Professional Documents

Culture Documents

This Partner Does Not Share in The Losses Incurred by The Partnership

Uploaded by

jahnhannalei marticioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Partner Does Not Share in The Losses Incurred by The Partnership

Uploaded by

jahnhannalei marticioCopyright:

Available Formats

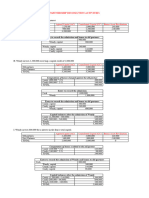

1.

This partner does not share in the losses incurred by the partnership

a. Limited partner

b. General partner

c. Industrial partner

d. General partner

2. All may be given to a partner whether the operation is a net profit or net loss, except

a. Salaries

b. Bonus

c. Interest

d. Regular drawings

3. This is the most equitable way of distributing profit

a. Average capital

b. Beginning capital

c. Ending capital

d. Original capital

4. A and B are partners, but only A is the managing partner. Both contributed equal assets. The

best profit-sharing ratio will be

a. Equally

b. Salary A and B, remaining profit to be shared equally

c. Salary to A, remaining profit to be shared equally

d. 1:1 ratio

5. Properties contributed by the partners should be recorded at

a. Acquisition cost

b. Fair market value

c. Book value

d. Historical cost

You might also like

- Qualifying Exam (Basic & ParCor)Document7 pagesQualifying Exam (Basic & ParCor)Rommel CruzNo ratings yet

- Midterm ParCorDocument5 pagesMidterm ParCorMae Ann RenlingNo ratings yet

- Partnership Dissolution Withdrawal Retirement Death and IncapacityDocument25 pagesPartnership Dissolution Withdrawal Retirement Death and IncapacityGale KnowsNo ratings yet

- Lesson 2 Formation of PartnershipDocument27 pagesLesson 2 Formation of PartnershipheyheyNo ratings yet

- Partnership OperationDocument71 pagesPartnership Operationglenn langcuyanNo ratings yet

- Accbp100 2nd Exam Part 1Document2 pagesAccbp100 2nd Exam Part 1emem resuento100% (1)

- Accounting ProjectDocument31 pagesAccounting ProjectDaisy Marie A. Rosel50% (2)

- CHAPTER 2 PartnershipDocument17 pagesCHAPTER 2 PartnershipLAZARO, Jaspher S.No ratings yet

- Amount of Investment Bonus Method: Than Investment Greater Than InvestmentDocument14 pagesAmount of Investment Bonus Method: Than Investment Greater Than InvestmentElla Mae Clavano NuicaNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- Financial Accounting and Reporting Part 1: Nature and Formation of a PartnershipDocument15 pagesFinancial Accounting and Reporting Part 1: Nature and Formation of a Partnershipambot balakajanNo ratings yet

- Cfas ReviewerDocument7 pagesCfas ReviewerDarlene Angela IcasiamNo ratings yet

- Estimated Value of Merchandise Destroyed by FloodDocument2 pagesEstimated Value of Merchandise Destroyed by FloodLoli WalkerNo ratings yet

- Batch 2021 - Corporation AccountingDocument34 pagesBatch 2021 - Corporation AccountingZia NuestroNo ratings yet

- Partnership and Corporation Solution Manual Chapter 1 ReviewDocument81 pagesPartnership and Corporation Solution Manual Chapter 1 ReviewGarp BarrocaNo ratings yet

- Lesson5-Bsa 2BDocument8 pagesLesson5-Bsa 2BEdraelyn MonatoNo ratings yet

- Partnership accounting concepts and calculations in 40 charactersDocument7 pagesPartnership accounting concepts and calculations in 40 charactersLLYOD FRANCIS LAYLAYNo ratings yet

- Tamala and Estrabilla Tuna Fish Business Financial StatementDocument2 pagesTamala and Estrabilla Tuna Fish Business Financial StatementAdam CuencaNo ratings yet

- Acct102 Midterm NotesDocument15 pagesAcct102 Midterm NotesWymple Kate Alexis FaisanNo ratings yet

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Accountancy Liquidation ProceduresDocument3 pagesAccountancy Liquidation ProceduresJizelle BianaNo ratings yet

- Partnership OpDocument25 pagesPartnership OpNeri La LunaNo ratings yet

- Short Case ActivitiesDocument2 pagesShort Case ActivitiesRaff LesiaaNo ratings yet

- Chapter 1 Introduction To Cost AccountingDocument9 pagesChapter 1 Introduction To Cost AccountingSteffany RoqueNo ratings yet

- Partnership Dissolution ActivitiesDocument9 pagesPartnership Dissolution Activitieschrstncstllj100% (1)

- XYZ Company Sold10 Units F Goods With A Unit List Price of P 2Document2 pagesXYZ Company Sold10 Units F Goods With A Unit List Price of P 2jude santos0% (1)

- Accounting Quizzes Answer KeyDocument11 pagesAccounting Quizzes Answer KeyRae SlaughterNo ratings yet

- Review QuestionsDocument4 pagesReview QuestionsShane Khezia Baclayon100% (1)

