Professional Documents

Culture Documents

Invoice To: Despatch To

Uploaded by

AYUSH PRADHANOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invoice To: Despatch To

Uploaded by

AYUSH PRADHANCopyright:

Available Formats

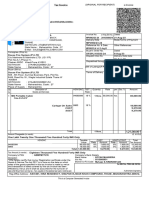

TAX INVOICE

(U/R. 46 of CGST Rules, 2017 read with Sec.31 of CGST Act, 2017)

(U/R. 46 of TNGST Rules, 2017 read with Sec.31 of TNGST Act, 2017)

HYUNDAI MOTOR INDIA LIMITED

CIN : U29309TN1996PLC035377

Plot No. H-1, SIPCOT Industrial Park, Irrungattukottai,

Sriperumbudur Taluk,

Kancheepuram District - 602117.

Tel : 044 - 47100600. Fax : 044 - 47100600.

IRN:093b91bffb71438fe0a478fd07a75dafa58f529654fe8a8ac927c93469d7cb97

Invoice No. : 201000181201 State Code : 33 G.S.T. Regstn No. : 33AAACH2364M1ZM

Invoice Date. : 19.10.2020 PAN No. : AAACH2364M

Place of Supply : Uttar Pradesh Tax Payable under Reverse Charge : NO

Invoice to : Despatch to :

Dealer Code : A10AGN3267 PR CARS LLP

G.S.T. Regstn No. : 09AAVFP5622J1ZL PLOT NO. 607, VILLAGE MAURA

PR CARS LLP NEAR MC SAXENA COLLEGE MALL JEHTA ROAD

439/6 KA,PEER BUKHARA, HARDOI ROAD LUCKNOW

OPPOSITE KALICHARAN INTER COLLEGE Uttar Pradesh

LUCKNOW

Uttar Pradesh

HYP / HPA : State Bank Of India Ltd.

Description of Goods/Services Amount

HSN CODE :8703.31.91

SVS61MC57 D072 1 QTY

i20 Magna 1.5 CRDi MT

Basic Price (EX-Works) 577,634.00

Freight Charges 22,694.00

Insurance Charges 80.00

Transaction Value 600,408.00

SGST @ 0.00 % 0.00

CGST @ 0.00 % 0.00

IGST @ 28.00 % 168,114.24

Comp.Cess @ 3.00 % 18,012.24

Total 786,534.48

TCS @ 0.075 % 590.00

Grand Total 787,124.48

VIN / Chassis No. Engine No. Key No. Colour

MALBG514LLM010717*K D4FALM087811 M0909 PWT

Total Invoice value (In Words)

RUPEES SEVEN LAKH EIGHTY SEVEN THOUSAND ONE HUNDRED TWENTY FOUR Rupees FORTY EIGHT Paise

Total Goods and Services Tax Payable (In Words)

RUPEES ONE LAKH SIXTY EIGHT THOUSAND ONE HUNDRED FOURTEEN Rupees TWENTY FOUR Paise

Total Compensation Cess Payable (In Words)

RUPEES EIGHTEEN THOUSAND TWELVE Rupees TWENTY FOUR Paise

TERMS & CONDITIONS OF SALE TO DEALERS:

1. The sale as covered by the invoice is governed only by the Warranty as quoted in "Warranty & Service Booklet" supplied with each new

vehicle.

2. The Payment shall be through A/c payee Demand Draft in favour of Hyundai Motor India Ltd., drawn on a schedule bank at Chennai or

through NEFT / RTGS to the account of Hyundai Motor India Ltd.,

3. The sales are subject to force Majeure clause.

4. The price, duties, levies and taxes are as applicable on the date of sale. However, all additional liabilities that may arise at a future date

due to any revision in such duties, levies, taxes, etc. shall also be borne by the buyer.

5. The sale of goods are ex-factory wherein, the risk and responsibility passes in the goods once they are invoiced and put on the common

carrier for dispatch from Irungattukottai or ex-warehouse / ex-depot if sale is made from ex-warehouse /ex-depot. Hence any expenses For Hyundai Motor India Limited

towards transportation and transit insurance will be to the buyers account.

