Professional Documents

Culture Documents

PD 851 - 13th Month Pay Law

Uploaded by

Maricar Corina Canaya0 ratings0% found this document useful (0 votes)

12 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesPD 851 - 13th Month Pay Law

Uploaded by

Maricar Corina CanayaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

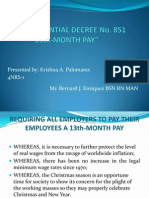

PRESIDENTIAL DECREE NO.

851

RULES AND REGULATIONS IMPLEMENTING

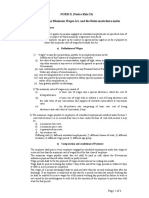

PRESIDENTIAL DECREE NO. 851

By virtue of the powers vested in me by law, the following rules and

regulations implementing Presidential Decree No. 851 are hereby

issued for the guidance of all concerned.

Section 1. Payment of 13th-month Pay. - All employers covered

by Presidential Decree No. 851, hereinafter referred to as

the "Decree" , shall pay to all their employees receiving a basic

salary of not more than P1,000 a month a thirteenth-month pay not

later than December 24 of every year.

Sec. 2. Definition of certain terms. - As used in this issuance: chanroblesvirtuallawlibrary

(a) "Thirteenth-month pay" shall mean one twelfth (1/12) of the

basic salary of an employee within a calendar year;

(b) "Basic salary" shall include all remunerations or earnings paid by

an employer to an employee for services rendered but may not

include cost-of-living allowances granted pursuant to Presidential

Decree No. 525 or Letter of Instructions No. 174, profit-sharing

payments, and all allowances and monetary benefits which are not

considered or integrated as part of the regular or basic salary of the

employee at the time of the promulgation of the Decree on

December 16, 1975.

Sec. 3. Employers covered. - The Decree shall apply to all employers

except to:chanroblesvirtuallawlibrary

(a) Distressed employers, such as (1) those which are currently

incurring substantial losses or (2) in the case of non-profit

institutions and organizations, where their income, whether from

donations, contributions, grants and other earnings from any source,

has consistently declined by more than forty (40%) percent of their

normal income for the last two (2) years, subject to the provision of

Section 7 of this issuance;

(b) The Government and any of its political subdivisions, including

government-owned and controlled corporations, except those

corporations operating essentially as private subsidiaries of the

Government;

(c) Employers already paying their employees 13-month pay or more

in a calendar year or its equivalent at the time of this issuance;

(d) Employers of household helpers and persons in the personal

service of another in relation to such workers; and

(e) Employers of those who are paid on purely commission,

boundary, or task basis, and those who are paid a fixed amount for

performing a specific work, irrespective of the time consumed in the

performance thereof, except where the workers are paid on piece-

rate basis in which case the employer shall be covered by this

issuance insofar as such workers are concerned.

As used herein, workers paid on piece-rate basis shall refer to those

who are paid a standard amount for every piece or unit of work

produced that is more or less regularly replicated, without regard to

the time spent in producing the same.

The term "its equivalent" as used in paragraph c) hereof shall

include Christmas bonus, mid-year bonus, profit-sharing payments

and other cash bonuses amounting to not less than 1/12th of the

basic salary but shall not include cash and stock dividends, cost of

living allowances and all other allowances regularly enjoyed by the

employee, as well as non-monetary benefits. Where an employer

pays less than 1/12th of the employees basic salary, the employer

shall pay the difference.

Sec. 4. Employees covered. - Except as provided in Section 3 of this

issuance, all employees of covered employers shall be entitled to

benefit provided under the Decree who are receiving not more than

P1,000 a month, regardless of their position, designation or

employment status, and irrespective of the method by which their

wages are paid, provided that they have worked for at least one

month during the calendar year.

Sec. 5. Option of covered employers. - A covered employer may pay

one-half of the 13th-month pay required by the Decree before the

opening of the regular school year and the other half on or before

the 24th day of December of every year.

In any establishment where a union has been recognized or certified

as the collective bargaining agent of the employees therein, the

periodicity or frequency of payment of the 13th-month pay may be

the subject of agreement.

Nothing herein shall prevent employers from giving the benefits

provided in the Decree to their employees who are receiving more

than One Thousand (P1,000) Pesos a month or benefits higher than

those provided by the Decree.

Sec. 6. Special feature of benefit. - The benefits granted under this

issuance shall not be credited as part of the regular wage of the

employees for purposes of determining overtime and premium pay,

fringe benefits, as well as premium contributions to the State

Insurance Fund, social security, medicare and private welfare and

retirement plans.

