Professional Documents

Culture Documents

Business Combinations - Questions 1

Business Combinations - Questions 1

Uploaded by

Savya Sachi0 ratings0% found this document useful (0 votes)

164 views15 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

164 views15 pagesBusiness Combinations - Questions 1

Business Combinations - Questions 1

Uploaded by

Savya SachiCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

Seda |

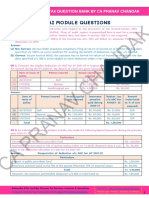

Consolidated Financial Statements

Ind AS 27, 28, 103, 110, 111, 112

Part 1: Calculations

Question 1

Ram Lid. acquires Shyam Ltd. by purchasing 60% of its equity for

value of non-controlling interest is determined as 10 lakh. The

h in cash. The fair

ate value of

[Gentifable assets and labilties, as measured in accordance with Ind AS 108 is delermined na te

lakh,

How much goodwill is recognized based on two:méasuretent bases of r olling interest

(NI)?

(Study Material)

Answer

A. NCI is measured at NCI’s proportionate share of the acquiree’s identifiable net assets

Ram Ltd, recganizss 100% of the identifiable net assets on the acquisition date and decides to

measure NCI at proportionate share.(40%) of Shyam Ltd. identifiable net assets,

Ine Joumal entry fecorded én the acquisition date for the 60% interest acquired is as folows (in

lakhs):

Dr. (@in tok) Cx (inten

Identifiable net assets Dr. 5

Goodwill (Balancing figure) Dr 12

To Cash | 15

To NCI | 2

fapn SS lakh x 40%) = & 2 lakh. Hence, goodwill of € 12 lakh is calculated as consideration €15

lakh plus NCIX 2 lakh less identifiable net assets and liabilities @ 5 lakh,

{The goodwill recognized under Ind AS 103, therefore, represents entity A's 60% share of the total

Scr attributable to Shyam Ltd. It does not include any amount of goodwill attributable to 40sec

Nel

B. NCI is measured atfair value

Ihe facts are as above, but Ram Ltd decides to measure NCI at flr value rather than at its share

of identifiable net assets.

878 Chap. 14 © Consolidated Financial Statements ind AS 27, 28, 403, 149

fe fet Value of NCI is determined as F 10 lakh (given in the question), which is the sa

{alr value on a per-share basis of in Purchased interest,

The acquirer recognizes at the acqui ition date

{100% ofthe identitable net assets

(ii) NCl at fair value, ang

(ii) Gooawit

[;he joumal entry recorded on the Scquisition date for the 60% interest acquired is as

lakhs):

[De ein taxny Cr in aka

or. | 5

Or,

'dentifiable net assets

Goodwill (Batancing figure) }

2 eee —|___

etefore, goodwil recognized where INClis measured at fair value ag er Ind AS 103 repm

ihe group's share to total goodwin attributable to Shyam Lt@. and tre NCI's share o

Geedwill attributable to Shyam Lita

ere hn

Question 2

Sesta Ltd. acquires Geeta’ lit by purthasing 70% of iis quity for @ 15 lakh in cash

Yaiue of NCI is deteritined ase 6 ere Managemtient have elected to adopt full goodwill mm

and to.measure NChat fair vais ndard i evalu of the identifiable assets ove!

asiMeasured in accordance w “fandard is determined as % 22 lai (Tax conse

ING Taoree)

fi

Answer

The, Bargain purchase gain is o Iculated as follow

Fair value of consideration transferred

Fair value of NC}

Fair value of previously held equity interest

| [ess: Recognised vaiue of 100% ‘he Net identifiable assets, measured in|

accordance with the standards

Gain on bargain purchase (4

par assets Is greater than the fair value

The recognized amount of the identifable

I roe scrallon transferred plus fair value or NCI. Therefore, a bargain purchane gain of & 0.

