Professional Documents

Culture Documents

Jurnal 15

Uploaded by

Muhammad FairusCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jurnal 15

Uploaded by

Muhammad FairusCopyright:

Available Formats

Advances in mathematical finance Published by IA University of

& applications, 2 (3), (2017), 91-105 Arak, Iran

Homepage: www.amfa.iau-

arak.ac.ir

Impact of Institutional Ownership and Board Independence on

the Relationship Between Excess Free Cash Flow and Earnings

Management

Allahkaram Salehi * a, Sajjad Mohammadi b, Marzieh Afshari b

a Department of Accounting, Masjed-Soleiman Branch, Islamic Azad University, Masjed-Soleiman, Iran

bDepartment of Accounting, Khoramshar-Persian Gulf International Branch, Islamic Azad University, Khoramshar,

Iran.

ARTICLE INFO ABSTRACT

Article history: However, the free cash flows scale is important for the financial health of the

Received 11 June 2017 company, but it has also its own limitations. Moreover, it’s not immune from

Accepted 22 August 2017 accounting tricks. Free cash flows can be considered as a measure of value for

shareholders of listed companies on Tehran Stock Exchange. The managers of

Keywords: these companies have tended to use the earnings management for managing the

Institutional Ownership, free cash flow and ultimately shareholder value and wealth. The main objective of

Board Independence, this study is to investigate the interactive effect of institutional ownership and

Excess Free Cash Flow, board independence on the relationship between excess free cash flow and earn-

Earnings Management. ings management in the Tehran Stock Exchange. The study is applied and correla-

tion research by its objective and nature. The variables used in this study have

been extracted from the financial reports of listed companies in Tehran Stock

Exchange and the web page of Tehran Stock Exchange in the period of 2009 to

2015. The results suggest that, "institutional ownership" and "board independ-

ence" on the relationship between "surplus free cash flow and earnings manage-

ment" had no significant effect.

1 Introduction

Profit includes cash items and accruals, and accruals are largely under the management’s control.

So management can manipulate accruals, or to use the modern term, manage earnings, in order to

portray a better picture of the company’s performance and predictable the future earnings. In other

words, by selecting the authorized methods of accounting, managers attempt to create predictable and

stable results. Because most investors and managers believe that companies that have good profitabil-

ity and their profits do not experience major changes compared to similar companies, have more value

and greater predictability and comparability [19].

Using assets is a measure for the ability of production assets and what they can produce; in contrast,

improper use of assets indicates losses on investment. That may be the result of inefficient use of as-

sets. Improper use of assets increases agency costs, because managers do not attempt to maximize the

* Corresponding author. Tel.: +989161113704 © 2017. All rights reserved.

E-mail address: a.k.salehi@iaumis.ac.ir Hosting by IA University of Arak Press

Impact of Institutional Ownership and Board Independence on the relationship between Excess…

interests of owners. Free cash flow is considered to be a factor for improper use of assets, because it

allows managers to spend financial resources on activities that reduce shareholder wealth and thus

increase agency costs. In the absence of effective governance, executives may invest in projects with

the negative present value to receive bonuses or rent. Studies have shown that some of the opportunis-

tic behavior of managers needs to be controlled by them, in order to ensure efficient use of assets to

create and increase value for shareholders. In fact, the value of every company is not only in its ability

to participate in creating free cash flow, but it also depends significantly on leveraging these funds, so

that the proper use of free cash flow by the director of a company with growing investment opportuni-

ties makes the market react positively to these kinds of free cash flows, and as a result, stock price

increases. Managers of companies with free cash flow may not only have a less than desirable per-

formance, but also do not use the available free cash properly [13]. Since part of the company’s prop-

erty belongs to the major professional stakeholders, that unlike the minority shareholders, have access

to valuable internal information about future prospects and business strategies and the company long-

term investments, and this information is available to them through direct communication with man-

agers. This situation is interpreted as concentration of ownership in corporations that large proportion

of the shares owned by large investors (institutional investors) such as banks, insurance companies

and corporate investment. Generally, it is believed that the presence of large investors may lead to a

change in corporate behavior. This emerges from the regular monitoring activities of those invest-

ments [17]. Considering the fact that managers tend to use management tool to manage profit, free

cash flow and ultimately, value and wealth of shareholders, therefore, it created an incentive in au-

thors to study the interactive effects of institutional ownership and board independence on the rela-

tionship between excess free cash flow and earnings management in Tehran's Stock Exchange. The

significance of this study lies in the fact that it shows investors whether institutional ownership and

board independence and their interactional effect on free cash flow and earning management can be

influential on creating value in corporations. Hence, we seek answer to this question that whether the

existence of major institutional shareholders and board independence as one of the components of

organizational monitoring can adjust the effects of excess free cash flow and earnings management? It

is expected that the results of this study can have extra scientific value and achievements as follows:

First, the results of this research could be the expansion of theoretical bases of relevant literature on

the investment and corporate governance. Second, the results of this research as a scientific contribu-

tion can provide useful information to investors, creditors and managers to achieve their goals. Third,

the results of this research may suggest new ideas for further research on the subject of the investiga-

tion.

2 Theoretical Foundations

2.1 Free Cash Flow and Earnings Management

Free cash flow is considered as a benchmark to measure the performance of companies and shows the

amount of cash that the company owns after expenditures for maintenance or development of assets.

Free cash flow is important in terms that allow the company to seek opportunities to increase share-

holder value. Without cash, development of new products, conducting business acquisition, paying

cash dividends to shareholders and debt reduction is not possible. But sometimes managers’ decisions

are not beneficial to shareholders and cause falsify to the financial reports. In fact, earnings manage-

[92] Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications

Salehi et al.

ment occurs when managers insert their judgements in financial reports and the way they record these

reports that the alterations in reports do not mislead some shareholders in regards to economic per-

formance of the corporation [17].

The findings of previous studies in other countries show that managers use earnings management to

maximize shareholder. The motivation of earnings management by executives is to obtain the appro-

priate status among competitors and to increase share value in the capital market, which makes inves-

tors and creditors of the company have more favorable terms toward the [19].

The main role of financial reporting is in effective transition of financial information to outsider users

in a reliable and timely manner. To this end, managers are exposed to opportunities for the exercise of

judgment in financial reporting. Managers can use their knowledge about the business activities to

improve the effectiveness of the financial statements as a tool to exhibit information to potential in-

vestors and creditors. However, if managers have incentives to mislead the users of financial state-

ments by applying their powers in the field of accounting and financial reporting choices, we expect

that earnings management occurs. Users of financial statements need to be aware that sometimes prof-

its are managed and therefore it may vary from actual profits. Therefore, it is essential that consumers

be more careful in making their decisions, and in addition to the quantity of the company's profit, also

pay attention to earnings management behavior [9].

