Professional Documents

Culture Documents

Declaration for TDS deduction under 194Q on purchase of petroleum products

Uploaded by

Yugant SonawaneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration for TDS deduction under 194Q on purchase of petroleum products

Uploaded by

Yugant SonawaneCopyright:

Available Formats

Declaration for applicability of deduction of tax at source (TDS) on purchase of goods u/s 194Q

We, M/s. ________________________________<< Business Name>>, hereby confirm that our total sales / gross receipts /

turnover from our business exceeded Rs.10 crores, during the FY 2020-21. Accordingly, we qualify as buyer for the purpose of

section 194Q of the Income Tax Act.

We confirm that, TDS as per the provisions of section 194Q is applicable on our purchases of petroleum products exceeding Rs.50

lakhs from Indian Oil Corporation Ltd. (PAN AAACI1681G) during FY 2021-22. We also confirm that we will be deducting the

applicable TDS @ 0.1% under section 194Q while remitting payment to the account of Indian Oil Corporation Ltd.

Our customer identification details for transacting with Indian Oil Corporation Ltd. are submitted in the Annexure.

We are aware that as per the provisions under section 206C (1H), TCS is not collectible by Indian Oil Corporation Ltd on above

sales of petroleum products to us, where TDS under section 194Q is applicable and has been deducted by us ( i.e buyer). We are

also aware that, Indian Oil Corporation Ltd, relying our subject declaration, will not be collecting TCS under section 206C(1H) on

sales to us exceeding Rs.50 lakhs during FY 2021-22.

We hereby undertake to indemnify Indian Oil Corporation Ltd against any liabilities (comprising of tax amount and interest /

penalty if any) arising on account any non-compliance on our part by way of non-deduction of TDS as per the applicable provisions

of section 194Q resulting in consequential non-collection of TCS under section 206C(1H) on the part of Indian oil Corporation

Ltd.

We hereby also undertake to refund, with interest, any amount credited by Indian Oil Corporation Ltd to our account, in giving

effect to the TDS under section 194Q which we have hereby declared that we will be deducting on our purchases, in the event of

any aforesaid non-compliance on our part by way of non-deduction of TDS/ non remittance of TDS deducted to Govt. as per the

applicable provisions of section 194Q.

Verification

I, ___________________________, son/daughter of Shri _________________________________ in the capacity of

_____________________ of M/s._________________________ solemnly declare that to the best of my knowledge and belief, the

information given in this declaration is correct and complete and particulars shown therein are true.

I hereby declare that I am duly authorized to submit and sign the declaration.

Place

Date (Authorized Signatory)

Signature & Seal

You might also like

- RT-6901 Alt 5 PDFDocument1 pageRT-6901 Alt 5 PDFmchkppNo ratings yet

- Atzpr8899q Q2 2023-24Document2 pagesAtzpr8899q Q2 2023-24Akansha Jain100% (1)

- TenderDocument94 pagesTenderBO-Manipur NHIDCLNo ratings yet

- Annexure - 1 Part D Subcontract Agreement (Sample Copy)Document6 pagesAnnexure - 1 Part D Subcontract Agreement (Sample Copy)Ahmed BoraeyNo ratings yet

- Encashment of EL & HPL Single BillDocument15 pagesEncashment of EL & HPL Single Billshabbir ahamed SkNo ratings yet

- Retaining Wall - 10MDocument1 pageRetaining Wall - 10MManupriya KapleshNo ratings yet

- Delivery Challan All You Need To Know Google DocsDocument2 pagesDelivery Challan All You Need To Know Google DocsSumeet KatariyaNo ratings yet

- Flight Ticket - New Delhi To Mumbai: Fare Rules & BaggageDocument2 pagesFlight Ticket - New Delhi To Mumbai: Fare Rules & BaggageRomeo BanerjeeNo ratings yet

- Sehgal Auto SparesDocument4 pagesSehgal Auto SparesDishank SehgalNo ratings yet

