Professional Documents

Culture Documents

Components of Indirect Cash Flow Statement

Uploaded by

Doris Joy ValdeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Components of Indirect Cash Flow Statement

Uploaded by

Doris Joy ValdeCopyright:

Available Formats

Components of Indirect Cash Flow Statement

The main difference between the direct method and the indirect method involves the cash flows from

operating activities. There is no difference at all in how the cash flow from investing activities or financing

activities are calculated under both methods.

Operating Activities

Whether this calculated through the direct method or the indirect method, the total cash from operating

activities will be the same and the only difference is in the format in which it is presented.

The operating section starts with the net income that has been calculated under accrual basis accounting

and principles of matching and recognition. Therefore, this net income needs to be adjusted to remove

the non-cash items.

Non-cash items such as depreciation & amortization expense, gains and losses from disposal of fixed

assets, provisions for future losses, impairment expenses, deferred income taxes, etc. are added back to

the net income. This is because, these non-cash items have previously impacted income statement which

it would not have if the net income had been calculated on a cash basis from the beginning.

Next, the net income is also adjusted for changes in current asset, current liability and income tax

accounts appearing on the balance sheet. An increase in the current asset accounts including accounts

receivables, inventory, prepaid expenses, etc. will have a negative impact on cash flows and need to be

subtracted from the net income. An increase in the current liability accounts including accounts payable,

current portion of long-term debt, etc. will have a positive impact on cash flows and need to be added to

the net income.

Rules for adjustments of balance sheet accounts

Current asset accounts

1. Increase in accounts receivables will be subtracted from net income.

2. Increase in Inventory will be subtracted from net income.

3. Increase in prepaid expenses will be subtracted from net income.

4. Decrease in accounts receivables will be added from net income.

5. Decrease in Inventory will be added from net income.

6. Decrease in prepaid expenses will be added from net income.

Current liability accounts

1. Increase in accounts payable will be added to the net income.

2. Increase in expense payables will be added to the net income.

3. Increase in current portion of long-term debt will be added to the net income.

4. Decrease in accounts payable will be subtracted from net income.

5. Decrease in expense payables will be subtracted to the net income.

6. Decrease in current portion of long-term debt will be subtracted to the net income.

All the above adjustments to the net income will give us the cash flow from operating activities for the

period.

Investing Activities

As suggested by the name itself, these include acquisition and disposal of any non-current assets or any

other investments. Understanding the nature of cash flows in this category is important for analysis of

financial statements. While a negative cash flow from operating activities is an indication of poor

performance by a company, a negative cash flow from investing activities could mean that the company

has made fixed long-term investments that will eventually help its long-term health.

Typical examples will include:

Purchase of fixed assets such as property, plant and equipment (PP&E) – a negative cash flow

activity.

Investment in long-term securities like stocks or bonds – a negative cash flow activity.

Lending money to other individuals or institutions – a negative cash flow activity.

Sale of fixed assets such as property, plant and equipment (PP&E) – a positive cash flow activity.

Sale of investments – a positive cash flow activity.

Proceeds from loans or insurance claim payouts – a positive cash flow activity.

If balance sheets of two period are compared side by side and there is a difference in the values of its

non-current assets, then it means that there has been an investing activity with-in the period.

Financing Activities

These are activities that change the size of borrowings or equity for a company. Financing activities could

include the following:

Issuing new common stock – a positive cash flow activity.

Issuing new debt offering – a positive cash flow activity.

Stock repurchases – a negative cash flow activity.

Dividend payments – a negative cash flow activity.

Repaying borrowing or debt – a negative cash flow activity.

Advantages and Disadvantages of an Indirect Method

Both methods are useful and whether one method is given preference over the other will depend on the

requirement of the company. The following are some of the advantages and disadvantages of preparing

the cash flow statements using the indirect method:

The indirect method is straight forward and has a simplified format.

The indirect method helps in linking back to the income statement which presents the

information in a systematic view. Many items on a company’s balance sheet can be traced back to

the operating activities section of the cash flow statement.

It helps in reconciling the net income with the cash position of a company.