6. Any dispute or difference or claim between the Company and the dealer / buyer in or in relation to the terms of the dealership agreement / Signer: Bimal V

sale agreement or this sale are agreed to be settled by recourse to arbitration in the city of Chennai. Date: Mon, Oct 19, 2020 18:59:58 IST

Location: Chennai

7. Hyundai Motor India Ltd. reserves the right to change the sale procedure, colour & model specifications without notice.

You might also like

- Interest Certificate: Shivam Garg and Ramkrishna GargDocument1 pageInterest Certificate: Shivam Garg and Ramkrishna GargShivamNo ratings yet

- Amazon BlazerDocument1 pageAmazon BlazerRomNo ratings yet

- Mphasis PF Guidelines for Employees With PF Numbers Starting KN/16573 and KN/46330Document10 pagesMphasis PF Guidelines for Employees With PF Numbers Starting KN/16573 and KN/46330Binoy Xavier RajuNo ratings yet

- Tax Invoice for Fitness TreadmillDocument1 pageTax Invoice for Fitness Treadmill65 KgNo ratings yet

- Life Motors: Shantanu BLDG, Shop No8/9, Pawar Nagar, Thane (West), Thane:400601Document2 pagesLife Motors: Shantanu BLDG, Shop No8/9, Pawar Nagar, Thane (West), Thane:400601abhishek pandeyNo ratings yet

- Elss - Fy 2021-22Document2 pagesElss - Fy 2021-22Amit SinghNo ratings yet

- Rent Paid Receipt: Revenue Stamp Rs.1Document1 pageRent Paid Receipt: Revenue Stamp Rs.1Pankaj AgarwalNo ratings yet

- Airtel DecemberDocument1 pageAirtel DecemberAnkur MishraNo ratings yet

- Chief Minister'S Relief FundDocument1 pageChief Minister'S Relief FundsrikantaNo ratings yet

- Leave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDocument6 pagesLeave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateAnonymous eCmTYonQ84No ratings yet

- Paf Base Welfare Filling Station: Arrow Head PetroliumDocument1 pagePaf Base Welfare Filling Station: Arrow Head PetroliumNeelesh ShirkeNo ratings yet

- UntitledDocument1 pageUntitledhumanNo ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Dengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateDocument1 pageDengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateAbhishek GoelNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- TG1628 School Fees I PDFDocument1 pageTG1628 School Fees I PDFAnandKumarPNo ratings yet

- ThyrocareDocument1 pageThyrocareAnkitChamoliNo ratings yet

- MedicalimDocument1 pageMedicalimsaurabhNo ratings yet

- Tax invoice for furniture purchaseDocument1 pageTax invoice for furniture purchaseRajnish JainNo ratings yet

- PaymentDocument1 pagePaymentPrasad PanditNo ratings yet

- Gym BillDocument1 pageGym BillShaikh RizwanNo ratings yet

- FeeReceipt 1 4502Document1 pageFeeReceipt 1 4502ManKap100% (1)

- Airtel Prepaid Recharge !Document1 pageAirtel Prepaid Recharge !vignesh_sundaresan_1No ratings yet

- PremiumRept MDS - RameshDocument2 pagesPremiumRept MDS - Rameshnavengg521No ratings yet

- Amc Charges PDFDocument1 pageAmc Charges PDFRiYa ChitkaraNo ratings yet

- Bill 12sep2023Document1 pageBill 12sep2023UR12ME148 PrafullaNo ratings yet

- Bharat Sanchar Nigam Limited: (A Govt. of India Enterprise)Document1 pageBharat Sanchar Nigam Limited: (A Govt. of India Enterprise)Kiran KumarNo ratings yet

- Registration Certificate of Vehicle: Issuing Authority: Madhubani, BiharDocument1 pageRegistration Certificate of Vehicle: Issuing Authority: Madhubani, Bihartabrez alamNo ratings yet

- Renewal Premium Receipt: Policy Number Date & Time AmountDocument1 pageRenewal Premium Receipt: Policy Number Date & Time AmountGokuNo ratings yet

