Professional Documents

Culture Documents

Resa AP q2 PDF Free

Resa AP q2 PDF Free

Uploaded by

paul0 ratings0% found this document useful (0 votes)

57 views14 pagesOriginal Title

Pdfcoffee.com Resa AP q2 PDF Free (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views14 pagesResa AP q2 PDF Free

Resa AP q2 PDF Free

Uploaded by

paulCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 14

ReSA

3) The Review School of Accountancy

‘Tel. No. 735-9807 & 734-3989

AUDITING PROBLEMS. IRENEO/ESPENILLA

QUIZZER 2 - AUDIT OF STOCKHOLDERS’ EQUITY

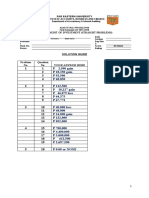

A partial list of the accounts and ending account balances taken from the post-closing trial

balance of ALPHA CORPORATION on December 31, 2014 is shown as follows:

‘Account Amount

Accumulated profits - unappropriated 410,000

Bonds payable 220,000

Ordinary shares subscribed 50,000

Long term investments in equity securities 210,000

‘Additional paid-in capital on ordinary shares 460,000

Premium on bonds payable 30,000

Authorized ordinary shares at P10 par value 900,000

Preference shares subscribed 45,000

Additional paid-in capital on preference shares 112,000

Authorized preference shares at P50 par value

Gain on sale of treasury shares

Unrealized increase in value of securities available for sale

Ordinary share warrants outstanding

Unissued ordinary shares

Unissued preference shares

Cash dividends payable ~ preference

Donated capital

Reserve for bond sinking fund

Reserve for depreciation

Revaluation increment in properties

‘Subscription receivable ~ preference (long term)

‘Subscription receivable ~ common (long term)

REQUIRED:

Compute the following:

A 8 c D

1. Ordinary shares issued 950,000 900,000 450,000 400,000

2. Preference shares issued 445,000 490,000 345,000 300,000

3. Additional paid-in capital 592,000 596,000 621,000 651,000

3. Total contributed capital 4,332,000 1,352,000 1,377,000 3,381,000

5. Total legal capital 1395000 1,300,000 795,000 700,000

6. Total stockholders’ equity 2'744,000 —2/244,000 2,114,000 2,144,000

PROBLEM 2: The stockholders’ equity of the WPC as of December 31, 2013 was as follows:

‘Common stock, P10 par, authorized 300,000 shares;

250,000 shares issued and outstanding 2,500,000

Paid-in capital in excess of par 3,750,000

Retained earnings 1,800,000

‘On June 1, 2014, WPC reacquired 40,000 shares of its common stock at P40 per share. The following

transactions occurred in 2014 with regard these shares:

July 4, Sold 15,000 treasury shares at P45,

Suty 45, 2 for 4 share split

‘Aug. 15, Sold 34,000 treasury shares at P15.

Sept. 1, Retired 2,000 shares.

Based on the information provided, determine the correct balances of the following:

A B c D

7. Treasury stock 310,000 280,000 130,000 _ 205,000

8. Common stock 2,490,000 2,500,000 2,460,000 2,210,000

9. Paid-in capital in excess of par 3,750,00 3,720,000 3,735,000 3,810,000

10. Paid-in capital from treasury stock 450,000" 60,000" 75,000 0

11, Retained earnings 1,690,000 1,810,000 1,825,000 1,905,000

PROBLEM 3: In the course of your first time audit of MISAMIS INC.’s stockholder’s equity accounts for

the audit year 2014, the following schedule of the company's stockholder’s equity accounts as of

December 31, 2013 were presented by the client:

‘Ordinary share capital, P100 par; 200,000 shares authorized; 50,000

shares issued and outstanding; options to purchase 10,000 shares at P100

per share are held by employees, no value having been assigned to these

ReSA: The Review School of Accounts) Page 2 of 14

options 5,000,000

Share premium from ordinary shares 1,000,000

3,000,000

Accumulated profits

Further investigation and inquiry reveaied the following intormation:

a. The options referred to above were granted to each of its 100 employees on January 1, 2012

which shall vest three years thereafter provided employees remain in the company’s employ and

Provided further that sales increase at least by an average of 5% per year. Ifthe sales increase

by an average of at least 5% pcr year, each year, employees shall receive 100 share options. If

the sales increase by an average of t icant 10% per year, each employee shall receive 200 share

options. If the sales increase by an average of at least 15% per year, each employee shall

receive 300 options.

The fair vaiue of each share option on the grant date was P30 per share, No employee left the

company during the said vesting periad. Records show that average sales increase over the

inclusive vesting period are: 2012, 8%; 2013, 10%, and 2014, 13%.

b. On May 1, 2014, the company issued bonds of P5,000,000 at 120 giving each P1,000 bond a

warrant enabling the holder to purchase 4 shares at P120 per share for a one year period.

Shares were selling for P140 at this time, The market value of bond ex-warrant is 105.

bonds were exercised,

On June 1, 2034, half of the warrants issued wit

4. On August 1, the company issued rights tu shareviolders, permitting holders to acquire for a 60-

day period, 1 share a: P136 with every 5 rights submitted, Shares were selling for P150 at this

time. All but 5,000 of these sights were exercised and additional shares were issued.

The company declarea a PS per share cash dividends on December 15, 2014 payable to

stockholders as of December 31, 2014 on January 31, 2015.

f. Net income before any adjustments amounted to P2,500,000 in 2014.

Required:

12, What is the retroactive adjustment to the beginning accumulated profits account related to the

options granted in 20127

2. P600,000 . P200,000

b. 400,000 d. No adjustment necessary

13. What is the correct credit to the share premium account as a result of the exercise of rights referred

to in item 42

‘a. 250,000 285,000

b. 270,000 ¢ 330,000

14. What is the total Additional Paid in Capital to be presented in the stockholders’ equity portion of the

balance sheet as of December 31, 2014?

a. 3,130,000 2,530,000

b. 3,505,000 4. 2/155,000

15. What is the correct Accumulated Protits as of Dacember 31, 20147

a. 5,145,000 <. 4,745,000

b. 4,900,000 4, 4,545,000

PROBEM 4: Effective April 23, 2614, the shareholders of Cold Corporation approved a 2 for 1 stock split

Of Cold ordinary share and an increase in authorized ordinary shate from 100,000 shares (per value P80

er share) to 200,000 shares (par value P49 per share). Cold’s Shareholders’ Equity accounts

immediately before issuance of the stock split shares were as follows.

