Professional Documents

Culture Documents

Financial Accounting I (A)

Uploaded by

RCC NPCCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting I (A)

Uploaded by

RCC NPCCCopyright:

Available Formats

ALHAMD ISLAMIC UNIVERSITY

FINAL TERM EXAMINATION SPRING 2021

MBA/MBA-EXE-l

Financial Accounting

Total Marks: 30

Note: Attempt all questions only handwritten paper will be accepted.

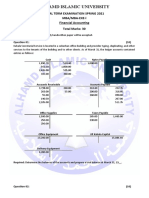

Question 01: (10)

Kahala Secretarial Service is located in a suburban office building and provides typing, duplicating, and other

services to the tenants of the building and to other clients. As of March 31, the ledger accounts contained

entries as follows:

Cash Notes Payable

1,890.70 518.60 1,000.00 14,000.00

561.50 1,000.00

2,465.00 595.00

315.00 360.00

Accounts Receivable Accounts Payable

3,798.00 260.00 318.60 232.35

263.00 55.00 200.00 318.60

55.00 360.00 890.00

190.50 267.00

2,105.00 511.35

Office Supplies Taxes Payable

1,500.00 265.00 1,465.00

250.00 330.00

250.00

Office Equipment Jill Kahala Capital

13,240.00 15,084.40

Delivery Equipment

6,200.00

Required: Determine the balances of the accounts and prepare a trial balance at March 31, 19__.

Question 02: (10)

ALHAMD ISLAMIC UNIVERSITY

FINAL TERM EXAMINATION SPRING 2021

MBA/MBA-EXE-l

Financial Accounting

Total Marks: 30

Note: Attempt all questions only handwritten paper will be accepted.

Security Service Company adjusts and closes its accounts at the end of the month on November 30 adjusting

entries are prepared to record:

a. Depreciation expense for November.

b. Interest expense that has accrued during November.

c. Revenue earned during November which has not yet been billed to customers.

d. Salaries payables to company employees which have accrued since the last payday in November.

e. The portion of the company’s prepaid insurance which has expired during November.

f. Earning a portion of the amount collected in advance from customer.

g. Rent expense for November.

h. Unrecorded Income Taxes Expense accrued during November.

i. Interest revenue that has accrued during November.

j. Prepaid Advertising expense for November.

Required: Indicate the effect of each of these adjusting entries upon the major elements of the company’s

Financial statements- that is upon revenue, expenses, net income, assets, liabilities and owner’s

equity.

Organize your answer in tabular form, using the column heading shown below and the symbols

I for increase, D for decrease and NE for no effect.

Adjusting Income statement Balance Sheet

Entry Revenue - Expense Net Income Assets = Liabilities + Owner’s Equity

XYZ NE - I D D = NE + D

a

Question 3:

a. Explain why each of the following groups is interested in the financial information

of the Business: (5)

i. Creditors

ii. Potential Investors

iii. Labor unions

iv. Owners

v. Management

b. Why are the total assets shown on a balance sheet always equal to the total of the liabilities

and the owner’s equity? (5)

……………Best of Luck………….

You might also like

- STP LectureDocument15 pagesSTP LectureRCC NPCCNo ratings yet

- Functional StrategyDocument11 pagesFunctional StrategyRCC NPCCNo ratings yet

- 10 Best Practices For Effective Project Monitoring and ControlDocument5 pages10 Best Practices For Effective Project Monitoring and ControlRCC NPCCNo ratings yet

- Key Responsibilities of A Project ManagerDocument4 pagesKey Responsibilities of A Project ManagerRCC NPCCNo ratings yet

- What Is A Projectvs ProgramDocument2 pagesWhat Is A Projectvs ProgramRCC NPCC100% (1)

- Why Is Project Scheduling ImportantDocument2 pagesWhy Is Project Scheduling ImportantRCC NPCCNo ratings yet

- The Growth and Recognition of Project Management Training Have Changed Significantly Over The Past Few YearsDocument12 pagesThe Growth and Recognition of Project Management Training Have Changed Significantly Over The Past Few YearsRCC NPCCNo ratings yet

- 1st Lec Organization PolicyDocument18 pages1st Lec Organization PolicyRCC NPCCNo ratings yet

- Top 16 Qualities of A Good Manager and A LeaderDocument5 pagesTop 16 Qualities of A Good Manager and A LeaderRCC NPCCNo ratings yet

