Professional Documents

Culture Documents

VCE Summer Internship Program 2020: Smart Task Submission Format

VCE Summer Internship Program 2020: Smart Task Submission Format

Uploaded by

ruchit guptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VCE Summer Internship Program 2020: Smart Task Submission Format

VCE Summer Internship Program 2020: Smart Task Submission Format

Uploaded by

ruchit guptaCopyright:

Available Formats

VCE Summer Internship Program 2020

Smart Task Submission Format

Intern’s Details

Name Ruchit Gupta

Email-ID gruchit270298@gmail.com

Smart Task No. 2

Project Topic Project Finance - Modeling and Analysis

Smart Task (Solution)

Task Q1: While preparing a financial model what are the assumptions we need to take. Please list

down the list of assumptions with the values, assuming the project will be set up in India.

Task Q1 Solution :

While preparing the financial model there are few assumptions which we need to take

are as follows:-

1. Inflation: - Inflation is the overall impact of price changes for a diversified set of products and services,

and allow for single value reprenstation of the increase in the price level of goods and services in an economy

over a period of time.

2. DDT: - Dividend Distribution Tax (DDT) is a tax levied on dividends distributed by companies out of their

profits among the shareholders. DDT is levied at the hands of the firms, and the shareholder.

3. Tax Holiday: - Tax holiday is a temporary reduction or elimination of a tax. Government usually create

tax holidays as incentives for business investment.

4. Tax Rate: - Tax rate is the percentage at which an individual or corporation is taxed.

5. Debt Rate/Interest Rate: - Interest rate is rate charged by a lender of money or credit to a borrower.

6. Moratorium: - It is the temporary suspension of an activity or law until future consideration warrants

lifting the suspension.

7. Debt Tenure: - Debt tenure refers to the time period for which the debt is been taken.

8. Depreciation: - Depreciation is defined as the reduction of recorded cost of a fixed asset in a systematic

manner until the value of the asset becomes zero.

9. Discount Rates

10. Construction Time

ST Solution Page 1 https://techvardhan.com

VCE Summer Internship Program 2020

Smart Task Submission Format

11. MAT: - The Minimum Alternative Tax is imposed on book profit of the companies to pay the usual

corporate income tax.

The assumptions with the values are as follows:-

A. Inflation:- 6.2%

B. DDT:- 0.0%

C. Tax Holiday- 1 Year

D. Tax rate :- 27%

E. Debt rate:- 9.2%

F. Moratorium:- 0.5 Year

G. Debt tenure:- 15 Year

H. Depreciation:- 8%

I. USD/INR:- 72.53

J. Discount:- 10%

K. Construction Time:- 2 Year

L. MAT:- 16.5%

500 Words (Max.)

Task Q2: Explain the function of revenue, cost and debt sheet of the financial model.

Task Q2 Solution:

The function of revenue, cost and debt sheet of the financial model is as follows:-

1. Cost: - The 2 types of cost is being covered in which one is the “PROJECT COST” which is also

referred to as the capital expenditure which is being incurred to construct and build up the project. Project

cost includes the Furniture’s, Fixtures, Stamp Duty, Interior Decoration, Loan and documentation fees etc.

The other cost which is being incurred is the “OPERATIONAL EXPENDITURE” which refers to the

expenditure done on the day-to-day operations of the business or the amount spent in order to run the project.

It includes Building Maintenance, Utilities (Electricity, Water and Internet), Salary, and Insurance etc.

2. Revenue: - In order to run the business over a longer period of time revenue is the most important part. It

acts as a major component.

In the financial model 2 types of revenue being shown one is in the form of “RENT” which is being received

in the city of Mumbai and the other one is in the form of “INTEREST ON DEPOSIT” and finally both

being added to receive the “TOTAL REVENUE”.

3. Debt: - Debt refers to the sum of money owned by one person and due to another person.

In project finance we use “Non- Recourse debt” which means that the owners do not have any kind of

ST Solution Page 2 https://techvardhan.com

VCE Summer Internship Program 2020

Smart Task Submission Format

recourse if debt is not being paid.

Debt sheet covers about the Amount of loan being taken, Rate of interest, Moratorium period, Period of loan,

series of loan payment etc.

500 Words (Max.)

Task Q3: Explain in detail the various steps involved (with the importance) in the fin flows sheet. Why

and what the bank needs to check before financing the project.

