Professional Documents

Culture Documents

Defi: Redefining The Future of Finance: APRIL 2021

Uploaded by

Long ThaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Defi: Redefining The Future of Finance: APRIL 2021

Uploaded by

Long ThaiCopyright:

Available Formats

DEFI: REDEFINING

THE FUTURE OF

FINANCE

APRIL 2021

GALAXY FUND MANAGEMENT 1

W H AT I S D E F I ?

It is difficult to imagine the future of finance without the without payment providers or banks. But Ethereum’s general

traditional financial intermediaries we rely upon today. programmability goes far beyond the Bitcoin blockchain’s

But the emerging area of decentralized finance (DeFi) has simple balance transfers. Ethereum is the world’s first

the potential to upend the entire financial ecosystem as programmable blockchain, which is to say all value is

we know it. DeFi offers global, inclusive financial service programmable. “Smart contracts” implement if/then logic

improvements with incomparable enhancements in into assets themselves; they are like computer programs

speed, cost, and accessibility. DeFi opens up entirely new running on the blockchain that can execute automatically

possibilities for economies and individuals worldwide. when certain conditions are met. Ethereum introduces this

into every asset, and in doing so, it significantly expands the

DeFi is a global, open alternative to traditional financial world’s choices for interacting with money.

services. Advancements in blockchain technology are

empowering DeFi developers to recreate the architecture You’ll often hear DeFi apps, built on the Ethereum

of legacy financial systems with a code-based digital blockchain, referred to as “killer apps.” In order to be a

infrastructure of DeFi apps and protocols. These apps and “killer app,” the app must be both disruptive and widely

protocols replicate traditional financial functions such as adopted. DeFi protocols and applications utilize Ethereum’s

borrowing, lending, and exchanging assets, and they do so smart contracts. They’re powered by native digital assets

in a permissionless manner without relying on traditional that operate as built-in incentive mechanisms. These digital

financial intermediaries. assets have been increasingly attracting attention since

DeFi’s explosion in mid-2020, with some touting market

This move away from traditional financial intermediaries caps that rival those of fast-growing tech startups.

is revolutionary. As usage of DeFi apps and protocols

surpasses all-time highs again and again, the disruptive One of the unique features of DeFi is that all of these

nature of DeFi is attracting savvy investors looking to be projects can use and leverage each other, a trait commonly

part of the revolution. Compared to traditional financial referred to in the community as “composability.” More

markets, the yields of the digital assets being borrowed, importantly, other developers can use all of these when

lended and exchanged on DeFi apps are very high. they build their own products. This level of permissionless

Moreover, with new technological advancements come interoperability is significant to the continued growth of the

new ways of generating returns. DeFi is creating brand new entire space. That said, all of this interoperability is enabled

opportunities in the areas of spot borrowing and lending, because these projects build on Ethereum. Composability is

call overwriting, yield farming, and liquidity mining. currently only possible between projects that operate within

the same blockchain ecosystem, such as Ethereum, and

DeFi is built primarily on the Ethereum blockchain. becomes increasingly difficult when trying to communicate

The Ethereum blockchain was launched in 2015 as a between two different blockchains. While other blockchains

technology that built on bitcoin’s innovation, with some are making efforts to bring forward DeFi applications, the

key differences. Both the Bitcoin and the Ethereum DeFi ecosystem originally developed on Ethereum. Thus,

blockchains allow users to transact with digital value DeFi is still mostly confined to Ethereum.

GALAXY FUND MANAGEMENT 2

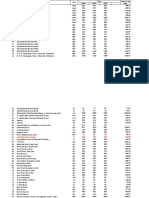

MARKET CAP OF PROTOCOLS VS. SELECT RECENTLY-PUBLIC TECH CO’S

$66.19B

SNOWFLAKE

$28.10B $23.34B $6.55B $6.10B

UNISWAP ZSCALER AGORA AAVE

$5.68B $5.62B $4.90B $4.50B $3.90B

LEMONADE ASANA CURVE COMPOUND SYNTHETIX

$3.10B $2.40B $2.10B

SHUSISWAP BALANCER MAKER

RECENTLY-PUBLIC TECH COMPANY CRYPTO PROTOCOL

Source: Galaxy Digital Research as of March 2021

GALAXY FUND MANAGEMENT 3

F O U N D AT I O N A L

P L AY E R S I N D E F I

Several key DeFi players have set the stage for the longer needed to be matched on a one-off basis (i.e., a peer-

current DeFi ecosystem by contributing significant to-peer lending market or an order book). Instead, anyone

innovations. The DeFi space moves quickly, but gaining an could borrow from a lending pool if they were comfortable

understanding of these innovators is a great place to start. with the rates and had the required collateral. Compound

has over $15B worth of cryptocurrency available for

The first notable DeFi platform is MakerDAO. This borrowing and currently dominates the market with about

project introduced the first decentralized stablecoin 19% of the total value locked up across all of DeFi. 2

called DAI. Here’s how it worked. Users deposited

an amount of Ether (ETH) into a smart contract. Uniswap was another step-function improvement in

Ether, commonly referred to as “Ethereum,” is the DeFi. Just as Compound changed DeFi lending, Uniswap

cryptocurrency that powers the Ethereum blockchain. pioneered the ”Automated Market Maker” model (AMM).

