippines Insolvency Laws OverviewGleir Galaez Guay100% (1)

- Republic Act No. 10142 Financial Rehabilitation and Insolvency Act of 2010Document21 pagesRepublic Act No. 10142 Financial Rehabilitation and Insolvency Act of 2010jasomNo ratings yet

- PDIC LawDocument27 pagesPDIC LawSuzette VillalinoNo ratings yet

- PDIC LAW Lecture NotesDocument3 pagesPDIC LAW Lecture NotesmarkNo ratings yet

- 2.0 Law On Credit Transactions 2.1 Pledge, Real Mortgage and Chattel Mortgage 2.1.1 Nature and RequisitesDocument5 pages2.0 Law On Credit Transactions 2.1 Pledge, Real Mortgage and Chattel Mortgage 2.1.1 Nature and RequisitesChristine Mae Fernandez MataNo ratings yet

- SECURITIES REGULATION CODE (My Own ReviewerDocument18 pagesSECURITIES REGULATION CODE (My Own ReviewerMaritesCatayong100% (5)

- Bulk Sales Law ReviewerDocument2 pagesBulk Sales Law ReviewerJojoNo ratings yet

- NOTES - Philippine Competition Act (PCA)Document6 pagesNOTES - Philippine Competition Act (PCA)JUAN MIGUEL GUZMANNo ratings yet

- Basic Queries About Money Laundering & The Anti-Money Laundering Act (Amla)Document19 pagesBasic Queries About Money Laundering & The Anti-Money Laundering Act (Amla)Agapito De Asis100% (2)

- Law On Secrecy of Bank Deposits and AMLA Case DigestsDocument21 pagesLaw On Secrecy of Bank Deposits and AMLA Case DigestsWan Wan100% (2)

- FRIA LectureDocument25 pagesFRIA LectureErika Angela GalceranNo ratings yet

- Cpat Reviewer - AmlaDocument3 pagesCpat Reviewer - AmlaZaaavnn Vannnnn100% (1)

- BK SECRECY LAWDocument5 pagesBK SECRECY LAWClem UyNo ratings yet

- SSS ReviewerDocument23 pagesSSS ReviewerAbbie Kwan100% (1)

- Sales (Maceda, Recto, PD 957)Document10 pagesSales (Maceda, Recto, PD 957)KfMaeAseronNo ratings yet

- Jurists Lecture (Securities Regulation Code)Document16 pagesJurists Lecture (Securities Regulation Code)Lee Anne Yabut100% (1)

- PCA encourages competition in PH marketsDocument6 pagesPCA encourages competition in PH marketsRay MalingiNo ratings yet

- FRIA Flow Chart FinalDocument44 pagesFRIA Flow Chart Finalamun din78% (9)

- Banking Laws SummaryDocument13 pagesBanking Laws SummaryTwentyNo ratings yet

- RFBT Reviewer - Revised Corporation CodeDocument57 pagesRFBT Reviewer - Revised Corporation CodeDanna De Pano100% (1)

- QUICKNOTES on Revised Corporation CodeDocument11 pagesQUICKNOTES on Revised Corporation CodeMichaelangelo MacabeeNo ratings yet

- Fria Flow Chart 9 Voluntary Liquidation Involuntary LiquidationDocument4 pagesFria Flow Chart 9 Voluntary Liquidation Involuntary LiquidationPaul Dean MarkNo ratings yet

- Financial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaDocument40 pagesFinancial Rehabilitation and Insolvency Act (Fria) : Atty. Ivan Yannick S. Bagayao Cpa, MbaChristoper BalangueNo ratings yet

- FRIA LawDocument15 pagesFRIA LawDonnNo ratings yet

- Pledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeDocument26 pagesPledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeAmie Jane MirandaNo ratings yet

- BP 22 Vs EstafaDocument4 pagesBP 22 Vs EstafaMinnie F. LopezNo ratings yet

- 2021 CORPORATE LAW OutlineDocument71 pages2021 CORPORATE LAW OutlineEliza Flores100% (2)

- Notes SSSDocument5 pagesNotes SSSaquanesse21No ratings yet

- Or Debtor's Business Operations Prior ToDocument8 pagesOr Debtor's Business Operations Prior ToZeah Viendell CruzatNo ratings yet

- Financial Rehabilitation Act SummaryDocument25 pagesFinancial Rehabilitation Act SummaryNaiza Mae R. Binayao100% (2)

- Financial Rehabilitation Act SummaryDocument27 pagesFinancial Rehabilitation Act SummaryNIKKA C MARCELONo ratings yet

- FRIADocument12 pagesFRIAbartabatoes rerunNo ratings yet

- (FRIA) of 2010: RA 10142 Financial Rehabilitation and Insolvency ActDocument14 pages(FRIA) of 2010: RA 10142 Financial Rehabilitation and Insolvency ActStephen ParaisoNo ratings yet

- Lecture Notes 2-FRIADocument5 pagesLecture Notes 2-FRIAAndre G. LagamiaNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument7 pagesFinancial Rehabilitation and Insolvency ActChristine BagindaNo ratings yet