Disclosure of non-cash transactions helps users to better understand how they are part of the

income statement but not the cash flow statement.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Onuaguluchi1996 1Document10 pagesOnuaguluchi1996 1IkaSugihartatikNo ratings yet

- RMP ContractDocument181 pagesRMP ContractHillary AmistosoNo ratings yet

- Measurement of Bioreactor K ADocument18 pagesMeasurement of Bioreactor K AAtif MehfoozNo ratings yet

- PulpectomyDocument3 pagesPulpectomyWafa Nabilah Kamal100% (1)

- Essay Type ExaminationDocument11 pagesEssay Type ExaminationValarmathi83% (6)

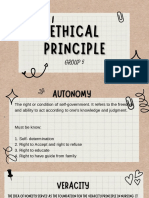

- Group 5 - Ethical PrinciplesDocument11 pagesGroup 5 - Ethical Principlesvirgo paigeNo ratings yet

- Library PDFDocument74 pagesLibrary PDFfumiNo ratings yet

- Chomp Excersie 3Document5 pagesChomp Excersie 3Omahri24No ratings yet

- Tiếng AnhDocument250 pagesTiếng AnhĐinh TrangNo ratings yet

- As Level Chemistry Practical Paper 3 - GCE GuideDocument1 pageAs Level Chemistry Practical Paper 3 - GCE GuideJamal AldaliNo ratings yet

- Debunking The Evergreening Patents MythDocument3 pagesDebunking The Evergreening Patents Mythjns198No ratings yet

- 24.2 The Core Assumptions of MindfulnessDocument9 pages24.2 The Core Assumptions of Mindfulnessale alvarezNo ratings yet

- Intoduction To WeldingDocument334 pagesIntoduction To WeldingAsad Bin Ala QatariNo ratings yet

- 2-Product Spec PDFDocument10 pages2-Product Spec PDFMhooMOoChaappHteenNo ratings yet

- Powerful Communication Tools For Successful Acupuncture PracticeDocument4 pagesPowerful Communication Tools For Successful Acupuncture Practicebinglei chenNo ratings yet

- Challenger 350 Recommended Operating Procedures and TechniquesDocument104 pagesChallenger 350 Recommended Operating Procedures and Techniquessebatsea100% (1)

- Operator'S Manual Controller R-30iBDocument25 pagesOperator'S Manual Controller R-30iBZied RaouakNo ratings yet

- Recommended Standards For Newborn ICU DesignDocument39 pagesRecommended Standards For Newborn ICU DesignAlbert SekarNo ratings yet

- Pressure Vessels SHO ProgrammeDocument42 pagesPressure Vessels SHO Programmehew ka yeeNo ratings yet

- Lesson Plan PPEDocument3 pagesLesson Plan PPEErika Jean Moyo ManzanillaNo ratings yet

- Schedule NDocument3 pagesSchedule Nmittal kelaNo ratings yet

- 21A Solenoid Valves Series DatasheetDocument40 pages21A Solenoid Valves Series Datasheetportusan2000No ratings yet

- Catalogue CV. Traka Abadi UniversalDocument15 pagesCatalogue CV. Traka Abadi UniversalHackers StevenNo ratings yet

- WeaknessesDocument4 pagesWeaknessesshyamiliNo ratings yet

- Aromatic Electrophilic SubstitutionDocument71 pagesAromatic Electrophilic SubstitutionsridharancNo ratings yet

- Remote Control Unit Manual BookDocument21 pagesRemote Control Unit Manual BookIgor Ungur100% (1)

- SSP 465 12l 3 Cylinder Tdi Engine With Common Rail Fuel Injection SystemDocument56 pagesSSP 465 12l 3 Cylinder Tdi Engine With Common Rail Fuel Injection SystemJose Ramón Orenes ClementeNo ratings yet

- Disorders of The Reproductive SystemDocument10 pagesDisorders of The Reproductive SystemRose Kathreen Quintans AuxteroNo ratings yet

- LIC Jeevan Labh Plan (836) DetailsDocument12 pagesLIC Jeevan Labh Plan (836) DetailsMuthukrishnan SankaranNo ratings yet

- Section 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsDocument7 pagesSection 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsP B ChaudharyNo ratings yet