Professional Documents

Culture Documents

Annexure II - Test Objectives NISM-Series-XV: Research Analyst Certification Examination

Uploaded by

Gaurav Anand0 ratings0% found this document useful (0 votes)

70 views6 pagesOriginal Title

Annexure-II-Research-Analyst

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

70 views6 pagesAnnexure II - Test Objectives NISM-Series-XV: Research Analyst Certification Examination

Uploaded by

Gaurav AnandCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

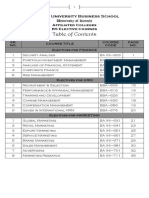

Annexure II – Test Objectives

NISM-Series-XV: Research Analyst Certification Examination

Unit 1: Introduction to Research Analyst Profession

1.1 Understand the primary role of a Research Analyst

1.2 Discuss the primary responsibilities of a Research Analyst

1.3 Know the basic principles of interaction with companies and/or clients

1.4 List the important qualities that are desired in a Research Analyst

Unit 2: Introduction to Securities Market

2.1 Define the term “Securities” and understand the basics of securities markets

2.2 Know the securities market terminology such as:

2.2.1 Equity Shares

2.2.2 Debentures/Bonds/Notes/Masala Bonds

2.2.3 Warrants and Convertible Warrants

2.2.4 Indices

2.2.5 Mutual Fund Units

2.2.6 Exchange Traded Funds

2.2.7 Hybrids/Structured Products

2.2.8 Commodities

2.3 Understand the structure of securities markets with a discussion on primary and secondary

markets

2.3.1 Primary market: Explain various ways to issue Securities - Initial Public Offer (IPO), Follow

on Public Offer (FPO), Private Placement, Qualified Institutional Placements (QIPs),

Preferential issue, Rights and Bonus issue, Onshore and offshore offerings, Offer for Sale

(OFS), ESOPs

2.3.2 Secondary market: Over-the-counter Market and Exchange Traded Markets, Trading,

Clearing and Settlement and Risk Management

2.4 Know the various market participants and their activities

2.4.1 Market Intermediaries: Stock Exchanges, Depositories, Depository Participant, Trading

Member/Stock Brokers, Authorised Person, Custodians, Clearing Corporation, Clearing

Banks, Merchant Bankers and Underwriters

2.4.2 Institutional participants: Foreign Portfolio Investors (FPIs), P-Note Participants, Mutual

Funds, Insurance Companies, Pension Funds, Venture Capital Funds, Private Equity Firms,

