Professional Documents

Culture Documents

Insurance Underwriting Process: Mock Exam Questions

Uploaded by

Montathar Abd Al NabiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Underwriting Process: Mock Exam Questions

Uploaded by

Montathar Abd Al NabiCopyright:

Available Formats

IF3.

Insurance Underwriting Process

Mock Exam Questions.

[Taster Set]

Examinable year: 2021

Valid for Examination Dates from: 1 January – 31 December 2021

Document last updated: 11 December 2020

Filename: IF3MockTaster

https://brandft.co.uk/

The CII examine from 1 January through 31 December each year.

Brand Financial Training is an independent company and has no connection with the

Chartered Insurance Institute™ or any other examining body.

All Intellectual Property Rights and goodwill in or relating to the contents of the Brand

Financial Training Ltd’s Goods and/or Services is the copyright of Brand Financial Training

Ltd.

All Goods and/or Services are purchased solely for the personal use of the Buyer. The

Goods and/or Services are supplied to the original Buyer only and may not be transferred.

The Buyer may not copy, summarise or reproduce any of the Goods and/or Services in

any form.

The Buyer may not email, lend, hire or give any Goods and/or Services to individuals or

companies for either commercial or non-commercial use.

The Buyer may not sell the Goods and/or Services to individuals or companies for either

commercial or non-commercial use.

Should any illegal use of any materials be discovered, legal actions may be instigated

against the Buyer.

Brand Financial Training Ltd shall perform the Services with reasonable skill and care.

However, where applicable, Brand Financial Training Ltd does not guarantee that the

Services will be uninterrupted, secure or error-free or that any data generated, stored,

transmitted or used via or in connection with the Services will be complete, accurate,

secure, up to date, received or delivered correctly or at all. Brand Financial Training Ltd

may have to suspend the Services for repair, maintenance or improvement. If so, Brand

Financial Training Ltd will restore them as quickly as is reasonably possible.

Whilst Brand Financial Training Ltd makes every effort to ensure that all information

(written and verbal) provided is accurate and correct at the time, no liability for any claims

in relation to loss of business or consequential damage incurred by a Consumer as a

result of using or relying on the information will be accepted. Brand Financial Training Ltd

shall not accept responsibility for loss or damage, whether direct, indirect, incidental or

consequential in connection with or arising from your use of or any information provided

by or omitted by Brand Financial Training Ltd.

The Goods and Services could include inaccuracies or typographical errors and is in no

way intended to be an official representation of the Chartered Insurance Institute™

examinations. The Chartered Insurance Institute™ does not review or warrant the

accuracy of any Goods or Services offered by Brand Financial Training Ltd. Brand

Financial Training Ltd may make improvements and/or changes to documentation at any

time without notice.

Our full Terms and Conditions of Sale can be found at:

https://brandft.co.uk/terms-of-sale/

brandft.co.uk Page 2 of 9 IF3MockTaster

Examinable Until 31 Dec 2021

© Brand Financial Training, 2021

Important Information

This Mock Exam paper is designed as a ‘taster’ version, to give you an example of what

you can expect if you go on to purchase the other available Mock papers.

Although it follows the format of the full version, the questions may not be as in-depth as

those given in the full exam and therefore will not score as many marks or take the same

amount of time to answer. Nevertheless, the questions are in the same style / format as

those in the actual exam and other Mock papers and are accompanied by full answers.

brandft.co.uk Page 3 of 9 IF3MockTaster

Examinable Until 31 Dec 2021

© Brand Financial Training, 2021

IF3 Examination Information

The examination consists of 75 multiple-choice questions (MCQs).

2 hours are allowed for this examination.

Unless otherwise stated, candidates will be examined on the basis of English law and

practice.

A multiple-choice question consists of a problem followed by four options, labelled A, B,

C and D. Each question will contain only one correct or best response to the problem.

A correct response is awarded one mark.

No marks are deducted for an incorrect response.

brandft.co.uk Page 4 of 9 IF3MockTaster

Examinable Until 31 Dec 2021

© Brand Financial Training, 2021

1. When a consumer is taking out insurance, what does the law now consider to be

‘material facts’?

A. Any fact which may influence the insurer’s opinion of the risk

B. Those for which questions are asked by the insurer

C. Facts which are required to be disclosed by law

D. Any fact which is material to the policy

2. Another name for insurance terms and conditions is:

A. subjectivities

B. objectives

C. reflexives

D. incentives

3. Which of these policies is subject to IPT?

A. Travel insurance

B. Risks based in the Isle of Man

C. Reinsurance contracts

D. Marine policies

4. Whereabouts in the policy document would you find an outline of the actual cover

provided?