2.2 Combination of Institutional Ownership and Investors

Various studies have been conducted regarding the relation between major and institutional share-

holders with return and corporate value and various results have been achieved depending on the vari-

ous economic, social and cultural situations. Studies in this area show that the existence of major

shareholders in the combined ownership could have positive and negative consequences for the com-

pany. Based on the efficient monitoring hypothesis, institutional shareholders have the ability to

monitor and influence executives and prevent any opportunistic actions by managers. As a result,

agency costs are reduced and thereby increase corporate value. But under the convergence of interest

hypothesis, due to the influence of institutional shareholders, the interests of major shareholders and

managers are aligned and causes ignorance of the interests of minor shareholders, and as a result of

this adjustment of benefits, share value reduces.

2.3 Earnings Management and Institutional Ownership

Institutional ownership is defined as the sum of the percentage of shares of companies belonging to

banking, insurance, financial institutions, holding companies, organizations, governmental institutions

and companies [6]. Owners have the necessary incentive and power to control the use of their assets

[3]. Ownership provides control over opportunistic behavior of managers by adjusting the relationship

between free cash flow and the use of assets. Moreover, given the task of governance of ownership

rights, agency costs that are caused by lack of information asymmetry and the separation of ownership

from management are reduced [29]. Koh [14] found evidence that the companies supervised by insti-

tutional investors have the ability to limit manager's behavior. In addition, institutional investors pos-

sess the opportunities, resources and the ability to monitor, regulate and influence managers. Monitor-

ing of firms by institutional investors force the managers to pay more attention on performance and

less interest in opportunistic behavior or self-serving. Also, Park and Shin [22] stated that institutional

Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications [93]

Impact of Institutional Ownership and Board Independence on the relationship between Excess…

owners have more ability in detecting earning management than non-institutional owners, because

they have access to relevant and on-time information.

2.4 Board Independence and Earnings Management

From the perspective of agency theory, the presence of non-executive directors and their monitoring

activities as individuals help to reduce conflict of interest among shareholders and company execu-

tives in board meetings. As some of the authors believed, board directors play a major role in corpo-

rate governance. The main responsibility of the board is to establish effective governance over corpo-

rate affairs and to provide independent supervision on the activities of the executive and to requires

managers' responsibility toward shareholders and the balance of the interests of various stakeholders.

It is generally believed that when the board is more independent, it is able to exercise more effective

control on the executive directors. In a study, Leuz et al. [16] surveyed the relationship between earn-

ings management and the support for the foreign investors in 31 countries. The results showed that the

accuracy of financial reporting and the support of foreign investors was positively associated and it

also increased by more logical support of foreign investor.

3 Literature Review

In this section we review the existing related works.

3.1 External Researches

Jaggi and Gul [10] investigate the relationship between earnings management and free flow cash.

They conclude that a direct link between earnings management and high free cash flows in companies

with low growth. They believed, according to Jensen's theory, in such companies, executives invest

the free cash flow in projects with negative net present value rather than distributing the cash flow

among shareholders, which leads to a reduction in corporate value. Thus, managers of such companies

try to adjust to the situation through the use of discretionary accruals increase of profit so that they

achieve some of their personal interests. Jones and Sharma [12] examined the relationship between

earning management and free cash flows in Australia and especially in companies with low and high

growth. They concluded that there is a significant direct relation between discretionary accruals and

free cash flow. The reason is that in this type of company, managers try to improve their business

performance through the use of discretionary accruals. But they found no such relation in the compa-

nies with high growth. Park and Shin [22] examined the relationship between corporate governance

(institutional investors, the presence of non-executive directors and financial managers on director

board) and earnings management. The results showed that there is no significant relationship between

the non-executive directors and manipulation of accruals. The presence of managers with financial

expertise prevents income smoothing and also the presence of an agent of active institutional investors

reduces earnings management.

Chung et al. [7] in their investigation of "earnings management, surplus flow free cash, external moni-

toring" suggests that managers in companies with low growth and high free cash flow use discretion-

ary accruals increased profit to compensate for their low or negative profit, which inevitably comes

with the projects that has a negative net present value. He concluded that high quality audit and insti-

[94] Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications

Salehi et al.

tutional investors, whose shares are significant, adjust the relationship between free cash flow and

accruals.

Yudianti [26] investigated the effect of earning management on the relationship between free cash

flow and shareholder value in a study using 150 samples. The results with 95 percent confidence

showed that changes in free cash flows are associated significantly with those in shareholder wealth.

He also showed that there is a direct correlation between positive free cash flow and shareholder val-

ue, but there is no significant and direct correlation between negative cash flows and the value of

shareholders. In the second hypothesis test with 99% confidence, he concludes that level of earnings

management across the entire sample and the whole positive cash flows undermined the relationship

between cash flows and created wealth for shareholders. In a research conducted in Sweden, Zerni et

al. [28] have acquired evidence of positive free cash flow valuation for companies that have a stronger

board and plan better for progressive investment opportunities. The results of the research by Takiah

et al. [25] first showed that there is a significant negative relationship between free cash flow and op-

timal use of assets and then demonstrated the moderating effect of each of the ownership structures on

the above mentioned relationship. They concluded that supervision on the optimal usage of assets in

companies with more foreign ownership and higher free cash flow is more efficient. Also, when the

managerial ownership is high, supervision on the optimal use of assets in companies with more cash is

more efficient compared to companies with less cash. Also they found that governmental ownership

resulted in inefficient use of assets in companies with high cash flow.

In his study in India, Bhundia [5] found that there exists a significant positive relationship between

earnings management and free cash flow, and confirmed that the company's free cash flow manages

to raise earning management. Al-Dhamari and Ismail [2] reviewed the corporate governance structure,

excess free cash flow and earnings quality. They concluded that the companies in which ownership

and management are two separate elements, levels of profits are fixed. The results suggest that when

the SFCF is high, current profit of the company with smaller board and independent audit committee

is more likely to remain stable in the future. Investors should also consider governance structure, free

cash flow and its complications when evaluating the company's profits. They therefore suggest that

the independence of the board of directors and institutional ownership does not have any impact on

free cash flow surplus. Nekhil et al. [20] in their study investigated the moderating role of corporate

governance and ownership structure in free cash flows and earnings management in France from 2001

to 2010 began. The results indicate that there is an opportunistic behavior of managers at the level of

free cash flow. Especially in those approaches of earnings management that can increase your revenue

or profit. The results also indicated that corporate governance mechanisms such as managerial owner-

ship, audit committee independence and institutional investors reduced their earnings management.

3.2 Internal Researches

Mehrani & Bagheri [17] reviewed this matter in the article entitled “The effect of free cash flow and

institutional shareholders on earnings management in listed companies in Tehran's Stock Exchange”.