- Banking Laws Chapters 19 21Document40 pagesBanking Laws Chapters 19 21john uyNo ratings yet

- Fria ReviewerdocDocument20 pagesFria ReviewerdocMaureen Kaye PaloNo ratings yet

- Fria OutlineDocument17 pagesFria OutlineKristine VillanuevaNo ratings yet

- Delsan Transport Lines, Inc. v. CADocument6 pagesDelsan Transport Lines, Inc. v. CALara DelleNo ratings yet

- Conflicts of Laws: CHAPTER 19: Real and Personal PropertiesDocument11 pagesConflicts of Laws: CHAPTER 19: Real and Personal PropertiesLara DelleNo ratings yet

- Conflicts Nov 6Document5 pagesConflicts Nov 6Lara DelleNo ratings yet

- Republic of The Philippines Manila en Banc: Supreme CourtDocument26 pagesRepublic of The Philippines Manila en Banc: Supreme CourtLara DelleNo ratings yet

- Case Assignment 1Document4 pagesCase Assignment 1Lara DelleNo ratings yet

- Mayer Steel Pipe Corp Vs CADocument3 pagesMayer Steel Pipe Corp Vs CAIrish M. DiosomitoNo ratings yet

- GENERAL PROVISIONS Case DigestsDocument13 pagesGENERAL PROVISIONS Case DigestsLara DelleNo ratings yet

- Supreme Court rules Filipinas insurance policy ceased for German-controlled firmDocument3 pagesSupreme Court rules Filipinas insurance policy ceased for German-controlled firmCases M7No ratings yet

- A. The Country To Which The Vessel Belongs Is The Locus DelictiDocument5 pagesA. The Country To Which The Vessel Belongs Is The Locus DelictiLara DelleNo ratings yet

- Philippines Supreme Court Ruling on Insurance Policy ViolationDocument7 pagesPhilippines Supreme Court Ruling on Insurance Policy ViolationLara DelleNo ratings yet

- Southern Luzon Employees' Assoc. vs. GolpeoDocument3 pagesSouthern Luzon Employees' Assoc. vs. GolpeoLara DelleNo ratings yet

- Republic of The Philippines Manila: Supreme CourtDocument15 pagesRepublic of The Philippines Manila: Supreme CourtLara DelleNo ratings yet

- Case DigestsDocument11 pagesCase DigestsLara DelleNo ratings yet

- Florendo v. Philam Plans, Inc.Document5 pagesFlorendo v. Philam Plans, Inc.Lara DelleNo ratings yet

- Delsan Transport Lines, Inc. v. CADocument6 pagesDelsan Transport Lines, Inc. v. CALara DelleNo ratings yet

- Sample FormatDocument5 pagesSample FormatKaren AdlawanNo ratings yet

- BEGINO Vs ABS CBNDocument1 pageBEGINO Vs ABS CBNLara DelleNo ratings yet

- Supreme Court Rules on Insurance Coverage Dispute Over Hijacked GoodsDocument10 pagesSupreme Court Rules on Insurance Coverage Dispute Over Hijacked GoodsLara DelleNo ratings yet

- ANSWER (Quieting of Title)Document9 pagesANSWER (Quieting of Title)Lara DelleNo ratings yet

- Contract To SellDocument3 pagesContract To SellLara DelleNo ratings yet

- CONSOLIDATED PUBLIC ATTORNEY%u2019S OFFICE LEGAL FORMS v1 - 0Document196 pagesCONSOLIDATED PUBLIC ATTORNEY%u2019S OFFICE LEGAL FORMS v1 - 0ErrolJohnFaminianoFopalanNo ratings yet

- Corporation's power to sue and be suedDocument7 pagesCorporation's power to sue and be suedLara DelleNo ratings yet

- Notary Public Acknowledgment DocumentDocument2 pagesNotary Public Acknowledgment DocumentLara DelleNo ratings yet

- Assignment No 9Document19 pagesAssignment No 9Lara DelleNo ratings yet

- Revised Rules On EvidenceDocument14 pagesRevised Rules On EvidenceArche Udtohan Gaudel100% (1)

- Module 1 Civil Law ReviewDocument6 pagesModule 1 Civil Law ReviewLara DelleNo ratings yet

- Module 1 Civil Law ReviewDocument6 pagesModule 1 Civil Law ReviewLara DelleNo ratings yet

- CORPO Case Digests 020921Document6 pagesCORPO Case Digests 020921Lara DelleNo ratings yet

- Matling Industrial and Commercial Corporation Vs Coros Facts: RulingDocument4 pagesMatling Industrial and Commercial Corporation Vs Coros Facts: RulingLara DelleNo ratings yet

- Recitation Q&a 032921Document4 pagesRecitation Q&a 032921Lara DelleNo ratings yet

- Jo Chung Cang vs. Pacific Commercial Co.Document11 pagesJo Chung Cang vs. Pacific Commercial Co.Aaron CariñoNo ratings yet

