Professional Documents

Culture Documents

HO, Branch and Agency - Additional Problems

Uploaded by

Francisco PradoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HO, Branch and Agency - Additional Problems

Uploaded by

Francisco PradoCopyright:

Available Formats

ACCTG 8

HO, Branch and Agency Accounting

JE Problems

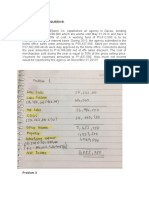

Problem 1

On May 1, 2018, the home office in Manila establishes a branch in Quezon City to act as a sales agency.

The following assets are sent to the sales agency on May 1:

Cash (for the working fund to be operated under the imprest system) P 10,000

Samples from the merchandise stock 50,000

During May, the sales agency submits sales on account of P 176,000 duly approved by the home office.

Cost of merchandise shipped to fill the orders from customers obtained by the sales agency is P 105,000.

Home Office disbursements chargeable to the sales agency are as follows:

Furniture and fixtures P 24,000

Manager’s and salesmen’s salaries 7,500

Rent 8,000

On May 31, the sales agency working fund is replenished; paid expense vouchers submitted by the sales

agency amounting to P 9,250. Sales agency samples are useful until Dec. 31 which, at this time, are

believed to have a salvage value of 40% of cost. Furnitures are depreciated at 20% per annum.

Required : Journal entries assuming: agency profit is determined separately.

Problem 2

Assume that Anthony Trading established a sales agency, Senior Agency. The results of operations are

recorded separately from those of the other sales agencies.

The following are transaction in relation to Senior Agency of Anthony Trading:

a. The transfer of P10,000 to Senior agency to establish a working fund.

b. Shipped merchandise to Senior agency for use as samples, P4,000.

c. Purchase of Senior agency equipment, P20,000.

d. Sales order from Senior Agency are filled and customers are billed, P100,000 and goods are delivered

by the home office.

e. The following expenses are incurred out of working fund: utilities, P2,000; advertising expense,

P2,500; Office supplies, P3,000.

f. Cost of goods sold identified with Senior Agency, P60,000.

g. Depreciation expense for Senior Agency equipment, P2,000.

h. Replenishment of Senior Agency’s working fund.

i. Senior Agency samples inventory amounted to P1,000, net realizable value.

Required:

1. Prepare journal entries for each transaction.

2. Prepare closing entries.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- How to Start a Vendor Management Consulting Business Business PlanFrom EverandHow to Start a Vendor Management Consulting Business Business PlanNo ratings yet

- Problem 4Document1 pageProblem 4AlexNo ratings yet

- AA Chap 11 Rev May 2016Document3 pagesAA Chap 11 Rev May 2016jbsantos09No ratings yet

- Tadena, Meleen Queen B. Problem 1Document2 pagesTadena, Meleen Queen B. Problem 1Meleen TadenaNo ratings yet

- Home Office, Branch, and Agency AccountingDocument4 pagesHome Office, Branch, and Agency Accountingkat kaleNo ratings yet

- Home Office and Branch AccountingDocument3 pagesHome Office and Branch AccountingRamainne RonquilloNo ratings yet

- HWC11Document3 pagesHWC11Jullia BelgicaNo ratings yet

- Name: - Date: - Midterm Examination - Accounting 1 Set A Problem IDocument3 pagesName: - Date: - Midterm Examination - Accounting 1 Set A Problem ITrixie VasquezNo ratings yet

- 1st Exam Chapter 11Document9 pages1st Exam Chapter 11Imma Therese YuNo ratings yet

- AFAR-05-Home Office, Agency and Branch AccountingDocument3 pagesAFAR-05-Home Office, Agency and Branch AccountingChristianAquinoNo ratings yet

- 5 6156785960404123873 PDFDocument1 page5 6156785960404123873 PDFellaNo ratings yet

- HO, BR, AgencyDocument10 pagesHO, BR, AgencyBlueBladeNo ratings yet

- CB Practice ProblemsDocument18 pagesCB Practice ProblemsAllan Leo Paran17% (6)

- Bookkeeping ActivityDocument11 pagesBookkeeping ActivityIest HinigaranNo ratings yet

- Accounting MidTermDocument16 pagesAccounting MidTermPrincess Claris Araucto33% (3)

- Acctg 1 Problems - JMCDocument1 pageAcctg 1 Problems - JMCJohn Alfred CastinoNo ratings yet

- Home Office, Agency and Branch AccountingDocument17 pagesHome Office, Agency and Branch AccountingPaupauNo ratings yet

- May 2016 c1 RegularDocument10 pagesMay 2016 c1 RegularKenneth Bryan Tegerero TegioNo ratings yet

- InventoriesDocument47 pagesInventoriesMarjorie NepomucenoNo ratings yet

- Exercises in Adjusting EntriesDocument5 pagesExercises in Adjusting EntriesJhon Robert BelandoNo ratings yet

- Sales Agency: UM Tagum College Arellano Street, Tagum City, 8100 Philippines Home Office and Branch AccountingDocument1 pageSales Agency: UM Tagum College Arellano Street, Tagum City, 8100 Philippines Home Office and Branch AccountingJoeNo ratings yet