Ordinary share (par value P80, 109,00 shares authorized,

50,000 shares outstanding} 4,000,000

Share premium (P12 per share cn the issuance) 600,000

Accumulated profits and losses 5,400,000

The stock split shares were issued on June 30, 201

16. In Cold’s June 30, 2014 statement of sharenolders’ equity, balance of Ordinary share, Share

premium and Accumulated profits and Losses are:

Ordinary share

‘8,000,000

8,000,000

4,000,000

4,000,000

PROBLEM 5: On December 31, 2012, santiagy inc." orainary shares were selling for P55 per share.

On this date, the company creates u compencatory strare option plan for its 70 employees. The plan

document states that each employee may purctiase 500 shares ofits P20 par ordinary shares for P35 per

share after one year if revenues reach P15M, after 2 years if revenues reach P18M, or after three years if

revenues reach P20M. On this date, Lased on a reliable option pricing model, Santiago Inc. estimates

that each option which can be exercisnd up to 2018 under the condition that the employee is still within

the employ of the company, has a fait value of P18.

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY

RgSA: The Review School of Accountancy Page 3 of 14

The company has experience a stable 25% increase in revenues for the past 5 years and reasonably

expects the same trend for the upcoming years.

The following information are available from the company’s records:

Year Actual Remaining Expected

Revenues emnioyees additional

Earned at vear end employee

resignation

2014 P14.sM 68 8

2015 175M 65 5

2016 20.5" 63 .

Forty-five employees exercised their vested options on June 15, 2017 while three employees resigned on

the same year without exercising their cptions, thus were forfeited

Required:

17. What is the compensation expense related to the share option plan to be recognized in the 2014

financial statements?

a. 315,000 207,000

b. 270,000 d. 90,000

18. What is the compensation expence related to the share option plan to be recognized in the 2015

financial statements?

a. 315,000 . 207,000

b. 270,000 4. 90,000

19. What is the balance of the additional paid-in-capital account related to the share options as of

December 31, 20167

a. 207,000 <. 567,000

b. 540,000 4. 630,000

20. What is the balance of the ordinary share option: outstanding account as of December 31, 2017.

a. 135,000 «. 270,000

b. 162,000 d. 405,000

21. What is the resulting Share prermum frorn ihe issuance of shares from the exercise of the employee

options

a. 405,000 ©. 742,500

b, 432,000 9. 877,500

PROBLEM 6: On January, 2014, Pandora Corp. granted to 600 employees, 100 share options each

exercisable after 3 years, subject to the employees staying with the company until the end of 2016,

Options can be exercised if share price increases from P40 at the beginning of 2014 to above P60 at the

end 2016. The share options can be exercised al any timne during the next five years, that is by the end

of 2021. The company estimates the fair value of =he share options on the grant date at PS per option

‘This estimate takes into account the possibility that the share price will exceed P6O per share at the end

of 2016, thus options are exercisable ard the possibility chat the share price will not exceed P60 at the

end of 2016, thus the share options wil be forfeited

‘The following information are-deemed relevant:

Fair value Fair Actual number of Estimated number of

of Shares value of employees actually additional employees

Options leasing the company _ expected to leave the

during the year ‘company by the end

of 2016

Dec. 31. 2014 ps8 Ps 5 45

Dec. 31, 2015 44 3 20 35

Dec. 31, 2016 56 5 30

Requirements:

22. What is the compensation expense in 2014?

‘a. 100,000 b. 91,667 c. 88,333 d. none

23. What is the compensation expense in 2035?

‘a. 100,000 b. 91,657) c. 88,333, 4. none

24, What is the compensation expense in 26167

‘a. 92,500 b. 91,567 c. 88,333 4. none

25. What is the ordinary share options outstanding as of December 31, 2015?

‘a. 180,000 b. 191,667 . 188,333 4. none

(On January, 2014 Jubee Cerp. grants each of its 100 employees in the sales department

share options. The share options will vest at the end of 2016, provided that the employees remain in the

entity’s employ and provided that the volume of sales increases by at least an average of 5% per year. If

the sales volume increase by an average of 5% to 10% per year, each employee will receive 100 options

each. If sales volume increase by 11% to 15%, each employee will receive 200 options each. If sales

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY ~ AP APQ 2 GR fo )

RgSA: The Review School of Accountancy Page 4 of 14

volume increases by more than 15%, each employee will receive 300 options each. Each option can be

exercised to acquire ordinary shares (P100 par) at P120 per share at any time up to December 31, 2017.

On the grant date, the company esumates that the share options have a fair value of P40 per option. The

company also estimates that the volume of saies for the product will increase by an average of 11% to

15% per year. The entity also estimates, based un weighted probability that 20% of the employees will

leave before the end of 2016

By the end of 2014, seven employees have left the company and the entity still estimates that a total of

20 employees will leave by the end of 2016. Product sales have increased by 12% and the entity expects

that this rate will continue over the next 2 years.

By the end of 2015, further five employees left the company. The entity now expects due to low turnover

that 15% of employees will leave by the end of 206, Product sales increased by 20% and expécts the

same increase in 2016,

By the end of 2016, additional two employzcs left, ne entity sales have increased by 16% in 2016.