- COFMOWDocument27 pagesCOFMOWArun Kumar SharmaNo ratings yet

- Intimation of Transfer of Ownership of Motor Vehicles: Form T.ODocument2 pagesIntimation of Transfer of Ownership of Motor Vehicles: Form T.OSocial Shout100% (2)

- UltraTech Cement Application Form 2022-2023Document2 pagesUltraTech Cement Application Form 2022-2023Aman Kumar MauryaNo ratings yet

- Hindustan Colas price offer for emulsion productsDocument1 pageHindustan Colas price offer for emulsion productsjitu2968100% (1)

- Adani Ahmedabad International Airport Limited: Document Reference Q/ L/GL/01 Rev. R0 Page NoDocument4 pagesAdani Ahmedabad International Airport Limited: Document Reference Q/ L/GL/01 Rev. R0 Page NoNRP Projects Private Limited AhmedabadNo ratings yet

- Method of Assessment of Property Tax in Andhra Pradesh MunicipalitiesDocument7 pagesMethod of Assessment of Property Tax in Andhra Pradesh MunicipalitiesgokedaNo ratings yet

- Acmv - Symbols & Legend: For TenderDocument1 pageAcmv - Symbols & Legend: For TenderVan DiepNo ratings yet

- GSTDocument9 pagesGSTAnonymous MkwpS2No ratings yet

- Ceritified That The Particulars Given Above Are True and CorrectDocument1 pageCeritified That The Particulars Given Above Are True and CorrectSHRIJITNo ratings yet

- Letter Head - JMCDocument2 pagesLetter Head - JMCsourabhj999No ratings yet

- 194Q TDS On Purchase of GoodsDocument25 pages194Q TDS On Purchase of GoodsPallavi SharmaNo ratings yet

- Vendor Registration Form - FKF1J.v2Document2 pagesVendor Registration Form - FKF1J.v2Ryzen AnimationNo ratings yet

- Old G.O 65Document22 pagesOld G.O 65Mohammed AzharNo ratings yet

- Export FEMA Scomet EVD Declr FormatDocument3 pagesExport FEMA Scomet EVD Declr FormatSatish KumarNo ratings yet

- SoR - 2021 - Part - I Arunachal PradeshDocument104 pagesSoR - 2021 - Part - I Arunachal Pradeshtai tahuNo ratings yet

- Form A1Document3 pagesForm A1gaytri mandapNo ratings yet

- Appointment Letter For CPDocument4 pagesAppointment Letter For CPSamaira SheikhNo ratings yet

- Challan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectDocument1 pageChallan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectMANOJNo ratings yet

- WB VAT Bill SummaryDocument92 pagesWB VAT Bill Summaryrahulchow2No ratings yet

- Thane Cluster Notification DT 04mar14Document15 pagesThane Cluster Notification DT 04mar14Unmesh BagweNo ratings yet

- Chandra (Format) ..... Electricals Tax InvoiceDocument2 pagesChandra (Format) ..... Electricals Tax InvoiceyaswanthNo ratings yet

- Declaration in Case of Transferor Initiated CallDocument1 pageDeclaration in Case of Transferor Initiated CallYASHASWINI PNo ratings yet

- DT MCQs & Case Scenarios Booklet Solutions Yash KhandelwalDocument89 pagesDT MCQs & Case Scenarios Booklet Solutions Yash Khandelwalhtassociates12No ratings yet

- Letter For Implementation of ICD 2.5Document3 pagesLetter For Implementation of ICD 2.5VARSHA GROUPNo ratings yet

- 5.0forms of Tender: (On The Letterhead of The Contractor)Document8 pages5.0forms of Tender: (On The Letterhead of The Contractor)Hemant SharmaNo ratings yet

- Format For Inspection of Maintenance Aspects of Completed PMGSY Works by Third Tier of QMDocument4 pagesFormat For Inspection of Maintenance Aspects of Completed PMGSY Works by Third Tier of QMAtul mishraNo ratings yet

- 240 2011-08-18 549729 PDFDocument95 pages240 2011-08-18 549729 PDFasitdeyNo ratings yet