Hedge Funds, Alternative Investment Funds, Investment Advisers

2.4.3 Retail participants

2.4.4 Proxy Advisory Services Firms

2.5 Discuss various securities market transactions, products and processes such as:

2.5.1 Cash, Tom and Spot trades/transactions

2.5.2 Forward transactions

2.5.3 Futures

2.5.4 Options

2.5.5 Swaps

2.5.6 Trading, Hedging, Arbitrage, Pledging of Shares

2.6 Know the dematerialization and rematerialization of securities

Unit 3: Terminology in Equity and Debt Markets

3.1 Understand the terminology related to Equity Markets such as:

3.1.1 Face Value

3.1.2 Book Value

3.1.3 Market Value

3.1.4 Replacement Value

3.1.5 Intrinsic Value

3.1.6 Market Capitalization

3.1.7 Enterprising Value

3.1.8 Earnings – Historical, Trailing and Forward

3.1.9 Earnings Per Share

3.1.10 Dividend Per Share

3.1.11 Price to Earnings Ratio

3.1.12 Price to Sales Ratio

3.1.13 Price to Book Value Ratio

3.1.14 Differential Voting Rights (DVRs)

3.2 Understand the terminology used in the Debt Markets

3.2.1 Face Value

3.2.2 Coupon Rate

3.2.3 Maturity

3.2.4 Principal

3.2.5 Redemption of a Bond

3.2.6 Holding Period Returns

3.2.7 Current Yield

3.2.8 Yield to Maturity (YTM)

3.2.9 Duration

3.3 List various types of Bonds and describe their features:

3.3.1 Zero Coupon Bonds

3.3.2 Floating Rate Bonds

3.3.3 Convertible Bonds

3.3.4 Principal Protected Note

3.3.5 Inflation Protection Securities

3.3.6 Foreign Currency Bonds

3.3.7 External Bonds

3.3.8 Perpetual Bonds

Unit 4: Fundamentals of Research

4.1 Define investing activity

4.1.1 Active investing

4.1.2 Passive investing

4.2 Know the role of research in the investment activity

4.2.1 Insider Information vs Mosaic Analysis

4.3 Outline the nature of Technical Analysis approach to securities research

4.4 Outline the nature of Fundamental Analysis approach to securities research and know E-I-C

analysis, top-down and bottom-up approaches of fundamental analysis

4.5 Outline the nature of Quantitative Analysis (Econometrics approach) to securities research

4.6 Outline the nature of Behavioral Finance approach to Equity Investing

Unit 5: Economic Analysis

5.1 Discuss the basic principles of microeconomics

5.2 Discuss the basic principles of macroeconomics

5.3 Introduce various macroeconomic variables such as:

5.3.1 National income

5.3.2 Savings and Investments

5.3.3 Inflation (Consumer/Wholesale Price Indices) and interest rate

5.3.4 Unemployment rate

5.3.5 Flows from Foreign Direct Investment (FDI) and Foreign Portfolio Investors (FPIs)

5.3.6 Fiscal policies and their impact on Economy

5.3.7 Monetary policies and their impact on Economy

5.3.8 International trade, Exchange rate and Trade Deficit

5.3.9 Globalization: Positives and Negatives

5.4 Understand the Role of economic analysis in fundamental analysis

5.5 Understand the nature of secular, cyclical and seasonal economic trends

5.6 Know various sources of information for economic analysis

Unit 6: Industry Analysis

6.1 Understand the role of industry analysis in fundamental analysis

6.2 Know the Industry Definition

6.3 Understand industry cyclicality

6.4 Discuss market sizing and trend analysis

6.5 Discuss secular trends, value migration and business life cycle

6.6 Understand the industry landscape

6.6.1 Michael Porter’s five force model for industry analysis

6.6.2 Political, Economic, Socio-cultural, Technological, Legal and Environmental (PESTLE)

Analysis

6.6.3 Boston Consulting Group (BCG) Analysis

6.6.4 Structure-Conduct-Performance (SCP) Analysis

6.7 Know the key industry specific drivers for various industries and Industry KPIs

6.7.1 Unit of Pricing

6.7.2 Key constraining factors

6.7.3 KPIs for select industries

6.8 Know why analysts should pay attention to the regulatory aspects of businesses

6.9 Understand the elements of taxation pertaining to (taxation related knowledge required for

research analyst):