Requirements:

26. What is the compensation expense in 2044?

a. 640,000 b. 213,333 c. 466,667 4. 352,000

27. What is the compensation expense in 2015?

a. 640,000 b. 213,333 c. 466,667 4. 352,000

28. What is the compensation expense in 2016?

a. 640,000 b. 213,333 <. 466,667 d. 352,000

29. Assuming that’ 60% of the options granted to employees were exercised, the entry to record the

exercise shall require a credit share prensium at’

a. 928,800 b. 925,200 c. 309,600 4. 306,000

30. Assuming that 40% of the options grantec to empioyees expires by the end of 2017, the entry to

record the expiration shall require a credit share premium at:

a. none b. 427,800 . 408,000 4. 400,000

PROBLEM 8: MYX Co. Issued stock appreciation rights to its Chief Operating Officer on January 1, 2012

The stock appreciation rights may be exercised beginning January 1, 2015 provided that the officer is still

Inthe employ of the Company at the date of exercise. Each right provides for a cash payment equal to

the amount the share price of MYX Co. exceed 50. The equivalent number of shares for stock

appreciation rights will be based on the level of sales of the corpany at the date of exercise, as follows

Sales Level (in Millions) Nuraher of SAK to be Granted

250 to P400 10,000

400+ to P750, 415,000

Above P750 20,000

Sales actually achieved by the Company and the stock price at the end of each year are

Year Sales Level Share Price at End of Year

2012 350 million P74

2013 410 million 85

2014 760 million 98

31. What is the compensation expense to be recognized in 2013?

2. 80,000 b. 270,000 ©. 575,000 4. 550,000

32. The entry to record the paymeit to emplovees in'2015 assuming all of the rights are exercised?

‘a. 80,000 b. 525,000 ©. 550,000 . 900,000

33. Assuming the SARs are not yot exercised as at December 31, 2015 and that the fair value of the

‘stock appreciation rights is at P1,000,000, what is the liability for the SAR to be recognized as of

December 31, 2015?

‘a. 500,000 b 525,000 ¢. 900,000 4. 1,000,000

PROBLEM 9: On December 31, 2013, Kalinga Co. issued share appreciation rights to 20 of its

employees. The rights will vest at the end of 3 years provided the employees remain with the company

‘and provided further that the average revenue growth over the same period Is at 10%. The following are

the approved terms of the sald rights

+ If the average revenue is 10 to 15%, each employee will receive 10,000 share appreciation

rights

+ If the average revenue is 16 to 20%, each employee will receive 20,000 appreciation rights,

+ Ifthe average growth more than 20%, each employee will receive 30,000 rights.

(On the grant date, each share appreciation right is determined to have a fair value of P6, Kalinga expects

an average growth rate of 12.5 percent during the 3 year vesting period and that 4 employees will

ultimately resign before the vesting period ends.

‘The following information are available from the company’s records:

Fair Market

AUDITING PROBLEMS - sTOCKWOLDERS' EQUITY = ABQD &

t

ReSA: The Review School of Accountincy Page 5 of 14

Actual revenue Estimated Value of the

growth rate for the resignations — share

Year year appreciation.

rights,

2014 10% 4 6.00

2015 15% 4 6.75

2016 25% 5 7.00

actual

Requirements:

34. How much is the compensation expense in relation to the share appreciation rights to be recognized

in 20147

‘a. 320,000 . 720,000

b. 660,000 d. $60,000

35. How much is the compensation expense in relation to the share appreciation rights to be recognized

in 20157

a. 1,080,000 ¢. 720,000

b. 960,000 d. 400,000

36. How much is the compensation expense in relation to the share appreciation rights to be recognized

in 20167

a. 2,100,000 © 1,710,000

b. 1,820,000 4. 1,380,000

37. What is the liability for the share appreciation rights to be recognized as of December 31, 20167

‘a. 1,440,000 ©. 2,160,000

b. 2/100,000 4. 3,150,000

PROBLEM 10: On December 1, PQR Company declares a property dividend of one share of SMC

ordinary share for every 5 shares of PGR distributable on January 31 the following year. SMC ordinary

shares have a carrying amount of P55 per share, equal to the original cost. The total outstanding PQR

shares is 10,000. SMC shares were held as trading securities.

SMC shares were quoted at P60 per share on Oecember 1, P63 per share on December 31 and P65 per

share on January 31.

38. The entry to record the deciaravcn of the property dividends would include a debit to retained

earnings at:

a0 b. 110,000 10,000 4. 126,000

39. The carrying value of property dividends on December 31 shall be:

a0 bb. 110,000 . 120,000 d. 126,000

40, The entry on January 31 upon the distribution of the dividends shall involve a credit to gain at:

a0 b. 4,000 . 6,000 d. 10,000

M14: On October 31, 2014, ABC Int deciared a building held as owner-occupied property with

{an original life of 10 years as dividend distrihutable to stockholders on January 31 of the following year.

‘This was acquired at P800,000 on October 21, 2013. The property had fair market value P900,000 on

‘October 31, 2014. On December 41, 2034 the value of the property declined to P700,000.

‘The property was transferred to shareholders on January 31 when the prevailing fair value was at

800,000.

41. The entry to record the declaration of the property dividends would include a debit to retained

earnings of:

‘a. 700,000 b. 800,000 900,000 4. 1,000,000

42. How much property dividends payable shsuid be reported in the statement of financial; position as of

December 317

‘a. 700,000 b. 800,000 «. 900,000 4. 1,000,000

43. How much should be charged to the protit ur loss as a result of the remeasurement of the property

dividends payable by December 31, 20147

a. 0 b. 100,000 =. 300,000 4. 200,000

44, What is the gain or loss to be recognized in the profit or losses as a result of the distribution of the

property dividends on January 31?

a0 b. 100,000 . 300,000 4. 200,000

PROBLEM 12: On September 30, 2014 May Company issued 3,000 shares of its P10 par ordinary shares

in connection with a share dividend. No ent.y was made on the share dividend declaration date. The

market value per share immediately after the issuance was P15, May's shareholders’ equity accounts

immediately before issuance of the share dividends were as follows:

Ordinary share, P10 par, 50,C00 shares authorized;

25,000 issued 250,000

Paid in Capital in Excess of Par 300,000

Retained earnings 350,000

es — _ (ER

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY ~ APQ2 ee agsa

ReSA: The Review School of Accountancy Page 6 of 14

Treasury shares, 5,000 shares at cost (40,000)

‘45. What should be the retained earninos balance immediately after the share dividend decla

a. 305,000 b. 32,000 227,54 4d. 350,000

46. Assuming that instead of declaring and issuing 3,000 shares, the company declared and issued 4,000

shares as share dividends, what should be the retained earnings balance immediately after the share

dividend declaration?

a. 310,000 b. 290,000 . 300,000 4. 350,000

jon?