Sec. 7. Exemption of Distressed employers. - Distressed employers

shall qualify for exemption from the requirement of the Decree upon

prior authorization by the Secretary of Labor. Petitions for

exemptions may be filed within the nearest regional office having

jurisdiction over the employer not later than January 15, 1976. The

regional offices shall transmit the petitions to the Secretary of Labor

within 24 hours from receipt thereof.

Sec. 8. Report of compliance. - Every covered employer shall make a

report of his compliance with the Decree to the nearest regional

labor office not later than January 15 of each year.

The report shall conform substantially with the following form:chanroblesvirtuallawlibrary

REPORT ON COMPLIANCE WITH P.D. NO. 851

1. Name of establishment

2. Address

3. Principal product or business

4. Total employment

5. Total number of workers benefited

6. Amount granted per employee

7. Total amount of benefits granted

8. Name, position and tel. no. of person giving information

Sec. 9. Adjudication of claims. - Non-payment of the thirteenth-

month pay provided by the Decree and these rules shall be treated

as money claims cases and shall be processed in accordance with

the Rules Implementing the Labor Code of the Philippines and the

Rules of the National Labor Relations Commission.

Sec. 10. Prohibition against reduction or elimination of

benefits. - Nothing herein shall be construed to authorize any

employer to eliminate, or diminish in any way, supplements, or other

employee benefits or favorable practice being enjoyed by the

employee at the time of promulgation of this issuance.

Sec. 11. Transitory Provision. - These rules and regulations shall

take effect immediately and for purposes of the 13th-month pay for

1975, the same shall apply only to those who are employees as of

December 16, 1975.

Manila, Philippines, 22 December 1975.

You might also like

- 13th-Month Pay LawDocument2 pages13th-Month Pay LawKim SalvoroNo ratings yet

- 13th Month Paw Law and Its Revised GuidelinesDocument5 pages13th Month Paw Law and Its Revised GuidelinesEi Ar TaradjiNo ratings yet

- Reporting 13 Mo Pay & KasambahayDocument12 pagesReporting 13 Mo Pay & KasambahayRegina CoeliNo ratings yet

- 13th Month Pay LawDocument9 pages13th Month Pay LawLantong JbNo ratings yet

- Wage Distortion and 13th Month PayDocument16 pagesWage Distortion and 13th Month PayJennybabe PetaNo ratings yet

- 13 Moth Pay LawDocument2 pages13 Moth Pay LawRouella May AltarNo ratings yet

- PD 851Document4 pagesPD 851Rodney S. ZamoraNo ratings yet

- 13th Month Pay LawDocument7 pages13th Month Pay LawOrlando O. Calundan100% (1)

- 13th Month PayDocument2 pages13th Month PayRodel De GuzmanNo ratings yet

- 13th Month Pay LawDocument7 pages13th Month Pay LawRaffy PangilinanNo ratings yet

- 13th Month Pay LawDocument11 pages13th Month Pay LawBonito Bulan100% (1)

- Presidential Decree No. 851Document4 pagesPresidential Decree No. 851Dianne BayNo ratings yet

- 13th Month and Kasambahay LawDocument14 pages13th Month and Kasambahay Lawrico eugenioNo ratings yet

- 13th Month RuleDocument8 pages13th Month Rulej L.T.No ratings yet

- 13th Month Pay LawDocument7 pages13th Month Pay LawPrncssbblgmNo ratings yet

- 13TH MONTH PAY (Highlights)Document3 pages13TH MONTH PAY (Highlights)XIANo ratings yet

- 13th Month Pay (PD 851)Document18 pages13th Month Pay (PD 851)Sj EclipseNo ratings yet

- P.D. 851 (13th Month Pay Law)Document3 pagesP.D. 851 (13th Month Pay Law)Anonymous HWfwDFRMPsNo ratings yet

- P.D. No. 851Document3 pagesP.D. No. 851Jazztine ArtizuelaNo ratings yet

- 24 28 LaborDocument17 pages24 28 LaborencinajarianjayNo ratings yet

- IRR of PD 851-1Document3 pagesIRR of PD 851-1Jansen OuanoNo ratings yet

- Rules AND Regulations Implementing Presidential Decree No. 851Document6 pagesRules AND Regulations Implementing Presidential Decree No. 851Joel G. Ayon100% (1)