Their results suggest that generally free cash flow of firms can be considered as an incentive to man-

age earnings, as well as managers of companies with free cash flow and low growth, are likely to

manage their earnings in order to achieve their personal interest in the short term. The results also

showed that there is no significant relationship between earnings management and institutional share-

holders in companies with high free cash flow and low growth. This suggests that the presence of

Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications [95]

Impact of Institutional Ownership and Board Independence on the relationship between Excess…

institutional shareholders could not prevent earnings management imposed by managers in companies

with free cash flow and low growth. Nikoumaram and Mohammadzade Salte [21] in a study exam-

ined the relationship between corporate governance and earnings management between 2002 and

2007 with a population of 40 companies.

The results showed that 1) companies with sufficient corporate governance are (whether they have

strong or weak corporate governance) own less discretionary accruals 2) companies with sufficient

corporate governance, on equal levels of corporate governance capability, also own less discretionary

accruals and 3) companies with poor corporate governance, compared to companies with strong cor-

porate governance, do not necessarily possess greater discretionary accruals. Ahmadpour & Montazeri

[1] in a study reviewed different approaches of earning managements and the effect of the corporate

size, ownership structure and corporate governance on earnings management between 2003 and 2008

with a sample of 119 firms. The results showed that corporate size and family owners are two ele-

ments that influence manager's tendency in the choice of the kind of earnings management. In con-

trast, there was no significant relationship between non-executive managers, institutional sharehold-

ers, independent audit quality and manager's tendency toward the choice of earnings management.

Moradzade fard et al. [19] in a research surveyed the effect of rewards from board of directors and

institutional ownership on earnings management. The results indicate that there is a negative relation-

ship between institutional ownership of shares and profit management and also a direct relationship

between the amount of reward from board of directors and profit management.

Sadeghzadeh Fasfandighi and Aghaie [24] in their study called "the impact of corporate governance

structure and surplus of free cash flow on the quality of corporate profit" showed that the independ-

ence of the board of directors and institutional shareholders has a significantly negative relationship

with quality of profit and this relationship becomes significantly positive with the presence of excess

free cash flow.

Setayesh and Salehnia [23] examined the impact of ownership structure and capital structure on the

free cash flow in listed companies in Tehran's Stock Exchange. Their results demonstrated that corpo-

rate ownership and free cash flow of listed companies in Tehran's Stock Exchange. Their results

demonstrated that there is a significant positive relationship between corporate ownership and free

cash flow of listed companies in Tehran Stock Exchange. They also showed that there is no signifi-

cant relationship between institutional ownership and management and ownership concentration in the

sample firms. Zabihi and Asghari [27] in a study entitled "A survey of the relationship between excess

free cash flow, corporate governance and company size with the ability to forecast profits" studied

101 companies listed in Tehran Stock Exchange during 2012 and 2014. To consider each of the ad-

justment factors on the ability to predict profits, they used components of excess free cash flow and

corporate governance and company size.

For the corporate governance, they also used components of board independence, board size, inde-

pendent Chairman of the Board and institutional owners. The results indicated that there is a signifi-

cantly negative relationship between excess free cash flow and the ability to predict profits. According

to the results obtained from the studied population, it also showed that there is no relationship among

the components of corporate governance, institutional ownership and board independence with excess

free cash flow. In some researches has been shown that elements of these two has no significant effect

on the relationship between level of free cash flow and earnings management. Their results also

showed that there is no significantly negative relationship between free cash flow and earnings man-

agement.

[96] Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications

Salehi et al.

4 Our Proposed Method

4.1 Research Hypotheses

H1: Institutional ownership effect on the relationship between excess free cash flow and earnings

management,

H2: Board independence effect on the relationship between excess free cash flow and earnings man-

agement,

4.2 Methodology of the Research

This study is applied research, and also a correlational study because the research to find a relation-

ship among several variables. Since this research is based on the past literature so this study will be

ex post facto. The population in this study includes all the listed companies in Tehran's Stock Ex-

change until end of 2008. The research period is from 2009 to 2015. We also used systematic elimina-

tion method for the selection of the sample. To this end, in each stage, companies that do not possess

the following items have been deleted from the list and the rest of the companies have been selected

for the test:

Companies must have going concern during the year.

Financial intermediary and investment companies are not in the sample.

Their fiscal year must be ended 20 March each year.

Their required information must be available.

Finally, applying conditions mentioned above, 166 companies were selected to estimate models and

test hypotheses.

In this study, data collection was done in two phases. In the first phase, library method (referring to

theses and papers in Persian and English through relevant websites) was used to develop theoretical

foundations, and in the second phase, audited financial statements of the companies listed on TSE,

databanks, software such as Rahavard Novin, report of the board of directors, internal audit reports,

and the official website of the TSE were used.

We also used statistical indices such as mean, median, and dispersion indices. In this research multi

variable regression was used for statistical analysis. We analyzed the data using Excel Software and

after required modification and classification, we put the data in the STATA Software according to

the variables under investigation.

4.3 Research Model and Variables

4.3.1 Independent Variables

Excess free cash flow(SFCF) is a dummy variable i.e. if retained cash flow (RCF) is higher than the

median of the year and the ratio of stock price to book value is lower than the median of the sample in

a year, the value is 1, otherwise 0. To measure free cash flows, the model proposed by Lehn and

Poulsen [15] was used:

+ − − −

=

، ، ، ،

،

،

Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications [97]

Impact of Institutional Ownership and Board Independence on the relationship between Excess…

In which:

، : Corporate free cash flow (i) in the year (t), ، ، : Earnings before interest and tax (i) in the

year (t)

، : Annual depreciation expense (i) in the year (t), ، : income tax (i) in the year (t)

، : Financial expenses (i) in the year (t), :

، common stock dividend (i) in the year (t)

and ، : book value of assets (i) in the year t-.1

Institutional ownership (Insown): is a dummy variable. If companies in which the percentage of

shared held by institutional shareholders is higher than the median of the sample, the value is 1, oth-

erwise 0.

Board independence: If ratio of non-executive directors to the total board is higher than the median

of the sample, the value is 1, otherwise 0.

4.3.2 Dependent Variable: Earnings Management- Discretionary Accruals

Discretionary accruals are commented on by managers. One feature of accruals is that they can be

considered as an indicator of the company's accounting choices. In earnings management studies it is

usually divided into two parts: discretionary accruals and non-discretionary accruals, and discretion-

ary accruals are an index of earnings management.