PROBLEM 13: John Q Company deciares # 10% scrip dividends on July 1, 2014 payable a year after

terest. The total par value of the outstanding shares of John Q. is P10,000,000,

47. What is the total appropriation to the retained earnings as a result of the script dividends declaration?

@. 1,000,000 b. 100,060 ©. 112,000, d. 12,000

48. How much interest expense from the script dividends should be recognized in 2015 profit or loss?

2. 100,000 b. 120,000 <. 50,000 4. 60,000

M_14: Orange Company has a retained earnings balance of 400,000 a the end of 2015.

During 2014, it had issued P100,000 of 5-year, 12%, long-term bonds. The bond provisions require that

each year over the 5-year period an additional P20,000 of retained earnings be unavailable for dividends

This restriction is in addition to any other retained earings restriction that the company might make.

During 2015, the company also decided to "self-nsure® against fire losses because of its previous safety

Fecord, and to avoid high insurance premiums. The board of directors decided to restrict retained

earnings at end of each year in an amourit equal to P8,000 annual premium that would have been paid.

49. How much is the total appropriated retained earnings as of December 31, 2015?

a. 108,000 b. 48,000 . 28,000 4. 20,000

PROBLEM 15: You were assigned to audit the Sans Corp's Stockholders’ Equity accounts and the related

capital transactions for its first year of operation ended December 31, 2014. In studying the transactions

you came across the following entries made by the client:

Date Particulars Debit Credit

Jan. 15 Land ‘500,000

Ordinary Shares 500,000

To record the issuance of 50,000 shares of

ordinary in exchange of a real property.

Mar. 1 ‘Subscription receivable 420,000

Ordinary Shares 420,000

To record the subscription of 20,000 shares

of ordinary at P21 per share subscription price.

Jun. 2 Ordinary Shares 125,000

Cash 125,000

To record the acquisitia.: of 5,000 shares of

the company’s own ordinary sisares.

‘Aug.15 Cash 252,000

‘Subscription receivable 252,000

To record the collection for the full payment

of 60% of the subscribed shares on March 1

Sept.2 Cash 40,000

‘Ordinary shares 40,000

To record the reissuanice of half of the

shares reacquied on June 1

Dec. 29 Accumulated profits 750,000

Share premiun: 750,000

To record the grant of 10 employees 5,000

share appreciation rights on the grant date

computed as: (10*5,000*P15)

Audit notes:

a. The company was authorized to issue 100,000 shares of ordinary at P10 par value.

b. The real property received on January 35, were fairly valued at P1,800,000, 30% of which is

attributed to the land with the balance te the building which the company intends to use as a

factory site.

c. The company declared a 4 for 1 share split up on August 31

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY APQ2 (ten

ReSA: The Review School of Accountancy Page 7 of 14

d. The share appreciation rights were granted to 10 of its key employees provided that the

employee stays with the company for 5 years from date of grant and provided further that

average revenue growth rate aver the five-year period is at 10%, each employee will receive

3,000 SAR each; if the average revenue growth rate is 20%, each employee will receive 4,000

SAR each; if the average revenve grovith rate is 30%, each employee will receive 5,000 SAR

each. By the end of the year. ic was ascertained by the management that three of the employees

will leave the company betore the fifth yea: ana projects that the average revenue growth rate

shall be around 25% over ihe five-year period. The prevailing fair value of the stock appreciation

rights by the end of the year war P35

©. On December 30, the Bo21u of Directors approved a P1 per share cash dividends to stockholders

of record as of December 20 payabie on January 30 of the subsequent year.

f. After all the necessary adjusting entries, you ascertained that the correct net income for the year

45 at P1,500,000,

Required

50. What is the balance of the Ordinary share accountt as of December 31, 2014?

a. 557,500 =. 700,000 f

b. 620,000 ¢. 1,000,000

51, What is the correct balance of the Stock appreciation Rights Payable as of December 31, 20147

a. 90,000 © 84,000

b. 105,000 4. 420,000

52. How much is the cash dividends payable as of December 31, 20142

a. 238,000 < 270,000

b. 248,000 4 280,000

53. What is the total Additional Paid in Capital balance as of December 31, 2014?

a. 1,300,000 < 1,520,000

bd. 11,497,500 4. 1,790,000

54, What is the Accumulated profits, uaappropviated balance as of December 31, 2014?

a. 1,500,000 1,145,000

b. 1,477,500 d. 1,207,500

55, What is the total Stockholder.’ equity to be reported in the 2014 statement of financial position?

a. 3,285,000 3,427,500

b. 3/635,000 d. 3,365,000

PROBLEM 16: The shareholders’ equity section of Stuart Company's statement of financial position as of

December 31, 2014, is as follows:

Ordinary shares, P10, par value, authorized,

2,000,000 shares; isswed 400,000 shares 4,000,000

Preference shares, P5 par value; authorized,

1,000,000 shares; issued 200,000 1,000,000

Share premivin - Ordinary shares 1,800,000

Share premium ~ Preference sharas 600,000

Retained earnings 6,000,000

Total 13,400,000

The following transactions occurred during 2015:

Jan. 5 ‘The company issued for P2,350,000, 100,000 ordinary shares and 50,000

preference shares. The company incurred share Issue cost at P150,000. The

ordinary shares were current, selling at P15 per share while the preference

shares at P10.

Feb. 16 50,000 preference shares were subscribed at P12 per share

Mar. 25 20,000 previously unissued ordinary shares were issued in exchange of an

‘equipment having a fair market valve of P500,000. The company incurred share

issue costs at P20,000.

Apr.20 -Reacquired 40,000 crdinary shares as treasury shares at P18 per share.

Jun. 30 The company declared and paid PO.S0 cash dividends to ordinary shares and P1

Per share cash dividends to preference shares.

Bul. 30 Reissued half of the treastiry st.ares at P16 per share.

‘Aug. 30 A 10% ordinary stock dividend was deciared and issued to ordinary shares. Market

value is currently at P17 per shes

Sep. 16 Collected full payments on 80% of the preference shares subscribed on February

16.