Then they were allowed to mint an amount of DAI capped This model allows traders to instantly fill market orders

at 66% of the value of their deposited ETH. In doing so, against a pool of capital, giving them the flexibility to swap

users were taking an over-collateralized loan of DAI, between any Ethereum-based assets at any time and in a

using ETH as collateral. The system has since expanded, permissionless manner. Uniswap (and AMMs in general)

allowing for the use of other collateral assets. There is is enabled by liquidity providers. Liquidity providers are

$7.4B in capital locked up in Maker loans. 1 Maker was users who act as market makers by depositing assets into a

the first Peer-to-Contract network to gain traction, but liquidity pool which can then be used to facilitate trading

Compound took things a step further. by others. Liquidity providers then earn a pro-rata share

of trading fees collected by the pool. Uniswap’s popularity

Compound is a money market protocol that allows exploded among decentralized exchanges in the last 6

users to deposit crypto assets into smart contracts months. It has processed more than $100B in trading

that pool assets and earn a yield while being borrowed. volume since it launched in early 2019. 3

Borrowers can pull from the pool by depositing collateral

and withdrawing up to 75% in another asset (or less, The rise of DeFi has been in the making for some time. At

depending on the collateral). Compound was unique the start of 2020, the entire DeFi industry was worth

because suppliers/lenders were consistently earning just $1B. As of 3/31, it was worth nearly $47B.4 The DeFi

a variable yield so long as there was at least a single industry’s initial boom was due to Compound’s launch in

borrower. The yield varied based on how much of the total mid-June 2020, and the widespread utilization of a new

lending capacity was utilized. This was a step-function incentive scheme referred to as Liquidity Mining, or

improvement in DeFi lending as borrowers and lenders no “Yield Farming.”

1) Source: DeFi Pulse, as of 3/31/21

2) Source: Decrypt.co, as of 4/4/21

3) Source: Decrypt.co, as of 2/15/21

4) Source: DeFi Pulse

GALAXY FUND MANAGEMENT 4

LIQUIDITY MINING

AND TOKEN

DISTRIBUTION

What is Liquidity Mining? A number of DeFi protocols, But what are these tokens? Often they are “Governance

led by Compound, have started rewarding the protocol Tokens.” In most cases, Governance Tokens are tokens

users with their own tokens. One way to think about these that allow the holder to vote on changes to the protocol, or

rewards is like mining rewards in Proof of Work systems. to delegate their vote to someone else (similar to a proxy

Since Compound’s token was launched, the protocol has advisor). However, many of these networks generate cash

been rewarding users with COMP tokens. Users earn a flows. Simply put, the ability to vote on protocol changes is

pro-rata share of tokens based on how much they borrow the ability to vote on how the protocol accrues value or how

or lend. This provides an additional yield to users, such it directs those cash flows.

that actively participating in a protocol now produces a

yield denominated in the protocol’s token (although some

may provide yield in ETH or other tokens). This additional

yield created the initial “yield farming ” craze, as the

prevailing yields exceeded 30% (annualized). Simply put,

users were able to realize double digit annual yields by

lending or borrowing crypto assets, including Stablecoins.

Stablecoins are digital assets created to act as a unit of

account or store of value, typically by being pegged to a fiat

currency such as the U.S. dollar.

GALAXY FUND MANAGEMENT 5

D E F I E X PA N D S

While there are too many DeFi projects to count, the Synthetix is a platform that allows users to mint synthetic

following all deserve acknowledgement. assets. These represent anything from synthetic short

positions, leveraged positions, commodities, and ultimately

Aave, formerly known as ETHLend, is a money market any asset that has a reliable price feed. Synthetix initially

protocol that preceded Compound. Aave initially struggled started by enabling users to mint representations of other

to gain traction. However, the larger DeFi ecosystem tokens, notably ones that gave synthetic short exposures.

warmed to subsequent innovations. Aave introduced Since then, the protocol has added synthetics that give

Flash Loans, an innovation with no exact parallel in exposure to commodities and the foreign exchange market,

traditional finance. In some ways, Flash Loans are similar and the platform is likely to add additional asset classes.

to overnight borrows. Flash Loans allow a user to borrow Anyone can mint these assets and become eligible to receive

assets from an Aave pool without collateral, but the loan trading fees paid by those who trade the synthetic assets.

must be repaid in the same transaction it is borrowed. This There are over $2.3B of assets locked by the Synthetix

process may seem strange. Why would one want to borrow protocol, and daily trading volume in Synths, the synthetic

and repay in the same transaction? Considering a single assets of the protocol, hovers around $100M per day.