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- Tax Deduction for Health Insurance Premium and Medical ExpensesDocument2 pagesTax Deduction for Health Insurance Premium and Medical ExpensesReeju KarunakaranNo ratings yet

- Screenshot 2023-12-14 at 1.02.56 PMDocument1 pageScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711No ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptDevesh TripathiNo ratings yet

- Donation Receipt for CRPF Wives Welfare AssociationDocument1 pageDonation Receipt for CRPF Wives Welfare AssociationNaveen BansalNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- PolicyDocument1 pagePolicyAlok SinghNo ratings yet

- Lpoiio: For Enquires Appointments Telemedicine Consultations ContactDocument2 pagesLpoiio: For Enquires Appointments Telemedicine Consultations ContactDinesh NallasivamNo ratings yet

- Multiple BillDocument2 pagesMultiple Billsachin sharmaNo ratings yet

- PPF Statement YTD Dec'23Document1 pagePPF Statement YTD Dec'23sumanpal78No ratings yet

- REG NO: KA28EU8808: Registration Certificate For VehicleDocument1 pageREG NO: KA28EU8808: Registration Certificate For VehicleMD ZubairNo ratings yet

- Self - 16sep22 - ELSS StatementDocument1 pageSelf - 16sep22 - ELSS Statementaju3167No ratings yet

- Tax Invoice for Arasi Soaps Coconut Oil Bath SoapDocument1 pageTax Invoice for Arasi Soaps Coconut Oil Bath SoapSreedharNo ratings yet

- HealthifyMe TransfrmStudio InvoiceDocument1 pageHealthifyMe TransfrmStudio InvoiceLifekeepers FoundationNo ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- 1 Makemytrip PDFDocument1 page1 Makemytrip PDFZusnsxnxNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFAkshay Shamrao GhanwatNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)MSM serviceNo ratings yet

- InvoiceDocument1 pageInvoiceAnonymous hoYLBuGNo ratings yet

- Branch Code 05999 Home Loan Interest CertificateDocument1 pageBranch Code 05999 Home Loan Interest CertificateKRIS BARSAGADE100% (1)

- HDFC Loan Approval for Consumer Durable PurchaseDocument1 pageHDFC Loan Approval for Consumer Durable PurchaseSâñjây Bîñd0% (1)

- Car Rental RecieptDocument1 pageCar Rental RecieptAnonymous rtDlncdNo ratings yet

- Certificate of Registration-Form 23Document1 pageCertificate of Registration-Form 23Joy GudivadaNo ratings yet

- Sample BSNL Bill PDFDocument3 pagesSample BSNL Bill PDFAjay KumarNo ratings yet

- LIC Online Payment ReceiptDocument4 pagesLIC Online Payment ReceiptAkriti SinghNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFbiswaNo ratings yet

- TAX INVOICE FOR HYUNDAI CAR SALEDocument1 pageTAX INVOICE FOR HYUNDAI CAR SALEAYUSH PRADHANNo ratings yet

- 082 Douse FireDocument4 pages082 Douse Firemetalcabin36No ratings yet

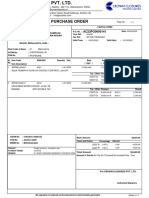

- 158 Prathmesh Po-Ac22po0600141Document1 page158 Prathmesh Po-Ac22po0600141Prathmesh EntNo ratings yet

- Sun Earth Painting - Proforma InvoiceDocument1 pageSun Earth Painting - Proforma Invoicebhikam jainNo ratings yet

- Suyash Pradhan New ResumeDocument2 pagesSuyash Pradhan New ResumeAYUSH PRADHANNo ratings yet

- Narain AutomobilesDocument1 pageNarain AutomobilesAYUSH PRADHANNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument16 pagesBajaj Allianz General Insurance Company LTDAYUSH PRADHANNo ratings yet

- Goldrush Sales & Services LTD.: PRICE LIST WEF 19.01.2022Document1 pageGoldrush Sales & Services LTD.: PRICE LIST WEF 19.01.2022AYUSH PRADHANNo ratings yet