Dec. 31 The company declared and paid P0.50 cash dividends to ordinary shares and P1

per share cash dividends to preference shares.

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY 7 “APQ2

ReSA: The Review School of Accountancy Page 8 of 14

Dec. 31 Adjusted net income for the year is at P3,510,000.

Required:

56. The entry to record cash dividends on Jue 30 requires a debit to retained earnings at

a. 560,000 b. $40,000 ©. $75,000 . 585,000

57. The entry to record the reissue treasury stares on July 30 requires a debit to

2. Share premium P40,000

b. Retained earnings P40,000

Share premium P69,00

1d. Retained earnings P80,000

to record the stock dividends on August 30 requires a debit to retained earnings at

a. $00,000 b. $4v,000 ‘¢. 850,000 d. 918,000

59. What is the balance of the share premium in excess over par from ordinary shares as of December

31, 20157

a. 3,040,000 b. 3,152,300 2,842,500 44. 2,730,000

60. What is the balance of the Retained c.arnings - unappropriated as of December 31, 20157

a. 7,436,000 b. 7,465 000 7,403,000 4. 7,145,000

PROBLEM 17: On May, 2013 Bob Inc., was urganized with 3,000,000 authorized shares of P10 par value

ordinary shares, and 300,000 of its ordicary shares were issued for P3,300,000. Net income through

December 31, 2013 was P525,000

On July 23, 2014, when the shares were selling at P13 per share, Bob Inc. issued 500,000 of its ordinary

shares in exchange of @ real estate properties which were fairly valued at P6,250,000. A 5% share

dividend was declared on October 2, 2014, to shareholders of record on October 23, 2014. The market

value of the ordinary shares was P11 per share wn the declaration date. Bob Inc.’s net income for the

year ended December 31, 2014 was 350,900

During 2015, Bob Inc. had the following transactions:

a. In February, Bob Inc. reacquired 30,000 of Its ordinary shares (originally issued in 2013) for P9

er share.

b. In June, Bob Inc. sold 15,000 of its treasury shares for P12 per share.

c. In September, each shareholder was issued (for each share held) one right to purchase two

additional ordinary shares for P13 per snare. The rights shall expire on December 31, 2015,

d. In October, 250,000 rights issues were exercised when the market value of the ordinary shares

was P14 per share.

€. In November, 400,000 rights issues were exercised when the market value of the ordinary shares

was P15 per share

£. On December 15, Bob Inc. deciared it= first cash dividend to shareholders of PO.30 per share,

payable on January 10, 2016, to siiareholders of record on December 31, 2015.

9. On December 31, in accordance with the apelicable law, Bob Inc. formally retired 10,000 of its

treasury shares and had them revert to an unissued basis. The market value of the ordinary

share was P16 per share on this date

fh. Net income for 2015 was 800,000

Based on the information presented above, dctermine the following:

61. The stock dividends declaration on October 2, 2014 includes a debit to retained earnings at

‘a. 400,000 b. 440,000 . 250,000 4. 275,000

62. The cash dividends declaration an December 5", 2915 includes a debit to retained earnings at

a. 349,500 b. 351,000 ©. 637,500 d. 639,000

63. What is the adjusted additional-oaid in capital as of December 31, 2015?

‘a. 5,545,000 b 5,502,000 c. 3,585,000 d. 3,595,000

64, What is the adjusted retained earnings-total (appropriated and unappropriated) balance, as of

December 31, 2015?

a, 885,500 b. 884,000 . $97,500 4. 596,000

65. What is the total stockholders’ equity a5 of December 31, 20157

a. 27,397,500 b. 27,442,500 ©. 14,822,500. 14,867,500

J: The following information has bees taken from the Accumulated profits ledger accounts.

2. Total net income since incorporation 3,200,000

b. Total cash dividends po:d 150,000

C. Carrying value of the company’s equipment declared as

property divided 600,000

4. Proceeds from sale of donated stocks 150,500

. Total value of stock dividends distributed 250,000

Gain on treasury share transaction 375,000

9. Unamortized premium on bonds payable 413,200

hh. Appropriated for plant expansion 700,000

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY

ReSA: The Review School of Accountancy Page 9 of 14

1. Loss on treasury share reissue 515,000

J. Share premium in excess of par fram issued shares 215,000

k. Share issuance expense 45,000

|. Appropriated for remaining treasury shares at cost PS0/share 1,000,000

Additional notes.

+ "The equipment declared as dividends had a recoverable value of P450,000 as of the date of

declaration

+ The stock dividends distributed wes based on a 10% share dividend declared on 100,000, P25 par

value shares issued shares The market value of shares on the date of declaration was at P42 per

share.

+The only transactions affecting the treasury shares were those described in item f and item |

66. How much should be the correct dcoit to retained earnings for the property dividends?

‘a. 600,000 b. 550,000 ‘c. $00,000 d. 450,000

67. How much should be the correct debit to retained earnings for the share dividends?

‘a. 420,000 b. 336,000 ¢. 250,000 d. 200,000

68. How much is the correct balance of the Accumulated retained earnings unappropriated account?

a. 190,000 b. 274,000 . 330,000 d. 424,000

69. What is the balance of the share premiunt from treasury stock transactions?

a0 b. 140,900 . 375,000 d. 515,000

70. The net necessary net adjustment involves an adjustment to additional paid in capital in the amount

of

2. 320,500 b. 365,500 . 460,500 4, 456,500

PROBLEM 19: The Accumulated profit account of Paranaque Company follows:

Date Item De. cr.

07-01-13 Balance

03-31-13 Dividends paid P 20,000

12-31-13 Net income for the year 32,400

04-01-14 Premium on capital. share 15,000

06-30-14 Gain on sale of treasury share 10,000

09-30-14 Dividends declared 30,000

12-31-14 Net income for the year 45,100

‘Appraisal increase of land 30,000

Balance 133,000 a

P18..009

71. What is the adjusted accumulated profits?

‘a. 76,000 ’. 86,000 90,000 . 131,000

During your audit of Remar Corporation for the year 2014, its initial year of operations,

you find the following entries in its" shareholaers’ equity” account:

Date Particulars Or. ce.