6.9.1 Direct Taxes

6.9.2 Indirect Taxes

6.9.3 Taxes on Securities (Corporate Tax, DDT and LTCG/STCG)

6.10 Know various sources of Information for carrying out industry analysis

Unit 7: Company Analysis – Business and Governance

7.1 Learn the role of company analysis in fundamental research

7.2 Understand the businesses and business models

7.3 Analyze the significance of pricing power of a business and its ability to sustain this power

7.4 Analyze a company’s competitive advantages or points of differentiation over the competitors

7.5 Know the SWOT analysis: Strengths, Weaknesses, Opportunities and Threats

7.6 Discuss the importance of quality of management, independent directors and good governance

standards

7.6.1 Evaluating management competency

7.6.2 Evaluating corporate governance

7.6.3 Promoters’ holding

7.7 Learn why it is important to understand the risks to a business

7.8 Understand the importance of knowing the history of credit rating of a company and how the

rating has changed over time

7.9 Learn about the Environment, Social and Governance (ESG) analysis of a Company / Business

7.10 Know various sources of Information for carrying out company analysis

Unit 8: Company Analysis – Financial Analysis

8.1 Understand the importance of studying the historical performance of a company and discuss

whether it will be a good indicator for future performance of the company

8.2 Understand the consolidated and stand-alone results of a company and know how to use them in

the analysis

8.3 Understand the basics of “Balance Sheet” of a company

8.3.1 Common Balance Sheet Line Items

8.3.2 Balance Sheet Metrics

8.4 Understand the basic concepts related to “Profit and Loss statement” of a company

8.4.1 Common profit and loss account line items

8.4.2 Key metrics from profit and loss account

8.5 Understand the need to study the historical equity expansion (equity dilution) trends of a

company and how it impacts the existing shareholders

8.6 Understand the Cashflows of a company

8.7 Discuss the Notes to Accounts

8.8 List the important points to be kept in mind while looking at a company’s financials

8.9 Discuss the importance of Reading audit report to understand the quality of accounting

8.10 Understand the financial statement analysis using ratios

8.11 Know the commonly used ratios used in financial analysis

8.11.1 Profitability Ratios

8.11.2 Return Ratios

8.11.3 Leverage Ratios

8.11.4 Liquidity Ratios

8.11.5 Efficiency Ratios

8.12 Know the computation of Dupont Analysis

8.13 Know why the analysts need to study a company’s history and ways in which they can use

such knowledge to cautiously look into the future prospects of the company

8.14 Know the importance of peer comparison in understanding the relative standing of a company

among its peers

8.15 Know the need to track the history of equity expansion, dividend and earnings history and past

corporate actions of a company as part of the analysis and ownership and insiders’ sales and

purchase of stocks in the past

Unit 9: Corporate Actions

9.1 Understand the philosophy of various corporate actions

9.2 Dividend

9.3 Rights Issue

9.4 Bonus Issue

9.5 Stock Split

9.6 Share Consolidation

9.7 Merger and Acquisition

9.8 Demerger / Spin off

9.9 Scheme of arrangement

9.10 Loan restructuring

9.11 Buy back of shares

9.12 Delisting of shares and relisting

9.13 Share swap

Unit 10: Valuation Principles

10.1 Understand the difference between Price and Value

10.2 List some of the reasons for carrying out valuation of businesses

10.3 Discuss the sources of value in a business (earnings and assets)

10.4 Know the various approaches to valuation

10.5 Explain the Discounted Cash Flows (DCF) model for business valuation

10.6 Introduce the relative valuations

10.7 Understand various earnings based valuation matrices

10.7.1 Dividend Yield: Price to Dividend Ratio

10.7.2 Earning Yield: Price to Earnings Ratio

10.7.3 Growth Adjusted Price to Earnings Ratio (PEG Ratio)

10.7.4 Enterprise Value to EBIT (DA) Ratio

10.7.5 Enterprise Value (EV) to Sales Ratio

10.8 Understand various assets based valuation matrices

10.8.1 Price to Book Value Ratio

10.8.2 Enterprise Value (EV) to Capital Employed Ratio

10.8.3 Net Asset Value Approach

10.8.4 Other metrics

10.9 Know the relative valuations (trading and transaction multiples), sum-of-the-parts valuation and

other valuation parameters in new age businesses

10.10 Know the Sum-Of-The-Parts (SOTP) Valuation

10.11 Understand the other valuation parameters in new age economy and businesses

10.12 Discuss Capital Asset Pricing Model

10.13 Explain the objectivity of valuations

10.14 List some of the important considerations in the context of business valuation

Unit 11: Fundamentals of Risk and Return

11.1 Understand the concept of return on investment

11.2 Calculate simple, annualized and compounded returns

11.3 Describe various risks that are seen in investments such as inflation risk, interest rate risk,

business risk, market risk, credit risk, liquidity risk, call risk, reinvestment risk, political risk and

country risk

11.4 Calculation of measuring risk

11.5 Understand the concept of Market Risk (Beta)

11.6 Understand the importance of sensitivity analysis

11.7 Understand the concept of Margin of Safety

11.8 Compare equity returns with bond returns

11.9 Calculation of Risk adjusted returns: Jensen’s Alpha, Sharpe ratio and Treynor’s ratio

11.10 Discuss various behavioural biases that influence investments and investment returns (loss-

aversion bias, confirmation bias, ownership bias, gambler’s fallacy, winner’s curse, herd mentality,

anchoring and projection bias)