- 13th Month Pay TentativeDocument13 pages13th Month Pay TentativeHardlyjun NaquilaNo ratings yet

- Ra 7641Document6 pagesRa 7641Iller Anne AniscoNo ratings yet

- The Payment of Wages Act, 1936Document19 pagesThe Payment of Wages Act, 1936H N Sahu90% (10)

- Revised Guidelines On The Implementation of The 13Th Month Pay LawDocument4 pagesRevised Guidelines On The Implementation of The 13Th Month Pay Lawnhizza dawn DaligdigNo ratings yet

- Labstan Finals RevisionDocument16 pagesLabstan Finals RevisionAinah KingNo ratings yet

- 13th Month Pay of Resigned or Separated Employee: (Revised Guidelines On Implementation of PD 851)Document8 pages13th Month Pay of Resigned or Separated Employee: (Revised Guidelines On Implementation of PD 851)MichaelCalzadoNo ratings yet

- Withholding On Wages SEC. 78. Definitions. - As Used in This ChapterDocument5 pagesWithholding On Wages SEC. 78. Definitions. - As Used in This ChaptershakiraNo ratings yet

- 13th Month PayDocument25 pages13th Month PayJuna May YanoyanNo ratings yet

- CM Unit 4Document21 pagesCM Unit 4Deepa SelvamNo ratings yet

- Davao Fruits Corporation vs. Associated Labor Unions (Alu)Document2 pagesDavao Fruits Corporation vs. Associated Labor Unions (Alu)Fayda CariagaNo ratings yet

- MODULE 15-SSS LawDocument84 pagesMODULE 15-SSS LawAleah Jehan AbuatNo ratings yet

- ASSIGNMENT 2 (Ii)Document6 pagesASSIGNMENT 2 (Ii)ashiba JohnNo ratings yet

- Labour Codes Summary .Document17 pagesLabour Codes Summary .Momina qayoomNo ratings yet

- Proposed City Manager ContractDocument11 pagesProposed City Manager ContractThe Press-Enterprise / pressenterprise.comNo ratings yet

- Labour Law Assigmnent 27-3-19Document8 pagesLabour Law Assigmnent 27-3-19shubham chauhanNo ratings yet

- Boie-Takeda Chemicals Inc Vs Dionisio C de La Serna Phil Fuji Xerox Vs Trajano Fuji Xerox UnionDocument7 pagesBoie-Takeda Chemicals Inc Vs Dionisio C de La Serna Phil Fuji Xerox Vs Trajano Fuji Xerox UnionCoyzz de GuzmanNo ratings yet

- Labourlaw Unit 5Document20 pagesLabourlaw Unit 5Fuwaad SaitNo ratings yet

- PRESIDENTIAL DECREE No.851Document11 pagesPRESIDENTIAL DECREE No.851Krishna PalomaresNo ratings yet

- Labor Law Leaves For CharlesDocument9 pagesLabor Law Leaves For CharlesLeia Fidelis Gisela CastroNo ratings yet

- The Employees State Insurance Act, 1948Document30 pagesThe Employees State Insurance Act, 1948Yogesh ChaudhariNo ratings yet

- How To Compute 13th Month PayDocument4 pagesHow To Compute 13th Month PayIliwacam Cath DhenNo ratings yet

- Revised Guidelines On The Implementation of The 13th Month Pay LawDocument4 pagesRevised Guidelines On The Implementation of The 13th Month Pay LawboysailorNo ratings yet

- Revised Guidelines On The 13TH Month LawDocument3 pagesRevised Guidelines On The 13TH Month LawAireen BonghanoyNo ratings yet

- Possibilities in Taxation - Atty. Bobby LockDocument14 pagesPossibilities in Taxation - Atty. Bobby LockROCHELLENo ratings yet

- Revised Guidelines PD 851Document4 pagesRevised Guidelines PD 851Abegail LeriosNo ratings yet

- RR Income Tax For Public Consultation Under TrainDocument25 pagesRR Income Tax For Public Consultation Under TrainGenesis ManaliliNo ratings yet

- Objective and Main Provision Of: Payment of Bonus ActDocument10 pagesObjective and Main Provision Of: Payment of Bonus ActSanjay shuklaNo ratings yet

- 13th Month PayDocument19 pages13th Month PayVernie Baldicantos TinapayNo ratings yet

- Sec. 2. Definition of Certain Terms. - As Used in This IssuanceDocument1 pageSec. 2. Definition of Certain Terms. - As Used in This Issuanceanjo020025No ratings yet