Ethereum transaction can perform many tasks, Flash

Loans become more appealing. For example, a user may Balancer is a new breed of AMM that lets users create a unique

take a Flash Loan to borrow $1M, use that $1M to conduct portfolio of assets and give others exposure to it. Each portfolio

a series of trades, say, close an arbitrage opportunity, and is leverageable as a source of market liquidity similar to

repay the $1M after they have performed the trades. All of Uniswap. Balancer expanded on Uniswap by allowing several

this can happen in a single transaction. Flash Loans open assets into a liquidity pool, replacing the Bonding Curve

the door for unique arbitrage opportunities. Now, anyone design with a Bonding Surface.

can obtain the capital needed to take advantage of these

opportunities so long as they can execute their trade in a

Curve is an AMM that was purpose-built for the trading of

single transaction.

Stablecoins. It employs a similar methodology to Balancer

(the founder started on the Balancer team), which uses

Bonding Surfaces. However, since it only allows Stablecoins,

its design allows for much lower price slippage than most

AMMs. Curve has become one of the most popular ways to

trade in and out of Stablecoins.

GALAXY FUND MANAGEMENT 6

Keep Network enables bitcoin holders to create a is something we call an Oracle. There is a massive need to

tokenized or synthetic version of bitcoin on Ethereum. incorporate off-chain data into on-chain smart contracts.

This workaround grew in popularity alongside Liquidity This is a major problem that the industry refers to as the

Mining as it now allows bitcoiners to earn yield on their “Oracle Problem.” Inherently, a blockchain only knows what

holdings without having to work with custodial lenders. happens inside of the blockchain. It does not have any ability

to verify data outside of the blockchain. So data input from

Chainlink is a decentralized Oracle network that provides outside of the chain, or “off-chain” data, doesn’t have the

real-world data to smart contracts. LINK tokens are same “trustless-ness” as native data. One might say, “I can

the digital asset tokens used to pay for services on the trust that the balances in my Ethereum wallet are correct,

network. LINK tokens allow Ethereum developers to because those are verified through the Proof of Work

incorporate data into their smart contracts (the software consensus process. But, if I incorporate a price feed into

they deploy on Ethereum). This data can be anything, but Ethereum, I’m now trusting whomever it is that is procuring

let’s consider price feeds for example. Any service that that feed.” Chainlink attempts to solve this by establishing

allows data from the outside world to come “on-chain” an Oracle protocol.

GALAXY FUND MANAGEMENT 7

THE FUTURE OF DEFI

One of the most popular measures of DeFi’s progress is The ethos of Decentralized Finance has far-reaching and

Total Value Locked (TVL), the amount of assets that are revolutionary implications. DeFi is actively innovating to

currently staked within DeFi protocols. DeFi has made rebuild the current financial infrastructure in a way that is not

incredible strides over the last year. Evidence of the only faster and more cost-efficient but also fully transparent.

power and influence of DeFi is plainly visible considering This is a future where transaction settlement is not only

the TVL has tripled over Q1 of 2021. DeFi protocols and instant but openly verifiable and one in which counterparty

networks are poised to capture significant value and risk is significantly mitigated. This is the future of finance.

appreciate, leading to index and basket product prices

rising over time. The generation of heightened demand

by institutional hedge funds, OTC desks, market makers,

and liquidity providers towards DeFi demonstrates this

movement’s longevity.

TOTAL VALUE LOCKED (USD) IN DEFI (AS OF MARCH 31, 2021)

$50B

$40B

$30B

$20B

$10B

$0

APR 20 JUN 20 AUG 20 OCT 20 DEC 20 FEB 21

Source: DeFi Pulse

GALAXY FUND MANAGEMENT 8

G A L A X Y F U N D S R I S K FA C T O R S

Please note that the following are not all the risk factors associated with Digital Assets or the Funds

(each, a “Fund”). Refer to the Offering Memorandum of the applicable Fund for more risk factors.

Investment Risks Generally. An investment in the Fund, involves a high degree Protocol. Many Digital Asset networks, including Bitcoin, Ethereum and

of risk, including the risk that the entire amount invested may be lost. The Fund DeFi tokens, operate on open-source protocols maintained by groups of core

will invest in Digital Assets (such as Bitcoin, Ethereum, other cryptocurrencies developers. The open-source structure of these network protocols means that

or blockchain based assets, including those that represent the Decentralized certain core developers and other contributors may not be compensated, either