A. The operative clause

B. The declaration

C. The recital clause

D. The preamble

5. What does the arbitration clause deal with?

A. Cancellation

B. Quantum

C. Average

D. Blame

6. How must an insurer provide renewal information to consumers, according to

ICOBS?

A. In good time and in a comprehensible form

B. 30 days prior to expiry of the current policy

C. In writing

D. In an open and timely manner

7. What is the minimum number of vehicles the majority of insurers usually consider for

motor fleet insurance?

A. 5 or more

B. 10 or more

C. 15 or more

D. 20 or more

brandft.co.uk Page 5 of 9 IF3MockTaster

Examinable Until 31 Dec 2021

© Brand Financial Training, 2021

8. Furs, jewellery and photographic equipment usually attract special terms on a

household policy because:

A. their individual value may exceed the unspecified single article limit

B. they should be insured elsewhere

C. they are otherwise uninsurable

D. they all attract ‘betterment’ rather than ‘depreciation’ in terms of value

9. Employers’ liability insurance usually excludes cover for:

A. disease

B. pure accidents

C. pain and suffering

D. working off-site

10. What is the upside of risk?

A. Failure to maximise opportunities

B. Discovery of threats that exist

C. Discovery of future threats

D. Failure to identify threats

11. Use of which of the following materials in the construction of a building is a particular

cause for concern in the food industry?

A. Timber

B. Brick

C. Polystyrene

D. Steel frame

12. The General Data Protection Regulation (GDPR) states that personal data must be

processed in a way that is:

A. lawful

B. efficient

C. expedient

D. vital

13. The control of downside risk is typically the concern of which level of management in

an organisation?

A. Operational

B. Board

C. Underwriting

D. Claims

14. IBNR claims are claims that are:

A. incurred but not reserved

B. incurred but not "run off"

C. incurred but not rated

D. incurred but not reported

brandft.co.uk Page 6 of 9 IF3MockTaster

Examinable Until 31 Dec 2021

© Brand Financial Training, 2021

15. Excess of loss reinsurance is often arranged in:

A. levels

B. layers

C. lines

D. loops

brandft.co.uk Page 7 of 9 IF3MockTaster

Examinable Until 31 Dec 2021

© Brand Financial Training, 2021

Answers

Alongside each answer, you will find a cross-reference to the relevant Chapter and

Section in the most up-to-date version of the CII study text.

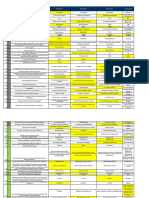

Q. Answer Chapter Section

1. B 1 B

2. A 2 A

3. A 2 F3

4. A 3 A4

5. B 3 C9

6. A 4 A

7. B 5 A3

8. A 5 C3A

9. B 6 C1

10. A 7 C

11. C 8 B4A

12. A 8 E

13. B 9 A

14. D 10 A6

15. B 11 C1B

brandft.co.uk Page 8 of 9 IF3MockTaster

Examinable Until 31 Dec 2021

© Brand Financial Training, 2021

Your Essential Resources for the CII IF3 Exam

For IF3 there are m o c k e x a m p a p e rs t o help you in your revision.

IF3 Mock Exam Questions

F re e t a s t e r set plus 3 f u l l s e t s o f 7 5 q u e s t i o n s e a c h.

Answers include cross references to the CII study text. Our

mock papers are not duplicates of the CII's specimen

papers, and can be used for additional exam practice.

"It was hard for me to commit myself to start studying again as I am a

full time mum of two under 5. However, I took the challenge and

decided to go for it. I was looking for past papers and that's when I

came across the mock exams through the Brand Financial Training

website. After doing them over and over again I was able to revise

the areas I was weak in. It gave me confidence and I was ready for

the exams. If I didn't do these papers I would have been a nervous

wreck! I guess I owe a big thank you to Brand Financial Training."

Shalini Devarajan, Ipswich

How Do I Find Out More?

G o s t ra i g h t t o h t t p s : / / b ra n d f t . c o . u k / c i i - i f 3- i n s u r a n c e - u n d e rw ri t i n g- p r o c e s s / Don ’t

forget to claim your free tasters too!