- 2018-Train ActDocument65 pages2018-Train ActAnthonette ManagaytayNo ratings yet

- ESISDocument28 pagesESISDhananjaySalgaonkarNo ratings yet

- Taxation Unit 2nd,, Material Related To Taxation LawDocument31 pagesTaxation Unit 2nd,, Material Related To Taxation LawARBAZ KHANNo ratings yet

- Abstract of The Minimum Wages Act, 1948Document4 pagesAbstract of The Minimum Wages Act, 1948Shabir TrambooNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument2 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress Assembledkay tunaNo ratings yet

- 13th Month Pay LawDocument11 pages13th Month Pay LawChristian Paul PeligroNo ratings yet

- Unit-28 The Payment of Gratuity Act 1972Document7 pagesUnit-28 The Payment of Gratuity Act 1972ujjwal kumar 2106No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- PAO RequirementsDocument1 pagePAO RequirementsMarjorie Mayordo100% (1)

- MOA SampleDocument3 pagesMOA SampleMarjorie MayordoNo ratings yet

- Affidavit For Loss or Damaged POSDocument1 pageAffidavit For Loss or Damaged POSMarjorie MayordoNo ratings yet

- Moya LimDocument22 pagesMoya LimMarjorie MayordoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMarjorie MayordoNo ratings yet

- Affidavit of Calamity Damage (For Typhoon Odette)Document1 pageAffidavit of Calamity Damage (For Typhoon Odette)Marjorie MayordoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMarjorie MayordoNo ratings yet

- Full TextDocument11 pagesFull TextMarjorie MayordoNo ratings yet

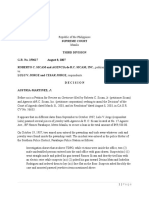

- People V CA, Feb 25, 2015Document6 pagesPeople V CA, Feb 25, 2015Marjorie MayordoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMarjorie MayordoNo ratings yet

- Population, Malthus Believed There Were Two Types of "Checks" That in All Times and Places KeptDocument1 pagePopulation, Malthus Believed There Were Two Types of "Checks" That in All Times and Places KeptMarjorie MayordoNo ratings yet

- Marriage NotesDocument1 pageMarriage NotesMarjorie MayordoNo ratings yet

- Ra 7438Document1 pageRa 7438Marjorie MayordoNo ratings yet

- RULE 114 - Trillanes Vs Pimentel To PP Vs GakoDocument10 pagesRULE 114 - Trillanes Vs Pimentel To PP Vs GakoMarjorie MayordoNo ratings yet

- People V CA, Feb 25, 2015Document6 pagesPeople V CA, Feb 25, 2015Marjorie MayordoNo ratings yet

- Warehouse Law, Trust Receipt (SPL)Document11 pagesWarehouse Law, Trust Receipt (SPL)Marjorie MayordoNo ratings yet

- Consolidated Case Digests Sales MidtermsDocument15 pagesConsolidated Case Digests Sales MidtermsMartinNo ratings yet

- Definition of TermDocument1 pageDefinition of TermMarjorie MayordoNo ratings yet

- Abalos V Macatangay and Uy V CADocument2 pagesAbalos V Macatangay and Uy V CAMarjorie MayordoNo ratings yet

- Mendez V People, July 11, 2014Document3 pagesMendez V People, July 11, 2014Marjorie MayordoNo ratings yet

- Environmental AnnotationDocument63 pagesEnvironmental AnnotationIvan Angelo ApostolNo ratings yet

- Policies. - On All Policies of Insurance or Bonds orDocument2 pagesPolicies. - On All Policies of Insurance or Bonds orMarjorie MayordoNo ratings yet

- C!Court: UpretneDocument9 pagesC!Court: UpretneMarjorie MayordoNo ratings yet

- Anti Money Laundering NotesDocument2 pagesAnti Money Laundering NotesMarjorie MayordoNo ratings yet

- Revised Penal Code Elements of Crimes UnDocument47 pagesRevised Penal Code Elements of Crimes UnRommel Tottoc100% (8)

- Belgica (PDAF)Document11 pagesBelgica (PDAF)Marjorie MayordoNo ratings yet

- SCL Reviewer FinalsDocument16 pagesSCL Reviewer FinalsMarjorie MayordoNo ratings yet

- Anti Money Laundering NotesDocument2 pagesAnti Money Laundering NotesMarjorie MayordoNo ratings yet