'S recognized in income statement

Chap. 14 « Consolidated Financial Statements Ind AS 27, 28, 103, 110, 114, 112 879

The journal entry recorded on the acquisition date for 70% interest is as follows:

(Cin lakh) | Cr. @in lakh)

Identifiable net assets 22.00

To Gash 15.00

To Gain on bargain purchase 0.10

ToNCI 6.90

Since NCI is required to be recorded at fair value, a bargain purchase is recognized for € 0.1 lakh.

Re a

Question 3

Continuing the facts as stated in the above illustration, except that Seta Ltd..chooses to

measure NCI using a proportionate share method for this business combination. (Tax

equences have been ignored).

This method calculates the bargain purchase same as under the fair value matfiod, except that

Cl is measured as the proportionate share of the identifiable net assets

e bargain purchase gain is as.follo

| (in takh)

air value of consideration wansterre 15.00 |

Fair value of NCI (30% of € 22:0 lak) 6.60

Fair value of previously héldCequity interest NIA

21.60

Less: Recognised value of 100% of the net identifiable assets, measured in| (22.00)

‘cordance with the standards

ain on bargain pure

As the recognized amount of the identifiable net assets is greater than the fair

sideration transferred, plus the recognized amount of NCI (at proportionate share), @ bargain

;chase gain of ¥ 0.4 lakh is recognized in the income statement.

The journal entry recorded on the acquisition date for 70% interest is as follows:

I Dr.(€in lakh) | Cr. (in lakh)

éentifiable net assets Dr, 22.0

To Cash 15.0

To Gain on bargain purchase 04

ToNCI 66

inder the proportionate share method, NCI is recorded at its proportionate share of its net

entifiable assets and not at fair value.

kk

880 Chap. 14 Consolidated Financial Statements Ind AS 27, 28, 103, 110, 111

Question 4

X Ltd, acquired Y Ltd. on payment of € 25 crore cash and transferring a retail business, the

value of which is € 15 crore,

Assets acquired and liabilities assumed in the acquisition are % 36 crore. Find out the Goodwi

Answer

i (All figures are &

Fair value of the consideration paid (& 25 or + € 15 cr)

Fair value of assets acquired net of fair value of liabilities assumed

Goodwill

Pictiniit ove

Question 5

Raja Ltd. purchased 60% shares of Ram Ltd. paying & 525 lakh. Number of issued capital of Ram

Lid. is 1 lakh. Fair value of identifiable assets of Ram Ltd. is ® 640 lakh and that of liabilities i ®

50 lakh,

As on the date of acquisition, market price per share of Ram Ltd. is ¥ 775. Find out the value a

goodwill

(Study Mate

Answer sz

(Fin take

(i) Fair value of consideration

(i) Fair value of non-contfoling interest (40% x 1 lakh x &'775)

Fic yalle’of ide!

Léss; Fair Value of liabilities,

| Fait.value’of Net ldéntitied Assets (B)

Goodwill ((A)= (B)]

Note! When goodwill is measured taking non-controlling interest at fair value, itis often termed =e

full goodwill

On the other hi

assets.

[iis

(i) Fair value of consideration paid

Proportionate value of non-controlling interest (40% x 590 lakh)

Fair value of identified assets

Minus fair value of liabilities

Fair value of Net assets (B)

Goodwill (A)-(8)]

0,111,112

ness, the fair

| Goodwil

fudy Material)

in crore)

40

(38)

4

al of Ram

ties is ©

© value of

dy Material

Fein tak |

625

Chap. 14 « Consolidated Financial Statements Ind AS 27, 28, 103, 110, 111, 112 881

When non-controliing interest is measured at proportionate share of net asset, the goodwill is

popularly termed as partial goodwill

x ek ok

Question 6

Entity D has a 40% interest in entity E. The carrying value of the equity interest, which has been

‘accounted for as an associate in accordance with IND AS 28 is %40 lakh. Entity D purchases the

remaining 60% interest in entity E for 600 lakh in cash. The fair value of the 40% previously held

equity interest is determined to be 400 lakh., the net aggregate value of the identifiable assets

and liabilities measured in accordance with Ind AS 103 is determined to be identifiable %880 lakh

‘The tax consequences have been ignored. How does entity D account for the business

‘combination?