- ABDULALI AL‐AJMI CO RFQ 6000118302Document8 pagesABDULALI AL‐AJMI CO RFQ 6000118302Anonymous 3QdF9qzrNo ratings yet

- For Non-Account Holder BeneficiaryDocument2 pagesFor Non-Account Holder BeneficiarySP CONTRACTORNo ratings yet

- GST Annual Return and AuditDocument10 pagesGST Annual Return and AuditRachit ChhedaNo ratings yet

- DPO No. 4600065994Document7 pagesDPO No. 4600065994Abhinn KothariNo ratings yet

- Affidavit Cum Undertaking PDFDocument1 pageAffidavit Cum Undertaking PDFSameerKhanNo ratings yet

- Drawings Section 6Document114 pagesDrawings Section 6VivekDhameliyaNo ratings yet

- Construction progress and payment certificate for road projectDocument8 pagesConstruction progress and payment certificate for road projectMriganka BorahNo ratings yet

- DT Icai MCQ 3Document5 pagesDT Icai MCQ 3Anshul JainNo ratings yet

- 02.94 921-RA Bill No-9 - VUP - ApproachesDocument61 pages02.94 921-RA Bill No-9 - VUP - ApproachesAshok KumarNo ratings yet

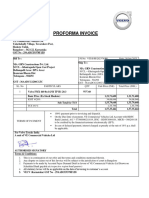

- Proforma Invoice - Volvo TrucksDocument1 pageProforma Invoice - Volvo TrucksRaviTeja KvsnNo ratings yet

- Tally Inventory Question 6 (Rice Mill)Document2 pagesTally Inventory Question 6 (Rice Mill)Suraj BiswakarmaNo ratings yet

- Kerala PWA CodeDocument444 pagesKerala PWA CodeHIVETECHNo ratings yet

- Business Form Report ChecklistDocument2 pagesBusiness Form Report ChecklistcaplusincNo ratings yet

- Imp Design of Rail Over BridgeDocument5 pagesImp Design of Rail Over BridgeShivangi MishraNo ratings yet

- Car Rental PDFDocument2 pagesCar Rental PDFvijaybhaskarthatitNo ratings yet

- Private and Confidential AgreementDocument9 pagesPrivate and Confidential AgreementTMNo ratings yet

- Technocommercial SheetDocument7 pagesTechnocommercial SheetRaja Rao KamarsuNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument12 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALNo ratings yet

- Sintex MRP PRICE LISTDocument3 pagesSintex MRP PRICE LISTPratik Choksi0% (1)

- Compliances Under GST & Income Tax Act-KinexinDocument3 pagesCompliances Under GST & Income Tax Act-KinexinDeepak ChauhanNo ratings yet

- DIRECT TAX Finalold p7Document5 pagesDIRECT TAX Finalold p7VIHARI DNo ratings yet

- DeclarationForm IoclDocument1 pageDeclarationForm Iocladarshkr100No ratings yet

- AnnuxureabDocument2 pagesAnnuxureabDeepak MaliNo ratings yet

- Declaration Turnover Below 10crDocument2 pagesDeclaration Turnover Below 10crAbhimanyuNo ratings yet

- TQC Installation Maintenance Manual - Rev 7 - 09Document25 pagesTQC Installation Maintenance Manual - Rev 7 - 09Bello100% (1)

- DeclarationForm IoclDocument1 pageDeclarationForm Iocladarshkr100No ratings yet

- TQC Installation Maintenance Manual - Rev 7 - 09Document25 pagesTQC Installation Maintenance Manual - Rev 7 - 09Bello100% (1)

- CarDocument4 pagesCarDHAWAL SHAHNo ratings yet

- p94-1738 Instrumentation t2000Document6 pagesp94-1738 Instrumentation t2000AaronNo ratings yet

- Team Leader WorkbookDocument171 pagesTeam Leader Workbooktousah2010No ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewDeepak Jindal67% (3)

- UEM Sol To Exerc Chap 097Document11 pagesUEM Sol To Exerc Chap 097sibieNo ratings yet

- Vapocresolene Fast FactsDocument2 pagesVapocresolene Fast Factsapi-275817812No ratings yet

- Ch2 MCQ PDFDocument6 pagesCh2 MCQ PDFPratibha BhondeNo ratings yet

- Saipem - FdsDocument8 pagesSaipem - FdsWaldemar100% (1)

- Chapter OneDocument18 pagesChapter Oneحيدر محمدNo ratings yet

- Balancing Uncertainty in Structural DecisionDocument10 pagesBalancing Uncertainty in Structural DecisionAfifi MohammadNo ratings yet

- Python Module 7 AFV Core-Data-StructureDocument48 pagesPython Module 7 AFV Core-Data-StructureLeonardo FernandesNo ratings yet

- Nanosafety Exam QuestionsDocument4 pagesNanosafety Exam QuestionsMulugetaNo ratings yet

- Teaching Organiser Bi Safeizal 2017Document9 pagesTeaching Organiser Bi Safeizal 2017safeizal100% (1)

- To Gamify or Not To GamifyDocument13 pagesTo Gamify or Not To GamifySedayeBaroonNo ratings yet

- Understanding and Applying The ANSI/ ISA 18.2 Alarm Management StandardDocument260 pagesUnderstanding and Applying The ANSI/ ISA 18.2 Alarm Management StandardHeri Fadli SinagaNo ratings yet

- LU9245Document2 pagesLU9245mudassir.bukhariNo ratings yet

- Insulation Coordination in Power System - Electrical4UDocument13 pagesInsulation Coordination in Power System - Electrical4UR.SivachandranNo ratings yet

- DET-2 Service ManualDocument105 pagesDET-2 Service Manualkriotron50% (2)

- Journal of Ethnopharmacology: Trilobata (L.) Pruski Flower in RatsDocument7 pagesJournal of Ethnopharmacology: Trilobata (L.) Pruski Flower in RatsHeriansyah S1 FarmasiNo ratings yet

- Cisco UCS 5108 Server Chassis Hardware Installation GuideDocument78 pagesCisco UCS 5108 Server Chassis Hardware Installation GuidemicjosisaNo ratings yet

- Physical Education 8 Quarter 2 - Module 1: Physical Activities Related To Team SportsDocument49 pagesPhysical Education 8 Quarter 2 - Module 1: Physical Activities Related To Team SportsHannah Katreena Joyce JuezanNo ratings yet

- Investigating and EvaluatingDocument12 pagesInvestigating and EvaluatingMuhammad AsifNo ratings yet

- RSSC IntroductionDocument31 pagesRSSC Introductioncalamus300No ratings yet

- Be Healthy, Happy and Holy - Sleep by 10 PM (By Mahanidhi Swami) PDFDocument4 pagesBe Healthy, Happy and Holy - Sleep by 10 PM (By Mahanidhi Swami) PDFDay FriendsNo ratings yet

- 1958 - The Automatic Creation of Literature AbstractsDocument7 pages1958 - The Automatic Creation of Literature AbstractsFranck DernoncourtNo ratings yet

- Donor Selections..Document17 pagesDonor Selections..OmamaNo ratings yet

- Creating and Using Virtual DPUsDocument20 pagesCreating and Using Virtual DPUsDeepak Gupta100% (1)

- Jig and Fixture Design AnnaDocument22 pagesJig and Fixture Design AnnaZemariyam BizuayehuNo ratings yet

- Assessment of Radical Innovation and Significant Relationship of Metromile Car Insurance CompanyDocument10 pagesAssessment of Radical Innovation and Significant Relationship of Metromile Car Insurance CompanyBidisha BhoumickNo ratings yet

- Macquarie Capital Cover LetterDocument1 pageMacquarie Capital Cover LetterDylan AdrianNo ratings yet

- National Drinking Water Quality StandardDocument26 pagesNational Drinking Water Quality Standardiffah nazira100% (2)