Finance (or DeFi) portion or sector of the digital assets market) using strategies directly or indirectly, for their contributions in maintaining and developing the

and investment techniques with significant risk characteristics, including risks network protocol. Lack of incentives to, or a failure to properly, monitor and

arising from the volatility of the global Digital Assets markets and the risk of loss upgrade network protocol could damage a Digital Asset network. It is possible

from counterparty defaults. The Fund’s investment program may use investment that a Digital Asset protocol has undiscovered flaws that could result in the loss

techniques that involve substantial volatility and can, in certain circumstances, of some or all assets held by the Fund. There may also be network-scale attacks

substantially increase the adverse impact to which the Fund may be subject. against a Digital Asset protocol, which could result in the loss of some or all of

All investments made by the Fund will risk the loss of capital. No guarantee or assets held by the Fund. Advancements in quantum computing could break a

representation is made that the Fund’s investment program will be successful, Digital Asset’s cryptographic rules. The Fund makes no guarantees about the

that the Fund will achieve its investment objective or that there will be any return reliability of the cryptography used to create, issue, or transmit Digital Assets

of capital invested to investors in the Fund, and investment results may vary. held by the Fund.

Different from Directly Owning Bitcoin, Ethereum or Other Digital Assets. Volatility & Supply. Values of Digital Assets have historically been highly

The performance of the Fund will not reflect the specific return an investor volatile, experiencing periods of rapid price increase as well as decline. For

would realize if the investor actually purchased a Digital Asset. Investors in the instance, there were steep increases in the value of certain Digital Assets,

Fund will not have any rights that Digital Asset holders have. including Bitcoin, over the course of 2017, and multiple market observers

asserted that digital assets were experiencing a “bubble.” These increases were

No Guarantee of Return or Performance. The obligations or performance of the followed by steep drawdowns. During the period from December 17, 2017 to

Fund or the returns on investments in the Fund are not guaranteed in any way. February 5, 2018, Bitcoin experienced a decline of roughly 60%. More recently,

Any losses of the Fund will be borne solely by investors in the Fund. Ownership during the period from February 13, 2020, until March 16, 2020, the value of

interests in the Fund are not insured by the Federal Deposit Insurance Bitcoin fell by over 50%. Supply of Digital Assets is determined by computer code,

Corporation, and are not deposits, obligations of, or endorsed or guaranteed in not by a central bank. For example, uncertainty related to the effects of Bitcoin’s

any way, by any banking entity. recent and future “halving ” could contribute to volatility in the Bitcoin markets.

The value of the Bitcoin or other Digital Assets held by a Fund could decline

Regulation. Digital Assets, including Bitcoin, Ethereum and DeFi tokens, are rapidly in future periods, including to zero.

loosely regulated. Ongoing and future regulatory actions may alter, perhaps

to a materially adverse extent, the value of a Fund’s investment. If any Digital Decentralized Finance (DeFi) Risks. Decentralized Finance (or DeFi) refers to

Asset is determined to be a “security” under U.S. federal or state securities laws a variety of blockchain-based applications or protocols that provide for peer-to-

or a Digital Asset exchange is determined to be operating illegally, it may have peer financial services using smart contracts and other technology rather than

material adverse consequences for Digital Assets due to negative publicity or a such services being offered by central intermediaries. Common DeFi applications

decline in the general acceptance of Digital Assets. As such, any determination include borrowing/lending Digital Assets and providing liquidity or market

Digital Asset exchanges are operating illegally or that any Digital Asset is a making in Digital Assets. Because DeFi applications rely on smart contracts,

security under U.S. federal or state securities laws may adversely affect the value any errors, bugs, or vulnerabilities in smart contracts used in connection with

of a particular Digital Asset or Digital Assets generally and, as a result, the value DeFi activities may adversely affect such activities. DeFi lending is subject to

of a Fund’s investment. counterparty risk and credit risk, but because lending is automated through the

DeFi protocol, rather than individual decisions made by a portfolio manager on

Exchanges. Exchanges may suffer from operational issues, such as delayed behalf of a Fund, such risks may be exacerbated, particularly if there are flaws

execution, that could have an adverse effect on the Fund. Digital Asset exchanges in DeFi protocol’s code or operation. DeFi applications may involve regulated

have been closed due to fraud, failure or security breaches. Any of the Fund’s financial products or regulated activities, however because of their decentralized

funds that reside on an exchange that shuts down or suffers a breach may be lost. nature, there is generally no entity subject to regulatory supervision. Accordingly,

DeFi applications may be subject to more risks than engaging in similar activities

Value. Several factors may affect the price of Digital Assets, including Bitcoin, through regulated financial intermediaries. In addition, in certain decentralized

Ethereum and DeFi tokens, including, but not limited to: supply and demand, protocols, it may be difficult or impossible to verify the identity of a transaction

investors’ expectations with respect to the rate of inflation, interest rates, counterparty necessary to comply with any applicable anti-money laundering,

currency exchange rates or future regulatory measures (if any) that restrict the countering the financing of terrorism, or sanctions regulations or controls. All

trading of a Digital Asset or the use of a Digital Asset as a form of payment. There of these risks could cause the value of DeFi tokens held by a Fund to decline,

is no assurance that a Digital Asset will maintain its long-term value in terms including to zero.

of purchasing power in the future, or that acceptance of bitcoin payments by

mainstream retail merchants and commercial businesses will continue to grow.

GALAXY FUND MANAGEMENT 9

DISCLAIMERS

The information (Information) contained herein may not be reproduced or redistributed “risk free”, or “risk averse.” Neither historical returns nor economic, market or other

in whole or in part, in any format, without the express written approval of Galaxy Digital performance is an indication of future results. Certain information contained herein

Capital Management LP (“GALAXY”). By accepting this document, you acknowledge (including financial information) has been obtained from published and non-published

and agree that all of the Information contained in this document is proprietary to sources. Such information has not been independently verified by Galaxy, and Galaxy

Galaxy. While not explicitly referenced within this piece, Galaxy manages the Galaxy does not assume responsibility for the accuracy of such information. Galaxy does not

Crypto Index Fund, the Galaxy Defi Index Fund, the Galaxy Bitcoin Funds, the Galaxy provide tax, accounting or legal advice. Notwithstanding anything to the contrary, each

Ethereum Fund LP, the Galaxy Institutional Ethereum Fund, Ltd. and the Galaxy recipient of this Information, and each employee, representative or other agent of such

Institutional Ethereum Fund LP (collectively the “Fund” and each a “Fund”) which recipient may disclose to any and all persons, without limitation of any kind, the U.S.

invests in Ethereum tokens (“ETH”). The Information is not an offer to buy or sell, nor income and franchise tax treatment and the U.S. income and franchise tax structure of

is it a solicitation of an offer to buy or sell, interests in the Fund or any advisory services the transactions contemplated hereby and all materials of any kind (including opinions

or any other security or to participate in any advisory services or trading strategy. If or other tax analyses) that are provided to such recipient relating to such tax treatment

any offer and sale of securities is made, it will be pursuant to the confidential offering and tax structure insofar as such treatment and/or structure relates to a U.S. income

memorandum of the Fund (the Offering Memorandum). Any decision to make an or franchise tax strategy provided to such recipient by Galaxy. Certain information

investment in the Fund should be made after reviewing such Offering Memorandum, contained herein constitutes forward-looking statements, which can be identified by the

conducting such investigations as the investor deems necessary and consulting the use of terms such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”,

investor’s own investment, legal, accounting and tax advisors in order to make an “intend”, “continue” or “believe” (or the negatives thereof ) or other variations thereof. Due

independent determination of the suitability and consequences of an investment. to various risks and uncertainties, including those discussed above, actual events or results,

Securities transactions are effected through Galaxy Digital Partners LLC, a member the ultimate business or activities of Galaxy or the Fund or the actual performance of

of FINRA and SIPC. Each Fund seeks to track the relevant Index (as defined below). Galaxy, the Fund, or bitcoin may differ materially from those reflected or contemplated in

The performance of each Fund will vary from the performance of the relevant such forward-looking statements. As a result, investors should not rely on such forward-

Bloomberg Index that it seeks to track. The Information is being provided to you solely looking statements in making their investment decisions. None of the Information has

for discussion purposes and may not be used or relied on for any purpose (including, been filed with the U.S. Securities and Exchange Commission, any securities administrator

without limitation, as legal, tax or investment advice) without the express written under any state securities laws or any other governmental or self-regulatory authority. No

approval of Galaxy. Certain statements reflect Galaxy’s views, estimates, opinions or governmental authority has opined on the merits of the offering of any securities by the

predictions (which may be based on proprietary models and assumptions, including, Fund or Galaxy, or the adequacy of the information contained herein. Any representation

in particular, Galaxy’s views on the current and future market for digital assets), and to the contrary is a criminal offense in the United States. Affiliates of Galaxy own

there is no guarantee that these views, estimates, opinions or predictions are currently investments in some of the digital assets, Defi tokens and protocols discussed in this

accurate or that they will be ultimately realized. To the extent these assumptions or document, including bitcoin and ETH.

models are not correct or circumstances change, the actual performance of Galaxy and

the Fund may vary substantially from, and be less than, the estimated performance. BLOOMBERG is a trademark or service mark of Bloomberg Finance L.P. GALAXY is a

None of Galaxy, the Fund nor any of their respective affiliates, shareholders, partners, trademark of Galaxy Digital LP. Bloomberg Finance L.P. and its affiliates (collectively,

members, directors, officers, management, employees or representatives makes any Bloomberg) are not affiliated with Galaxy, the Fund and their respective affiliates

representation or warranty, express or implied, as to thea ccuracy or completeness of any (collectively, Galaxy). Bloomberg ’s association with Galaxy is to act as the administrator

of the Information or any other information (whether communicated in written or oral and calculation agent of the XET, the BGCI, XBT and the index for the Galaxy Defi Index

form) transmitted or made available to you. Each of the aforementioned parties expressly Fund(collectively, the “Index”), which is the property of Bloomberg. Neither Bloomberg

disclaims any and all liability relating to or resulting from the use of the Information or nor Galaxy guarantee the timeliness, accurateness, or completeness of any data or

such other information. Except where otherwise indicated, the Information is based on information relating to the Index or results to be obtained. Neither Bloomberg nor Galaxy

matters as they exist as of the date of preparation and not as of any future date and will make any warranty, express or implied, as to the Index, any data or values relating thereto

not be updated or otherwise revised to reflect information that subsequently becomes or any financial product or instrument linked to, using as a component thereof or based

available, or circumstances existing or changes occurring after the date hereof. Investing on the Index (Products) or results to be obtained therefrom, and expressly disclaims all

in financial markets, the Fund and digital assets, including Bitcoin, Defi tokens, and ETH, warranties of merchantability and fitness for a particular purpose with respect thereto.

involves a substantial degree of risk. There can be no assurance that the investment To the maximum extent allowed by law, Bloomberg, it licensees, Galaxy and its and

objectives described herein will be achieved. Any investment in the Fund may result their respective employees, contractors, agents, suppliers, and vendors shall have no

in a loss of the entire amount invested. Investment losses may occur, and investors liability or responsibility whatsoever for any injury or damages—whether direct, indirect,

could lose some or all of their investment. No guarantee or representation is made that consequential, incidental, punitive, or otherwise—arising in connection with the

Galaxy’s investment strategy, including, without limitation, its business and investment Index, any data or values relating thereto or any Products—whether arising from their

objectives, diversification strategies or risk monitoring goals, will be successful, and negligence or otherwise.

investment results may vary substantially over time. Nothing herein is intended to imply

that the Galaxy’s investment methodology or that investing any of the protocols or Defi

tokens listed in the Information or the Funds may be considered “conservative”, “safe”,

GALAXY FUND MANAGEMENT 10

You might also like

- Qredo Research PaperDocument21 pagesQredo Research PaperĐào TuấnNo ratings yet

- De FiDocument39 pagesDe FiJoaoNo ratings yet

- 608833906677c51f2f4daf9f Mastering DeFiDocument28 pages608833906677c51f2f4daf9f Mastering DeFiInalegwu Emmanuel100% (5)

- Minds WhitepaperDocument34 pagesMinds WhitepaperVictor Mariano LeiteNo ratings yet

- Algorand's Layer 1 Strategy-2Document5 pagesAlgorand's Layer 1 Strategy-2tompascalNo ratings yet

- The State of The TOKEN: MarketDocument24 pagesThe State of The TOKEN: MarketMatthewNo ratings yet

- Binance Research Libra PDFDocument11 pagesBinance Research Libra PDFClark KenNo ratings yet

- Matic AnalysisDocument13 pagesMatic AnalysisIvanNo ratings yet

- What Blockchain Could Mean For MarketingDocument2 pagesWhat Blockchain Could Mean For MarketingRitika JhaNo ratings yet

- Sec18-Reverse Engineering EthereumDocument16 pagesSec18-Reverse Engineering EthereumShuixin ChenNo ratings yet

- Privacy-Preserving Solutions For Blockchain Review and ChallengesDocument33 pagesPrivacy-Preserving Solutions For Blockchain Review and ChallengesNDNo ratings yet

- Scaling Ethereum Applications and Cross-Chain Finance @stse Harmony - One/talkDocument11 pagesScaling Ethereum Applications and Cross-Chain Finance @stse Harmony - One/talkstargeizerNo ratings yet

- Blockchain-Based Systems for the Modern Energy GridFrom EverandBlockchain-Based Systems for the Modern Energy GridSanjeevikumar PadmanabanNo ratings yet

- IEEE Conference Template ExampleDocument14 pagesIEEE Conference Template ExampleEmilyNo ratings yet

- Fintelum Security Token Offering (STO) ImplementationDocument25 pagesFintelum Security Token Offering (STO) ImplementationJuan Manuel FigueroaNo ratings yet

- CeFi Vs DeFiDocument18 pagesCeFi Vs DeFirurubmNo ratings yet

- Token as value rights & Token offerings and decentralized trading venues: An analysis of securities civil law and securities supervision law from the perspective of Liechtenstein, with particular reference to relevant Union actsFrom EverandToken as value rights & Token offerings and decentralized trading venues: An analysis of securities civil law and securities supervision law from the perspective of Liechtenstein, with particular reference to relevant Union actsNo ratings yet

- Distributed Ledger: Putting the Wealth and Faith in a Mathematical Framework, Free of Politics and Human ErrorFrom EverandDistributed Ledger: Putting the Wealth and Faith in a Mathematical Framework, Free of Politics and Human ErrorNo ratings yet

- Blockchains in DetailsDocument25 pagesBlockchains in Detailsdineshgomber100% (2)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Illuminating The Dark Age of Blockchain AlgorandDocument40 pagesIlluminating The Dark Age of Blockchain AlgorandChris DENo ratings yet

- Blockchain Technology for Paperless Trade Facilitation in MaldivesFrom EverandBlockchain Technology for Paperless Trade Facilitation in MaldivesNo ratings yet

- The J Curve PDFDocument129 pagesThe J Curve PDFKekukoNo ratings yet

- Smart ContractDocument30 pagesSmart ContractblueiconusNo ratings yet

- Chain Whitepaper PDFDocument32 pagesChain Whitepaper PDFdazeeeNo ratings yet

- Work White PaperDocument55 pagesWork White PaperDubravka VilotićNo ratings yet

- ALGORANDDocument18 pagesALGORANDteo2005100% (1)

- Ethereum Blockchain As A Service A Complete Guide - 2021 EditionFrom EverandEthereum Blockchain As A Service A Complete Guide - 2021 EditionNo ratings yet

- A Decentralized Governance Layer For The Internet of Value: George Samman David FreudenDocument51 pagesA Decentralized Governance Layer For The Internet of Value: George Samman David FreudenIguaNo ratings yet

- Blockchain Technology in GamingDocument25 pagesBlockchain Technology in GamingashwindokeNo ratings yet

- Fintech RevolutionDocument49 pagesFintech RevolutionKevinNo ratings yet

- Blockchain and Tourism Three Research PropositionsDocument4 pagesBlockchain and Tourism Three Research PropositionsAbu Aisyah Yat SaaidalNo ratings yet

- Accelerating Digitalization: Bloomberg Crypto OutlookDocument8 pagesAccelerating Digitalization: Bloomberg Crypto OutlookChiemNo ratings yet

- Fintech Landscape FDocument1 pageFintech Landscape FJason NikolaouNo ratings yet

- The Future of Blockchain in Asia Pacific Codex3240 PDFDocument28 pagesThe Future of Blockchain in Asia Pacific Codex3240 PDFEng Eman HannounNo ratings yet

- Bitcoin Cash Versus Bitcoin: the Battle of the Cryptocurrencies: Crypto for beginners, #2From EverandBitcoin Cash Versus Bitcoin: the Battle of the Cryptocurrencies: Crypto for beginners, #2No ratings yet

- Blockchain Technology Revolution: The Next Big Thing to Change Everything for EveryoneFrom EverandBlockchain Technology Revolution: The Next Big Thing to Change Everything for EveryoneNo ratings yet

- Discovering Institutional Demand For Digital AssetsDocument75 pagesDiscovering Institutional Demand For Digital AssetsForkLogNo ratings yet

- Blockchain Technology in The Library - 8trDocument8 pagesBlockchain Technology in The Library - 8trTrangTran0% (1)

- Defi - The Future of Finance and My Role in Making It To The Next LevelDocument19 pagesDefi - The Future of Finance and My Role in Making It To The Next LevelUmang Arora100% (1)

- NFT Secrets Revealed: The Next Big Asset Breakthrough - Everything You Need to Know, But Were Too Afraid to Ask...From EverandNFT Secrets Revealed: The Next Big Asset Breakthrough - Everything You Need to Know, But Were Too Afraid to Ask...No ratings yet

- Blockchain Application On Financial Sector in The FutureDocument12 pagesBlockchain Application On Financial Sector in The FutureVincent RinaldyNo ratings yet

- Cryptocurrency Chronicles: Unlocking The Secrets Of Blockchain TechnologyFrom EverandCryptocurrency Chronicles: Unlocking The Secrets Of Blockchain TechnologyNo ratings yet

- Blockchain InteroperabilityDocument62 pagesBlockchain InteroperabilityBrkNo ratings yet

- Blockchain EconomicsDocument147 pagesBlockchain EconomicsRafael Barbosa100% (1)

- Go-to-Market in Web3 New Mindsets Tactics MetricsDocument20 pagesGo-to-Market in Web3 New Mindsets Tactics MetricsAly ChangizNo ratings yet

- Decentralized Autonomous Organization A Complete Guide - 2021 EditionFrom EverandDecentralized Autonomous Organization A Complete Guide - 2021 EditionRating: 4 out of 5 stars4/5 (1)

- As5040 DS000374 5-00Document62 pagesAs5040 DS000374 5-00Long ThaiNo ratings yet

- Delphi Digital: EIP-1559: Burn Baby BurnDocument8 pagesDelphi Digital: EIP-1559: Burn Baby BurnLong ThaiNo ratings yet

- Research - 2021.07.05 - Money Market ALPHADocument5 pagesResearch - 2021.07.05 - Money Market ALPHALong ThaiNo ratings yet