Jan. 1 Issuance of 15,000 o:dinary shares of

10 par, authorized 50,609 shares in

exchange for real astate property with a

market value of P200,000 150,000

Jan. 15 Sale of 20,000 ordinary shares at P12 per share 240,000

Mar. 1 Purchase of 2,000 Romar Corporation's

shares at P15 per share 30,000

May 15 Loss on sale of motor equipment 10,000

June 10 Proceeds from sale of 1,000 treasury shares 17,000

Dec. 31 Declared cash dividends payable quarterly

beginning Apr. 1, 2015 20,000

Dec. 31 Net profit for the year 79,000

‘The Stockholders’ equity portion of the balance sheet of the company should show the following adjusted

balances:

A 8 >

72. Ordinary shares 320,000 350,000 500,000

73. Additonal paid-in capital 42,000 92000 ‘40,000

74. Net profit for the year 49,900 69,000 89,000

75. Retained earnings 29.000 49,000 79,000

76. Total stockholders’ equity 446,029 476,000 526,000

77. Book value per share 14.44 14.00 12.82

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY _

ReSA: The Review School of Accountancy Page 10 of 14

over-the-counter market.

PF |24: Wood, Inc. is a public enterprise whose shares are traded in the :

of

At December 31, 2014, Wood had 6,000,000 authorized shares of P10 par value ordinary shares,

Which 2,000,000 shares were issued and outstanding. The shareholders’ equity accounts at December

31, 20013, had the following balances’

Ordinary shares 20,000.000

Additional paid-in capital 7,500,000

‘Accumulated profit 6,500,000

‘Transactions during 2014 and other information

78, Accumulated profits beginning

(as restated) 6,620,000 6,800,000 6,580,000 6,680,000

79, Accumulated profits ending,

Unappropriated 2,100,000 8,250,000 8,090,000 7,990,000

80. Total contributed capita 41,450,000 41,610,000 41,400,000 41,000,000

81. Treasury stocks 320,000 "160,000 ‘210,000 ‘110,000

82, Total stockholders’ equity 49,700,000 49,650,000 49,540,000 49,380,000

PROBLEM 22: On January 1, 2014 the sharenolders’ equity section of Iriga Electronics Company's

balance sheet revealed the following information

5, Convertible preference shares (P40 par value; 50,000

shares authorized, 20,000 shares issued and outstanding 800,000

Ordinary shares (P5 stated value; 200,000 shares authorized,

120,000 shares Issued and outstanding) 600,000

Share premium - Preference shares, 500,000

Share premium - Ordinary shares 1,500,000

Retained earnings 4,500,000

Total shareholders’ equity a-900.000

In addition, the following information is known

1. Cash dividends are declared for preference and ordinary shares on October 31 and April 30 of

each year. Semiannuat cash dividends for ordinary shares are PO.5O.

2. Net income for 2014 was PE60,000, aad for 2015, 890,000.

3. On February 2, 2014, 15,000 ordinary shares were acquired by the company for P33 per share

(assume the cost method)

4. On September 30, 2014, 5,000 preference shares were converted to ordinary shares. One

preference share is convertible into one ordinary share. At the time of conversion, the ordinary

shares had a market value of P42 per share.

5. On December 21, 2014, the co:npany placed a share subscription for 10,000 ordinary shares at a

subscription price of P33 per share. The subscription contract required a cash down payment

equal to 60% of the subscription price, with the balance due on February 1, 2015.

6. On February 1, 2015, 8,500 ordinary shares were issued upon collection in full of the subscription

receivable from the 8,500 shares. Because of default by the subscriber, 1,500 shares were not

Issued, The subscription contract requires the forfeiture of all cash advances.

7. On April 16, 2015, 10,000 shares held in the treasury were reissued at PSO per share.

‘AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY APQ2 (ft)

Rae

The Review School of Accountancy Page 11 of 14

8. On May 16, 2015, a special dividend of preference shares was distributed to ordinary

shareholders. One hundred ordinary shares entitled a shareholder to one preference share. The

market price of preference shares was P40 per share at the time.

Determine the adjusted balances of the following:

83. How much is the corresponding credit to share premium account from the conversion of the preferred

stocks?

‘a. 200,000 b. 25,000 . 175,000 . 300,000

‘84, The entry to record on the default on subscription receivables on February 1, 2015 involves

a. Credit to Share premium at P29,700 . Credit to Share premium at P49,500

D. Credit to Retained earnings at P29,700 __d._ Credit to Retained earnings at P49,500

85. How much is the resulting debit to retainec earnings as a result of the declaration of the special

dividends on May 16, 2015?

a. 51,400 b. 128,500 c. 49,400 4.0

86. How much should be presented in the 2015 balance sheet as treasury shares?

a. 495,000 b. 330,000 ‘c. 165,000 4.0

87. How much is the total cash dividends paid in 2014?

a. 201,713 b. 298,500 . 282,500 d. 284,925

88. How much is the total cash dividends paid in 2015?

a. 201,713 b. 298,500 . 282,500 d. 284,925

PROBLEM 23: The Batangas Corp. has requested you to audit its financial statements for the year

2014. During your audit, Batangas Corp. presented to you its balance sheet as of December 31, 2013

which had the following shareholders’ equity section:

Preference shares, P10 par; 90,000 shares authorized and issued,

of which 9,000 are in the treasury costing P135,000 and

shown as an asset 900,000

Ordinary shares, P4 par value; 900,000 shares authorized, of

which 675,000 shares are issued and outstanding 2,700,000

‘Share premium (P5 per share on preference shares

issued in 2012) 450,000

Allowance for doubtful accounts receivable 18,000

Reserve for depreciation 1,260,000

Reserve for fire insurance 297,000

Accumulated profits 3,375,000

‘Total shareholders’ equity 9,000,000

‘Audit notes:

2. 4,500 treasury shares were sold for P18 per share on August 30, 2014. Batangas Corp. credited

the proceeds to the Preference share account. The treasury shares as of December 31, 2013

‘were acquired in one purchase in 2013.

b. The preference shares carries an annual dividend of P1 per share. The dividend is cumulative.