The most famous model in estimating accruals in relation to earnings management research is Jones

model [11], in which non-discretionary accruals are estimated by minimum regression. In this study,

to calculate earnings management and discretionary accruals, we calculate non-discretionary accruals

using the adjusted model by Jones presented by Dechow et al. [8]. In this model, total accruals are

calculated as follows:

TA = EBIT – CFO

In which:

TA: total operational accruals; EBIT: operation profit; and CFO cash flow from operation.

After the calculation of total accruals by using the following model coefficients are calculated for

each industry:

1 ∆ −∆

= + + +

, ( ) ( ) ( )

In which:

TA: total operational accruals; At-1: last year assets; ΔREV: Changes in net revenue

ΔREC: Change in trade receivable accounts; PPE: Gross Property, Plant and Equipment; εit: estima-

tion error

Then, using coefficients and the information from each company, non-discretionary accruals (NDA)

for each year firm is calculated using the following model:

1 ∆ −∆

= + +

( ) ( ) ( )

[98] Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications

Salehi et al.

In the final stage, discretionary accruals (DA) are calculated as follows:

DA = TA – NDA

4.3.3 Control Variables

Size=Ln (total assets)

Financial leverage (LEV): total debt/ total assets

The study used regression models as follows:

Model 1

DISACC = β0 + β1SFCFi, t + β2Insowni, t + β3Insnow.SFCFi, t + β4Sizei, t + β5Leveragei, t + ε i, t

Model 2

DISACC = β0 + β1SFCFi, t + β2Indepndi, t+ β3Independ.SFCFi, t +β4Sizei, t + β5Leveragei, t + ε i, t

Table 1: Research Variables

DISACC Earnings management- discretionary accruals

SFCF Excess free cash flow

Insown Institutional ownership

Independ Boards of directors independence

Size Firm size

Leverage Financial leverage

Table 2: Results of the descriptive analysis of quantitative variables

Variable Frequency Mean Standard Median Minimum maximum

deviation

Earnings man- 1162 -0.02 1.00 -0.04 -2.82 3.58

agement

Free cash flow 1162 -0.003 0.98 -0.02 -2.90 3.17

Institutional 1162 0.74 0.20 0.79 0.02 1

ownership

Board of direc- 1162 0.65 0.20 0.60 0.00 1

tors independ-

ence

Financial lev- 1162 0.65 0.26 0.65 0.02 3.06

erage

Firm size 1162 13.59 1.47 13.43 9.88 18.82

5 Findings

5.1 Descriptive Indicators of Variables

Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications [99]

Impact of Institutional Ownership and Board Independence on the relationship between Excess…

In this section we describe research variables with the use of central and dispersion parameter such as

mean, median, standard deviation, minimum and maximum. Table 2 shows the descriptive indicators

of the research variables. In this research, we calculated mean, standard deviation, median (p50), min-

imum and maximum to study the descriptive indicators of variables.

5.2 Correlation Coefficients between Variables

To determine the type and the size of the relationship between the explanatory variables, including the

independent variables and control variables, Pearson correlation coefficients were calculated and

shown in table 3 below.

Table 3: Correlations between variables

Variables Earnings Free Institution- Board inde- Financial Firm

manage- cash al owner- pendence leverage size

ment flow ship

Earnings Correlation : 1

management significance:

Free cash Correlation: -0.532 1

flow significance 0.000

:

Institutional Correlation: 0.073 0.036 1

ownership Significance 0.018 0.201

:

Board inde- Correlation: -0.036 0.049 -0.087 1

pendence Signifi- 0.424 0.063 0.003

cance:

Financial Correlation: -0.160 - -0/010 -0/155 1

leverage Signifi- 0.000 0/189 0/724 0/000

cance: 0/000

Firm size Correlation: 0/074 0/046 0/066 -0/026 -0/038 1

Signifi- 0/012 0/121 0/025 0/369 0/192

cance:

*Source: Research Results

5.3 Test Results of Suitable Estimation Model Selection

It is necessary to run Chow (F Limer) test before model estimation. This test determines whether to

use Pooled model or fixed effects model.

[100] Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications

Salehi et al.

Table 4: Test results of suitable model selection

Model F test Chow test Hausman test Approach

Statistics Statistics probability Statistics probabil-

probability ity

Model 1 83.42 1.97 0.000 27.41 0.000 Panel regression with

0.000 fixed effects

Model 2 85.81 2.47 0.000 24.83 0.000 Panel regression with

0.000 fixed effects

*Source: Research Results

If the F statistic is significant at the 5% level, the null hypothesis (Pooled) will be rejected and fixed

effects model will be accepted. Results are shown in Table 4.

A panel regression is significant. Now, to recognize whether to use panel regression with random or

fixed patterns to estimate above models we look at the column of Hausman test. Because the probabil-

ity of Hausman test was 0.000 and this value is smaller than 0.05 In order to estimate the model, the

panel regression with fixed effects should be used.

5.4 Results of Research Hypotheses and Analysis

First hypothesis states that "institutional ownership influences the relationship between excess free

cash flow and earnings management". The results of this test using a panel regression with fixed ef-

fects is shown in Table 5 below. According to this table, the variable "excess free cash flow" has a

significantly and negative impact on the variable of "earnings management". It is because the possibil-

ity of that is less than 0.05. Also the Interactive effects of two variables of "excess free cash flow" and

"institutional ownership" is positive on "earnings management" but since the amount is likely to be

greater than 0.05, so the impact is not significant.

Table 5: Test results of the first Hypothesis

Results of model estimation

variable Ratio Standard error T statistics probability

constant -3.87 1.09 -3.36 0.000

Excess free cash flow -1.24 0.23 -4.89 0.000

Institutional owner- -0.03 0.24 -0.04 0.910

ship

Excess free cash 0.31 0.36 1.09 -0.249

flow+ institutional

ownership

Firm size 0.34 0.04 5.13 0.000

Financial leverage -1.03 0.18 -6.06 0.000

F statistics 71.12

probability 0.000

Adjusted coefficient 0.1249

of determination

*** Source: Research Results

Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications [101]

Impact of Institutional Ownership and Board Independence on the relationship between Excess…

As a result, the first hypothesis is rejected with 95 percent confidence. It should be noted that the vari-

able "size", has a positive and significant impact on the variable of "earnings manage" and variable of

"leverage" has a significant negative impact on the variable of "earnings management". Table 5 also

shows that the statistical probability of F is 0.000, and because this value is smaller than 0.05, There-

fore, this model has been considered significant to test this hypothesis with 95 percent of confidence.

The coefficient of determination of the model is equal to 0.1249.

This value indicates that 12.49 percent of the changes of the variable of "earnings management" is

determined by the changes of "excess free cash flow", "board of director's independence", and the

interactive effect of these two variables and also the control variables of " size" and " leverage". The

result: "institutional ownership" had no significant effect on the relationship between "excess free

cash flow" and "earnings management". Thus the first hypothesis is rejected.