You might also like

- If1 Syllabus 2016 20160107 115441Document5 pagesIf1 Syllabus 2016 20160107 115441Mohamed ArafaNo ratings yet

- Certificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryDocument29 pagesCertificate in Insurance: Unit 1 - Insurance, Legal and RegulatorytamzNo ratings yet

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- IC-24 - Legal Aspects of Life AssuranceDocument1 pageIC-24 - Legal Aspects of Life Assuranceaman vermaNo ratings yet

- Rnis College of Insurance: New Ic 33 - Model Test 4Document6 pagesRnis College of Insurance: New Ic 33 - Model Test 4Raj Kumar DepalliNo ratings yet

- Assurance - Md. Raghib Ahsan FCADocument94 pagesAssurance - Md. Raghib Ahsan FCAShahid MahmudNo ratings yet

- Mock TestDocument11 pagesMock TestSnehil SinghNo ratings yet

- Mock Exam Questions WUEDocument37 pagesMock Exam Questions WUEMr. Ahsan Jamal ahsan.jamal0% (1)

- General Insurance Business: ObjectiveDocument4 pagesGeneral Insurance Business: ObjectiveJeremy JarvisNo ratings yet

- WCE Examination Guide For Exams From 1 May 2023 To 30 April 2024Document25 pagesWCE Examination Guide For Exams From 1 May 2023 To 30 April 2024Endale Birhanu0% (1)

- Credit Point SystemDocument3 pagesCredit Point Systemshanmuga89No ratings yet

- IRDA Workbook PDFDocument662 pagesIRDA Workbook PDFNancy Singh100% (1)

- CII Insurance Quals Brochure 11 14Document22 pagesCII Insurance Quals Brochure 11 14manojvarrierNo ratings yet

- Rnis College of Insurance: New Ic 33 - Model Test 3Document6 pagesRnis College of Insurance: New Ic 33 - Model Test 3Raj Kumar DepalliNo ratings yet

- CII IF2-General Insurance Business-1Document276 pagesCII IF2-General Insurance Business-1paschalpaul722100% (1)

- Ciin SyllabusDocument61 pagesCiin SyllabusejoghenetaNo ratings yet

- Motor Insurance Study Material FinalDocument67 pagesMotor Insurance Study Material FinalsekkilarjiNo ratings yet

- If1 Examination Guide For Exams From 1 January 2023 To 31 December 2023 PDFDocument29 pagesIf1 Examination Guide For Exams From 1 January 2023 To 31 December 2023 PDFJ Ferns100% (1)

- Pce.a.chapter1 8Document73 pagesPce.a.chapter1 8Ela DerarajNo ratings yet

- Ceilli EnglishDocument84 pagesCeilli EnglishKanna Nayagam100% (1)

- Free Irda Ic 38 Insurance Agents GeneralDocument12 pagesFree Irda Ic 38 Insurance Agents GeneralShabaz AliNo ratings yet

- CEILLI New Edition Questions English Set 1 PDFDocument19 pagesCEILLI New Edition Questions English Set 1 PDFTillie LeongNo ratings yet

- Risk in InsuranceDocument40 pagesRisk in Insuranceshazlina_liNo ratings yet

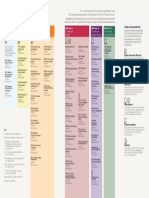

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkWill SackettNo ratings yet

- Ans: B. The Insurance CompanyDocument3 pagesAns: B. The Insurance Companyved100% (1)

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkContentsNo ratings yet

- FINS1612 Quiz 1 Practice Semester 2, 2014Document4 pagesFINS1612 Quiz 1 Practice Semester 2, 2014Tofuu Power100% (1)

- C12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyDocument5 pagesC12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyStef CNo ratings yet

- Life and General InsuranceDocument28 pagesLife and General InsuranceAravinda ShettyNo ratings yet

- Ceilli EnglishDocument197 pagesCeilli EnglishSitisaiful0% (1)

- IF7 Syllabus 2008Document3 pagesIF7 Syllabus 2008TelehealthNo ratings yet

- Claim Settlement of GICDocument51 pagesClaim Settlement of GICSusilPandaNo ratings yet

- Essentials of Life InsuranceDocument15 pagesEssentials of Life InsuranceAayush AgrawalNo ratings yet

- IC 38 Short Notes Chapter 2: Customer ServiceDocument10 pagesIC 38 Short Notes Chapter 2: Customer ServiceTaher BalasinorwalaNo ratings yet

- E97 Examination Guide For Exams From 1 May 2016 To 30 April 2017Document22 pagesE97 Examination Guide For Exams From 1 May 2016 To 30 April 2017Anonymous qAegy6GNo ratings yet