(Study Material)

Answer

Entity D recognizes at the acquisition date:

(i) 100% of the identifiable net assets.

(i) Goodwill as the excess of 1 over 2 below:

The aggregate of:

+ Consideration transferred

+. The amount of any fon controlling interest (Not applicable in this example)

combination attiieved in stages, the acquisition date fair value of

viously held equity interest in the acquire.

2. The assets and the liabilities recognized in accordance with Ind AS 103.

The journal entry recorded on the date of acquisition of the 60% controlling interest is as follows:

‘Consolidated Statement - Journal Dr. cr.

i |(¢ in takh) (& in lakh)

identifiable net assets Dr.| 880

Goodwill | pr. | 120

To Cash 600

To Associate interest 40 |

To Gain on equity interest (to be recognized in inc 360 |

statement) J}

Goodwill is calculated as follows:

Fair value of consideration transferred

Fair value of previously held equity interest

Less: Recognised value of 100% of the identifiable net assets, measured in| (880)

accordance with the standards

Goodilrecognised [a0

Chap. 14 # Consolidated Financial Statements Ind AS 27, 28, 103, 1

he gain on the 40% previously held equity interest is recognized in the income state

{air value of the previously held equity interest less the carrying value of the previously h

interest is ¥ 360 lakh (400 — 40).

Cie RIHICE

Question 7

A Lid, acquired 70% of equity shares of B Ltd. on 1,04.20X1 at cost of & 10,00,000 when

hrad an equity share capital of ® 10,00,000 and other equity of ¢ 60,000. In the four e

years B Ltd. fared badly and suffered losses of € 2,50,000, ¢ 4,00,000, & 5,00,000 and ¢ ¢

mecpectively. Thereafter in 20X5-20X6, B Ltd. experienced turnaround and registered a

Profit of ® 0,000. In the next two years i.e. 20X6-20X7 and 20X7-20X8, B Lta, recor

Profits of © 1,00,000 and ¥ 1,50,000 respectively. Show the non- controlling intereste

Control at the end of each year for the purpose of consolidation,

Assume that the assets are at fair value.

Answer

Year Profitiloss Non-| Additional | NCI's share

controlling | Consolidated of losses

Interest borne by A

Ltd.

© | Balance

| Atthe time of 3,24,000

acquisition in (WN)

20xXi

20x1-20x2 2150,000) 75,000), 175,000) |

12.000

2038 20%4 (6.00000) [120000] (260.000

(e000 |

20%4.20x5 (4.20000)| 6.000)| (24.000)

| (67.000)

(20X5-20X6 5 0 15,000 | 35,000 |

| 20x6-20x7 100,000 | __ 30,000 70,000

(12,000)

33,000 |

Chap. 14 » Consolidated Financial Statements Ind AS 27, 28, 103, 110, 114, 112 883

Working Note:

Calculation of Non-controlling interest: z

Share Capital 10,00,000

Other equity 80,000

Total 10,80,000

30% « 10,80,000) | 3,24,000

Nel

NCI is measured at NCI's proportionate share of the acquiree’s identifiable net assets.

(Considering the carrying amount of share capital & other equity to be fair value]

Calculation of Goodwill! cost of control: x

Consideration +10,00,000

Non-controlling interest 3,24,000

Loss: Net Assets (10,80,000)

| Goodwin 2,44,000

Question 8

From the followin;

(1) Non-co ition and at the date of consolidation using

proportionate share method:

(2) Goodwill or Gain on bargain purctias

(3) Amaunt of holding company’s profit in the consolidated Balance Sheet assuming holding

company's own fetained eamings to be ¥ 2,00,000 in each case

Case Subsidiary eof Cost _Date of Acquisi Consolidation date

company shares 1.04.20%1 31.03.20x2

‘owned

Share Retained Share_—Retained

Capital earnings Capital earnings |

(Al (e) Ic 1)

A 90% 1,40,000 1,00,000 50,000 1,00,000 70,000

85% 1,04,000 1,00,000 30,000 1,00,000 20,000

c 56,000 50,000 20,000 $0,000 20,000

D 100% 1,00,000 50,000 40,000 50,000 _—_—§5,000

The company has adopted an accounting policy to measure Non-controlling interest at NCI's

proportionate share of the acquiree’s identifiable net assets.