The second hypothesis states that the board independence influences the relationship between excess

free cash flow and earnings management. The results of this test using a panel regression with fixed

effects is shown in Table 6. According to this table, the variable of "excess free cash flow" has a sig-

nificant and negative impact on the variable of "earnings management. This is because this value is

less than 0.05. Also, Interactive effects of the two variables of "excess free cash flow" and "independ-

ence of the board" is positive on the variable of "earnings management", but because its possibility is

greater than 0.05, so the impact is not significant.

As a result, the second hypothesis in both cases is rejected with 95 percent confidence. It should be

noted that the variable of "size" has a positive and significant impact on the variable of "earnings

management" and the variable of "leverage" has a significant negative impact on the variable of

"earnings management.

Table 6: Test results of the second hypothesis

Results of model estimation

variable ratio Standard error T statistics probability

constant -3.21 1.01 -3.92 0.000

Excess free cash -1.28 0.19 -5.09 0.000

flow

Board of directors -0.18 0.26 -0.74 0.761

independence

Excess free cash 0.30 0.28 1.72 0.282

flow+ board of

directors independ-

ence

Firm size 0.39 0.07 5.11 0.000

Financial leverage -1.07 0.18 -4.95 0.000

F statistics 83.56

probability 0.000

coefficient of de- 0.1231

termination

Source: research results

[102] Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications

Salehi et al.

Table 6 shows that the probability of F statistic of 0.000, and because these values is smaller than

0.05, Therefore, the proposed model to test this hypothesis is considered significant with a 95% con-

fidence.

The coefficient of determination of the model is equal to 0.1231. This value indicates that 12.31 per-

cent of changes of variable of "earnings management" is determined by the variables of "excess free

cash flow" and "board independence" and the interactive effects of these two variables and control

variables of "size" and "Leverage". As a result, "independent board" had no significant effect on the

relationship between "excess free cash flow" and "earnings management". So, the second hypothesis

is rejected.

6 Discussions and Conclusion

The aim of this study was to investigate the interactive effects of institutional shareholders and board

independence on the relationship between excess free cash flow and earnings management in firms

listed in the Tehran stock exchange. The results show that generally free cash flow of firms can be

considered as an incentive to manage earnings and managers of companies with high free cash flows,

are likely to manage earnings to achieve their own personal interests in the short term. Today, the

institutional shareholders (as one of the corporate governance mechanisms) are of particular im-

portance to prevent opportunistic behavior of managers in order to apply earnings management. Cor-

porate governance reports suggest that institutional shareholders, due to the high percentage of its

ownership, possess the ability to control the actions of company managers and thus can affect corpo-

rate performance. But the results of this research showed that institutional ownership and board inde-

pendence, as corporate governance mechanisms, do not influence earnings management independent-

ly. This finding is not in line with the previous research in the literature. Also, the interaction of each

of these components with free cash flow has no effect on earnings management.

Among the reasons that can be cited is the low percentage of institutional investors and high percent-

age of government ownership in ownership structure, small number of non-executive board members

and possibly uses of other tools to manage earnings. Thus, the results indicate that the major share-

holders and board independence in the Iranian capital market are not considered as important criteria

in corporate governance. It is therefore proposed to the Stock Exchange and standard setters to recon-

sider the components of corporate governance. The financial experts are also advised to use larger

samples, especially banks and intermediary companies to investigate the matter in future studies. The

results of this study is in line with those from some literatures and do not comply with the results ob-

tained by Nekhili et al. [20].

References

[1] Ahmadpour, A., Montazeri H, Type of earnings management and the impact of company size and ownership

structure on it. Shiraz University of developments in accounting, 2011, 3(2), P. 1 -35.

[2] Al-Dhamari, R. A., Ismail, K. N. I. B. K., Governance Structure, Surplus Free Cash Flow(SFCF), And

Earning Quaility: Evidence from Malaysia. Journal of Modern Accounting and Auditing, 2013, 1(83), P. 8121-

8189.

Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications [103]

Impact of Institutional Ownership and Board Independence on the relationship between Excess…

[3] Ang, J. S., Cole, R. A., Lin, W. J., Agency cost and ownership structure. Journal of Finance, 2000, 55(1), P.

81–106.

[4] Baradaran Hasanzadeh, R., Badavar nahandi, Y. and Esmaili, S., The Effect of Ownership Structure on Au-

diting Quality. The Financial Accounting and Auditing Researches, 2014, 23(3), P. 99-115. (In Persian)

[5] Bhundia, A., A comparative study between free cash flows and earnings management. Business Intelligence

Journal, 2012, 5(1), P. 123-129.

[6] Bushee, Brian. J., The Influence of Institutional Investors on Myopic R&D Investment Behavior. Journal

Financial Economics, 1998, 86, P. 279–305.

[7] Chung, R., Firth, M., Kim, J. B., Earnings management ،surplus free cash flow and external monitoring.

Journal of Business Research, 2005, 58(6), P. 766-776.

[8] Dechow, P., Sloan, R., Sweeney, A., Detecting Earnings Management. Accounting Review, 1995, 70, P.

193 – 225.

[9] Jabbarzadeh Langarluie, S., Mohammad Salteh, H., Bayazidi, A., Moneskhah, G., The relationship between

earnings management in group companies (integrated) with the output of the main corporate in Tehran Stock

Exchange. Quarterly Stock Exchange, 2010, 11, P. 106-191.

[10] Jaggi, B., and Gul, A., Evidence of Accrual Management: A Test of the Free Cash Flows and Debt Moni-

toring Hypothesis, 2000, Working Paper, www.ssrn.com.

[11] Jones, J., Earnings management during import relief investigations. Journal of Accounting Research, 1991,

29(2), P. 193-228.

[12] Jones, S., Sharma, R., The Impact of Free Cash Flow, Financial Leverage and Accounting Regulation on

Earnings Management in Australia’s ‘Old’ and ‘New’ Economies, Managerial Finance, 2001, 27(12), P. 18-39.

[13] Khodadadi, V., Rashidi Baghi, M., Ghorbani, R., Kaviani, M., Impact of Ownership Structure on the rela-

tionship between free cash flow and efficient utilization of assets, Research journal of asset management and

financing, 2013, 1(1), P. 108-193

[14] Kohl, P. S., On the Association between Institutional Ownership and Aggressive Corporate Earnings Man-

agement in Australia, The British Accounting Review, 2003, 35, P.105–128.

[15] Lehn, K., Poulsen, A., Free Cash Flow and Stakeholder Gains in Going Private Transactions, The Journal

of Finance, 1989, 44(3), P. 771–787.