- Principles of TakafulDocument3 pagesPrinciples of TakafulMuhamad NazriNo ratings yet

- 01 - LLMIT CH 1 Feb 08Document18 pages01 - LLMIT CH 1 Feb 08Pradyut TiwariNo ratings yet

- CEILI PREPARATORY PACK English PDFDocument96 pagesCEILI PREPARATORY PACK English PDFHanis Ahmad BadriNo ratings yet

- New Syllabus PDFDocument77 pagesNew Syllabus PDFPrashantNo ratings yet

- Mock Test AnswersDocument19 pagesMock Test Answerstoll_meNo ratings yet

- 02 - LLMIT CH 2 Feb 08Document24 pages02 - LLMIT CH 2 Feb 08Pradyut TiwariNo ratings yet

- Motor OD Manual - Underwriting & Calims PDFDocument201 pagesMotor OD Manual - Underwriting & Calims PDFMani Rathinam100% (1)

- Presented By: Ria John (10090) Rini Thomas (10091)Document35 pagesPresented By: Ria John (10090) Rini Thomas (10091)Deepak SinghNo ratings yet

- IC 78 Miscellaneous InsuranceDocument306 pagesIC 78 Miscellaneous InsuranceKrishna GowdaNo ratings yet

- Licentiate HandbookDocument81 pagesLicentiate HandbookvindyjcNo ratings yet

- CEILI Study Guide (Eng)Document46 pagesCEILI Study Guide (Eng)liksyarnahNo ratings yet

- Additional Advanced Questions IC 72 Motor ChaptwewiseDocument20 pagesAdditional Advanced Questions IC 72 Motor ChaptwewiseSandeep NehraNo ratings yet

- Insurance, Legal and Regulatory 2019Document276 pagesInsurance, Legal and Regulatory 2019beatricezabron0503No ratings yet

- Miscellaneous Manual 1Document507 pagesMiscellaneous Manual 1shrey12467% (3)

- Ic s01 Miscellaneous InsuranceDocument60 pagesIc s01 Miscellaneous InsuranceRanjith0% (1)

- Nism Q & ADocument13 pagesNism Q & APriya PyNo ratings yet

- Claim Management For Life Insurance-Mr. Zain IbrahimDocument35 pagesClaim Management For Life Insurance-Mr. Zain IbrahimAsad HamidNo ratings yet

- Guide For Marketing & Public Relations: Key For Fellowship ExaminationDocument14 pagesGuide For Marketing & Public Relations: Key For Fellowship ExaminationRakesh KumarNo ratings yet

- Full BookletDocument392 pagesFull BookletEugenie PetrovaNo ratings yet

- Ic 86 Last Day Test 1Document29 pagesIc 86 Last Day Test 1Samba SivaNo ratings yet

- ch2 Introduction To Claims HandlingDocument94 pagesch2 Introduction To Claims HandlingTamour BaigNo ratings yet

- Fundamental of Insurance PDFDocument20 pagesFundamental of Insurance PDFMuhd Hisyamuddin50% (4)

- If 2 Mock Taster PDFDocument10 pagesIf 2 Mock Taster PDFtamzNo ratings yet

- Financial Accounting The Impact On Decision Makers 9th Edition Porter Test BankDocument11 pagesFinancial Accounting The Impact On Decision Makers 9th Edition Porter Test Bankhopehigginslup31100% (23)

- SA P8 - DMND Project Template SlidesDocument96 pagesSA P8 - DMND Project Template SlidesMontathar Abd Al NabiNo ratings yet

- p8 - DMND Project Sampath v1Document77 pagesp8 - DMND Project Sampath v1Montathar Abd Al NabiNo ratings yet

- Gelato News 2021 - enDocument20 pagesGelato News 2021 - enMontathar Abd Al NabiNo ratings yet

- Classmate Peer-CoachingDocument14 pagesClassmate Peer-CoachingMontathar Abd Al NabiNo ratings yet

- Ccra'S Global Preferred Hotel Program Join Ccra'S Global Preferred Hotel Program and Gain Access To Over 60,000 Agency Members Across The GlobeDocument3 pagesCcra'S Global Preferred Hotel Program Join Ccra'S Global Preferred Hotel Program and Gain Access To Over 60,000 Agency Members Across The GlobeMontathar Abd Al NabiNo ratings yet

- SU International - Admissions Booklet - Mar2021Document36 pagesSU International - Admissions Booklet - Mar2021Montathar Abd Al NabiNo ratings yet