- A Partnership With A Capital Less Than 3000 Is Void If It Is Unregistered With SECDocument4 pagesA Partnership With A Capital Less Than 3000 Is Void If It Is Unregistered With SECElla Mae TuratoNo ratings yet

- Solutions - Problems 1 To 5 (Handout-Manufacturing)Document4 pagesSolutions - Problems 1 To 5 (Handout-Manufacturing)Reniella AllejeNo ratings yet

- Classification of CostDocument4 pagesClassification of CostSha Heradura AngadNo ratings yet

- Towards A Resilient and Inclusive Financial SectorDocument36 pagesTowards A Resilient and Inclusive Financial SectorSpare ManNo ratings yet

- Quiz 2 Partnership OperationsDocument4 pagesQuiz 2 Partnership OperationsChelit LadylieGirl FernandezNo ratings yet

- 1.2. Partnership Operations and Distributions of Profits or LossesDocument4 pages1.2. Partnership Operations and Distributions of Profits or LossesKPoPNyx EditsNo ratings yet

- LC22Document28 pagesLC22John MaynardNo ratings yet

- Basic Economics Task Performance (Prelims)Document1 pageBasic Economics Task Performance (Prelims)godwill oliva0% (1)

- Acctg 2.1-Partnership: Accounting 2 - Partnership and Corporation AccountingDocument45 pagesAcctg 2.1-Partnership: Accounting 2 - Partnership and Corporation AccountingMaria Carmela MoraudaNo ratings yet

- Mock Aqe 1Document15 pagesMock Aqe 1AshNor RandyNo ratings yet

- Partnership Admission Problems and Journal EntriesDocument2 pagesPartnership Admission Problems and Journal EntriesKaren Joy Jacinto ElloNo ratings yet

- Guide Questions For Chapter 2Document5 pagesGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Respecting Rights of Stakeholders and Effective Redress For Violation of StakeholderDocument2 pagesRespecting Rights of Stakeholders and Effective Redress For Violation of StakeholderEDELYN PoblacionNo ratings yet

- Accounting for dividends on preference and ordinary sharesDocument5 pagesAccounting for dividends on preference and ordinary sharesBernadette Joyce ManjaresNo ratings yet

- Review Questions 4Document5 pagesReview Questions 4John Joseph Addo0% (1)

- ACCTG122 Homework On Partnership LiquidationDocument2 pagesACCTG122 Homework On Partnership LiquidationJoana TrinidadNo ratings yet

- BERISO, Ella's Financial Status Analysis 2022Document8 pagesBERISO, Ella's Financial Status Analysis 2022kasandra dawn BerisoNo ratings yet

- Ipil Grocery T AccountsDocument5 pagesIpil Grocery T AccountsJelaina Alimansa100% (1)

- Admission and Retirement Problems for PartnershipsDocument3 pagesAdmission and Retirement Problems for PartnershipsJohn Eric MacallaNo ratings yet

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- Partnership and CorporationDocument41 pagesPartnership and CorporationJoana TatacNo ratings yet

- ACEFIAR Quiz No. 7Document2 pagesACEFIAR Quiz No. 7Marriel Fate CullanoNo ratings yet

- Activity 2 ECODocument2 pagesActivity 2 ECOEugene AlipioNo ratings yet

- Partnership OperationDocument21 pagesPartnership OperationDonise Ronadel SantosNo ratings yet

- Partnership LiquidationDocument9 pagesPartnership LiquidationPeter PiperNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Dong Rosello100% (1)

- Tom-Sawyer - Company CompleteDocument45 pagesTom-Sawyer - Company CompleteCresenciano MalabuyocNo ratings yet

- Article 1767Document2 pagesArticle 1767Noreen67% (9)

- Partnership Profit Loss AgreementDocument3 pagesPartnership Profit Loss AgreementtelleNo ratings yet

- AC1104 Mockexams AnswerkeyDocument10 pagesAC1104 Mockexams AnswerkeyKarl ExacNo ratings yet

- Accounting-for-Partnership-Corporation-AC-34 (1) - Answer KeyDocument7 pagesAccounting-for-Partnership-Corporation-AC-34 (1) - Answer KeyRhelyn Dato-onNo ratings yet

- Stated Interest RateDocument1 pageStated Interest Ratejahnhannalei marticioNo ratings yet

- Share Dividends IssuableDocument1 pageShare Dividends Issuablejahnhannalei marticioNo ratings yet

- An Intangible Asset Acquired by An Issuance of Share Capital Should Generally Be Valued at The Fair Market Value of The Stock IssuedDocument1 pageAn Intangible Asset Acquired by An Issuance of Share Capital Should Generally Be Valued at The Fair Market Value of The Stock Issuedjahnhannalei marticioNo ratings yet

- Accounting for Intangible Assets - Recognition, Measurement, and DisclosuresDocument1 pageAccounting for Intangible Assets - Recognition, Measurement, and Disclosuresjahnhannalei marticioNo ratings yet