- Financial Accounting I (A)Document2 pagesFinancial Accounting I (A)RCC NPCCNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Impact of Basel III On Financial MarketsDocument4 pagesImpact of Basel III On Financial MarketsAnish JoshiNo ratings yet

- #Pvofguaranteedpaymentof10,000In5Years: PV PVDocument7 pages#Pvofguaranteedpaymentof10,000In5Years: PV PVL.E.O.ZNo ratings yet

- Acps 4 Complete SolutionsDocument2 pagesAcps 4 Complete SolutionsLuna ShiNo ratings yet

- Sreview of Financial Accounting Theory and Practice: Framework For The Preparation and Presentation of FsDocument10 pagesSreview of Financial Accounting Theory and Practice: Framework For The Preparation and Presentation of FsGwen Cabarse PansoyNo ratings yet

- Chapter 4 Getting Funding or FinancingDocument33 pagesChapter 4 Getting Funding or Financingj9cc8kcj9wNo ratings yet

- Form Voucher - Kas BankDocument14 pagesForm Voucher - Kas BankabcdNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesAira Mae Hernandez CabaNo ratings yet

- Names of BanksDocument26 pagesNames of BanksWaleed ButtNo ratings yet

- Sol Vamshi Final 30nov19Document10 pagesSol Vamshi Final 30nov19Balaji MahiNo ratings yet

- F3内部讲义Document554 pagesF3内部讲义geng chenNo ratings yet

- Deed of Agreement: ThailandDocument16 pagesDeed of Agreement: Thailandruby calde100% (4)

- Conceptual Framework and Accounting Standards Quiz Reviewer PDFDocument26 pagesConceptual Framework and Accounting Standards Quiz Reviewer PDFZeo AlcantaraNo ratings yet

- ACCCOB1 Module 3Document19 pagesACCCOB1 Module 3Ayanna CameroNo ratings yet

- Zoltan Pozsar - Global Money Notes #1-26 (2015-2019) - Excess Reserves - Federal Reserve PDFDocument521 pagesZoltan Pozsar - Global Money Notes #1-26 (2015-2019) - Excess Reserves - Federal Reserve PDFNameNo ratings yet

- Qs PT Harapan Sukses PerkasaDocument2 pagesQs PT Harapan Sukses Perkasakopkar hakasimaNo ratings yet

- Corporate Governance and Risk Management in Malaysia: December 2017Document9 pagesCorporate Governance and Risk Management in Malaysia: December 2017KIRUTHIGAAH A/P KANADASANNo ratings yet

- Profit MaximizationDocument42 pagesProfit MaximizationSwarnima SinghNo ratings yet

- Credit AppraisalsssDocument4 pagesCredit AppraisalsssVikram ShettyNo ratings yet

- HRAA Product SheetDocument7 pagesHRAA Product SheetANLE ANLENo ratings yet

- Account StatementDocument1 pageAccount StatementИван ИвановNo ratings yet

- Insurance & Risk ManagementDocument4 pagesInsurance & Risk ManagementTeju PaputejNo ratings yet

- Lanen 5e ch13 StudentDocument39 pagesLanen 5e ch13 StudentDagnachew TsegayeNo ratings yet

- Tutorial Test 5: 1. Three Types of ActivitiesDocument4 pagesTutorial Test 5: 1. Three Types of ActivitiesVan Nguyen Thi HoangNo ratings yet

- Phases in BankingDocument2 pagesPhases in BankingAnkur TyagiNo ratings yet

- Full Download Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test BankDocument35 pagesFull Download Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test Banktantalicbos.qmdcdj100% (22)

- Short-Term Financing: After Studying This Chapter, You Will Be Able ToDocument13 pagesShort-Term Financing: After Studying This Chapter, You Will Be Able ToMohammad Salim HossainNo ratings yet

- Sample PDFDocument30 pagesSample PDFNur KarimaNo ratings yet

- Baron Partners Fund 12.31.22Document6 pagesBaron Partners Fund 12.31.22Vinci ChanNo ratings yet

- HDFC Focused 30 Fund PresentationDocument18 pagesHDFC Focused 30 Fund PresentationYuvaNo ratings yet

- UNIT 1 Introduction To Treasury ManagementDocument7 pagesUNIT 1 Introduction To Treasury ManagementCarl BautistaNo ratings yet