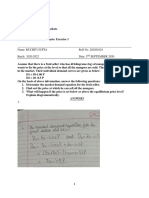

Task Q3 Solution :

The various steps involved in the fin flows sheet are as follows:-

The first step is to calculate the “Total Revenue” i.e. The amount received in the form of rent, interest on

deposit and from other sources.

The second step is to calculate the “OPERATING EXPENSES i.e. The amount which is need to run the

day-to-day operations of the business or the project. It includes Building Maintenance, Utilities (Electric +

Water + Internet), Salary (Maid + Accountant), Plumber, Electrician, Misc. etc., Insurance. All of these

constitutes to the “TOTAL OPERATING EXPENSES”.

The third step is to calculate the “EARNINGS BEFORE INTEREST TAX DEPRECIATION and

AMMORTIZATION” which is calculated by subtracting the Total Operating Expense from Total Revenue.

The importance of calculating EBITDA is to analyze and compare profitability among companies and

industries, as it eliminates the effects of financing and capital expenditure.

The fourth step is to calculate the “NON OPERATING EXPENSES” which includes the payment of the

interest on the debt as well as the depreciation. Non-operating expenses are often considered to be

the cost that a company must incur to fulfil certain monetary obligations. Other than that, these expenses are

said to play a vital role when it comes to ascertaining the net earnings of a firm during any given period.

The fifth step is to calculate the “INCOME BEFORE TAXES” after which the “TAX” is being deducted

in order to arrive at the “NET INCOME”.

The final step is to calculate the Final Project Cash flow which calculated using the :-

EQUITY

NET INCOME

ST Solution Page 3 https://techvardhan.com

VCE Summer Internship Program 2020

Smart Task Submission Format

DEPRECIATION

PRNICIPAL PAYMENT

CSR(certain % of net income)

The bank needs to check certain things before financing any project are as follows:-

1. Business Plan

2. Project Financial Structure + Legal Structure + Management Structure

3. Revenue Model

4. Cash Flow Projections for the next five to ten years

5. SWOT Analysis of the project

6. Risk Analysis & Mitigation details

7. SPV/SPC(Special Purpose Company/Vehicle) Registration documents

8. Federal and Local Government Departmental Clearances and Approval records

9. Environmental Clearances

10. Market Research Report

11. Detailed Project Report (DPR)

12. Off Taker Agreements/ Contracts /PPAs

13. Procurement Agreements / Contracts supported by Equipment specs and Performa Invoices

14. Operations & Maintenance (O&M) Agreements / Contracts

15. Debt Exposure Details

16. Patents or Copyright certificates (If any)

17. Project Land Status and records including ownership/lease records

500 Words (Max.)

Please add /delete blocks for if needed.

ST Solution Page 4 https://techvardhan.com

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Geith Catalogue 3.0Document43 pagesGeith Catalogue 3.0Sara Sarmiento Echeverry100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 12 Ethical Leadership Rev2Document44 pagesChapter 12 Ethical Leadership Rev2chibishunNo ratings yet

- Someone Like You - PianoDocument8 pagesSomeone Like You - PianotheshuNo ratings yet

- Lesson 3 - TAX Its Characteristics and ClassificationDocument18 pagesLesson 3 - TAX Its Characteristics and ClassificationAbigail MangaoangNo ratings yet

- Validation RuleDocument7 pagesValidation Ruleravilla naveenNo ratings yet

- Boy Who Loved Words Complete PDFDocument19 pagesBoy Who Loved Words Complete PDFJay CollyNo ratings yet

- Pre-Placement Training Program: Task SheetDocument4 pagesPre-Placement Training Program: Task Sheetruchit gupta50% (2)

- HR Policies of Semantic TechnologiesDocument45 pagesHR Policies of Semantic Technologiesruchit guptaNo ratings yet

- VCE Summer Internship Program 2020: Ruchit GuptaDocument5 pagesVCE Summer Internship Program 2020: Ruchit Guptaruchit guptaNo ratings yet

- Human Resource Management ProjectDocument9 pagesHuman Resource Management Projectruchit guptaNo ratings yet

- Ba Projet Term 2Document18 pagesBa Projet Term 2ruchit guptaNo ratings yet

- Capital StructureDocument13 pagesCapital Structureruchit guptaNo ratings yet

- Digital Marketing Survey: Your AnswerDocument1 pageDigital Marketing Survey: Your Answerruchit guptaNo ratings yet

- Happy Birthday Teena Di PDFDocument2 pagesHappy Birthday Teena Di PDFruchit guptaNo ratings yet

- Build An Email List Retargeting: © The Complete Digital Marketing CourseDocument1 pageBuild An Email List Retargeting: © The Complete Digital Marketing Courseruchit guptaNo ratings yet