[16] Leuz, C., Dhananjay, N., Management: An international comparison., Peter, W., Investor protection and

earnings, Journal of Financial Economics, 2003, 69, P. 505-527.

[17] Mehrani, S., & Bagheri, B., The effect of free cash flow and institutional shareholders on earnings man-

agement in listed companies in Tehran Stock Exchange, Journal of Accounting Research, 2009, 1(2), P. 50- 71.

[18] Moradzade Fard, M., Gheytasi, R., Masjet Mousavi, S., The study of the relationship between corporate

free cash flow and shareholder free cash flow with stock market value of companies listed in Tehran Stock Ex-

[104] Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications

Salehi et al.

change, Journal of Financial Studies, Islamic Azad University, Science and Research Branch of Tehran, 2015, 7,

P. 1 -18.

[19] Moradzade fard, M., Zarezade Mehrizi, M. S., Taker, R., The impact of board of director's Bonus and insti-

tutional ownership on earnings management in companies listed in Tehran Stock Exchange, Quarterly Stock

Exchange, 2012, 18, P. 137- 152.

[20] Nekhili, M., Amer, I., Chtioui, T., Lakhal, F., Free cash flow and earnings management: the moderating

role of governance and ownership, 2015, Available at www.ssrn.com.

[21] Nikoumaram, H. & Mohammadzede Salteh, H., A model to explain the relationship between corporate

governance and earnings quality, Journal of Managerial Accounting, 2010, 3(4), P. 80-85.

[22] Park, Y. W., Shin, H. H., Board composition and earnings management in Canada, Journal of Corporate

Finance, 2004, 10(3), P. 431-457.

[23] Setayesh, M.H., and Salehinia, M., Impact of Ownership Structure and Capital Structure on free cash

flows, Research in financial accounting and auditing, 2015, 7(25), P. 15-32.

[24] Sadeghzadeh Fasfandiqghi, A.Salar, Aghaie., II Study of the effect of Excess free cash on the quality of

corporate profits. Third International Conference on Management, Economics and Accounting, Tabriz, East

Azerbaijan agency of industrial Management organization, 2015.

[25] Takiah, M., Iskandar, R., Br Bukit., Zuraidah, M. S., The Moderating Effect of Ownership Structure on the

Relationship Between Free Cash Flow and Asset Utilization, 2012.

[26] Yudianti, N., The Effect of Investment Opportunity Set and Earnings Management to the Relationship be-

tween Free Cash Flow and Shareholder Value, Journal of Business Research, 2008, 12, P. 193-228.

[27] Zabihi, A., and Asghari, M., The relationship between free cash flow, corporate governance and company

size with the ability to predict profit. Fourth National Conference of modern management, 2015.

[28] Zerni, M. K., and Nilsson, H., The entrenchment problem, corporate governance mechanisms, and firm

value, Contemporary Accounting Research, 2010, 27(4), P. 1169 - 1206.

[29] Watts, R. L., and Zimmerman, J. L., Agency problems, auditing, and the theory of the firm: some evidence.

Journal of Law and Economy, 1983, 26, P. 613–633.

Vol. 2, Issue 3, (2017), Advances in mathematical finance and applications [105]

You might also like

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- An Evaluation of The Relationships Between The Corporate Governance Mechanisms, The Free Cash Flow, and Earnings Management in Tehran Stock Exchange Listed CompaniesDocument19 pagesAn Evaluation of The Relationships Between The Corporate Governance Mechanisms, The Free Cash Flow, and Earnings Management in Tehran Stock Exchange Listed CompaniesAliNo ratings yet

- Barkhordar Tehrani 2015Document20 pagesBarkhordar Tehrani 2015Fauzan DaffaNo ratings yet

- Earnings Management: An Analysis of Opportunistic Behaviour, Monitoring Mechanism and Financial DistressDocument12 pagesEarnings Management: An Analysis of Opportunistic Behaviour, Monitoring Mechanism and Financial DistressRizqi AminiNo ratings yet

- Studying The Managers' Overconfidence Effect On The Relationship Between The Firm Risk and Managers' RewardsDocument8 pagesStudying The Managers' Overconfidence Effect On The Relationship Between The Firm Risk and Managers' RewardsInternational Journal of Business Marketing and ManagementNo ratings yet

- Relationship Between Capital Structure, Free Cash Flow and Performance in Companies Listed On Tehran Stock ExchangeDocument8 pagesRelationship Between Capital Structure, Free Cash Flow and Performance in Companies Listed On Tehran Stock ExchangeWaqar HassanNo ratings yet

- A Comparative Study Between Free Cash Flows and ManagementDocument7 pagesA Comparative Study Between Free Cash Flows and ManagementCatharinaNo ratings yet

- Investigating The Effects of Stable ProfitabilityDocument8 pagesInvestigating The Effects of Stable ProfitabilityTuan NguyenNo ratings yet

- 1 s2.0 S187704281203666X MainDocument6 pages1 s2.0 S187704281203666X MainMu Macammad IbNo ratings yet

- Bilal Ahmed 516 PP (85-101)Document17 pagesBilal Ahmed 516 PP (85-101)International Journal of Management Research and Emerging SciencesNo ratings yet

- CoauthorDocument23 pagesCoauthornoraida.hafni.2304218No ratings yet

- TehranDocument7 pagesTehranailakania7No ratings yet

- A Study On Ratio Analysis at KSRTC, BangaloreDocument96 pagesA Study On Ratio Analysis at KSRTC, BangaloreVivek Tr100% (1)

- A Study On The Impact of Cash Management On The FiDocument12 pagesA Study On The Impact of Cash Management On The Firahul nishadNo ratings yet

- KD Fatmala, IB RiharjoDocument23 pagesKD Fatmala, IB RiharjoHaliza NathaniaNo ratings yet

- Jurnal 8Document10 pagesJurnal 8Anjar FadhliaNo ratings yet

- Effect of Accounting Conservatism Level, Debt Contracts and Profitability On The Earnings Management of Companies: Evidence From Tehran Stock ExchangeDocument6 pagesEffect of Accounting Conservatism Level, Debt Contracts and Profitability On The Earnings Management of Companies: Evidence From Tehran Stock ExchangeTI Journals PublishingNo ratings yet

- Impact of Working Capital Management in The Profitability of Hindalco Industries LimitedDocument7 pagesImpact of Working Capital Management in The Profitability of Hindalco Industries LimitedMuhammad Khuram ShahzadNo ratings yet

- A Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedDocument8 pagesA Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedBabasaheb JawalgeNo ratings yet

- SSRN Id4264971Document12 pagesSSRN Id4264971samashrafNo ratings yet

- Effect of Profitability, Leverage & Ownership on FraudDocument15 pagesEffect of Profitability, Leverage & Ownership on Fraudkaka adikNo ratings yet