[As of December 31, 2013, unpaid cumulative dividends amounted to P5 per share. The entire

‘accumulation was liquidated in June 2014, by issuing to the preference shareholders 81,000

ordinary shares.

€. Accash dividend of P1 per share was declared on December 1, 2014 to preference shareholders of

record December 15, 2014. The dividends are payable on January 15, 2015,

1d. At December 31, 2014, the Allowance for Doubtful Accounts Receivable and Reserve for

Depreciation had bafances of P37,500 and P1,575,000, respectively.

e. On March 1, 2014, the Reserve for fire insurance was increased by P90,000; Accumulated profits

was debited.

f. On December 31, 2014, the Reserve for fire insurance was decreased by P45,000 which

represents the carrying value of a machine destroyed by fire on that date. Fire cleanup costs of

P9,000 does not appear in the records

g. The December 31, 2013 Accumulated profits consists of the following

Donated land from a stockholder 675,000

Gains from treasury stock transactions 76,500

Earnings retained in the business. 2,623,500

3,375,000.

fh. Unadjusted net income for the year ended December 31, 2014 was P1,946,250 per company's

books.

Based on the information above, answer the following:

89. What is the adjusted net income for the year ended December 31, 20147

a. 1,946,250 b. 1,973,250 1,937,250 d. 1,892,250

90. What is the correct Additional paid in capital as of December 31, 2014?

a. 1,296,000 b. 1,215,000 . 1,206,000 d. 621,000

&

APQ2 *

AUDITING PROBLEMS - STOCKHOLDERS’ EQUITY _

ReSA: The Review School oi Accountancy

91. What is the correct Appropr

Page 12 of 14

ced accumulated profits as of December 31, 20147

b, 387,000 c. 342,000 a0

‘a. 454,500

92. What is the correct Unappropriated accumulated profits as of December 31, 20147

a, 4,016,250 b. 3,939,750 ¢. 3,935,250 4, 3,867,750

93. What is the total Shareholders’ equity 45 ¢f

PROBLEM 26: In your audit of SV

aiscovered the following charges

Deceniher 31, 20147

5,550,750 b. 8,718,750 . 9,474,750 d. 9,479,250

125 INC. for the calendar year ended December 31, 2014, you

‘company’s Retained Earnings account:

Balance, January 1 7,800,000

Unrealized holding loss on financial assets held as available for sale (400,000)

Inventory fire loss (150,000)

Impairment loss on Property Plant. and Equipment (750,000)

15% Stock dividends declared (100,000 shaves outstanding at P100 par) (1,500,000)

oss on sale of equipment (200,000)

Correction of a prior period error (1,500,000)

Loss on retirement of ordinary shaves as uCestiy (1,050,000)

Gain on sale of ordinary shates az excess over par 4,000,000

Gain on premature retirement 9: 06.798 '300,000

Unrealized holding gain on finariel ascet held at fair value through profit/ioss 300,000

Proceeds from sale of donated shares 800,000

Net income for the year 9,000,000

(3,000,000)

Reserve for plant expansion

Audit Notes

The 15% stock dividends were deciared 01 November 1, 2014 distributable to stockholders as of

December 1, 2014 distributable a1: Januvry 15, 2015. Spurs stocks were selling at P110 on

November 1, P105 on December 1, anu P12 on December 31, 2015.

‘The company's Share premiun: from treasury stock transaction account amounted to P850,000.

‘The company’s management dccided to change its inventory costing method from the weighted

average to the FIFO approach dung the current year The inventory balances under the two

methods are as follows.

AVERAGE FIFO.

Beginning 2,500,000 2,600,000

Ending 1,900,000 2,200,000

‘The company, however, is yet to effect the said change in its current financial statements,

Using the information above, answer the following

‘94. What is the net adjustment to the retaiiec earnings account fer the deciaration of the stock

dividends?

a. no adjustment «100,009

b. 50,000 4, 150,000

95. What is the correct net income for the year 20147

‘a. 9,000,000 . 9,200,000

b. 9,100,000 4. 9,300,000

96. What is the restated beginning retained earnings in 20147

‘2. 6,400,000 ©. 6,200,000

b. 6,300,000 4. 6,100,000

97. What is the correct retained earning: at the end of 20147

‘a, 10,650,000 10,200,000

b. 10,750,000 13,200,000

198. Based on the information above, what is the net adjustment to Additional-paid-in capital?

a. 1,900,000 credit . 1,400,000 credit

b. 850,000 debit 4. 950,000 creait

PROBLEM 25: You have been asked to aucit the financial statements of HEAT INC. as of and for the

period ended December 31, 2014.

During the course of your audit, you were asked to prepare a

Eomparative data from the company's inception to the present. | You ascertained the following

information:

Heat Inc.'s charter became effective on Jenuary 2010, when 40,000 shares of P10 ordinary

shares and 20,000 of 14% cumulative, nenparticipating, preference shares were issued. The

“ordinary shares were sold at P12 pe: share, and the preference shares were sold at its par value

‘of P100 per share.

Heat was unable to pay preferance slividends at the end of its first year. The preference

shareholders agreed to accept 2 shares of common shares for every 50 shares of preference

Shares owned in lieu of the preference dividends due in the first operating year. The said

ordinary shares were issued on January 2, 2011 when the fair market value of the ordinary

shares was at P30.

ITING PROBLEMS - STOCKHOLUE?S’ EQUITY “APQ2

ReSA: The Review School of Accountancy Page 13 of 14

+ Heat acquired all the outstanding stock of Raptors Corporation on May 1, 2012 in exchange for

20,000 Heat ordinary shares.

+ Heat effected a stock split on its ordinary shares 3 for 2 on January 1, 2013 and 2 for 1 on

January 1, 2014

+ Heat offered to convert 20% of preference shares to common shares on the basis of 2 shares of

‘common for every share of preference. The offer was accepted and the conversion was made on

July 1, 2014.

+ No cash dividends were declared on ordinary shares until December 31, 2012. Cash dividends

er share of ordinary were declared and paid as follows:

December 31, 2012 3.20

June 30, 2013 1.50

December 31, 2013, 2.50

June 30, 2014 1.25

December 31, 2014 1,00

Based on the information above and as a result of your audit, answer the following:

99. The number of ordinary and preference shares outstanding at the end of 2014, respectively?

a. 190,400 and 16,000 ‘¢, 186,400 and 15,680

b. 99,200 and 20,000 4d. 186,400 and 16,000

100. Balances of the Ordinary and Preference Share accounts at the end of 2011, respectively?

‘@. 400,000 and 2,000,000 ‘¢, 500,000 and 2,000,000

b. 408,000 and 2,000,000 4. 404,000 and 1,960,000

101. The amount of cash dividends declared and paid to ordinary shares in 2013?

2. 364,800 ¢. 319,200

b. 167,200 d. 243,200

102. The amount of cash dividends declared and paid to ordinary shares in 2014?

a. 428,400 ¢. 306,400

b. 434,400 d. 418,400

=M 26: Nevada Square has the following selected accounts in its shareholders’ equity section as

of December 31, 2013:

Preference shares, P100 par, 10 percent cumulative,

100,000 shares issued and outstanding 10,000,000

Ordinary shares, P20 par, 1,000,000 shares authorized,

700,000 shares issued and outstanding 44,000,000

Share premium ‘8,000,000

Accumulated profits 30,000,000

There are no dividends in arrears on the preference shares. During 2014, the following transactions

occurred:

'a, The board of directors declared a cash dividend totaling to P2,800,000 to be paid to preference

and ordinary shareholders. Later, a share dividend of 100,000 ordinary shares were declared on

‘ordinary shares. The market value of ordinary shares is P68 per share on the date the share

dividends were declared,

b. Sometime after the above dividends were declared and settled, the board of directors declared as

property dividends one shares of its investment in Bingo Corp. stocks being held by the company

as trading securities for every two ordinary share outstanding. Bingo Corp. stocks were originally

purchased by the company at P12 per share and have a carrying value based on their fair value

‘as per the last remeasurement (balance sheet) date, at P20 per share. Bingo Corp. shares were

selling at P24 when the property dividends were declared and were selling at P25 when the

property dividends were settled. The company had a total of 500,000 shares of Bingo Corp.

shares.

c. Atthe end of 2014, the board declares a four-for-one share split. With the split, the number of

ordinary shares authorized to be issued increased to 4,000,000. At the date of the share split,

the market value of ordinary share is P75 per share.

d. Net earnings during 2014 total P6,000,000.

Required:

103. What is the adjusted balance of the company's Accumulated profit account at the end of year?

2. 26,400,000. . 18,400,000

b. P21,600,000, . P16,400,000,

104, What is the balance of the ordinary shares account as of December 31, 20147

a. P14,000,000. . P18,000,000.

b. P16,000,000. . P20,800,000.

105. What is the balance of the share premium account as of December 31, 2014?

a. P8,000,000. . P12,800,000.

b. P10,800,000. d. P14,800,000,

AUDITING PROBLEMS ~ STOCKHOLDERS’ EQUITY ~ APQ2 ¢ asa)

ReSA: The Review School of Accountancy Page 14 of 14

106. What is the adjusted balance of the company’s Shareholders’ equity account at the end of the

year?

a. P54,400,000. +57,200,000.

b. P55,200,000. J. 60,400,000.

PROBLEM 27: Overkill Company presented

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Quiz 8 - Audit of Inventory (Straight Prob - KEY)Document8 pagesQuiz 8 - Audit of Inventory (Straight Prob - KEY)Kenneth Christian Wilbur100% (1)

- Quiz 8 - Audit of Inventory (Straight Prob - KEY)Document8 pagesQuiz 8 - Audit of Inventory (Straight Prob - KEY)Kenneth Christian Wilbur100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Quiz 12 - Subs Test - Audit of Investment (Q)Document3 pagesQuiz 12 - Subs Test - Audit of Investment (Q)Kenneth Christian WilburNo ratings yet

- Quiz 9 - Subs Test - Audit of Inventory (KEY)Document4 pagesQuiz 9 - Subs Test - Audit of Inventory (KEY)Kenneth Christian WilburNo ratings yet

- Case DigestsDocument2 pagesCase DigestsKenneth Christian WilburNo ratings yet

- Quiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Document6 pagesQuiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Kenneth Christian WilburNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Chapter-4 Homework ReceivablesDocument3 pagesChapter-4 Homework ReceivablesKenneth Christian WilburNo ratings yet

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Q4 - Audit of Receivables (Prob - KEY)Document5 pagesQ4 - Audit of Receivables (Prob - KEY)Kenneth Christian Wilbur100% (1)

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- Aklan State Univeristy School of Management SchoolDocument4 pagesAklan State Univeristy School of Management SchoolKenneth Christian WilburNo ratings yet

- LABORATORIES - It Is Defined As A Place Equipped For Experimental Study in ADocument1 pageLABORATORIES - It Is Defined As A Place Equipped For Experimental Study in AKenneth Christian WilburNo ratings yet

- Joint Products-By ProductsDocument19 pagesJoint Products-By ProductsKenneth Christian WilburNo ratings yet

- Controls TestDocument19 pagesControls TestKenneth Christian WilburNo ratings yet

- Theories: Far Eastern University - Manila Quiz No. 1Document6 pagesTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburNo ratings yet

- Chapter-3 Homework CashDocument5 pagesChapter-3 Homework CashKenneth Christian WilburNo ratings yet

- Q3 - Audit of Cash (S. Prob - KEY)Document7 pagesQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Chapter-2 Homework MisstatementsDocument4 pagesChapter-2 Homework MisstatementsKenneth Christian WilburNo ratings yet

- Q2 - Correction of Errors (S. Prob - KEY)Document7 pagesQ2 - Correction of Errors (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Q2 - Correction of Errors (S. Prob - KEY)Document7 pagesQ2 - Correction of Errors (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Quiz 10 - Audit of Investment (BASIC PROB - KEY)Document5 pagesQuiz 10 - Audit of Investment (BASIC PROB - KEY)Kenneth Christian WilburNo ratings yet

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Q3 - Audit of Cash (S. Prob - KEY)Document7 pagesQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Midterm ExamDocument1 pageMidterm ExamKenneth Christian WilburNo ratings yet