(Study Materi

884

Answer

Chap. 14 © Consolidated Financial Statements Ind AS 27, 28, 103, 110, 4

(1) Non- controlling Interest = the equity in a subsidiary not attributable, directly or

toa parent. Equity is the residual interest in the assets of an enterprise after de

its liabilities i.e. in this given case Share Capital + statement of Profit & Loss (As

to be the Net aggregate value of identifiable assets in accordance with Ind AS

h % Shares Non-controiling interest _ Non-controlling int=raam

! ‘Owned by as at the dato of as at the date of

. NCI [E] acquisition consolidation

(E]x[A+8] (1X Ic +0)

> Case 1 [100 - 90} 10% 15,000 17,000

| Case 2 (100 - 85] 15% 19,500 18,000

Case 3 [100 - 80] 20% 14,000 16,000

Case 4 [100 - 100] Nil Ni Nil

(2) Calculation of Goodwill or Gain on bargain purchase

Consideration | Non- Net [ Gooawitt Gain on

{cl controlting {Identifiable | 1ey+uj—-| bargain

interest assets t! Purchase

sw | wen) U-(6)-

40,000. | 15,000 5000 | 7

1,04,000: 19,500° 6,500

00 44,000 Nil N

K gop00 | 0 | _ 90,000 10,000 - @

(9) Th balance in the Statement of Profit & Loss on the date of acquisition (1.04.2036) ml

Capital Profit, as such the balance of Consolidated Profit & Loss Account shal

to Holding Co.'s Profi.

On 31.03.20X2 in each case the following amount shall be added or deducted

balance of holding Co.'s Retained earnings,

| % Share | Retained Retained Retained ‘Amount to Be

Holding earnings as | earnings as on earnings post- | added/(deductes)

i om on consolidation | acquisition

31.03.20x1 | “Date tM] | In]=[M]—[L] | Retained earningall

. wu [0] = [K] xN

Sy 1 90% 50,000 70,000 20,000 18,000

2 85% | 30,000 20,000 (10,000) (8,500)

3 0% 20,000 30,000 | — 10,000

4 100% 40,000 | 85,000 15,000 _|

steakintinke

Chap. 14 * Consolidated Financial Statements ind AS 27, 28, 103, 110, 111, 112 885

Question 9

P bought S on the 1 July 20X1. S retained earings at 31 December 20X1 are 715,000 and S

profit for the year was 8,000. Immediately after acquisition, P gave S a loan of 240,000 which

Carried interest of 10%,

What were S retained eamings at acquisition?

(Dip. IFRS — UK)

‘Answer: Normally, to find S retained earnings at acquisition, S profit could be time apportioned to

find the post acquisition profit. If the intra-group loan didn't exist, then S post acquisition profit

would be 74,000 (6/12 x 8,000). This would make retained eamings at acquisition 711,000

(@15,000 at year end less post acquisition profits of 74,000),

However, the intra-group loan skews the results of S. While S has made a profit of 8,000, there

is a %2,000 finance cost (%40,000 x 10% x 6/12) in the post acquisition period which’ would not

have existed in the first six months.

Therefore the underlying profit without that interest is 710,000, 75,000 must have been made in

each 6 month period, with the additional 22,000 interest in the post acquisition period taking the

post acquisition profit down to £3,000.

Therefore retained earings at acquisition will be 712,000

000 les %3,000 post acquisition)

and the post acquisition profits to go to consolidated retained earnings aré €3,000.

x em

Question 10

D acquired 80% of the ordinary share capital of C on 31 December 20X6 for 278,000. At this date

the net assetsiofC were 785,000

What goddwill aftses on the:acquisition.