- The Relationship Between Working Capital Management and Profitability: Evidence From PakistanDocument12 pagesThe Relationship Between Working Capital Management and Profitability: Evidence From PakistanJudith N Gavidia MNo ratings yet

- 5784 14518 1 PBDocument10 pages5784 14518 1 PBMariam AlraeesiNo ratings yet

- Earnings Management and Quality of Accounting Information in JordanDocument14 pagesEarnings Management and Quality of Accounting Information in JordanVeronika BellaNo ratings yet

- Jiabr 03 2017 0030Document14 pagesJiabr 03 2017 0030Mariam AlraeesiNo ratings yet

- Pengaruh Faktor Good Corporate Governance, Free Cash Flow, DanDocument16 pagesPengaruh Faktor Good Corporate Governance, Free Cash Flow, DanDavid Hermawan SipayungNo ratings yet

- Jurnal InternDocument10 pagesJurnal InternMr XNo ratings yet

- Internship ReportDocument19 pagesInternship ReportAnamul HaqueNo ratings yet

- The Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingDocument7 pagesThe Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingEditor IJTSRDNo ratings yet

- The-Relationship BetweenDocument7 pagesThe-Relationship BetweenRajeev NepalNo ratings yet

- Mortaal"S Comprehensive Test-A Measure of Profitability and LiquidityDocument8 pagesMortaal"S Comprehensive Test-A Measure of Profitability and LiquidityTJPRC PublicationsNo ratings yet

- DEVAKI FMDocument21 pagesDEVAKI FMkhayyumNo ratings yet

- Impact of Free Cash Flow on ProfitabilityDocument15 pagesImpact of Free Cash Flow on Profitabilitysajid gulNo ratings yet

- Jurnal 1 DocumentDocument11 pagesJurnal 1 DocumentIrfan MNo ratings yet

- 422-Research Paper-832-1-10-20200319Document13 pages422-Research Paper-832-1-10-20200319Kampus MoneyNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementDuke CyraxNo ratings yet

- Article 4Document16 pagesArticle 4Javeria MullaNo ratings yet

- Daba Research ProposalDocument33 pagesDaba Research Proposalyifru gizachewNo ratings yet

- The Effect of Growth Opportunities and Capital Structure To Earning ManagementDocument9 pagesThe Effect of Growth Opportunities and Capital Structure To Earning ManagementAnita NytaNo ratings yet

- A Study On Financial Performance Analysis of Sri Karpagam Organic Cotton Industry at Karur General IntroductionDocument79 pagesA Study On Financial Performance Analysis of Sri Karpagam Organic Cotton Industry at Karur General Introductionk eswariNo ratings yet

- GROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsDocument5 pagesGROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsJUDIL BANASTAONo ratings yet

- FCF, 23 163Document9 pagesFCF, 23 163Azizur Rahman RejviNo ratings yet

- The Impact of Corporate Governance On Market Capitalization: Evidence From Bahrain BourseDocument10 pagesThe Impact of Corporate Governance On Market Capitalization: Evidence From Bahrain BourseAty HutagalungNo ratings yet

- The Effect of Corporate Governance On Earnings Quality With Surplus Free Cash Flow As Moderating VariableDocument11 pagesThe Effect of Corporate Governance On Earnings Quality With Surplus Free Cash Flow As Moderating VariablereskinoNo ratings yet

- The Influence of the Structure of Ownership and Dividend Policy of the Company (The Quality of the Earnings and Debt Policies are Intervening Variable): Empirical Study on Manufacturing Companies Listed on the Indonesia Stock ExchangeDocument22 pagesThe Influence of the Structure of Ownership and Dividend Policy of the Company (The Quality of the Earnings and Debt Policies are Intervening Variable): Empirical Study on Manufacturing Companies Listed on the Indonesia Stock ExchangeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Relationship Between Working Capital Management and ProfitabilityDocument5 pagesRelationship Between Working Capital Management and ProfitabilityEditor IJIRMFNo ratings yet

- SSRN Id2444294Document10 pagesSSRN Id2444294Anonymous LUvUBT60pnNo ratings yet

- Article 14 Earnings Management and Banks PerformanceDocument12 pagesArticle 14 Earnings Management and Banks PerformanceSalma ChakrounNo ratings yet

- Analysis of Impact of Working Capital Management On Profitability of Adani Wilmar Ltd.Document6 pagesAnalysis of Impact of Working Capital Management On Profitability of Adani Wilmar Ltd.Shruti UpadhyayNo ratings yet

- Study On The Relationship Between Corporate Financial Leverage and Financial Performance Based On Linear Multiple Regression Model Via Stata SystemDocument10 pagesStudy On The Relationship Between Corporate Financial Leverage and Financial Performance Based On Linear Multiple Regression Model Via Stata SystemRicalyn VillaneaNo ratings yet

- Impact of Working Capital Parameters On The Profitability of Various Industries PDFDocument9 pagesImpact of Working Capital Parameters On The Profitability of Various Industries PDFarcherselevatorsNo ratings yet

- Paper 4Document17 pagesPaper 4pejuang masa depanNo ratings yet

- Accepted Manuscript: Research in International Business and FinanceDocument27 pagesAccepted Manuscript: Research in International Business and FinanceintanulitNo ratings yet

- My Project 5 ChaptersDocument88 pagesMy Project 5 ChaptersPSBALARAM0% (1)

- Capital Structure and Financial Performance: Evidence From IndiaDocument17 pagesCapital Structure and Financial Performance: Evidence From IndiaanirbanccimNo ratings yet

- 4-1-66-231Document5 pages4-1-66-231Sri KamalNo ratings yet

- A Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDocument11 pagesA Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDr Abhijit ChakrabortyNo ratings yet

- Controle Interne 3Document10 pagesControle Interne 3Ayoub J•シNo ratings yet

- Jurnal 12Document14 pagesJurnal 12Muhammad FairusNo ratings yet

- Ownership Structure and Earnings Management: Evidence From PortugalDocument20 pagesOwnership Structure and Earnings Management: Evidence From PortugalAsrie DyahNo ratings yet

- Kualitas AuditDocument26 pagesKualitas AuditDicky AfrizalNo ratings yet

- Jurnal 11Document21 pagesJurnal 11Muhammad FairusNo ratings yet

- Monitoring Mechanisms and Financial Distress of Public Listed Companies in MalaysiaDocument18 pagesMonitoring Mechanisms and Financial Distress of Public Listed Companies in MalaysiaMuhammad FairusNo ratings yet