- Assignment CFM (RUCHIT GUPTA) PDFDocument11 pagesAssignment CFM (RUCHIT GUPTA) PDFruchit gupta50% (2)

- Address PDFDocument1 pageAddress PDFruchit guptaNo ratings yet

- Compensation PDFDocument260 pagesCompensation PDFruchit gupta100% (2)

- Final - LVC Faculty Paper No. Paper Name Special Sessions/Regular Sessions ExpertsDocument1 pageFinal - LVC Faculty Paper No. Paper Name Special Sessions/Regular Sessions Expertsruchit guptaNo ratings yet

- Ruchit Gupta: Academic Qualifications Qualification Institute/University Year % / CgpaDocument1 pageRuchit Gupta: Academic Qualifications Qualification Institute/University Year % / Cgparuchit guptaNo ratings yet

- Types of UniversitiesDocument2 pagesTypes of Universitiesashtikar_prabodh3313No ratings yet

- Topic 6 Benefits of PayingDocument8 pagesTopic 6 Benefits of Payingcharlenealvarez59No ratings yet

- EconomicsDocument62 pagesEconomicsisha04tyagi100% (1)

- Public ProsecutorDocument24 pagesPublic ProsecutorROHITGAURAVCNLU100% (1)

- Bench Bulletin Issue 51Document76 pagesBench Bulletin Issue 51MaryNo ratings yet

- OEP Application and GuidelinesDocument11 pagesOEP Application and GuidelinesTay Jin TangNo ratings yet

- Quiz Akhir Semester GENAP 2020/2021: The Advertising of A ProductDocument6 pagesQuiz Akhir Semester GENAP 2020/2021: The Advertising of A ProductImeldayanti NeheNo ratings yet

- 4 - Value Education VE-MY-WSDocument12 pages4 - Value Education VE-MY-WSSunitha Nandhini. BNo ratings yet

- Perspective On 2012... by Steve BeckowDocument4 pagesPerspective On 2012... by Steve BeckowspiritualbeingNo ratings yet

- Postcolonial Quotations.Document4 pagesPostcolonial Quotations.Mazhar Meeran0% (1)

- KasoDocument1 pageKasoRoms ConchaNo ratings yet

- Buddhism & JainismDocument17 pagesBuddhism & JainismV.NIRANJAN KUMARNo ratings yet

- Scion - Hero-93Document1 pageScion - Hero-93JdRNo ratings yet

- Mrunal (Environment) SC Ban On Tiger Tourism, Core and Buffer Areas, Project Tiger, NTCA Guidelines Explained MrunalDocument12 pagesMrunal (Environment) SC Ban On Tiger Tourism, Core and Buffer Areas, Project Tiger, NTCA Guidelines Explained MrunalMonoj DasNo ratings yet

- Chapter 4: Relation of Education To RedemptionDocument2 pagesChapter 4: Relation of Education To RedemptionLeny Joy DupoNo ratings yet

- Econ 445 Problem Set 3 Linear Programming: Heinz2Document4 pagesEcon 445 Problem Set 3 Linear Programming: Heinz2Urbi Roy BarmanNo ratings yet

- Drone Notes Al MacDocument120 pagesDrone Notes Al MacAlister William MacintyreNo ratings yet

- Change, Cause and Effect B2Document1 pageChange, Cause and Effect B2Nguyễn LyNo ratings yet

- Top 10 Solar O&M KPIs To Track - Arbox Renewable EnergyDocument4 pagesTop 10 Solar O&M KPIs To Track - Arbox Renewable EnergySoundy 07 (Soundy)No ratings yet

- Practice Test 026Document4 pagesPractice Test 026Truong LaiNo ratings yet

- Representations and Coverage of Non-English-Speaking Immigrants and Multicultural Issues in Three Major Australian Health Care PublicationsDocument13 pagesRepresentations and Coverage of Non-English-Speaking Immigrants and Multicultural Issues in Three Major Australian Health Care PublicationsOlgaNo ratings yet

- Social Determinants of HealthDocument42 pagesSocial Determinants of HealthSharon DenhamNo ratings yet

- To Study in Flanders (Belgium) : Vlir-Uos Master ScholarshipsDocument3 pagesTo Study in Flanders (Belgium) : Vlir-Uos Master Scholarshipsabdelhamid el bakkariNo ratings yet

- Internet ConceptDocument36 pagesInternet ConceptDorisday Caballes EsperanzaNo ratings yet