(i)_ if the NCI is valuéd using the proportion of net assets method

(ii) if the NCiig valued using the fair value method and the fair value of the NCI on the

acquisition dates 0

(Dip. IFRS ~ UK)

Answer: z

() Parent holding (investment) at fair value 78,000

NCI value at acquisition

(20% x %85,000) 47,000

95,000

Less:

Fair value of net assets at acquisition

Goodwill on acquisition

(i) Parent holding (investment) at fair value 78,000

NCI value at acquisition 19,000

97,000

Less: (85,000)

Fair value of net assets at acquisition

Goodwill on acquisition 12,000

* kok

886 Chap. 14 Consolidated Financial Statements Ind AS 27, 28, 103, 110, 4

Question 11

J Ltd acquires 24 million 71 shares (80%) of the ordinary shares of B Ltd by offering a st

share exchange of two shares for every three shares acquired in B Ltd and a cash payment at

per share payable three years later. J Ltd shares have a nominal value of 21 and a current m

value of %2. The cost of capital is 10% and €1 receivable in 3 years can be taken as 70.75

(Calculate the cost of investment and show the journals to record it in J Ltd accous

(ii) Show how the discount would be unwound.

(Dip. IFRS

Answer:

(i) Cost of investment

Deferred cash (at present value)

20.75 x (¥1 x 24m)

Shares exchange

(24m x 2/3) x 82

50m is the cost of investment for the purposes of the calculation of goodwill

Journals in J Ltd individual accounts:

Dr Cost of investment in subsidiah

Non-current liabilities “ deferred consideration

Share capital (16 million shates issued x €1-Aominal value)

‘Share premium (16 million shares issued x %1 premium element)

Unwinding the discount

18m x 10% = T.8m

Finarice coe

Cr’ Nonicurrent liabilities - deferred consideration

For the next three years the discount will be unwound, taking the interest to finance =m

Until the full £24 million payment is made in Year 3.

a Mina,

Question 12

Sompany A acquired 90% equity interest in Company B on April 1, 2010 for a cons

85 crores in a distress sale. Company B did not have any instrument recognised in e

Company appointed a registered valuer with whose assistance, the Company val

value of NCI and the fair value identifiable net assels at % 15 crores and

respectively. Required

Find the value at which NCI has to be shown in the financial statements

Answer

In this case, Company A has the option to measure NCI as follows:

* Option 1: Measure NCI at fair value i.e., ® 15 crores as derived by the value!

Chap. 14 » Consolidated Financial Statements Ind AS 27, 28, 103, 110, 111, 112 887

* Option 2: Measure NCI as proportion of fair value of identifiable net assets i.e., % 10

crores (100 crores x 10%)

Aiton nes ks

Question 13

Company A acquires 70 percent of Company $ on January 1, 20X1 for consideration transferred

of @ 5 million. Company A intends to recognise the NCI at proportionate share of fair value of

identifiable net assets. With the assistance of a suitably qualified valuation professional, A

measures the identifiable net assets of B at 7 10 million. A performs a review and determines that

the business combination did not include any transactions that should be accounted for

separately from the business combination

Required

State whether the procedures followed by A and the resulting measu

not. Also calculate the bargain purchase gain in the process.

ments are appropriate or

(Study Material)

Answer

The amount of B's identifiable net assets exceeds the fair v

plus the fair value of the NCI in B, resulting in an initial indication of a gain on a bargain purchase.

Accordingly, A reviews the procedures it used to identify and measure the identifiable net assets

acquired, to measure the fair value of both.the NCI and the consideration transferred, and to

identify transactions that were not part of the

ue oF the ‘consideration transferred

isiness combination

Following that review, A concludes that the procedures followed and the resulting measurements

were appropriate, @)

4,00,00,000

rere (60,00,000

000)

Gain on bargain paralié

eae ae)

Question 14

On 4st January, 20X1, A Ltd. acquires 80 per cent of the equity interests of B Ltd. in exchange for

cash of €15 crore. The former owners of B Ltd. were required to dispose off their investments in B

Ltd. by a specified date, and accordingly they did not have sufficient time to find potential buyers.