- Narain AutomobilesDocument1 pageNarain AutomobilesAYUSH PRADHANNo ratings yet

- Suyash Pradhane 2 EDocument2 pagesSuyash Pradhane 2 EAYUSH PRADHANNo ratings yet

- 2018-19 - 222 - Jatin MotwaniDocument11 pages2018-19 - 222 - Jatin MotwaniAYUSH PRADHANNo ratings yet

- CertificateDocument1 pageCertificateAYUSH PRADHANNo ratings yet

- SRM Motors Pvt. Ltd. Goldrush Sales & Services Ltd Ledger AccountDocument16 pagesSRM Motors Pvt. Ltd. Goldrush Sales & Services Ltd Ledger AccountAYUSH PRADHANNo ratings yet

- Assignment Marks: 30: InstructionsDocument3 pagesAssignment Marks: 30: InstructionsAYUSH PRADHANNo ratings yet

- International Finance - Assigment September 2017 JN6LWcz6TDDocument3 pagesInternational Finance - Assigment September 2017 JN6LWcz6TDA Kaur Marwah100% (1)

- Tax Invoice: Hyundai Motor India LimitedDocument1 pageTax Invoice: Hyundai Motor India LimitedAYUSH PRADHANNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument16 pagesBajaj Allianz General Insurance Company LTDAYUSH PRADHANNo ratings yet

- International Finance - Assigment September 2017 JN6LWcz6TDDocument3 pagesInternational Finance - Assigment September 2017 JN6LWcz6TDA Kaur Marwah100% (1)

- NMIMS Marketing AssignmentDocument2 pagesNMIMS Marketing AssignmentRaj Aryan YadavNo ratings yet

- International Finance - Assigment September 2017 JN6LWcz6TDDocument3 pagesInternational Finance - Assigment September 2017 JN6LWcz6TDA Kaur Marwah100% (1)

- Dec'13Document1 pageDec'13ashish10mca9394100% (1)

- Invoice PrintDocument1 pageInvoice PrintAYUSH PRADHANNo ratings yet

- CGST & Central Excise - Range OfficeDocument2 pagesCGST & Central Excise - Range OfficeAYUSH PRADHANNo ratings yet

- CGST & Central Excise - Range OfficeDocument2 pagesCGST & Central Excise - Range OfficeAYUSH PRADHANNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- Aditya Birla Insurance Brokers provides Hyundai car insuranceDocument3 pagesAditya Birla Insurance Brokers provides Hyundai car insuranceAYUSH PRADHANNo ratings yet

- CGST & Central Excise - Range OfficeDocument2 pagesCGST & Central Excise - Range OfficeAYUSH PRADHANNo ratings yet

- Aditya Birla Insurance Brokers provides Hyundai car insuranceDocument3 pagesAditya Birla Insurance Brokers provides Hyundai car insuranceAYUSH PRADHANNo ratings yet

- Alcazar Marketing Launch KitDocument6 pagesAlcazar Marketing Launch KitAYUSH PRADHANNo ratings yet

- Aditya Birla Insurance Brokers provides Hyundai car insuranceDocument3 pagesAditya Birla Insurance Brokers provides Hyundai car insuranceAYUSH PRADHANNo ratings yet

- Medical Professionals GuidelineDocument8 pagesMedical Professionals GuidelineAYUSH PRADHANNo ratings yet

- Ravi UpadhyayDocument3 pagesRavi UpadhyayAYUSH PRADHANNo ratings yet

- Aditya Birla Insurance Brokers provides Hyundai car insuranceDocument3 pagesAditya Birla Insurance Brokers provides Hyundai car insuranceAYUSH PRADHANNo ratings yet

- Mr. Riyaz Ahamd Khan PolicyDocument3 pagesMr. Riyaz Ahamd Khan PolicyAYUSH PRADHANNo ratings yet

- Export of Services: BY PL - SubramanianDocument31 pagesExport of Services: BY PL - SubramanianArun KennethNo ratings yet