- Pract 1Document12 pagesPract 1Kylie TarnateNo ratings yet

- Advanced PROJECT FinalDocument11 pagesAdvanced PROJECT FinalAliyaaaahNo ratings yet

- Home Office, Agency and Branch AccountingDocument17 pagesHome Office, Agency and Branch AccountingRain LerogNo ratings yet

- HO Branch Accounting MC ProblemsDocument4 pagesHO Branch Accounting MC ProblemsDivine CuasayNo ratings yet

- Accounting For Decentralized Operations: Inventory at Cost of P40,000Document6 pagesAccounting For Decentralized Operations: Inventory at Cost of P40,000Nicole Allyson AguantaNo ratings yet

- TGAS Less Ending Inv in Pesos: 991, 200 - 294,000Document13 pagesTGAS Less Ending Inv in Pesos: 991, 200 - 294,000cherry blossomNo ratings yet

- Problem 1: PostingDocument7 pagesProblem 1: Postingbunny bunnyNo ratings yet

- Business Taxes ProblemsDocument6 pagesBusiness Taxes ProblemsMendoza KlariseNo ratings yet

- Audit Practice ExamDocument17 pagesAudit Practice ExamNoel CaingletNo ratings yet

- Quiz BowlDocument3 pagesQuiz BowljayrjoshuavillapandoNo ratings yet

- Ex06 - Comprehensive BudgetingDocument14 pagesEx06 - Comprehensive BudgetingANa Cruz100% (2)

- Branch Accounting TestbankDocument5 pagesBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- Prof 3 (Midterm)Document24 pagesProf 3 (Midterm)Tifanny MallariNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1jhefster_81No ratings yet

- Ho BRDocument3 pagesHo BRSummer Star33% (3)

- MidtermQ2 - Home Office Branch Accounting Billing Above CostDocument7 pagesMidtermQ2 - Home Office Branch Accounting Billing Above Costsarahbee33% (3)

- Chap 12 Home Office Brranch Special Jan 2019Document7 pagesChap 12 Home Office Brranch Special Jan 2019Agatha de CastroNo ratings yet

- Accounting For Home Office, Branch and AgencyDocument17 pagesAccounting For Home Office, Branch and AgencyTrace ReyesNo ratings yet

- Consignment & Sales AgencyDocument4 pagesConsignment & Sales AgencydarlenexjoyceNo ratings yet

- HOBA Problem SetDocument3 pagesHOBA Problem SetFayehAmantilloBingcangNo ratings yet

- Template - Accounting 108 - Final ExaminationDocument11 pagesTemplate - Accounting 108 - Final ExaminationRochelle BuensucesoNo ratings yet

- Assignment AdvaccDocument6 pagesAssignment AdvaccAccounting Materials0% (1)

- Quizzers 9Document12 pagesQuizzers 9Shanen Mendoza Young67% (6)

- Problem #3 SciDocument2 pagesProblem #3 SciJhazz Kyll100% (1)

- BSA4A-Midterm Exam - Questions PDFDocument6 pagesBSA4A-Midterm Exam - Questions PDFRochelleDianRaymundoNo ratings yet

- HobDocument5 pagesHobcutieaikoNo ratings yet

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinNo ratings yet

- ACC16 - HO 2 Installment Sales 11172014Document7 pagesACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- CPA Reviewer FARDocument14 pagesCPA Reviewer FARCristine LetranNo ratings yet

- ACCT. Cycle Reviewer 2Document7 pagesACCT. Cycle Reviewer 2Rosemarie GoNo ratings yet

- Hand Out 2Document6 pagesHand Out 2Layka ResorezNo ratings yet

- Q11 OpaudDocument9 pagesQ11 OpaudShane CabinganNo ratings yet

- Afar Midterm Major Exam Key Answer PDFDocument4 pagesAfar Midterm Major Exam Key Answer PDFMadelyn Jane IgnacioNo ratings yet

- IACCTG 1 Partnership and Corporation AccountingDocument3 pagesIACCTG 1 Partnership and Corporation AccountingPAGDATO, Ma. Luisa R. - 1FMBNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- How to Start a Product and Brand Promotion Business: Step by Step Business PlanFrom EverandHow to Start a Product and Brand Promotion Business: Step by Step Business PlanNo ratings yet

- Revenue Recognition - Construction AccountingDocument5 pagesRevenue Recognition - Construction AccountingFrancisco PradoNo ratings yet

- Franchise - Additional ProblemsDocument2 pagesFranchise - Additional ProblemsFrancisco PradoNo ratings yet

- Franchise - Additional ProblemsDocument2 pagesFranchise - Additional ProblemsFrancisco PradoNo ratings yet

- CH 3 Problem SolutionsDocument9 pagesCH 3 Problem SolutionsFrancisco PradoNo ratings yet

- CH 2 Problem SolutionsDocument23 pagesCH 2 Problem SolutionsFrancisco PradoNo ratings yet

- Chapter 3 - Construction AccountingDocument18 pagesChapter 3 - Construction AccountingFrancisco PradoNo ratings yet

- Chapter 2 - Corporate LiquidationDocument11 pagesChapter 2 - Corporate LiquidationFrancisco PradoNo ratings yet

- Chapter 1 - PartnershipDocument18 pagesChapter 1 - PartnershipFrancisco PradoNo ratings yet