11.11 Briefly discuss some quotes (market wisdom) from Investment Gurus

11.12 Discuss Measuring liquidity of equity shares

Unit 12: Qualities of a good Research Report

12.1 Discuss the qualities of a good Research Report and know the rating conventions

12.2 Know the advantages of checklist based approach to the Research Reports

12.3 Understand the constituents of the checklist with the help of a sample checklist

Unit 13: Legal and Regulatory Environment

13.1 Describe the regulatory framework of Indian financial markets:

13.1.1 Ministry of Finance (MoF)

13.1.2 Ministry of Corporate Affairs (MCA)

13.1.3 Reserve Bank of India (RBI)

13.1.4 Securities and Exchange Board of India (SEBI)

13.1.5 Insurance Regulatory and Development Authority (IRDA)

13.1.6 Pension Fund Regulatory and Development Authority (PFRDA)

13.1.7 Insolvency and Bankruptcy Board of India (IBBI)

13.2 Understand the important regulations in Indian securities markets:

13.2.1 Securities Contract (Regulation) Act, 1956

13.2.2 Securities and Exchange Board of India (SEBI) Act, 1992

13.2.3 Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations,

2015

13.2.4 SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities

Markets) Regulation, 2003 (and its amendments)

13.2.5 Securities and Exchange Board of India (Research Analyst) Regulations, 2014 (and its

amendments)

13.2.6 IBC related provisions relevant to Research Analyst

13.3 Know the Code of Conduct prescribed for Research Analysts

13.4 Discuss the management of conflicts of interest and the disclosure requirements for Research

Analysts

13.5 Know the surveillance mechanism of Exchanges: ASM and GSM

***

You might also like

- Teach Yourself About Shares: A Self-help Guide to Successful Share InvestingFrom EverandTeach Yourself About Shares: A Self-help Guide to Successful Share InvestingNo ratings yet

- NISM Series-XXI-A: Portfolio Management Services (PMS) Distributors CertificationDocument7 pagesNISM Series-XXI-A: Portfolio Management Services (PMS) Distributors CertificationAugustus PrimeNo ratings yet

- Finding Value in the Market - The Fundamentals of Fundamental AnalysisFrom EverandFinding Value in the Market - The Fundamentals of Fundamental AnalysisNo ratings yet

- NISM Research Analyst Certification Exam ObjectivesDocument3 pagesNISM Research Analyst Certification Exam Objectivesnaveen0037No ratings yet

- Annexure II IA Level 1Document16 pagesAnnexure II IA Level 1Amit KapoorNo ratings yet

- Alternative Investment Strategies and Risk Management: Improve Your Investment Portfolio’S Risk–Reward RatioFrom EverandAlternative Investment Strategies and Risk Management: Improve Your Investment Portfolio’S Risk–Reward RatioRating: 5 out of 5 stars5/5 (2)

- NISM-Series-X-A: Investment Adviser (Level 1) Certification ExaminationDocument7 pagesNISM-Series-X-A: Investment Adviser (Level 1) Certification ExaminationNikhil KhandelwalNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Capital MarketDocument221 pagesCapital MarketdsecsureshNo ratings yet

- NISM Course Topics For Mutual Fund 5 ADocument6 pagesNISM Course Topics For Mutual Fund 5 AJagadish KNo ratings yet