- Jurnal 22Document97 pagesJurnal 22Muhammad FairusNo ratings yet

- Jurnal 23Document23 pagesJurnal 23Muhammad FairusNo ratings yet

- Sharing KnowledgeDocument2 pagesSharing KnowledgeMuhammad FairusNo ratings yet

- IDC Standarisasi Produk Spun PileDocument1 pageIDC Standarisasi Produk Spun PileMuhammad FairusNo ratings yet

- 190522-Negosiasi Penawaran Analisa Produk WSBP PDFDocument1 page190522-Negosiasi Penawaran Analisa Produk WSBP PDFMuhammad FairusNo ratings yet

- 2.PC PilesDocument6 pages2.PC PilesRajinda BintangNo ratings yet

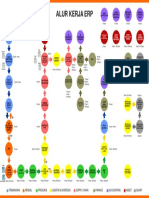

- Alur Kerja Erp: Pemasaran Rendal Produksi Logistik & Ekspedisi Supply Chain Finance Accounting Asset QuaryDocument1 pageAlur Kerja Erp: Pemasaran Rendal Produksi Logistik & Ekspedisi Supply Chain Finance Accounting Asset QuaryMuhammad FairusNo ratings yet

- Pengaruh Penerapan Good Corporate Governance Terhadap Manajemen Laba Serta Kinerja KeuanganDocument12 pagesPengaruh Penerapan Good Corporate Governance Terhadap Manajemen Laba Serta Kinerja KeuanganMuhammad FairusNo ratings yet

- Strategic Marketing: 5. Capabilities For Learning About Customers and MarketsDocument25 pagesStrategic Marketing: 5. Capabilities For Learning About Customers and MarketsamitcmsNo ratings yet

- Tes Bending SP 1200Document12 pagesTes Bending SP 1200Muhammad FairusNo ratings yet

- 6a. Precast Concrete Repairs For WI MBSDocument29 pages6a. Precast Concrete Repairs For WI MBSMuhammad FairusNo ratings yet

- Journal Mhs 2Document23 pagesJournal Mhs 2Muhammad FairusNo ratings yet

- Lifting Beam SprigWP Cap 25ton-ModelDocument1 pageLifting Beam SprigWP Cap 25ton-ModelMuhammad FairusNo ratings yet

- 6a. Precast Concrete Repairs For WI MBSDocument29 pages6a. Precast Concrete Repairs For WI MBSMuhammad FairusNo ratings yet

- Chat GPTDocument3 pagesChat GPTQuang Le TrongNo ratings yet

- Technical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEDocument30 pagesTechnical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEJayant Sharma100% (1)

- Financial Statement Analysis: K R Subramanyam John J WildDocument35 pagesFinancial Statement Analysis: K R Subramanyam John J Wildchristina dwi setiaNo ratings yet

- DCF Application - Asian PaintsDocument6 pagesDCF Application - Asian PaintsKashish PopliNo ratings yet

- Case Hansson Private LabelDocument15 pagesCase Hansson Private Labelpaul57% (7)

- Sessions 2 and 3 - Equity Valuation - in Session - Section EDocument88 pagesSessions 2 and 3 - Equity Valuation - in Session - Section EAnurag JainNo ratings yet

- Lecture 4 - ReformattingDocument31 pagesLecture 4 - ReformattingnopeNo ratings yet

- Trade Me analysis reveals stock valuationDocument20 pagesTrade Me analysis reveals stock valuationCindy YinNo ratings yet

- FM S 2012 HW5 SolutionDocument49 pagesFM S 2012 HW5 SolutionInzhu SarinzhipNo ratings yet

- Dividend PolicyDocument76 pagesDividend PolicyNazli KerimovaNo ratings yet

- MAS Financial-RatiosDocument4 pagesMAS Financial-RatiosJulius Lester AbieraNo ratings yet

- Cooper Industries' Potential Acquisition of Nicholson File CompanyDocument12 pagesCooper Industries' Potential Acquisition of Nicholson File CompanyLutful Kabir71% (7)

- The Cost of CapitalDocument178 pagesThe Cost of CapitalRAKESH SINGHNo ratings yet

- Merger Analysis APV MethodDocument22 pagesMerger Analysis APV MethodPrashantKNo ratings yet

- Examining Firm Performances of M&As With IT-firms Versus M&As With Non-IT FirmsDocument37 pagesExamining Firm Performances of M&As With IT-firms Versus M&As With Non-IT FirmsRushil AhmedNo ratings yet

- Banking Academy: Assignment Financial Statement AnalysisDocument25 pagesBanking Academy: Assignment Financial Statement AnalysisDiệp NguyễnNo ratings yet

- Security Structures and Determining Enterprise Values FocusDocument24 pagesSecurity Structures and Determining Enterprise Values FocusMuhammad Qasim A20D047FNo ratings yet

- Stock Market Efficiency & Stock ValuationDocument23 pagesStock Market Efficiency & Stock ValuationKaila SalemNo ratings yet

- Projected Financials and ValuationDocument44 pagesProjected Financials and ValuationAlex ElliottNo ratings yet

- Assignment Chapter 15Document4 pagesAssignment Chapter 15Ibrahim AbdallahNo ratings yet

- Thermo Fisher 2020 Annual Report Highlights Global Leadership in COVID ResponseDocument104 pagesThermo Fisher 2020 Annual Report Highlights Global Leadership in COVID ResponseAlessandro PolledroNo ratings yet

- Foundations of Financial Management 14th Edition Block Solutions ManualDocument25 pagesFoundations of Financial Management 14th Edition Block Solutions ManualMaryMurphyatqb100% (50)

- Simple Checklist For Quality StocksDocument4 pagesSimple Checklist For Quality StocksErvin KhouwNo ratings yet

- Financial Statements, Cash Flow, and Taxes - Solutions - Solutions - Solutions - SolutionsDocument73 pagesFinancial Statements, Cash Flow, and Taxes - Solutions - Solutions - Solutions - SolutionspepeNo ratings yet

- Financial Modeling BenningaDocument17 pagesFinancial Modeling BenningaBeatriz Montoya17% (6)

- Eurofins Scientific 2021 Annual Report - FinalDocument298 pagesEurofins Scientific 2021 Annual Report - FinalLalitSinghNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 5.0) : Click To Subscribe (It'S Free!)Document49 pagesSafal Niveshak Stock Analysis Excel (Ver. 5.0) : Click To Subscribe (It'S Free!)Ramesh ReddyNo ratings yet

- Finanças Corporativas II quiz valuationDocument3 pagesFinanças Corporativas II quiz valuationRicardoNo ratings yet

- M&a ValluationDocument11 pagesM&a ValluationSumeet BhatereNo ratings yet

- Mergers and Acquisitions Question List and Exercices Valuation With Full SolutionsDocument5 pagesMergers and Acquisitions Question List and Exercices Valuation With Full SolutionsAbdelhadi KaoutiNo ratings yet