- Warehouse Law, Trust Receipt (SPL)Document12 pagesWarehouse Law, Trust Receipt (SPL)Marjorie MayordoNo ratings yet

- 1968-01-17 The Enterprise RomanDocument20 pages1968-01-17 The Enterprise RomanRomulus Historical NewspapersNo ratings yet

- Jennings v. Stephens (2015)Document24 pagesJennings v. Stephens (2015)Scribd Government DocsNo ratings yet

- Secretary-Certificate LetterDocument2 pagesSecretary-Certificate Letterteresa bautistaNo ratings yet

- 1-12 (W)Document1 page1-12 (W)Sữa ChuaNo ratings yet

- One Direction ScriptDocument12 pagesOne Direction ScriptNatasha PeraltaNo ratings yet

- CABALLERO Vs SandiganbayanDocument4 pagesCABALLERO Vs SandiganbayanElias IbarraNo ratings yet

- Torts and Damages Part 3Document545 pagesTorts and Damages Part 3ConnieAllanaMacapagaoNo ratings yet

- Malala Yousafzai PresentationDocument17 pagesMalala Yousafzai Presentationapi-313702742No ratings yet

- Apple Samsung SettlementDocument7 pagesApple Samsung Settlementjeff_roberts881No ratings yet

- D.K. Yadav Vs J.M.A. Industries LTD On 7 May, 1993 PDFDocument9 pagesD.K. Yadav Vs J.M.A. Industries LTD On 7 May, 1993 PDFJayashree ChatterjeeNo ratings yet

- Leandro Carillo Vs People of The Philippines G.R. No. 86890, January 21, 1994Document214 pagesLeandro Carillo Vs People of The Philippines G.R. No. 86890, January 21, 1994Ia HernandezNo ratings yet

- Difference Between Homicidal and Suicidal Hanging - in Details With PicturesDocument2 pagesDifference Between Homicidal and Suicidal Hanging - in Details With PicturesSHAN AliNo ratings yet

- 3Document5 pages3Raaima AliNo ratings yet

- L 10817 18Document1 pageL 10817 18Anonymous Xhp28mToJNo ratings yet

- FTEB List+of+Accredited+NVOCC,+IFF+and+DFFs 31may2022Document97 pagesFTEB List+of+Accredited+NVOCC,+IFF+and+DFFs 31may2022Mark Romeo GalvezNo ratings yet

- Ta-Octa Vs Eguia and TorresDocument1 pageTa-Octa Vs Eguia and TorresJudy Miraflores DumdumaNo ratings yet

- Japanese Aggression and The Emperor, 1931-1941Document41 pagesJapanese Aggression and The Emperor, 1931-1941Lorenzo FabriziNo ratings yet

- 1920s PresentationDocument7 pages1920s Presentationapi-356669213No ratings yet

- Human Rights Law Final PaperDocument6 pagesHuman Rights Law Final PaperKvyn HonoridezNo ratings yet

- Order Form - H - E - 12th January - 2021Document11 pagesOrder Form - H - E - 12th January - 2021SanjeevNo ratings yet

- New Wordpad DocumentDocument2 pagesNew Wordpad DocumentSuraj BeraNo ratings yet

- GEC 9 Reaction Paper 2Document2 pagesGEC 9 Reaction Paper 2Cristal Cielo MarzanNo ratings yet

- Sagebrush Residents File A LawsuitDocument8 pagesSagebrush Residents File A LawsuitbparkTCNNo ratings yet

- Modern FamilyDocument4 pagesModern FamilyLuciana Gossmann100% (1)

- Christian Faith and DemonologyDocument21 pagesChristian Faith and DemonologyJBSfanNo ratings yet

- Is CODE MINIMUM STEEL - What Is The Maximum Percentage of Reinforcement That Can Be Provided For A RCC StructureDocument9 pagesIs CODE MINIMUM STEEL - What Is The Maximum Percentage of Reinforcement That Can Be Provided For A RCC StructureKENNY0% (3)

- Social Science 1 - PPG Week 2Document20 pagesSocial Science 1 - PPG Week 2Sherri Bonquin100% (1)

- Suffrage (Art. V)Document10 pagesSuffrage (Art. V)alfieNo ratings yet

- Contract Agreement Between HRL and SJ - SMEC - EGC 15 March 2021Document31 pagesContract Agreement Between HRL and SJ - SMEC - EGC 15 March 2021Arshad MahmoodNo ratings yet

- Hanak V GreenDocument23 pagesHanak V GreenLordMarlockNo ratings yet