- M14 - Final Exam & RevisionDocument43 pagesM14 - Final Exam & RevisionJashmine Suwa ByanjankarNo ratings yet

- NISM Social Auditors Certification Exam ObjectivesDocument8 pagesNISM Social Auditors Certification Exam Objectivesuma vermaNo ratings yet

- Study Material: For Capital Market Examination-3 (CME-3) of Broker-Dealer Qualification CertificateDocument235 pagesStudy Material: For Capital Market Examination-3 (CME-3) of Broker-Dealer Qualification CertificateLim Chan CheeNo ratings yet

- Portfolio TutorialDocument77 pagesPortfolio TutorialJason Lim100% (3)

- Investment Patterns in Indian Stock Market: Project Report OnDocument112 pagesInvestment Patterns in Indian Stock Market: Project Report OnSalman Syed MohdNo ratings yet

- Syllabus Outline (W.e.f. September 30, 2021) NISM-Series-X-A: Investment Adviser (Level 1) Certification ExaminationDocument18 pagesSyllabus Outline (W.e.f. September 30, 2021) NISM-Series-X-A: Investment Adviser (Level 1) Certification ExaminationsunidhiNo ratings yet

- 5540-Investment & Securities ManagementDocument8 pages5540-Investment & Securities ManagementMariam LatifNo ratings yet

- Ir Qualification SyllabusDocument7 pagesIr Qualification Syllabussimone_reid_1No ratings yet

- Gso Syllabus V6aDocument18 pagesGso Syllabus V6aNikhil KumarNo ratings yet

- CME-1 General Securities Part 1 - Securities Regulations 30-4-2015Document116 pagesCME-1 General Securities Part 1 - Securities Regulations 30-4-2015JeezNo ratings yet

- Investment Portfolio Management and Security AnalysisDocument5 pagesInvestment Portfolio Management and Security Analysisvandana_daki3941No ratings yet

- Syllabus For NISM Research Analyst ExamDocument7 pagesSyllabus For NISM Research Analyst Examvignesh75% (4)

- NISM-Series-XXII: Fixed Income Securities Certification ExaminationDocument5 pagesNISM-Series-XXII: Fixed Income Securities Certification ExaminationVinay ChhedaNo ratings yet

- Basic Concepts: Mba Iii SemesterDocument11 pagesBasic Concepts: Mba Iii SemesterDrDhananjhay GangineniNo ratings yet

- Investment Management V3.5 finalDocument30 pagesInvestment Management V3.5 finalhassanhammadNo ratings yet

- Ba 5012 Security Analysis and Portfolio Management Unit 1 Part ADocument7 pagesBa 5012 Security Analysis and Portfolio Management Unit 1 Part AHarihara PuthiranNo ratings yet

- Financial Accounting Exam SpecsDocument6 pagesFinancial Accounting Exam SpecsJohn Rashid HebainaNo ratings yet

- PGDFMDocument6 pagesPGDFMAvinashNo ratings yet

- IFMP Mutual Fund Distributors Certification (Study and Reference Guide) PDFDocument165 pagesIFMP Mutual Fund Distributors Certification (Study and Reference Guide) PDFPunjabi Larka100% (1)

- CT2 - Finance and Financial Reporting Syllabus OverviewDocument6 pagesCT2 - Finance and Financial Reporting Syllabus OverviewVignesh Srinivasan0% (1)

- CT2 Finance and Financial ReportingDocument7 pagesCT2 Finance and Financial ReportingSunil Pillai0% (1)

- WQU Financial Markets Module 5Document28 pagesWQU Financial Markets Module 5joca12890% (1)

- Capital Market Analysis & Corporate LawsDocument696 pagesCapital Market Analysis & Corporate LawsManikanteswarNo ratings yet

- Security Analysis and Portfolio Management FaqDocument5 pagesSecurity Analysis and Portfolio Management Faqshanthini_srmNo ratings yet