- Camarilla Status Packet ExplainedDocument17 pagesCamarilla Status Packet ExplainedLee Richard100% (1)

- Roman V ABC Digest - Warehouse ReceiptsDocument1 pageRoman V ABC Digest - Warehouse ReceiptsLook ArtNo ratings yet

- Validation Proof of ClaimDocument4 pagesValidation Proof of Claimroyalarch13100% (5)

- CA Erred in Granting ReceivershipDocument2 pagesCA Erred in Granting ReceivershipHector Mayel MacapagalNo ratings yet

- Contract of IndemnityDocument17 pagesContract of IndemnityNiraj PandeyNo ratings yet

- Deal Memo Real Estate Investment ManagerDocument7 pagesDeal Memo Real Estate Investment Managermtharan100% (1)

- Courts and Banks - Effects of Judicial Enforcement On Credit MarketsDocument43 pagesCourts and Banks - Effects of Judicial Enforcement On Credit Marketsvidovdan9852No ratings yet

- Sheriff Fined for Failing to Properly Execute WritDocument2 pagesSheriff Fined for Failing to Properly Execute WritMarky RamoneNo ratings yet

- 2011 Commercial Law Bar Questions and AnswersDocument34 pages2011 Commercial Law Bar Questions and AnswersSam Fajardo0% (2)

- Credit Training PackDocument37 pagesCredit Training PackSohailuddin AlaviNo ratings yet

- Supreme Court Rules on Liability of Partners in Workmen's Compensation CaseDocument6 pagesSupreme Court Rules on Liability of Partners in Workmen's Compensation Caseyangkee_17No ratings yet

- Maria Antonia Siguan vs. Rosa Lim, Linde Lim, Ingrid Lim and Neil Lim, G.R. No. 134685, November 19, 1999.Document6 pagesMaria Antonia Siguan vs. Rosa Lim, Linde Lim, Ingrid Lim and Neil Lim, G.R. No. 134685, November 19, 1999.Fides DamascoNo ratings yet

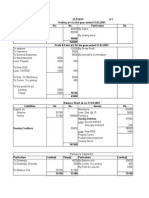

- Amalgamation, Absorption & External Reconstruction: Chapter-IDocument15 pagesAmalgamation, Absorption & External Reconstruction: Chapter-Ibharat wankhedeNo ratings yet

- Cipla Performance AnalysisDocument33 pagesCipla Performance Analysis9987303726No ratings yet

- MF GLOBAL HOLDINGS LTD., AS PLAN ADMINISTRATOR AND CORZINE ComplaintDocument149 pagesMF GLOBAL HOLDINGS LTD., AS PLAN ADMINISTRATOR AND CORZINE ComplaintACELitigationWatchNo ratings yet

- Sale of GoodsDocument27 pagesSale of GoodsPavel Shibanov100% (3)

- Extinguishing An Obligations Payment and CompensationDocument28 pagesExtinguishing An Obligations Payment and CompensationAnonymous dvDBzOcJCNo ratings yet

- LegalEthicsDigest - Cayetano vs. Monsod, 201 SCRA 210 (September 1991)Document2 pagesLegalEthicsDigest - Cayetano vs. Monsod, 201 SCRA 210 (September 1991)Lu CasNo ratings yet

- Answer Sheet v-1 24052014Document7 pagesAnswer Sheet v-1 24052014psawant77No ratings yet

- Liability of Attorney as Guarantor in Wise & Co. vs Tanglao CaseDocument1 pageLiability of Attorney as Guarantor in Wise & Co. vs Tanglao CaseAices SalvadorNo ratings yet

- Chattel Mortgage: What Is A Chattel?Document8 pagesChattel Mortgage: What Is A Chattel?Erica Dela CruzNo ratings yet

- Kaizen Builders vs. ApostolDocument30 pagesKaizen Builders vs. Apostollyka timanNo ratings yet

- Los Abogados de Levidow: Sanción Por Mal Uso de ChatGPTDocument43 pagesLos Abogados de Levidow: Sanción Por Mal Uso de ChatGPTDialogo con la JurisprudenciaNo ratings yet

- (Outline) Business AssociationDocument109 pages(Outline) Business AssociationSihangZhangNo ratings yet

- Advanced Accounting Baker Test Bank - Chap020Document31 pagesAdvanced Accounting Baker Test Bank - Chap020donkazotey100% (2)

- Pretest (Clean)Document3 pagesPretest (Clean)CharlesNo ratings yet

- IBC 2016: Key Provisions of the Insolvency and Bankruptcy CodeDocument15 pagesIBC 2016: Key Provisions of the Insolvency and Bankruptcy CodeRam IyerNo ratings yet

- Case Note Judgment of The Supreme Court in The Essar Steel CaseDocument9 pagesCase Note Judgment of The Supreme Court in The Essar Steel CaseSakthi NathanNo ratings yet

- Business LawDocument36 pagesBusiness LawSu MinNo ratings yet