- Periodic Depreciation Expense Is Primarily The Result of Applying TheDocument1 pagePeriodic Depreciation Expense Is Primarily The Result of Applying Thejahnhannalei marticioNo ratings yet

- Barit Island Is North ofDocument1 pageBarit Island Is North ofjahnhannalei marticioNo ratings yet

- Property Available For LeaseDocument1 pageProperty Available For Leasejahnhannalei marticioNo ratings yet

- The Following Statements All Relate To The Recording ProcessDocument1 pageThe Following Statements All Relate To The Recording Processjahnhannalei marticioNo ratings yet

- Business Entity Concept & Going Concern Assumption MCQDocument1 pageBusiness Entity Concept & Going Concern Assumption MCQjahnhannalei marticioNo ratings yet

- Which of The Following Would Not Be Reported As Investment PropertyDocument1 pageWhich of The Following Would Not Be Reported As Investment PropertyJAHNHANNALEI MARTICIONo ratings yet

- Unearned RevenueDocument1 pageUnearned Revenuejahnhannalei marticioNo ratings yet

- Capitalization of Construction Period Interest Is Based Primarily Upon TheDocument1 pageCapitalization of Construction Period Interest Is Based Primarily Upon Thejahnhannalei marticioNo ratings yet

- Calayan IslandDocument1 pageCalayan Islandjahnhannalei marticioNo ratings yet

- Transfers From Investment Property To PropertyDocument1 pageTransfers From Investment Property To PropertyJAHNHANNALEI MARTICIONo ratings yet

- PFRS 6 Applies To Expenditures IncurredDocument1 pagePFRS 6 Applies To Expenditures IncurredJAHNHANNALEI MARTICIONo ratings yet

- Adjusting Entries Worksheet QuizDocument1 pageAdjusting Entries Worksheet Quizjahnhannalei marticioNo ratings yet

- When A Net Loss Has Been SufferedDocument1 pageWhen A Net Loss Has Been Sufferedjahnhannalei marticioNo ratings yet

- Which of The Following Costs Related To Computer Software Is Capitalized To An Intangible Asset AccountDocument1 pageWhich of The Following Costs Related To Computer Software Is Capitalized To An Intangible Asset Accountjahnhannalei marticioNo ratings yet

- Under The Perpetual Inventory MethodDocument1 pageUnder The Perpetual Inventory Methodjahnhannalei marticioNo ratings yet

- Answers 1. Memorandum Entry 2. Professional Partnership 3. Partnership 4. Agreed ValueDocument1 pageAnswers 1. Memorandum Entry 2. Professional Partnership 3. Partnership 4. Agreed Valuejahnhannalei marticioNo ratings yet

- The Specific Identification Method Can Be Used OnlyDocument1 pageThe Specific Identification Method Can Be Used Onlyjahnhannalei marticioNo ratings yet

- Cost of Transporting Goods From The SupplierDocument1 pageCost of Transporting Goods From The Supplierjahnhannalei marticioNo ratings yet

- Which Item Listed Below Does Not Qualify As An Intangible AssetDocument1 pageWhich Item Listed Below Does Not Qualify As An Intangible Assetjahnhannalei marticioNo ratings yet

- When The Accounts Receivable of A Company Is Sold Outright To A Company Which Normally Buys Accounts ReceivableDocument1 pageWhen The Accounts Receivable of A Company Is Sold Outright To A Company Which Normally Buys Accounts Receivablejahnhannalei marticioNo ratings yet

- An Investment Property Is DerecognizedDocument1 pageAn Investment Property Is Derecognizedjahnhannalei marticioNo ratings yet

- Under PFRS No. 9, Which Is Not A Category For Accounting For InvestmentsDocument1 pageUnder PFRS No. 9, Which Is Not A Category For Accounting For Investmentsjahnhannalei marticioNo ratings yet

- PAS 16 Property, Plant and Equipment, Until Construction Is Complete and Then It Is Accounted For Under PAS 40, Investment PropertyDocument2 pagesPAS 16 Property, Plant and Equipment, Until Construction Is Complete and Then It Is Accounted For Under PAS 40, Investment Propertyjahnhannalei marticioNo ratings yet

- Is An Allocation of Property, Plant and Equipment Cost To The Time Period of Usefulness, in Systematic and Rational MatterDocument1 pageIs An Allocation of Property, Plant and Equipment Cost To The Time Period of Usefulness, in Systematic and Rational Matterjahnhannalei marticioNo ratings yet

- Transactions Costs Do Not IncludeDocument1 pageTransactions Costs Do Not Includejahnhannalei marticioNo ratings yet

- An Entity Requires A Subsidiary Exclusively With A View To Selling It. The Subsidiary Meets The Critera To Be Classifies As Held For SaleDocument1 pageAn Entity Requires A Subsidiary Exclusively With A View To Selling It. The Subsidiary Meets The Critera To Be Classifies As Held For Salejahnhannalei marticioNo ratings yet