- O.R RateDocument2 pagesO.R RatesinghincorporationNo ratings yet

- Fkcci Sept 2012Document40 pagesFkcci Sept 2012Varghese AlexNo ratings yet

- HTTP://WWW - Ascgroup.in/mag/asc Times Jun 18th Jun 23rd PDFDocument16 pagesHTTP://WWW - Ascgroup.in/mag/asc Times Jun 18th Jun 23rd PDFDigital marketerNo ratings yet

- Time of Supply GSTDocument51 pagesTime of Supply GSTSONICK THUKKANINo ratings yet

- Ideal Spacio Draft AgreementDocument30 pagesIdeal Spacio Draft AgreementMandeep SinghNo ratings yet

- 74811bos60500 cp2Document102 pages74811bos60500 cp2Kapil KumarNo ratings yet

- 1 Proforma of Allotment LetterDocument32 pages1 Proforma of Allotment LetterGovind SandhaNo ratings yet

- MR - MD Samiullah: Page 1 of 1 M-2263937Document1 pageMR - MD Samiullah: Page 1 of 1 M-2263937Notty AmreshNo ratings yet

- 164291xsports April 10Document8 pages164291xsports April 10Maria ProstoNo ratings yet

- Laxmi Timber 2 BillDocument1 pageLaxmi Timber 2 BillAcma Renu SinghaniaNo ratings yet

- SSS - Volume 1 of 2 (Part 1 of 3)Document196 pagesSSS - Volume 1 of 2 (Part 1 of 3)kokuei100% (1)

- Fixedline and broadband bill detailsDocument24 pagesFixedline and broadband bill detailsCharu MehtaNo ratings yet

- Customs Officer Duties & Career PathDocument22 pagesCustoms Officer Duties & Career PathR K MeenaNo ratings yet

- Your Tata Docomo Bill Account NoDocument2 pagesYour Tata Docomo Bill Account NoSuman RoyNo ratings yet

- Accounting Journal Entries For Taxation Excise Service Tax Tds Accounts Knowledge Hub PDFDocument8 pagesAccounting Journal Entries For Taxation Excise Service Tax Tds Accounts Knowledge Hub PDFCHANDRASHEKAR SHAMANNANo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsRajNo ratings yet

- Npcil Guide LineDocument29 pagesNpcil Guide LineKedar ChoksiNo ratings yet

- Enjoy your passions even in retirementDocument5 pagesEnjoy your passions even in retirementmuzpatNo ratings yet

- CAPEX Audit Programme and ManualDocument19 pagesCAPEX Audit Programme and Manualpriyaannand100% (5)

- Resonance Information Leaflet 2017-18Document16 pagesResonance Information Leaflet 2017-18Resonance EduventuresNo ratings yet

- Transaction Journal Posting Flow of Purchase CycleDocument8 pagesTransaction Journal Posting Flow of Purchase Cyclemukiiraeve100% (1)

- Ficci Pre Budget Memorandum 2015 16Document194 pagesFicci Pre Budget Memorandum 2015 16Viral SavlaNo ratings yet

- Design BidDocument57 pagesDesign BidpraveenNo ratings yet

- Background of Works Contract Under GST Works Contract" Means A Contract For BuildingDocument4 pagesBackground of Works Contract Under GST Works Contract" Means A Contract For BuildingSATYANARAYANA MOTAMARRINo ratings yet

- Brochure FTREDocument37 pagesBrochure FTREArindam AhlawatNo ratings yet

- Objective Type Questions and Answers On Central ExciseDocument5 pagesObjective Type Questions and Answers On Central ExciseGayathri Prasad Gayathri0% (2)

- Karnataka RERA Proforma Allotment LetterDocument29 pagesKarnataka RERA Proforma Allotment Letterddafny99No ratings yet

- GST - Final Presentation On Mutual Funds Sector - FINALDocument44 pagesGST - Final Presentation On Mutual Funds Sector - FINALSulochana ChoudhuryNo ratings yet

- Godrej Office Furniture Rate Contract DetailsDocument33 pagesGodrej Office Furniture Rate Contract DetailsjalapallyNo ratings yet