- Delphi Digital: Yield Strats #16Document8 pagesDelphi Digital: Yield Strats #16Long ThaiNo ratings yet

- Delphi Digital: Yield Strats #17Document8 pagesDelphi Digital: Yield Strats #17Long ThaiNo ratings yet

- Aos Unit-1Document7 pagesAos Unit-1Ash SemwalNo ratings yet

- ConfirmationPage 210310444655Document1 pageConfirmationPage 210310444655Naman KapoorNo ratings yet

- 11.2.4.4 Packet Tracer - Configuring Port Forwarding On A Linksys Router InstructionsDocument2 pages11.2.4.4 Packet Tracer - Configuring Port Forwarding On A Linksys Router InstructionsLiyanNo ratings yet

- Apply For Ethiopian Passport Online3Document1 pageApply For Ethiopian Passport Online3Abreham AynalemNo ratings yet

- Price List 2020 & 2021 From HardwareDocument48 pagesPrice List 2020 & 2021 From HardwareChinangNo ratings yet

- Cold Climate Application Guideline DuctlessDocument1 pageCold Climate Application Guideline DuctlessZineddine AlicheNo ratings yet

- Notebook Toshiba Satellite M30 - Compal - La-2462 - r0.1 - Schematics PDFDocument48 pagesNotebook Toshiba Satellite M30 - Compal - La-2462 - r0.1 - Schematics PDFRonny Kimer Fiestas VargasNo ratings yet

- Integration of Collabora Online With WOPIDocument8 pagesIntegration of Collabora Online With WOPIfarikNo ratings yet

- Parts of The FrontpageDocument4 pagesParts of The Frontpagecathymae riveraNo ratings yet

- Man 1194 Sigma A CP Installation and Operation Manual 1.06Document114 pagesMan 1194 Sigma A CP Installation and Operation Manual 1.06Christine May CagaraNo ratings yet

- Identity Protection PIN Opt-In Program For Taxpayers: About The IP PINDocument2 pagesIdentity Protection PIN Opt-In Program For Taxpayers: About The IP PINMark HeadrickNo ratings yet

- IoT Training ModuleDocument10 pagesIoT Training ModuleShishir Kant SinghNo ratings yet

- Math-102-Section-8.5-L52-with SolutionDocument16 pagesMath-102-Section-8.5-L52-with SolutionGharsellaoui MuhamedNo ratings yet

- How Space Can Improve Life On EarthDocument4 pagesHow Space Can Improve Life On EarthSara Manuela B. GonzalezNo ratings yet

- Annex B: Application Information For Ampacity CalculationDocument16 pagesAnnex B: Application Information For Ampacity Calculationfa2iiNo ratings yet

- The Database ApproachDocument9 pagesThe Database ApproachRhoda Mae BucadNo ratings yet

- Hydro Unit DSC - Control Unit - FasteningDocument3 pagesHydro Unit DSC - Control Unit - FasteningKifah ZaidanNo ratings yet

- MR 222 Trafic 2Document116 pagesMR 222 Trafic 2RobertNo ratings yet

- Software and Software EngineeringDocument60 pagesSoftware and Software EngineeringprasadbbnNo ratings yet

- SSD SDLC ModelDocument63 pagesSSD SDLC ModelPrince MagnusNo ratings yet

- Heart Failure Prediction Using Hybrid MethodDocument8 pagesHeart Failure Prediction Using Hybrid Methodabhi spdyNo ratings yet

- Lista Motor 3066 (Exc. 320c)Document5 pagesLista Motor 3066 (Exc. 320c)enrique chavezNo ratings yet

- (A305) Otomatik Kontrol Ders Notu (Slayt)Document27 pages(A305) Otomatik Kontrol Ders Notu (Slayt)Mücahit Ezel100% (1)

- Principles of InternetDocument41 pagesPrinciples of InternetSekhar AnasaniNo ratings yet

- Power Electronics Lec 12Document11 pagesPower Electronics Lec 12Fahmeed Ali MeoNo ratings yet

- STUCOR - Online Examination - Student ManualDocument18 pagesSTUCOR - Online Examination - Student ManualPanthalaraja JagaaNo ratings yet

- Mechanical Cartage CalculationDocument16 pagesMechanical Cartage CalculationManojNo ratings yet

- Juniper Networks - (Archive) Oracle - PeopleSoft Doesn't Work After Upgrade Through DXDocument1 pageJuniper Networks - (Archive) Oracle - PeopleSoft Doesn't Work After Upgrade Through DXManoj Kumar PradhanNo ratings yet

- Sentiment Emotion RecognitionDocument6 pagesSentiment Emotion RecognitionSam RockNo ratings yet

- LB Aw ns12 Man - enDocument52 pagesLB Aw ns12 Man - enWaldir Donatti JuniorNo ratings yet