A qualified valuation professional hired by the management of A Ltd. measures the identifiable

net assets acquired, in accordance with the requirements of Ind AS 103, at 20 crore and the fair

value of the 20 per cent non-controlling interest in B Ltd. at 4.2 crore. How should A Ltd.

recognise the above bargain purchase?

(Study Materia

Answer

‘The amount of B Ltd's identifiable net assets i.e., 220 crore exceeds the fair value of the

consideration transferred plus the fair value of the non-controlling interest in B Ltd. Le. 719.2

crore. Therefore, A Ltd. should review the procedures it used to identify and measure the net

assets acquired and the-fair value of non-controlling interest in B Lid. and the consideration

transferred. After the review, A Ltd. decides that the procedures and resulting measures were

888 Chap. 14 + Consolidated Financial State,

appropriate. A Ltd. measures the gain

the difference between the amount of crore and

of purchase consideration ‘on-controlling interest, which is &19.2 ero

consideration of 15 crore and fair value of Non-controling interest of &4.2 crore).

Assuming there exists clear evidence of the

Combination as a bargain purchase,

calculated at 280 lakh, which

date and accumulated the same

It the acquirer chose to measure

Proportionate share of ot recognised a

Maul nag interest would be £4 crore (220 crore v0 20). The gain on the bargain purcha

‘would be €1 crore 20 crore - (715 crore + &4 crore)

ek &

Question 15

Gompany A and Company B are in power business. Company A holds 25% of oq uity

pompany 8. On November 1, Company. A obtains control of Company B wher it

further 65% of Company B's shares, ‘hereby resuling in a total holding of 90% ‘The

had the following features:

* Gonsideration: Company A transters cash of ¢ °,00:000 andiissues 1,0

Sp November 1. The market price of Comoe A's Shares on the date of issue

share. The equity shares issued as per tie transaction will coniprise 5°

acquisition equity capital of Company.

Gontingent consideration: Company A agrees to-Bay additional consi

¥°7,00,000 if the- cumulative, profits of c mpany:B exceed F 70,00,000 over th

Years.-At the acqui itis ng cd probable that the extra

will be ‘paid, T He of 8 contingent consideration is determined ta te

acduisition de

‘Transaction costs:-Com; sts of ® 1,00,000,

Non-controlling interests is determined to be #7

at. the acquisition date based on m ny A elects to

olling. interest at fair value for th

Previously held non- i A has owne:

shares in Company B years. At November 1, the investment is in

Company A's consolidated statement of Financial position at 6,00,000, arcou

vale, ne eauity method: the fair value is ® 20,0000,

ihe fair value of Company B's net identiiable assets at November 1 is € 60,00,0%

in accordance with ind AS 103,

Required

Determine the accounting under acquisition method for the business combination by Comp

Answer

St us evaluate each of the steps discussed in the above analysis:

Identify the acquirer

In this case, Company A has paid cash to pderation to shareholders of Company

hates issued to Company B pursuant to the ‘2cquisition do not transfer control of

ta wile shareholders of Company 8. Therchag Company A is the a:

the acquirer.

Chap. 14 « Consolidated Financial Statements ind AS 27, 28, 103, 110, 114, 112 889

Determine acquisition date

As the control over the business of Company B is transferred to Company A on November 1, that

da nsidered as the acquisition date.

Determine the purchase consideration

The purchase consideration in this case will comprise the following:

Cash consideration ®.59,00,000

Equity shares issued (1,00,000 x 10 te., at fair value) % 410,00,000

‘Contingent consideration (at fair value) %3,00,000

Fair value of previously held interest % 20,00,000

‘As such, the total purchase consideration is € 92,00,000.

‘Acquisition cost incurred by and on behalf of the Company A for acquisition of Company B should

be recognised in the Statement of profit and loss. As such, an amount of % 1,00,000 should be

recognised in Statement of profit and loss.

Determine fair value of identifiable assets and liabilities

‘The fair value of identifiable net assets is determined at % 60,00,000

Measure NCI

‘The management has decided to recognis:

recognised at € 7,50,000.

Re-measure previously held interests in cas@ business combination is achieved in stages

In this case, the control has:beén acquired in stages i.e., betore acquisition to control, the

Company A exercised significant infllence over Company 8: As such, the previously held interest

should bestfeasured at fair value and the differefice between the fair value and the carrying

amount as, athe actuisition dat ‘ecognised in Statement of Profit and Loss. As such.

it of 114,001000 (i... 20, 00,000) will be recognised in Statement of profit

the NCI at its fair valtie, AS such, the NCI will be

bul. be

0000

Determination of goodwill or gain on bargain purchase

Goodwill ¢hould be

alculated as follows: ®)

Total consideration ~_92,00,000

Recognised amount of any non-controlling interest 7,50,000

Less: fair value of Lila-Domestic’s net identifiable assets (60,00,000)

| Goodwit! _ 39,50,000

ke ok ok

Question 16

On ‘st April, 20X1, POR Ltd. acquired 30% of the voting ordinary shares of XYZ Ltd. for €8,000

crore. POR Ltd. accounts its investment in XYZ Ltd. using equity method as prescribed under Ind

AS 28. At 31st March, 20X2, PQR Ltd. recognised its share of the net asset changes of XYZ Ltd.

using equity accounting as follows:

(in crore)

Share of profit or loss 700}

Share of exchange difference in OCI 100]

‘Share of revaluation reserve of PPI

inocl 50

890 Chap. 14 © Consolidated Financial Statements Ind AS 27, 28, 103, 110, 11

The carrying amount of the investment in the associate on 31st March, 20X2 was ther

£8,850 crore (8,000 + 700 + 100 + 50),

On 1st April, 20X2, POR Ltd. acquired the remaining 70% of XYZ Ltd. for cash 25,000

The following additional information is relevant at that date:

(in cron}

Fair value of the 30% interest already owned

Fair value ofXYZ's identifiable net assets

How should such business combination be accounted for?

(Study Mate

ph 42 of Ind AS 103 provides that in a business combination achieved in sta

acquirer shall remeasure its previously held equity interest in the acquiree at its acquisitio

fair value and recognise the resulting gain or loss, if any, in profit or loss or other comprehy

income, as appropriate. In prior reporting periods, the acquirer may have recognized chan

the value of its equity interest in the acquire in other comprehensive income. If so, t

that was recognised in other comprehensive income shall be recognised on the same bi

would be required if the acquirer had disposed directly of the previously held equity interes!

Applying the above, POR Ltd. records the following entry in olidated financial stateme

1 Snell

Deb) Cre

Foreign cumericy translation reserve Dr. 100

PPE révaluatioti reserv Dr. 50

To Cash

To.tnvestment in'associate -XYZ Ltd.

To Retained earings (W.N.2)

dn previously held interest in XYZ. recognised in Profit or loss|

|r

Working Notes:

1. Calculation of Goodwill

ICash consideration

|Adc: Fair value of previously held equity interest in XYZ Ltd

Total consideration

Less: Fair value of identifiable net assets acquired

[Goodwill

2. The credit to retained earnings represents the reversal of the unrealized gain

Other Comprehensive Income related to the revaluation of property, plant and

accordance with Ind AS 16, this amount is not reclassified to profit or loss.

Chap. 14 * Consolidated Financial Statements Ind AS 27, 28, 103, 110, 111, 112

oot

3.The gan on th previously held uty interest in XYZ Lid calotaad osfolon

Fa Value of 0% reat XYZ at fap RE 2.000

NS jevacess nsec cE Bos

150)

Piveciod gn proven recoeed in O61 $00

Ganon previounly held terest in XYZ i, recopisd in rt ros a

250

FOI = (oh MN) ke

Question 17

On April 1, 20X1, Company A acq

quired 5% of the equity share capital of Company B for 1,00,000.

A accounts for its invest men

in B at Fair Value through OCI (FVOCI) under Ind AS 109, Finan

instruments: Recognition and Measurement. At March 31, 20X2, A carried its investment in B at

air value and reported an unrealised gain of ® 5,000 in other comprehensive income, which was

Presented as a separate component of equity. On April 1, 20X2, A obtains control of B by

acquiring the remaining 95 percent of B.

Required

Comment on the treatment to be done b

ven in the question

(Study Material)

Answer

1e acquisitioh date A Pog

be recycled to/income ‘statement

ould be at fair value and therefore

ombination. The fair value of the

onsideration for the @5:per

£:5,000'in OCI as the gain or loss is not allowed

Fequirement of Ind AS 109. A's investment in B

equire remeasurement as a result of the business

Percent investment (1,05,000) plus the fair value of the

jewly acquired interest is included in the acquisition accounting,

ke kk

Part 2: Treatment

Question 18

Z Ltd. purchased 80% shares of ABC Lid. on

ABC Lid., on 1st April, 20X1

% 60,000.

1st April, 20X1 for Z 1,40,000. The issued capital

was € 1,00,000 and the balance in the statement of Profit & Loss

/ear ending on 31st March, 20X2 ABC Ltd, has earned a profit of ¥ 20,000

ame time, declared and paid a dividend of 2 30,000

ume, the fair value of Non-controlling interest is

Purchased interest. All net assets are identifiable net assets, there are no non-identifiable

sets. The fair value of identifiable net assets is € 1,50,000

w by an entry how the dividend should be recorded in the books of XYZ Ltd.

Rat is the amount of non-controlling interest as on 1st April, 20X1 and 3ist \

Value method. Also pass a Journal entry on the acquisition Date.

and at the

same as the fair value on a per-share basis of

farch, 20X2 using

(Str “taterial

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Atul Agarwal IDT Question BankDocument490 pagesAtul Agarwal IDT Question BankSavya Sachi100% (8)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Organic and Inorganic Compounds Around UsDocument6 pagesOrganic and Inorganic Compounds Around UsSavya Sachi100% (1)

- Economics Amendments Part 1 National IncomeDocument11 pagesEconomics Amendments Part 1 National IncomeSavya Sachi100% (1)

- Dividend Decision NotesDocument6 pagesDividend Decision NotesSavya SachiNo ratings yet

- Chapter 19 Professional EthicsDocument26 pagesChapter 19 Professional EthicsSavya SachiNo ratings yet

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- Dividend Decision Question-3Document10 pagesDividend Decision Question-3Savya Sachi50% (2)

- Unit 7: Ind AS-40: Investment PropertyDocument13 pagesUnit 7: Ind AS-40: Investment PropertySavya SachiNo ratings yet

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocument25 pages7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiNo ratings yet

- InD As 41 - Agriculture BookDocument5 pagesInD As 41 - Agriculture BookSavya SachiNo ratings yet

- Accounts - Past Years Que CompilationDocument393 pagesAccounts - Past Years Que CompilationSavya SachiNo ratings yet

- SA Charts ICAI Student's Journal J21Document17 pagesSA Charts ICAI Student's Journal J21Savya Sachi100% (1)

- SA Charts ICAI Part 2Document15 pagesSA Charts ICAI Part 2Savya SachiNo ratings yet

- Property, Plant and Equipment-Case Studies: Supplementary Material Prime Ca-Advanced Financial ReportingDocument4 pagesProperty, Plant and Equipment-Case Studies: Supplementary Material Prime Ca-Advanced Financial ReportingSavya SachiNo ratings yet

- Ch-2 Audit PlanningDocument3 pagesCh-2 Audit PlanningSavya Sachi100% (1)

- Merger and Acquisition Notes (Pavan Karmele)Document33 pagesMerger and Acquisition Notes (Pavan Karmele)Savya SachiNo ratings yet