- Capital MarketsDocument696 pagesCapital MarketsSaurabh VermaNo ratings yet

- CB3 Syllabus 2021Document4 pagesCB3 Syllabus 2021S PatNo ratings yet

- CT2 - Finance and Financial Reporting Exam GuideDocument7 pagesCT2 - Finance and Financial Reporting Exam GuideAnkit BaglaNo ratings yet

- CME 3 Broker Dealer 30-4-2015Document235 pagesCME 3 Broker Dealer 30-4-2015Jeez100% (1)

- WQU Financial Markets Module 5 Compiled ContentDocument29 pagesWQU Financial Markets Module 5 Compiled Contentvikrant50% (2)

- Element 1 Key ConceptsDocument26 pagesElement 1 Key ConceptsMohamed HalimNo ratings yet

- SN Long 2009Document201 pagesSN Long 2009Hiwin CooNo ratings yet

- BA1727 - SECURITY ANALYSIS & PORTFOLIO MANAGEMENT Question BankDocument13 pagesBA1727 - SECURITY ANALYSIS & PORTFOLIO MANAGEMENT Question BankAnonymous y3E7iaNo ratings yet

- Financial Markets ModuleDocument248 pagesFinancial Markets ModuleTrường Nguyễn100% (2)

- Elective Useless NotesDocument24 pagesElective Useless NotesNishadNo ratings yet

- Elective Courses SyllabusDocument37 pagesElective Courses SyllabusAsif WarsiNo ratings yet

- Business Plan GuidelinesDocument10 pagesBusiness Plan GuidelinesVladan StojanovicNo ratings yet

- CB1 - Understanding Business FinanceDocument6 pagesCB1 - Understanding Business Financesankar KNo ratings yet

- Sapm QBDocument8 pagesSapm QBSiva KumarNo ratings yet

- Stock Market Investor Behavior During RecessionDocument16 pagesStock Market Investor Behavior During RecessionshikhaNo ratings yet

- Investment Analysis and Portfolio ManagementDocument237 pagesInvestment Analysis and Portfolio ManagementKannan RNo ratings yet

- ShiiiDocument59 pagesShiiiShiva Prasad KasturiNo ratings yet

- Equity Research CertificationDocument9 pagesEquity Research CertificationVskills CertificationNo ratings yet

- Factors Affecting Investment Decisions and The Process of Investment DecisionDocument14 pagesFactors Affecting Investment Decisions and The Process of Investment Decisionnikhil khajuriaNo ratings yet

- Topic List of Financial Management - 2Document4 pagesTopic List of Financial Management - 2Arpita Dhar TamaNo ratings yet

- ICM - Mutual Fund Distributors (Study and Reference Guide-January 2013)Document150 pagesICM - Mutual Fund Distributors (Study and Reference Guide-January 2013)Umar Sarfraz KhanNo ratings yet

- Financial Markets and Specialised Institutions - New Syllabus NotesDocument100 pagesFinancial Markets and Specialised Institutions - New Syllabus NotesDanielNo ratings yet

- Security Analysis and Portfolio Management: Question BankDocument12 pagesSecurity Analysis and Portfolio Management: Question BankgiteshNo ratings yet

- Af 602Document2 pagesAf 602Haseeb KhanNo ratings yet

- NISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketDocument6 pagesNISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketSanket MohapatraNo ratings yet

- Lajoma FurnitureDocument3 pagesLajoma FurnitureKris TineNo ratings yet

- FINECO 03 Investments Under UncertaintyDocument50 pagesFINECO 03 Investments Under UncertaintyHiếu Nhi TrịnhNo ratings yet

- Fiscal Policy - The Basics: A) IntroductionDocument7 pagesFiscal Policy - The Basics: A) IntroductionmalcewanNo ratings yet

- University of Delhi: (3-Year Semester Exam May-June 2018) (CBCS Exam Scheme) TranscriptDocument2 pagesUniversity of Delhi: (3-Year Semester Exam May-June 2018) (CBCS Exam Scheme) TranscriptshahzarNo ratings yet