- Questionnare Natural Person ApplicationDocument5 pagesQuestionnare Natural Person ApplicationMontathar Abd Al NabiNo ratings yet

- CPT Timetable 05 21 UPDATEDDocument1 pageCPT Timetable 05 21 UPDATEDMontathar Abd Al NabiNo ratings yet

- Important Acceptance, Offer ContractDocument7 pagesImportant Acceptance, Offer ContractHari HaranNo ratings yet

- Multiple or Several Interest On Same Property - Geagonia V CADocument2 pagesMultiple or Several Interest On Same Property - Geagonia V CAMarioneMaeThiamNo ratings yet

- Contrato A Casco DesnudoDocument13 pagesContrato A Casco DesnudoBoris YoungNo ratings yet

- Artist Booking ContractDocument3 pagesArtist Booking ContractKeisha Head Wallace100% (2)

- Mod 1. 4. Capacity To ContractDocument10 pagesMod 1. 4. Capacity To ContractTejal1212No ratings yet

- Unit-1Basic Principles of InsuranceDocument32 pagesUnit-1Basic Principles of InsuranceNikhil VaralaNo ratings yet

- Kindergarten: Siyahan Nga Bahin: Semana 1 - Naiiba AkoDocument12 pagesKindergarten: Siyahan Nga Bahin: Semana 1 - Naiiba AkoMichelle CasinNo ratings yet

- DBP Vs Court of Appeals (284 SCRA 14)Document2 pagesDBP Vs Court of Appeals (284 SCRA 14)Judy Miraflores Dumduma75% (4)

- Rock Counterculture and The Avant Garde 1966 1970 PDFDocument60 pagesRock Counterculture and The Avant Garde 1966 1970 PDFmojo7337No ratings yet

- Accounting For Special TransactionsDocument11 pagesAccounting For Special Transactionsjohn carloNo ratings yet

- Awangan-Assignment (Ac-Elec2-8243)Document5 pagesAwangan-Assignment (Ac-Elec2-8243)Mikaela AwanganNo ratings yet

- LAW2130 - Mock Exam PaperDocument6 pagesLAW2130 - Mock Exam PaperVavaNo ratings yet

- When Does A Letter of Comfort Becomes A Contract of GuaranteeDocument11 pagesWhen Does A Letter of Comfort Becomes A Contract of GuaranteeJ Imam100% (3)

- Jovan Land Vs CA DigestDocument2 pagesJovan Land Vs CA DigestJien LouNo ratings yet

- Heather Carrico False Witness PDFDocument74 pagesHeather Carrico False Witness PDF1SantaFeanNo ratings yet

- Types of Intellectual Property RightsDocument3 pagesTypes of Intellectual Property RightsNaman Bansal100% (1)

- Audio Imperia LLC - Licensing AgreementDocument3 pagesAudio Imperia LLC - Licensing Agreementfabio frezzatoNo ratings yet

- Guarantees in Supply of Goods To ConsumersDocument22 pagesGuarantees in Supply of Goods To ConsumersGunasundaryChandramohanNo ratings yet

- Código Civil CaliforniaDocument10 pagesCódigo Civil CaliforniaCarla PieriniNo ratings yet

- Law CONTRACT - 1337 - 1355Document4 pagesLaw CONTRACT - 1337 - 1355Andrea TugotNo ratings yet

- Power of AttorneyDocument1 pagePower of AttorneyFatim ArbabNo ratings yet

- Lesson 6 Corporate LiquidationDocument11 pagesLesson 6 Corporate Liquidationheyhey100% (2)

- Guaranty and SuretyshipDocument3 pagesGuaranty and SuretyshipMary Joy Barlisan Calinao100% (3)

- Technology Agreements in ChinaDocument24 pagesTechnology Agreements in ChinaDeborah DuganNo ratings yet

- Vda de Sindayen v. Insular, 62 Phil. 51 (1935)Document20 pagesVda de Sindayen v. Insular, 62 Phil. 51 (1935)Justine UyNo ratings yet

- Law of ContractDocument48 pagesLaw of Contractayla josephNo ratings yet

- 3 - Law of Carriage, Unit-I, PPT-02Document49 pages3 - Law of Carriage, Unit-I, PPT-02Ila SinghNo ratings yet

- Obligations and ContractsDocument24 pagesObligations and ContractsIshimaru ThorNo ratings yet

- SampledocretentionpolicyDocument3 pagesSampledocretentionpolicyAbhijeet MukherjeeNo ratings yet

- Contract 2Document232 pagesContract 2Skanda KiranNo ratings yet