- Characteristics of Indian EconomyDocument4 pagesCharacteristics of Indian EconomyAkchat JainNo ratings yet

- 14 Lessons From A Millionaire TraderDocument200 pages14 Lessons From A Millionaire TraderMichel Duran100% (1)

- HKUST Macroeconomics Course Covering IS-LM Model and Labor MarketsDocument28 pagesHKUST Macroeconomics Course Covering IS-LM Model and Labor Marketsyaoamber9628No ratings yet

- Types of BanksDocument23 pagesTypes of BankscrazysidzNo ratings yet

- InflationDocument23 pagesInflationTianlu WangNo ratings yet

- Financial Risk and Return AnalysisDocument8 pagesFinancial Risk and Return Analysismuhammad hasanNo ratings yet

- Gide To Indiv Work-2Document13 pagesGide To Indiv Work-2Daiva ValienėNo ratings yet

- Violante - Heterogeneity in Macroeconomics PDFDocument29 pagesViolante - Heterogeneity in Macroeconomics PDFStuff84No ratings yet

- HBS Ameritrade Corporate Finance Case Study SolutionDocument6 pagesHBS Ameritrade Corporate Finance Case Study SolutionEugene Nikolaychuk100% (5)

- Chap 003Document31 pagesChap 003Magix SmithNo ratings yet

- Case Study Plant RelocationDocument5 pagesCase Study Plant Relocationviren gupta100% (1)

- Reading Amartya Sen - 1988 - The Concept of DevelopmentDocument2 pagesReading Amartya Sen - 1988 - The Concept of DevelopmentgioanelaNo ratings yet

- Macroeconomics: Test of Macroeconomic ThinkingDocument25 pagesMacroeconomics: Test of Macroeconomic ThinkingcoupleteaNo ratings yet

- Lewoye Cover LetterDocument2 pagesLewoye Cover LetterLEWOYE BANTIENo ratings yet

- Theories of Entrepreneurship: Schumpeter in ContextDocument12 pagesTheories of Entrepreneurship: Schumpeter in ContextGiacomo FasolatoNo ratings yet

- Merchant BankingDocument235 pagesMerchant BankingKarthikeyan Elangovan100% (1)

- Chapter 11Document39 pagesChapter 11Muthia Khairani100% (1)

- Sales Promotion: Different Types of Sales Promotion, Relationship Between Sales Promotion and AdvertisingDocument14 pagesSales Promotion: Different Types of Sales Promotion, Relationship Between Sales Promotion and AdvertisingArunima BanerjeeNo ratings yet

- Corprate Finance BBM 312Document53 pagesCorprate Finance BBM 312jemengich100% (1)

- Principles or Canons of Taxation FinalDocument6 pagesPrinciples or Canons of Taxation FinalTonie Wa MumNo ratings yet

- IB Econ Chap 02 Demand SupplyDocument17 pagesIB Econ Chap 02 Demand SupplyMilan v.de MeebergNo ratings yet

- Choosing The Best Option Strategy: March 10, 2016 Peter Lusk - The Options Institute at CBOEDocument28 pagesChoosing The Best Option Strategy: March 10, 2016 Peter Lusk - The Options Institute at CBOEdebaditya_hit326634No ratings yet

- Chapter 5 The Behavior of Interest RatesDocument20 pagesChapter 5 The Behavior of Interest RatesSamanthaHandNo ratings yet

- Lessiker Business Communication Solution-Part1Document1 pageLessiker Business Communication Solution-Part1Sajid Shafiq92% (12)

- A Deeper Look at Uber's Dynamic Pricing Model - AbovethecrowdDocument11 pagesA Deeper Look at Uber's Dynamic Pricing Model - AbovethecrowdPrashant Pratap SinghNo ratings yet

- Newnan Ch1Document30 pagesNewnan Ch1Chelsy BarberNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet